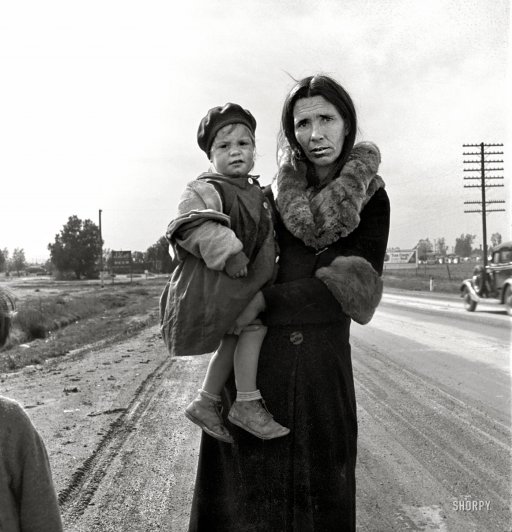

Dorothea Lange Homeless mother and child walking from Phoenix to Imperial County CA Feb 1939

So, Matthew Lynn, I’m sure you’re a fine young man and your mommy loves you to bits, but you’re obviously in the wrong line of work. Or maybe the right one, come to think of it, since if you can make enough people see the world your way, in the end you’ll be right. That’s how journalism is defined these days. Anything goes, provided you can make people believe what you write. The problem is, that process can only end up with everyone a lot dumber than they already are. The lowest common denominator wins the day, every day.

My problem with that is, why does someone work for a finance site like MarketWatch who has no clue what finance actually is, and how it works? Your ignorance leads you, I’m sure without any bad intentions, to insult millions of people who are having a very bad time. Does that mean anything to you? See, I’m guessing it doesn’t. I think you don’t know bad times, because if you did, you would never write the offensive blubber you do.

But Matthew, this once, and only once, I’m going to say what I have to say about your mindless drivel. Because I don’t care one bit about the investor crowd whose fancy you’re trying to tickle, I’m here for the people you aim to leave by the wayside (yeah, I know, you had no idea..). And you know, normally I don’t care anymore, I can’t get angry every single time some nutjob gets his stuff upside down. But this goes too far, you’ve overstretched even your lowest common standards.

In your article, you paint the perfect example of why seeing deflation only as falling prices is so completely useless, numbing and dumbing. Hey, maybe I should thank you for that.

If you refuse to look a WHY prices fall, you never learn a thing, and you will always be behind. Apart from the fact that the idea of Greece and Spain doing well can easily be refuted by 1000 other data sources, there’s the simple fact that looking at one day or week or month tells you nothing. You need to look at consumer spending over at least the past few years. That would also show more respect for the over 25% of the working population, and over 50% of youth, who are unemployed in both Greece and Spain, and who are the topic of your ‘article’.

Here’s you, Matthew:

If Deflation Is So Terrible, Why Are Spain, Greece Growing?

Prices are starting to fall across the European continent. Mass unemployment, and a grinding recession are forcing companies with too much capacity to charge less for their products. Company profits will soon be collapsing, while government debt ratios threaten to spiral out of control. The threat of deflation is so worrying, the European Central Bank is expected to throw everything in its armory to prevent it, and to get prices rising again. It may even move towards full-blown quantitative easing as early as Thursday.

You get it awfully wrong from the get-go. What you call “companies with too much capacity” are simply those who could sell their products before the recession set in, and would now have to fire people to get rid of that ‘overcapacity’, thereby lowering spending capacity, which would lead to even more ‘overcapacity’, and therefore more unemployed. I’m thinking you must have studied economics, because that’s the only place people pick up such warped notions. It’s a chicken and egg thing, Matthew, a horse and a cart, and getting them the wrong way around is not going to help.

What you describe but don’t understand is deflation. It starts with a drop in spending, caused by lower or no wages, saving or simply the demise of confidence. It doesn’t start with overcapacity. It starts with people losing their jobs.

But here’s a puzzle. The two countries with the worst deflation in Europe are Greece and Spain. And two of the countries with the best growth? Funnily enough, that also happens to be Greece and Spain. So if deflation is so terrible, how come those two are recovering fastest? The answer is that deflation is not nearly as bad as it sometimes made out to be by mainstream economists.

Matthew, I’m not a mainstream economist. I’m not an economist at all, and I see that as my saving grace. Steve Keen is a good friend, but I don’t know any other economists who make any sense to me (Steve says he know a few, so we’re covered). But I don’t think even Steve fully gets deflation either. Which of course he’ll deny.

Still, saying that Greece and Spain are doing just great despite their deflation is simply meaningless. Deflation is not about prices, it’s about spending. And people in Greece have been forced to lower their spending for years now. So much so that one single extra boat of tourists would suffice to raise its GDP. But that makes no difference for the population. Which means Greece is not doing well. Yeah, the highest GDP growth in Europe, but that only says something about the rest. Still, selling a few additional retsinas and tzatzikis may lift Greece, but not Europe. Here’s more you:

The real problem is debt. But if that is true, perhaps the eurozone would be better off trying to fix its debt crisis than campaigning to raise prices – especially as it probably won’t have much success with that anyway. There is no question that the eurozone is sliding inexorably towards deflation. Only last week, we learned that the inflation rate across the zone ratcheted down to 0.3% last month, from 0.4% a month earlier, and a significantly lower figure than the market expected. It has been going steadily down for some time. Consumer inflation has not hit the ECB’s target level of 2% since the start of 2013. It has been falling steadily since it peaked at 3% in late 2011.

I must admit, after reading that again, I have no idea where you’re going with it. The problem is debt, I get that, and I agree too, and that should be fixed, kudos, but after that, you don’t seem to have much of a train of thought, just numbers.

It would be rash to expect that to change any time soon. The oil price has collapsed, and other commodity prices are coming down as well. That will all feed into the inflation rate. Retail sales are still weak, and unemployment is still rising. People who have lost their job don’t spend money – and companies don’t hike prices when the shops are empty.

What you’re describing there is not so much deflation itself, but its consequences. And you yourself just claimed that deflation is not all that bad, didn’t you?

Most economists will tell you that is very worrying — and that the ECB needs to act immediately to stop it getting worse. People will postpone buying anything because they think it will be cheaper next month. Companies will be reluctant to invest because they see their prices and profits going down. Confidence will be sapped, and the economy will suffer. Even worse, the debts of peripheral eurozone countries will spiral out of control — because the amount they owe will remain the same, but there will be less income to service it. But there is something odd about that analysis. The two countries with the worst price data are also the two countries doing best within Europe.

What happens is that Greece and Spain have become so cheap that tourists from other countries come and spend their money on their beaches. That lifts their GDP. Nothing to do with the people in the street. Nor does it have anything to do with deflation. Deflation is defined by the speed at which people spend their money (provide the money supply remains reasonably high). If no-one spends, prices fall. The reason people don’t spend is because they’re too poor. I’m lousy at rocket science, but I do get that one.

Just take a look at the figures. In Greece, prices are falling at an annual rate of 1.7%. In Spain, they are falling by 0.4%. So presumably those are the two countries that have been hit hardest? Well, it has not quite worked out like that. The fastest growing economy in the eurozone right now is none other than Greece. True, it is not exactly China, but it is expanding at an annual rate of 1.9% right now. And how about Spain? Its economy is also growing again, at an annualized rate of 1.6%.

You see, this is where you start to be insulting. You have a nation full of people who don’t even know anymore how to pay for a doctor, and because of some empty government massaged number you want to tell those same people they’re actually doing fine? They’re still as poor as they were before Samaras published that number, and before you reported on it.

By contrast, the economies where prices are still rising are not doing as well. Over in Germany, the supposed powerhouse of Europe, the inflation rate is still just in positive territory, at an annual rate of 0.5%. But growth in the third quarter was only 0.1%, narrowly avoiding recession. The same is true in France – inflation just about stayed positive, but growth has completely stalled.

Yeah, I know, it’s shooting fish in a barrel here for me: if you don’t know what inflation or deflation is, you’re bound to get everything wrong and upside down. But even then, don’t you at least think when you write “the economies where prices are still rising are not doing as well”, that that is weird? Because it would mean that countries who are already knee deep in deflation, whether it’s your definition or mine, with lower prices and therefore higher unemployment, do better than those who have fewer jobless. Doesn’t that strike you as odd?

So there does not appear to be much of a connection between rising prices and stronger growth. Nor do falling prices appear to be hurting very much.

See, now I’m getting pissed off. Did you even read that? Falling prices, Matthew, are the result of having more than half of your young people out of work for years on end. What the f*ck do you mean, they don’t appear to be hurting that much?

So what is going on? In reality, there is nothing terrible about prices falling. It is what happens in a competitive economy. Most of us like it when the stuff we buy gets cheaper. There is no serious evidence to suggest that it deters people from buying things. If it did, no one would ever buy a television or a smartphone, because they know perfectly well that they can get a better one for less money next year. In reality, they buy plenty of both.

This is where I give up on you, Matthew, and where I call on the MarketWatch board to fir your ass. Chances are, I know, that they agree with this absurdity, but what the heck, I’m calling anyway. I mean, what the hell is this supposed to mean: “There is no serious evidence to suggest that it deters people from buying things. If it did, no one would ever buy a television or a smartphone ..”

There’s plenty evidence, go to Athens, go to their soupkitchens and hospitals, and you’ll see that deflation DOES deter people from buying smartphones. Because they need the money, if they even have any, to pay for treatments to keep their children alive that we don’t even have to think twice about. It doesn’t deter them becise deflation loewred prices, but because deflation took their jobs away.

People buy things when they need them, taking price trends into account – after all, you can’t take either the money or the phone with you when you die, so you can’t postpone the purchase forever. Neither is there much evidence that it saps the confidence of companies. Again, if it did, no one would make any kind of consumer electronics. Businesses will invest where they think they can make money, and so long as costs are falling as well it is fine for prices to come down.

No people don’t buy things when they need them when they can’t afford them, you ignorant drip. You’re completely clueless about the world out there. And I take that personal, because these are my people. They’re all my people.

The threat to growth from deflation is wildly oversold. Indeed, for most of the 19th century deflation was completely normal — and that didn’t stop the industrial revolution in its tracks. Indeed, mild deflation may actually be helping Spain and Greece. As things get cheaper, consumers feel a bit more confident – and start spending again.

Yeah, the 19th century was a great period, wasn’t it, Matthew, and completely normal to boot, whatever that may mean. Just ask Marx and Dickens how normal it was, or the millions who came to America escaping the hell that was much of Europe. All Oliver Twist needed was a bit more confidence, so he could start spending again…

The one thing that is a problem is where there are high debts, as there certainly are across the eurozone. If prices fall, then those debt ratios are just going to get worse and worse. At a certain point, they will be unsustainable. But in that case, surely the right response is to deal with the debt, not the deflation. Many eurozone countries have debts that they probably won’t ever be able to repay.

If they thought inflation was going to deal with that for them, they will be disappointed. It isn’t going to happen. By far the best thing for them to do now would be to restructure their debts. The ECB will throw everything it has at fighting deflation. But it is probably not going to work – and it might well be better if it didn’t.

See, Matthew, you actually know some things. But you don’t understand them. I know, if only because you end with this cracker:

Deflation is not nearly as bad as everyone thinks.

I don’t really know what to say in the face of so much, what do you call this, nonsense, propaganda, ignorance? I write because I don’t like what happens to the people that folks like Matthew Lynn couldn’t care less about, as long as their little economic theories seem to fit whatever little rich lives they lead.

I have nothing with that. I have something with the people. And I therefore find comments like the ones above by Matthew Lynn repulsive.

Here’s real life:

Is The Greek Economy Improving?

The Guardian’s Greece correspondent, Helena Smith, is deeply sceptical about the heralded recovery having any real impact on the ground. “The ‘success story’ peddled by the government differs wildly to what life is really like on the ground – with plummeting living standards, unprecedented unemployment and the inability of most to keep up with bills, including the barrage of new taxes that can change with lightning speed on any given day,” she says.

“Five years down the road the crisis, to great degree, has been ‘normalised’ but the disconnect is evident in the collateral damage caused by the massive devaluation Greece has been forced to undergo in return for emergency funding: suicides, homelessness, a middle class pauperised by austerity. “And all eclipsed by a level of uncertainty, shared by all who live in a country whose debt load – the biggest impediment to real economic recovery – has actually grown since the crisis began.” [..]

Catherine Moschonas, from Thessaloniki: “Wages still much lower than a few years ago but taxes are MUCH higher, especially land taxes – the state is now taxing real estate that people can’t find tenants for and can’t sell because nobody’s buying. Generally policies are driving rather than limiting tax evasion – otherwise people can’t make ends meet (quite apart from perceived lack of social justice in measures taken).

“For families, healthcare increasingly a major financial concern as hospitals or sections close and social insurance is cut – but most people can’t afford private healthcare. People with relatively decent paychecks are one sick parent away from disaster. I don’t see any sign that things are improving”

Greece’s Recovery Is Deceptive

A small economic recovery is little consolation when one considers that in the past 5 years of recession, the Greek economy has lost a fifth of its total volume. And in a country that has seen unemployment rise to 28%, a drop of half a percentage point is not particularly noticeable.

.. the conservative Prime Minister Antonis Samaras desperately needs successes to mobilize his core voters. But real life is not helping him much. Growth in Greece is still very fragile, restructuring of inefficient state apparatuses is still very slow, tax avoidance has not been clamped down on, privatization is stalling, and austerity measures are driving more and more people to despair – younger generations in particular are struggling with a dearth of opportunities ..

.. even in these unusual circumstances, the Greek parties are not in a position to achieve even a basic consensus on how to rescue the country. Even now, they are feverishly preparing for a new election instead of trying to establish some political stability and continuity. Leading members of Syriza have even suggested demanding leftover war reparations from Germany and use them in calculations for a new budget. This might sound like a farce from the periphery of the eurozone, but it is testament to the backwardness of political culture in Greece. Anyone who wants to help the Greek people needs to keep their politicians and governments under control first.

Greeks Struggle To Get By Despite Economic ‘Recovery’

The number of Greeks at risk of poverty has more than doubled in the last five years – from about 20% in 2008 to 44% in 2013, according to a report by the International Labor Organization.

Sorry if I get too emotional for your taste at times, but I have a hard time with sheer and especially mean hubris. Telling people things are great since their basic necessities just got cheaper, exactly BECAUSE they can no longer afford them (because that IS deflation), that must be the pits. Still, it’s how 99% of economists ‘understand’ the world. Now you know why it’s all such a mess.

Home › Forums › No No No! That Is Not Deflation!