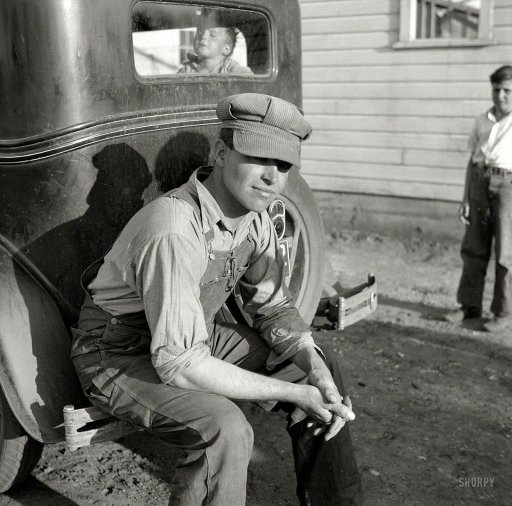

Arthur Rothstein First settler on Douglas County farmsteads, Nebraska May 1936

But we can’t have permnent QE. Ambrose claims China and the Fed will yet see the light and start pumping again, but what have they left?

• World Economy So Damaged It May Need Permanent QE (AEP)

Combined tightening by the United States and China has done its worst. Global liquidity is evaporating. What looked liked a gentle tap on the brakes by the two monetary superpowers has proved too much for a fragile world economy, still locked in “secular stagnation”. The latest investor survey by Bank of America shows that fund managers no longer believe the European Central Bank will step into the breach with quantitative easing of its own, at least on a worthwhile scale. Markets are suddenly prey to the disturbing thought that the five-and-a-half year expansion since the Lehman crisis may already be over, before Europe has regained its prior level of output. That is the chief reason why the price of Brent crude has crashed by 25pc since June. It is why yields on 10-year US Treasuries have fallen to 1.96pc, and why German Bunds are pricing in perma-slump at historic lows of 0.81pc this week. We will find out soon whether or not this a replay of 1937 when the authorities drained stimulus too early, and set off the second leg of the Great Depression.

If this growth scare presages the end of the cycle, the consequences will be hideous for France, Italy, Spain, Holland, Portugal, Greece, Bulgaria, and others already in deflation, or close to it. The higher their debt ratios, the worse the damage. Forward-looking credit swaps already suggest that the US Federal Reserve will not be able to raise interest rates next year, or the year after, or ever, one might say. It is starting to look as if the withdrawal of $85bn of bond purchases each month is already tantamount to a normal cycle of rate rises, enough in itself to trigger a downturn. Put another way, it is possible that the world economy is so damaged that it needs permanent QE just to keep the show on the road. Traders are taking bets on capitulation by the Fed as it tries to find new excuses to delay rate rises, this time by talking down the dollar. “Talk of ‘QE4’ and renewed bond buying is doing the rounds,” said Kit Juckes from Societe Generale.

Gentle declines in the price of oil are typically benign, a shot in the arm for companies and consumers alike. The rule of thumb is that each $10 drop in the price adds 0.3pc to GDP growth over the next year. Crashes are another story. They signal global stress, doubly dangerous today because the whole industrial world is one shock away from a deflation trap, a psychological threshold where we batten down the hatches and wait for cheaper prices. That is the Ninth Circle of Hell in economics. Lasciate ogni speranza. The world is also more stretched. Morgan Stanley calculates that gross global leverage has risen from $105 trillion to $150 trillion since 2007. Debt has risen to 275pc of GDP in the rich world, and to 175pc in emerging markets. Both are up 20 percentage points since 2007, and both are historic records.

Without excess stimulus, nothing moves anymore.

• Liquidity Nightmare Blamed For Crazy Market Moves (CNBC)

Investors are blaming an unprecedented lack of liquidity for Wednesday’s gut-wrenching stock market open, which saw the S&P 500 fall as much as 2.2% from Tuesday’s close, sent the VIX screaming to 28 and led to outsized moves in major stocks like Disney. According to Eric Hunsader of Nanex, there were 179 “mini flash crashes” during the first 15 minutes of trading, which is the most since the Knight Capital Group fiasco in August 2012. Additionally, Hunsader reports that there were 68 trades in the S&P e-mini that moved that key futures contract 3 or more ticks. And Treasury futures, too, moved sharply as a result of low liquidity. The definition that Nanex uses for a mini flash crash is that a stock sees 10 or more down ticks, for a price change exceeding 0.8%, within 1.5 seconds. “There was no liquidity at all, so it doesn’t take a whole lot of size to really move the price,” Hunsader told CNBC. But “some people come in, and they’re used to buying or selling X-amount, and they’re not paying attention. And X-amount now causes significant movements in price.”

When this lack of liquidity collided with a great number of traders willing to get out at any price, markets got ugly. “This was a pukage. People were putting in market order to sell on the open—’Just get me out’—without thinking,” said Brian Stutland of Equity Armor Investments. The issue, Hunsader said, is that high-frequency trading creates the appearance of liquidity. He gives the example of a trader who wants to buy 10,000 shares of a stock. That order might get routed to two exchanges, but instead of the order getting completed with 5,000 shares traded on each exchange, the first trade of 5,000 shares will cause the other 5,000 share offered on the other exchange to dry up. When these are market-order trades to buy or sell at the available price, the effect of this is a ricochet effect that leads to an outsized move. This explains why not all of Wednesday morning’s moves were to the downside.

Heed Dennis.

• This Is Just The Beginning Of The Bear Market: Gartman (CNBC)

The selloff in global markets is set to continue as a bear market takes hold “for a long period of time,” according to widely followed investor Dennis Gartman, who warned investors not to go long on stocks. “This is the start of a bear market,” Gartman, the founder of the closely watched Gartman Letter, told CNBC Europe’s “Squawk Box” on Thursday. “You stay in cash and you stay in short term bonds and you don’t move out, this is a very difficult period of time and I’m afraid – and I don’t like to think about it – but this might be the very beginnings of a bear market that could last some period of time,” he warned. Gartman’s comments come amid global market turmoil, particularly in the U.S. this week on the back of weaker economic data and fears of an economic slowdown in previous growth engines China, the U.S. and Germany. [..]

Gartman warned that there was going to be “more than a mere 7% to 10% correction” in markets which had enjoyed a bull run since the U.S. Federal Reserve announced an unprecedented bond-buying program designed to stimulate growth in the world’s largest economy. “I don’t like to be that way- you have to remember that in the business of trading…in the business of trading bears don’t eat. Only bulls in the market enjoy the upside, only bulls actually get paid over time. I don’t like to be bearish but this is a time to be at least neutral and perhaps at worst bearish.” Earlier this week, Gartman told CNBC he has “north of 80% in cash and short-term bond funds.” He said Wednesday’s flight to Treasurys was “real panic buying in the bond market probably by those that have been short, because so many people have been bearish of the bond market.”

The US will sink right along with the rest.

• World Economy Gives Investors Growth Scare as They Look to US (Bloomberg)

The global economy faces its biggest test of confidence since the European sovereign debt crisis as investors fear it’s running out of engines. Japan and the euro area are throwing up fresh signs of weakness by the day and emerging markets such as China are dragging instead of driving growth. The sense of tumult is being exacerbated by war in the Middle East, the standoff in Ukraine, street protests in Hong Kong and the spread of Ebola to Dallas. The worry is that five years since the world limped out of recession, central banks have virtually exhausted their stimulus arsenals if activity keeps fading. That leaves the hopes of financial markets riding on the U.S. to resume its historical role as a locomotive robust enough to pull up demand elsewhere. “The global economy and the markets have a history of traumatic economic events,” said Paul Mortimer-Lee, chief economist for North America at BNP Paribas SA in New York.

“Psychologically and physically they have not recovered fully and are anxious about a relapse.” The doubts were evident across financial markets yesterday as a bear market in oil deepened, the Standard & Poor’s 500 Index came close to surrendering its gains for the year and bonds from Germany to the U.S. rallied. The Chicago Board Options Exchange Volatility Index (VIX), a measure of investor nerves known as the VIX, is at its highest since June 2012. U.S. stocks pared losses after Bloomberg News reported that Fed Chair Janet Yellen voiced confidence in the durability of the American expansion at a closed-door meeting in Washington last weekend. The S&P 500 closed 0.8% lower after dropping as much as 3%.

If it’s up to the Saudi-US combo, bring it on!

• Tumbling Oil Prices: Recession In Russia, Revolt In Venezuela? (Guardian)

The sudden slump in oil prices, which have fallen 15% in the past three months, has sent tremors through the capitals of the world’s great oil powers, many of whom could face testing budget crunches if the tendency persists. Higher output coupled with weaker demand from China and Europe has driven the price of crude down to $85 – its lowest for four years. The US also now produces 65% more oil than it did five years ago following the boom in shale production. The rise has contributed to the global glut of crude and allowed the US to import 3.1 million fewer barrels of oil a day compared with its peak in 2005. Prices are now well below the level on which many oil exporters have based their budgets.

If prices remain weak – and many forecasters suggest they will – then from Moscow to Caracas and from Lagos to Tehran governments will start to feel the impact on macroeconomic policy. Brent has averaged $103 since 2010 – trading mostly between $100 and $120 – so a continued period of $80 oil, or less, would have an impact across the world, and from multiple angles. The lower price isn’t bad news for everyone. For example, India would not suffer much – commodities account for 52% of India’s imports but only 9% of its exports (paywall), and unlike Brazil, Russia or South Africa, India would reap immediate advantages from a fall in commodity prices.

Sure. Things do look spectacularly different when you live in just one dimension.

• Citigroup Sees $1.1 Trillion Stimulus From Oil Plunge (Bloomberg)

The lowest oil price in four years will provide stimulus of as much as $1.1 trillion to global economies by lowering the cost of fuels and other commodities, according to Citigroup Inc. Brent, the world’s most active crude contract, closed at $83.78 a barrel in London yesterday. That’s more than 20% below its average for the past three years, amounting to savings of about $1.8 billion a day based on current output, Citigroup estimates. Savings will climb to $1.1 trillion annually as the slide cuts costs of other commodities, leaving consumers and companies with extra cash to spend and bolstering growth, according to Ed Morse, the bank’s head of global commodities research in New York.

Crude prices are plunging amid signs that OPEC, supplier of 40% of the world’s oil, won’t act to eliminate a surplus as global growth slows. Combined supplies from the U.S. and Canada rose last year to the highest since at least 1965 as producers tapped stores locked in shale-rock formations and oil sands. The global economy will rebound next year, with growth quickening to 2.98%, the fastest since 2010, according to analyst forecasts compiled by Bloomberg. “A reduction in oil prices also results in a reduction in prices across commodities, starting with natural gas, but also including copper, steel, and agriculture,” Morse said yesterday in an e-mailed response to questions. “All commodities are energy intensive to one degree or another.”

Let’s have the margin calls come in, see what’s left behind.

• Oil Drop Makes US Drillers Own Worst Enemy (Bloomberg)

U.S. oil producers that saw profits soar on the North American shale boom are feeling the downside of success: falling prices and shrinking cash are threatening to slow development. At the same time, as crude prices approach four-year lows, natural gas companies are experiencing a reversal of fortune after having been shunned by many investors when a supply glut drove the fuel to a decade-low. Gas producers are now viewed as a safer haven than oil companies. Whiting Petroleum hit an all-time high in August after striking a deal to become the biggest oil producer in North Dakota, the state with the second-largest output. It has since lost more than $4 billion in value as its shares plunged 38%. Meanwhile, Southwestern Energy, an independent producer whose output is 99% gas, has fallen just 13%. “Natural gas is becalmed through this,” Donald Coxe, who manages about $200 million at Coxe Advisorsin Chicago, said in an interview. “It is Walden Pond compared to a hurricane in Florida.”

Whiting is one of 26 companies on the S&P Oil & Gas Exploration and Production Select Industry Index that have declined more than 30% in the past month. Shale producers had shifted their focus to more profitable oil as gas prices fell. Now a growing glut of crude has deflated the price of the U.S. benchmark by 18% in the past three months, as gas futures dropped 7.2%. “We’re running into a wall,” said Scott Hanold, an Austin, Texas-based analyst for RBC Capital Markets. “We’re producing more light, sweet crude than we need.” West Texas Intermediate touched $80.01 a barrel, the lowest since June 2012, on the New York Mercantile Exchange today. Brent prices, an international benchmark, fell to the lowest price since November 2010. Exploration and production companies “just drill and produce and all at once say, ‘My God, we’ve oversupplied the market,’” T. Boone Pickens said in an Oct. 9 interview. If crude prices stay below $80 a barrel for three months, they “are going to sober up.”

Well, well. Talking her book.

• Yellen Voices Confidence in U.S. Economic Expansion (Bloomberg)

Federal Reserve Chair Janet Yellen voiced confidence in the durability of the U.S. economic expansion in the face of slowing global growth and turbulent financial markets at a closed-door meeting in Washington last weekend, according to two people familiar with her comments. The people, who asked not to be named because the meeting was private, said Yellen told the Group of 30 that the economy looked to be on track to achieve growth of around 3%. She also saw inflation eventually rising back to the Fed’s 2% target as unemployment falls further, according to the people. The G-30 describes itself as a “nonprofit, international body composed of very senior representatives of the private and public sectors and academia.” Former European Central Bank President Jean-Claude Trichet is chairman, and former Fed Chairman Paul Volcker is chairman emeritus. G-30 Executive Director Stuart Mackintosh was unavailable for immediate comment.

Stocks pared losses after Yellen’s comments were reported, and Treasury yields rose. The S&P 500 was down 0.8% to 1,862.49 at the 4 p.m. close of trading in New York after falling as much as 3%. The yield on the two-year Treasury note was down 5 basis points, or 0.05 %age point, to 0.32% after dropping as much as 13 basis points. “She expressed some confidence” in the outlook, said Thomas Roth, senior Treasury trader in New York at Mitsubishi UFJ Securities USA Inc. Yellen’s reported remarks were roughly in line with the forecasts presented by Fed policy makers at their last meeting in September. They saw the economy growing by 2.6 to 3% next year and inflation rising to 1.7 to 2% in 2016, according to their central tendency forecasts, which excludes the three highest and three lowest projections.

” … a cathartic, cataclysmic crescendo of capitulation”.

• U.S. Stocks Drop as Weakening Economic Data Fuel Selloff (Bloomberg)

An afternoon rebound helped the Standard & Poor’s 500 Index pare its biggest intraday plunge since 2011 amid speculation the selloff was overdone. The S&P 500 lost 0.8% to 1,862.49 at 4 p.m. in New York, trimming an earlier plunge of as much as 3%. The index pared its gain for the year to less than 0.8% and has tumbled 7.4% since a record on Sept. 18. The Dow Jones Industrial Average fell 173.45 points, or 1.1%, to 16,141.74 after dropping as much as 460 points. The Russell 2000 Index of smaller companies jumped 1%. “Investor sentiment has clearly been pummeled of late as some signs of surrender are forming,” Tobias Levkovich, Citigroup Inc.’s chief U.S. equity strategist in New York, wrote in a note today. “While no one ever rings a bell at the bottom and there is not generally a cathartic, cataclysmic crescendo of capitulation, fear is emerging which intimates that a floor may be within reach.”

The Chicago Board Options Exchange Volatility Index, the benchmark gauge of options prices known as the VIX, jumped 15% to 26.25, the highest level since 2012, amid demand for protection against losses in equities. Almost 12 billion shares changed hands in the U.S., the most since October 2011. Stocks pared losses after the S&P 500 fell to its low of the day of 1,820.66 shortly before 1:30 p.m. in New York. About an hour later, Bloomberg News reported that Federal Reserve Chair Janet Yellen voiced confidence in the durability of the U.S. economic expansion in the face of slowing global growth and turbulent financial markets at a closed-door meeting in Washington last weekend. Retail sales in the U.S. dropped more than forecast in September, decreasing 0.3% after a 0.6% gain in August that was the biggest in four months, Commerce Department figures showed. Another report today showed manufacturing in the Federal Reserve Bank of New York’s region slowed more than projected in October. The bank’s so-called Empire State index dropped to 6.2 this month from an almost five-year high of 27.5 in September. Readings greater than zero signal growth.

It’s the bubble as much as it is Draghi. All he could do would be temporary and grossly expensive.

• Draghi Letdown Sends European Equities Down 11% (Bloomberg)

Just last month, Europe’s stocks were trading near their highest levels in six years, with optimism spreading that central-bank stimulus would ignite the economy. Much has changed. The Stoxx Europe 600 Index plunged the most in almost three years yesterday, closing down 11% from its June high to meet the definition of a correction. At one point, Greece’s ASE Index was down 10% from the previous day’s close, finishing with a loss of 6.3%. Italy’s FTSE MIB Index fell 4.4% and Portugal’s PSI 20 Index hit a two-year low. Europe is leading a rout that has wiped almost $5 trillion from the value of equities worldwide. While data on everything from industrial production in Germany to manufacturing in the U.K. has contributed to the gloom, sentiment began souring on Oct. 2, when European Central Bank President Mario Draghi stopped short of spelling out how many assets the ECB might buy to head off deflation.

“The shock to markets has been so big in the past days, I have doubt that equities will recover from this very quickly,” Francois Savary, chief investment officer of management firm Reyl & Cie., said in a phone interview from Geneva. “Draghi’s latest communication to the market was a nightmare.” Equities in the Stoxx 600 have lost more than 6% since Draghi spoke this month as investors came to grips with prospects that policy makers might lack tools to keep Europe out of its second recession in a year. It was Draghi’s promise to leave no option off the table in saving the euro that ended the region’s last crisis. “It’s the realization that there’s a real limit to his ‘whatever it takes’ promise,” said Savary. “Any signs that U.S. growth won’t do as well as expected throws markets into a panic because it’s still carrying the global economic recovery on its shoulders.”

It’s all just politics.

• ECB Stress Test Dead On Arrival As Deflation Hits (Telegraph)

It’s the banking fix which is meant to set Europe on the path to economic recovery. Regrettably, it’s all too likely to be just another damp squib. Too little, too late, and too backward looking, it may already have become largely irrelevant for a continent that seems fast to be slipping into deflation. For much of the past year, the European Union’s 130 largest banks, together accounting for 85pc of European banking assets, have been conducting an exhaustive process of “stress testing” their balance sheets against a series of supposedly worst-case economic calamities. One bank, I’m told, has devoted 20pc of its staff to the tests, leaving everything else to go to hell in a handcart. The purpose of the exercise is to identify which banks do not have sufficient capital to meet the imagined shocks, and then require them to recapitalise accordingly, thus restoring confidence in a banking system that nobody trusts as things stands.

The results are due to be published on 26 October, triggering further capital raising which according to some City estimates could amount to €50bn or more. This is in addition to the €70bn already raised so far this year in anticipation. Once complete, then credit growth can begin anew, and economic recovery will follow seamlessly in its wake. That at least is the hope; as ever with Europe, it seems to be built largely on sand. There have been two previous attempts to stress test Europe’s banks. The first was so deficient that it famously found the Irish banking system to be perfectly solvent. Since then, a sum roughly equivalent to half a year’s national GDP has been spent on Irish bailouts. The second one wasn’t much better, so there is a lot riding on the third attempt, particularly as it marks the ECB’s official appointment as overarching supervisor for the eurozone banking system.

The birth of a “single supervisory mechanism” for Europe is, by the way, in itself proving a mind numbingly complicated process, involving multiple layers of duplication, instruction and general regulatory grief. If there is still a banking sector left at all by the time the bureaucrats have had their fill, it will be a minor miracle. There will be 69 individual “supervisors” looking after Deutsche Bank alone, with the lead regulator a French national to avoid any suspicion of national favouritism. Likewise, the lead supervisor for BNP Paribas will be Spanish. It would be amusing to think the Greek banking system will be assigned a German, but that might be thought an insensitivity too far.

At least they still have the cash.

• German States Join Ranks Pressing Merkel to Spur Spending (Bloomberg)

Germany’s state governments stepped up calls for infrastructure spending, adding another source of pressure on Chancellor Angela Merkel to boost investment as economic growth falters. Much like Merkel’s national government, the states are caught between a deteriorating growth outlook and the balanced-budget drive that Germany started in response to the euro area’s debt crisis. It’s making the 16 regions set aside political differences to challenge the status quo, from rich Bavaria to rural Mecklenburg-Western Pomerania in the east, home to Merkel’s electoral district. A day after the German government lowered its growth outlook, proposals to spend more on projects such as highways in Europe’s biggest economy are on the table at a retreat of state premiers starting today that Merkel plans to attend.

“To unleash growth impulses, additional investment is needed in infrastructure and other future-oriented sectors,” according to a summary of the states’ negotiating position in fiscal talks with the federal government that was prepared for the meeting in Potsdam. The states want a “lasting” funding boost, saying a lack of spending is holding back economic development nationwide. The struggle in Germany parallels the international conflict pitting Merkel and Finance Minister Wolfgang Schaeuble against the International Monetary Fund and countries such as France and Italy that advocate spending to stimulate growth. Germany cut its forecast as investor confidence fell to the lowest level in two years, the latest in a series of data fueling speculation the country may be facing recession.

Merkel didn’t flinch, telling lawmakers yesterday that Germany won’t raise public spending and reaffirming her goal of balancing the budget next year, according to a party official who asked not to be named because the session was private. While Merkel said last week her government is looking at measures that don’t threaten her budget goal, such as spurring investment in digital technology and renewable energy, she and Schaeuble say fiscal leeway is tight. “We are agreed in the German federal government that we must stay the course even in difficult times,” Schaeuble said after a meeting of European Union finance ministers yesterday.

Bloomberg uber-douche Bernidsky gets something halfway right.

• Why Putin and Merkel Don’t Put Growth First (Bloomberg)

The notion requires something of an-apples-and-oranges leap, but President Vladimir Putin of Russia and Chancellor Angela Merkel of Germany may have more in common than their experience in the former East Germany and the ability to speak each other’s language. Both defy their critics by continuing to pursue policies that are bad for economic growth. From their perspective, however, it may make sense to resist placing growth above other considerations. Conventional wisdom holds that if gross domestic product is growing, a government must be doing something right, or at least nothing too wrong. If GDP drops 0.2%, as it did in Germany in the second quarter of this year, and especially if it goes down for two consecutive quarters – the formal definition of a recession – the government is supposed to do something about it.

Merkel is under pressure to borrow and spend more to address the slowdown. For Putin, who is faced with a potential recession, the course would be comply with Western demands on Ukraine and earn the lifting of economic sanctions. The GDP, however, is a deeply flawed reflection of a nation’s welfare. Simon Kuznets, who laid the groundwork for the modern methods of GDP calculation, asked in a report to the U.S. Congress in 1934, “If the GDP is up, why is America down?” He continued: “Distinctions must be kept in mind between quantity and quality of growth, between costs and returns, and between the short and long run. Goals for more growth should specify more growth of what and for what.” Both Merkel and Putin are trying to mind those distinctions.

In Germany, the low growth and threat of recession don’t necessarily mean living standards will deteriorate. Economics Minister Sigmar Gabriel forecast that the number of working Germans would increase by 325,000 this year, and by half as many more in 2015. At the same time, he said, the number of unemployed would stay at 2.9 million, or about 4.9%. Net wages per employee will increase by 2.6% this year and by 2.7% next year. With such numbers in hand, German officials must be asking themselves what would be achieved if they gave in to the growing demands from both home and abroad to resort to deficit spending.

Panic is as panic does.

• Biggest Pain Trade Gives 37% Loss to Bond Bears Getting It Wrong (Bloomberg)

What a dismal time for bond traders who were optimistic about growth. Investors who poured more than $1 billion this year into a $3.8 billion leveraged exchange-traded fund that bets against long-dated U.S. Treasuries are suffering a 10.7% loss this month alone, Bloomberg data show. The fund is down 36.5% this year, a small window into the magnitude of pain in a market where many traders have been wagering debt prices would fall. Treasuries have defied predictions across Wall Street for higher yields all year, and yesterday’s move is sending bond bears into a tailspin. Yields on 10-year Treasuries fell the most since March 2009, trading below 2% for the first time since June 2013 as a decline in retail sales prompted traders to reduce wagers the Federal Reserve will start raising interest rates next year. The move is in part driven by traders covering their short bets, according to Jack Flaherty, an investment manager at GAM USA in New York. “There’s been weakness, weakness, weakness and today it’s just ‘Get me out’,” Flaherty said yesterday.

Primary dealers had the biggest short position on benchmark government notes at the beginning of the month since June 2013. They had a net $20.7 billion wager against notes maturing in the seven-to-eleven year range in the week ended Oct. 1, Fed data show. It seems, though, that almost everything in the world is going against these bears right now. The global economy is slowing down, the Ebola epidemic in Western Africa is spreading, and conflicts in Iraq and Syria are escalating. All of that is translating into a surge in demand for the safety of Treasuries. “We keep thinking we’re getting capitulation trades, but clearly there’s a lot more skeletons in the closet than we thought,” Ira Jersey, an interest-rate strategist at Credit Suisse in New York, wrote in an e-mail. “We’re also seeing more flight to quality buyers out of global asset classes that are considered ‘riskier.’” Adding to the bout of general anxiety overwhelming the market was the data yesterday showing that U.S. retail sales dropped more than forecast in September on a broad pullback in spending.

Not a lot of money there lately. They should all disband and find something useful to do with their lives. These are not stupid people, but they do make stupid choices like chasing money 24/7. Go be useful to society, I’d say.

• Hedge Funds Face Their Worst Year Since 2011 (FT)

Hedge funds are on course for their worst year since 2011, as several of their biggest and most popular trades turned sour and some managers were forced to cut their losses. Wednesday’s new and sudden fall in US Treasury yields wrongfooted numerous funds that had positioned themselves for rising interest rates and an improving macroeconomy. Hedge fund bets on tax-driven mergers and on US housing finance giants Fannie Mae and Freddie Mac have also unraveled this month. October is shaping up to be a worse month for some hedge funds even than September, when the industry lost 0.75%. Big name managers including so-called “Tiger cubs” Rob Citrone, Philippe Laffont and Chase Coleman, who used to work under veteran hedge fund manager Julian Robertson at Tiger Management, have all fallen into the red as technology stocks have been hard hit.

Claren Road, the hedge fund controlled by Carlyle Group, has suffered an 11% fall in its credit opportunities fund since the start of October. Some funds have pulled back their positions as financial market volatility has jumped in recent weeks, and more appeared to capitulate on Wednesday amid a flash crash in US Treasury yields. The unexpected drop in the price of oil has created cascading losses through popular hedge fund trades, said Mino Capossela, head of liquid alternative investments for Credit Suisse Asset Management. The price of Brent crude has fallen by almost a quarter since mid-June. As well as using oil as a bet on improving economic growth, funds have also bought energy stocks and bonds. Oil companies have been among the biggest recent issuers of high-yield bonds, meaning that credit funds have also been affected.

And I warn the US.

• US Warns Europe On Deflation, ECB Policies (Reuters)

The United States on Wednesday renewed a warning that Europe risks falling into a downward spiral of falling wages and prices, saying recent actions by the European Central Bank may not be enough to ward off deflation. In a semiannual report to Congress, the U.S. Treasury Department said Berlin could do more to help Europe, namely by boosting the German economy. “Europe faces the risk of a prolonged period of substantially below-target inflation or outright deflation,” the Treasury said.

Moot.

• U.S. Says China Shows Some ‘Willingness’ to Let Yuan Rise (Bloomberg)

The U.S. said China has shown “some renewed willingness” to let the yuan strengthen while reiterating the currency “remains significantly undervalued.” In a twice-yearly report to Congress on foreign exchange, the Treasury Department said changes to China’s currency policy remain incomplete and the world’s second-largest economy should allow the market to play a greater role in setting the yuan’s value. The report covering the first half of this year concluded that no country was designated a currency manipulator. The Treasury reiterated its call for more balanced global growth as the U.S. economy gathers strength, the euro area and Japan struggle, and emerging markets such as China face slowdowns. Countries including Germany, where domestic demand has been “persistently weak,” need to do more to support domestic growth and help the world economy, the report said.

“The report tries to strike a fine balance between encouraging economies that have weak growth and current-account surpluses to boost domestic demand, but to do so using fiscal policy and other responses,” said Eswar Prasad, a professor of trade policy at Cornell University in Ithaca, New York, and a senior fellow at the Washington-based Brookings Institution. China should build on “the apparent recent reduction in foreign-exchange intervention and durably curb its activities in the foreign-exchange market,” the department said in yesterday’s report. The Treasury also pushed for changes in South Korea, saying the won “should be allowed to appreciate further.” Treasury Secretary Jacob J. Lew, in a meeting with South Korea’s finance minister last month, emphasized the importance of avoiding currency intervention.

The Treasury said Japanese authorities need to “carefully calibrate the pace of overall fiscal consolidation” to help escape deflation, according to the report. “Monetary policy cannot offset excessive fiscal consolidation nor can it substitute for necessary structural reforms that raise trend growth and domestic demand.” To boost growth, Japan could raise household income through greater labor-force participation and higher earnings to “durably increase” consumers’ buying appetite, the Treasury said. The yen has depreciated 23% from October 2012 to August 2014 on a real trade-weighted basis, according to the report.

Nice approach.

• How Both Dating And Finance Have Been Screwed By The Internet (Slate)

Your parents dated the way Warren Buffett picks a stock: a close review of the prospectus over dinner, careful analysis of long-term growth potential, detailed real asset evaluation. Sure, the old economy dating market in which they participated had the occasional speculative frenzy: Woodstock, V-E day, whatever went on at Studio 54. My parents met during spring break. In Florida. But love and its compounding interests were usually pursued with appropriate due diligence. Then came the Internet. The “innovation” that has driven the financial industry over the last two decades has also transformed the dating market, with similar effects on romance as on the economy. The traditional focus on long-term security—marriage and retirement—has been replaced by a relentless pursuit of instant gratification and immediate returns. These days, the Wolf is as much on Tinder as on Wall Street.

Just look at what online dating has done to the meet market. The speed and frequency of transactions has gone up. Volatility has spiked as relationship investment strategy has changed from building long-term value to quarterly—or nightly—profits. New investors have entered the market with greater ease, although all too often only to be taken advantage of by more sophisticated players. New avenues for fraud have opened up: Manti Te’o meet Bernie Madoff on Ashley Madison. Even inequality has risen. Some investors are rolling in it; others have just lost their shirts. How did the bedroom end up looking so much like the boardroom? In successive waves, innovation pioneered in the financial markets has been adopted to dating. Online dating’s initial trading platforms—Match created in 1995, JDate in 1997, etc.—were the relationship equivalent to the online trading sites that first allowed investors to directly manage their own portfolios. Think “Talk to Chuck,” except if he can message you first (hopefully not about the size of his portfolio).

Unbelievable. What else is there to say? She cared for a patient who died, and who already infected one other nurse. She should have been in isolation.

• US Health Official Allowed New Ebola Patient On Plane With Fever (Reuters)

A second Texas nurse who has contracted Ebola told a U.S. health official she had a slight fever and was allowed to board a plane from Ohio to Texas, a federal source said on Wednesday, intensifying concerns about the U.S. response to the deadly virus. The nurse, Amber Vinson, 29, flew from Cleveland to Dallas on Monday, the day before she was diagnosed with Ebola, the U.S. Centers for Disease Control and Prevention (CDC) said. Vinson told the CDC her temperature was 99.5 Fahrenheit (37.5 Celsius). Since that was below the CDC’s temperature threshold of 100.4F (38C) “she was not told not to fly,” the source said. The news was first reported by CNN.

Chances that other passengers were infected were very low because Vinson did not vomit on the flight and was not bleeding, but she should not have been aboard, CDC Director Dr. Thomas Frieden told reporters. Congress will hold a hearing on Thursday on the U.S. response to Ebola, with Frieden and other officials scheduled to testify. Vinson was isolated immediately after reporting a fever on Tuesday, Texas Department of State Health Services officials said. She had treated Liberian patient Thomas Eric Duncan, who died of Ebola on Oct. 8 and was the first patient diagnosed with the virus in the United States. Vinson was transferred to Emory University Hospital in Atlanta by air ambulance and will be treated in a special isolation unit. Three other people have been treated there and two have been discharged, the hospital said in a statement.

Home › Forums › Debt Rattle October 16 2014