Lee Angle Fort Worth Flood 1949

Crimea just declared itself part of Russia. Well, its government did. What the status is of that government is unclear, but then that’s also true for the Ukrainian government, which the west is all too eager to declare the one and only. Perhaps the first thing to do for the US and EU is to sit down with Russia and agree on the legal standing of the Kiev government, since without any such agreement no progress can be achieved. They’d have to do that without “Yats” present, because Russia doesn’t recognize him as a talking partner. Putin can promise to leave Yanukovych home if the US does the same with “Yats”.

First burst of sanctions just in: US visa restrictions for Russians AND Crimeans (that was fast…). Toothless nonsense of course, that only makes diplomacy harder. Obama and Putin were on speaking terms until recently, did things on Syria and Iran together, wonder what happened. Planning to blame it all on Putin? Not wise. “Yats” says Crimean declaration today and March 16 referendum are illegal, but they were accepted by Crimean parliament, just as he claims his presidency was in Kiev. Under international law, a region can’t just switch nations, but it does have the right of self-determination. Russia has vowed to wait for results of the referendum. As long as no-one starts shooting, that might work.

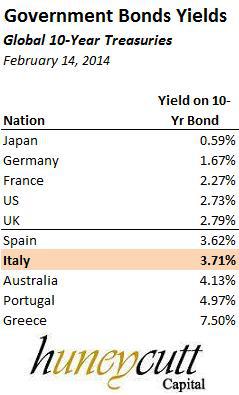

But I was going to address something else today. I saw something to the tune of record low yields for Italy and Spain last night, and I was thinking that’s very peculiar. Like a sign of how much the world has been turned on its head. Things that look good at first sight but are not at all when you lift the veil. Mario Draghi just did a press-op and tried to sound cheery when explaining the ECB decision not to cut rates, the usual we got it all under control meme, which nobody believes but then all they want is for him to keep up stimulus. And they bet he’s going to do QE at some point anyway, if only because he can’t cut rates much from 0.25%, and the IMF too hinted he should QE. Draghi’s Kodak moment of the day came when he said that ” … inflation should be around 1.7% by the final quarter of 2016″. That’s 3 years from now, and Mario has a hard time seeing ahead 3 weeks.

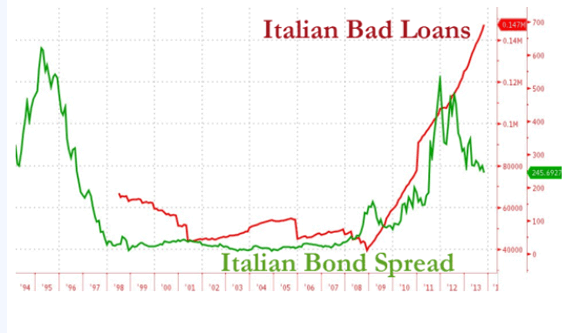

Still, it’s true, Italian and Spanish 10 year yields are at 3.36% or so now, the lowest since about 2006, so pre-crisis. and that’s down from 3.6-3.7% 3 weeks ago, and 7% in 2011. That’s right, that’s when Draghi said he’d do anything to protect them. He managed to push that beyond Germany because they think he won’t have to, and anyway it won’t cost them, but they could be wrong in that. See this graph for instance, that shows bond spreads Italy vs Germany have come down a lot, but numbers and percentage of bad loans just keep increasing.

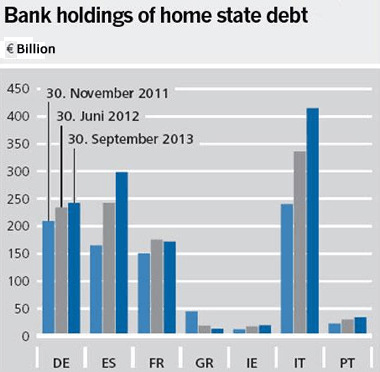

The ECB, and hence Germany, are now effectively guaranteeing those loans. In the same way that they’re propping up the huge holdings in domestic sovereign bonds held by Italian and Spanish banks. You may remember the story behind those purchases: the ECB can’t lend to nations, but it can lend to banks, so governments push banks to borrow in Frankfurt and buy sovereign bonds with the proceeds. The fact that this practice is still ongoing assures us that Draghi is in on it.

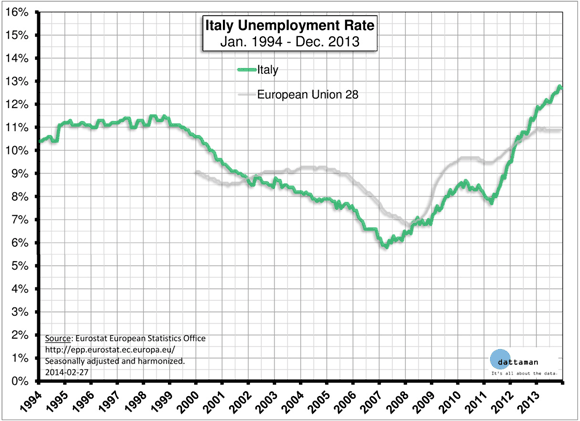

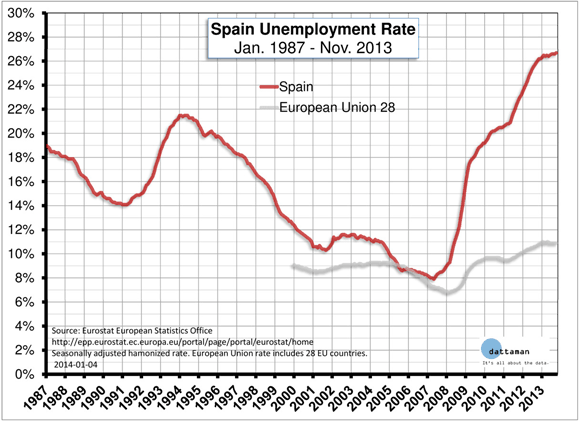

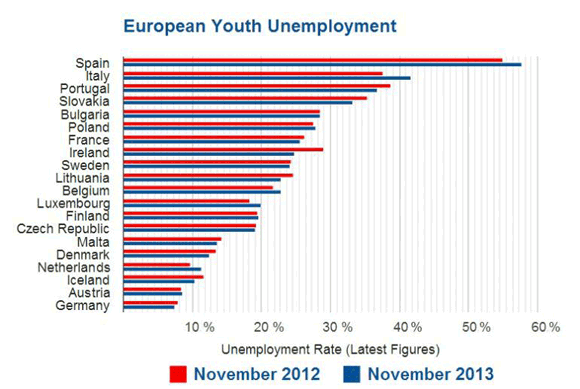

The tale out of the ECB is that Italy and Spain are doing much better. But that doesn’t show anywhere other than in made up financial stats. There is not a single healthy economy on the planet that has unemployment issues such as these:

And you must wonder about the Italian 13% rate vs the Spanish 26%, certainly in light of youth unemployment rates. Which are worse in Spain than Italy, but not by the 100% the overall unemployment numbers differ.

But just look at that last graph, and tell me how it can be that an economy can be considered healthier than it was (which makes yields fall) two years ago, when – youth – unemployment stats just keep getting worse. If those yields were any sort of barometer of an economy, why are they where they are today?

Look at French and German jobless youth, and then at their 10 year yields. Do the same with Spain and Italy vs Germany. And then please explain what’s going on.

I think the only conclusion is that Mario Draghi has created a very distorted – picture of – Europe. The markets don’t care as long as he keeps pumping money in. And they may even buy Italian and Spanish bonds as long as these a’re de facto guaranteed by Germany. But Spain still has an enormous real estate problem, and Italy unveils more bad loans by the day. And the EU just promised $15 billion to Ukraine that it clearly doesn’t have and even if it did could be put to good use among member states.

Yes, it all looks good, those yields. But they also mean that Spain and Italy can borrow more, cheaper. And while that sounds nice, is it really a good idea that they can get even deeper into debt? What Mario Draghi does is paper over the cracks, but the cracks just keep getting wider – see the unemployment stats – and he will need ever more paper. Until he runs out.

China, Japan, the US, Britain and the EU, they’re all playing the exact same game. Hide and don’t seek. It’s a stupid game, and it’s even stupider that people believe what they’re told they see.

• ECB holds rates, looks at back door measure to loosen policy (Reuters)

The European Central Bank left interest rates unchanged on Thursday, holding its nerve in the face of uncomfortably low inflation though it may unleash other measures to pep up a fragile euro zone recovery. The decision to leave its main interest rate at 0.25% was generally expected by markets, though a third of economists polled by Reuters forecast a cut. The ECB also left the deposit rate it pays banks for holding their money overnight at zero. “This is no surprise,” RBS economist Richard Barwell said. “There will be two messages: firstly, things are eventually going to get better and therefore we don’t need to act today. Secondly, if things get any worse in the near future, we absolutely will act.”

Attention now turns to ECB President Mario Draghi’s 1330 GMT news conference, at which he may yet announce a measure to loosen lending conditions. With inflation running in the ECB’s “danger zone” below 1% – 0.8% at the last count – the bank has discussed ending operations to drain funds from the financial system, a back door way of increasing liquidity.

The ECB currently offsets money it put into the system through government bonds it bought at the height of the euro debt crisis by withdrawing an equivalent amount of funds from week to week. Stopping this “sterilisation” would effectively release around €175 billion euros (143 billion pounds) into the banking system. Such a move would mark a big philosophical shift at the ECB by showing it is ready to increase the money supply – a step towards U.S.-style quantitative easing (QE), or buying assets to drive money into the system.

An ECB source predicted there would be unanimous agreement to end sterilisation of bond purchases under the bank’s Securities Markets Programme (SMP). The International Monetary Fund believes the ECB needs to do more than that. Reza Moghadam, the head of the IMF’s European Department, said in a blog on Wednesday that the ECB should cut interest rates and pump out more money, perhaps through QE.

• BOE Extends Record-Low Rates Into a 6th Year (Bloomberg)

Bank of England policy makers extended unprecedented stimulus into a sixth year today as they seek to ensure the economy fully recovers from the damage wrought by the financial crisis. The Monetary Policy Committee led by Governor Mark Carney held its benchmark interest rate at 0.5%, as predicted by all 52 economists in a Bloomberg News survey. The central bank has maintained borrowing costs at a record low since March 2009, the longest stretch of unchanged policy since the 1940s.

Carney says there’s “no rush” to remove the emergency stimulus put in place by his predecessor Mervyn King, even after the strongest expansion since 2007 pushed unemployment toward the 7% level at which officials had said they’d consider a rate increase. With signs the recovery is becoming entrenched, traders are betting the BOE will lift borrowing costs next year after officials raised their growth forecasts last month. “The outlook for growth and employment remains strong,” said James Knightley, an economist at ING Bank NV in London. He said the risks to his forecast for a rate increase in February 2015 “are skewed towards an earlier move rather than a later move.”

The economy was 1.4% smaller in the fourth quarter than at its peak in early 2008, supporting the BOE’s view that there is enough spare capacity to keep rates on hold without fueling faster inflation. Only Italy is further behind the U.K. among Group of Seven nations. This month is also the fifth anniversary of the asset-purchase plan, under which the BOE has bought 375 billion pounds ($627 billion) of government bonds. It announced the last round of quantitative easing in July 2012 and left the program unchanged today.

• Spain Yields Fall to 8-Year Low as Greek, Italy Bonds Rally

Spain’s bond yields dropped to an eight-year low and Italian and Greek government securities rallied as evidence mounted the euro-area economy is improving before the European Central Bank meets tomorrow.

German bunds underperformed all their euro-zone peers as an industry report based on a survey of purchasing managers showed the region’s services and manufacturing grew more in February than initially estimated, damping demand for safer assets. Spain’s bonds were also supported as HSBC recommended investors purchase the nation’s 10-year securities at an auction tomorrow.

“There’s been some better news from the euro zone and some of the PMIs were better,” said John Wraith, a fixed-income strategist at Bank of America Corp. in London. “There’s still not a great deal to shout about but the peripheral economies have still managed to turn a corner. People are still viewing yields even at these historically compressed levels as offering some value.”

Spain’s 10-year yield fell eight basis points, or 0.08 percentage point, to 3.36% at 4:03 p.m. in London after dropping to 3.35%, the lowest since January 2006. The 3.8% bond due in April 2024 rose 0.685, or 6.85 euros per 1,000-euro ($1,374) face amount, to 103.73. Similar-maturity Italian yields declined five basis points to 3.37% after reaching 3.36%, the lowest since October 2005. Portugal’s 10-year yields slid 13 basis points to 4.71% and Greece’s fell 12 basis points to 6.81%.

Spanish and Italian 10-year borrowing costs have both dropped below 4% this year for the first time since 2010 with investors emboldened by what ECB President Mario Draghi said last month was “remarkable progress in gaining competitiveness.” Portuguese and Greek bond rates have also declined as the nations move toward exiting bailout programs introduced at the height of the regions’ debt crisis.

Markit Economics said today its index of euro-area services and manufacturing increased to 53.3 from a provisional figure of 52.7 published on Feb. 20. A level above 50 indicates growth. The Spanish Treasury is scheduled to sell bonds maturing in 2017, 2019 and 2024 tomorrow. The country paid the least since 2006 to borrow for 10 years at an auction on Feb. 20. The last time the Treasury borrowed so cheaply the economy was growing 4% a year, public debt was 40% of output and a property boom was approaching its peak. Since then Spain has suffered two recessions, pushing the public debt burden close to 100% and unemployment to more than 25%.

I hope the press will dig in to this story. It’s nuts that the BoE categorically denies the whole thing, only to be caught already having suspended people over it. There’s a lot more lurking here.

• BoE Admits Employee Suspended Over Forex Manipulation (Telegraph)

The Governor of the Bank of England will be quizzed by MPs next week about the central bank’s alleged involvement in the manipulation of the foreign exchange market after it emerged that one of its employees had been suspended following an internal probe. In an unexpected twist, the Bank said on Wednesday that the staff member had breached “internal control processes”. It said no decision had been taken on disciplinary action.

Mark Carney will appear in front of the Treasury Select Committee (TSC) next Tuesday where he will be asked how aware the Bank was about any foreign exchange manipulation, alongside regular questions about the Bank’s February Inflation Report. Paul Fisher, the Bank’s executive director for markets who is directly responsible for forex trading, will also appear.

Andrew Tyrie, chairman of the TSC, said the Bank had been slow to act on allegations of forex rigging. “There is a strong case that the non executives in the Bank should have taken the initiative on this from the moment the need for external assistance was considered,” he said. “That was last October, possibly earlier. Yet this issue does not appear to have been raised with Court or the Oversight Committee – the nearest the Bank has to a board – until December.”

The Bank of England also published minutes on Wednesday of meetings held between Bank staff and leading foreign exchange dealers between 2005 and 2013 which showed participants raised the issue of possible manipulation of the £3 trillion-a-day global market as early as 2006. Minutes of a July 4 meeting noted “that there was evidence of attempts to move the market around popular fixing times by players that had no particular interest in that fix. “This was not in the interest of customers if the market was forced away from where it should be when the fixing snapshot was taken. It was noted that ‘fixing business’ generally was becoming increasingly fraught due to this behaviour,” the minutes said.

An investigation into attempts by traders to manipulate foreign exchange markets was launched by the Financial Conduct Authority (FCA) – a division of the Bank – last October. The probe centres around how traders discussed the way they handled deals ahead of the crucial daily setting of a benchmark – known as WM – at 4pm each day. It has been alleged that traders at major banks shared information in order to manipulate benchmark rates. A Bloomberg report last month said a senior trader had informed the FCA that Bank of England officials knew about the controversial practices and did not make any effort to stop them.

The Oversight Committee of the Bank’s Court of Directors – which is responsible for monitoring Bank conduct – has launched an investigation to assess whether Bank officials were involved in forex rigging, shared confidential client information or were involved in or aware of “any other unlawful or improper behaviour or practices in the foreign exchange market”.

Bank staff have so far trawled through 15,000 emails, 21,000 Bloomberg and Reuters chat room records and more than 40 hours of telephone call recordings as part of its internal review. The Bank said on Wednesday that this review had to date “found no evidence that Bank of England staff colluded in any way in manipulating the foreign exchange market or in sharing confidential client information”. Last month, Andrew Bailey, head of the Prudential Regulation Authority (PRA) and a deputy governor of the Bank, denied the Bank knew about any foreign exchange manipulation.

“We have no evidence to substantiate the claim that Bank officials in any sense condoned or were informed of price manipulation or the sharing of confidential client information but… we do not regard that review as over,” he told the TSC.

Someone’s laughing …

• EU Spars Over Russia Sanctions as Crimea Readies Secession Vote (BusinessWeek)

European Union leaders quarreled over how to tame Russia after its military moves in Ukraine, reawakening divisions that have plagued the bloc since it absorbed former Soviet satellite countries a decade ago. A summit in Brussels today started with eastern European countries calling for a tough line on the Kremlin and western countries offering Russia more time to pull back its forces in Crimea before imposing sanctions. The messages are “not unison,” Lithuanian President Dalia Grybauskaite told reporters before the summit. “Russia is trying to threaten all Europe, becoming unpredictable, and they are trying to rewrite the borders after the Second World War in Europe.”

The standoff plunged the EU back into the realtime crisis management that dominated the euro-area debt crisis, with the summit outcome hinging on separate diplomatic talks in Rome and events on the ground in Ukraine. The parliament in Crimea, the southern Ukraine region seized by pro-Russian forces, voted today to hold a referendum March 16 on becoming part of Russia.

Today’s emergency summit in Brussels had loomed as a deadline for President Vladimir Putin to withdraw forces to bases which Russia leases in Crimea, where the Black Sea fleet is headquartered. On March 3, EU foreign ministers demanded that Russia “immediately” take “de-escalating steps” or face consequences.

Three days later, some leaders said Russia deserves more time. Dutch Prime Minister Mark Rutte said the EU needs to “give the route of de-escalation a chance,” Austrian Chancellor Werner Faymann sought “a de-escalation and the inclusion of Russia in a solution,” and Luxembourg Prime Minister Xavier Bettel looked to a possible decision on sanctions at the next scheduled summit in two weeks.

That contrasted with the message from the Baltic countries and countries such as Poland that events in Ukraine should not be seen in isolation. Moldovan Prime Minister Iurie Leanca, whose country shares a border with Ukraine and is not an EU member, said in an interview in New York yesterday that he was concerned the Crimea situation was “very contagious.”

United Nations envoy Robert Serry “cut short” a fact-finding mission to the Ukrainian peninsula yesterday after unidentified armed men ordered him to leave Crimea immediately. About 10 to 15 men, some of them lightly armed and wearing military fatigues, stopped Serry as he was leaving naval headquarters in Crimea, UN Deputy Secretary-General Jan Eliasson told reporters on a call from Kiev. Ukraine’s international bonds due in June declined 0.7% to 93.08 cents on the dollar as of 1:54 p.m. in Kiev, lifting the yield by 3.37%age points to 39.86%. The yield jumped 8%age points yesterday after the Finance Ministry signaled it may consider debt restructuring.

In Brussels, Europe’s fiscal crisis also cast an economic shadow over the meeting, lessening the will to curb commercial ties with Russia. Germany, Europe’s largest economy, relies on Russia for 35% of its gas and oil imports. German Chancellor Angela Merkel, who was at the center of the debt-crisis diplomacy, said the outcome of today’s deliberations may depend on whether a breakthrough comes at a meeting in Rome to be attended by U.S. Secretary of State John Kerry and Russian Foreign Minister Sergei Lavrov, as well as the foreign ministers of Germany, France, the U.K. and Italy.

Lavrov told reporters in Madrid yesterday that any resolution must be based on last month’s accord negotiated by the Polish, Germany and French foreign ministers and signed by ousted Ukrainian President Viktor Yanukovych and the opposition. Television pictures showed Merkel in conversation with Ukraine’s Prime Minister Arseniy Yatsenyuk, who is also attending the meeting, introducing him to EU President Herman van Rompuy. The summit is slated to end in mid-afternoon.

European consensus was closer on a proposal to add 1 billion euros ($1.4 billion) to the emergency aid that the EU plans to disburse once Ukraine strikes a standby agreement with the International Monetary Fund. Those cash injections to avert a Ukrainian default would form the nucleus of a package of grants and project loans that could top 11 billion euros over seven years, the European Commission said in making the proposal yesterday. Merkel, speaking to reporters, put help for Ukraine as the first item on her list of three points to be discussed. “We will also look at sanctions,” she said. “Whether they have to be put into effect or not — we will decide that based in part on how the diplomatic process advances.”

• The Clash In Crimea Is The Fruit Of Western Expansion (Guardian)

Diplomatic pronouncements are renowned for hypocrisy and double standards. But western denunciations of Russian intervention in Crimea have reached new depths of self parody. The so far bloodless incursion is an “incredible act of aggression”, US secretary of state John Kerry declared. In the 21st century you just don’t invade countries on a “completely trumped-up pretext”, he insisted, as US allies agreed that it had been an unacceptable breach of international law, for which there will be “costs”.

That the states which launched the greatest act of unprovoked aggression in modern history on a trumped-up pretext – against Iraq, in an illegal war now estimated to have killed 500,000, along with the invasion of Afghanistan, bloody regime change in Libya, and the killing of thousands in drone attacks on Pakistan, Yemen and Somalia, all without UN authorisation – should make such claims is beyond absurdity.

It’s not just that western aggression and lawless killing is on another scale entirely from anything Russia appears to have contemplated, let alone carried out – removing any credible basis for the US and its allies to rail against Russian transgressions. But the western powers have also played a central role in creating the Ukraine crisis in the first place. The US and European powers openly sponsored the protests to oust the corrupt but elected Viktor Yanukovych government, which were triggered by controversy over an all-or-nothing EU agreement which would have excluded economic association with Russia.

In her notorious “fuck the EU” phone call leaked last month, the US official Victoria Nuland can be heard laying down the shape of a post-Yanukovych government – much of which was then turned into reality when he was overthrown after the escalation of violence a couple of weeks later. The president had by then lost political authority, but his overnight impeachment was certainly constitutionally dubious. In his place a government of oligarchs, neoliberal Orange Revolution retreads and neofascists has been installed, one of whose first acts was to try and remove the official status of Russian, spoken by a majority in parts of the south and east, as moves were made to ban the Communist party, which won 13% of the vote at the last election.

It has been claimed that the role of fascists in the demonstrations has been exaggerated by Russian propaganda to justify Vladimir Putin’s manoeuvres in Crimea. The reality is alarming enough to need no exaggeration. Activists report that the far right made up around a third of the protesters, but they were decisive in armed confrontations with the police.

Fascist gangs now patrol the streets. But they are also in Kiev’s corridors of power. The far right Svoboda party, whose leader has denounced the “criminal activities” of “organised Jewry” and which was condemned by the European parliament for its “racist and antisemitic views”, has five ministerial posts in the new government, including deputy prime minister and prosecutor general. The leader of the even more extreme Right Sector, at the heart of the street violence, is now Ukraine’s deputy national security chief.

Neo-Nazis in office is a first in post-war Europe. But this is the unelected government now backed by the US and EU. And in a contemptuous rebuff to the ordinary Ukrainians who protested against corruption and hoped for real change, the new administration has appointed two billionaire oligarchs – one who runs his business from Switzerland – to be the new governors of the eastern cities of Donetsk and Dnepropetrovsk. Meanwhile, the IMF is preparing an eye-watering austerity plan for the tanking Ukrainian economy which can only swell poverty and unemployment.

From a longer-term perspective, the crisis in Ukraine is a product of the disastrous Versailles-style break-up of the Soviet Union in the early 1990s. As in Yugoslavia, people who were content to be a national minority in an internal administrative unit of a multinational state – Russians in Soviet Ukraine, South Ossetians in Soviet Georgia – felt very differently when those units became states for which they felt little loyalty.

In the case of Crimea, which was only transferred to Ukraine by Nikita Khrushchev in the 1950s, that is clearly true for the Russian majority. And contrary to undertakings given at the time, the US and its allies have since relentlessly expanded Nato up to Russia’s borders, incorporating nine former Warsaw Pact states and three former Soviet republics into what is effectively an anti-Russian military alliance in Europe. The European association agreement which provoked the Ukrainian crisis also included clauses to integrate Ukraine into the EU defence structure.

That western military expansion was first brought to a halt in 2008 when the US client state of Georgia attacked Russian forces in the contested territory of South Ossetia and was driven out. The short but bloody conflict signalled the end of George Bush’s unipolar world in which the US empire would enforce its will without challenge on every continent.

Given that background, it is hardly surprising that Russia has acted to stop the more strategically sensitive and neuralgic Ukraine falling decisively into the western camp, especially given that Russia’s only major warm-water naval base is in Crimea.

Clearly, Putin’s justifications for intervention – “humanitarian” protection for Russians and an appeal by the deposed president – are legally and politically flaky, even if nothing like on the scale of “weapons of mass destruction”. Nor does Putin’s conservative nationalism or oligarchic regime have much wider international appeal.

But Russia’s role as a limited counterweight to unilateral western power certainly does. And in a world where the US, Britain, France and their allies have turned international lawlessness with a moral veneer into a permanent routine, others are bound to try the same game.

Fortunately, the only shots fired by Russian forces at this point have been into the air. But the dangers of escalating foreign intervention are obvious. What is needed instead is a negotiated settlement for Ukraine, including a broad-based government in Kiev shorn of fascists; a federal constitution that guarantees regional autonomy; economic support that doesn’t pauperise the majority; and a chance for people in Crimea to choose their own future. Anything else risks spreading the conflict.

What surprise! China plays with numbers too.

• China’s 7.5% GDP growth target is ‘flexible’ (Reuters)

It is all right for China to slightly miss the government’s 7.5% economic growth target this year as long as enough jobs are created, the finance minister said on Thursday, stressing that a healthy labor market is more important. Lou Jiwei told a briefing at China’s annual parliament meeting that the government has three broad economic policy goals each year: create jobs, control inflation and boost the economy. He said jobs are the most important of the three.

“Let’s say for instance, this year’s economic growth is not 7.5%, but 7.3% or 7.2%. Does this count as around 7.5%? Yes, it counts,” said Lou, who was previously the chairman of China’s sovereign wealth fund, China Investment Corp. CIC.UL. “Whether GDP growth is to the left or to the right of 7.5%, that is not very important. What is important is job creation.” China aims to create 11 million jobs this year, he said.

China has for years set annual growth targets to drive its centrally-planned economy. But these targets were mostly meaningless as they were always exceeded by the government in its pursuit of double-digit growth. However, as China seeks to revamp its maturing economy and move it towards slower but better-quality growth, away from exports- and investment-driven expansion, the annual growth targets are taking on a new meaning.

• China’s Li Doesn’t Believe His Own Numbers (Bloomberg)

China’s Premier Li Keqiang isn’t the sort of man to blush in public. But yesterday, when he went in front of China’s national legislature and targeted 7.5% growth in gross domestic product for 2014, he should have. The problem isn’t the number — most economists agree that 7.5% is a manageable if difficult goal. Rather, the issue is that Li Keqiang himself doesn’t believe in the accuracy of Chinese GDP statistics.

That, at least, is what he told then-U.S. ambassador to China Clark Randt over dinner on Mar. 12, 2007. At the time, Li was the Secretary General of Liaoning Province, and widely viewed as a potential successor to Chinese President Hu Jintao. According to a Mar. 15, 2007, declassified U.S. diplomatic cable (released by Wikileaks) recounting the dinner, a “smiling” Li declared that Chinese GDP figures were “man-made” and therefore unreliable — “for reference only.”

Of course, only the most naïve economist would believe that a country as large and unruly as modern China could produce accurate GDP figures. Li told Randt that he preferred three different measures for evaluating his province’s economy, all of which were harder to fudge: electricity consumption, volume of rail cargo, and loan disbursements. “By looking at these three figures, Li said he can measure with relative accuracy the speed of economic growth,” the cable reported. Not long after the cable was released, the Economist — in tribute to Li’s candor — created the Keqiang Index, revealing a far more volatile Chinese economy than official GDP numbers suggested.

Although even China’s state-owned media is now referring to “GDP worship” as a national economic religion with increasingly negative consequences, there’s no way that Li could have repeated what Bloomberg View’s William Pesek last week suggested he tell the National People’s Congress: “The Chinese government will do all in our power to maintain gross domestic product growth, but from now on, we will do so without the pressure to meet some arbitrary GDP figure.”

Still, there was a hint that the candid Li Keqiang of 2007 had some role in writing up the Work Report that he delivered on Wednesday. The evidence is a brief passage in which he describes progress made in “adjusting the economic structure.” Briefly, two of his three favorite economic indicators, as revealed to Clark Randt, appear: “China’s total electricity consumption increased by 7.5%, and the volume of freight transport rose by 9.9%.” Notably, Li shared no data on the third indicator — loan disbursements. But that, perhaps, is no great surprise at a time when the Chinese government is struggling to control credit supply and the growth of bad bank loans. Some data might be a little too reliable for even this privately candid premier to share.

If you’re not yet mesmerized by stock-drop securities class action lawsuits, well, you really should, and lucky you, here’s your chance.

• Supreme Court Has Some Theories on Market Efficiency (Bloomberg)

The lawsuit argued in front of the Supreme Court today, Halliburton v. Erica P. John Fund, is about whether the Supreme Court should allow stock-drop securities class action lawsuits, or whether it shouldn’t. If you spend a lot of time thinking about stock-drop securities class action lawsuits – say because you are a lawyer at a big law firm – then you probably think this is the most important Supreme Court case in years and you already know all about it.

If you don’t spend a lot of time thinking about securities class action lawsuits, there are people who will endeavor to convince you that this case is worth your time anyway, but they are braver than I am. Here is a good effort that I can mostly endorse.1 Anyway, right now those lawsuits are mostly allowed, under a 1988 case called Basic v. Levinson, and the smart money seems to think that they’ll still be mostly allowed after Halliburton is decided, though maybe with some more limits. But while Halliburton is really about whether stock-drop securities class actions should be allowed, it is technically about something else. It is about … whether markets are efficient? That can’t be right.

Ugh, but it is, sort of. The basic rule of securities fraud is that if a company is cooking its books and sells you some shares, say in its IPO, and then later the book-cooking is revealed and the shares are worth less than you paid, you can sue the company for fraud: It has deceived you about its financial condition and thereby tricked you into overpaying for your shares.

Similarly, though more oddly, if a company is cooking its books and you buy shares in the open market from a third party, relying on those cooked books, and then later the book-cooking is revealed and the shares are worth less than you paid, you can sue the company for fraud: It has deceived you about its financial condition and thereby tricked you into overpaying for your shares, even though you didn’t pay the company for those shares.

The problem is that it’s hard to prove that you relied on cooked books. I mean, really, you never looked at the financial statements. And even if you did, you can’t prove that thousands of other investors did too. So it’s tough to get a class action together. And if you can’t get a class action together, it’s hard to get a lawyer to care.

But, you say — or the people in Basic v. Levinson, lo these 26 years ago, said — come on, that’s not how it works. Most people don’t buy a stock because they’ve read all the financials and relied on each line of them. People buy a stock because they think that other people will think that other people will think that other people will think that other people will want to buy that stock. But that doesn’t mean the financials don’t matter. Somebody does the financial analysis. And everyone else just relies on that guy: All that beauty-contest-ing rests, ultimately, on some view of the present value of future cash flows.

The proof of this is self-evident: When financial fraud is disclosed, the stock goes down. That’s why they’re called stock-drop cases: If the stock doesn’t go down, you have no losses, so you don’t sue.

This concept is called “fraud on the market”: The idea is that some people rely on the company’s financial statements to “set” the market price, and most people just rely on the market price being right, so everyone in effect relies on the company’s financial statements, though sometimes at one or two removes. So if those statements are wrong, everyone has relied on them, and everyone can sue.

This strikes me as obviously correct as a description of the world. You don’t have to like stock-drop class actions – I don’t! – to think, well, yes, if a company is hiding accounting fraud, that will tend to prop up its stock price, and if it discloses that fraud, that will tend to make its stock price go down. Lawyers are easily confused, though, and somehow this “fraud on the market” theory of Basic v. Levinsonhas gotten wrapped up in the question of “is the efficient markets hypothesis correct?”

Maybe some even find it exiting to realize they’re seeing it all …

• Governments are spying on our sexual lives. Will we tolerate it? (Guardian)

The Guardian recently published yet another disturbing revelation from files supplied by state-surveillance whistleblower Edward Snowden.

Co-ordinated by British intelligence service GCHQ as a partner of the Five Eyes alliance of spying nations (which include the USA, Canada, New Zealand and Australia), from 2008 until at least 2012 a surveillance programme named Optic Nerve has been screencapping and storing images of webcam chats from Yahoo’s servers. Snowden’s files reveal the images were harvested in bulk from millions of ordinary Yahoo users who were not suspected of wrongdoing, and were not intelligence targets. In a single six-month period, the agency siphoned webcam images from more than 1.8m global Yahoo user accounts.

Yahoo is apparently furious. They’ve denied any knowledge of the Optic Nerve programme, accusing the agencies of “a whole new level of violation of our users’ privacy”. But the surprises are not limited to one side. The collected webcam imagery apparently contained “substantial quantities of sexually explicit communications”. With stupendous naiveté, the GCHQ documents declare:

Unfortunately … it would appear that a surprising number of people use webcam conversations to show intimate parts of their body to the other person… (and) it appears sometimes to be used for broadcasting pornography.

If the spooks are genuinely surprised that webcams are being used in sexual conversations, they clearly are spending too much time at the office spying on people rather than talking to their friends, reading Cosmopolitan, or, well, using a webcam. As the nature of work, travel and education has globalised, so, too, has the structure of intimate personal relationships. Digital communication technologies have provided a means for adult relationships that are denied the tactility of proximity to establish, at least, audio and visual explicitness in an ongoing intimate dialogue.

This is no marginal activity, either; recent pieces in glossy magazines have featured burlesque artists advising women how to “spice up” their webcam conversations with sexy outfits and strip routines. Sexual contact webcam is an unremarkable assumption of long distance relationships. Amidst online dating and internet hookup cultures, webcam conversations can also play a role in facilitating early courtship or exploring anonymous pleasures with maximum safety.

The intrusion of the state’s prying eyes into this particular arena of human intimacy is yet another reason to express the greatest possible civic outrage against “dataveillance”, its agents and sponsors. The Yahoo spying not only compromises each individual whose “intimate parts of their body” that Snowden’s documents reveal have been examined, assessed and collated by government employees, but compromises that powerful and necessary role that privacy – particularly sexual privacy – plays in personal development and individual agency.

Who we are and how we function as adults within society is intersectional with the identity we develop as the result of our intimate experiences, the sexual boundaries we choose, and the personas with which we experiment. We are as socially confident as citizens as we are sexually integrated as individuals – and this is precisely why every authoritarian society in history has policed sexual behaviour, from the enforced celibacy of the Catholic Church, to the neo-Puritanism of the American right, to female genital mutilation in patriarchal communities, the Third Reich’s attempt at exterminating LGBTQ people, and Mao’s Little Red Book recommendation to lie back and think of the People’s Republic (but only once a fortnight).

Our intimate conversations, too, exist as parallel societies. The great boon of the webcam for heterosexual women, in particular, is that sexual performance can be negotiated beyond the paradigm of physical presence, or pressure, or real or imagined threat; a woman commences a webcam session confident in the knowledge that she can safely conclude her encounter at any time. This sense of personal control is no doubt one of the reasons that a broader sexual culture has sprung up around webcam use: using it, the adult performance of sexuality appears both expressive and safe and becomes a powerful means of self-realisation that we carry out with us into the wider world.

The compromise of this agency by the Five Eyes spies – and the creation of a generation of people who, as Yahoo users, now have the explicit performance of their intimate secrets in government possession – neatly attunes to the tradition of authoritarian sexual oppression.

Five Eyes is, of course, perfectly metaphoric for the Panopticon – a prison designed by Jeremy Bentham on the principle that prisoners aware they were constantly under surveillance would eventually just presume surveillance and therefore automatically police themselves. Philosopher Michel Foucault employed the Panopticon in his book Discipline and Punish as an analogy of state power: and as we now must consider the potential oversight of the state as we reach for the webcam button to talk to our overseas boyfriends, Foucault’s explanation of “the function of discipline as an apparatus of power” is something that could and should be on our minds.

Governments have explained the violation of their electorate’s privacy as a necessary abrogation of civic rights in the fight against global terrorism. But with Snowden’s revelations proving the Obama administration’s own January 2014 review findings that not “a single instance” in which electronic eavesdropping “made a concrete difference in the outcome of a terrorism investigation”, it is time to remind ourselves that Americans alone are 4,706 times more likely to drink themselves to death than be killed by terrorists. As citizens of a sexually violated democracy, far more important than the war against terror is the fight against our own governments to turn off the data taps.

And there are still people saying Russia’s political gas power is diminishing …

• UK Energy Security At Risk As Gas Imports Surge (Telegraph)

Britain must find new sources of energy fast as the quantity of imported natural gas is expected to increase at a much faster rate than the government had previously expected, the chief executive of Centrica has warned. “In primary energy, the UK’s production of gas is falling rapidly,” Sam Laidlaw has told an international energy conference in Houston. “North Sea oil and gas output has fallen by 38pc over the last three years. By 2020 we will be reliant on imports to meet 70pc of the country’s gas needs. So when it comes to security of supply, there is a pressing need for solutions.”

Energy Minister Michael Fallon had previously said in November than Britain would import three-quarters of its natural gas by 2030, up from about 50pc at present. Late last year, Centrica signed a new deal with Qatar to import liquefied natural gas by tanker. The Gulf state already accounts for 15pc of UK supplies. Rising energy bills and a growing dependence on imported gas have increased pressure to step up development of shale resources in the UK through fracking. The vulnerability of UK energy supplies has also been exposed by the unfolding dispute between Russian and Europe over Ukraine in Crimea. Russia is Europe’s largest supplier of gas and a significant exporter to the UK.

Half of Britain could be opened up for fracking to tap 1,300 trillion cubic feet of gas that is estimated to be locked under ground in the North of England alone to ease the growing dependence on imports. Laidlaw also cautioned in his speech over the security of supply becoming the “forgotten priority” of European energy policy. “Political uncertainty is the enemy of investment. As a result, investment in new UK generating capacity has virtually ground to a halt,” said Laidlaw. “But no country or company controls global events or markets, and domestic energy policies which do not acknowledge these international realities are fundamentally flawed,” he said.

Centrica has said that in the UK an estimated 3.7 gigawatts of coal-fired electricity generating capacity will be shut down by the end of 2015 as a result of European directives to curb emissions. The country’s reserve capacity is forecast to shrink to 4pc, increasing the risk of power cuts, the company said.

Man’s biggest conundrum: are we going to burn it or sit in the cold watching butterflies?

• ‘Carbon bubble’ poses serious threat to UK economy, MPs warn (Guardian)

Stock markets are inflating a “carbon bubble” by overvaluing companies that produce fossil fuels and greenhouse gases, and this poses a serious threat to the economy, an influential committee of UK MPs has warned. The idea of a carbon bubble – meaning that the true costs of carbon dioxide in intensifying climate change are not taken into account in a company’s stock market valuation – has been gaining currency in recent years, but this is the first time that MPs have addressed the question head-on.

Much of the world’s fossil fuel resource will have to be left unburned if the world is to avoid dangerous levels of global warming, the environmental audit committee warned. To avoid the carbon bubble, the report says the Bank of England’s financial policy experts should take advice from the Committee on Climate Change to monitor the risks to financial stability – a controversial recommendation that is likely to ruffle feathers in the Treasury. Equally as contentious is the committee’s call for the government to support binding national renewable energy targets for European Union member states, a move that the coalition has strongly resisted, preferring instead to rely solely on an emissions reduction target.

Companies should also be forced by law to report on their greenhouse gas emissions and assess the risk this could pose to their future financial performance, the MPs urged. The committee said there was a substantial gap between the investments that are being made to take carbon out of the economy – for instance by building more low-carbon power generation capacity – and the investments that will be needed if emissions reduction targets are to be met and global warming halted. Current investments in “green finance” only run to about half of the amount needed to meet emissions reduction targets.

Joan Walley, chair of the committee, said: “The government and Bank of England must not be complacent about the risks of carbon exposure in the world economy. Financial stability could be threatened if shares in fossil fuel companies turn out to be overvalued because the bulk of their oil, coal and gas reserves cannot be burnt without further destabilising the climate. “The record-breaking extreme weather events causing chaos across the globe should be a wake-up call. The transition to a low-carbon economy will be much more painful if we wait until there is a climate crisis before recognising that more than half of the world’s fossil fuel reserves will have to remain in the ground.”

The committee will launch its report, entitled Green Finance, at a conference in the City of London on Thursday. Christiana Figueres, executive secretary of the UN Framework Convention on Climate Change (UNFCCC), who was visiting businesses in London this week ahead of upcoming climate talks in Bonn, said companies had a “fiduciary duty” to their shareholders to move to a low-carbon economy, because of the effects of the carbon bubble. “If corporations continue to invest in new fossil fuels, they are really in blatant breach of their fiduciary duty, as the science [of climate change] is abundantly clear,” she said. “Understanding the science, the fact is that we have to move to low-carbon no matter what, with or without policy.”

She said that the world had a choice between moving to a low-carbon economy through policies and through businesses playing a role in investing in green technologies, or being forced to move to a low-carbon world through runaway climate change. “We will move to a low-carbon world because nature will force us, or because policy will guide us. If we wait until nature forces us, the cost will be astronomical.”

What a lovely state to be in!

• North Carolina’s Toxic Future (Bloomberg)

A dystopian nightmare is unfolding in North Carolina. It is what the whole country would look like if you were to marry David Koch to Ted Cruz, with a prenup by ALEC, the outside agitator also known as the American Legislative Exchange Council. ALEC is the group that writes regressive laws, saving right-wingers the trouble of having to do it themselves.

Republicans in North Carolina took over both houses of the legislature with the election of Governor Pat McCrory in 2012, the first time the party has had complete control of state government in more than 100 years. They went straight to work. If the Republicans were to inscribe their philosophy above the statehouse door it would read: “Let us seek to deregulate business and regulate everyone else.”

The legislature promptly raised taxes on the bottom 80%, eliminated the earned income tax credit for 900,000 people, slashed education spending, declined the Medicaid expansion (leaving 500,000 of its poorest residents without health insurance), and grafted a draconian abortion restriction onto a motorcycle safety law. If you were a worker, a minority, a teacher, a woman, a doctor or poor, the legislature got you.

When it wasn’t kicking kids to the curb, lawmakers found time to attack one of the right wing’s most pressing issues, keeping Shariah law from taking over the judiciary. They passed a bill that sought to keep the epidemic of foreign laws taking over U.S. courts from finding its way to North Carolina. McCrory declined to veto it.

If you were trying to put guns into the wrong hands, you couldn’t do better than the bill to prohibit police departments from destroying confiscated firearms. Just short of dealing out of the trunk of their squad cars, police officers are supposed to sell or auction off the weapons they seize, rather than destroy them, as is done elsewhere. This is one of the model laws devised by ALEC and blessed by the National Rifle Association.

Another hobby of conservatives is providing a solution to the pressing, yet nonexistent, problem of voter fraud. In 2012, of the almost 7 million ballots cast in North Carolina, 121 were referred to the Board of Elections for fraud, a rate of .00173%. A new law invalidates the identification documents Democratic voters are most likely to use: IDs used by college students, public or municipal employees, public assistance agencies, and out-of-state driver’s licenses (unless the voter registers 90 days before the election).

If you aren’t a frequent international flier, driver, veteran or American Indian who belongs to a tribe, you are out of luck. You are also facing interminable waits as voting places have become as inconvenient and poorly located as possible. Hillary Clinton gave a speech decrying the law, as did General Colin Powell, in one of his very rare forays into the political fray. The state estimates that as many as 318,000 voters could now lack appropriate identification.

In the meantime, McCrory was doing what he could to remove regulations on business so they could do pretty much what they wanted. It usually takes a while to see what happens when business are allowed to conduct unfettered business, but not in North Carolina. According to the New York Times, the North Carolina Department of Environment and Natural Resources was ordered in June to focus on customer service — expediting environmental permits for businesses.

The results were quickly apparent. In February, as many as 27 million gallons of water and 82,000 tons of coal ash spewed into the Dan River after a storm drainage pipe ruptured under a containment pond at a shuttered coal plant owned by Duke Energy Corp.

Last year, operating under their new business-friendly mandate, state environmental regulators forged a deal with Duke over pollution from its coal ash ponds, which were known to be leaky and unlined. Critics said the deal was overly favorable to Duke, where McCrory worked for 28 years until he ran for governor in 2008. Federal prosecutors have opened a criminal investigation into the spill that will look at the company’s possible ties to the state regulator.

Beleaguered North Carolinians aren’t taking this sitting down. Monthly protests, organized under the aegis of HKonJ (Historic Thousands on Jones Street) and the NAACP have gained momentum to the point where between 80,000 and 100,000 people turned out last month. The protests are called Moral Mondays as a way of showing the Christian right that laws favoring the rich over the poor aren’t a bit Christian. We know what Jesus and Pope Francis would do for the poorest and most vulnerable. Let Republicans in North Carolina do it, too.

Hope this is not news to you.

• Sydney Opera House and Statue of Liberty ‘will be lost to sea level rise’ (Guardian)

Famous global landmarks including the Statue of Liberty, Tower of London and Sydney Opera House will be lost to rising seas caused by climate change, scientists have warned. Even with just a further 3C of warming – well within the range to which the UN climate science panel expects temperatures to rise by the end of the century – nearly one-fifth of the planet’s 720 world heritage sites will affected as ice sheets melt and warming oceans expand.

The study, published in the journal Environmental Research Letters, looked at how many Unesco sites would be threatened after 2000 years of rising sea levels, but the authors said the first impacts would “definitely” be felt much sooner without action on flood defences.

Still from “The Day After Tomorrow”

“It’s relatively safe to say that we will see the first impacts at these sites in the 21st century,” lead author Prof Ben Marzeion, of the University of Innsbruck in Austria, told the Guardian. “Typically when people talk about climate change it’s about the economic or environmental consequences, how much it’s going to cost. We wanted to take a look at the cultural implications.”

Marzeion said that in Europe, particularly vulnerable sites included the leaning tower of Pisa, which is not directly on the coast but would be affected by sea level rises as a result of even a low temperature increase because it is very low-lying. He also cited Venice, which “in a sense you can say is being impacted right now” and Hanseatic League cities including Hamburg, Lübeck and Bremen in Germany.

Sea level rising : floods in Venice The foyer of the Hotel Principe flooded by waters of the Grand Canal, Venice in 2013. The city is ‘in a sense being impacted right now,’ scientists said. Photograph: Paul Brown/Rex FeaturesOther sites that would be affected by rising waters include Westminster Abbey and Westminster Palace, as well as the city centres of Bruges in Belgium, Naples in Italy and St Petersburg in Russia, the study says. South-east Asia will have the highest number of people affected by sea level rises, partly because of low-lying, densely populated cities, but also because sea level rises will be the most extreme there.

The UN’s climate science panel, the IPCC, said in a landmark report last September that it expects sea level rises of 26-82cm by 2100 although there is no scientific consensus on high rises. There are concerns among some scientists that the IPCC is underestimating sea level rises, with one recent study suggesting global sea levels could rise by as much as 0.7-1.2m by 2100, and 2-3m by 2300.

it’s remarkable that two reports come out more or less at the same time about dinosaur fossils of 160 million years ago, and in 2 locations that are so far apart.

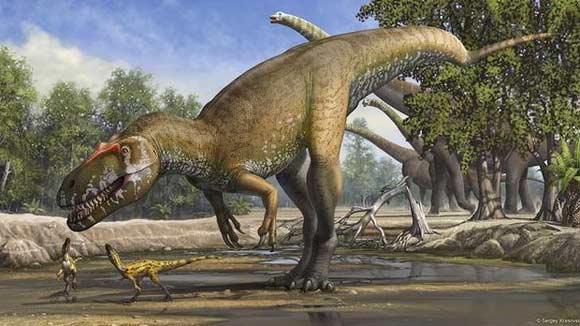

• Meet the biggest carnivorous dinosaur ever found in Europe (Reuters)

Two scientists in Portugal announced they have identified the largest carnivorous dinosaur ever found in Europe, a 10-metre-long brute called Torvosaurus gurneyi that was the scourge of its domain in the Jurassic Period. “It was indeed better not to cross the way of this large, carnivorous dinosaur,” said paleontologist Christophe Hendrickx of Universidade Nova de Lisboa and Museu da Lourinha in Portugal.

Torvosaurus gurneyi was an imposing beast. It was bipedal, weighed 2.5 to 3.6 tonnes, had a skull almost 1.2 metres long, boasted powerful jaws lined with blade-shaped teeth 10 centimetres long, and may have been covered with an early type of feather, Mr Hendrickx said. “Torvosaurus gurneyi was obviously a super predator feeding on large prey like herbivorous dinosaurs,” he said.

Artist impression of Torvosaurus gurneyi

Remains of the new species were unearthed in Portugal by an amateur fossil hunter in 2003 in the rock cliffs of Lourinha, a small town about 72 kilometres north of Lisbon, Mr Hendrickx said. He said fossilised embryos probably belonging to this species were identified last year in Portugal. The findings were published in the journal PLOS ONE.

At the time that Torvosaurus prowled the landscape, the region was a lush river delta with abundant fresh water and vegetation. The area teemed with dinosaurs and flying reptiles known as pterosaurs, primitive birds, crocodiles, turtles and mouse-sized mammals, according to paleontologist Octavio Mateus, also of Universidade Nova de Lisboa and Museu da Lourinha. Plant-eating dinosaurs living in the area included the huge, long-necked Lusotitan, the armoured, tank-like Dracopelta and the spiky-tailed Miragaia, Dr Mateus added.

The two scientists said this is the second species of the genus Torvosaurus. The other one, Torvosaurus tanneri, lived at the same time in North America. It was known from the states of Colorado, Utah and Wyoming and was identified in 1979. Its genus name, Torvosaurus, means “savage lizard.” Its species name, gurneyi, honours James Gurney, the author and illustrator of the popular Dinotopia book series.

Torvosaurus gurneyi was not the only meat-eating dinosaur in its neighbourhood. For example, there was a European species of the well-known North American Jurassic predator Allosaurus, but the Torvosaurus found in Portugal was larger. Torvosaurus gurneyi not only is the largest known meat-eating dinosaur from Europe, but is the biggest land predator of any kind ever found on the continent, they added.

There were larger dinosaur carnivores elsewhere, however. Tyrannosaurus in North America, Carcharodontosaurus and Spinosaurus in North Africa and Giganotosaurus in Argentina all were bigger, but appeared on Earth much later than Torvosaurus, during the Cretaceous Period that followed the Jurassic Period. “This animal, Torvosaurus, was already a fossil for 80 million years before the TRex ever walked the Earth,” Dr Mateus said.

• Jurassic fossil bed in China yields incredible feathered dino finds (LiveScience)

A fossil bed in China that contains some of the world’s most exquisitely preserved feathered dinosaurs, early birds, reptiles and mammals may also be home to an equally rich set of older fossils from the Middle Jurassic, a new study finds. These older fossils, dating back about 160 million years, contain the earliest known gliding mammal, earliest swimming mammal, a flying reptile and the earliest feathered dinosaurs. Now, a new study classifies these fossils as belonging to a distinct ecological group, or biota.

The new biota was found in layers of rock beneath the so-called Jehol Biota, a famous collection of 130-million-year-old fossils from China’s western Liaoning Province and nearby northeastern China; the Jihol organisms are now thought to have been killed and preserved in a Pompeii-style eruption. In recent years, fossils that are 30 million years older have surfaced from beneath the Jehol Biota, but have not been definitively linked to the same time period.

Artist impression of newly found dinosaur species

The fossils from the Jehol Biota literally lie on top of the older specimens, said David Hone, a dinosaur biologist at Queen Mary University of London and leader of the study published March 4 in the Journal of Vertebrate Paleontology. “They seem to be from the same environments — lots of trees and probably a lot of water,” Hone told Live Science.

The researchers have catalogued and described the older fossils in unprecedented detail, naming them the Daohugou Biota after a village in Inner Mongolia near one of the six main fossil sites examined. Like the Jehol fossils, the Daohugou fossils have remarkably intact skeletons, often still containing soft tissues and even feathers.

The fossil trove dates from the Middle-Upper Jurassic, a period when birds are thought to have evolved from feathered dinosaurs. The team found feathered dinosaurs that were extremely birdlike, thought not any actual birds. At the moment when birds and dinosaurs split from each other, as expected, “you can barely tell them apart,” Hone said.

They also found mammals that glided from trees (“the Mesozoic equivalent of a flying squirrel”), a classic transitional form of flying reptile called a pterosaur and even a “weird little bucktoothed dinosaur,” Hone said. Hone predicts his colleagues will find a bird in the Daohugou Biota within the next decade. “It has only been in the last two to three years that we’ve recognized that this is a place we should really be looking,” he said.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Mar 6 2014: Hide and Don’t Seek