John Vachon Times Square on a rainy day March 1943

Oh Japan, what are you doing, where are you going? As Japanese consumer prices rose 3.4% in May (and I do wish people would stop calling this inflation, it is not and never will be), consumer spending was down -8.9% (!). That is from a year earlier, so it has nothing to do with the April 1 tax hike! It’s an insane number when you think about it, and it’s the direct result of Abenomics tightening the thumb screws. With the population having seen their savings collapse, their wages move way down, and now rising prices for food and other basics. While the government and central bank are spending with unparalleled abandon, and pension funds are moving into riskier assets, away from government bonds, which have that same central bank as their only buyer left. Is it also going to purchase all the bonds the pensions funds will bring into the market? Frankly, how can it not?

As for the US, Lance Roberts at STA sums it up in just a few words:

The Great American Economic Growth Myth

… the economic prosperity of the last 30 years has been a fantasy. While America, at least on the surface, was the envy of the world for its apparent success and prosperity, the underlying cancer of debt expansion and declining wages was eating away at the core. The only way to maintain the “standard of living” that American’s were told they “deserved,” was to utilize ever increasing levels of debt. The now deregulated financial institutions were only too happy to provide that “credit” as it was a financial windfall of mass proportions.

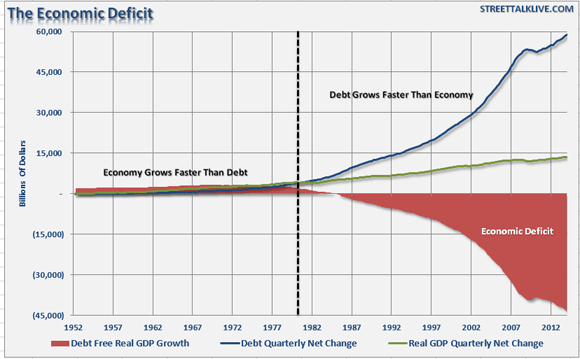

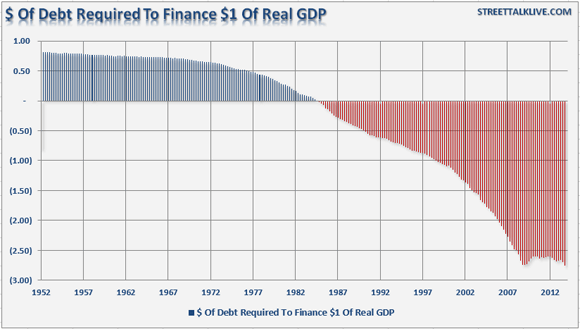

When credit creation can no longer be sustained, the process of clearing the excesses must be completed before the cycle can resume. Only then can resources be reallocated back towards more efficient uses. [..] … fiscal and monetary policies, from TARP and QE to tax cuts, only delay the clearing process. Ultimately, that delay only potentially worsens the inevitable clearing process. The clearing process is going to be very substantial. The economy currently requires $2.75 of debt to create $1 of real (inflation adjusted) economic growth. A reversion to a structurally manageable level of debt would require in excess of $35 Trillion in debt reduction.

This is one of the primary reasons why economic growth will continue to run at lower levels going into the future. We will continue to observe an economy plagued by more frequent recessionary spats, more volatile equity market returns and a stagflationary environment as wages remain suppressed while costs of living rise.

The Automatic Earth has been warning you about this for years now. I said again, only recently, that Japan’s biggest mistake has been that in the mid 1990s, it refused to accept restructuring and defaults of its financial sector debt. Now it has public debt of some 400% of GDP, a level that is miles beyond out-of-proportion. The only reason Japan hasn’t collapsed in the past 20 years is that the rest of the world plunged headfirst into excessive debt as well, and could therefore – seemingly – continue to afford to buy Japanese products. Shinzo Abe’s desperate reply to the demise of that insurance policy has been to pile in more debt, not to restructure the already humongous existing pile.

Neither are America or Europe doing it, their policies are solely based on declaring banks too big to fail, which precludes restructuring, a fatal error, at least from the point of view of the real economy and the majority of the population who depend on it for their incomes. As Roberts says, the restructuring of debt, or ‘clearing process’, is inevitable, and because of the shortsighted measures taken by myopic ‘leaders’ interested only in short term power, the process, when it comes, will bring with it deep and bitter misery for most.

And as I also said again yesterday, they couldn’t get away with it if they didn’t play masterfully on our own short term memories and interests. Just imagine what would happen if it were the US that announced an -8.9% plunge in consumer spending. Still, that is not much different from that -2.96% drop in US Q1 GDP. What is different is that the latter lies well in the rearview mirror, where objects always appear to be smaller, and our attention is without fail focused on today and tomorrow, not yesterday.

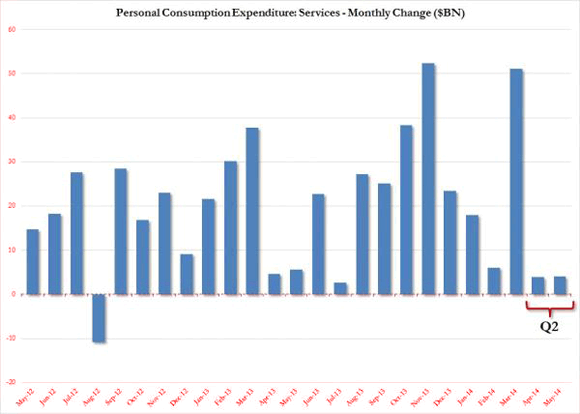

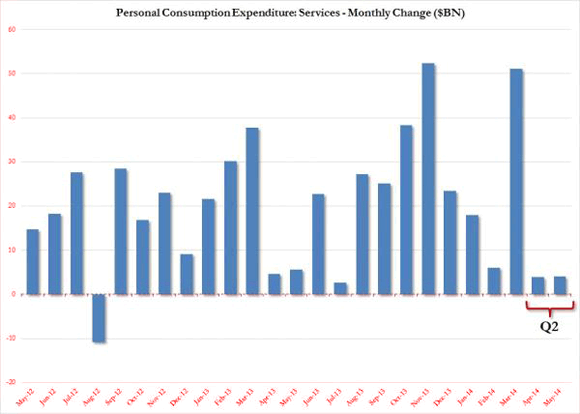

All it takes to divert attention away from Q1 GDP is rosy predictions for Q2 (we see nothing else, though ‘experts’ have hastily started backtracking). Predictions which can and will then subsequently be lowered time and again just like the last one. It’s a stupid ploy to fall for, but then we’re not all that bright to begin with at all. What will Q2 GDP be like? Tyler Durden has the perfect graph to show you:

• Please Help Us Find The Q2 “Spending Surge”

US services (and thus services spending) account for 68% of US GDP and 4 out of 5 US jobs. Thus, without spending on services the US economy can barely grow. That much is clear. What is also clear is that pundit after pundit has been lining up to explain how the Q1 economic collapse is to be ignored because it was due to, don’t laugh, snow. Snow, which somehow wiped out of $100 billion in growth from initial expectations of Q1 GDP rising by 2.5%. [..] What is certainly clear is that without spending on services in the second quarter, it is impossible for US GDP to hit its much desired 4% “bounceback” GDP print. All of that is very clear. What is not at all clear is just where is this services spending spree.

Durden also dug up a video from April 2014 posted at Renegade Economist, which features longtime and dear friend of The Automatic Earth, Steve Keen, who we must congratulate on his recent appointment as professor and Head of the School of Economics, History and Politics at Kingston University in London. Which means at least one university will teach something resembling sound economics.

In the video, which is an absolute must see and can’t miss, Steve explains exactly what is wrong with the US – and global – economy , as well as why and how this must be resolved the way it will be. It is not rocket science, it’s terribly simple really, we just have to deal with the constant stream of haze, befuddlement and discombobulation unleashed upon us by those who either have an active interest in keeping us locked up in a constant state of confusion, or are just not that sharp. That’s why the voice over in the video says “There are no black swans, there are just people who ignore the lessons of history”. And 2008 was just the beginning.

“In economics, [the mainstream] rely on experts who don’t know what they are talking about,” explains Professor Steve Keen in this brief but compelling documentary discussing ‘when the herd turns’. “Herd behavior is a fundamental aspect of capitalism,” Keen chides, but it is left out of conventional economic theory “because they don’t believe it;” instead having faith that investors are all “rational individuals”, which he notes, means “[economists] can’t foresee any crisis in the future.” The reality is – “we do have herd behavior” and people will follow the herd off a cliff unless they are aware it’s going to happen. “Contrary to herd wisdom, financial crises are not unpredictable black swans…”

To sum it up: it’s inevitable that there will be no economic recovery, and it’s equally inevitable that the economy must crash. If you move with the herd, you will be crushed.

• The Great American Economic Growth Myth (STA)

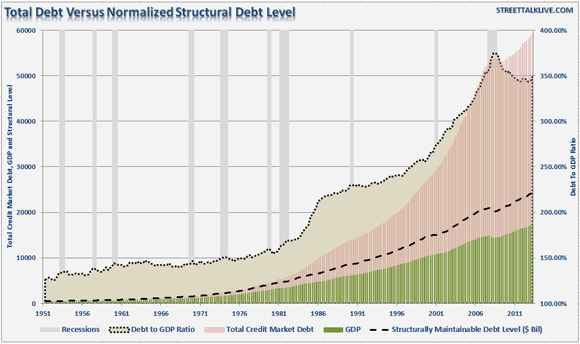

The decline in economic growth over the past 30 years has kept the average American struggling to maintain their standard of living. As their wages declined, they were forced to turn to credit to fill the gap in maintaining their current standard of living. This demand for credit became the new breeding ground for the financed based economy. Easier credit terms, lower interest rates, easier lending standards and less regulation fueled the continued consumption boom. By the end of 2007, the household debt outstanding had surged to 140% of GDP. It was only a function of time until the collapse in the “house built of credit cards” occurred.

This is why the economic prosperity of the last 30 years has been a fantasy. While America, at least on the surface, was the envy of the world for its apparent success and prosperity; the underlying cancer of debt expansion and declining wages was eating away at the core. The only way to maintain the “standard of living” that American’s were told they “deserved,” was to utilize ever increasing levels of debt. The now deregulated financial institutions were only too happy to provide that “credit” as it was a financial windfall of mass proportions.

The massive indulgence in debt, what the Austrians refer to as a “credit induced boom,” has likely reached its inevitable conclusion. The unsustainable credit-sourced boom, which led to artificially stimulated borrowing, has continued to seek out ever diminishing investment opportunities. Ultimately these diminished investment opportunities repeatedly lead to widespread mal-investments. Not surprisingly, we clearly saw it play out “real-time” in everything from subprime mortgages to derivative instruments which were only for the purpose of milking the system of every potential penny regardless of the apparent underlying risk. We see it playing out again in the “chase for yield” in everything from junk bonds to equities. Not surprisingly, the end result will not be any different.

When credit creation can no longer be sustained, the process of clearing the excesses must be completed before the cycle can resume. Only then, and it must be allowed to happen, can resources be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. Those fiscal and monetary policies, from TARP and QE to tax cuts, only delay the clearing process. Ultimately, that delay only potentially worsens the inevitable clearing process. The clearing process is going to be very substantial. The economy currently requires $2.75 of debt to create $1 of real (inflation adjusted) economic growth. A reversion to a structurally manageable level of debt* would require in excess of $35 Trillion in debt reduction. The economic drag from such a reduction would be dramatic while the clearing process occurs.

*Structural Debt Level – Estimated trend of debt growth in a normalized economic environment which would be supportive of economic growth levels of 150% of debt-to-GDP.

This is one of the primary reasons why economic growth will continue to run at lower levels going into the future. We will continue to observe an economy plagued by more frequent recessionary spats, more volatile equity market returns and a stagflationary environment as wages remain suppressed while costs of living rise. Ultimately, it is the process of clearing the excess debt levels that will allow personal savings rates to return to levels that can promote productive investment, production and consumption. The end game of three decades of excess is upon us, and we can’t deny the weight of the debt imbalances that are currently in play. The medicine that the current administration is prescribing is a treatment for the common cold; in this case a normal business cycle recession. The problem is that the patient is suffering from a “debt cancer,” and until the proper treatment is prescribed and implemented; the patient will most likely continue to suffer.

• Please Help Us Find The Q2 “Spending Surge” (Zero Hedge)

US services (and thus services spending) account for 68% of US GDP and 4 out of 5 US jobs. Thus, without spending on services the US economy can barely grow. That much is clear. What is also clear is that pundit after pundit has been lining up to explain how the Q1 economic collapse is to be ignored because it was due to, don’t laugh, snow. Snow, which somehow wiped out of $100 billion in growth from initial expectations of Q1 GDP rising by 2.5%.

What is certainly clear is that without spending on services in the second quarter, it is impossible for US GDP to hit its much desired 4% “bounceback” GDP print. All of that is very clear. What is not at all clear is just where is this services spending spree. The chart below shows the monthly change in service spending as just reported by the BEA. The two bars comprising two-third of the second quarter are highlighted. So – can someone please help us find just where is this much-hyped consumer spending spreed is please?

Longtime friend of The Automatic Earth, Steve Keen, features in this brilliant and absolutely must see April 2014 video from Renegade Economist, h/t Zero Hedge.

• When The Herd Turns (Steve Keen)

“In economics, [the mainstream] rely on experts who don’t know what they are talking about,” explains Professor Steve Keen in this brief but compelling documentary discussing ‘when the herd turns’. “Herd behavior is a fundamental aspect of capitalism,” Keen chides, but it is left out of conventional economic theory “because they don’t believe it;” instead having faith that investors are all “rational individuals”, which he notes, means “[economists] can’t foresee any crisis in the future.” The reality is – “we do have herd behavior” and people will follow the herd off a cliff unless they are aware its going to happen. “Contrary to herd wisdom, financial crises are not unpredictable black swans…”

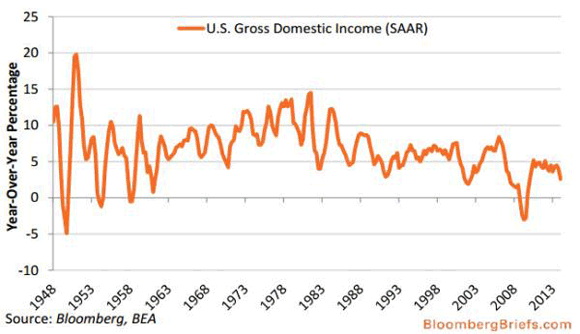

• This Has Never Happened Without The US Falling Into Recession (Zero Hedge)

With all eyes firmly focused on yesterday’s disastrous GDP report (and ultimately dismissing it as ‘weather’ and one-off exogenous factors), we thought Bloomberg Brief’s Rich Yamarone’s analysis of a lesser-known (yet just as key) indicator of the state of US economic health was intriguing. As he notes, according to the latest data from the Bureau of Economic analysis, there has never been a time in history that year-over-year gross domestic income has been at its current pace (2.6%) without the U.S. economy ultimately falling into recession. That’s more than 50 years of history, which is about as good as one could ever hope for in an economic indicator.

Spending down -8% YoY, so not because of the April 1 tax hike. Abenomics is squeezing the Japanese.

• Japan Consumer Prices Soar 3.4%, Spending Plummets -8% (CNBC)

Japan’s core consumer prices rose 3.4% in May from a year earlier, data on Friday showed, rising at their fastest pace since April 1982. The rise in the core consumer price index (CPI), which excludes volatile food prices, was in line with analyst expectations in a Reuters poll for a 3.4% rise. Annual consumer prices in Japan have risen for 12 straight months – a positive sign for the Bank of Japan and Prime Minister Shinzo Abe’s plan to finally rid the world’s third biggest economy of deflation risks. “The inflation numbers have been driven by a rise in fresh food prices and utility prices,” said Glenn Levine, senior economist at Moody’s Analytics. A slew of economic data released at the same time showed Japan’s household spending fell 8% in May from a year earlier, compared with forecasts for a 2% decline.

Japan lifted its consumption tax to 8% from 5% in April – and with consumers front-loading their spending before the tax increase, consumption has fallen since then. Other data showed Japan’s retail sales fell 0.4% in May on-year, smaller than the 1.8% fall anticipated by economists polled by Reuters. Japan’s jobless rate meanwhile fell to its lowest level in over a decade and a measure of labor demand rose to its highest in two decades. “The data, on aggregate, should be please the Bank of Japan and government,” said Levine. “The jobs data was strong and the retail sales numbers were better than expected,” he said, adding that the retail sales number gives a broader picture of Japanese consumer spending trends than the household consumption data.

This is going to end so bad.

• Japan Pension Fund ‘Not Ready To Move Into Riskier Assets’ (Bloomberg)

The world’s biggest pension fund is planning to buy more risky assets before it has the structure to cope with the investment overhaul, an economist specializing in state retirement programs said. The 128.6 trillion yen ($1.3 trillion) Government Pension Investment Fund needs rules for cutting losses when asset prices fall, according to Yuri Okina. GPIF must also get agreement for a clearer mechanism for safeguarding the fund when its finances deteriorate. Governance changes should be completed before the portfolio overhaul, said Okina, who’s also an adviser to the finance ministry and a director of Bridgestone Corp. The bond-heavy fund is expected to boost local stocks to about 20% of assets in coming months after Prime Minister Shinzo Abe ordered a faster review of its portfolio and included the overhaul in the nation’s growth strategies. Planned reform of its governance structure, including adding a board of directors, is taking longer after a bill to change it wasn’t submitted in the most recent Diet session.

“There’s a lot of focus on how GPIF can revitalize the stock market and that has been coming first,” Okina, an economist at Japan Research Institute Ltd., said in an interview in Tokyo on June 23. “The fund needs to decide on things like organizational structure and what its goals are at the same time.” “Given that Japan is exiting deflation, I do think GPIF needs to diversify its assets,” Okina said. “But it needs to be clearer on how it’ll do this. It needs more distance from the government and to be clear it’s for the benefit of pension savers and retirees.” Before taking on more risk, GPIF must set rules for when to cut its losses, Okina said. It must also reach a verdict with the health ministry on what to do when investment losses threaten the fund’s sustainability, she said, giving the example of whether it should cover shortfalls by asking for bigger contributions from workers or lowering payouts to retirees.

We want our bubbles back!

• US Treasury Begins Push to Revive Mortgage-Bond Market (Bloomberg)

The Treasury Department will start an initiative to revive the market for mortgage securities without government backing as part of an effort to aid recovery of the housing market, Treasury Secretary Jacob J. Lew said. The Treasury also will begin offering financing for loans for affordable apartment buildings and extend aid programs for troubled borrowers for an additional year, Lew said remarks prepared for a speech in Washington today. Together the moves are designed to bring more capital to the housing market to ease the crunch for those most affected by tight credit and a dwindling supply of affordable rentals, while aiding those still struggling with the aftermath of the 2008 credit crisis.

“Middle class families continue to find it difficult to find affordable housing,” Lew said. “And more than 6 million Americans still owe more on their homes than their homes are worth. That is why we remain focused on providing relief to responsible homeowners, rebuilding hard-hit communities, and reforming our housing finance system.” Homeowners having trouble making their loan payments will now have until December 31, 2016 to apply for a mortgage modification under Treasury’s Home Affordable Modification Program and other Treasury-run aid programs. The affordable apartment building loans would be backed by Federal Housing Administration and state housing agencies.

Will we see all dark pools broken up?

• Cracks Open in Dark Pool Defense With Barclays Lawsuit (Bloomberg)

Last October, managers told an employee in Barclays’ trading unit to keep from clients a report showing the bank routed most of their dark pool orders to itself, according to the New York attorney general. He refused, Eric Schneiderman said, and was fired the next day. The state’s top law-enforcement official released the account, which he said he got from the former Barclays senior director, in a 30-page document that portrayed the London-based bank as bilking its own customers to expand its dark pool. Schneiderman cited a pattern of “fraud and deceit” starting in 2011 in which Barclays hoarded orders for stocks and assured investors they were protected from high-frequency firms while simultaneously aiding predatory tactics.

“The behavior described in this complaint would put a bank’s financial interest in marketing its dark pool and profiting by providing access to predatory high-speed traders ahead of the interests of investors,” Senator Carl Levin, the Michigan Democrat who leads the Permanent Subcommittee on Investigations, said in a statement. “Action is needed to end conflicts of interest in the U.S. stock market.” [..]

Scrutiny from law-enforcement authorities is increasing as concern grows that America’s fragmented and computerized market structure enriches professional traders at the expense of individuals. U.S. Securities and Exchange Commission Chairman Mary Jo White proposed changes to the market this month, and the regulator this week announced it wants to test a curb on dark pool trading. Last week, Levin’s panel held hearings focused on where brokers send their customers’ orders. Schneiderman’s case is the boldest initiative and may open fissures in the decade-old defense of U.S. equity markets that has been championed by brokerages and traders. In their version of the story, dark pools serve as havens for institutional investors tired of seeing orders to buy and sell stocks front-run on public exchanges. According to Schneiderman, institutions may not have been much safer on Barclays’ platform.

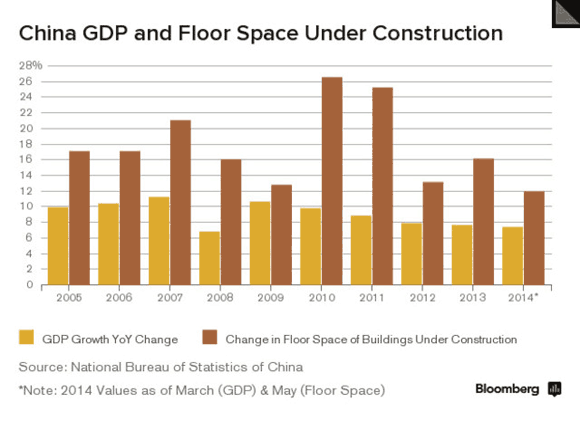

Building dominoes.

• Shanghai Developer Halts Project on Funding Shortage (Bloomberg)

A closely held Shanghai developer has suspended construction at a property project due to a lack of funds, according to two government officials familiar with the matter. Construction at Shanghai Yuehe Real Estate’s mixed-use project, including residential, office and retail space, in the city was halted this month and the project was frozen by a court, according to the people, who asked not to be identified because they aren’t authorized to speak publicly about the matter. Shanghai Pudong Development Bank, a medium-sized Chinese bank, loaned about 240 million yuan ($39 million) to the 220,000 square meter (2.4 million square foot) development in suburban Jiading district, they said.

“There will be more developers having troubles as the property downturn prolongs,” said Duan Feiqin, a Shenzhen-based property analyst at China Merchants Securities Co., in a phone interview today. “Many Chinese cities face oversupply of those mixed-use property projects amid the e-commerce boom, while a lot of developers, especially those small ones, are not capable of doing such developments.” Yuehe is the latest example of Chinese developers facing pressure as the nation’s slowing property market weighs on the growth of the world’s second-largest economy. Moody’s Investors Service in May revised its credit outlook for Chinese developers to negative from stable, citing a slowdown in home- sales growth as liquidity weakens and inventories rise.

Juicy.

• China’s Manhattan Project Turns Into Ghost Town (Bloomberg)

China’s project to build a replica Manhattan is taking shape against a backdrop of vacant office towers and unfinished hotels, underscoring the risks to a slowing economy from the nation’s unprecedented investment boom. The skyscraper-filled skyline of the Conch Bay district in the northern port city of Tianjin has none of a metropolis’s bustle up close, with dirt-covered glass doors and construction on some edifices halted. The area’s failure to attract tenants since the first building was finished in 2010 bodes ill across the Hai River for the separate Yujiapu development, which is modeled on New York’s Manhattan and remains in progress. “Investing here won’t be better than throwing money into the water,” Zhang Zhihe, 60, said during a visit to the area last week from neighboring Hebei province to look at potential commercial-property investments. “There will be no way out – it will be very difficult to find the next buyer.”

The deserted area underscores the challenge facing China’s leaders in dealing with the fallout from a record credit-fueled investment spree while sustaining growth and jobs in the world’s second-biggest economy. A Tianjin local-government financing vehicle connected to the developments said revenue fell 68% in 2013 to an amount that’s less than one-third of debt due this year. “There will have to be a reckoning,” said Stephen Green, head of Greater China research at Standard Chartered Plc in Hong Kong. Sales of bonds by local-government vehicles to repay bank loans are just “buying time,” he said. “The people will pay” for it through bank bailouts, recapitalization with public money or inflation.

Hey, they just print it all anyway, and so does everyone else, so why not?

• China Expands Plans For World Bank Rival (FT)

China is expanding plans to establish a global financial institution to rival the World Bank and the Asian Development Bank, which Beijing fears are too influenced by the US and its allies. In meetings with other countries, Beijing has proposed doubling the size of registered capital for the proposed bank to $100bn, according to two people familiar with the matter. So far, 22 countries across the region, including several wealthy states in the Middle East, which China refers to as “West Asia”, have shown interest in the multilateral lender, which would be known as the Asian Infrastructure Investment Bank. It would initially focus on building a new version of the “silk road”, the ancient trade route that once connected Europe to China. Most of the funding for the lender would come from China and be spent on infrastructure projects across the region, including a direct rail link from Beijing to Baghdad.

China’s push for a regional institution that it would control reflects Beijing’s frustration at western dominance of the multilateral bodies. Chinese leaders have demanded a greater say in institutions such as the World Bank, IMF and Asian Development Bank for years but changes to reflect China’s increasing economic importance and power have been painfully slow. “China feels it can’t get anything done in the World Bank or the IMF so it wants to set up its own World Bank that it can control itself,” said one person directly involved in discussions to establish the AIIB. “There is a lot of interest from across Asia but China is going to go ahead with this even if nobody else joins it.” [..] China has discussed its plans for an AIIB with countries in southeast Asia, the Middle East, Europe and Australia and it has also contacted the US, India and arch-enemy Japan, according to people familiar with the matter. But these people also said the bank was specifically intended to exclude the US and its allies, or at least greatly reduce their influence.

Qingdao goes on.

• Risks Rising For China’s Commodity Traders (Reuters)

A warehouse fraud at China’s third-largest port has forced banks and trading houses to consider new controls in the country’s massive commodity financing business, which traders say could lead to drying up of credit for all but large firms and state-owned companies. On Thursday, Standard Chartered, a major foreign provider of such finance deals, become one of the first firms to put a dollar figure on its activities, saying its commodity-related exposure around the port was about $250 million, although not all of that was at risk. “That is across multiple clients, multiple locations, multiple types of facilities, not all of which will be affected,” CEO Peter Sands said on a conference call. China’s commodities trading is dominated by the large and state-owned companies but there are thousands of small firms in the market. Faced with tougher bank requirements for financing, they could sell down stockpiles, squeezing demand for metals and other raw materials such as rubber in the world’s biggest consumer of commodities.

Any new requirements would also ratchet up the risk that customers who do not regain credit lines may default on payments for services such as hedging, or for imports. “The fear is not so much about the big boys, but some of the other smaller, newer players, who may have only been in this commodity financing game for the last two to three years,” said Jeremy Goldwyn, a director with commodities broker Sucden in charge of Asia business. “If all of a sudden the tap is turned off to them, they might have more of a crisis. Is it having an effect on the market? Yes, people are very nervous. We obviously have a lot of business in China so we are watching it very closely,” he said. According to sources, Standard Chartered has suspended some commodity financing deals in Qingdao port after authorities there launched a probe into a private trading firm, Decheng Mining, that is suspected of duplicating warehouse certificates to use a metal cargo multiple times to raise financing.

A Standard Chartered spokesman in London said the bank was reviewing its exposure to commodity financing but was not “pulling back” from that type of business, or from China itself, which remains a “key market”. For Western banks such as Standard Chartered, HSBC and BNP Paribas, which are restricted in the domestic loan market in China, the metals financing business is a lucrative alternative but the Qingdao scandal has renewed focus on counterparty risk. Goldman Sachs estimates that commodity-backed deals account for as much as $160 billion, or about 30% of China’s short-term foreign-exchange borrowing. Besides metals, the banks are now taking a fresh look at loans backed by other commodities such as iron ore, soybeans and rubber, fueling concerns that any drying up of credit could spark a series of defaults on trade loans, or force other cash-strapped firms to cancel term shipments in the second half of this year.

China’s water problems will rise to the fore in a very rapid fashion.

• Water Shortages Threaten China’s Agriculture (BW)

China has a fifth of the globe’s population but only 7% of its available freshwater reserves. Moreover, its water resources are not evenly distributed. The lands north of the Yangtze River—including swaths of the Gobi desert and the grasslands of Inner Mongolia—are the driest, but more than half of China’s people live in the north. Water is not well managed in China. Nearly two-thirds of water withdrawals in China are for agriculture. Due to the use of uncovered irrigation channels (leading to evaporation) and other outdated techniques, a significant portion of that water never reaches the field.

A new paper by scientists in China, Japan, and the U.S. published in the Proceedings of the National Academy of Sciences sounds the alarm: “China faces … major challenges to sustainable agriculture,” the authors write. Failure to conserve water resources could threaten China’s food security, a longtime priority for the country’s leaders. When it comes to fresh water, geography did not bless China. “Agriculture is located mainly in the dry north, where irrigation largely relies on groundwater reserves,” the authors write. Meanwhile, due to unsustainable withdrawals, China’s aquifers are fast being depleted. The paper analyzes water usage for four key crops (rice, wheat, soybeans, and corn) and livestock (poultry, pigs, and cows) in China. Taken together, those make up more than 90% of China’s domestic food supply.

The obvious elephant.

• The Coming Global Generational Adjustment (CH Smith)

Here’s what often happens when people start discussing Baby Boomers, Gen-X and Gen-Y online: rash generalizations are freely flung, everyone gets offended and nothing remotely productive results from the generational melee. These sorts of angry, accusatory generalizations reflect what I call the Generational Monster Id (GMI), the urge to list faults in generations other than our own. I think the source of generational angst and anger is the threat that the entitlements promised by the developed-world governments will not be delivered as promised. These entitlements range from healthcare to education to old-age pensions to “a good paying job now that I have a college degree.” The bottom line is that the promises cannot and will not be kept. The promises were issued in an era of cheap, abundant fossil fuels and favorable demographics: the next generation was considerably larger and more productive (due to more education, longer working lives, etc.) than the previous generation it would support through old age with taxes.

In that bygone era, there were as many as 16 workers for every retiree. Even 4 workers for every retiree is a sustainable level if energy remains cheap and full-time jobs remain plentiful. But the global reality is the Baby Boom generation is so large that it dwarfs the younger generations. Regardless of any other conditions, this reality negates all the promises issued to retirees: as the ratio of workers paying substantial taxes on their full-time earnings to retirees slips below two workers to one retiree, there is no way the workers can support the lavish costs of healthcare and old age pensions without becoming impoverished themselves. This is already a reality. As I have noted in this week’s series, there are 118 million full-time jobs in the U.S. and 57 million people drawing benefits from Social Security, and a similar number drawing Medicare and Medicaid benefits. As Boomers retire en masse in the decade ahead and full-time employment stagnates or declines, the ratio will slip to 1.5-to-1 or even lower. Many low-birth-rate European nations are facing worker-retiree ratios of 1-to-1. This is simply not sustainable.

How ugly can this get? Vulture funds buy debt at 30%, and demand back 100%. The amounts involved are so huge they don’t mind waiting 10 years and paying millions in lawyer’s fees. And Argentine debt issues are decided in a US court. What kind of sovereignty is that?

• Argentina Economy Minister Says Nation Being Pushed To Default (Reuters)

Argentina’s Economy Minister Axel Kicillof warned United Nations diplomats on Wednesday the country is being pushed toward a new default after a U.S. Supreme Court decision favored holdout creditors seeking payment on bonds it defaulted on in 2001-2002. Referring to those creditors as “vulture funds,” Kicillof said the June 16 decision by the top U.S. court to deny Argentina the chance to appeal a lower court ruling means it faces an insurmountable payment to all bondholders, given it has just $28.5 billion in foreign currency reserves. “So probably this is going to push us into a technical default,” Kicillof said through an interpreter. “Whichever way you look at it this ruling is forcing Argentina towards the risk of economic crisis.” The holdouts are led by Elliott Management’s NML Capital and Aurelius Capital Management. “Once these funds get recognition of 100% of the value of their bonds, which were purchased under vile conditions of having paid only 30 cents on the dollar, there could be more demand from other holders who did not participate in the restructurings,” Kicillof said. [..]

Argentine officials, including President Cristina Fernandez, have said the country will not pay these investors, arguing it could face potential demands for up to $15 billion from other holdouts not involved with the case – an amount representing more than half of the government’s $28.5 billion in foreign currency reserves. The United Nations trade agency, or UNCTAD, weighed in on the case on Wednesday, echoing concerns voiced by the United States as well as the International Monetary Fund that the ruling in favor of holdouts erodes sovereign immunity and is a setback for the debt restructuring process. However, investors and legal advisors alike note changes to the covenants in bond contracts have adapted to avoid such disputes and the legal battle with Argentina is so unique that chances for a repeat situation have been dramatically reduced.

• ‘EU Trade Deal Is Economic Suicide For Ukraine’ (RT)

“For Ukraine, signing the agreement is economic suicide,” Sergey Glazyev, an economic aide to Russian President Putin said, warning of a sharp currency devaluation, soaring inflation, and lower living standards. Kiev’s new government [signed] a free trade agreement with the EU on Friday, after the previous government failed to sign the agreement in November leading to public protest and near all-out civil war. “There is no doubt that by signing this agreement it will result in an acute devaluation of the hryvnia, an inflation surge and in turn hyperinflation, and a drop in living standards,” Glazyev said on Tuesday. Glazyev, an outspoken opponent of Ukraine joining the EU’s orbit, echoed President Putin’s warning that Ukraine will no longer be able to import goods from Russia duty-free. Glazyev calculated last year, before the dispute with Russia began, that flooding Ukraine’s economy with European goods could cost the country $4 billion, or 2% of its GDP.

Ukraine signed the political portion of the treaty in March, but the economic content is much more significant as it sets a path for Ukraine to open itself to Europe’s $17 trillion market. Ukraine’s exports to Russia totaled over $16 billion last year, nearly a quarter of all goods, and exports to Europe were just over $17 billion, according to EU trade data. Russian Finance Minister Aleksey Ulyukaev also sees little value in the trade deal, as it will turn Ukraine into a “second-rate EU state”, but without any of the benefits. “By signing the Association Agreement the countries must restructure their laws to comply with European standards and open the markets. However, in return, they don’t receive any influence on European legislation or policy,” Ulyukaev said. He was referring to the cost of adopting 350 new laws and 200,000 pieces of legislation to ready the country for trade with Europe.

The Anglo Saxon destruction machine is on a roll.

• Australia’s Prime Minister Proposes Destroying Environment for Votes (Vice)

Since being elected to power last September, Australia’s conservative Prime Minister Tony Abbott and his Liberal-National coalition government have been attempting to scale back or altogether dispose of initiatives and policies important to environmentalists, while proposing initiatives that they hate. Abbott’s administration has axed the independently-run Climate Commission and legislation that would repeal Australia’s carbon tax, and has cut funding to the Australian Renewable Energy Agency. It also approved the expansion of a coal port that would allow some 3 million cubic meters of soil to be dredged and dumped near the Great Barrier Reef, which is already frighteningly imperiled. Another of Abbott’s provocations concerned the protective boundaries of a World Heritage forest area in Tasmania. Last year, Australia’s previous and more progressive Labor government successfully proposed that the area’s boundaries be extended.

The current government wanted to reduce that extension by 43% — more than 180,000 acres — and open it up for logging. It argued that “these areas detract from the Outstanding Universal Value of the property” because they “contain plantations and logged and degraded areas.” This week, at a meeting of UNESCO’s World Heritage Committee in Qatar, the proposal was quickly and unanimously rejected. Early talk from the government and media suggested that the proposal stood a chance. It is clear, watching the committee discuss the proposal, that there was no way it would pass. There was no debate, and the seven minutes spent on the proposal was so short, there’s no link to it on the relevant UNESCO website. The delisting of land from World Heritage status for the sake of logging would have been a dangerous precedent. The committee in Qatar apparently agreed.

• Canada Is Drastically Cutting Environmental Research (Vice)

It’s no secret Canada faces tough environmental challenges in the next few decades. While the bitumen flowing from the Alberta tar sands produces revenues accounting for over 2% of our GDP in oil and other petrol-goodies—relying on extraction methods that provoke scientific concern and visceral horror, means increased emissions and brutal toxic pollution. These sort of problems tend to get taken to scientists with the questions “how bad is it?” and “what do we do?” attached. But Environment Canada claims to have Canadians covered, noting in their 2014-2015 Report on Plans and Priorities that they will “reduce threats to health and the environment posed by pollution and waste from human activities,” and “develop regulations in support of the sector-by-sector approach to reducing greenhouse gas emissions.” All of which sounds very reassuring until you notice the same report projects an overall funding decrease for the department of 37% over the next two years.

First let’s cover the good news: If you’re a fan of migratory birds, no stress, the money to continue preservation efforts is safe. Other projects aren’t so lucky. Funding for the Ecosystems Initiatives will fall from $53 to $26 million, Substance and Waste Management from $76 to $44 million, and the Climate Change and Clean Air budget will be reduced from $155 to $55 million—a staggering 64% lower than current funding levels. The report stresses that much of the planned funding reduction is due to “sun-setting,” referring to the expiry of temporarily funded programs, and that some programs may be extended, or replaced, which can’t be reflected in the projections. In a May 29 meeting of the Parliamentary Environment Committee, Liberal MP John McKay asked about the decrease in funding for the Clean Air and Climate Change Department. Minister of the Environment Leona Aglukkaq had a similarly noncommittal answer to those found in her report: “Decisions on the renewal of programs are yet to be made. We can’t anticipate what the next budget will be,” she said.

Oh man, we’re so green!

• Germany’s New Coal Plants Push Power Glut to 4-Year High (Bloomberg)

Germany is headed for its biggest electricity glut since 2011 as new coal-fired plants start and generation of wind and solar energy increases, weighing on power prices that have already dropped for three years. Utilities from RWE AG to EON SE are poised to bring units online from December that can supply 8.2 million homes, 20% of the nation’s total, according to data compiled by Bloomberg. That will increase spare capacity in Europe’s biggest power market to 17% of peak demand, say the four companies that operate the nation’s high-voltage grids. The benchmark German electricity contract has slumped 36% since the end of 2010.

The new coal plants are starting as Germany aims to almost double renewable-power generation over the next decade. Wind and solar output has priority grid access by law and floods the market on sunny and breezy days, curbing running hours for nuclear, coal and gas plants, and pushing power prices lower. The profit margin for eight utilities in Germany narrowed to 5.4% last year from 15% a decade ago. “The new plants will run at current prices, but they won’t cover their costs,” Ricardo Klimaschka, a power trader at Energieunion GmbH who has bought and sold electricity for 14 years, said June 25 by e-mail from Schwerin, Germany. “The utilities will make much less money than originally thought with their new units because they counted on higher power prices.”

I’d say it’s all of the above.

• It’s Not Pesticides Hurting Moth Pollinators, It’s Car Fumes (Science 2.0)

Due to the president making bee colonies a national priority, there is a lot of talk from environmentalists about banning neonicotinoid pesticides but they may be blaming out of convenience rather than evidence. Car and truck exhaust fumes can be bad for humans and for pollinators too. In new research on how pollinators find flowers when background odors are strong, University of Washington and University of Arizona researchers have found that both natural plant odors and human sources of pollution can conceal the scent of sought-after flowers. When the calories from one feeding of a flower gets you only 15 minutes of flight, as is the case with the tobacco hornworn moth studied, being misled costs a pollinator energy and time.

“Local vegetation can mask the scent of flowers because the background scents activate the same moth olfactory channels as floral scents,” according to Jeffrey Riffell, UW assistant professor of biology. “Plus the chemicals in these scents are similar to those emitted from exhaust engines and we found that pollutant concentrations equivalent to urban environments can decrease the ability of pollinators to find flowers.” “Nature can be complex, but an urban environment is a whole other layer on top of that,” said Riffell. “These moths are not important pollinators in urban environments, but these same volatiles from vehicles may affect pollinators like honeybees or bumblebees, which are more prevalent in many urban areas.”

Home › Forums › Dent Rattle Jun 27 2014: There Are No – Financial – Black Swans