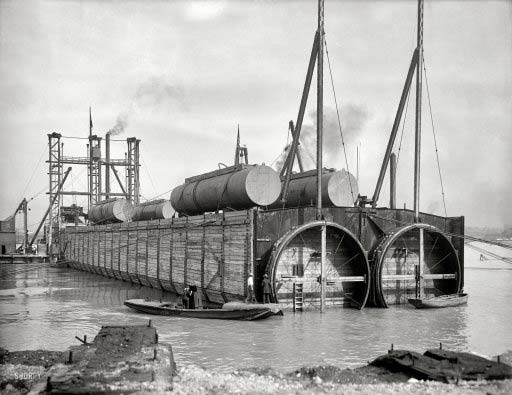

DPC S�i�n�k�i�n�g� �l�a�s�t� �t�u�b�u�l�a�r� �s�e�c�t�i�o�n�,� �M�i�c�h�i�g�a�n� �C�e�n�t�r�a�l� �R�.�R�.� �t�u�n�n�e�l�, D�e�t�r�o�i�t� �R�i�v�e�r 1910

Some still see a very long bull market dead.

• More S&P 500 Pain Seen as 10% Losses Spread (Bloomberg)

For most American stocks, the correction has arrived. While gauges such as the Standard & Poor’s 500 cling to gains for the year, declines that exceed the 10% are spreading in the broader market. In the Russell 3000 Index (RAY), for example, 79% of companies are down that much from their highs, according to data compiled by Bloomberg. That’s a bad sign to Doug Ramsey, the chief investment officer of Leuthold Group who correctly predicted in July 2013 that the U.S. bull market had months more to go. He said that when losses multiply in stocks away from benchmark indexes, it usually means the bigger companies are next. “We’re not expecting a bear market, but we are expecting a significant additional correction,” Ramsey, who helps oversee $1.7 billion at Minneapolis-based Leuthold, said by phone. “We’re seeing very classic late-cycle action where the Dow and S&P 500 are painting a very false picture of what’s going on underneath.”

Concern the rate of global growth is slowing and the Federal Reserve is preparing to raise interest rates has pushed the S&P 500 down 5.2% from its September record. The 1,700-stock Value Line Arithmetic index, which strips out weightings related to market value to show how the average U.S. stock has fared, is down 10% since July. An average of 7.9 billion shares a day changed hands on U.S. exchanges this week, the most since November 2011, as the Dow Jones Industrial Average erased its 2014 gain. The Chicago Board Options Exchange Volatility Index jumped 46% to 21.24, the highest since February. Three weeks of declines have broken the almost unprecedented calm that had enveloped markets for most of 2014. Eight trading days into October, the S&P 500 has posted six single-day moves exceeding 1%. The market went without any swings of that size for 62 days in May, June and July, the longest stretch since 1995.

Markets need volatility simply to make money.

F�e�a�r� �i�s� �r�i�s�i�n�g�.� �T�h�e� �C�B�O�E� �V�o�l�a�t�i�l�i�t�y� �I�n�d�e�x� �(�V�I�X�)� �c�o�n�t�i�n�u�e�d� �i�t�s� �u�p�w�a�r�d� �c�l�i�m�b� �t�o�d�a�y�,� �r�i�s�i�n�g� �9�%� �t�o� �2�0�.�4�5� �a�f�t�e�r� �e�a�r�l�i�e�r� �r�i�s�i�n�g� �a�b�o�v�e� �2�2� �o�n� �t�h�e� �h�e�e�l�s� �o�f� �e�y�e�-�p�o�p�p�i�n�g� �g�a�i�n�s� �y�e�s�t�e�r�d�a�y�.� U�B�S� �S�t�r�a�t�e�g�i�s�t� �J�u�l�i�a�n� �E�m�a�n�u�e�l� �a�r�g�u�e�s� �t�h�a�t� �v�o�l�a�t�i�l�i�t�y� �c�o�u�l�d� �k�e�e�p� �r�i�s�i�n�g�.� �I�n� �a� �n�o�t�e� �p�u�b�l�i�s�h�e�d� �t�o�d�a�y�,� �h�e� �w�r�o�t�e�:�

��W�h�e�n� �c�o�n�s�i�d�e�r�i�n�g� �t�h�e� �n�u�m�e�r�o�u�s� �g�e�o�p�o�l�i�t�i�c�a�l� �h�o�t� �s�p�o�t�s�,� �p�u�b�l�i�c� �h�e�a�l�t�h� �c�o�n�c�e�r�n�s�,� �t�h�e� �e�n�d� �o�f� �t�h�e� �F�e�d�’s� �Q�E� �d�u�e� �o�n� �1�0�/�2�9� �a�n�d� �t�h�e� �u�n�k�n�o�w�n� �o�f� �e�l�e�c�t�i�o�n�s� �i�n� �B�r�a�z�i�l� �a�n�d� �U�k�r�a�i�n�e� �(�1�0�/�2�6�)� �a�n�d� �t�h�e� �U�S� �M�i�d�t�e�r�m� �e�l�e�c�t�i�o�n� �o�n� �1�1�/�4�,� �w�e� �e�x�p�e�c�t� �v�o�l�a�t�i�l�i�t�y� �t�o� �r�e�m�a�i�n� �e�l�e�v�a�t�e�d�,� �g�r�a�v�i�t�a�t�i�n�g� �t�o�w�a�r�d� �t�h�e� �l�o�n�g� �t�e�r�m� �m�e�a�n� �o�f� �2�0�,� �w�i�t�h� �t�h�e� �p�o�t�e�n�t�i�a�l� �t�o� �s�p�i�k�e� �h�i�g�h�e�r� �s�h�o�u�l�d� �2�0�1�4�2 s� �g�r�o�w�t�h� �s�c�a�r�e� �m�o�r�e� �c�l�o�s�e�l�y� �r�e�s�e�m�b�l�e� �2�0�1�1�2 s� �(�S�&�P� �5�0�0� �d�e�c�l�i�n�e� �o�f� �1�7�.�9�%�)� �r�a�t�h�e�r� �t�h�a�n� �2�0�1�3�2 s� �(�S�&�P� �5�0�0� �d�e�c�l�i�n�e� �o�f� �5�.�8�%�)�.� �P�u�t�t�i�n�g� �i�t� �i�n�t�o� �c�o�n�t�e�x�t�,� �a� �V�I�X� �o�f� �2�0� �i�m�p�l�i�e�s� �a�n� �a�v�e�r�a�g�e� �d�a�i�l�y� �m�o�v�e� �i�n� �t�h�e� �S�&�P� �5�0�0� �o�f� �a�r�o�u�n�d� �2�4� �p�o�i�n�t�s� �a�n�d� �i�n� �t�h�e� �D�o�w� �J�o�n�e�s� �I�n�d�u�s�t�r�i�a�l� �A�v�e�r�a�g�e�,� �2�1�0� �p�o�i�n�t�s�.� �E�x�p�e�c�t� �m�o�r�e� �v�o�l�a�t�i�l�i�t�y�!�

�

�T�h�e� �V�I�X�,� �k�n�o�w�n� �a�s� �W�a�l�l� �S�t�r�e�e�t’s� �f�e�a�r� �g�a�u�g�e�,� �h�a�s� �b�e�e�n� �r�i�s�i�n�g� �s�i�n�c�e� �m�i�d�-�J�u�n�e�,� �w�h�e�n� �i�t� �f�e�l�l� �b�e�l�o�w� �t�h�e� �1�1� �m�a�r�k�,� �t�h�e� �l�o�w�e�s�t� �l�e�v�e�l�s� �s�i�n�c�e� �2�0�0�7�.� �T�h�e� �i�n�d�e�x� �i�s� �i�n�v�e�r�s�e�l�y� �c�o�r�r�e�l�a�t�e�d� �w�i�t�h� �t�h�e� �S�&�P� �5�0�0� �a�n�d� �m�a�n�y� �v�i�e�w� �i�t� �a�s� �a�n� �i�n�d�i�c�a�t�o�r� �o�f� �m�a�r�k�e�t� �p�e�a�k�s�.� �T�o�d�a�y�’s� �i�n�t�r�a�d�a�y� �h�i�g�h� �o�f� �2�2�.�0�6� �i�s� �a�l�s�o� �a� �5�2�-�w�e�e�k� �h�i�g�h� �f�o�r� �t�h�e� �i�n�d�e�x�.� �T�h�e� �b�u�l�l�s� �a�n�d� �b�e�a�r�s� �a�r�e� �b�a�t�t�l�i�n�g� �v�a�l�i�a�n�t�l�y�.� �Y�e�s�t�e�r�d�a�y�,� �t�h�e� �g�r�i�z�z�l�i�e�s� �w�o�n�,� �w�i�t�h� �t�h�e� �D�o�w� �s�u�f�f�e�r�i�n�g� �a� �m�o�r�e� �t�h�a�n� �3�0�0�-�p�o�i�n�t� �d�r�o�p� �a�n�d� �c�o�n�t�i�n�u�i�n�g� �t�o� �f�a�l�l� �t�o�d�a�y�.�

More to come.

• US Stocks Close Out Worst Week Since May 2012 (AP)

U.S. stocks are closing out a turbulent week with another loss, giving the market its worst week since May 2012. Technology shares were especially hard hit. Semiconductor makers slumped after Microchip Technology cut its sales forecast for the quarter and warned investors to expect bad news from others in the sector. The Dow Jones industrial average lost 115 points, or 0.7%, to 16,544 Friday. The Standard and Poor’s 500 fell 22 points, or 1.2%, to 1,906. The technology-heavy Nasdaq fell 102 points, or 2.3%, to 4,276. The stock market has been swinging sharply this week. The Dow had its biggest decline of the year Thursday, a day after its biggest gain. Bond prices rose. The yield on the 10-year Treasury note fell to 2.29%.

That sounds terrible unwise.

• Wall Street Goes Short Bonds at Bad Time as Debt Rallies (Bloomberg)

It’s been a painful week for Wall Street’s biggest bond brokers. Primary dealers had the biggest short position on benchmark government notes at the beginning of the month since last year’s taper tantrum. It was the wrong bet: The debt has gained 1.5% in October as 10-year Treasury yields plunged to the lowest since June 2013. The surprise rally has even the most experienced bond traders struggling to figure out how to maneuver in this market. On one hand, the Federal Reserve is slowing its unprecedented stimulus, suggesting that yields are poised to rise. On the other, central banks elsewhere across the globe are accelerating their easy-money policies to suppress borrowing costs and avoid deflation.

“Over the last year, what’s sort of been the market’s focus is everyone is bearish,” preparing for rates to rise, said David Ader, head of interest-rate strategy at CRT Capital Group LLC. Given banks’ unwillingness to take on risk in the face of new regulations, even a modest short position on a historical basis shows a meaningful bet, he said. The 22 primary dealers that trade with the U.S. central bank had a net $20.7 billion wager against notes maturing in the seven-to-eleven year range during the week ended Oct. 1, Fed data show. That’s the biggest short position on the notes since June 2013. It makes sense that Wall Street would bet against benchmark bonds given economists predict that 10-year Treasury yields will rise to 2.71% by year-end from 2.3% now, according to a Bloomberg survey. Of course, instead of rising this year, yields have fallen from 3% on Dec. 31.

The Keynes camp knows the solution, as always. Always the same solution too.

• Dam Breaks In Europe As Deflation Fears Wash Over ECB Rhetoric (AEP)

A key gauge of deflation risk in Europe is flashing red, dropping to record lows on fears of fresh recession and lack of decisive action by the European Central Bank. The sudden lurch downwards came as Bank of America warned that France’s debt ratio could rocket to 120pc of GDP within five years, unless the EU authorities take radical steps to reflate the region’s economy. Italy’s debt could threaten 150pc even earlier. The 5-year/5-year forward swap rate monitored closely by traders plummeted beneath 1.77pc on Friday morning as a global growth scare drove European stock markets to a 12-month low. “This rate is the most important market signal on the planet right now. Everybody is watching the chart, and it has just gone off a cliff,” said Andrew Roberts, credit chief at RBS. Bond markets echoed the refrain, with yields on 10-year German Bunds falling to an all-time low of 0.88pc on flight to safety, though the bond rally can also be seen as a bet by traders that the ECB will soon be forced to launch full-blown quantitative easing.

Mario Draghi, the ECB’s president, has adopted the 5Y/5Y rate as the bank’s policy lodestar, used to distill expectations of future inflation. Any fall below 2pc is deemed a risk that expectations are becoming “unhinged” and could lead to a Japanese-style deflation trap. Mr Roberts said the ECB’s plan for asset purchases – or “QE-lite” – does not yet add up to a coherent strategy. “We don’t think they can boost their balance sheet by more than €165bn over the next two years by buying asset-backed securities (ABS) and covered bonds together, given the haircut effects. The sums are trivial,” he said. RBS estimates that the inflation rate has already dropped to below 0.1pc in the eurozone if one-off tax rises and fees are stripped out, and this measure may turn negative in October. “Deflation is already knocking on the door. We think it could happen as soon as next month given the latest fall in food prices,” said Mr Roberts. “We are reaching the end game in Europe. If they don’t launch real QE and start reflation by the end of the year or soon after, the consequences are too awful to contemplate,” he said.

Gartman’s right. Question is how much damage it can still do before it’s over.

• Dennis Gartman Says The Euro ‘Is Doomed To Failure’ (CNBC)

Conflicting economic priorities in Europe likely will spell the end for the region’s common currency, widely followed investor Dennis Gartman said. The author of The Gartman Letter attributes much of the global market tumult this week to weakness in the European Union, and specifically remarks Thursday from European Central Bank President Mario Draghi. Speaking in Washington, Draghi, who famously promised two years ago to do “whatever it takes” to keep the EU together, emphasized that central banks can’t by themselves save the world and need cooperation from fiscal policy. It’s hardly the first time that message has been sent—former Federal Reserve Chairman Ben Bernanke often pleaded with Washington for fiscal policy coordination—but Gartman, writing in his daily missive, said global markets needed to hear more:

As the world awaited a hoped-for clear and precise statement that the ECB was prepared to actually take action on monetary policy and become expansionary, it instead heard a lecture explaining that he and the others on the ECB’s monetary policy committee had done all that they could do to try to strengthen the economy there and that the real battle had to be waged by the political authorities to reform the sclerotic nature of the economies there.

The result, he said, is a bifurcated Europe. On one side there are the “GAFs,” or Germany, Austria and Finland, who oppose U.S.-style quantitative easing, or asset purchases aimed at goosing financial markets. On the other side are the “FIGs,” or France, Italy and Greece, whose economies are struggling and need liquidity measures. So far, he said, the GAFs have won, and this is what is roiling markets that have come to depend on central bank largess since the financial crisis.

The (euro), we fear, is doomed to failure at this point. The political anger that has been evidenced in the battles over (European Commission president-elect) Mr. (Jean-Claude) Juncker’s proposed Cabinet … shall erupt in full flower in the days ahead. The FIG countries cannot abide further austerity; austerity in the face of 20+% unemployment is economic nonsense. On the other hand the GAFs, with sub 6% unemployment, really don’t need an expansionary monetary policy, can abide fiscal conservatism and will fight for both.

This is what I’ve mentioned a few times already: using the price of oil to get at Russia. However, there’s much more to it than just changing Putin’s position on Syria, as the article claims. The US wants to break Putin, period, and gain control over Russian resources. Still, messing with Syria is messing with Russia’s only Middle East link, which is just too dangerous for Putin, and therefore a very risky approach. The Saudis may be overestimating their own savvy. Or they may just be getting very desperate.

• Why Oil Is Plunging: The “Secret Deal” Between The US And Saudi Arabia (ZH)

Two weeks ago, we revealed one part of the “Secret Deal” between the US and Saudi Arabia: namely what the US ‘brought to the table’ as part of its grand alliance strategy in the middle east, which proudly revealed Saudi Arabia to be “aligned” with the US against ISIS, when in reality John Kerry was merely doing Saudi Arabia’s will when the WSJ reported that “the process gave the Saudis leverage to extract a fresh U.S. commitment to beef up training for rebels fighting Mr. Assad, whose demise the Saudis still see as a top priority.”

What was not clear is what was the other part: what did the Saudis bring to the table, or said otherwise, how exactly it was that Saudi Arabia would compensate the US for bombing the Assad infrastructure until the hated Syrian leader was toppled, creating a power vacuum in his wake that would allow Syria, Qatar, Jordan and/or Turkey to divide the spoils of war as they saw fit. A glimpse of the answer was provided earlier in the article “The Oil Weapon: A New Way To Wage War“, because at the end of the day it is always about oil, and leverage. The full answer comes courtesy of Anadolu Agency, which explains not only the big picture involving Saudi Arabia and its biggest asset, oil, but also the latest fracturing of OPEC at the behest of Saudi Arabia…

… which however is merely using “the oil weapon” to target the old slash new Cold War foe #1: Vladimir Putin. To wit:

Saudi Arabia to pressure Russia, Iran with price of oil

Saudi Arabia will force the price of oil down, in an effort to put political pressure on Iran and Russia, according to the President of Saudi Arabia Oil Policies and Strategic Expectations Center. Saudi Arabia plans to sell oil cheap for political reasons, one analyst says. To pressure Iran to limit its nuclear program, and to change Russia’s position on Syria, Riyadh will sell oil below the average spot price at $50 to $60 per barrel in the Asian markets and North America, says Rashid Abanmy, President of the Riyadh-based Saudi Arabia Oil Policies and Strategic Expectations Center. The marked decrease in the price of oil in the last three months, to $92 from $115 per barrel, was caused by Saudi Arabia, according to Abanmy.

With oil demand declining, the ostensible reason for the price drop is to attract new clients, Abanmy said, but the real reason is political. Saudi Arabia wants to get Iran to limit its nuclear energy expansion, and to make Russia change its position of support for the Assad Regime in Syria. Both countries depend heavily on petroleum exports for revenue, and a lower oil price means less money coming in, Abanmy pointed out. The Gulf states will be less affected by the price drop, he added. The Organization of the Petroleum Exporting Countries, which is the technical arbiter of the price of oil for Saudi Arabia and the 11 other countries that make up the group, won’t be able to affect Saudi Arabia’s decision, Abanmy maintained. The organization’s decisions are only recommendations and are not binding for the member oil producing countries, he explained.

Today’s Brent closing price: $90. Russia’s oil price budget for the period 2015-2017? $100. Which means much more “forced Brent liquidation” is in the cards in the coming weeks as America’s suddenly once again very strategic ally, Saudi Arabia, does everything in its power to break Putin.

Because they’re worthless?

• Here’s Why Shale Oil Stocks Are Tanking (CNBC)

Why are shale plays getting hit so hard? The short answer is, because oil is dropping. West Texas Intermediate has gone from $105 to $85 in three months. But a large part of the problem has to do with the way shale drilling is financed. Let’s say you own a shale company and you want to finance drilling a well in, say, the Bakken. You need $10 million (I am just using $10 million as an example). You have a demonstrated reserve value from the well of, say, $20 million. Here’s how you might finance the $10 million deal. First, get a line of credit from a bank based on the value of the reserves. In turn, the lender becomes a secured creditor. Let’s say that based on a value of $20 million, a secured lender is willing to put up $5 million. You can fund another $2 million from your own cash flow. Now you have $7 million. For the remaining $3 million, you go to the high-yield debt market, which of course is an unsecured creditor. Here’s what the deal looks like:

Secured creditor: $5 million

Cash flow: $2 million

Unsecured creditor: $3 million (high yield)

Total: $10 millionThis is simplified, but you get the point. Now, let’s look at what happens when oil starts to drop fast, which is exactly our scenario. That secured creditor with the line of credit? He’s getting nervous, because now instead of reserves worth $20 million for your project, those reserves are now worth only, say, $16 million. That’s a problem. The line of credit you will be able to get will drop because as the price of oil drops banks don’t want to lend as much So, instead of $5 million, your secured creditor will only lend $4 million, and at a higher rate. Now you need $6 million more. Another problem: because the price of oil is down, you can’t contribute as much from your cash flow, so instead of $2 million that you contribute, you can only contribute $1 million. That’s $5 million total. You still need another $5 million, and now you have to go to the high-yield market. Except the high-yield market is aware of your problems, and they want a higher interest rate too. So here’s what this new deal looks like:

Secured creditor: $4 million

Cash flow: $1 million

Unsecured creditor: $5 million

Total: $10 millionThis is a problem, because you are: 1) making less money from selling oil, and 2) shelling out a lot more money in interest to your creditors. As oil drops, you now run an increased risk of cash flow problems, and there is default risk in the debt. So you are making less money, and your one cheap source of financing (the line of credit) is shrinking, forcing you to go to high yield. You are in a debt spiral. Get it? So, at what point does all this start to get problematic? That’s not easy to answer, because every company is different. There are different yields from different wells, and some have more gas than oil. But there’s no doubt that things get a bit difficult for some producers when oil is in the low $80’s, which is where it is heading now. And rather than differentiate between companies…which is what analysts are paid to do…there is a lot of indiscriminate selling. Oil vs. gas, doesn’t matter. Sell and ask questions later.

Could be a big booost for the yuan. Ironically, that’s the last thing China needs.

• ECB Weighing First Step to Buying Yuan for Foreign Reserves (Bloomberg)

The European Central Bank will discuss next week whether to begin laying the groundwork to add the Chinese yuan to its foreign-currency reserves, according to two people with knowledge of the matter. Governing Council members gathering in Frankfurt for their Oct. 15 mid-month meeting will consider the move, said the people, who asked not to be named because the discussions aren’t public. Should officials eventually decide to buy the currency, initial purchases would be small and might start in a year at the earliest, one of them said Such a measure by the ECB would mark a major step in the internationalization of China’s currency, also known as the renminbi. While China is the world’s second-largest national economy, the yuan isn’t ranked among the most-held foreign reserve assets, according to data from the International Monetary Fund. The U.S. dollar leads at 61% of holdings. The agenda of the Governing Council is confidential, an ECB spokesman said, declining to comment further on the matter.

Speaking in Washington yesterday, former Bundesbank President Axel Weber predicted a greater international role for the yuan. “The emergence of the renminbi will be a big factor,” he said. “You will have an appreciation of the renminbi.” The ECB’s push comes against a backdrop of global central bank diplomacy to ease the way for China’s currency, after a series of swap agreements on emergency liquidity. Officials will review the IMF’s basket of so-called Special Drawing Rights, which doesn’t currently include the yuan, by 2015, according to the fund’s web site. China hopes its currency can join, Li Bo, head of the People’s Bank of China’s second monetary policy department, said in Hong Kong in March. The basket currently includes the dollar, euro, pound and yen.

If the Americans won’t do it, German prosecutors are welcome to take over where they can.

• Deutsche Bank Latest ‘Untouchable’ Target for Munich Prosecutor (Bloomberg)

Manfred Noetzel has a message for Deutsche Bank: Don’t mess with Bavarian justice. A day after his Munich Prosecutors Office sealed a $100 million settlement with Formula One’s Bernie Ecclestone in August, Noetzel’s team slapped criminal charges on five current and former executives at Germany’s largest bank. Noetzel, 64, is taking his fight on crime to the heart of the country’s financial industry as he reaches the pinnacle of a career that spans more than three decades and blazes a trail through the boardrooms of companies from Siemens to MAN and now Deutsche Bank. “Today, there’s no company that could say: ‘We’re untouchable, no one can get us,’” Noetzel, chief of the Munich Prosecutors Office, said in an interview. “Those times are over.”

The bank officials, including Co-Chief Executive Officer Juergen Fitschen and former CEOs Josef Ackermann and Rolf Breuer, were charged with attempted fraud for allegedly misleading a Munich appeals court in a lawsuit by the late media magnate Leo Kirch. His office has been investigating the Deutsche Bank cases since 2011 when the Munich appeals court said at a hearing that Ackermann, Breuer and two other managers lied to judges hearing a €2 billion ($2.5 billion) dispute between the lender and Kirch, who passed away in 2011. “To have yourself taken for a ride by deliberately wrong statements, aimed at subverting a clearly justified civil claim – no one puts up with that,” Noetzel said. “Neither does the Bavarian judiciary.

The integrity and impartiality of the administration of justice must be protected.” Deutsche Bank’s resolution of the more than 10-year-old civil dispute with Kirch’s heirs didn’t dissuade Noetzel from pursuing the case that may likely be the major one in the last year of his career in public service. The Frankfurt-based lender in February paid €925 million to the heirs of Kirch to end the litigation over the collapse of his media empire. Instead, a month later prosecutors added in-house lawyers and outside attorneys to the list of suspects, searched the bank for a third time and raided the offices of law firms that worked on the case. “The whole case is a declaration of war against Deutsche Bank,” said Martin Buecher, a defense lawyer in Cologne, who isn’t involved in the matter. “It’s also a demonstration of power.”

Think maybe earlier experiences scared S&P away from expressing too harsh judgments on France?

• S&P: Negative Outlook For France’s Risky Reform (CNBC)

Ratings agency S&P cut its outlook for France to negative from stable on Friday, amid growing concerns about the strength of the country’s economic recovery. Still, S&P affirmed France’s AA/A-1+ rating. France has been dubbed the “sick man” of the euro zone over recent months, after economic data which have continued to surprise on the downside. GDP failed to expand during the second quarter of this year after stalling in the first, and is expected to have grown only slightly—by 0.2%—in the third quarter, according to the Bank of France. “In our view, the French government’s budgetary position is deteriorating in light of France’s constrained nominal and real economic growth prospects,” S&P wrote in its research update on the country released Friday. S&P last downgraded France in November 2013, when it cut its sovereign credit rating to AA. Last month, rival credit agency Moody’s said it was keeping its Aa1 rating (the agency’s second highest) on French government debt, but maintained its negative outlook.

S&P pointed to France’s high per capita income and skilled workforce in explaining the affirmation of an AA rating. But the outlook revision “reflects our view of receding fiscal space for the French government in light of the economy’s constrained real and nominal growth prospects against the background of policy implementation risk,” S&P wrote. France’s finance minister, Michel Sapin, told CNBC as the S&P announcement came out that the change of outlook does not represent an issue with France, but is actually about the euro zone. “Of course it is about France,” Moritz Kraemer, who heads sovereign ratings for S&P, told CNBC in response to Sapin’s comments. “We indeed think that the risks are increasingly tilted towards the downside, which has to do with a number of things. Some of them are home-made, others of them are indeed sort of a pan-European phenomenon.” Kraemer said S&P is “now quite doubtful” that France can hit its 3% 2017 deficit target.

With Germany on the cusp of recession, nothing in Europe is sacred anymore.

• S&P Downgrades Finland To AA+ from AAA (CNBC)

Standard & Poor’s downgraded Finland’s sovereign debt rating to AA+ from AAA on Friday, citing economic weak development. It also revised the country’s outlook to “stable” from “negative.” The ratings agency said Finland could experience “protracted stagnation” due to its aging population, shrinking workforce and weakening external demand. In addition, S&P cited the country’s dwindling market share in the global IT industry and its relatively rigid labor market as contributing factors. Finland, which has an economy of about $256 billion, has struggled to consolidate its public finances and reduce public debt, the agency said. It expects the country’s deficit to widen to 2.7% of its gross domestic product in 2014.

Fully confident they’ll get it right this time.

• Six Years After Lehman, US And UK Play Financial Crisis War Game (Guardian)

The top financial brass from the Treasuries and central banks of Britain and the US are to take part in a war game, behind closed doors in Washington on Monday, to test how they would handle another Lehman Brothers-style banking crisis. Six years after the financial earthquake that led to the multibillion-pound taxpayer bailouts of Royal Bank of Scotland and Lloyds Banking Group, the most senior policymakers from both sides of the Atlantic will try to find out whether they are now any better prepared for the collapse of a bank deemed too big to fail. The chancellor, George Osborne, and Mark Carney, the governor of the Bank of England, will stay on at the end of the annual meetings of the International Monetary Fund and World Bank to head the UK team in the exercise, which is to be held at the offices of the Federal Deposit Insurance Commission – the organisation that guarantees US bank deposits.

They will be joined by 11 others, including the chairman of the Federal Reserve, Janet Yellen, the US treasury secretary, Jack Lew, and regulators from Britain and America, for a test of how the authorities would respond to two possible scenarios – the collapse of an American bank with UK operations and the failure of a British bank with operations in the US. Although the war game will not be based on any specific institution, UK banks with operations in the US include Barclays and HSBC, while US investment banks such as Goldman Sachs and Bank of America have a big presence in the City. Osborne said it was the first time a war game had been conducted at such a senior level. “We will work through how we would respond to the failure of a cross-border firm. We are going to make sure we could handle an institution previously regarded as too big to fail,” he said.

Still sucking in the dupes.

• 30-Year Mortgages Back Below 4%, But For How Long? (MarketWatch)

Borrowers who thought they’d seen the last of 30-year fixed mortgages with interest rates below 4% got a pleasant surprise this week, as stock market selloffs, fears of another world-wide economic slowdown, and perhaps an Ebola scare helped drive down mortgage rates to their lowest levels in more than a year. Interest rates on the 10-year Treasury note have fallen to 2.55%, down from 2.61% a week ago, leading to some 30-year fixed mortgages dipping below 3.99% for the first time since June 2013, according to Bankrate.com. “We have seen a flurry of activity in the last 24 to 48 hours,” said Mark Livingstone, a mortgage broker at Cornerstone First Financial in Washington, D.C., who said the sharp fall in Treasurys has potential borrowers heading back into the market. “Everything has come down and we’re expecting it to come down a little bit more,” he said.

The drop in interest rates has corresponded with an increase in mortgage loan application volume, the Mortgage Bankers Association said Oct. 8, with its Market Composite Index increasing 3.8% for the week ending Oct. 3, from a week earlier. MBA’s Refinance Index rose 5% from the previous week. It was the first increase in three weeks, MBA said. The average contract rate for a conforming loan ($417,000 or less) on a 30-year fixed mortgage for the week ending Oct. 3 was 4.3%, down from 4.33% a week earlier, MBA said. For contracts greater than $417,000, or most jumbo loans, the rate decreased to 4.21% for the week ending Oct. 3, down from 4.28% a week earlier, MBA said. FHA loans through Oct. 3 dropped to 4%, down from 4.07% a week earlier. The MBA’s survey covers about three-quarters of all U.S. retail residential mortgage applications. A “parade of horribles” has driven down Treasury yields amid an equity market selloff, says Mike Fratantoni, chief economist with the Mortgage Bankers Association. “It’s a very strong flight to quality,” he said.

A little cold? You can now be quarantined.

• Ebola Screening at JFK Focusing on a Few Among Masses (Bloomberg)

John F. Kennedy International Airport begins added screening for arriving passengers today to help stem the spread of Ebola, the virus that’s killed more than 4,000 people this year in three African nations. While all international passengers will be sent through Customs and Border Protection’s primary inspection booth at the New York airport, inspectors will use special procedures for people listed on airlines’ manifests as having traveled from Liberia, Sierra Leone or Guinea. Anyone showing symptoms of the disease will be sent immediately to a Centers for Disease Control quarantine center inside the airport, Steve Sapp, a Customs spokesman, said in an e-mail. Others from the at-risk regions will be sent for a secondary examination to take their temperature, complete a health questionnaire and provide contact information. Travelers will be given health pamphlets with information on Ebola symptoms and contacts for medical professionals, according to a fact sheet from the CDC and Department of Homeland Security.

Anyone with a temperature over 101.5 degrees Fahrenheit (38.6 degrees Celsius) will be taken to the quarantine center, Sapp said. “Our hope is that the screening will improve vigilance and increase awareness about the Ebola disease for those individuals traveling from the affected areas,” said Jason McDonald, a CDC spokesman. Of the 275,000 daily airport customers, about 150 – or less than 0.1%- come to the U.S. from at-risk regions in Africa. About half the people who came to the U.S. from those three countries in the 12 months ending July 2014 arrived through JFK, according to Thomas Frieden, director of the CDC. 94% of passengers from the affected region to the U.S. fly through Kennedy and Washington Dulles, Newark Liberty, Chicago O’Hare and Atlanta Hartsfield airports. Those other four airports will get the enhanced entry screenings next week.

China is so polluted we don’t know the half of it.

• China Pollution Levels Hit 20 Times Safe Limit (Guardian)

Days of heavy smog shrouding swathes of northern China pushed pollution to more than 20 times safe levels on Friday, despite government promises to tackle environmental blight. Visibility dropped dramatically as measures of small pollutant particles known as PM2.5, which can embed themselves deep in the lungs, reached more than 500 micrograms per cubic metre in parts of Hebei, a province bordering Beijing. The World Health Organization’s guideline for maximum healthy exposure is 25. In the capital, buildings were obscured by a thick haze, with PM2.5 levels in the city staying above 300 micrograms per cubic metre since Wednesday afternoon and authorities issuing an “orange” alert. “It’s very worrying, the main worry is my health,” said a 28-year-old marketing worker surnamed Hu, carrying an anti-smog mask decorated with a pink pig’s nose as she walked in central Beijing. China has for years been hit by heavy air pollution, caused by enormous use of coal to generate electricity to power a booming economy, and more vehicles on the roads.

But public discontent about the environment has grown, leading the government to declare a “war on pollution” and vow to cut coal use in some areas. Nonetheless poor air quality has persisted with officials continuing to focus on economic growth, and lax enforcement of environmental regulations remains rife. In a sign of growing environmental activism, Greenpeace East Asia projected the message “Blue Sky Now!” on to a facade of the Drum Tower, a historic building north of the Forbidden City. The pollution – which also hit areas hundreds of kilometres from Beijing – comes as the city hosts a high-profile cycling tournament, the Tour of Beijing, and a Brazil-Argentina football friendly. Global heads of state from the US, Russia and Asia are set to gather in the capital for a key summit next month. City authorities said Thursday that they would place tighter restrictions on vehicle use during the APEC Economic Leaders’ Meeting in November, while requesting neighbouring areas to shut down polluting facilities.

Home › Forums › Debt Rattle October 11 2014