Arthur Rothstein President Roosevelt tours drought area, Bismarck, North Dakota August 1936

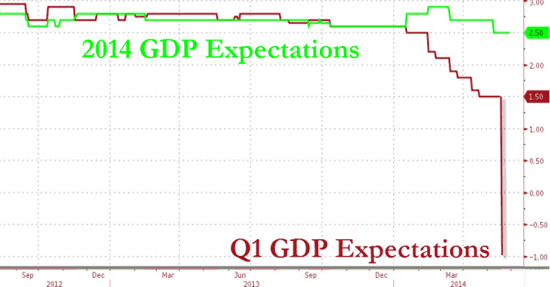

No, the nonsense will not stop, and neither will the torture. At least 5 years into the alleged recovery, US GDP contracted by -1% in Q1 2014, down from last month’s estimate of a 0.1% growth. Why? It’s still the weather, say the “experts”. But worry not, because now the sun will shine and we will reach the promised land our deity and his high priests laid out before us. Bloomberg has gathered this bouquet of whatever:

U.S. Economy Shrank for First Time Since 2011

A pickup in receipts at retailers, stronger manufacturing and faster job growth indicate the first-quarter setback will prove temporary as pent-up demand is unleashed. Federal Reserve policy makers said at their April meeting that the economy has strengthened after adverse weather took its toll. “We do have business investment picking up, the household sector is in pretty good shape with the labor market improving a bit,” Sam Coffin, an economist at UBS Securities LLC in New York, said before the report. “That combination of slightly braver businesses, slightly faster job growth, should add up to broader, better growth.” [..]

Wait. A pick-up at retailers? Retail was down, way down in Q1, the most in 13 years. Faster job growth? Excuse me? Pent-up demand? Where? People spent their sparse cash on heating fuel. And no, the proper expression would be: “That combination of slightly braver businesses (Geez!), slightly faster job growth, should HAVE ADDED up to broader, better growth.” And it didn’t, did it?

Companies boosted stockpiles by $49 billion in the first quarter, less than the $111.7 billion in the final three months of 2013. Inventories subtracted 1.62 percentage points from GDP from January to March, the most since the fourth quarter 2012. Slower inventory accumulation may encourage factories to step up production should demand accelerate.

“Growth in key indicators such as employment, income, and consumer spending have recently begun to improve from weather-affected levels earlier in the year,” Robert Niblock, the chief executive officer at home-improvement retailer Lowe’s, said on a May 21 earnings call. “Performance has already improved in May, and continued improvement in the macroeconomic landscape and the consumer sentiment” help give the chain a positive outlook in 2014. The economy in the second quarter will expand at a 3.5% rate, according to the median projection of 72 economists surveyed by Bloomberg from May 2 to May 7.

“Slower inventory accumulation may encourage factories to step up production should demand accelerate.” Or it may not, because retailers know demand is dead. Take your pick. What useless drivel.

Non-residential investment dropped at a 1.6% annualized rate. Companies reduced their spending on structures at a 7.5% pace, the biggest decrease in a year. Spending for equipment fell 3.1%, the most since the third quarter 2012. Consumer purchases, which account for about 70% of the economy, increased at a 3.1% annualized rate in the first quarter. The gain, which added 2.1 percentage points to GDP, was more than the previous estimate of 3%. The increase reflected a stronger pace of spending on services, including utilities as colder winter weather prompted Americans to adjust their thermostats, than the previous three months.

Hello! People spent more on keeping warm. That’s all the positives that are on offer. And they didn’t have that extra cash lying around somewhere either, so what they spent on heating they won’t spend again through some pent-up demand on something else, because they already spent it! So exactly how is that positive, and how positive is it exactly? Let me put it like this: if consumer purchases (70% of GDP) were up 3.1% annually in Q1, shouldn’t you guys be looking at how totally disastrous the rest of the economy was to still print a -1% rate for Q1, instead of cheerleading something that doesn’t even exist?

Today’s report offered a first look at corporate profits. Earnings fell 9.8% in the first quarter from the previous three months, and declined 3% from the same period last year. Exports declined at a 6% rate in the first quarter, while imports rose as trade subtracted 0.95 percentage point from GDP, the most since the second quarter 2010.

Less exports, less imports, less earnings and corporate profits down. Is that how you spell recovery these days? It’s all snow and ice? Let’s turn to Tyler Durden’s take:

US Economy Shrank By 1% In The First Quarter: First Contraction Since 2011

Weather 1 – Quantitative Easing 0. Joking aside, while the realization that nobody can fight the Fed except a cold weather front, is quite profound, in the first quarter GDP “grew” by a revised -1.0%, down from the +0.1% first estimate, and well below the -0.5% expected, confirming that while economists may suck as economists, they are absolutely horrible as weathermen. This was the worst print since the -1.3% recorded in Q1 2011. Bottom line: for whatever reason, in Q1 the US economy contracted not only for the first time in three years, but at the fastest pace since Q1 of 2011. It probably snowed then too. Some highlights:

- Personal consumption was largely unchanged at 2.09% from 2.04% in the first estimate and down from 2.22% in Q4. Considering the US consumer savings rate has tumbled to post crisis lows at the end of Q1, don’t expect much upside from this number.

- Fixed investment also was largely unchanged, subtracting another 0.36% from growth, a little less than the -0.44% in the first estimate and well below the 0.43% contribution in Q4.

- Net trade, or the combination of exports and imports, declined from -0.83% to -0.95%, far below the positive boost of 0.99% in Q4.

- The biggest hit was in the change in private inventories, which tumbled from -0.57% in the first revision to a whopping -1.62%: the biggest contraction in the series since the revised -2.0% print recorded in Q4 2012.

- Finally, government subtracted another -0.15% from Q1 growth, more than the -0.09% initially expected.

So there you have the priced to perfection New Normal growth (inclusive of “harsh weather”, which obviously has to be excluded for non-GAAP GDP purposes), which also now means that in the rest of the year quarterly GDP miraculously has to grow at just shy of 5% in the second half for the Fed to hit the “central tendency” target of 2.8%-3.0%.

And now we await for stocks to soar on this latest empirical proof that central planning does not work for anyone but the 1%.

And whaddaya know, they did:

S&P 500 Pushes To All Time Highs On First Economic Contraction In Three Years

What do you do when GDP prints twice as bad as expected… buy stawks! And so it is that -1.0% GDP print for Q1 has been greeted with a buying drive in S&P 500 futures to lift it back near all-time record highs this morning. Gold, silver, and the USD are also rising.. and bond yields are rising very modestly.

There’s so much nonsense in all this it makes you wish that, while everyone can accept the government will lie as long and as much as it can (and is still forced to take a -1% number “lying” down), at least Bloomberg would make an attempt at actual reporting. Instead, something tells me the media are just getting started. Still, it’s of course absolute nonsense to contend that US retailers hit their worst patch in 13 years because it snowed. Wal-Mart, Staples and Target simply hit disastrous numbers in Q1, and less snow won’t change that.

The bottom line remains that 5 years into the “recovery”, there is no recovery to be seen other than in the S&P, and that is fully due to QE, which won’t last forever, a truth that will exert a heavy downward pressure on the future of America. Just not on the upper echelons. But other than them, Americans, and America, are getting progressively poorer day by day. That is the new normal. And that is what this GDP number tells you. It’s not an aberration, it’s a trend. Despite many trillions worth of QE, recovery has been elusive for 5 years now. Why do you think that is?

• U.S. Q1 Economy Shrank by -1%, First Time Since 2011 (Bloomberg)

The economy in the U.S. contracted for the first time in three years from January through March as companies added to inventories at a slower pace and curtailed investment. Gross domestic product fell at a 1% annualized rate in the first quarter, a bigger decline than projected, after a previously reported 0.1 percent gain, the Commerce Department said today in Washington. The last time the economy shrank was in the same three months of 2011. The median forecast of economists surveyed by Bloomberg called for a 0.5% drop. A pickup in receipts at retailers, stronger manufacturing and faster job growth indicate the first-quarter setback will prove temporary as pent-up demand is unleashed. Federal Reserve policy makers said at their April meeting that the economy has strengthened after adverse weather took its toll.

Ouch!

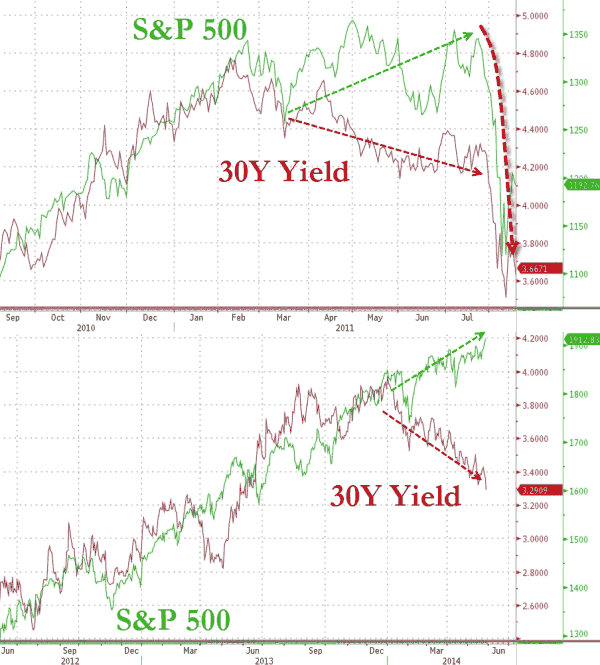

• What Happened The Last Time Bonds & Stocks Were So Disconnected (Zero Hedge)

Presented with little comment aside to note that bond shorts have not covered (in fact they added last week) and the last time we got this disconnected (with negative breadth in stocks and super low volatility) – things went south very quickly…

To be expected.

• Japan Retail Sales Fall at Record 13.7% Pace After Tax Increase (Bloomberg)

Japan’s retail sales dropped at the fastest pace in at least 14 years last month after the first consumption-tax increase since 1997 depressed consumer spending. Sales in April declined 13.7% from the previous month, the trade ministry reported today, more than the median forecast of an 11.7% decline in a Bloomberg News survey of 11 economists. The drop-off follows a consumer splurge ahead of the April 1 tax increase, and highlights the task Prime Minister Shinzo Abe faces in steering the nation through a forecast contraction this quarter. The focus now is whether the economy will rebound enough for the government to further raise the levy as planned. The economy is forecast to shrink an annualized 3.4% this quarter after 5.9% growth in the first three months of the year. Even so, gauges of business spending to consumer sentiment indicate the setback from the three percentage point tax increase could be fleeting.

Desperation does that to people.

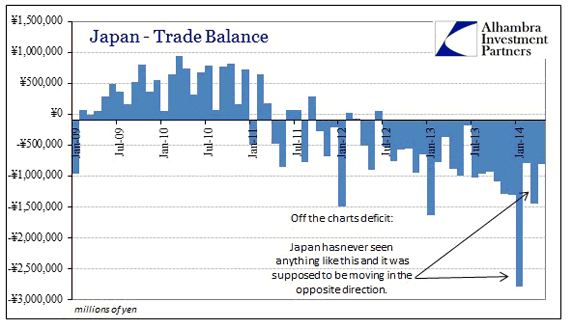

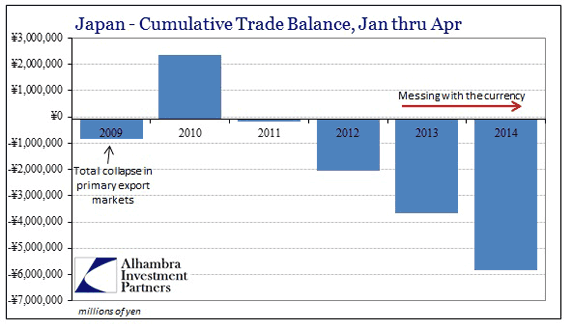

• Abenomics Has Wiped Out Japan’s Trade Accounts (Alhambra)

The running narrative all over the developed world is temporary factors. In the US it is weather-related, while Europe is seized by not enough euphoria (more on that later), and Japan by the tax increase attempt at fiscal responsibility. In the Japanese case, as it relates to the ever-important trade balance, the record debilitation in the first quarter under an incomprehensible surge in imports was explained as a demand factor. As Japanese consumers and businesses splurged ahead of the tax change, it was assumed that “demand” brought forward importation.

If that was the case, and it is far more palatable to the optimistic view, than we should have seen a dramatic decline in importation in April to net out such a temporary skew. Like the netted weather difference in US factors, that simply has not happened. Importation growth did taper in April, but the net merchandise deficit was about even with April 2013. If the short-term burst narrative was valid, the trade imbalance in April 2014 should have been far, far more favorable.

The fact that it was not reinforces the counter notion that it is not temporary tax change behavior that destroyed the Japanese trade advantage (after the tsunami in 2011 severely damaged it). Rather, it is becoming increasingly clear that Abenomics has heralded a structural change in the exact opposite manner as estimated, planned and advertised. The idea of currency devaluation as a “stimulus” is as old as currency, but the modern financialized affair is distinctly different than even when floating currencies were championed by Milton Friedman’s excitement over central bank control and assumed precision. Again, the assumption of a closed system is the primary fatal flaw. In the case of Japan, we see this most clearly in its trade data with Asia, a geography Japan Inc. dominated not so long ago.

Probably. That would strangle millions.

• BOE Policymaker: Interest Rate Rise ‘Sooner Rather Than Later’ (Guardian)

The chances of an increase in interest rates before the end of 2014 moved a significant step closer on Wednesday night when one of the Bank of England’s key policymakers said a rise in the cost of borrowing should happen “sooner rather than later”. In a sign that Threadneedle Street’s unanimous line on keeping interest rates at 0.5% is at risk of breaking down, monetary policy committee (M%) member Martin Weale said too long a delay would eventually mean sharper and more painful tightening of policy. “If you want to have baby steps you do have to start sooner,” he told the Financial Times. “The question is: how close are we getting to ‘soon’? Of course we can never be sure, but the economy … has sustained fairly rapid growth in demand. “So I’m having to ask the question – and the answer is less definite than it was six months ago – ‘where do I think the interest rate should be at the moment?'”

The Bank has held interest rates at 0.5% – their lowest on record – for more than five years and until now the City has expected no change in borrowing costs until the first half of 2015. But Weale’s comments are likely to prompt speculation that faster-than-expected growth and evidence of bubble-like conditions in London’s property market will lead to the Bank moving during the autumn. Weale – one of the four independently appointed M% members – said he saw no immediate need for a rate rise but said the Bank should not wait too long if it wanted to avoid a sudden lurch upwards. Weale said he thought “we can wait a bit longer. How long that ‘bit longer’ will be I’m not sure, but the best judgment I can have is that it’s not so urgent it needs doing now.”

This guy’s got it.

• Middle Classes To Disappear In Next 30 Years: UK Government Adviser (Telegraph)

The middle classes will die out within 30 years because of rising property prices, which will rob today’s children of their dreams, an economist has warned. David Boyle, a government advisor and fellow of the New Economics Foundation think-tank, said that youngsters can no longer expect the same level of affluence as their parents. Speaking at the Hay Festival he warned that Britain will be left with a ‘tiny elite and a huge sprawling proletariat’ who have no chance of ‘clawing their way out of a hand-to-mouth existence. He predicted that the average house price will reach £1.2 million by 2045, putting a home beyond the range of most people as wages fail to keep up with huge increases.

Boyle said that the traditional middle classes will need three or four jobs just to be able to pay soaring rents. People will no longer have the space or time to pursue cultural interested. And he blamed bankers bonuses for artificially inflating the property market. “The really scary thing is if in the next 30 years house prices rise as much as they have done in the last 30 years then the average house in Britain will cost £1.2 million,” he said. “We cheerled the rise of property prices not realising that it would destroy, if not our own lives, but the lives of our children. “The place where this is heading is a strange society with a tiny elite and a long struggling, straggling line which is the rest of us, a new proletariat, who will be in hock to Landlord PLC. “We won’t own our own homes, we won’t be able to afford it.

“It will constrain our dreams and constrain the dreams of our children. It’s a new kind of economy where there are no middle classes at all. “Nobody in society will have the kind of space in their lives, space in their homes, space in their careers for any kind of culture at all, because we will be having three or four jobs to make ends meet.” “I think will impoverish society, make it more intolerant and make it more difficult to live.” [Boyle] suggests a ‘parallel’ housing market were new homes were sold at the initial price for 100 years. He predicted that without such a radical solution, mortgages will be inherited and only be paid off by the grandchildren of the original buyer. [..] “I think if there is no place in the middle that anywhere can go to claw their way out of desperate hand to mouth existence, and the precariat, then that condemns us all to a precarious existence because there is no ladder.”

Hopeful?!

• Unemployment Rising in Germany and France (Guardian)

Unemployment is rising in Europe’s two largest economies, with a shock jump in Germany and a new record high in France, according to the latest figures. The number of unemployed people in Germany rose unexpectedly by 24,000 to 2.905 million in May. It was the biggest monthly increase since April 2009, and a long way off economist’s expectations of a 15,000 decrease. Economists said the drop could partly be explained by the weather, with a loss of fewer seasonal jobs during a milder than usual winter.

Christian Schulz, senior economist at Berenberg, said: “The rise in unemployment by 24,000 in May is likely a consequence of the usual spring upturn turning out weaker than in normal years because the downturn this winter had been less pronounced due to the mild weather.” Despite the rise in unemployment numbers, the jobless rate was unchanged in May at 6.7%, and Schulz said Germany’s labour market “remains on a strong positive trend despite the slight May setback”. Meanwhile, the latest data from the French labour market showed that the jobless total rose by 14,800 in April to a new record high of 3.364m, piling further pressure on the embattled president François Hollande. Economists had predicted a smaller rise of around 5,500.

Less supply, less velocity.

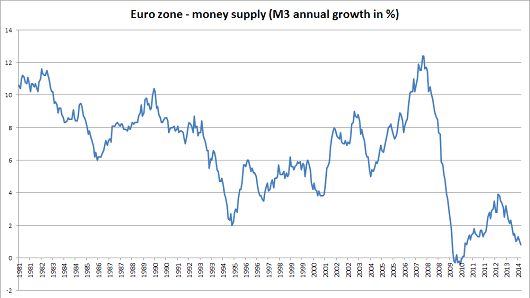

• Eurozone M3 Growth Falters (CNBC)

The European Central Bank published further data Wednesday that shows a continued reluctance by banks to lend cash to businesses – statistics that could prompt its governing council to act next week. Annual growth in M3 – the general measure of cash in the economy – has barely flickered above 1% in recent months. During the boom times of 2007 it was closer to 12%. The latest figures showed that annual growth rate decreased to 0.8% in April, from 1% in March. This is far below the ECB’s old reference rate of 4.5%. ECB President Mario Draghi warned on Monday that credit constraints were putting a brake on the recovery in stressed countries. Banks still rebalancing after the sovereign debt crisis have shown little interest in lending to the wider economy, curbing investment and wage growth.

“Another soft report,” Claus Vistesen, an economist at Pantheon Macroeconomics, said of the latest figures. He said in a research note he believes the message is getting more negative for Draghi. “The drop in M3 growth to below 1% year-over-year probably means that the central bank is losing patience fast,” he said. “The likelihood of the ECB acting next week to spur credit demand has increased.” Draghi has been increasingly vocal about the policy tools available to him when the governing council meets next week. A speech he delivered in Portugal on Monday left some analysts with the belief that he would go further than a cut in interest rates and would pump liquidity into the economy via some sort of refinancing plan.

Please, France, leave and save the rest from Brussels..

• Europe Has An Even Bigger Crisis On Its Hands Than A British Exit (AEP)

It is a fair bet that EU leaders would search for an amicable formula, letting Britain go its own way while remaining a semi-detached or merely titular member of the EU. Let us call it the Holy Roman Empire solution. Yet Britain is the least of their problems. The much greater shock is the “Séisme” in France, as Le Figaro calls it, where Marine Le Pen’s Front National swept 73 electoral departments, while President Francois Hollande’s socialists were reduced to two. Mr Hollande’s address to the nation on Monday night was mournful. He had no answers beyond a few pro-forma utterings about “growth, jobs and investment”, instantly undercut by his vow to press on doggedly with the same contractionary policies that led to disaster. His premier, Manuel Valls, even had to announce that the president would see out his five-year term, as if this were already in doubt.

It is widely claimed that the Front is eurosceptic only on the surface. Perhaps, but when I asked Mrs Le Pen what she would do on her first day in office if she ever reached the Elysee Palace, her reply was trenchant. She would instruct the French Treasury to draft plans for the immediate restoration of the franc, that great symbol of emancipation from the English occupation (franc des Anglais). She vowed to confront Europe’s leaders with a stark choice at their first meeting: either to work with France for a “sortie concertee” or coordinated EMU break-up, or resist and let “financial Armageddon” run its course. “The euro ceases to exist the moment that France leaves, and that is our incredible strength. What are they going to do, send in tanks?” she said.

She said there can be no compromise with monetary union, deeming it impossible to remain a self-governing nation within the structures of EMU, and impossible to carry out the reflation policies necessary to defeat the economic slump. “The euro blocks all economic decisions. France is not a country that can accept tutelage from Brussels. We have succumbed to a spirit of slavery,” she said. The EU authorities are now in a near hopeless situation. The logic of EMU is a further erosion of nation states. The “Two Pack”, “Six Pack” and “Fiscal Compact” are all coming into force, and national regulators are losing control over their banking systems. The euro will inevitably lurch from crisis to crisis without some form of fiscal union and debt pooling. Yet voters have just let forth a primordial scream against any further transfers of power.

We effectively have a two caste system.

• Rich Saving More As Poorest Earn Less Than They Spend (Guardian)

The richest 20% of the population in Britain will have, on average, the spare sum of £18,680 to put into their savings this year, while the poorest 20% will spend £1,910 more than they earn, latest figures suggest. In research published this Thursday, the Post Office said saving was still being driven by the wealthiest people while lower earners were suffering a debt crisis. According to the Centre for Economics and Business Research, which undertook the analysis, this trend has been happening for the past 12 years. The poorest 40% of the population have spent more than they have earned over this period, in contrast to the top 40% of earners who had money to save every year. Even during the financial crisis of 2007-2008 those in the highest income brackets had enough disposable income to increase the amount they saved annually.

By contrast, the rise of payday lenders in Britain’s “Wonga economy” symbolised the squeeze on living standards faced by ordinary families, the report says. Henk Van Hulle, head of savings and investments at the Post Office, said: “These figures are incredibly worrying. While the UK’s highest earners continue to account for the majority of savings, the poorest in our society are actually spending more than they earn.” Despite the economy’s “green shoots” the poorest 20% would continue to spend more than they earned, though the researchers forecast that the figure would fall to £1,053 by 2018, based on average incomes and spending patterns. Van Hulle said: “Even with indicators of improvement we are still in the middle of a significant crisis for the UK’s poorest people who are sinking further into debt and unable to save.”

• Real Estate The Biggest Macro Risk China Faces (CNBC)

China’s slowing property market poses the most substantial macro risk to its economy in the coming quarters, analysts at JP Morgan said. If real estate investment were to slow another 5%, it could shave 0.6 percentage points from China’s already-flagging gross domestic product growth rate, according JP Morgan analysts. However, the risk of an actual house-price collapse remains limited as the authorities still have room for policy adjustment, they added. “A housing market adjustment may pose the biggest macro risk in China in the coming quarters, mainly via a slowdown in real estate investment and a decline in land sale revenues,” the analysts said.

China’s property market has turned a corner this year after government-imposed restrictions successfully cooled the previously frothy market. After a bumper 2013 home sales in the first four months of 2014 fell 9.9% in value terms versus a 26.6% rise in 2013, JP Morgan’s data showed. Meanwhile, home inventory in China’s ten largest cities increased from 10 months’ sales at the beginning of the year to 17.7 months in April. Furthermore, the number of cities that reported price declines in April rose to 45 out of 100 from 37 out of 100 in March, the most since June 2012.

Shilling part 3.

• Free Toasters for China’s Depositors? (A. Gary Shilling)

The easiest way to curb — even eliminate — the shadow banks is to deregulate interest rates and erase those institutions’ competitive advantage. If inefficient state-owned enterprises were also privatized, they wouldn’t need to borrow at below-market rates and would lose their political and competitive advantages over smaller businesses. Putting all financial institutions under the same regulatory framework would solve a lot of problems, but powerful state-owned enterprises are resisting vigorously. Still, some of these changes are in the offing. Actions by the central bank, the People’s Bank of China, to weaken the yuan have reduced market interest rates to the disadvantage of shadow banks. Last summer, controls on bank lending rates were lifted. And the PBOC has been working with the International Monetary Fund on the mechanics of interest-rate liberalization. These steps, of course, would allow the state banks to catch up with their shadowy counterparts in attracting deposits.

With rate deregulation, banks will need to compete for deposits. Are free toasters and gambling junkets to Macao coming soon? Higher deposit rates will give consumers more spending money but they will also raise interest costs for state-owned enterprises, which will need to restructure to survive. Banks also will need to compete with the private banks the government plans to establish, and they’ll need to push up lending rates to offset higher deposit rates. That would challenge local governments, real estate developers and others that are struggling with debt repayments. Of course, some banks are likely to get into trouble with excessive deposit rates and risky loans, so deposit insurance and a mechanism for handling busted banks are still needed. Prime Minister Li Keqiang has promised to institute both.

Nevertheless, these safeguards are no guarantee against widespread financial problems. Before deregulation in the 1980s, the financial sectors of Finland, Norway and Sweden had a number of important similarities to China’s today. From 1978 to 1991, the Nordic countries liberalized their financial markets, which set off a sustained lending boom, capital inflows, rising asset prices, and rapidly increasing consumption and investment. By pegging its exchange rate to the dollar, these countries prevented monetary policy from reining in the boom with interest-rate increases. Nor were fiscal policies tightened enough to control the bonanza, although national budgets displayed large surpluses due to rising tax revenue from higher consumption, wages, property values and capital gains.

Why not?

• Why Have Americans Stopped Moving? (Bloomberg)

Americans are much less mobile than we think. Almost 70% of us who were born in the U.S. still live in the state of our birth, as only 1.5% of population moves across state borders, a rate lower even than that of our parents. When we do move, it is most often in search of a new job, less expensive housing or a warmer climate — and not, as is often suggested, to find a state with lower or no income taxes. Yes, people do move from high-tax states such as New York to no-income-tax states such as Florida. But the vast majority of such migrants are low-and moderate-income families, who are less affected than more affluent families are by state income taxes, a new analysis by Michael Mazerov of the Center on Budget and Policy Priorities has found. In any case, more people move away from Florida to states with income taxes, such as North Carolina and Georgia, than go in the opposite direction.

Arizona is one of many income-tax states that have been experiencing significant net in-migration. South Dakota and Alaska have no income tax, but have been losing population. To be sure, these are simple correlations. But academic efforts to isolate the impact of state income-tax rates on mobility generally find it explains little about observed migration patterns. What is the primary driver? One force, especially for older people, is the sun. Over the past two decades, cold-weather states such as Ohio, Pennsylvania, New Jersey and Michigan have lost a significant share of population to sun-belt states. A second motivator is housing; people who move from cities in California or New York to those in Texas or North Carolina typically benefit from substantially lower housing costs. (That reduction is often far larger than any income-tax savings, by the way.)

“They don’t want to get out of the chair they’re sitting in because they’re not reasonably confident they’ll find another chair to sit down in.” Guess they want to spend their lives sitting down.

• Homeseller Reluctance Worsens U.S. Inventory Shortage (Bloomberg)

The average rate for a 30-year fixed loan was 4.14% last week, according Freddie Mac. While that’s the lowest since October, it’s almost 1 percentage point above where it was a year ago. The 30-year rate probably will reach 5% by the end of the year as the Federal Reserve scales back bond-buying that has held borrowing costs close to record lows, according to the Mortgage Bankers Association. A rate increase would only exacerbate the supply constraints, Yun said. Fewer homes are trading and prices are soaring in part because buyers have limited choices, especially in the strongest markets. While completed sales of previously owned dwellings rose in April from the previous month, the first gain this year, they were down 6.8% from a year earlier, according to NAR. The listings shortage has fueled price gains for two years, with the median existing-home value rising to $201,700 last month, up 5.2% from April 2013.

Sellers had owned their homes for a median of nine years in 2013 compared with six years at the housing market’s peak in 2006, data from the National Association of Realtors show. Buyers last year planned to stay in their homes for 15 years, compared with eight years in 2006, according to the group. The number of listings on Zillow’s website, adjusted for seasonal variations, fell each month this year through April, when they reached a nine-month low, according to the Seattle-based property-data provider. The number of properties on the site had climbed through most of the latter half of 2013. “It’s like a game of musical chairs for sellers,” said Stan Humphries, chief economist of Seattle-based Zillow. “They don’t want to get out of the chair they’re sitting in because they’re not reasonably confident they’ll find another chair to sit down in. That sets into play a negative feedback loop that feeds on itself.” NAR’s inventory numbers, which are based on a sampling of multiple listings service data, jumped in April.

• How Much Is Going Clean Costing China? (CNBC)

Rather than blaming China’s slowing economic growth on the usual property and debt suspects, some analysts are pointing the finger at the mainland’s war on pollution. “The negative impact of the anti-pollution campaign on economic growth has been quite visible,” Claire Huang, an economist at Societe Generale, said in a note Monday. “Polluting steel mills have been torn down, low-efficiency coal-fired boilers have been dismantled, and high-emission cars are being removed from the road,” she said. Huang expects the war on pollution will shave around 0.35 percentage point off gross domestic product (GDP) growth through 2017, with most of the haircut coming this year. “Coal, iron and steel, cement and glass production account for around 16% of overall industrial output and 6% of GDP,” she noted.

In March, Premier Li Keqiang “declared war” on pollution in response to increasing public outcry after a large number of days in 2013 when the air was considered hazardous. Li said efforts would focus on reducing hazardous particulates and shutting down outdated factories and energy production. Whatever the cause, there’s little doubt China’s economic growth has slowed. In the first quarter, China’s GDP grew 7.4% from a year earlier, slowing from 7.7% in the last quarter of 2013. Last year, it expanded 7.7% its slowest rate since 1999 and down from 7.8% growth in 2012. Some of the northern provinces where China’s heavy industry is concentrated are seeing their worst growth performances since the 2008 financial crisis, Huang noted. “The more polluted the region, the greater the slowdown.”

Yeah, but the question is how.

• It’s Simple. If We Can’t Change Our Economic System, Our Number’s Up (Monbiot)

Let us imagine that in 3030BC the total possessions of the people of Egypt filled one cubic metre. Let us propose that these possessions grew by 4.5% a year. How big would that stash have been by the Battle of Actium in 30BC? This is the calculation performed by the investment banker Jeremy Grantham. Go on, take a guess. Ten times the size of the pyramids? All the sand in the Sahara? The Atlantic ocean? The volume of the planet? A little more? It’s 2.5 billion billion solar systems. It does not take you long, pondering this outcome, to reach the paradoxical position that salvation lies in collapse. To succeed is to destroy ourselves. To fail is to destroy ourselves. That is the bind we have created. Ignore if you must climate change, biodiversity collapse, the depletion of water, soil, minerals, oil; even if all these issues miraculously vanished, the mathematics of compound growth make continuity impossible.

Economic growth is an artefact of the use of fossil fuels. Before large amounts of coal were extracted, every upswing in industrial production would be met with a downswing in agricultural production, as the charcoal or horse power required by industry reduced the land available for growing food. Every prior industrial revolution collapsed, as growth could not be sustained. But coal broke this cycle and enabled – for a few hundred years – the phenomenon we now call sustained growth. It was neither capitalism nor communism that made possible the progress and pathologies (total war, the unprecedented concentration of global wealth, planetary destruction) of the modern age. It was coal, followed by oil and gas. The meta-trend, the mother narrative, is carbon-fuelled expansion. Our ideologies are mere subplots. Now, with the accessible reserves exhausted, we must ransack the hidden corners of the planet to sustain our impossible proposition. [..]

The trajectory of compound growth shows that the scouring of the planet has only just begun. As the volume of the global economy expands, everywhere that contains something concentrated, unusual, precious, will be sought out and exploited, its resources extracted and dispersed, the world’s diverse and differentiated marvels reduced to the same grey stubble. Some people try to solve the impossible equation with the myth of dematerialisation: the claim that as processes become more efficient and gadgets are miniaturised, we use, in aggregate, fewer materials. There is no sign that this is happening. Iron ore production has risen 180% in 10 years. The trade body Forest Industries tells us that “global paper consumption is at a record high level and it will continue to grow”. If, in the digital age, we won’t reduce even our consumption of paper, what hope is there for other commodities?

Take out carbs – corn syrup – and your problem’s gone.

• Weight Of The World: 2.1 Billion People Obese Or Overweight (Reuters)

Obesity is imposing an increasingly heavy burden on the world’s population in rich and poor nations alike, with almost 30% of people globally now either obese or overweight – a staggering 2.1 billion in all, researchers said on Wednesday. The researchers conducted what they called the most comprehensive assessment to date of one of the pressing public health dilemmas of our time, using data covering 188 nations from 1980 to 2013. Nations in the Middle East and North Africa, Central America and the Pacific and Caribbean islands reached staggeringly high obesity rates, the team at the University of Washington’s Institute for Health Metrics and Evaluation in Seattle reported in the Lancet medical journal.

The biggest obesity rises among women came in Egypt, Saudi Arabia, Oman, Honduras and Bahrain. Among men, it was in New Zealand, Bahrain, Kuwait, Saudi Arabia and the United States. The richest country, the United States, was home to the biggest chunk of the planet’s obese population – 13% – even though it claims less than 5% of its people. Obesity is a complex problem fueled by the availability of cheap, fatty, sugary, salty, high-calorie “junk food” and the rise of sedentary lifestyles. It is a major risk factor for heart disease and stroke, diabetes, arthritis and certain cancers. Chronic complications of weight kill about 3.4 million adults annually, the U.N. World Health Organization says.

During the 33 years studied, rates of being obese or overweight soared 28% in adults and 47% in children. During that span, the number of overweight and obese people rose from 857 million in 1980 to 2.1 billion in 2013. That number exceeds the total world population of 1927, when it first hit 2 billion. Earth’s population now tops 7 billion.

Diabetes here we come.

• Australia’s Obesity Problem Worst In World (CNBC)

63% of Australians are overweight, up from 49% in 1980, a study published Thursday showed, highlighting the country’s growing obesity problem. Australasia – Australia, New Zealand, New Guinea and neighboring islands in the Pacific Ocean – saw the largest absolute increase in adult obesity worldwide over the past 34 years, rising to 29% from 16% in 1980. It also saw the largest jump in adult female obesity to 30% from 17%. People are considered obese when their body mass index – a measurement derived by dividing a person’s weight by the square of their height – exceeds 30. The study, which was published in The Lancet medicine journal, found over 68% of Australian men and 56% of women are overweight or obese, the second largest gender gap in overweight/obesity globally.

The study also found that Australian children are at risk; around 24% are either obese or overweight, up from 16% in 1980. While obesity has increased globally over the last 30 years, the study found variations across countries. In developed countries, increases in obesity that began in the 1980s and accelerated from 1992 to 2002 have slowed since 2006. Conversely, in developing countries, where almost two-thirds of the world’s obese people currently live, increases are likely to continue. Health experts are particularly worried about the risks associated with obesity: “In the last three decades, not one country has achieved success in reducing obesity rates, and we expect obesity to rise steadily as incomes rise in low- and middle-income countries in particular, unless urgent steps are taken to address this public health crisis,” said Professor Rob Moodie at the University of Melbourne.

Speculation is what it is, whether in wind or fracking. It’s all about money. That’s the way we built our world.

• Fracking Sucks Money From Wind While China Eclipses U.S. (Bloomberg)

U.S. President Barack Obama says natural gas can be a bridge from coal to a cleaner energy future. Investors are showing it’s more likely a bridge to nowhere. The country’s embrace of natural gas means less love for wind and solar. New investments in renewable energy sources declined 5% in North America last year to $56 billion, the lowest since 2010, according to Bloomberg New Energy Finance. By comparison, North American oil and gas companies spent $168.2 billion on exploration and production last year, more than double 2009. Fracking has helped push U.S. natural gas production to new highs in each of the past seven years, according to the Energy Information Administration. It’s also more expensive than traditional drilling and contributes to global warming, according to the U.S. Environmental Protection Agency.

Renewables, which are getting cheaper, have lost support even as the United Nations warns that time is running out to stem climate change and China forges ahead with sustainable power. “Everyone in Washington thinks gas is a savior, so Washington has been oblivious to the renewables revolution, but China hasn’t been oblivious,” said Hal Harvey, the chief executive officer of San Francisco-based Energy Innovation: Policy and Technology LLC who has been appointed to energy panels by presidents George H.W. Bush and Bill Clinton. The shale revolution has brought the country closer to energy self-sufficiency than at any time in the last three decades, according to the EIA.

It’s also changed the way Americans invest, said James McDermott, managing director of the U.S. Renewables Group, [which] is currently raising money only overseas. Hydraulic fracturing, the technical name for fracking, has helped open the money tap for gas and oil. Since 2012, investors added more than $2.3 billion to the Energy Select Sector SPDR Fund, which tracks oil and gas companies. In the same period, investors withdrew $32.5 million from the Powershares Wilderhill Clean Energy Portfolio, the biggest exchange-traded fund tied to renewable-energy equities, according to data compiled by Bloomberg. “There’s absolutely no question that investors’ dollars have moved from one to the other,” said Bruce Jenkyn-Jones, a managing director at London-based Impax Asset Management Group Plc, which oversees about $4.2 billion.

• GOP Climate Science Deniers Threaten US National Defense (Paul B. Farrell)

I’m mad as hell. The GOP used to be the party of national defense. No more. What happened? In 2003 Bush launched the Iraq War to “defend our freedom.” Flash forward: Last week 227 of 231 GOP members of the House voted to turn the Pentagon into climate-science deniers, a decision certain to weaken national security. That’s about as absurd as telling Silicon Valley they can’t use technology.Seriously, the Republicans just passed an amendment to the $607 billion National Defense Authorization Act funding the Pentagon in 2014. Yes, 227 members of the GOP-dominated House just voted to limit the Pentagon’s ability to defend America, by preventing military planners from using any strategic research the military’s been gathering for years about threats to national security. Listen:

“None of the funds authorized to be appropriated or otherwise made available by this act may be used to implement the U.S. Global Change Research Program National Climate Assessment, the Intergovernmental Panel on Climate Change’s Fifth Assessment Report, the United Nation’s Agenda 21 sustainable development plan, or the May 2013 Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis Under Executive Order.” Get it? The Republican Party is now officially on record as the party of climate-science denialism. These research programs, ongoing and widely used by the Pentagon in strategic national defense planning for many years, could, if the Senate agrees, become illegal to use.

Yes, this Marine veteran is mad as hell. GOP science deniers have “crossed the line,” they’re now messing with national security. America is now under attack from an enemy within, irrational science denialism, a toxic mind-set, a spreading, self-destructive mental virus. Yes, this is a “War on America.” The military has been using climate-science research for decades. This vote is self-destructive. These research studies are essential in our national defense. If you’re at all concerned about the safety of your family and our nation, you’ll be mad as hell, too, about this new “War on America.” All 227 Republicans are on record as science deniers, a real dumb message to send to our allies worldwide. Why? If the GOP regains the Senate in November, it may become the law of the land.

Home › Forums › Debt Rattle May 29 2014: The New Normal is Negative