Jack Delano Two Trains passing on Atchison, Topeka & Santa Fe Railroad near Ash Fork, AZ March 1943

It was strange to see two Bloomberg articles side by side yesterday that didn’t look as if they were written in the same universe. Not Bloomberg’s fault, I think, they simply reported on an FOMC statement and incoming US economy numbers. But it was strange nonetheless. First, here’s the FOMC’s reasoning behind its decision to taper more:

Fed Says Economy Has Picked Up As It Trims Bond Buying Further

Growth “has picked up recently,” the Federal Open Market Committee said today in a statement in Washington, hours after a government report showed gross domestic product barely grew in the first quarter. “Household spending appears to be rising more quickly.”

But as we could see absolutely everywhere in the news, growth as it is normally defined has not ‘picked up’, and there’s something about that household spending too:

Growth Freezes Up As US Business Spending, Exports Slump

The U.S. economy barely grew in the first quarter as harsh winter weather chilled investment and exports dropped. The expansion stalled even as consumer spending on services rose by the most in 14 years. Gross domestic product grew at a 0.1% annualized rate from January through March …

So much for growth. There ain’t none. It’s a mere rounding error. And if anyone ever talks about the weather again, they risk corporal punishment. I liked the comment today, I forget by whom, sorry, that the polar vortex this year has apparently decided to skip Canada, because its economy shows no signs at all of having been hurt by the cold.

Household spending got some more ‘texture’ in that quote as ‘consumer spending on services’. Wonder what those services are?! Tyler Durden is among those who figured it out:

If It Wasn’t For Obamacare, Q1 GDP Would Be Negative

… if it wasn’t for the (government-mandated) spending surge resulting from Obamacare, which resulted in the biggest jump in Healthcare Services spending in the past quarter in history and added 1.1% to GDP … [..] … real Q1 GDP (in chained 2009 dollars), which rose only $4.3 billion sequentially to $15,947 billion, would have been a negative 1.0%!

And then just now, Bloomberg runs this story, which seems a tad less innocent on their part:

Consumer Spending in U.S. Jumps by Most in Five Years

Consumer spending surged in March by the most in almost five years as warmer weather brought shoppers back to auto-dealer lots and malls, a sign the U.S. economy gained momentum heading into the second quarter. Household purchases, which account for about 70% of the economy, climbed 0.9%, the most since August 2009, after a 0.5% gain in February that was larger than previously estimated …

Hey, what did I just say about talking about the weather? More importantly, did you guys at Bloomberg completely miss the Obamacare spending bit? Or did you decide to ignore it? I know, I know, Durden’s comment covers January through March, and this number is just March, but given the above, does anyone believe the numbers are entirely unrelated? Here’s Durden again, just in, on the rise in consumer spending.

US Savings Rate Drops To 2nd Lowest Since 2008 To Pay For March Spending Spree

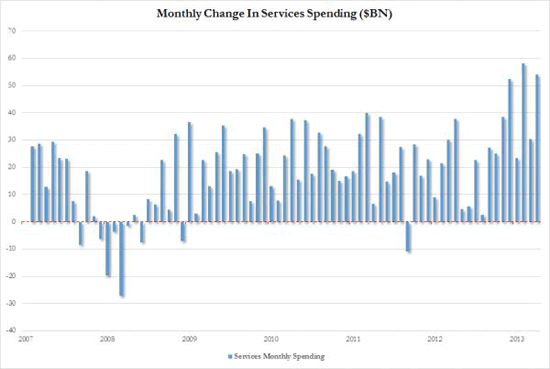

Curiously the increase in goods spending was the single biggest monthly increase also since August 2009. As for services, the systematic increase on spending over the past several months is unmistakable as far more money is allocated toward healthcare, that one major spending category which rescued Q1 GDP.

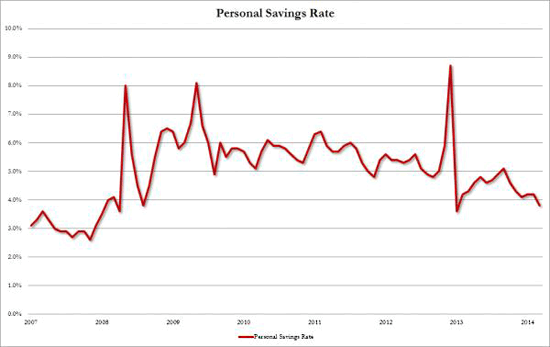

It would appear there was no “harsh weather” effect in March, even though corporations, and not to mention the Q1 GDP, can’t complain fast enough about how horrible the month and the quarter both were. End result: since spending was so much higher than income for one more month, at least according to the bean counters, the savings rate tumbled once more, and at 3.8% (down from 4.2% in February), was the second lowest since before the Lehman failure with the only exception of January 2013 after the withholding tax rule changeover.

So for all those clueless sellside economists who are praying that the March spending spree, funded mostly from savings, will continue into Q2 (because remember March is in Q1, which as we already know had an abysmal 0.1% GDP growth rate), we have one question: where will the money come from to pay for this ongoing spending spree?

And sure, income went up a little, and a few more people did buy a few more fridges and cars, as they undoubtedly always do in March, but the rise in spending has a very solid link to healthcare services, and while that may boost GDP, so do traffic accidents. And those don’t raise the standard of living either. Which leaves me still wondering why Janet Yellen et al “defended” their taper decision with referring to growth and consumer spending, i.e. a recovering economy. I’m wholly in favor of removing the stimulus related distortions from the markets, even if that means applying shock therapy, but must you guys really lie about the reasons you do it? Isn’t people’s confidence worth anything to you? Or do you feel that confidence has been shot anyway?

• Fed Says Economy Has Picked Up As It Trims Bond Buying Further (Bloomberg)

The Federal Reserve said it will keep trimming the pace of asset purchases as the economy shakes off the winter doldrums, putting the central bank on a course to end the unprecedented stimulus program by the close of 2014. Growth “has picked up recently,” the Federal Open Market Committee said today in a statement in Washington, hours after a government report showed gross domestic product barely grew in the first quarter. “Household spending appears to be rising more quickly.” The committee pared monthly asset buying to $45 billion, its fourth straight $10 billion cut, and said further reductions in “measured steps” are likely. At that pace, the quantitative easing program intended to push down borrowing costs for companies and consumers would end in December.

• Growth Freezes Up As US Business Spending, Exports Slump (Bloomberg)

The U.S. economy barely grew in the first quarter as harsh winter weather chilled investment and exports dropped. The expansion stalled even as consumer spending on services rose by the most in 14 years. Gross domestic product grew at a 0.1% annualized rate from January through March, compared with a 2.6% gain in the prior quarter, figures from the Commerce Department showed today in Washington. The median forecast of 83 economists surveyed by Bloomberg called for a 1.2% increase. Household purchases rose at a 3% pace, spurred by utility outlays and spending on health care tied to President Barack Obama’s Affordable Care Act.

The pullback in growth came as snow blanketed much of the eastern half of the country, keeping shoppers from stores, preventing builders from breaking ground and raising costs for companies including United Parcel Service Inc. Gains in retail sales, employment and manufacturing at the end of the quarter indicate the setback will be temporary, so Federal Reserve policy makers meeting today in Washington will probably take little heed. “So much of this is conditioned by that anomalous drop in exports and inventories and by the weather effect, and if anything one expects more of a rebound in the second quarter,” said Samuel Coffin, an economist at UBS Securities LLC in New York, who projected a 0.5% gain in GDP. Coffin called this an “odd day” for Fed policy makers. “I think they’re still tapering. I think they’ll blame this on the weather.”

• If It Wasn’t For Obamacare, Q1 GDP Would Be Negative (Zero Hedge)

Here is a shocker: for all the damnation Obamacare, which according to poll after poll is loathed by a majority of the US population, has gotten if it wasn’t for the (government-mandated) spending surge resulting from Obamacare, which resulted in the biggest jump in Healthcare Services spending in the past quarter in history and added 1.1% to GDP …

… real Q1 GDP (in chained 2009 dollars), which rose only $4.3 billion sequentially to $15,947 billion, would have been a negative 1.0%!

It’s curious how the weather impacted (or rather is used as an excuse to explain) everything but government-mandated healthcare spending in the first quarter. And of course, for all those who correctly point out that mandatory spending on healthcare, also known as malinvestment, took away from spending on every other discretionary item possible, well… you are right.

• Recovery? What Recovery? (Bloomberg)

There’s really not much good to say about this morning’s first-quarter gross domestic product numbers. An annualized growth rate of 0.1% is not so much a growth rate as a rounding error. There are, of course, the standard caveats: These are preliminary numbers, which are notoriously volatile; they may well get revised upward in the coming months. And the lousy winter weather probably depressed retail sales, housing starts and other things that generally contribute to economic growth. But these caveats aren’t really all that cheering. The figures seem quite likely to be revised upward, but quite unlikely to be revised upward to, say, 3% annual growth – a figure that we used to view as solid but not spectacular, rather than hopelessly aspirational.

Relatedly, it’s undoubtedly true that the weather depressed economic output. But it didn’t depress economic output enough to explain these lackluster figures. If economic growth were actually healthy, it shouldn’t be possible to see numbers this low. No, despite the caveats, the fact remains that we seem to be stuck. Six years after the financial crisis, we still haven’t entered anything that could really be called a “recovery.” A recovery would mean some sort of catch-up growth that reabsorbed stranded workers and capital. Instead, we’re barely limping forward, and the most cheerful thing we can say about any of it is that at least we’re no longer falling back.

Weird story developing. I should come back to this.

• Criminal Charges Against Banks Risk Sparking Crisis (Bloomberg)

As U.S. Justice Department prosecutors angle to bring the first criminal charges against global banks since the financial crisis, they’ll have to stare down warnings of uncontainable collateral damage. Stung by lawmakers’ criticism that multi-billion-dollar settlements have done too little to punish Wall Street in the wake of the financial crisis, prosecutors are considering indictments in probes of Credit Suisse Group AG (CSGN) and BNP Paribas, a person familiar with the matter said. Even after talking with financial regulators about ways to mitigate damage — such as ensuring banks keep charters — prosecutors might not fully understand consequences for the market, according to industry lawyers and bankers who are following the case.

Bank clients — including trustees, fiduciaries and pension funds — could be forced to cut ties with a financial institution labeled a criminal enterprise, the lawyers and bankers said, asking not to be named because they weren’t authorized to talk publicly. Counterparties also might think twice before entering into billion-dollar transactions with such firms. Damaging a bank’s business could lead to broader fallout across the financial industry, just as Lehman Brothers Holdings Inc.’s collapse in 2008 prompted investors to withdraw from other firms on concern its exit would set off a wave of losses. Criminal action would have to be handled so that any review of a bank’s charter wouldn’t spook customers or revoke a firm’s license, said Gil Schwartz, a partner at Schwartz & Ballen LLP and a former Federal Reserve lawyer. “The mere threat of requiring a hearing could cause customers to lose confidence in the institution and could cause a run on the bank,” Schwartz said.

• Prosecutors Rarely Charge Banks Since Result Can Be Fatal (Bloomberg)

If the Justice Department follows through on a threat to bring criminal charges against Credit Suisse and BNP Paribasm it would go against years of standard prosecutorial practice. The government rarely charges large banks – or any other corporation – because it usually proves fatal for the company. The 2002 indictment of accounting firm Arthur Andersen put some 85,000 people out of work and created a public relations debacle for the Justice Department that still influences its decision-making, former officials and defense lawyers said. “If you indict a major financial institution, absent orchestrated board-level crimes, it will have ramifications for years,” said Jamie Wareham, a partner at DLA Piper law firm in Washington who stressed he was not commenting on specific firms. “Who pays for that? Customers, shareholders, the community.”

Six years past the financial crisis, U.S. prosecutors and Wall Street regulators have continued to probe the industry as lawmakers and advocacy groups argue that no bank executive has paid the price for helping drive the country into recession. Attorney General Eric Holder added to the furor last year when he told a congressional panel that some banks may have become too large to prosecute. Still, history shows, that has long been the case. In the few instances where banks have pleaded guilty to U.S. criminal charges – the Bank of Credit and Commerce International in 1992 and Washington’s Riggs Bank in 2005 – the firms were already finished.

It’s been bad news for a while now.

• This Is Bad News For US Housing (Yahoo!)

Home prices may be up, but don’t make the mistake of thinking the housing market is strong. The S&P/Case-Shiller Home Price Index of 20 metropolitan areas showed a seasonally-adjusted gain of 0.8% in February from January and 12.9% from the previous year. But, that gain was based on the sale of fewer homes, according to David M. Blitzer, chairman of the committee at S&P Dow Jones Indices which administers the index. He said several factors are pointing to a frail housing market. “Despite continued price gains, most other housing statistics are weak,” Blitzer said in a statement on Tuesday.

“Sales of both new and existing homes are flat to down. The recovery in housing starts, now less than one million units at annual rates, is faltering. Moreover, home prices nationally have not made it back to 2005. Mortgage interest rates, which jumped in May last year and are steady since then, are blamed by some analysts for the weakness. Others cite difficulties in qualifying for loans and concerns about consumer confidence. The result is less demand and fewer homes being built.” Steve Cortes, founder of Veracruz TJM, said Blitzer doesn’t go far enough to describe the state of the housing market. “I think that he’s being too tepid to say that it’s weak,” Cortes said. “I think that it’s very weak to extremely weak.”

Cortes cited recent U.S. Census data showing homeownership rates have fallen to 64.8%, a 19-year low. Though household formations have declined slightly in the past decade, Cortes found it troubling that near-record low interest rates haven’t been enough to encourage more homeownership. That could translate as long-term bad news for homebuilder stocks. “When low rates can’t convince people to buy homes, I think what you have is a structural problem,” Cortes said. “This kind of secular change in the housing market means that housing stocks will do worse from here.”

Wait for regret “numbers” when rates go up.

• Many US Homeowners Regret Buying A House (Yahoo!)

One out of four homeowners admit they wouldn’t buy their home again if they had the chance, according to a recent survey by real estate brokerage Redfin.m The biggest factor contributing to homebuyers’ remorse appeared to be affordability. Nearly one-third of homeowners who reported a household income of less than $100,000 said they were unhappy with their decision. In contrast, just 14% of homeowners who earned more than $100,000 said they were unhappy, according to the survey. Younger homeowners were also more likely to have regrets. About 28% of homeowners under 65 said they regretted buying their home, compared to 14% of senior homeowners.

And one in five homeowners with kids still living at home said they regretted their home purchase as well. Redfin’s findings come around the same time as new home sales have begun to lag in the U.S. Sales of single-family homes fell by 14.5% to an eight-month low in March, with just 384,000 units sold. Experts have blamed slow sales on bad weather, low home inventory, rising mortgage rates, and a rise in vacant homes (homes that are under repair or being rented). Whatever the case, one thing is certain — buyers today are at a distinct disadvantage when it comes to finding a home that meets every point on their checklist.

Core question: how long can you get people to buy cars with savings and plastic?

• U.S. Lost $11.2 Billion in GM Bailout (Bloomberg)

The U.S. Treasury’s bailout fund lost $11.2 billion on the rescue of General Motors with the government’s exit of the largest U.S. automaker, a report said. The total includes $826 million that the Treasury wrote off in March for its remaining claim in old GM, the special inspector general for the Troubled Asset Relief Program said in a report to Congress today. In December, the government had put the loss at about $10.5 billion on its $49.5 billion investment. The Treasury sold its remaining shares in GM in December, signaling the end of Government Motors, as the Detroit-based automaker was derisively labeled by some critics after the U.S. government stepped in with emergency funding in 2008.

Bailouts from the George W. Bush and Barack Obama administrations helped GM avoid liquidation and reorganize in a 2009 bankruptcy that has given new life to the company. “The goal of Treasury’s investment in GM was never to make a profit, but to help save the American auto industry, and by any measure that effort was successful,” Adam Hodge, a Treasury spokesman, said in an e-mail. Buoyed by lower debt, reduced labor costs and a focus on only its strongest brands, GM is emblematic of a revitalized U.S. auto industry. While the government lost money, its exit paved the way for an influx of fresh investor capital.

More public funds at risk. Great risk, given the ugly housing numbers.

• Stress Test Reveals Fannie, Freddie Could Need Another $190 Billion (Bloomberg)

Fannie Mae and Freddie Mac could require an additional bailout of as much as $190 billion in a severe economic downturn, according to the results of stress tests released by the regulator for the U.S.-owned companies. The two mortgage-finance giants, which have already taken $187.5 billion in taxpayer aid since 2008, would need more funds to stay afloat if home prices plummeted in a severe downturn, the Federal Housing Finance Agency said in a report today. The stress tests, mandated by the Dodd-Frank Act, use the same assumptions that the Federal Reserve does in gauging the ability of the nation’s largest banks to withstand a recession.

The results reflect the terms of the companies’ bailout, which require them to send to the Treasury all of their quarterly profits above a minimum net worth threshold. That money, counted as a return on the U.S. investment, prevents them from rebuilding capital or paying down debt to taxpayers. “These results of the severely adverse scenario are not surprising given the company’s limited capital,” Fannie Mae Senior Vice President Kelli Parsons said in a statement. “Under the terms of the senior preferred stock purchase agreement, Fannie Mae is not permitted to retain capital to withstand a sudden, unexpected economic shock of the magnitude required by the stress test.” The companies would need $84 billion to $190 billion by the end of 2015 in the worst circumstances, depending on accounting assumptions, the tests showed.

This will get worse.

• Japan’s Consumption Hangover Begins as Car Sales Decline (Bloomberg)

Vehicle deliveries last month in Asia’s second-largest auto market fell to the lowest since December 2012 after Japan raised its consumption tax for the first time 17 years, according to industry figures released today. In the run-up to the levy being increased 3 percentage points to 8% on April 1, sales had surged for seven straight months. More broadly, the figures may foreshadow the extent of the consumer backlash resulting from the higher taxes Prime Minister Shinzo Abe imposed to counter the world’s biggest debt burden. Economists estimate that this quarter, Japan will see its biggest economic contraction since the earthquake and tsunami that ravaged the country three years ago.

“Any sane person was buying big-ticket items in February or March rather than in April,” Martin Schulz, an economist at Fujitsu Research Institute in Tokyo, said by telephone. “The Japanese carmakers will have to prove how much they really can work this very difficult market.” Total sales fell 5.5% to 345,226, according to the Japan Automobile Dealers Association and Japan Mini Vehicle Association. The slump may deepen this month as poor weather prevented some customers, who placed orders before the sales tax increase, from getting their cars delivered until April.

Tokyo keeps pretending to have unlimited funds. It doesn’t.

• Japan Props Up More Power Utilities to Avoid Rate Increases (Bloomberg)

Japan moved to prop up another two unprofitable power companies after they posted losses of 159 billion yen ($1.6 billion), underscoring how the idling of atomic reactors is forcing losses on most of the nation’s utilities. Kyushu Electric Power and Hokkaido Electric Power will receive a combined 150 billion yen from a state-owned Japanese bank, joining Tokyo Electric Power Co., operator of the wrecked Fukushima plant, on the list of utilities to secure government aid. The investment comes as the government seeks to forestall electricity rate increases by utilities that could hinder the country’s fragile economic recovery. The investment from the Development Bank of Japan Inc. would help the utilities offset fossil fuel costs that have soared since the 2011 accident at the Fukushima Dai-Ichi nuclear plant idled their atomic plants.

Weakness is the proper term for China.

• China April Manufacturing Data Add to Signs of Weakness (Bloomberg)

China’s manufacturing grew less than analysts estimated in April, highlighting weakness in the economy from exports to construction that could force extra government measures to support growth. The Purchasing Managers’ Index was at 50.4, the National Bureau of Statistics and China Federation of Logistics and Purchasing said today in Beijing, less than the 50.5 median estimate of 38 analysts in a Bloomberg News survey. March’s reading was 50.3, with numbers above 50 signaling expansion.

Today’s data showed weakness in export orders that may make it harder for Premier Li Keqiang to avoid a deeper slowdown after property construction plunged in the first quarter and economic growth cooled. China’s gross domestic product is projected to expand 7.3% this year, the weakest pace since 1990, as the government reins in credit. “We continue to expect growth to slow,” said Zhang Zhiwei, chief China economist at Nomura Holdings Inc. in Hong Kong. “We expect the government to loosen fiscal and monetary policies in the next few months,” he said, adding that banks’ reserve ratios may be reduced in May or June and then again in the third quarter.

Cutting reserve ratios for banks that have very questionable leding standards may not be the brightest idea.

• China Plans Measures to Boost Trade After Unexpected Drop (Bloomberg)

China will implement measures to stabilize the country’s “severe and complicated” foreign-trade situation, Premier Li Keqiang said. “Arduous efforts” are needed to ensure the government meets its full-year trade target, Li said during a State Council meeting yesterday, according to a statement posted on the central government’s website. March data showed exports and imports unexpectedly dropped. The government will accelerate the development of cross-border e-commerce, further streamline trade processes, reduce the types of merchandise that require inspection, improve trade financing and encourage trade in services to support growth, according to the statement.

China’s government has rolled out some economic support measures, such as reserve-ratio cuts for rural banks and faster spending on railways, while pledging to avoid broader stimulus for now. Li’s government is chasing a growth target of about 7.5% for the year, compared with expansion in the first quarter of 7.4%. A manufacturing index to be released later today will give the latest reading on the strength of the world’s second-biggest economy. While exports fell 6.6% in March from a year earlier, the customs administration said the drop was partly caused by distortions in previous data.

What, not doing so well, mates?

• Australian Asset Sales, Cuts to Welfare Urged to Lower Debt (Bloomberg)

Australia should privatize its rail and postal assets and cut family welfare payments as Prime Minister Tony Abbott seeks to meet election pledges to rein in record public debt, a report ordered by his government advised. Australian Rail Track Corp. and Australian Postal Corp. are among 10 bodies that should be sold, the National Commission of Audit said in Canberra today as it identified measures that could save as much as A$70 billion ($65 billion) a year within a decade. Among recommendations, it called for the pension age to be raised, payments for doctor visits, and cuts to the number of government bodies. “Australia confronts a substantial budgetary challenge,” the report said. “The fiscal situation is far weaker than it should be and the long-term outlook is ominous due to an unsustainable increase in expenditure commitments.”

Abbott and Treasurer Joe Hockey, preparing the Liberal-National coalition’s May 13 budget, face a A$123 billion shortfall for the four years through June 2017. Fiscal austerity comes at the same time mining companies are cutting back on projects, threatening to damp a recovery in domestic demand and pressuring the central bank to maintain low borrowing costs. In the next decade, Australia should adopt fiscal rules including reaching a budget surplus of 1% of gross domestic product, substantially reducing net debt and keeping tax receipts below 24% of GDP, the commission said today.

Looking good in borrowed clothes.

• Polish $300 Billion Aid Package Hides EU Expansion Flaws (Bloomberg)

The pristine metal and glass laboratories and landscaped lawns of the Olsztyn Science and Technology Park are a shiny emblem of Poland’s transition from communist state to European Union member, at least on appearance. Paid for with EU aid, the $23 million development 200 kilometers (124 miles) north of Warsaw opened in November to attract startup companies. Yet with two smaller science parks already close to the northeastern Polish town, half of the space remains empty in a region with among the highest poverty rates in Europe and where more people are leaving than arriving.

“The EU certainly helps fulfill Polish dreams, even the completely unrealistic and costly ones,” said Sylwia Tymicka, 40, who set up her accounting and business advice company in Olsztyn just as Poland joined the EU on May 1, 2004. “That often leads to spending for spending’s sake. It doesn’t correspond to basic needs.” As Poles mark 10 years of absorption into the world’s biggest single market, the fault lines remain. Halfway through a 229 billion-euro ($317 billion) EU aid package, more than the entire Marshall Plan for postwar Europe in today’s dollars, the money kept the Polish economy growing when the rest of the continent went into recession. The new business parks, highways, soccer stadiums and airport terminals also mask how for many Poles the passage to prosperity is still to come, with 17% of families of four living on less than $400 a month.

Not shale, but land speculation. There’s your driver.

• Shale Revolution Luring Trading Houses Into US Energy Assets (Bloomberg)

Merchants from Vitol Group, the largest independent oil trader, to a company backed by billionaire Paul Tudor Jones are amassing physical energy assets in the U.S. at an unprecedented rate as shale output revives stagnant fuels markets. Castleton Commodities International LLC, financed in part by hedge fund managers Tudor Jones and Glenn Dubin, acquired Texas gas wells in February. Mercuria Energy Group Ltd. is buying JPMorgan’s physical commodities business. Vitol and Trafigura AG are helping build oil pipelines, and Freepoint Commodities LLC is investing in offshore production. Of the $1 billion Trafigura has invested in the U.S., the majority was spent in the past five years, the company said.

“International trading companies have been buying assets all along, just not so much in America,” JP Fjeld-Hansen, managing director of Musket Corp., a commodity supplier and trading company in Houston, said April 29. “Now we’ve had this renaissance of U.S. energy markets and they’re bringing their capital here.” The world’s biggest commodity merchants, most privately owned, are buying or building more physical assets in the U.S. as drilling technologies unleash record oil and gas volumes from shale, creating arbitrage opportunities between regions. They’re also stepping in as banks including Barclays, JPMorgan Chase and Morgan Stanley reduce their commodity businesses as returns decline and regulatory scrutiny intensifies.

“Companies are realizing if you can understand the physical flows, there’s a value chain from source all the way through to consumption here,” Gary Morsches, managing director for global energy at CME Group in Chicago, said in an interview at Bloomberg’s Houston office this month. “You don’t care whether prices go up or down because you know you can arb 50 cents out of this because of your supply arrangements.”

Yay! More gambling!

• Drillers Hooked on Oil Bolster Goldman $6 Gas Outlook (Bloomberg)

U.S. energy producers are sticking with oil over natural gas, boosting Goldman Sachs Group Inc.’s view that gas at a six-year high may still have room to rally. Drillers switched their focus to oil in 2012, when gas futures dropped to a decade low. While gas has more than doubled since then, surging this year as frigid weather eroded stockpiles, crude remains more profitable, according to Loomis, Sayles & Co., which manages $200 billion. Goldman Sachs said this month that gas may have to trade between $5.75 and $6.50 per million British thermal units to spur a supply increase, up at least 19% from current prices. Chesapeake Energy, the second-largest U.S. gas producer, estimated that its output in 2014 will grow at half the rate of the company’s oil production.

“You need either $6 gas or oil at $70 a barrel for drilling to switch back to natural gas,” Salil Sharma, vice president and portfolio manager at Loomis, Sayles in Boston, said in an April 28 phone interview. “The industry has both the resources and the ability to fill the storage deficit. It’s just a question of at what price.” Natural gas for June slipped 1.6 cents to settle at $4.815 per million Btu today on the New York Mercantile Exchange. Futures have gained 14% in 2014 and are trading at the highest level for this time of year since 2008. Prices surged to $6.493 on Feb. 24, the highest intraday price since Dec. 2, 2008.

• How US State Dept. Exposes Itself To Propaganda (RT Editor-in-Chief)

Mr. Richard Stengel, the US Under Secretary of State who wrote such an impassioned “takedown” of RT in the US State Department blog, did get one thing right. Propaganda IS the deliberate dissemination of information that you know to be false or misguided. And boy, does Mr. Stengel make a valiant attempt at propagandizing, because anyone would be hard-pressed to cram more falsehoods into a hundred words:

“From assertions that peaceful protesters hired snipers to repeated allegations that Kiev is beset by violence, fascism and anti-Semitism, these are lies falsely presented as news.” (…) “Consider the way RT manipulated a leaked telephone call involving former Ukrainian Prime Minister Yulia Tymoshenko. Through selective editing, the network made it appear that Tymoshenko advocated violence against Russia.” Or the constant reference to any Ukrainian opposed to a Russian takeover of the country as a “terrorist.” “Or the unquestioning repetition of the ludicrous assertion last week that the United States has invested $5 billion in regime change in Ukraine. These are not facts, and they are not opinions. They are false claims, and when propaganda poses as news it creates real dangers and gives a green light to violence.”

I thought that was funny comment from Rogozin.

• US May Need Trampoline To Get Into Space (ITWire)

A Russian official stated that if U.S. sanctions continue to be directed at Russia due to its activities in the Ukraine, then the United States might try using a trampoline to get its astronauts to the International Space Station. Russian deputy prime minister Dmitry Rogozin used his Twitter account to state, “After analyzing the sanctions against our space industry, I suggest to the USA to bring their astronauts to the International Space Station using a trampoline.” The NBC News article Trampoline to Space? Russian Official Tells NASA to Take a Flying Leap, by Alan Boyle, should be read to learn more about this interesting way to launch astronauts into low-Earth orbit (LEO).

In fact, one of the Twitter responses to Rogozin was highlighted by Boyle. Douglas Burke (@doug_burke) stated, “@planet4589 how come you never mentioned trampolines as an effective space launch method? https://www.nbcnews.com/storyline/ukraine-crisis/trampoline-space-russian-official-tells-nasa-take-flying-leap-n92616 …” And, Jonathan McDowell (@planet4589) tweets, “@doug_burke Back of the envelope calculation suggests you may need to dig 50 km hole for trampoline to stretch into, jump on it from plane” Then, Elon Musk (@elonmusk), the CEO and founder of SpaceX, responds with, “Sounds like this might be a good time to unveil the new Dragon Mk 2 spaceship that @SpaceX has been working on w @NASA. No trampoline needed.”

And we’re off!!

• BP Pipeline Sprays ‘Oily Mist’ Over 33 Acres Of Alaskan Tundra (RT)

Alaska state officials confirmed Wednesday that an oily mist sprung from a compromised oil pipeline and sprayed into the wind without stopping for at least two hours, covering 33 acres of the frozen snow field in the oil well’s vicinity. The discovery was at the BP-owned Prudhoe oil field on Alaska’s North Slope, the northernmost region of the state where a number of profitable oil fields sit beneath the tundra. The Alaska Department of Environmental Conservation (DEC) revealed that BP officials found the mist during a routine inspection on Monday. Initial reports said that 27 acres had been covered, although that figure was updated later on Wednesday.

The cause is still under investigation, according to the Associated Press, but officials know that the mist was made up of a mixture of gas, crude oil, and water. They also reported that while the noxious mist was distributed over such a wide area by 30 mph winds, no wildlife was impacted. BP spokeswoman Dawn Patience said the company is “still assessing repairs” and will soon know what, if any, long-term effects the spill could have. The Prudhoe Bay region, like elsewhere in the North Slope, is home to a great number of migratory birds and caribou, as well as other animals, such as a massive porcupine herd. Clean-up efforts are expected to be complete before birds pass through the region again in the coming weeks.

You got to hope this won’t get out of hand, like with highly contagious diseases, or you friends and family will start dropping like flies.

• ‘Devastating’ Implications Of Drug-Resistant Superbugs Now A Reality (RT)

Deadly antibiotic-resistant superbugs are a ‘serious threat’ to world health and no longer merely a prediction for the future, according to a new report by the World Health Organization (WHO). Previously treatable illnesses can now once again kill. “The world is headed for a post-antibiotic era, in which common infections and minor injuries which have been treatable for decades can once again kill,” said Keiji Fukuda, the WHO’s assistant director-general for health security. The new resistance has the capacity to strike anyone, of any age, on a global scale according to the WHO report, entitled ‘Antimicrobial resistance: global report on surveillance’, released on Wednesday. It’s the organization’s first ever global report on antibiotic resistance. “The implications will be devastating,” stated Fukuda.

Data spanning 114 different countries was utilized in the study and superbug resistance was found in all regions of the world. The infections were even resistant to a class of antibiotic which fall into a category known as carbapenems – a broad-spectrum beta-lactam antibiotic considered one of the last resorts in the treatment of infectious bacterial diseases. Resistance to last-resort treatments for potentially deadly hospital infections caused by the common Klebsiella pneumoniae bacteria have been found in all parts of the world, as has resistance to the most common drugs to treat urinary tract infections caused by E.coli, as well as last resort gonorrhea treatment in 10 developed countries – among them the UK.

Home › Forums › Debt Rattle May 1 2014: How America Grows Its Way Into Poverty