�Hans Behm Windy City tourists at Monroe Street near State� 1908

“The push that came to shove might have been the grim October data, which showed industrial output, investment, exports, and retail sales all slowing fast. Those data suggest it will be much harder to get anywhere close to the government’s 2014 target of 7.5% GDP growth .. ”

• China’s Surprise Rate Cut Shows How Freaked Out The Government Is (Quartz)

Earlier [this week], the People’s Bank of China slashed the benchmark lending rate by 40 basis points, to 5.6%, and pushed down the 12-month deposit rate 25 basis points, to 2.75%. Few analysts expected this. The PBoC—which, unlike many central banks, is very much controlled by the central government—generally cuts rates only as a last resort to boost growth. The government has been rigorously using less broad-based ways of lowering borrowing costs (e.g. cutting reserve requirement ratios at small banks, and re-lending to certain sectors). The fact that the government finally cut rates suggests that these more “targeted” measures haven’t succeeded in easing funding costs for Chinese firms. The push that came to shove might have been the grim October data, which showed industrial output, investment, exports, and retail sales all slowing fast.

Those data suggest it will be much harder to get anywhere close to the government’s 2014 target of 7.5% GDP growth, given that the economy grew only 7.3% in the third quarter, its slowest pace in more than five years. But wait. Isn’t the Chinese economy supposed to be losing steam? Yes. The Chinese government has acknowledged many times that in order to introduce the market-based reforms needed to sustain long-term growth and stop piling on more corporate debt, it has to start ceding its control over China’s financial sector. Things like, for instance, setting the bank deposit rate artificially low, which generally punishes savers to benefit state-owned enterprises (SOEs). But clearly, the economy’s not supposed to be decelerating as fast as it is. Tellingly, it’s been more than two years since the central bank last cut rates, when the economic picture darkened abruptly in mid-2012, the critical year that the Hu Jintao administration was to hand over power to Xi Jinping.

The all-out push to boost growth that followed made 2013 boom, but also freighted corporate balance sheets with dangerous levels of debt. But this could only last so long; things started looking ugly again in 2014. Up until now, attempts to buoy the economy have mainly focused on helping out small non-state companies, says Mark Williams, chief economist at Capital Economics, in a note. Often ineligible for state-run bank loans, small firms have mostly been paying steep rates for shadow financing. Since the benchmark rate cut affects official loans given out by mostly state-run banks, today’s cut will mainly benefit SOEs, hinting that the authorities “apparently feel larger firms are now in need of support too,” writes Williams. In addition, lowering the amount banks charge for capital makes them less likely to lend. Though that should in theory be offset by the lowering of the deposit rate, savers have been shunting their money into higher-yielding wealth management products, making deposits increasingly scarce.

“I could see empty apartment buildings stretching for miles, with just a handful of cars driving by. It made me think of the aftermath of a neutron-bomb detonation.”

• The End of China’s Economic Miracle? (WSJ)

On a trip to China in 2009, I climbed to the top of a 13-story pagoda in the industrial hub of Changzhou, not far from Shanghai, and scanned the surroundings. Construction cranes stretched across the smoggy horizon, which looked yellow in the sun. My son Daniel, who was teaching English at a local university, told me, “Yellow is the color of development.” During my time in Beijing as a Journal reporter covering China’s economy, starting in 2011, China became the world’s No. 1 trader, surpassing the U.S., and the world’s No. 2 economy, topping Japan. Economists say it is just a matter of time until China’s GDP becomes the world’s largest. This period also has seen China’s Communist Party name a powerful new general secretary, Xi Jinping , who pronounced himself a reformer, issued a 60-point plan to remake China’s economy and launched a campaign to cleanse the party of corruption.

The purge, his admirers told me, would frighten bureaucrats, local politicians and executives of state-owned mega companies—the Holy Trinity of vested interests—into supporting Mr. Xi’s changes. So why, on leaving China at the end of a nearly four-year assignment, am I pessimistic about the country’s economic future? When I arrived, China’s GDP was growing at nearly 10% a year, as it had been for almost 30 years—a feat unmatched in modern economic history. But growth is now decelerating toward 7%. Western business people and international economists in China warn that the government’s GDP statistics are accurate only as an indication of direction, and the direction of the Chinese economy is plainly downward. The big questions are how far and how fast. My own reporting suggests that we are witnessing the end of the Chinese economic miracle.

We are seeing just how much of China’s success depended on a debt-powered housing bubble and corruption-laced spending. The construction crane isn’t necessarily a symbol of economic vitality; it can also be a symbol of an economy run amok. Most of the Chinese cities I visited are ringed by vast, empty apartment complexes whose outlines are visible at night only by the blinking lights on their top floors. I was particularly aware of this on trips to the so-called third- and fourth-tier cities—the 200 or so cities with populations ranging from 500,000 to several million, which Westerners rarely visit but which account for 70% of China’s residential property sales. From my hotel window in the northeastern Chinese city of Yingkou, for example, I could see empty apartment buildings stretching for miles, with just a handful of cars driving by. It made me think of the aftermath of a neutron-bomb detonation—the structures left standing but no people in sight.

“China’s had a decade which has been very, very similar to that of the US in the 1920s.”

• Hugh Hendry: “A Bet Against China Is A Bet Against Central Bank Omnipotence” (MW)

Merryn Somerset Webb: That brings us, I guess, to China. You were one of the first to point out the native problems in China. Your rather amazing video wandering around empty housing estates, etc, which I think was pretty well watched. What’s your view now?

Hugh Hendry: I think my view would surprise you. Before I surprise you, I would like to seek legitimacy of my view by telling you that I have made money. It’s been my most successful profit centre in the year to date, and we’ve made over 5% trading in China-related macro themes. In terms of surprising you, I am more sanguine about China. Actually I’ve been rather impressed by their policy responses over the last two years. When I look at China, China has got two components. It’s got this manic investment gross capital formation and in something which has been deepening these global deflationary fears, because they kept expanding over capacity industries such as cement and steel and undermining prices in the rest of the world. That in itself lowers these inflation figures below Central Bank targets. It becomes reflexive and then the central bank says “Crikey, I’ve got to be radical here. I’ve got to buy equities”. So there’s been that going on.

On the other hand, there’s been a robbing Peter to pay Paul, and China’s had a decade which has been very, very similar to that of the US in the 1920s. The US, people forget this, but Liaquat Ahamed – I’ve just destroyed his name, forgive me, but the Lords of Finance author – I reread it recently and I was very taken by the notion of how mean the Fed had been in the 1920s. Again, I say it to you with cathartic crisis, the response of the rest of the world is to be long dollars invested in America and that was certainly the case in the 1920s. But America was recovering nicely from the Great War and it had this incredible productivity revolution. There was great demand for credit and so it was fine on its own.

What can you expect from Jon Hilsenrath?

• Central Banks in New Push to Prime Pump (WSJ)

Two major central banks moved Friday to pump up flagging global growth, sending stock markets soaring but raising new questions about the limitations of a seven-year effort to use monetary policy to address economic problems. The People’s Bank of China announced a surprise reduction in benchmark lending and deposit rates, the first cuts since 2012, after other measures to boost faltering growth fell short. Hours later, European Central Bank President Mario Draghi said the bank might take new measures to boost inflation, now near zero, his strongest signal yet that the ECB is getting closer to buying a broader swath of eurozone bonds.

The moves came less than two weeks after the Bank of Japan said it would ramp up its own securities-purchase program known as quantitative easing, or QE, as the Japanese economy fell into recession. The twin steps Friday, half a world apart, sent global stock prices sharply higher, bolstered the U.S. dollar and boosted oil prices. The Shanghai Composite Index rose 1.4%, while Germany’s DAX index jumped 2.6%. The Dow Jones Industrial Average finished up 0.51%, and at 17810.06 is now closing in on the 18000 threshold that has never been surpassed. The Nikkei rose 0.3%. Amid the flurry of central bank activity, the dollar was the winner among global currencies, rising 0.27% against a broad index of other currencies to put it up 9% for the year.

Though the moves toward easier money in Europe and Asia are good for investors, they come with multiple risks. They could perpetuate or spark asset bubbles, or stoke too much inflation if taken too far. Also, they don’t address structural problems that policy makers in each economy are struggling to fix. The steps, particularly in Europe, represent a subtle endorsement of the Federal Reserve’s easy-money approach to postcrisis economics, but come as the U.S. central bank shifts its own low-interest-rate policies. The Fed last month ended a six-year experiment with bond purchases, and it has begun talking about when to start raising short-term interest rates as the U.S. economy improves, though those discussions are early and rate increases are likely months away, at the earliest.

“Even low inflation can be damaging, particularly if it breeds the expectation that outright deflation will follow. If people expect prices to fall, they are encouraged to hold off spending.” Makes you wonder about Christmas sales.

• Forget What Central Bankers Say: Deflation Is The Real Monster (Observer)

The European Central Bank might like to update its website – specifically, its educational video to teach teenagers about the importance of keeping prices in check. In it, a spotted, fanged, snarling “inflation monster” floods money into the marketplace, making vivid the perils of prices rising too quickly. Near the end of the cartoon a much smaller, smiling, pink creature makes a brief appearance – the “deflation monster”. Fear of inflation is understandable in a continent that saw devastating hyperinflation last century – a shock seen by some as pivotal in the rise of Hitler. But look around the eurozone now and the bigger threat is deflation. Even in the UK, inflation is well below the Bank of England’s target and the central bank expects it to fall further over coming months.

Oil prices have been falling, as have other commodity prices. In Britain a supermarket price war is pushing food prices down further still. Wages are barely budging and a price freeze for energy bills should also help to keep inflation low this winter. The Bank fully admits it failed to forecast this significant drop below the government-set 2% target for inflation. Governor Mark Carney used the Bank’s latest forecasts earlier this month to warn of “some pretty big disinflationary forces”, largely coming from abroad. He predicted inflation would fall even further, to below 1% over the next six months. If it does, he will face the unenviable task of being the first governor since BoE independence in 1997 to write a letter to the chancellor explaining why inflation is so low.

All of the 14 letters written until now have been because inflation missed the target too far in the other direction, overshooting by more than 1 percentage point. Aside from the awkwardness of the Dear George moment, there are very real reasons why Carney is saying the Bank needs to get inflation back to target. The inflation monster may be scary, but the deflation monster is by no means harmless. Even low inflation can be damaging, particularly if it breeds the expectation that outright deflation will follow. If people expect prices to fall, they are encouraged to hold off spending. Economic stagnation and rising unemployment can follow.

Why would anyone doubt that?

• “I Am 100% Confident That Central Banks Are Buying S&P Futures” (Zero Hedge)

I have been an independent trader for 23 years, starting at the CBOT in grains and CME in the S&P 500 futures markets long ago while they were auction outcry markets, and have stayed in the alternative investment space ever since, and now run a small fund. I understand better than most I would think, the “mechanics” of the markets and how they have evolved over time from the auction market to ‘upstairs”. I am a self-taught, top down global macro economist, and historian of “money” and the Fed and all economic and governmental structures in the world. One thing so many managers don’t understand is that the markets take away the most amounts of money from the most amounts of people, and do so non-linearly.

Most sophisticated investors know to be successful, one must be a contrarian, and this philosophy is in parallel. Markets will, on all time scales, through exponential decay (fat tails, or black swans, on longer term scales), or exponential growth of price itself. Why was I so bearish on gold at its peak a few years back for instance? Because of the ascent of non-linearity of price, and the massive consensus buildup of bulls. Didier Sornette, author of “Why Stock Markets Crash”, I believe correctly summarizes how Power Law Behavior, or exponential consensus, and how it lead to crashes. The buildup of buyers’ zeal, and the squeezing of shorts, leads to that “complex system” popping. I have traded as a contrarian with these philosophies for some time.

The point here is, our general indices have been at that critical point now for a year, without “normal” reactions post critical points in time, from longer term time scales to intraday. This suggests that many times, there is only an audience of one buyer, and as price goes up to certain levels, that buyer extracts all sellers. After this year and especially this last 1900 point Dow run up in October, and post non-reaction, that I am 100% confident that that one buyer is our own Federal Reserve or other central banks with a goal to “stimulate” our economy by directly buying stock index futures. Talking about a perpetual fat finger! I guess “don’t fight the Fed” truly exists, without fluctuation, in this situation. Its important to note the mechanics; the Fed buys futures and the actual underlying constituents that make up the general indices will align by opportunistic spread arbitragers who sell the futures and buy the actual equities, thus, the Fed could use the con, if asked, that they aren’t actually buying equities.

“Public sector net debt, excluding public sector banks, was £1.45 trillion in October, and now represents almost 80pc of UK gross domestic product. Britain’s debt pile has increased by almost £100bn over the past year alone .. ”

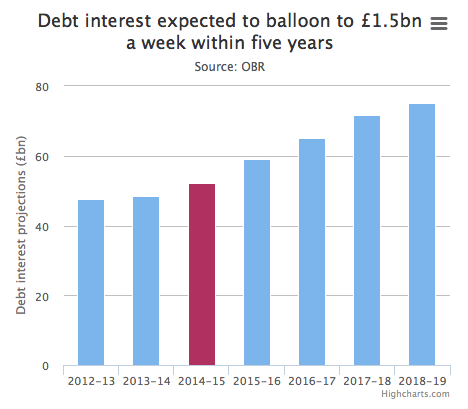

• UK Chancellor Haunted By Deficit And £1.45 Trillion Debt Pile (Telegraph)

The Government’s ability to reduce the deficit this year and tame Britain’s huge debt mountain is in doubt, despite a slight fall in borrowing last month. Public sector net borrowing, excluding public sector banks, fell to £7.7bn in October, from £7.9bn in the same month a year ago. The deficit was also in line with economists’ expectations. While an across-the-board rise in tax receipts, including a 1.5pc increase in income tax to £10.5bn in October, helped to reduce borrowing last month, the deficit remains £3.7bn – or 6pc – higher this year than in 2013. The Office for Budget Responsibility had forecast a 7pc increase in income tax receipts this year, which are currently down 0.4pc compared with the same period in 2013, at £81.5bn. Income from VAT and stamp duties increased by 4.9pc and 3.6pc, to £10.3bn and £1.3bn respectively in October, while corporation tax payments also edged up, despite weak oil and gas revenues.

The OBR is expected to revise up the Government’s borrowing forecasts on December 3, when the Chancellor will present the Autumn Statement. This will reduce the likelihood of any big tax giveaways before the next election. Samuel Tombs at Capital Economics said: “This year’s poor borrowing figures limit the Chancellor’s room for manoeuvre and undermine his argument that the public finances can be restored to a sustainable position after the next election through spending cuts alone.” Robert Chote, the chairman of the OBR, said last month that the Government was likely to miss its income tax targets this year as weak pay growth and a surge in low paid jobs means the Treasury rakes in less revenue than predicted. A Treasury spokesperson said borrowing remained “in line with the Budget forecast” and stressed that the Government would continue to take steps to “build a resilient British economy”.

The Treasury and OBR expect a “sizeable” increase in income tax receipts from self-employed workers in January 2015 as distortions related to the reduction of the top rate of tax unwind. Economists were sceptical that any January boost would make up the current shortfall. Michael Saunders, chief UK economist at Citibank, expects the deficit to overshoot the OBR’s forecast by £13bn this fiscal year, taking borrowing up to £100bn this year. “The tax and benefit reforms of the last 15 years have proved very successful in boosting employment and workforce participation, but also have eroded the extent to which economic recovery generates a fiscal windfall,” he said. The size of Britain’s debt pile also continued to balloon in October. Public sector net debt, excluding public sector banks, was £1.45 trillion in October, and now represents almost 80pc of UK gross domestic product.

Britain’s debt pile has increased by almost £100bn over the past year alone, and the Treasury is expected to pay almost £1bn a week in debt interest payments this year. Debt interest payments are now close to the Goverment’s combined transport and defence budget, with payments expected to rise to £75bn in 2018-19.

Noted this before: as capital fless junk bonds, big bad things can happen.

• Junk Bonds Whipsawed as Trading Drought Rattles Investors (Bloomberg)

Junk bond investors have a bad case of the jitters. Every bit of bad news is whipsawing prices, with bonds tumbling as much as 50% in a single day. “We’ve seen some flash crashes in the market,” said Henry Craik-White, analyst at ECM Asset Management. “If you get caught on the wrong side of a name, you can get severely punished in this market.” Investors are rattled because they’re concerned that a lack of liquidity in the bond market will make it impossible for them to sell holdings in response to negative headlines. Trading dropped about 70% since 2008, with a corporate bond that changed hands almost five times a day a decade ago now only being sold once a day on average, according to Royal Bank of Scotland. Alarms started ringing in September with the collapse of British retailer Phones 4u after Vodafone and EE refused to renew contracts. The retailer shut its business and sought creditor protection on Sept. 15, sending the company’s payment-in-kind bonds down to 1.9 pence on the pound, according to data compiled by Bloomberg.

A month later, notes of Spanish online travel service EDreams Odigeo fell 57% in one afternoon when Iberia Airlines and British Airways said they were withdrawing tickets from the company’s websites. The 10.375% bonds almost fully recovered the following trading day when the airlines reinstated the tickets. Abengoa’s debt plunged as much as 32% last week amid investor confusion about how the Spanish renewable energy company accounted for $632 million of green bonds. The Seville-based company’s 8.875% notes dropped to 74 cents on the euro from 107 cents in two days and rebounded to 95 cents after Abengoa held a conference call to reassure bondholders.

” .. a Dutch pension fund for nurses and social workers that she invests for paid more than €400 million (about $500 million) to private-equity firms in 2013..”

• Pension Funds Lambaste Private-Equity Fees (WSJ)

Pension-fund managers from the Netherlands to Canada, searching for new ways to invest, lambasted private-equity executives at a conference in Paris this week for charging excessive fees. Ruulke Bagijn, chief investment officer for private markets at Dutch pension manager PGGM, said a Dutch pension fund for nurses and social workers that she invests for paid more than €400 million (about $500 million) to private-equity firms in 2013. The amount accounted for half the fees paid by the PFZW pension fund, even though private-equity firms managed just 6% of its assets last year, she said. “That is something we have to think about,” Ms. Bagijn said.

The world’s largest investors, including pension funds and sovereign-wealth funds, are seeking new ways to invest in private equity to avoid the supersize fees. Some investors are buying companies and assets directly. Others are making more of their own decisions about which funds to invest in, rather than giving money to fund-of-fund managers. Big investors are also demanding to invest alongside private-equity funds to avoid paying fees. Jane Rowe, the head of private equity at Ontario Teachers’ Pension Plan, which manages Can$141 billion (US$124.4 billion), is buying more companies directly rather than just through private-equity funds. The plan invests with private-equity firms including Silver Lake Partners and Permira, according to its annual report. Ms. Rowe told executives gathered in a hotel near Place Vendome in central Paris that she is motivated to make money to improve the retirement security of Canadian teachers rather than simply for herself and her partners.

“You’re not doing it to make the senior managing partner of a private-equity fund $200 million more this year,” she said, as she sat alongside Ms. Ruulke of the Netherlands and Derek Murphy of PSP Investments, which manages pensions for Canadian soldiers. “You’re making it for the teachers of Ontario. You know, Derek’s making it for the armed forces of Canada. Ruulke’s doing it for the social fabric of the Netherlands. These are very nice missions to have in life.”

That’ one cute graph. But any article that quotes Yergin is dead in the water.

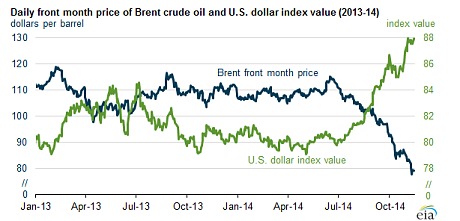

• Sun Sets On OPEC Dominance In New Era Of Lower Oil Prices (Telegraph)

It wouldn’t be the first time that a meeting of OPEC has taken place in an atmosphere of deep division, bordering on outright hatred. In 1976, Saudi Arabia’s former oil minister Ahmed Zaki Yamani stormed out of the OPEC gathering early when other members of the cartel wouldn’t agree to the wishes of his new master, King Khaled. The 166th meeting of the group in Vienna next week is looking like it could end in a similarly acrimonious fashion with Saudi Arabia and several other members at loggerheads over what to do about falling oil prices. Whatever action OPEC agrees to take next week to halt the sharp decline in the value of crude, experts agree that one thing is clear: the world is entering into an era of lower oil prices that the group is almost powerless to change This new energy paradigm may result in oil trading at much lower levels than the $100 (£64) per barrel that consumers have grown used to paying over the last decade and reshape the entire global economy.

It could also trigger the eventual break-up of OPEC, the group of mainly Middle East producers, which due to its control of 60pc of the world’s petroleum reserves has often been accused of acting like a cartel. Even worse, some experts warn that a prolonged period of lower oil prices could reshape the entire political map of the Middle East, triggering a new wave of political uprisings in petrodollar sheikhdoms in the Persian Gulf, which depend on the income from crude to underwrite their high levels of public spending and support less wealthy client states in the Arab world. “We are now entering a new era in world oil and we will have lower prices for some time to come,” says Daniel Yergin, the Pulitzer prize-winning author of The Quest: Energy Security and the Remaking of the Modern World. “Oil was really the last commodity in the super-cycle to remain standing.” Mr Yergin spoke exclusively to The Sunday Telegraph ahead of what is being called the most important gathering of OPEC in more than 20 years.

Don’t think the Financial Times finds it a good idea.

• Google Break-Up Plan Emerges From European Parliament (FT)

The European parliament is poised to call for a break-up of Google, in one of the most brazen assaults so far on the technology group’s power. The gambit increases the political pressure on the European Commission, the EU’s executive arm, to take a tougher line on Google, either in its antitrust investigation into the company or through the introduction of laws to curb its reach. A draft motion seen by the Financial Times says that “unbundling [of] search engines from other commercial services” should be considered as a potential solution to Google’s dominance. It has the backing of the parliament’s two main political blocs, the European People’s Party and the Socialists.

A vote to effectively single out a big US company for censure is extremely rare in the European parliament and is in part a reflection of how Germany’s politicians have turned against Google this year. German centre-right and centre-left politicians are the dominant force in the legislature and German corporate champions, from media groups to telecoms, are among the most vocal of Google’s critics. Since his nomination to be the EU’s digital commissioner, Germany’s Günther Oettinger has suggested hitting Google with a levy for displaying copyright-protected material; has raised the idea of forcing its search results to be neutral; and voiced concerns about its provision of software for cars.

Google has become a lightning rod for European concerns over Silicon Valley, with consumers, regulators and politicians assailing the company over issues ranging from its commercial dominance to its privacy policy. It has reluctantly accepted the European Court of Justice’s ruling on the right to be forgotten, which requires it to consider requests not to index certain links about people’s past. The European parliament has no formal power to split up companies, but has increasing influence on the commission, which initiates all EU legislation. The commission has been investigating concerns over Google’s dominance of online search for five years, with critics arguing that the company’s rankings favour its own services, hitting its rivals’ profits.

Eh, no. UKIP did not start this.

• European Season of Political Discontent Rung In by UKIP (Bloomberg)

Some 16,867 voters in southeast England ushered in a season of European political tumult that in an extreme scenario could lead to Britain exiting the European Union, Greece quitting the euro or Catalonia seceding from Spain. Victory by the anti-EU U.K. Independence Party in a British parliamentary contest was fueled by the same sense of economic injustice and antagonism to politics-as-usual that will unsettle Europe in coming months. It also gave a flavor of the potential fallout, as the pound fell against most of its 16 major peers. “The markets have a lot to worry about,” Edmund Phelps, a Nobel Prize-winning economist at Columbia University in New York, said in an interview before the British vote. “It’s possible that we could see a swing toward the extreme right, and one must wonder what ramifications this would have for the European Union and the euro area.”

Since Greece’s runaway debt convulsed the euro region in 2010, Europe has avoided doomsday storylines like the breakup of the EU, the euro or a member state. Whether those risks were banished or merely deferred will become clearer in the next rounds of political jousting. Early elections are beckoning in Greece, Catalonia, Italy and Austria, and that’s before scheduled ballots including in the U.K. in May, Portugal in September or October and in Spain at year’s end. The re-emergence of political risk in Europe is cited by Royal Bank of Scotland Plc analysts including Alberto Gallo as among the “top trades” for 2015. Europeans rehearsed the revolt in last May’s European Parliament balloting, upping the vote count of anti-establishment parties to about 30% from 20%. The motley groups failed to form a cohesive force and mainstream parties retained control. Protest parties are now set to consolidate gains at the national level.

I’ll pay plastic, please.

• The Curse Of Black Friday Sales (NY Post)

After a tough 2014, nervous retailers couldn’t afford to wait for the traditional day after Thanksgiving to pull the trigger on holiday shopping discounts. So retail titans from Amazon to Walmart — and nearly every store in between — have been stretching the selling season with Black Friday discounts that started the day after Halloween. Macy’s, JCPenney and Toys R Us, which started opening on Thanksgiving a couple of years ago, are opening earlier than ever for Turkey Day 2014. Retail experts say the hysterical bombardment of deals both online and in stores all November long shows just how ineffective — and dysfunctional — the Black Friday business model has become. Just 28% of shoppers are expected to hit the stores the day after Thanksgiving this year, according to a survey released last week from Bankrate.com.

“Retailers know that big pop, the big Black Friday day — it’s not working,” said Bankrate.com analyst Jeanine Skowronski. Black Friday used to be the day retailers’ profit ledgers entered the black for the year. Now it’s known for chaos, stampeding crowds and deals that can be found with less hassle online or some other time. As shoppers struggle with stagnant wages and high food prices, stores are fighting to win their limited discretionary dollars and turn a profit amid all the price-cutting. Add to that, on Black Friday, picketers will be outside 1,600 Walmart stores, calling for higher wages and full-time jobs for those who want them. “Personally, I never go to a store on Black Friday—there’s no need to,” said Edward Hertzman, publisher of Sourcing Journal.

“A better sale is probably just around the corner, especially on seasonal merchandise.” Since the 2008 Black Friday trampling death of a Long Island Walmart employee by a mob of shoppers, the post Turkey Day doorbuster sales have been notorious for attracting dangerous crowds. This year, Walmart and other stores are staggering deals and trying new strategies to keep the crowds less dangerous. Stores began extending Black Friday to try to bounce back from the recession. Now, however, they have trained consumers to expect a constant stream of price cuts, and are jockeying for first place in a fiercely competitive race. The discounts may help stores reach the forecast of up to 4% revenue growth for the 2014 holiday season, but margins will suffer.

Have they incorporated Alibaba’s Singles Day yet? How about if we have one ‘special’ event every week? Would they all shop like crazy?

• UK Retailers Pin Hopes On American Shopping Extravaganza (Independent)

Black Friday begins on Monday. If that’s the sort of sentence that elicits a double-take, I can only apologise — and say, blame the Americans. Ever a nation to milk something for all it’s worth and a bit more, the US has turned the day after Thanksgiving, when retailers cut their prices, into a week-long extravaganza. So Amazon will begin its “Black Friday Deals Week” promotions from 8am on Monday, with “lighting deals” every 10 minutes and lasting until stocks run out. The climactic day will still be Friday, and this year, more than ever, Britain will be swamped with discounts online and in the High Street. Visa Europe is forecasting that £360,000 will be spent every minute, or £6000 per second on its cards next Friday.

Once the preserve of Amazon, which in 2010 brought the phenomenon of the day after Thanksgiving as the day for retailers to offer big bargains, it’s now become one of the most important dates in the retail calendar. Friday is already set to become the biggest online shopping day in the UK. [..] In the US, Black Friday got its name from Philadelphia, where the police had to cope with the collision of shoppers heading for the sales and American football fans going to the annual Army v Navy fixture. It quickly acquired another interpretation, as the day when stores moved from being in the red to the black. UK retailers are crossing their fingers and hoping that the second meaning comes true.

So all we need to do is cut our holiday shopping?

• Don’t Prick The Christmas Spending Bubble, It Keeps Capitalism Alive (Observer)

Global capitalism, as a system, simply doesn’t work. Russell Brand’s new book provides the proof. As does my new book. And the hundreds of other new books that are just out. And the Sainsbury’s advert. And all the current adverts for booze and perfume, chocolates and jewels, supermarkets and computer games. The gaudy, twinkly proof is going up all around us as the last of the leaves come down. It’s called Christmas. [..]

Christmas is an annual bubble – an irrational buying fever that’s actually scheduled. We know it will come and, like all bubbles, we know it will end. Unlike most bubbles, we also know precisely when it will end. The huge signs advertising a collapse in prices are already stacked in department stores’ stockrooms as the final spasm of Christmas Eve top-whack spending is taking place. At this time of year, the invisible hand gets delirium tremens – possibly from the number of drinks the invisible mouth is sticking away. Looked at with a Scrooge-like economist’s hat on (gift idea for an accountant!), this makes no sense. Millions of people are each buying hundreds of things they don’t need – often luxuries they can scarcely afford – and at a time when such items’ prices are artificially inflated because everyone else is also buying them.

Wait a couple of weeks and jumpers with reindeer on, chocolates in stocking-shaped presentation packs and sacks of brussels sprouts will be going for a song. The rational economic choice, even for an alcoholic gourmand who likes wearing jewels, would be to schedule a knees-up for 10 January. And, as every shopkeeper will tell you, a huge sector of our economy depends on this. Our already beleaguered high streets would be wastelands without it, the hellish out-of-town malls exist primarily to harness this “golden quarter” of spending. The capitalist dream that western economies aspire to live is sustained by a crazy retail spike caused by a bastardised form of religious observance.

And now, after three pieces on shopping crazes, here’s your moment of zen:

• Food Banks Face Record Demand As Low-Income Families Look For Help (PA)

Growing numbers of people on low incomes are turning to food banks to survive, new research has revealed. Almost 500,000 adults and children were given three days’ food in the first six months of the current financial year – a record – the Trussell Trust reported. The charity said the number of adults being referred to one of its 400 food banks had increased by 38% compared with the same period last year. Problems with social security were the biggest trigger for going to a food bank, but more than a fifth blamed low income. In the six months to September, 492,641 people were given three days’ food and support, including 176,565 children, compared with 355,982 during the same period in the previous year.

Trussell Trust chief executive David McAuley said: “Whilst the rate of new food banks opening has slowed dramatically, we’re continuing to see a significant increase in numbers helped by them. “Substantial numbers are needing help because of problems with the social security system but what’s new is that we’re also seeing a marked rise in numbers of people coming to us with low income as the primary cause of their crisis. “Incomes for the poorest have not been increasing in line with inflation and many, whether in low-paid work or on welfare, are not yet seeing the benefits of economic recovery. “Instead they are living on a financial knife-edge where one small change in circumstances or a life shock can force them into a crisis where they cannot afford to eat.”

“He said that when international sanctions had been used against other countries such as Iran and North Korea, they had been designed not to harm the national economy.”

• Russia FM Lavrov Accuses West Of Seeking ‘Regime Change’ In Russia (Reuters)

Foreign Minister Sergei Lavrov accused the West on Saturday of trying to use sanctions imposed on Moscow in the Ukraine crisis to seek “regime change” in Russia. His comments stepped up Moscow’s war of words with the United States and the European Union in their worst diplomatic standoff since the Cold War ended. “As for the concept behind to the use of coercive measures, the West is making clear it does not want to force Russia to change policy but wants to secure regime change,” Tass news agency quoted Lavrov as telling a meeting of the advisory Foreign and Defence Policy Council in Moscow. He said that when international sanctions had been used against other countries such as Iran and North Korea, they had been designed not to harm the national economy.

“Now public figures in Western countries say there is a need to impose sanctions that will destroy the economy and cause public protests,” Lavrov said. His comments followed remarks on Thursday in which President Vladimir Putin said Moscow must guard against a “colour revolution” in Russia, referring to protests that toppled leaders in other former Soviet republics. Western sanctions have limited access to foreign capital for some of Russia’s largest companies and banks, hit the defence and energy industries, and imposed asset freezes and travel bans on some of Putin’s allies.

Move over, Pussy Riot?!

• Rapper May Face 25 Years In Prison Over ‘Gangsta Rap’ Album (RT)

Brandon Duncan has no criminal record, but could face a life sentence of 25 years in prison as prosecutors say his latest album lent artistic motivation for a recent string of gang-related shootings. San Diego County prosecutors have charged Duncan, 33, with nine felonies connected to a wave of gang-related shootings in the California city. Although the musician has not been charged with discharging or providing firearms in the recent shootings, prosecutors say his musical lyrics encourage gang behavior. Duncan’s latest album, entitled “No Safety,” features a photograph of a revolver with bullets on the cover. The gangsta rapper, who is being held on $1 million bail, is scheduled to head to court in December. If found guilty of felony charges, Duncan could serve a life sentence of 25 years in prison, his lawyer said. San Diego police say Duncan is a gang member, who goes by the name TD.

In 2000, California, faced with an increase in gang-related violence, passed Proposition 21, which takes aim at individuals “who actively participates in any criminal street gang with knowledge that its members engage in or have engaged in a pattern of criminal gang activity.” Prosecutors, citing a section of the law, argued that Duncan, through his music and gang affiliations “willfully promotes, furthers, or assists in any felonious criminal conduct by members of that gang.” “We’re not just talking about a CD of anything, of love songs. We’re talking about a CD (cover)… There is a revolver with bullets,” said Deputy District Attorney Anthony Campagna, as quoted by the Los Angeles Times. Duncan’s lawyer, Brian Watkins, disputes the claim, saying the prosecution’s use of an obscure California law is “absolutely unconstitutional” and impedes his client’s First Amendment right to the freedom of speech.

“It’s no different than Snoop Dogg or Tupac,” Watkins, naming other rappers known for their controversial lyrics, said. “It’s telling the story of street life.” “If we are trying to criminalize artistic expression, what’s next, Brian De Palma and Al Pacino?” said Watkins, in reference to the 1983 movie “Scarface” directed by De Palma and starring Pacino.

“Our living wonders, which have persisted for millions of years, are disappearing in the course of decades.”

• We Need A New Law To Protect Our Wildlife From Critical Decline (Monbiot)

One of the fears of those who seek to defend the natural world is that people won’t act until it is too late. Only when disasters strike will we understand how much damage we have done, and what the consequences might be. I have some bad news: it’s worse than that. For his fascinating and transformative book, Don’t Even Think About It: why our brains are wired to ignore climate change, George Marshall visited Bastrop in Texas, which had suffered from a record drought followed by a record wildfire, and Sea Bright in New Jersey, which was devastated by Hurricane Sandy. These disasters are likely to have been caused or exacerbated by climate change.

He interviewed plenty of people in both places, and in neither case – Republican Texas or Democratic New Jersey – could he find anyone who could recall a conversation about climate change as a potential cause of the catastrophe they had suffered. It simply had not arisen. The editor of the Bastrop Advertiser told him: “Sure, if climate change had a direct impact on us, we would definitely bring it in, but we are more centred around Bastrop County.” The mayor of Sea Bright told him: “We just want to go home, and we will deal with all that lofty stuff some other day.” Marshall found that when people are dealing with the damage and rebuilding their lives they are even less inclined than they might otherwise be to talk about the underlying issues.

In his lectures, he makes another important point that – in retrospect – also seems obvious: people often react to crises in perverse and destructive ways. For example, immigrants, Jews, old women and other scapegoats have been blamed for scores of disasters they did not create. And sometimes people respond with behaviour that makes the disaster even worse: think, for instance, of the swing to Ukip, a party run by a former banker and funded by a gruesome collection of tycoons and financiers, in response to an economic crisis caused by the banks. I have seen many examples of this reactive denial at work, and I wonder now whether we are encountering another one. The world’s wild creatures are in crisis. In the past 40 years the world has lost over 50% of its vertebrate wildlife. Hardly anywhere is spared this catastrophe. In the UK, for example, 60% of the 3,000 species whose fate has been studied have declined over the past 50 years. Our living wonders, which have persisted for millions of years, are disappearing in the course of decades.

Home › Forums › Debt Rattle November 23 2014