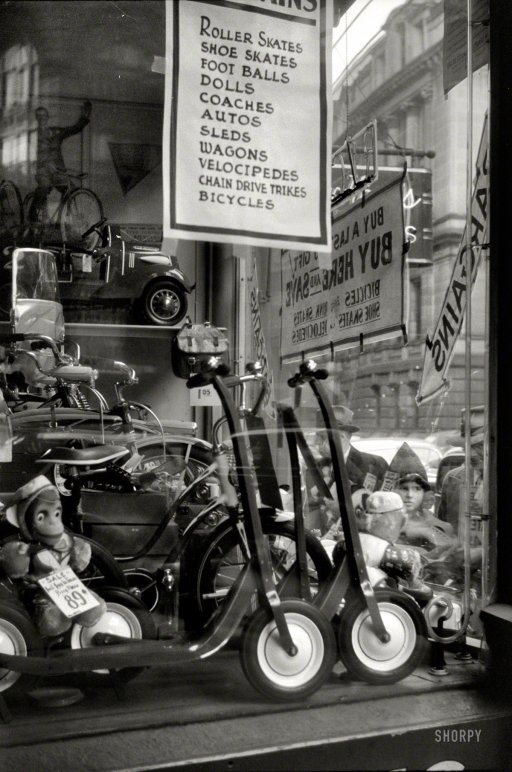

Jack Delano Window display for Christmas sale, Providence, Rhode Island Dec 1940

“First thing that’s going to happen is we’re going to get deflation over here in the U.S.”

• Japan Stimulus Likened To Bear Stearns (CNBC)

Stocks closed at all-time highs after the Bank of Japan announced additional monetary stimulus Friday, but Brian Kelly of Brian Kelly Capital said the move gave him serious misgivings. “What they did is outrageous. It is a terrible idea,” he said. “It is going to have massive, massive ramifications. The U.S. stock market hasn’t woken up to it yet, but they absolutely will. “First thing that’s going to happen is we’re going to get deflation over here in the U.S.” Additionally, the country’s Government Pension Investment Fund also said it would put half its assets—roughly $1.14 trillion—in U.S. and Japanese stocks. The Dow Jones Industrial Average closed at 17,390.52, up 1.13%, while the S&P 500 ended at 2,018.15, up 1.17%. On CNBC’s “Fast Money,” Kelly said investors would do well to buy U.S. Treasury bonds. Japan’s additional foreign investment could total about $200 billion going into the U.S. stock and bond markets, he added.

“Once again, everything is going to be manipulated, and eventually when the levee breaks, it’s going to completely fall apart,” he said. Kelly also said he had made a winning bet by being short Japanese yen coming into the trading day, adding the massive Japanese stimulus program gave him pause. “However, I felt this way before—and it was during Bear Stearns. Everybody cheered that Bear Stearns got a bailout from the Fed. And within three days, they were out of business,” he said. “So, this is Japan bailing themselves out, they had no choice. They have to raise taxes. They are now monetizing their debt—100% monetizing their debt, and buying stocks. They’re buying REITs. They’re buying ETFs. It’s insane.” Kelly clarified he wasn’t calling for a massive selloff in the near future. “I’m not saying the market’s going to fall apart on Monday morning,” he said. “I’m just saying it’s the same type of feeling where people are cheering a bailout they shouldn’t cheer.”

” … the Japanese bond market soared on this dumping announcement because the JCBs are intended to tumble right into the maws of the BOJ’s endless bid. Charles Ponzi would have been truly envious!”

• The BOJ Jumps The Monetary Shark (Stockman)

This is just plain sick. Hardly a day after the greatest central bank fraudster of all time, Maestro Greenspan, confessed that QE has not helped the main street economy and jobs, the lunatics at the BOJ flat-out jumped the monetary shark. Even then, the madman Kuroda pulled off his incendiary maneuver by a bare 5-4 vote. Apparently the dissenters – Messrs. Morimoto, Ishida, Sato and Kiuchi – are only semi-mad. Never mind that the BOJ will now escalate its bond purchase rate to $750 billion per year – a figure so astonishingly large that it would amount to nearly $3 trillion per year if applied to a US scale GDP. And that comes on top of a central bank balance sheet which had previously exploded to nearly 50% of Japan’s national income or more than double the already mind-boggling US ratio of 25%.

In fact, this was just the beginning of a Ponzi scheme so vast that in a matter of seconds its ignited the Japanese stock averages by 5%. And here’s the reason: Japan Inc. is fixing to inject a massive bid into the stock market based on a monumental emission of central bank credit created out of thin air. So doing, it has generated the greatest front-running frenzy ever recorded. The scheme is so insane that the surge of markets around the world in response to the BOJ’s announcement is proof positive that the mother of all central bank bubbles now envelopes the entire globe. Specifically, in order to go on a stock buying spree, Japan’s state pension fund (the GPIF) intends to dump massive amounts of Japanese government bonds (JCB’s). This will enable it to reduce its government bond holding – built up over decades – from about 60% to only 35% of its portfolio.

Needless to say, in an even quasi-honest capital market, the GPIF’s announced plan would unleash a relentless wave of selling and price decline. Yet, instead, the Japanese bond market soared on this dumping announcement because the JCBs are intended to tumble right into the maws of the BOJ’s endless bid. Charles Ponzi would have been truly envious! Accordingly, the 10-year JGB is now trading at a microscopic 43 bps and the 5-year at a hardly recordable 11 bps. So, say again. The purpose of all this massive money printing is to drive the inflation rate to 2%. Nevertheless, Japanese government debt is heading deeper into the land of negative real returns because there are no rational buyers left in the market – just the BOJ and some robots trading for a few bps of spread on the carry.

You won’t have to wait long to find out just how destructive this is.

• Japan Risks Asian Currency War With Fresh QE Blitz (AEP)

The Bank of Japan has stunned the world with fresh blitz of stimulus, pushing quantitative easing to unprecedented levels in a bid to drive down the yen and avert a relapse into deflation. The move set off a euphoric rally on global equity markets but the economic consequences may be less benign. Critics say it threatens a trade shock across Asia in what amounts to currency warfare, risking serious tensions with China and Korea, and tightening the deflationary noose on Europe. The Bank of Japan (BoJ) voted by 5:4 in a hotly-contested decision to boost its asset purchases by a quarter to roughly $700bn a year, covering the fiscal deficit and the lion’s share of Japan’s annual budget. “They are monetizing the national debt even if they don’t want to admit it,” said Marc Ostwald, from Monument Securities. In a telling move, the bank will concentrate fresh firepower on Japanese government bonds (JGBs), pushing the average maturity out to seven to 10 years.

It also pledged to triple the amount that will be injected directly into the Tokyo stock market through exchange-traded funds, triggering a 4.3pc surge in the Topix index. Governor Haruhiko Kuroda said the fresh stimulus was intended to “pre-empt” mounting deflation risks in the world, and vowed to do what ever it takes to lift inflation to 2pc and see through Japan’s “Abenomics” revolution. “We are at a critical moment in our efforts to break free from the deflationary mindset,” he said. The unstated purpose of Mr Kuroda’s reflation drive is to lift nominal GDP growth to 5pc a year. The finance ministry deems this the minimum level needed to stop a public debt of 245pc of GDP from spinning out of control. The intention is to erode the debt burden through a mix of higher growth and negative real interest rates, a de facto tax on savings. Mr Kuroda’s own credibility is at stake since he said in July that there was “no chance” of core inflation falling below 1pc. It now threatens to do exactly that as the economy struggles to overcome a sharp rise in the sales tax from 5pc to 8pc in April.

100%.

• Markets Are Still Addicted To Money Printing (CNBC)

Friday’s stock surge provides yet another reminder that when it comes to moving the market, there’s nothing like a little old-fashioned money printing. What waits on the other side—asset bubbles, inflation, the prospects for still greater wealth disparity—remains, of course, an issue for another day. The important thing is that the market wants what the market wants, and the Bank of Japan appears only too happy to comply, announcing a fairly aggressive stimulus package Friday that traders cheered by pushing the major averages back near record territory. The announcement came just two days after the Federal Reserve—the BOJ’s U.S. counterpart—said it was ending a quantitative easing program that saw its balance sheet swell by nearly $4 trillion since its inception. “So much for the end of QE! The Bank of Japan’s announcement today that it is stepping up its asset purchases is a timely reminder that not everyone has to follow the Fed,” Julian Jessop, chief global economist at Capital Economics, said.

“Further QE in Japan should help to support equity prices worldwide and especially in the euro zone if expectations build that the (European Central Bank) will follow with full-blown QE of its own.” Indeed, Wall Street is rubbing its hands together contemplating that at a time when global growth appears to be slowing, the willingness of central banks to crank up their virtual printing presses hasn’t abated a bit, the Fed notwithstanding. Of course there are words of caution: Jessop warned investors not to go “overboard” in their enthusiasm over the BOJ’s move. At current exchange rates, the action amounts to just more than a quarter of the $85 billion a month the Fed was adding when it it began the third leg of its QE program. Even Europe may not deliver the goods to the extent the market hopes.

Clueless.

• Central Banks Answer the Markets’ Prayers – For Now (Bloomberg)

It’s the party that just keeps going: the first batch of guests leave, the next ones arrive. Just as the U.S. Federal Reserve winds down its asset purchases, the Bank of Japan expands its own program. World stock markets, rejoice! For a while anyway. So far, quantitative easing, the policy of national bond purchases has arguably succeeded in perking up the economy, almost certainly succeeded in helping along the stock market and (this is key) certainly not led to the out-of-control inflation that critics predicted. Bloomberg Businessweek’s Peter Coy answers some of the folks who were sure bond buying would lead to economic catastrophe and still won’t admit they’re wrong.

That said, don’t get too comfortable. Central bank asset purchases dramatically lower bond returns and effectively push money into the stock market. When they end, the flow of money reverses. The idea is to do it slowly and gradually and not cause a panic. So far the Fed is succeeding. However, over the long run pulling out of the stimulus without scaring the markets is a tough difficult maneuver to pull off (and stock market returns aren’t necessarily the central bank’s concern. The Bank of Japan pulled out of its last stimulus program, in 2006, fairly smoothly. But as the chart below shows, it was the prelude to three years of market declines.

Here’s how clueless the Bloomberg editorial staff is: “Abe has shown no great zeal for exposing farmers to foreign competition or freeing up the labor market. Japan’s agricultural protections are a double burden, because it’s holding up agreement on the Trans-Pacific Partnership free-trade pact. A breakthrough on farm trade is just the tonic Japan needs.”

• Japan’s Shock and Awe (Bloomberg Ed.)

Bank of Japan Governor Haruhiko Kuroda stunned investors today by announcing a big expansion of the central bank’s bond-buying program. The move won’t fix Japan’s ailing economy by itself, but it might help, and Kuroda is right to try. The U.S. Federal Reserve likes to signal its intentions and avoid taking financial markets by surprise. Kuroda prefers shock and awe. Investors were wrong-footed by the scale of the BOJ’s quantitative easing when it was first announced last year. Now Kuroda has ambushed them again. Few expected the scale of purchases to be ramped up so soon – to 80 trillion yen a year ($724 billion), from 60 trillion to 70 trillion. Just three of 32 economists surveyed by Bloomberg News predicted it. Kuroda’s board was surprised as well, and was divided on the announcement. If Kuroda wanted investors to sit up and pay attention, it worked.

Fed doctrine notwithstanding, the element of surprise serves a purpose. QE works partly because it sends a message to investors that the central bank is determined to be forceful. At the moment, Japan’s economy needs all the forceful support it can get. The main worry is that inflation is falling again. After rising to 1.5% earlier this year, as the BOJ intended, the rate has since fallen back to 1%. The central bank’s target of 2% looked to be moving out of reach. Kuroda is saying he isn’t about to let that happen. The problem is that the BOJ can’t repair Japan’s economy by itself. At the moment, macroeconomic policy is pulling in two directions: bold stimulus from the central bank combined with a recent hefty sales-tax increase to cut public debt, with another tax increase planned for next year. The tax rise appears to have had a more dampening effect on the economy than expected. Yet it’s hard to deny that it was needed: After years of high borrowing and stagnant growth, Japan’s public debt is enormous.

How long before we get some real bad numbers out of China from some unexpected source?

• China’s October Factory Growth Unexpectedly Hits 5-Month Low (Reuters)

China’s factory activity unexpectedly fell to a five-month low in October as firms fought slowing orders and rising costs in the cooling economy, reinforcing views that the country’s growth outlook is hazy at best. The official Purchasing Managers’ Index (PMI) eased to 50.8 in October from September’s 51.1, the National Bureau of Statistics said on Saturday, but above the 50-point level that separates growth from contraction on a monthly basis. Analysts polled by Reuters had forecast a reading of 51.2.

Underscoring the challenges facing the world’s second-largest economy, the PMI showed foreign and domestic demand slipped to five- and six-month lows, respectively, with overseas orders shrinking slightly on a monthly basis. “There remains downward pressure on the economy, and monetary policy will remain easy,” economists at China International Capital Corp said in a note to clients after the data. Noting that inventory levels of unsold goods rose last month even as factories cut output levels and drew down on stocks of raw materials, the investment bank argued that the economy still faced tepid demand.

We’re sure to have some fun conversations on gold going forward.

• Gold Sinks To Levels Not Seen Since 2010 (MarketWatch)

Gold took a hard fall on Friday, at one point trading at levels not seen since 2010, as the dollar surged in the wake of a surprise stimulus move from the BOJ\. Gold for December delivery slumped $27, or 2.3%, to settle at $1,171.60 an ounce, closing out the week 5.3% lower. The precious metal shed 3.7% in October and is down 3.3% for the year to date. December silver gave up 31 cents to $16.11 an ounce. A more hawkish-than expected Fed statement has already been weighing on gold this week. The Fed’s ending of its bond-buying stimulus program on Wednesday smacked prices hard as gold shed 2.2% amid signs of a healing economy. The U.S. economy expanded 3.5% in the third quarter, data showed Thursday. “The surprisingly robust US GDP figures yesterday confirmed the Fed’s more optimistic economic outlook of the day before and thus indirectly dampened demand for gold as a safe haven,” said analysts at Commerzbank, in a note.

Gold was further pummeled after the Bank of Japan shocked markets with a move to expand the pace of quantitative easing, triggering a 5% surge in the Nikkei 225 index. The dollar touched its highest level against the yen since January 2008. The BOJ expanded the size of its Japanese Government Bond purchases to the equivalent of “about 80 trillion yen” ($727 billion) a year, a rise of ¥30 trillion on the previous amount. It also said it would buy longer-dated JGBs, and triple its purchase of exchange-traded funds and real-estate investment trusts. Gold losses speeded up as a pageant of economic numbers rolled out, including one that showed a slowdown in consumer spending. Commzerbank said gold has taken out its psychologically important $1,200 per troy ounce mark, but also its four-year low of around $1,180. Jim Wyckoff, a Kitco analyst, is more pessimistic on gold than he has been in a while, and noted that prices could be in trouble if they don’t hold the $1,183 level. “If [gold] prices fall below that, you’ll probably see a stiff leg down in prices, and a challenge of $1,000 could not be ruled out,” he warned.

Big number. No snow, no excuses, just a bad print. With no other reason than people simply don’t have the spending power.

• Consumer Spending In US Unexpectedly Drops As Incomes Cool (Bloomberg)

The drop in fuel prices couldn’t have come at a better time for the U.S. economy. Consumer spending unexpectedly dropped 0.2% in September, weaker than any economist projected in a Bloomberg survey, after rising 0.5% in August, according to Commerce Department data issued today in Washington. The report also showed incomes rose at a slower pace last month. “This is a little blip, a bit of payback, but all the numbers are pointing to solid growth between now and the end of the year,” said Nariman Behravesh, chief economist of IHS, who is among the top-ranked forecasters of consumer spending over the past two years, according to data compiled by Bloomberg. “There are a variety of factors that are playing into it. Better finances for consumers, very good jobs growth and you’ve got more money in consumers’ pockets because of lower gasoline prices.” The lowest costs at the gas pump in four years and the biggest payroll gains in more than a decade are projected to lift buying power and household purchases heading into the holiday-shopping season.

Other reports today showed consumer confidence jumped this month to a seven-year high and manufacturing in the Chicago area picked up, bolstering prospects for a rebound. The U.S. consumer spending data showed that after adjusting for inflation, which generates the figures used to calculate gross domestic product, purchases also dropped 0.2% last month after a 0.5% gain in August. The data provided a monthly breakdown of the third-quarter figures issued yesterday. That report showed consumer spending, which accounts for almost 70% of the economy, climbed at a 1.8% pace after growing at a 2.5% rate in the previous three months. The weak reading at the end of the quarter gives consumption little momentum heading into the last three months of the year. In a research note, economists at JPMorgan Chase & Co. in New York said it will probably be difficult to reach their 2.9% spending forecast for the fourth quarter, though they maintained the projection until more data are available.

More slices cut from the same pie.

• Why that Glorious Economy of Ours Feels so Crummy (WolfStreet)

That the economy grew at a “faster than expected” annual rate of 3.5% in the third quarter has been touted as a sign that now – finally, after years of false promises – it is reaching that ever elusive “escape velocity.” But instantly, people with keen eyes began to quibble with it. One big factor was military spending, which spiked 16%, the fasted since Q2 2009. This rate is based on the increase from the second quarter that is then annualized, assuming that spending wound continue at this rate for a year. This type of quarter-to-quarter annualized rate is volatile. For example, it plunged 20% in Q4 2012, jumped 17% in Q2 2009, and 18% in Q3 2008. Spikes and plunges often run in sequence (chart). In reality…. According to data from the US Treasury, the Department of Defense spent $149 billion in Q3, which was actually down a smidgen from the $150 billion it spent in Q3 2013.

This lets out a lot of hot air. That spike was likely a fluke, much like other spikes and plunges before it, and much of it may well be undone in Q4. The other two big factors in that “faster than expected” growth of GDP were inventories, which ballooned and will eventually have to be whittled back down, and exports. The surges in these three categories caused JPMorgan to cut its Q4 GDP growth forecast to 2.5% from 3.0%. “All three of these categories tend to be associated with payback the following quarter,” explained chief US economist Michael Feroli. And the crux of the economy, the consumer? “Still plodding along in a steady, but unspectacular, manner….” Whether or not that annualized quarterly rate of 3.5% was a mirage – year over year, the economy grew by just 2.3%.

A growth rate barely above 2% is exactly where the US economy has been for the last five years! Nothing has changed. For a recovery by US standards, it’s a very crummy growth rate, and far from the escape velocity that Wall Street hype artists have predicted for years in their justification for the ceaselessly skyrocketing stock market. But it gets worse. The population in the US has been growing too. And the economic pie has to be divvied up among more people. So the pie has to grow faster than the population or else, on an individual basis, that growing overall economy, gets cut into smaller slices of the pie.

But without spending they lose even more reserves and production …

• Top US Oil Companies See More Pressure To Clamp Down On Spending (Reuters)

Top U.S. oil producers, which already were reining in spending before crude prices started to slip in June, are now looking to trim more fat from their budgets while reminding investors they must spend to grow. Exxon Mobil said on Friday it would keep its current spending plan intact, though it is about 15% less than 2013. ConocoPhillips said it will spend less money next year, and Chevron said it is looking for budget “flexibility.” Crude oil prices have slumped 25% since June as global supplies grow and demand weakens. Exxon, which sets budgets using a long-term horizon, still expects to spend a little bit less than $37 billion a year from 2015 to 2017, an executive told investors on Friday on a conference call. “We always are mindful of what’s happening in the near future but I keep on pulling back that we are a long-term investor,” said Jeff Woodbury, Exxon’s head of investor relations.

Exxon tests projects “across the full range of economic parameters including price” to ensure favorable returns, he said. The Irving, Texas company saw capital spending peak at $42.5 billion last year when it was advancing projects to deliver future production growth. Exxon has spent $28 billion so far this year, down 14% versus the first nine months of 2013. ConocoPhillips, the largest independent oil and gas company, said on Thursday it plans to spend less than $16 billion next year, below the $16.7 billion it expects to spend in 2014. “(Capital spending) is going to be lower because of the commodity price environment,” Jeff Sheets, ConocoPhillip’s chief financial officer said in an interview with Reuters. “We have the flexibility in our capital program to reduce it without giving up any opportunities.”

Not sure I’m happy with how Euan places nuclear so close to renewables.

• The Failure of Green Energy Policies (Euan Mearns)

Whilst enjoying the good natured exchanges on this blog concerning the pros and cons of new renewable energy sources I decided to dig deeper into the success of Green energy policies to date. Roger Andrews produced this chart the other day and the low carbon energy trends caught my eye. It is important to recall that well over $1,700,000,000,000 ($1.7 trillion) has been spent on installing wind and solar devices in recent years with the sole objective of reducing global CO2 emissions. It transpires that since 1995 low carbon energy sources (nuclear, hydro and other renewables) share of global energy consumption has not changed at all (Figure 1). New renewables have not even replaced lost nuclear generating capacity since 1999 (Figure 2). ZERO CO2 has been abated and the world has done zilch to prepare itself for the expected declines (escalating costs) of fossil fuels in the decades ahead. If this is not total policy failure, what is?

Figure 1 Nuclear, Hydro and Other Renewables (mainly wind and solar) expressed as % of total global energy consumption. The combined low carbon share reached 13.1% in 1995. In 2013 it was 13.3%. From this chart it is easy to see that Other Renewables have simply compensated for the decline in nuclear power a point made more clear in Figure 2.

One of the main problems with Green thinking is that many Greens are against both fossil fuel (FF) based energy and nuclear power. There are some notable exceptions, James Lovelock and George Monbiot, and I recognise that a number of the “pro-renewable” commenters on this blog are at least not anti-nuclear. It would also be unfair to blame the relative decline of nuclear power since 2001 exclusively on Greens but they do have to shoulder a significant slice of that responsibility.

Figure 2 shows that the recent growth in Other Renewables does not compensate for the relative decline in nuclear power. What is more, stable base load is being replaced with intermittent supply that is seldom correlated with demand. FF generation is wrestling in the background, unloved and unappreciated, maintaining order in our society.

Figure 2 Nuclear and Other Renewables as a%age of total global energy consumption. Nuclear’s contribution peaked in 2001 and the decline in nuclear since then has not been fully compensated by the rapid expansion of renewables.

All about a dam.

• Riots, Clashes In France After Activist Dies In Police Grenade Blast (RT)

Another anti-police brutality protest turned violent in the French city of Rennes, with masked youths and police engaging in running street battles. The unrest follows the death of a young environmental activist earlier this week. Overnight Thursday, protesters in the northwestern city lobbed flairs at police and flipped over cars, some of which they set ablaze. Police responded by firing tear gas. The number of arrests or injures, if any, remains unclear. A similar protest in Paris on Wednesday also descended into violence. Around 250 people gathered outside City Hall in Paris, with some throwing rocks at police and writing “Remi is dead, the state kills” on walls, The Local’s French edition reports. At least 33 people were taken into police custody following the unrest. The protests are in response to the death of 21-year-old activist Remi Fraisse. He was killed early on Sunday by an explosion, which occurred during violent clashes with police at the site of a contested-dam project in southwestern France.

His death, the first in a mainland protest in France since 1986, has been blamed on a concussion grenade fired by police. France’s Interior Minister Bernard Cazeneuve, who came under serious pressure to resign following the incident, announced an immediate suspension of such grenades, which are intended to stun rather than kill. On Monday, outrage at Fraisse’s death sparked protests in several French cities. Violence erupted in Albi, the town close to the dam, as well as in Nantes and Rennes. Fraisse was one of 2,000 activists present in the southwestern Tarn region to protest the €8.4m ($10.7) million Sivens dam project. Activists said the project would harm the environment, but officials say it is needed to irrigate farm land and boost the local economy. On Friday, however, local authorities suspended work on the project, saying it would be impossible to continue in light of current events. The executive council, however, which is tasked with overseeing the project, has not ruled to abandon it all together.

Home › Forums › Debt Rattle November 1 2014