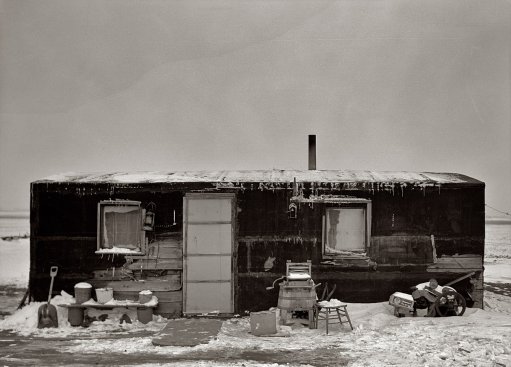

Russell Lee 3-room shack of hired man for tenant farmer and family of 10, Dickens, Iowa 1936

Hurray! Americans have found a new source of spending money; after ATM-draining their home equity till even the roofs were underwater, and maxing out every single little shred of plastic they could lay their hands on, “families looked around for what was left”, and now it’s time to empty out 401(k)’s until there’s really nothing left at all anymore. Then it’ll be recovery or die, presumably. But a recovery is not going to happen, and certainly not for society’s bottom rung. Oh well, maybe there’s some form of slavery they can enter into. Not surprisingly, the US government is quite content with this new development:

Early Tap of 401(k) Replaces Homes as American Piggy Bank

“They get hit with the penalty at exactly the time when they’re the most vulnerable,” said Reid Cramer, director of the Asset Building Program at the NAF, which tries to improve savings for lower-income families. “So it’s a real double-whammy.” For decades, Americans’ homes were their piggy banks. As values rose, they refinanced or took out second mortgages. Since the housing collapse of 2008, that’s often no longer an option.

The IRS collected $5.7 billion in 2011 from penalties, meaning that Americans took out about $57 billion from retirement funds before they were supposed to. [..] Adjusted for inflation, the government collects 37% more money from early-withdrawal penalties than it did in 2003. Meanwhile, the amount of home-equity loans outstanding was $704 billion in 2013, down 38% from the 2007 peak, according to Federal Reserve data.

“They didn’t have access to the home equity that they had in the past”, Cramer said. “And families looked around for what was left and they actually drained the value from the 401(k).” In 2011, 5.7 million tax returns, or about 4% of all U.S. households, reported paying penalties on early withdrawals. The government collected more than enough money from these penalties to fund the National Oceanic and Atmospheric Administration.

But wait, there’s hope. Eternal hope. Karen Weise for BusinessWeek reports in a piece filled with joyful glee that Americans who still have a home are less underwater than they used to be:

America’s Underwater Homeowners Are Afloat Once Again

At the bottom of the housing crash, more than a third of all homeowners owed more than their houses were worth. They were plunged underwater by a combination of collective overborrowing during the housing bubble and plummeting prices during the crash. Bit by bit over the years, homeowners have been climbing out of that hole, and new data from Black Knight Financial Services show that borrowers are approaching a threshold that will see only one in 10 U.S. borrowers underwater on home loans.

But not so fast, I beg of thee. Let’s see what’s brought about this happy news. Karen does know something:

Foreclosures wiped away the mortgages of many of the most indebted. In January 2010, 10% of borrowers owed at least 50% more than their homes were worth. By January 2014, that number fell to 2% of borrowers.

Hmm. That puts a bit of a dent in the joy, doesn’t it? The last number I’ve seen for total foreclosures in the US since the wrecking ball came down is about 7 million. If we may assume the majority of those were the deepest underwater loans out there, it’s no wonder that A) there are fewer “owners” underwater, and B) the average amount owed has gone down. On top of that, there’s something else that murks the numbers:

Cash buyers have flooded the markets, making up more than a quarter of all home sales in March. That means homes that were once financed with debt are now paid for entirely with equity.

By now I don’t feel all that joyful anymore, but Karen has less scruples. She came to write a happy piece, and she’ll stick with that idea. For the rest of us, what this comes down to is that the tens of thousands of all-cash purchases by the likes of America’s biggest homeowner, private equity fund Blackstone, have not only lifted prices, they also make numbers of average debt owed look much better. Just don’t tell the better-looking “owners” that Blackstone cut its purchases by 90% recently, and other all-cash buyers will follow suit, if they haven’t already. A simple matter of supply and demand, investment and return.

Average debt owed went down because the “worst offenders” of the subprime craze were foreclosed on, home prices rose somewhat because institutional investors stepped in to scoop up foreclosed properties, banks sit on huge numbers of homes they don’t want to finalize the foreclosure process on lest they have to transfer the losses to their books, and mortgage rates are only now coming up from a very low bottom. All factors that distort the picture.

The proof in the pudding: If these factors did not strongly influence the numbers we’re seeing, one number would be very different: the amount of home-equity loans. If things were really that much better now, banks would be more than happy to let people borrow more, not less, against their homes. They’re not. And that’s as good a sign of what is real and what’s not as we should need.

So count on a huge wave of Americans draining their 401(k)’s and other pension provisions, because many don’t have anywhere else to turn anymore. And don’t forget that much more even than home-equity loans, early 401(k) withdrawals are signs of desperation. They’re not used to buy granite kitchen tops or trips around the world or flashy foreign cars. Your typical early 401(k) withdrawal is about survival. About people who look around for what is left, and find nothing else.

• Early Tap of 401(k) Replaces Homes as American Piggy Bank (Bloomberg)

Premature withdrawals from retirement accounts have become America’s new piggy bank, cracked open in record amounts during lean times by people like Cindy Cromie, who needed the money to rent a U-Haul and start a new life. Her employer, the University of Pittsburgh Medical Center, had outsourced Cromie’s medical transcription work. Cromie said the move cut her income by as much as 60%, at times leaving her with minimum-wage pay. So, last year, at age 56, she moved about 90 miles from her home in Edinboro, Pennsylvania, into her mother’s basement. To make ends meet as she moved and then quit the job, Cromie pulled out $2,767 from her retirement savings. “We made two trips and it just got to be real expensive,” she said. “That money, it was a security that I needed.”

Still unemployed, Cromie is trying to avoid tapping what’s left of her retirement savings – $7,000 that would be subject to taxes and a 10% extra penalty if she touches it in the next two to three years, before she turns 59 1/2. It’s a small number that’s part of a much larger picture: The Internal Revenue Service collected $5.7 billion in 2011 from penalties, meaning that Americans took out about $57 billion from retirement funds before they were supposed to. The median size of a 401(k) is $24,400 as of March 31, with people older than 55 having $65,300, according to Fidelity Investments. Those funds can disappear quickly in retirement, and the early withdrawals indicate that the coming retirement crisis could be even more acute than expected.

“They get hit with the penalty at exactly the time when they’re the most vulnerable,” said Reid Cramer, director of the Asset Building Program at the New America Foundation, which tries to improve savings for lower-income families. “So it’s a real double-whammy.” For decades, Americans’ homes were their piggy banks. As values rose, they refinanced or took out second mortgages. Since the housing collapse of 2008, that’s often no longer an option. Taking money from a 401(k) – and worrying about the consequences later – became a more attractive alternative and a record number of Americans made early withdrawals in 2010.

Adjusted for inflation, the government collects 37% more money from early-withdrawal penalties than it did in 2003. Meanwhile, the amount of home-equity loans outstanding was $704 billion in 2013, down 38% from the 2007 peak, according to Federal Reserve data. “They didn’t have access to the home equity that they had in the past,” Cramer said. “And families looked around for what was left and they actually drained the value from the 401(k).” In 2011, 5.7 million tax returns, or about 4% of all U.S. households, reported paying penalties on early withdrawals. The government collected more than enough money from these penalties to fund the National Oceanic and Atmospheric Administration. As economic conditions deteriorate, such withdrawals spike, as they did in 1991, 2002 and 2007. The inflation-adjusted penalty collections declined 5% in 2011, the last year for which complete data is available.

Well, it’s still one bubble in the end.

• Is the Housing Market Filled With 1,000 Mini Bubbles? (Wall St. Cheat Sheet)

The housing market is experiencing a case of deja vu. While the economy is still trying to recover from the credit meltdown that took place more than five years ago, home values in more than 1,000 cities and towns are already at or near their bubble-era peaks. According to a new analysis from Zillow, home values increased 5.7% year-over-year in the first quarter to an average of $169,800. In fact, home values have climbed higher on a year-over-year basis for 21 consecutive months. This has helped erase the losses of the housing bubble for 1,080 cities and towns across the nation. Seven of the largest 35 metros in the United States have already exceeded or will exceed their bubble peak levels by March 2015. [..]

Americans appear more than willing to forget about the disastrous housing bubble of yesteryear. Gallup recently found that 56% of Americans expect average home prices in their local area to increase, its highest reading since 2007, and up from only 33% two years ago. Meanwhile, 30% of Americans believe real estate is the best long-term investment option, compared to stocks and gold at 24%. Home values are rising, but fewer people are buying. The National Association of Realtors recently announced that total existing-home sales in March posted their seventh decline in the past eight months, representing the slowest pace since July. In a separate report, the U.S. Census Bureau said purchases of new single-family homes plunged 14.5% in March from the previous month.

I don’t like the combination of “stubbornly-high unemployment rates” and “a crucial buying opportunity”. That can only exist in manipulated markets.

• Market Reversal Alert (Michael Pento)

Scenario number one: Economic growth and inflation reach the Fed’s target levels and interest rates rise sharply on the long end of the yield curve to reflect the increase in nominal GDP. This will cause a selloff in the major averages, as the 10-Year Note jumps to 5% from its current level of 2.70%. Surging interest rates—the result of inflation and the end of QE rate suppression—will provide competition for stocks for the first time in seven years and a correction of around 10-20% occurs.

Scenario number two: The economy once again fails to make a meaningful recovery, and the overvalued market crumbles under the weight of anemic revenue and earnings growth that is woefully insufficient to support the current lofty PE ratios. Without the aid of massive money printing from the Fed, or a surge in GDP growth, a significant correction north of 20% is highly probably. Keep in mind revenue and earnings growth are less than half the historical average, and need to rapidly accelerate in order to justify the current level of the market.

For stocks prices to rise from this point, the economy must grow rapidly without causing interest rates to rise. This is a virtually impossible scenario, especially since the Fed is removing its bid for Treasuries. So, it’s either the economy doesn’t improve and stocks fall—because the Fed won’t reverse course and increase QE on a dime; or the economy improves and the interest rates spike spooks the market. Either way, the market goes down in the short term. I believe a bear market will ensue from weakening economic growth combined with the attenuation of Fed asset purchases. Further proof of our structurally-anemic economy, came when the BEA released data on April 30th that showed the economy grew at an annual growth rate of just 0.1% during Q1.

Our central bank is now buying $45 billion per month of MBS and Treasuries. Down from $85 billion at the start of this year. That number will be near zero in just a few months. Real estate and stock prices have already stopped rising and economic growth has almost completely stalled since the start of 2014. The bear market in equities and stubbornly-high unemployment rates should bring the Fed back into the debt monetization business shortly after the market crashes. This significant selloff should prove to be a crucial buying opportunity in which investors need to be preparing now to take full advantage of.

Check. Check. Check. Check. Check. Check. Check. Check.

• Eight Characteristics Of Stock Market Manias (GMO)

1. This-time-is-different mentality. Throughout history, successive market manias have been rationalized with the argument that history is no longer a reliable guide to the future. Both the “new era” of the 1920s and “new paradigm” of the 1990s were marked by a “this-time-is-different” mentality.

2. Moral hazard. Speculative bubbles tend to form when market participants believe that financial risk has been underwritten by the authorities.

3. Easy money. Great speculative bubbles have generally been accompanied by periods of low interest rates.

4. Overblown growth stories. Another common feature of a bubble is the overblown growth story. We witnessed this during the Dotcom bubble, ad nauseam.

5. No valuation anchor. The most speculative markets – from the 17th century Dutch tulip mania onwards – have been marked by the absence of any valuation anchor; when there’s no income to tether the speculator’s imagination, asset prices can become unbounded.

6. Conspicuous consumption. Asset price bubbles are associated with quick fortunes, rising inequality, and luxury spending booms.

7. Ponzi finance. Manic markets are often marked by a decline in credit standards.

8. Irrational exuberance. Valuation is the truest measure of speculative mood.

Reform. Deregulation. Abe’s got a free copy of the IMF handbook.

• Abenomics Third Arrow Creates Anxiety Among Japanese Workers (CNBC)

The prospect of labor market deregulation – a key feature of the third “arrow” of Prime Minister Shinzo Abe’s economic revival program – is creating anxiety amongst workers in Japan, says Nobuaki Koga, president of the Japanese Trade Union Confederation (Rengo). “We as workers are very much concerned about how that will be implemented. We have doubts about such a direction in policy and are quite concerned,” Koga told CNBC on the sidelines of the annual meeting of the Organisation for Economic Co-operation and Development (OECD) in Paris. Rengo is the nation’s biggest umbrella body for labor unions, representing over 6 million working men and women in Japan. “What we are hearing and seeing are only measures and ideas that will give anxiety and worries to people in terms of the security of their employment. Because of that, we oppose this [labor deregulation],” he said.

Freeing up the rigid labor market is seen as central to the government’s structural reform program. However, Abe has so far made little progress with pushing ahead labor reforms due to strong domestic opposition. Relaxing stringent job protections is seen as a step necessary to make Japanese companies more competitive and to attract foreign investment. Abe last week said he remains committed to make working conditions more flexible. “Over the past year we’ve realized how difficult it has been to do so. But we cannot grow without labor reforms. We are determined to make that happen,” Abe said in in a meeting with business leaders in London last Thursday.

Financial innovation. Redux.

• Here They Go Again: Wall Street Is Offering Debt-On-Debt-On-Debt! (Stockman)

Here’s how the daisy chain of debt works— short form. LBO’s issue debt—loads of it. Leveraged buyouts are now being priced at typical top-of-the-bubble ratios of 10X cash flow (“adjusted EBITDA”). The portion of these LBO debt towers that consists of bank term loans and revolver facilities is sold to freshly minted financial conduits called CLOs (for Collateralized Loan Obligations) which are not real companies and which do not have any money! No problem. What happens is that credit hedge funds and Wall Street trading desk hit a computer key, open a new spreadsheet window, wrap it in legal boilerplate, provide this newly minted CLO with a credit line and then start bidding for available LBO paper in the junk loan market.

When they have accumulated enough offers, they slice and dice the resulting portfolio of LBO loans, and issue multiple tiers of debt– with these new slices being rated from AAA to junk against the loans listed on the spreadsheet. So we now have a spreadsheet, a part-time “portfolio manager” and hundreds of millions of the latest CLO toxic waste. For 95 weeks running, there was no want of buyers for this CLO issued paper. In its infinite wisdom, the Fed drove interest rates on CDs and high quality paper to nearly zero—–so the scramble for “yield” was on. Soon Grandpa was being forced to buy a high yield mutual fund in order to pay the light bills.

But now LBO risks are soaring due to recklessly escalating deal prices and also because the LBO kings are stepping-up their patented late cycle cash strip-mining operations in the form of “leveraged recaps” funded with new “cov lite” debt. So even yield starved retail investors have begun to turn tail and run. During the last two weeks there were actually outflows from high yield mutual funds. That leaves a big gap in the market, however. The CLO jockeys are still banging out new spreadsheets, but buyers for the sliced and diced CLO paper are suddenly getting scarcer. Still, no problem! Here’s why. Wall Street is back in the business of lending money at the Fed’s gifted rate of zero plus a modest 80 basis point spread—so that the fast money can buy CLO paper on 9 to 1 leverage. There is your triple shuffle.

We want QE! We want your citizens’ money!

• OECD Calls For ECB To Cut Rates Immediately (WSJ)

The European Central Bank should immediately cut its benchmark interest rate, and may even then have to take additional measures to end a period of too low inflation in the euro zone, the Organization for Economic Cooperation and Development said Tuesday. In its twice-yearly Economic Outlook report, the Paris-based research body once again lowered its forecast for global economic growth, since it now expects a number of large developing economies to be more sluggish than it anticipated when it last published projections in November. The OECD said the global economy is in a less perilous state than it has been in recent years, and that policy makers “can now switch from avoiding disaster to fostering a stronger and more resilient recovery.”

But it added that growth is still more likely to be weaker than forecast, and faces a number of potential impediments, ranging from the impact on developing economies of a normalization of U.S. monetary policy, to instability in China’s financial system and the relatively new danger posed by rising tensions between Russia, the U.S. and the European Union over the future of Ukraine. The research body raised its growth forecast for the euro zone, but warned there is a risk that it will slip into deflation – or a period of self-reinforcing price declines – unless the ECB acts swiftly.

In unusually direct language, the OECD said the ECB’s main refinancing rate “should be reduced to zero” from 0.25% now, while policy makers should “possibly” cut the deposit rate “to a slightly negative level.” The research body said interest rates should not be raised from those levels until the end of 2015 at the earliest. “In particular, we call on the European Central Bank to take new policy actions to move inflation more decisively toward target and to be ready for additional nonconventional stimulus if inflation were to show no clear sign of returning there,” said Rintaro Tamaki, the OECD’s acting chief economist. He noted that new, longer-term funding for banks and purchases of government and company bonds known as quantitative easing may be necessary.

I don’t think so. it’d be great, but there’s too much resistance.

• EU Eyes Financial Transaction Tax to Start in 2016 (Bloomberg)

European finance ministers are designing a financial-transaction tax on equities and derivatives that could start in 2016 for the 11 nations that have signed up to participate. French Finance Minister Michel Sapin said details could be presented by the end of this year, to take effect at the start of 2016. “A critical mass” is emerging among nations including France, Germany, Italy and Spain, he told reporters yesterday after euro-area ministers met in Brussels. Work on a transaction tax for the 11 willing countries began more than a year ago, after a European Union-wide proposal failed. So far, the participants have remained committed to the cause without finding agreement on how the tax could work.

The participants haven’t been able to agree on whether to tax all derivatives, only equity derivatives or none at all. Nations pushing for the levy are also split over who should get to collect it, a trading firm’s country of origin or the nation where trading takes place. Smaller countries have generally sought a broader tax that raises more revenue, while bigger nations have been willing to start on a smaller scale. EU Tax Commissioner Algirdas Semeta said in Vilnius yesterday that there isn’t a common approach on how to handle derivatives. Sapin said further work would pin down how the tax’s scope would take shape.

Think it’s bad now?

• China Property Value Concern Deepens (Bloomberg)

Chinese stocks trading in the U.S. snapped a four-day gain as E-House China Holdings led a drop in real-estate companies amid mounting concern that home sales in the world’s second-largest economy are slowing. The Bloomberg index of the most-traded Chinese stocks in the U.S. fell 0.5% to 99.65 yesterday, while a gauge of Shanghai property stocks was little changed today. The American depositary receipts of E-House, a real-estate agent, dropped as much as 6.1%. SouFun Holdings, which operates a real estate website, sank for the first time in three days. New Oriental Education & Technology Group tumbled the most on the ADR gauge as Deutsche Bank cut it to hold from buy.

Sales of new homes in 54 cities during the May 1 to May 3 holiday fell 47% from the same period in 2013 to the lowest level in four years, Centaline Group, parent of China’s biggest real-estate brokerage, said May 4. The report comes two weeks after the National Bureau of Statistics said the value of residential sales slumped 7.7% in the first quarter. “I am cautious toward the Chinese property market,” Elena Ogram, a Zurich-based investor at Bank Bellevue AG, who oversees $50 million in emerging-market assets including Chinese stocks, said by phone. “The government may take steps to support the market, but we are not expecting any rosy news.”

The iShares China Large-Cap ETF, the largest Chinese exchange-traded fund in the U.S., dropped 0.9% to $34.70. The Shanghai property stock index dropped 0.1% today, extending a four-day, 5.2% decline. E-House fell 3.3% to $8.91. SouFun retreated 2.7% to $12.25. Developers including China Vanke Co. and Greentown China Holdings Ltd. have cut prices, and discounts have spread from smaller cities with “a massive” oversupply to big cities including Shanghai and Guangzhou where demand remains strong, according to an April 28 report by China Real Estate Information Corp., a property data and consulting firm.

Hey, just buy in London …

• China’s Millennials Can’t Afford Homes in Beijing (BusinessWeek)

For many young professionals in Beijing, the dream of owning a home feels increasingly remote. Soaring home prices—driven in large part by the popularity of real estate as an investment vehicle in China—mean that even relatively successful young workers find it hard to climb onto the housing ladder in leading cities. According to a recent study by the University of International Business & Economics in Beijing, fewer than a quarter of college-educated, employed professionals in Beijing age 34 and younger are homeowners. Those with relatives in the capital city often reside with family members. Others rent apartments—paying, on average, 37% of their monthly income in rent.

Of those young respondents who were homeowners in Beijing, fully three-quarters said they received substantial help from their parents or other family members. And of those, 25% said their parents had paid the full price of their home outright in cash. The financial wherewithal of the prior generation is “playing a decisive role” in determining which young people are able to sign property deeds, as “support from parents is a crucial way to obtain a house,” the report concluded. In other words, class mobility is apparently shrinking—at least for young people trying to make it on their own in China’s most expensive cities.

Hm. WHo are they going to sell it to? And at what price? And what happens to the double digit interest rate shadow loans?

• China Provinces Eye Sales From $7 Trillion Asset Holdings (Bloomberg)

President Xi Jinping’s plans to open China’s state-owned enterprises to competition are spurring local officials to consider asset sales that could help rein in provincial and municipal debt. Businesses controlled by local administrations, which range from hotels to retailers to power generators, had assets of 43.8 trillion yuan ($7 trillion) as of the end of March, according to Ministry of Finance estimates. The southern provinces of Guangdong, which has the biggest regional economy, and Guizhou pledged this year to look at changes in ownership structures for their holdings in coming years.

With the central government setting direction, such as through the transfer of assets at Citic Group Corp. to its Hong Kong-listed unit, a “quiet wave” of stake sales by local authorities may come in 2015-16, according to Standard Chartered Plc. Productivity gains from revamping public-sector businesses would help China counter its investment-led slowdown. “The movement on this has happened at a surprisingly fast pace,” said Andrew Batson, an analyst in Beijing at researcher Gavekal Dragonomics who has covered China since 1998. “Local governments have these huge off-balance-sheet debts, so they have a much stronger incentive than the central government necessarily does to try to raise cash from asset sales.”

Hello New Zealand.

• China Imposes New Limits On Foreign Dairy Imports (NY Times)

The Chinese government has imposed new limits on foreign brands of milk powder and infant formula sold in China, according to reports on Monday by the state-run news media. The restrictions appear to be the latest attempt by the government to reduce the enormous demand for foreign-made dairy products and bolster the sales of domestic brands. The new restrictions require foreign makers of milk powder to register the products, as well as their manufacturing and storage centers, with the government before the products can be sold in China.

On Monday, The Beijing News released a list of the 41 foreign companies and manufacturing sites that have been registered so far. It includes subsidiaries of Nestlé, a Swiss company, in Germany and the Netherlands; Wyeth Nutrition, a company that Nestlé recently bought from Pfizer, in Ireland; Abbott Laboratories, an American company, in the Netherlands; and Nutricia, owned by Danone of France, in New Zealand, Germany and the Netherlands. The list could expand as more companies apply to register their products with China’s General Administration of Quality Supervision, Inspection and Quarantine.

The new rule officially went into effect last Thursday. A month before, the government began requiring foreign makers of milk powder to put Chinese-language labels on products intended for sale in China before the products were shipped to the country. The Beijing News quoted a dairy industry expert who said that the government was trying to stop “illegal” brands from being sold in China and to allow only large, trusted brands into the market. The demand in China for foreign-made infant formula and milk powder surged in 2008, when at least six babies died and more than 300,000 children fell ill after drinking milk products tainted with melamine, a toxic chemical used in manufacturing. Government officials prevented Chinese news organizations from reporting the deaths and illnesses until after the end of the Beijing Summer Olympics, leading to accusations of a government cover-up. Later, the government suppressed calls by grieving parents for a thorough investigation.

Sacrilege!

• UK Energy Too Cheap, Says Study (Guardian)

The government must urgently establish a strategic authority to oversee the future growth of Britain’s ageing energy infrastructure, a study argues on Tuesday . Academics at Newcastle University challenge the government’s market-based approach, saying the £100bn needed to secure energy security is not being delivered by a fragmented system that lacks central direction. The academics, led by Prof Phil Taylor, argue that the country needs a “systems architect” and that energy, at least for the bulk of the population, is too cheap, which is leading to waste.

While the Labour party has already said it wants an energy security board, one leading figure in the industry has said that Taylor was highlighting that “nobody is in charge” of the country’s energy policy. Before Tuesday’s launch of the university’s latest energy briefing note, Taylor, who leads its Institute for Research on Sustainability, said: “The current pricing model does not accurately reflect the high economic and environmental cost of generating, storing and distributing energy. In fact, because of the way energy is sold today, it becomes cheaper the more we use. This is unsustainable. “Although we must make sure people can afford to heat their homes, for the majority of us energy is actually too cheap – this is why we leave lights on, keep appliances running and use machines at peak times when energy costs more.”

“The last refuge of the desperate”.

• Self-Employment Surge Hides Real Story Behind Upbeat UK Job Figures (Guardian)

Coalition claims that “more people are in work than ever before” have been undermined by a report that shows the number of traditional employee jobs is falling or flatlining across the country – a phenomenon masked by an explosion in recorded self-employment which one economist describes as “the last refuge of the desperate”. Only London has shown a marked rise in employee jobs in the last six years, according to new analysis by the independent thinktank the Resolution Foundation, seen exclusively by the Guardian.

The research reveals that the total number of employed jobs fell in nine of 12 regions between 2008 and 2013, ranging from a drop of 156,000 posts in Scotland, to a fall of 24,000 in the east Midlands. The numbers of employee jobs in the south-east (-1,000) and eastern region (+4,000) remained virtually static, while in London, uniquely, 285,000 were created. Any increase in the number in work in other regions over the 2008 baseline, after four years of recovery, was due to rising rates of self-employment, which was up everywhere except Northern Ireland.

The number of self-employed jobs rose by 116,000 in the south-east, by 85,000 in London itself, by 67,000 in the east and by 61,000 in the west Midlands. The 58,000 additional self-employed posts in the south-west and 43,000 in the east Midlands were sufficient to offset the loss of employed jobs locally. The labour market economist and former Bank of England rate-setter David Blanchflower, who has studied trends in self-employment for many years, said: “Particularly after a prolonged downturn, there is a well-documented pattern of people failing as jobseekers and then moving into self-employment status, often out of desperation rather than anything more positive.”

Don’t Brits still just like the idea of a ruling class?

• Welcome To Britain, The New Land Of Impunity (Monbiot)

When I first worked in Brazil in the late 1980s, the country was widely described as o pais da impunidade – the land of impunity. What this meant was that there were no political consequences. Politicians, officials and contractors could be exposed for the most flagrant corruption, but they remained in post. The worst that happened was early retirement with a fat pension and the proceeds of their villainy safely stashed offshore. It is beginning to look a bit like that here. This is not to suggest that the people or companies I name in this article are crooked or corrupt; it is to suggest that the political class no longer seems to care about failure.

The failure works both ways, of course. As Polly Toynbee has shown, the Help to Work pilot projects, which G4S will run, reveal that it is a complete waste of time and money. Yet the government has decided to go ahead anyway, subjecting the jobless to yet more humiliation and pointlessness. Contrast the boundless forgiveness of G4S to the endless castigation for being unemployed. A record of failure reflects the environment in which such companies are hired: one in which ministers launch improbable schemes then look the other way when they go wrong. G4S had to pay back so much money for the phantom criminals it wasn’t monitoring because it had been doing it for eight years, and no one in government had bothered to check. There is no such thing as failure any more, just lessons to be learnt.

Accountability has always been weak in the UK, but under this government you must make spectacular efforts to lose your post. At the Leveson inquiry in May 2012, the relationship between the then culture secretary Jeremy Hunt and the Murdoch empire that he was supposed to be regulating was exposed in gory detail. He was meant to be deciding impartially whether to allow the empire to take over the broadcaster BSkyB, but was secretly exchanging gleeful messages with James Murdoch and his staff. We all knew what it meant. The emails, the Guardian observed, were likely to “sever the slim thread connecting Hunt to his cabinet job”. “After this he’s toast … it’s over for Hunt,” wrote Tom Watson MP. Ed Miliband said: “He cannot stay in his post. And if he refuses to resign, the prime minister must show some leadership and fire him.” We waited. Hunt remained culture secretary for another four months, then he was promoted to secretary of state for health.

“You all know each other. You work together. You trade with each other. You are part of this little clique and we the ordinary taxpayer lose out on it.”

• There’s No Proof That Privatisation Works, But Britain Keeps Selling (Guardian)

If you think the government might hesitate to sell other national assets after the Royal Mail fiasco, think again. The Land Registry, the office that certifies property ownership, a quasi-judicial function, is being readied for privatisation. It collates data on prices and transactions and catches fraudsters. It has cut its fees, scores 98% satisfaction and last year made a £98.7m profit for the Treasury – yet it’s part of this government’s £20bn asset sell-off. In the Royal Mail debacle, shares sold at £1.7bn rose to £2.7bn. The 16 investors chosen as “long-term” custodians included the most wolfish hedge funds, who sold the shares at once. Let’s hope that ends any pretence that shareholders look after companies.

What’s more, the investment arm of Lazards, key adviser to Vince Cable, was also given “priority” status. But Lazard Asset Management sold its entire stake within a week at a profit of £8m. Likewise Goldman Sachs, employed to facilitate the sale, told its investors share prices would hit 610p a month after advising the government to float at 330p. How well these companies deserved their tongue-lashing from Margaret Hodge: “You all know each other. You work together. You trade with each other. You are part of this little clique and we the ordinary taxpayer lose out on it.” This is a case of caveat vendor.

We should beware the inherent asymmetry when the state sells contracts and assets. On the government side, this is negotiating with a political gun at the head, conducted by inexperienced civil servants told to secure complex objectives, unable to walk away from already announced sell-offs. On the market side is rat-like native cunning impelled by profit, willingness to give mendacious assurances with one easy objective – to make money. Governments will always need to deal with markets for procurement and regulation – but that needs a strong, experienced civil service with equal cunning, not one cut by 30%, losing memory of past errors.

Jim Kunstler quotes me…

• Lying or Just Stupid? (Jim Kunstler)

• It’s not always easy to define what exactly is wrong with America, but what ever it is, it’s huge.

— Raúl Ilargi Meijer, The Automatic Earth.com• Nobody knows, from sea to shining sea, why we’re having all this trouble with our Republic.

— Tom McGuane, Ninety-Two in the ShadeDespite its Valley Girl origins, the simple term clueless turns out to be the most accurate descriptor for America’s degenerate zeitgeist. Nobody gets it — the “it” being a rather hefty bundle of issues ranging from our energy bind to the official mismanagement of money, the manipulation of markets, the crimes in banking, the blundering foreign misadventures, the revolving door corruption in governance, the abandonment of the rule-of-law, the ominous wind-down of the Happy Motoring fiasco and the related tragedy of obsolete suburbia, the contemptuous disregard for the futures of young people, the immersive Kardashian celebrity twerking sleaze, the downward spiral of the floundering classes into pizza and Pepsi induced obesity, methedrine psychosis, and tattooed savagery, and the thick patina of public relations dishonesty that coats all of it like some toxic bacterial overgrowth. The dwindling life of our nation, where anything goes and nothing matters.

It’s not just the individual cluelessness of ordinary people leading lives too frantic for a moment’s reflection about anything, but the appalling institutional cluelessness of enterprises where you’d think combined intellects might tend toward a more faithful view of reality. But these days all we get is a low-order of wishful and clownish group-think, such as this item from today’s New York Times discussing a proposed reversal of Gazprom pipelines along the Ukraine / Slovakian frontier as the solution to the Kiev government’s fuel problem:

Nearly all the gas Washington and Brussels would like to get moving into Ukraine from Europe originally came from Russia, which pumps gas westward across Ukraine, into Slovakia and then on to customers in Germany and elsewhere. Once the gas is sold, however, Gazprom ceases to be its owner and loses its power to set the terms of its sale.

Get that? To avoid depending on Russian gas, they’re going to buy Russian gas from sources other than Russia. What New York Times editor can read this story without spraying her video display with coffee? What genius in John Kerry’s “Haircut-in-Search-of-a-Brain” State Department dreamed up this dodge? Who would think that you could improve a Chinese fire drill by tacking on a Polish blanket trick (i.e. trying to make your blanket longer by cutting a foot from the top and sewing it onto the bottom).

I do look this.

• New York City To Spend $41 Billion On Affordable Housing (CNBC)

New York City mayor Bill de Blasio has unveiled a 10-year plan—that will cost $41 billion—add 200,000 apartments to one of the most expensive and crowded housing markets in America. The plan aims to create enough housing to serve more than half a million New Yorkers. About 40% of the units will be newly built, while the remaining 60% will be “preserved”—which can mean anything from repairing and renovating existing affordable housing to protecting tenants from rising rents or eviction. It will also double the budget of the city’s Housing Preservation and Development agency, and will be funded through taxes, loans and money from private investors.

More than three quarters of these units will go toward households considered “low income” or poorer. About the 22% of the remaining apartments will go to moderate and middle-income New Yorkers, (which includes families of four making anywhere from $68,000 to nearly 140,000 annually). More than half of all New Yorkers pay more than 30% of their income toward rent, and about 35% of the city’s poorest—those who make less than about $42,000 a year—pay more than half of their income, according to figures cited in the plan. The complex plan will not just involve construction. The other initiatives include securing affordable housing in neighborhoods at risk of rising rents, providing tax incentives for building owners and subsidizing energy efficiency retrofits in existing buildings.

When you read the entire article, a very peculiar picture emerges. German parliamentarians who are threatened with criminal liability in the US for wanting to hear Snowden?!

• Merkel Sacrifices NSA Investigation For Unity On Ukraine (Spiegel)

In the world of diplomacy, moments of candor are rare, obscured as they are behind a veil of amicability and friendly gestures. It was no different last Friday at the meeting between US President Barack Obama and German Chancellor Angela Merkel in Washington. Obama welcomed Merkel by calling her “one of my closest partners” and a “friend” and took her on a tour of the White House vegetable garden as part of the four hours he made available. He praised her as a “strong partner” in the Ukraine crisis and thanked her many times for the close cooperation exhibited in recent years.

The birds in the Rose Garden sang happily as the president spoke. But then Obama made clear who had the upper hand in this wonderfully harmonious relationship. When a reporter asked why, in the wake of the NSA spying scandal, the no-spy deal between Germany and the US had collapsed, Obama avoided giving a clear answer. He also dodged a question as to whether Merkel’s staff is still monitored. Instead, he stayed vague: “As the world’s oldest continuous constitutional democracy, I think we know a little bit about trying to protect people’s privacy.” That was it.

Merkel, when asked if trust had been rebuilt following the NSA revelations, was much less sanguine. “There needs to be and will have to be more than just business as usual,” she said. If accepting defeat with a smile on one’s face is part of political theater, then Angela Merkel delivered a virtuoso performance. As recently as January, she delivered a sharply worded speech to parliament on the tactics used by US intelligence. “An approach in which the end justifies the means – one which employs every technical tool available – violates trust. It sows distrust.” She added: “I am convinced that friends and allies should also be able and willing to cooperate when it comes to defending against outside threats.”

I’ll say it one more time: Shale is about land speculation, not energy. The energy part is only a passing phase.

• No Gas No Problem for Shale Pipelines Backed by Private Equity (Bloomberg)

Pipeline companies have come down with shale fever. They’re so eager to grab a stake in the U.S. energy boom that they’re building transmission networks before getting the traditional commitment from drillers that anyone will actually use them. Instead of negotiating guarantees from drillers that they’ll pay fees or pump a minimum volume of oil and gas through their systems, pipeline companies such as Eagle Rock Energy Partners LP and Oryx Midstream Services LLC say they are signing agreements based on the acreage of the fields the producers plan to drill. Producers are getting away with it because there’s more competition to ship as domestic crude-oil output has risen to its highest level since 1988.

“There’s an assumption, and I’m not sure it’s exactly valid, that acreage will equal volume,” said Allen Gilmer, chairman and chief executive officer of Austin, Texas-based Drillinginfo Inc., which tracks wells. “I’d sure as heck want to have a volume consideration.” Six years into the shale-driven energy boom, pipeline companies, many of them backed by private-equity funds, are taking on the risk usually shouldered only by drillers — if the wells come in, they can reap a bonanza. If not, they face losses. Infrastructure firms have historically been less vulnerable to energy-price changes and unpredictable wells.

Money trumps it all.

• Rosneft And ExxonMobil Approve 4 Arctic Projects (RT)

Rosneft, one of the world’s largest oil companies, has given the go ahead on four Arctic projects with US oil giant ExxonMobil, despite the US government’s attempt to derail business relations with sanctions. The two companies will develop hydrocarbon reserves in the Arctic waters of Russia, including the Laptev and Chukchi Seas, Rosneft said in a statement Monday. The projects will explore and develop four licensed oil-rich reservoirs: the Anisinsk-Novosibirsk and Ust-Olenksk shelf sites in the Laptev Sea zone, as well as the North-Wrangel-2 and South-Chukchi shelf reserves, the statement said. No financial details were provided. Rosneft also plans to team up with Texas-based ExxonMobil to explore the remote Kara Sea in August.

Only Russian state-owned companies can obtain licenses to explore the Arctic, which has oil reserves estimated at 90 billion tons, or 13% of the world’s supply. Natural gas reserves stand at 1.67 trillion cubic meters, or 30% of the world reserves, and liquefied natural gas weigh in at 44 billion barrels, or 20% of potential reserves. Abundant and untapped, oil and gas above Russia offers a great investment opportunity, but at the same time, it is expensive and laborious to explore and drill in the harsh Arctic climate, which is only possible in three short summer months. The most recent round of US-led sanctions against the Russian economy put Igor Sechin, the CEO of Rosneft, but not the company, under sanctions. If further sanctions are pursued and the company itself is targeted, it could complicate business in Russia.

Hey, it’s 86 years till 2100. Burn, baby, burn.

• ‘Uncorking’ East Antarctica Could Mean 10 Foot Sea-Level Rise (Discovery)

The melting of a small area of ice on the shore of East Antarctica could lead to sea level rise for thousands of years, reports a new study. The study appears in Nature Climate Change by scientists from the Potsdam Institute for Climate Impact Research (PIK). “East Antarctica’s Wilkes Basin is like a bottle on a slant,” said lead-author Matthias Mengel in a statement. “Once uncorked, it empties out.” A rim of ice currently holds back the largest region of marine ice on rocky ground in East Antarctica. Warming oceans could lead to loss of ice on the coast, while the air over Antarctica stays cold, the researchers say. If this rim is lost it could trigger sea-level rise of 300-400 centimeters (about 10-13 feet) the researchers report.

Sea level rise from Antarctica is projected to increase by 16 centimeters this century. “If half of that ice loss occurred in the ice-cork region, then the discharge would begin. We have probably overestimated the stability of East Antarctica so far,” said co-author Anders Levermann. Computer simulations of the region show it would take 5,000-10,000 years for the basin to discharge completely. But once started the basin would empty, even if global warming was halted. “This is the underlying issue here,” said Matthias Mengel. “By emitting more and more greenhouse gases we might trigger responses now that we may not be able to stop in the future.” Rising sea level could put coastal cities at risk, including Tokyo, Mumbai or New York, the researchers said.

Home › Forums › Debt Rattle May 6 2014: Americans Find A New Source Of Spending Money