Dorothea Lange Missouri drought family on U.S. 99 near Tracy, California February 1937

If we get even the simplest things wrong, and we do it on a consistent basis, because we lack the tools to look beyond our noses, then what chance do we have of getting the bigger and harder things right? A point I’ve often belabored, and will again a thousand times because it’s the very essence of what we get wrong, is growth, or rather our myopic relationship with it.

There’s not a single school of economics, be it classical, neoclassical, Keynesian or all the others, that even wants to discuss why we need growth, they all take it as a given that we do. Still, what we truly need is a discussion on growth, not growth itself. Because it’s the blind quest for it that is at the root of much of our troubles, not that some of us may or may not have the wrong way we go about achieving it.

There’s nothing special or peculiar, let alone wrong, about the fact that a system, any system, may at some point reach the boundaries to its growth potential. And by flatly denying that these boundaries are even possible at all, we not only risk doing enormous damage to our economies, societies and natural world, we guarantee and lock in that damage. A system that has reached the boundaries to its growth potential tends to self destruct looking for additional but elusive growth.

Again, nothing special. And certainly something we can understand. Except when it’s applied to our own economies. A curious quality of ours.

We see, but we don’t recognize, that tendency towards self destruction today in the various ways we for instance heap additional debt on existing debt like there’s no tomorrow, or in our willingness to dig and drill and inject toxins into our planet just to find a few more drops of fossils to fuel our faltering economic machine. We see the tendency as well as in our attitudes about these things. But we don’t recognize that either.

The illusion that fossils with very low energy efficiencies compared to what we once had can still fuel the same kind of economy and the same kind of growth in that economy, is eerily similar to the illusion that debt can get us out of debt. The only way to sustain such illusions is to have a religious certainty that growth will and must appear at some point. But it mustn’t, and the way things are going, it won’t.

Which might well be fine, if only we would stop chasing it. What are the chances of that, though? If you were a betting man, what would you put your money on, us accepting that we have hit the boundaries of our system, or us going down in flames trying to beat those boundaries? Looks like we’ll never get to talk about how we could use that much touted intelligence of ours to find ways to deal with accepting our boundaries, because we lack the smarts to accept them.

These days, it’s striking to see how this works when it comes to all the new debt and liabilities we load upon our shoulders with, and the way we go about it. More credit growth is seen and presented as a positive thing only, the more the merrier. The choice of words is remarkably void of even an inch of critical thought. Like in this Business Insider piece:

Credit Growth Continues To Boom

The best economic data can sometimes surface when the market isn’t looking. The weekly H.8 report from the Federal Reserve, which shows the assets and liabilities of commercial banks in the U.S., is released at 4:15 on Friday afternoon. And this week’s report looks pretty good. The most recent report showed that commercial bank loans and leases in bank credit continue to surge, and are now up more than 5% year-over-year. Next week is jam-packed with headline economic data, and all of these data are important for gauging the health of the economy. Credit growth, however, is the way you really find out how things are going out there. And it looks pretty good.

Or this from Bloomberg:

Bond Buyers Love That Companies Are Borrowing More Than Ever (Bloomberg)

Companies are on a borrowing binge that’s only accelerating, with investment-grade bond sales poised for a new record year. No one seems to be too concerned because leverage levels – debt to a measure of profitability – are in check, and central banks across the globe are working hard to keep suppressing borrowing costs. Companies have sold $668.4 billion of high-grade notes in the U.S. this year, 11% more than the same period last year and on pace for the biggest annual volume ever, according to data compiled by Bloomberg. Monsanto, the world’s largest seed company, is one of the latest to complete its biggest-ever bond deal, selling $4.5 billion of notes yesterday to help fund a share buyback. Buyers still can’t get enough.

The more people and companies borrow, the better it is. That’s how you “gauge the health of the economy”, is the idea.

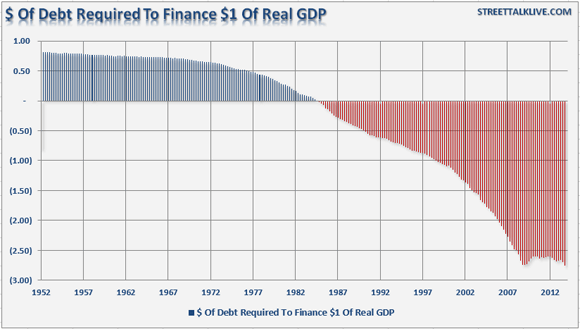

But isn’t it true that a healthy economy makes money, instead of borrowing it? And that if it does borrow, it uses the money to produce products, not just paper value? I think it is. And if that is true, we’re in darn deep doodoo. Because the marginal utility of our debt, the amount of debt needed to produce $1 of real value, has fallen through the floor of a bottomless basement, and it will take a thorough and complete revision of everything we do, and all the models we use to do it, to ever find it back.

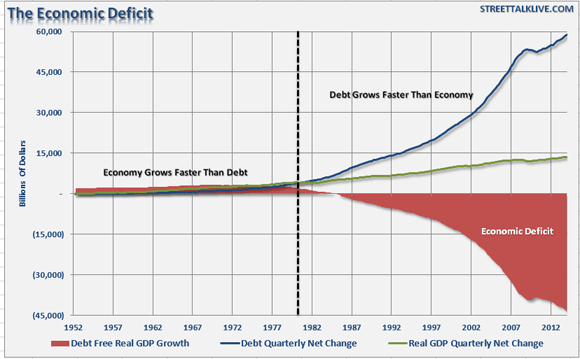

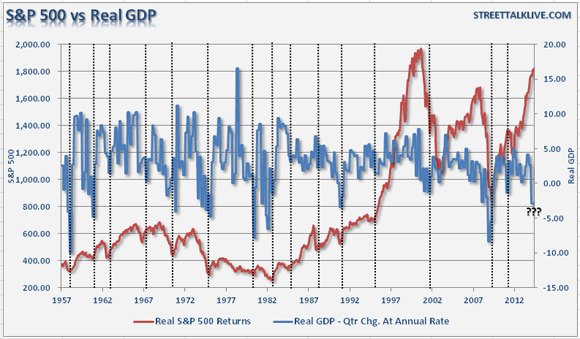

We know that because of what graphs like these from Lance Roberts at STA tell us. First, the difference between growth and debt has led to a huge deficit:

Which means that ever more dollars in debt are needed to produce one dollar of GDP:

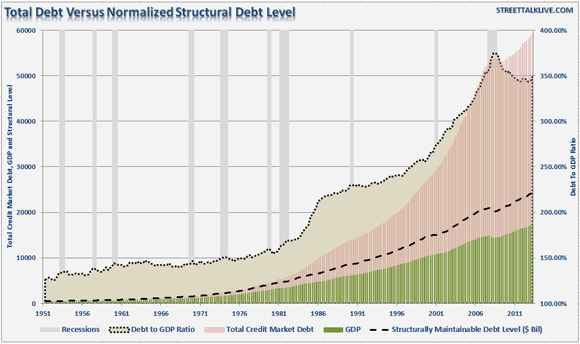

And that in turn means we have a structural, not an incidental, problem:

“Sustainable” debt is “at best” about $25 trillion, and I personally find that a very high level to label “sustainable”. Our actual debt level, however, is $60 trillion. So we will need to shave off at least $35 trillion, or twice yearly GDP, to get back to an economy that could be called functioning and/or productive. Or as Roberts put it:

The Great American Economic Growth Myth

… the economic prosperity of the last 30 years has been a fantasy. [..] The only way to maintain the “standard of living” that American’s were told they “deserved,” was to utilize ever increasing levels of debt. The now deregulated financial institutions were only too happy to provide that “credit” as it was a financial windfall of mass proportions.

When credit creation can no longer be sustained, the process of clearing the excesses must be completed before the cycle can resume. Only then can resources be reallocated back towards more efficient uses. [..] The clearing process is going to be very substantial. The economy currently requires $2.75 of debt to create $1 of real (inflation adjusted) economic growth. A reversion to a structurally manageable level of debt would require in excess of $35 trillion in debt reduction.

This is not some optional exercise. We can’t avoid it, no matter how smart we – think we – are. Nor can we grow our way out of it. We will have to adapt and adjust. If we don’t, we will end up beating each other’s brains in. Though I guess you can call that a way of adapting as well. But it’s not what most of us would like to do, or have done to us. Still, we continue to scramble for a seat in a musical chairs game with ever less seats available. We scramble for our piece of a growth pie that is an illusion, that exists only in our heads.

We are smart enough to understand that. Are we also smart enough to stop trying? Here’s how 86 year old Hong Kong tycoon Li Ka-shing put it to a student audience in a speech about inequality he called “Sleepless in Hong Kong”:

“Today when you rang the bell of truth, what promise did you make to the future? When dawn breaks, is today the tomorrow you worried about yesterday? Your dedication and undertaking to be the custodian of the future is the best antidote for everyone’s insomnia.”

Many more good graphs and observations in the original.

• Q2 Economic “Hope” Misses The Point (STA)

The release of the final estimate of the Q1-2014 Gross Domestic Product report took most everyone by surprise by plunging to a negative 2.9% versus a negative 1.8% consensus. However, not to fear, the ever bullish media spin machine quickly stepped in to assuage fears by stating:

“If GDP were truly so weak, we would not expect aggregate hours worked to climb 3.7% annualized through May, jobless claims to remain near cycle lows, consumer confidence to hit a cycle high, industrial production to climb 5.0% at an annual rate over the first five months of the year, core capital goods orders to be up 5.8%, ISM to be above 55, and vehicle sales to hit their strongest annualized selling pace for the year,” said Renaissance Macro’s Neil Dutta. “GDP is the outlier in these data points. I will roll my eyes and move on. Most of the data we just mentioned is consistent with underlying growth over 3.0%.” [..]

As individuals, we are investing capital in business models that should produce an expected return over time based on several factors: 1) the price paid, 2) projected future cash flows, and 3) the point within the current business cycle. If we pay too much for a projected stream of cash flows at a very late point in a normal business cycle – the net return will be extremely low, if not negative. The only reason that we care about economic data is solely to determine the current point within any given economic or business cycle. In the financial markets, our sole job as investors is to “buy low and sell high” and those “low points” highly correspond to the lows in the economic cycle as shown in the chart below.

Currently, the parabolic rise in the markets, extreme bullish optimism, and high levels of complacency are “trumping” the drop the Q1 GDP in “hopes” that it was indeed just a “weather related anomaly.” This is very similar to what happened in late 1999 as the economy began its slip into a recession. The initial drops in GDP were disregarded by analysts and economists until it was far too late. The same thing occurred again in 2007 with Bernanke’s call of a “Goldilocks Economy.”

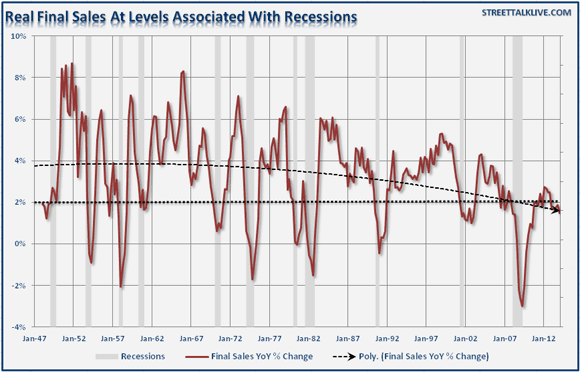

When it comes to evaluating the underlying strength of the economy, one of the most important measures is the level of “final sales.” While GDP measures total domestic production, final sales reflects the demand by consumers, businesses, and government. Since the economy is almost 70% driven by consumption this number is far more important in determining what is happening beneath the headline GDP report. The chart below shows real, inflation adjusted, final sales.

• Crushing The Q2 “Recovery” Dream In 1 Simple Chart (Zero Hedge)

For a week or two, the ‘news’ appeared to confirm the ‘hope’; faith that Q1’s dysphoria would emerge phoenix-like into Q2 euphoria as a ‘hibernating’ American public emerging from their weather-shelter and spent-spent-spent all their borrowed-borrowed-borrowed money. That ended last week! Despite the dramatically low volume liftathon in stocks since the FOMC meeting, major risk markets around the world are cracking. European bonds and stocks had a bad week, Treasuries rallied the most in 6 weeks, and the key to it all, USDJPY, slipped to 4 week lows. Why? As the chart below shows, US macro data is collapsing again (right on cue) and stands at 2-month lows… (and is the worst-performing macro nation in the world this year!)

• Bond Buyers Love That Companies Are Borrowing More Than Ever (Bloomberg)

Companies are on a borrowing binge that’s only accelerating, with investment-grade bond sales poised for a new record year. No one seems to be too concerned because leverage levels – debt to a measure of profitability – are in check, and central banks across the globe are working hard to keep suppressing borrowing costs. Companies have sold $668.4 billion of high-grade notes in the U.S. this year, 11% more than the same period last year and on pace for the biggest annual volume ever, according to data compiled by Bloomberg. Monsanto, the world’s largest seed company, is one of the latest to complete its biggest-ever bond deal, selling $4.5 billion of notes yesterday to help fund a share buyback. Buyers still can’t get enough.

Investors are now demanding about the smallest premium over benchmark rates to own the debt since 2007, according to Bank of America index data. They’re gaining confidence from default rates that have plunged far below historic averages. Moody’s Investors Service predicts the global speculative-grade default rate will decline to 2.1% at year-end from 2.3% in May. Both are less than half the rate’s historical average of 4.7%. Balance sheets are also getting better, with companies improving their profitability faster than they’re borrowing. Gross leverage ratios for the average investment-grade issuer fell to 2.58 times in the first quarter from 2.59 times at the end of the year, according to Morgan Stanley data measuring total debt to earnings before interest, taxes, depreciation and amortization. That’s down from 2.73 times in 2009.

Federal Reserve Chair Janet Yellen is fueling the debt party by making it clear that she’s planning to hold benchmark rates low for a prolonged period. And even though the amount of outstanding investment-grade bonds in the U.S. has ballooned by almost $1.6 trillion since 2008, some of that growth has stemmed from companies shifting into longer-term bonds and out of shorter-term commercial paper, Barclays strategists led by Jeffrey Meli noted in a report today. Maybe investors shouldn’t be too complacent because equations will change when benchmark yields rise, making it more costly for companies to borrow.

• Investors Who Bought Foreclosed Homes in Bulk Look to Sell (NY Times)

A year ago, buying foreclosed homes to rent out was the sure-thing trade for investment firms backed by money from private equity companies, hedge funds and pension systems. But with the supply of cheap foreclosed homes dwindling, some early investors are looking to cash out a bit by flipping homes to competitors. The Waypoint Real Estate Group, one of the first companies to raise money from private investors to buy foreclosed homes, is quietly shopping as many as 2,000 houses in California that it acquired in the last few years in several private investment funds, said three people who had been briefed on the matter but were not authorized to discuss it. The homes, which are largely rented, are being shown to other companies backed by investor money that have also scooped up distressed houses in states including Arizona, California, Florida, Georgia, Illinois and Nevada.

Waypoint is considering selling about half of its 4,000 homes. Some of the biggest institutional investors in the market for foreclosed homes – companies like the Blackstone Group, American Homes 4 Rent and American Residential Properties – have slowed their pace of acquisitions in response to an increase in home prices and a dearth of foreclosed homes that do not require significant renovation. Waypoint is following other early investors like the Och-Ziff Capital Management Group and Oaktree Capital Management, which have sold homes bought near the start of the financial crisis. But unlike Och-Ziff and Oaktree, Waypoint is not leaving the single-family home market. It is still managing more than 7,000 homes for a publicly traded real estate investment trust, or REIT, it formed last year with the Starwood Capital Group called Starwood Waypoint Residential Trust.

• US Rental Home Crisis Looms: 4.9 Million Without Affordable Housing (USFP)

The United States is facing a new housing crisis, this time dealing with a shortage of rental housing. Experts warn that this problem will worsen in the coming years and may start to harm economic growth. There are currently 11.8 million low-income renters with an income that is at or below 30% of their area’s median, yet only 6.9 million affordable rental units on the market, according to Harvard’s Joint Center for Housing Studies. The number of very low-income renters rose by 3 million from 2001 to 2011, while the number of affordable rental homes has remained unchanged. This leaves 4.9 million without affordable housing. One million more renters are also expected to enter the market by the end of the decade, as many young adults choose to rent rather than buy a home.

Homeownership has reached its lowest point in 19 years as millions struggle to recover from the housing collapse and tighter lending requirements have put homeownership out of reach for many. While rental vacancies drop across the United States, rents are rising. Nationwide, rents rose 3% in 2012, but some markets saw rent increases of 6% or more during the year. New multifamily construction has grown in response to the demand, but the supply of rental properties continues to fall short. Multifamily housing starts increased 25% in 2013, surpassing the 300,000 mark for the first time in six years. Still, multifamily construction in nearly 50% of the 100 largest metropolitan areas has fallen. The report found that the number of cost-burdened renters who are paying more than 30% of their income on housing rose in all but one year between 2001 and 2011 and is now more than 50% of renters, while more than 25% of households spend at least half of their income on housing.

• Credit Growth Continues To Boom (BI)

The best economic data can sometimes surface when the market isn’t looking. The weekly H.8 report from the Federal Reserve, which shows the assets and liabilities of commercial banks in the U.S., is released at 4:15 on Friday afternoon. And this week’s report looks pretty good. The most recent report showed that commercial bank loans and leases in bank credit continue to surge, and are now up more than 5% year-over-year. Next week is jam-packed with headline economic data, and all of these data are important for gauging the health of the economy. Credit growth, however, is the way you really find out how things are going out there. And it looks pretty good.

• S&P 500 Heads for Longest Rally Since 1998 on Economy, Stimulus (Bloomberg)

The Standard & Poor’s 500 is one trading day away from completing the longest stretch of quarterly gains in 16 years, as central bank stimulus and confidence in economic growth sent stocks to all-time highs. Netflix and Facebook advanced more than 12% in the quarter, leading a rebound from a two-month selloff in Internet and small-cap stocks. Allergan and Williams Cos. jumped at least 40% during the busiest period of takeovers in seven years. Schlumberger and ConocoPhillips surged more than 20%, driving energy companies to the best gain among 10 S&P 500 industries, as oil prices climbed amid unrest in Iraq and Ukraine. The S&P 500 has climbed 4.7% to 1,960.96 for the three months, poised for a sixth quarterly gain, the longest stretch since 1998. The Dow Jones Industrial Average added 394.18 points, or 2.4%, to 16,851.84. The Nasdaq Composite Index has jumped 4.7% and the Russell 2000 Index is up 1.4%.

“It’s as remarkable as anything that the market’s been given plenty of opportunity to sell off and it hasn’t,” Mark Luschini, chief investment strategist at Philadelphia-based Janney Montgomery Scott LLC, which oversees $65 billion in assets, said by phone. “The equity markets continue to move higher even though I think what we’re seeing more recently is a bit of a struggle to get through some of the economic data.” The S&P 500 rose to an all-time high of 1,962.87 on June 20 as data from employment to housing fueled confidence that the U.S. economy is rebounding after the worst contraction in gross domestic product since 2009. The index held at record levels in the latest week, falling only 0.1% for the five days, in the face of conflicts in Iraq and Ukraine, weaker-than-anticipated economic data and concern over rising rates.

Fed Chair Janet Yellen said on June 18 that accommodative monetary policy, rising property and equity prices and the improving global economy should lead to above-trend growth. Fed Bank of Philadelphia President Charles Plosser said June 24 that he’s “fairly optimistic” economic growth will exceed 2.4% for the remainder of this year and next amid steady growth in jobs. U.S. stocks joined an equity rally worldwide as stimulus spanned from Europe to Japan and the U.S. The European Central Bank unveiled an unprecedented package of stimulus measures designed to boost the economy. In Japan, Prime Minister Shinzo Abe said deflation has ended and will be thwarted by new government policies designed to encourage business expansion.

“Abe’s policies are complete and utter failures.”

• Shinzo Abe And The Three Magic Arrows (Mises Inst.)

Despite claims to the contrary in the mass media, Japan’s economy is continuing to suffer mightily under the leadership of Prime Minister Abe Shinzo. Abe is from a famous family and he’s a convincing talker, so he was able to bamboozle people into believing that he could make Japan prosper with his three arrows. These metaphorical arrows stand for “monetary stimulus,” “fiscal stimulus,” and “structural reform.” When Abe was elected using his “three arrows” symbolism to attract votes, I thought the Japanese people were beginning to believe in magic. Perhaps they were gullible or a little lazy in thinking or thought they would receive “free stuff” from Abe. No matter, Abe became Prime Minister in December 2012 and shot off his arrows.

With his “monetary stimulus” arrow, Abe arm-twisted the central bank into doubling the money supply in just a few months time. I could just imagine Abe rubbing his palms together and fiendishly muttering “We’re going to be rich, rich, RICH!” All that the central bank had to do was type a few numbers into their computers to make this happen. Naturally, the newly created money was distributed to politically powerful banks. How did all of this money creation affect the common people? Despite claims that Japan has less than 2% inflation, I can assure you that the prices of many goods, especially imported goods like energy, have increased dramatically since the monetary stimulus arrow was fired. Wages, on the other hand, have remained depressed.

With higher expenses to pay, Japanese people can’t afford other goods they would like to buy and businesses can’t afford to raise wages, hire, or expand. Only Abe’s bankster friends have profited from this scheme by speculating in the stock market with the counterfeited money that had been credited to their accounts with the central bank computer. Japanese people are mostly smart enough to realize that typing numbers into a computer can’t make an economy strong, yet they just haven’t figured out that Abe’s monetary stimulus is nothing but a sneaky counterfeiting scheme. [..]

Abe’s arrows have been praised in the media by the economically ignorant, the politically motivated, and those who believe prosperity is parceled out by some all powerful shaman. However, the arrows, seen in the harsh light of reality, turn out to be counterfeiting schemes, “investing” in money losing ventures, taking money from the productive, and squabbling with the neighbors. These counterproductive political actions won’t ever result in a stronger economy and have instead left the Japanese people with a crushing debt and tax burden. Don’t get taken in by the hogwash you read in mainstream media propaganda pieces. Abe’s policies are complete and utter failures.

Love this: “Today when you rang the bell of truth, what promise did you make to the future? When dawn breaks, is today the tomorrow you worried about yesterday?”

• Hong Kong Sipping ‘Toxic Cocktail’ of Inequality (Bloomberg)

The widening wealth gap is keeping Hong Kong billionaire Li Ka-shing up at night and Asia’s richest man warns it could become “the new normal” if left unaddressed. The government must introduce fresh impetus to enable dynamic and flexible redistribution policies, Cheung Kong Chairman Li said when addressing students at China’s Shantou University, according to a speech titled “Sleepless in Hong Kong” posted on the website of the Li Ka Shing Foundation yesterday. The growing scarcity of resources and waning trust are also reasons he’s being deprived of sleep, he said.

“The howl of rage from polarization and the crippling cost of welfare dependence is a toxic cocktail commingled to stall growth and foster discontent,” said Li, who turns 86 next month. “Trust enables us to live in harmony, without which more and more people will lose faith in this system, breeding skepticism towards what is fair and just, doubting everything and believing all has turned sour and rancid.”

Li’s comments come as the debate over how to elect Hong Kong’s next leader in 2017 divides the city, with more than 750,000 people voting in an unofficial democracy poll. Lawyers in the territory yesterday marched through the central business district in silence, in protest against a Chinese policy paper they said jeopardizes judicial independence, the South China Morning Post reported today. [..] “What is most unsettling for me is that trust, the bedrock of an enlightened society, is crumbling before our eyes,” Li said. “Without a modicum of trust, society will downward spiral into a painful vicious cycle.”

Occupy Central activists have called on the Hong Kong and Chinese governments to heed public opinion expressed through its polls, while urging residents to join an annual protest march on July 1, the anniversary of the city’s return to Chinese rule. The activists want public nomination of election candidates. “Today when you rang the bell of truth, what promise did you make to the future? When dawn breaks, is today the tomorrow you worried about yesterday?” Li said. “Your dedication and undertaking to be the custodian of the future is the best antidote for everyone’s insomnia.”

• Moody’s Cuts Russia’s Rating Outlook To ‘Negative’ (RT)

Moody’s ratings agency has cut Russia’s outlook to negative, citing the threat to the Russian economy from the Ukraine crisis and a deterioration in Russia’s medium-term growth outlook. Moody’s Investors Service held Russia’s overall rating at Baa1 against a background of the country’s strong fiscal and external accounts. However, it warned that the spread of the conflict in Ukraine has raised the danger of a “geo-political event risk” for Moscow, including from Western sanctions. Moody’s said in its report that it views the situation in eastern Ukraine as more difficult compared to Crimea, “given the complicated background of separatist forces and the outbreak of violence.” The investors service also cited Russia’s lower annual growth outlook, which has fallen to 1.7% from previous forecasts of three% over the next five years.

It said the fall was more pronounced than in Russia’s “peer countries such as India, Italy, Kazakhstan, Mexico, and South Africa, among which the median and average decline is estimated at only around 0.2% by the IMF.” The report says that Russia’s Baa1 rating remains constrained by its weak institutions and an over-reliance on oil price developments. It also citeds a “lack of structural reforms” and a “declining working age population” as reasons for the negative outlook. These factors add to “downward pressure on Russia’s potential growth rate in the coming ten years,” the report states. If Russia’s domestic growth outlook were to deteriorate further, Moody’s warns, there could be a downgrade of Russia’s sovereign rating, “in particular if lower growth were to negatively affect Russia’s fiscal and external accounts.” But the agency did not cut Russia’s sovereign rating, saying it does not foresee the conflict getting worse or further lowering Russia’s growth.

• BNP Paribas CEO: Bank Facing Heavy US Penalties (Reuters)

BNP Paribas Chief Executive Officer Jean-Laurent Bonnafe in a message to employees has warned that the French bank is facing heavy penalties following a U.S. probe into breaking sanctions which should end “very soon”, a French TV channel reported on Saturday. BNP Paribas declined to comment but sources this week said the French bank is expected to plead guilty to a federal criminal charge and pay nearly $9 billion as part of a larger settlement with multiple enforcement authorities that could be announced as early as next week. “I want to say it clearly, we are going to be heavily sanctioned,” broadcaster iTele quoted Bonnafe as saying in an internal message posted on June 27. “Malfunctions have occurred and mistakes were made. But this difficulty we are experiencing should not impact our roadmap.”

U.S. authorities are examining whether BNP Paribas evaded U.S. sanctions relating primarily to Sudan between 2002 and 2009 and whether it stripped identifying information from wire transfers so they could pass through the U.S. financial system without raising red flags, sources have said. “This is good news for all teams and for our customers,” iTele quoted Bonnafe as saying regarding the imminent settlement. “This will help remove current uncertainties in our group. This will allow us to turn the page on these events.” BNP Paribas is likely to be suspended from converting foreign currencies to dollars on behalf of clients in some businesses for as long as a year, sources familiar with the matter said this week.

• Europe: Let’s Have A Confederacy, Not An Empire (Steve Cook)

The Liberty Beacon UK is not opposed to the ideal of European Union. We think it is a great idea that sovereign European countries should confederate in a spirit of brotherhood and cooperation. But if that ideal of confederation is hijacked by men of authoritarian and less than honest disposition; if it runs on a bogus, malfunctioning money system based on debt; if it inhibits the freedoms of or by increments disenfranchises European peoples; if it becomes riddled by corruption or stifled by bureaucracy; if it is rigged so as to covertly serve vested interests and if it does not engender in its citizens a sense of pride in it as something worth fighting to uphold, then it requires repair.

Like a faulty machine, if it does not receive due repair when it starts belching smoke from all the wrong places or making disturbing noises, it will sooner or later conk out and wind up in the scrap yard. So please, let’s not have Europe go the way of Rome. We have a chance here to build something worthwhile.

Home › Forums › If We Get Even The Simplest Things Wrong ..