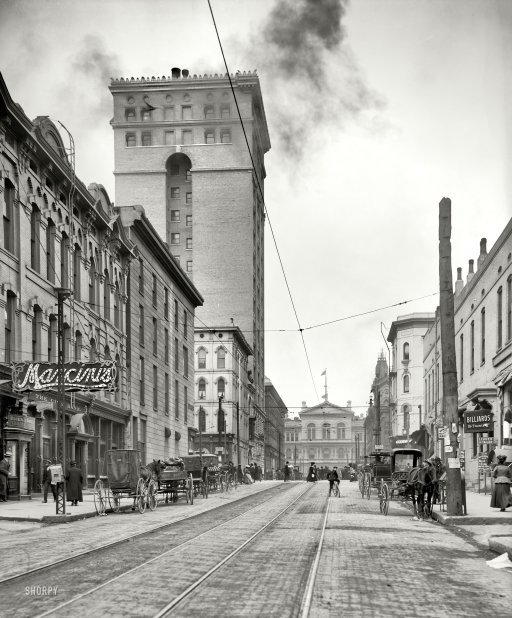

DPC Madison Avenue, Memphis, Tennessee 1906

“The Chinese economy is a giant Ponzi scheme. Tens of trillions of dollars are owed to essentially bankrupt banks – and worse, bankrupt near-banks that operate in the murky shadowlands of a deeply dysfunctional mix of Leninism and rapacious capitalism. “

• Why Are We Looking On Helplessly As Markets Crash All Over The World? (Hutton)

There has always been a tension at the heart of capitalism. Although it is the best wealth-creating mechanism we’ve made, it can’t be left to its own devices. Its self-regulating properties, contrary to the efforts of generations of economists trying to prove otherwise, are weak. It needs embedded countervailing power – effective trade unions, law and public action – to keep it honest and sustain the demand off which it feeds. Above all, it needs an ordered international framework of law, finance and trade in which it can do deals and business. It certainly can’t invent one itself. The mayhem in the financial markets over the last fortnight is the result of confronting this tension. The oil price collapse should be good news. It makes everything cheaper. It puts purchasing power in the hands of business and consumers elsewhere in the world who have a greater propensity to spend than most oil-producing countries. A low oil price historically presages economic good times. Instead, the markets are panicking.

They are panicking because what is driving the lower oil price is global disorder, which capitalism is powerless to correct. Indeed, it is capitalism running amok that is one of the reasons for the disorder. Profits as a share of national income in Britain and the US touch all-time highs; wages touch an all-time low as the power of organised labour diminishes and the gig economy of short-term contracts takes hold. The excesses of the rich, digging underground basements to house swimming pools, cinemas and lavish gyms, sit alongside the travails of the new middle-class poor. These are no longer able to secure themselves decent pensions and their gig-economy children defer starting families because of the financial pressures.

The story is similar if less marked in continental Europe and Japan. Demand has only been sustained across all these countries since the mid-1980s because of the relentless willingness of banks to pump credit into the hands of consumers at rates much faster than the rate of economic growth to compensate for squeezed wages. It was a trend only interrupted by the credit crunch and which has now resumed with a vengeance. The result is a mountain of mortgage and personal debt but with ever-lower pay packets to service it, creating a banking system that is fundamentally precarious. The country that has taken this further than any other is China. The Chinese economy is a giant Ponzi scheme. Tens of trillions of dollars are owed to essentially bankrupt banks – and worse, bankrupt near-banks that operate in the murky shadowlands of a deeply dysfunctional mix of Leninism and rapacious capitalism.

The Chinese Communist party has bought itself temporary legitimacy by its shameless willingness to direct state-owned banks to lend to consumers and businesses with little attention to their creditworthiness. Thus it has lifted growth and created millions of jobs. It is an edifice waiting to implode. Chinese business habitually bribes Communist officials to put pressure on their bankers to forgive loans or commute interest; most loans only receive interest payments haphazardly or not at all. If the losses were crystallised, the banking system would be bust overnight. On top, huge loans have been made to China’s vast oil, gas and chemical industries on the basis of oil being above $60 a barrel, so more losses are in prospect.

Some $600 billion lost in one week.

• China’s Stock Market Value Plummets (Xinhua)

China’s declining stock market has resulted in a sharp decrease in the market capitalization of the two bourses in Shanghai and Shenzhen. The market value of the Shanghai and Shenzhen bourses plummeted to 42.74 trillion yuan (about 6.5 trillion U.S. dollars) on Friday’s closing of market, down nearly 9% from the previous week. There are 1,081 and 1,747 listed companies in the Shanghai and Shenzhen stock markets, where the price-earnings ratio were 14.54 and 41.38 respectively. China’s has the world’s second-most capitalized stock market behind the United States, after overtaking Japan a year ago. After a bearish week, the Shanghai and Shenzhen bourses were valued at 24.26 trillion yuan and 18.48 trillion yuan respectively by the close of market on Friday.

Amid global market turbulence accompanying lackluster domestic economic data, the benchmark Shanghai index lost 8.96% to end at 2,900.97 points, and the Shenzhen index shrank 8.18% to close at 9,997.92 points over the week. On Saturday, China’s securities watchdog vowed to learn a lesson from the stock market rout. “Wild market swings revealed our supervision and management loopholes,” said Xiao Gang, head of the China Securities Regulatory Commission, at a national conference on securities market regulation. “We will improve regulation mechanisms, intensify supervision and guard against risks so as to create a stable and sound market,” Xiao said.

Reconfirming what I’ve written on China earlier: “Coal miners do not become internet programmers overnight, or even delivery men.”

• The Ugly Subtext Beneath China’s Two-Track Economy Tale (FT)

This week the Chinese government will attempt to take back control of the narrative. The release of its 2015 economic growth estimate on January 19 provides an opportunity for Beijing to argue that a renewed outburst of stock market chaos and currency policy confusion over recent weeks was just surface noise, while the underlying economy remains sound. That China’s once vaunted economic managers suddenly find themselves in this position is a reminder of how dramatically they too can be wrong-footed by events, albeit ones that were under their control until a series of self-inflicted policy errors. Until China’s stock market bubble burst on June 15 — President Xi Jinping’s birthday of all days — the rest of the world was obsessed with the country’s downwards economic growth trajectory.

An ill-advised stock market rescue in July, followed by a poorly communicated currency policy adjustment in August, gave the world a bigger issue to worry about — the competence of China’s leadership, or lack thereof. In this context, the second and third quarter gross domestic product estimates, in line with the government’s 7% growth target, were reassuring. Chinese officials now freely admit that the country’s growth story is a tale of two economies. There is the bad old industrial economy — credit-fuelled and investment-led, resulting in chronic overcapacity and unsold apartment blocks. And there is the good new services economy — innovative and consumption-driven. Their key point is that the rise of the latter will balance the decline of the former, as has been the case this year.

As a result, they argue, the overall economy will hum along at a “sustainable” rate of about 6.5% over the next five years. This spells trouble for the African, Australian, Russian and South American commodity producers who have grown fat off Chinese demand over the past 20 years. But it should benefit European and US service providers, market access permitting, as well as Japanese and South Korean gadget makers. If only it were that simple. There are at least two known unknowns that could disrupt China’s smooth glide path. The first is what happens to rust-belt regions that have plenty of the old economy but not much of the new. “It will be very difficult for those who work in the old economy to transition into the new economy,” says Chen Long, China economist at Gavekal Dragonomics.

“Coal miners do not become internet programmers overnight, or even delivery men.” The second is a potential debt crisis of historic proportions, stemming in part from the government’s fears about the consequences for coal country if they were to turn off the credit taps. In 2007, on the eve of the global financial crisis, China’s overall debt to GDP ratio was 147%. Now it is at 231% and climbing. “They absolutely have no room left for further debt accumulation,” says Rodney Jones at Wigram Capital, an economic advisory firm. “That’s the central issue — not the exchange rate, not the stock market. These are symptoms. The problem is unsustainable growth and continued rapid accumulation of debt, leverage and credit.”

“China is expected to release fourth-quarter GDP, industrial production and retail sales data Tuesday morning.”

• Buckle Your Seatbelts: China Could Rock Markets Next Week (CNBC)

Global markets are poised for more volatility next week with key economic data from China expected to show that the world’s second-largest economy continues to grow at its slowest pace since the financial crisis, despite aggressive measures taken by the central bank to boost growth. “There has been ongoing fear bubbling since August that the China slowdown is worse than expected. Investors are nervous that we’ll see a massive downside correction in China’s economy. That’s why this data is so important to markets,” said James Rossiter at TD Securities. China is expected to release fourth-quarter GDP, industrial production and retail sales data Tuesday morning. Wasif Latif at USAA Investments agrees.

“These data reports next week could be very important in their power to either confirm or refute the current narrative that China is experiencing a very bad slowdown,” said Latif. The kick-off to 2016 has been challenging to say the least for China which continues to show signs of weakness, particularly on the manufacturing and services front. This downbeat data has pushed investors to alter their global forecasts, readjust earnings expectations and talk about what life with a slowing China means for trading stocks bonds and commodities this year. Markets around the world have been under pressure due in part to China worries. The Shanghai Composite is already down 18% this year and down over 40% from its June 2014 high.

Barclays strategists wrote that China remains a key source of turmoil as it affects currencies, commodities and financial volatility. Analysts also point to Beijing’s unpredictable nature in addressing the country’s economic woes and market structure. For instance in the last week, China reversed a new rule on circuit breakers that had brought stocks to a complete halt after just minutes of trading. Questions remain over whether the central bank of China will respond to weak data through its currency, or if the government will intervene in new ways if stocks continue to fall on the domestic markets.

Li Keqiang decided to give us the good news a few days early. Curious.

• China’s Economy Grew By Around 7% In 2015, Premier Li Says (Reuters)

China’s economy grew by around 7% in 2015, with the services sector accounting for half of GDP, Premier Li Keqiang said on Saturday. The premier also said that employment had expanded more than expected and that consumption contributed nearly 60% of economic growth. Li made theremarks at the opening ceremony for the China-backed Asian Infrastructure Investment Bank (AIIB) in Beijing. China’s fourth-quarter and full-year 2015 GDP figures are expected to be released on Jan. 19. Analysts polled by Reuters have forecast 2015 growth cooled to 6.9%, down from 7.3% in 2014 and the slowest pace in a quarter of a century. China does not intend to use a cheaper yuan as a way to boost exports and has the tools to keep the currency stable, the premier said, state news agency Xinhua had reported earlier Saturday.

“China has no intention of stimulating exports via competitive devaluation of currencies,” the premier said at the meeting in Beijing, which marks China’s previously announced official entry into the bank. Li added that China is capable of keeping the yuan’s exchange rate basically stable at an appropriate and balanced level, Xinhua reported. After a nearly 3% devaluation in mid August 2015 which rattled markets, China’s yuan has fallen over 1% so far in 2016, as the nation has struggled to contain capital outflows in the wake of a dramatic equity market collapse and weak economic data. Despite recent declines, China has the world’s largest foreign exchange reserves, and policymakers have repeatedly said they have the firepower to keep the yuan stable.

From January 11.

• The Fantasy And The Reality Of China’s Economic Rebalancing (CNBC)

China’s economic expansion may be far less than official estimates of 6.8% and could be closer to 2.4%, according to a new report. The GDP growth of the world’s second-largest economy has slowed steadily since 2010, although levels remain far higher than those achieved by most developed and many developing economies. Last month, China’s central bank forecast that GDP would slow to 6.8% in 2016 from an estimated in 6.9% in 2015. However, Fathom, a macro research consultancy based in London, claimed in a report that China’s economy is only expanding at 2.4% per annum.

“We have long questioned the legitimacy of China’s official GDP statistics. Pointing to only a mild growth deceleration, we find these impossible to reconcile with a whole host of alternative evidence, not least our own measure of China’s economic activity which suggests that growth could be as low as 2.4%,” Fathom said in the report published Friday entitled “The fantasy and the reality of China’s economic rebalancing.” This year, global markets remain alert to any hints that China’s economic slowdown might be accelerating. Major U.S. stock indexes lost around 6% or more last week, as these fears helped fuel a rout in global stocks. International analysts and economists have long suspected that Chinese official GDP figures were inflated. Not many have suggested that annual growth could actually be as low as 2.4%, however. The IMF, for instance, estimates that China’s economy grew by 6.8% in 2015 and forecasts it will expand by 6.3% in 2016.

“While there is evidence that the old growth engine, powered by manufacturing, investment and exports, has started to stutter, we find far fewer indicators that point to a pickup in consumption. This is contrary to China’s official GDP breakdown, which suggests that activity in the tertiary sector is not only the largest as a share of nominal GDP but also the fastest growing, with annual growth outpacing that of both primary and secondary industries,” Fathom said. The official GDP data reported by Chinese regional government is particularly questionable. In December, China official news agency, Xinhua, reported that economic levels in parts of China’s northeastern rust belt were overstated. One county in Liaoning province posted extra fiscal revenue of 847 million yuan ($129 million) in 2013, 127% higher than the real figure, according to media reports.

“The slumping stock market, fleeing liquidity, speedy deleveraging activities, augmented by self-defeating redemption at mutual funds and selloffs in futures, spiraled into a full-scale crisis like a domino effect..”

• China Stocks Watchdog Acknowledges Flaws in Equities Regulation (BBG)

The Chinese equities watchdog has acknowledged loopholes and ineptitude within its regulatory system after a review of the turmoil that’s shaken markets since last June. An immature bourse and participants, incomplete trading rules, an inadequate market system and an inappropriate regulatory system were to blame and regulators will learn from their mistakes, Xiao Gang, chairman of China Securities Regulatory Commission, said in a transcript of an internal meeting of the regulator that was posted on the agency’s website on Saturday. Chinese shares fell into a bear market again on Friday, wiping out gains from an unprecedented state rescue amid waning confidence in the government’s ability to manage the country’s financial markets.

The initial collapse in June, which came after cheerleading by state media helped fuel an unprecedented boom in mainland equities, triggered stock purchases by the government, restrictions on trading and a temporary ban on initial public offerings. Xiao was criticized for helping to talk up the market as the bubble developed. “The slumping stock market, fleeing liquidity, speedy deleveraging activities, augmented by self-defeating redemption at mutual funds and selloffs in futures, spiraled into a full-scale crisis like a domino effect,” Xiao said in the transcript. “During the abnormal volatility in the stock market, some institutions let illegal and irregular activities ride instead of taking responsibility to stabilize the market.”

It’s been a wild ride for Chinese stock investors. The Shanghai Composite Index more than doubled in the 12 months through May before losing 34% by the end of September as regulators failed to manage a surge in leveraged bets by individual investors. A state-sponsored market rescue campaign sparked a rally toward the end of the year but those gains have been wiped out this month. “The stock market developed so fast that the regulations failed to catch up,” said Ronald Wan, chief executive of Partners Capital International Ltd., an investment bank in Hong Kong. “Only when the laws and regulations improve, can the market develop in a healthy way. That cannot be done in one or two months.”

Losses this year were fueled by a controversial circuit-breaker system, which authorities scrapped in the first week of January after finding that it spurred investors to rush for the exits on big down days. The turbulence in China has rippled through global markets this year, contributing to a 8.5% drop in the MSCI All-Country World Index. The CSRC will try to learn from its overseas counterparts but will avoid wholesale adoption of another nation’s regulatory system, said Xiao. IPO reforms will be gradual and the registration system for offerings won’t be settled in one step, he said. China plans to shift to a registration-based system for IPOs, loosening the grip of the CSRC, which has controlled the timing and pricing of listings.

Peanuts.

• China-Led AIIB Development Bank Aims to Swiftly Approve Loans (AP)

The head of the newly opened Asia Infrastructure Investment Bank said the China-led group is aiming to approve its first loans before the end of the year, part of Beijing’s efforts to weave together regional trade partners and solidify its global status. The AIIB officially opened at a ceremony on Saturday in Beijing, formalizing the emergence of a competitor to the Washington-led World Bank and strengthening China’s influence over global development and finance. AIIB’s inaugural president, the Chinese banker Jin Liqun, said Sunday that Asia still faces “severe connectivity gaps and significant infrastructure bottlenecks.” The bank would welcome the US and Japan, two economic powers that have declined invitations to join the organization, said Jin, who was previously a high-ranking official at both the World Bank and Japan-led Asian Development Bank.

Washington has said it welcomes the additional financing for development but had expressed concern looser lending standards might undercut efforts by existing institutions to promote environmental and other safeguards. Chinese officials have said the bank will complement existing institutions and promised to adhere to international lending standards. Chinese President Xi Jinping has outlined a broad plan called “One Belt One Road” to deepen trade relations with neighboring countries and open new markets, with the AIIB a key component of that strategy. Leaders in the world’s No. 2 economy have long felt they don’t have proportional influence inside international financial institutions dominated by Western powers. China pledged to put up most of the bank’s $50 billion in capital and says the total will eventually be as high as $100 billion. Xi on Saturday unveiled an additional $50 million fund for infrastructure projects in less-developed countries.

Fed sees recession.

• Dallas Fed Quietly Suspends Energy Mark-To-Market On Loss Contagion Fears (ZH)

We can now make it official, because moments ago we got confirmation from a second source who reports that according to an energy analyst who had recently met Houston funds to give his 1H16e update, one of his clients indicated that his firm was invited to a lunch attended by the Dallas Fed, which had previously instructed lenders to open up their entire loan books for Fed oversight; the Fed was shocked by with it had found in the non-public facing records. The lunch was also confirmed by employees at a reputable Swiss investment bank operating in Houston. This is what took place: the Dallas Fed met with the banks a week ago and effectively suspended mark-to-market on energy debts and as a result no impairments are being written down.

Furthermore, as we reported earlier this week, the Fed indicated “under the table” that banks were to work with the energy companies on delivering without a markdown on worry that a backstop, or bail-in, was needed after reviewing loan losses which would exceed the current tier 1 capital tranches. In other words, the Fed has advised banks to cover up major energy-related losses. The reason for such unprecedented measures by the Dallas Fed? Our source notes that having run the numbers, it looks like at least 18% of some banks’ commercial loan book are impaired, and that’s based on just applying the 3Q marks for public debt to their syndicate sums.

In other words, the ridiculously low increase in loss provisions by the likes of Wells and JPM suggest two things: i) the real losses are vastly higher, and ii) it is the Fed’s involvement that is pressuring banks to not disclose the true state of their energy “books.” Naturally, once this becomes public, the Fed risks a stampeded out of energy exposure because for the Fed to intervene in such a dramatic fashion it suggests that the US energy industry is on the verge of a subprime-like blow up. Putting this all together, a source who wishes to remain anonymous, adds that equity has been levitating only because energy funds are confident the syndicates will remain in size to meet net working capital deficits. Which is a big gamble considering that as we firsst showed ten days ago, over the past several weeks banks have already quietly reduced their credit facility exposure to at least 25 deeply distressed (and soon to be even deeper distressed) names.

Bail-in or bail-out?

• Wall Street Braces for Bigger Shale Losses After Oil Drops Below $30 (BBG)

The Wall Street banks that financed the U.S. shale boom are facing growing losses as oil falls below $30 a barrel. Losses are spreading from bondholders to banks amid the worst oil crash in a generation. Wells Fargo, Citigroup and JPMorgan have set aside more than $2 billion combined to cover souring energy loans and will add to that safety net if prices remain low, the companies reported this week. Losses are mounting as more oil and natural gas producers default on debt payments and declare bankruptcy. Wells Fargo lost $118 million on its energy portfolio in the fourth quarter and Citigroup lost $75 million. “It takes time for losses to emerge, and at current levels we would expect to have higher oil and gas losses in 2016,” John Stumpf, Wells Fargo’s chairman and CEO, said during a Friday earnings call.

Oil plunged 36% in the past year, putting an end to the debt-fueled drilling spree that pushed U.S. oil production to the highest in more than 40 years. After years of spending more than they made, shale companies have parked drilling rigs and fired thousands of workers in an effort to conserve cash. In 2015, 42 oil and and gas producers went bust owing more than $17 billion, according to law firm Haynes & Boone. The weakness in oil and gas lending was a hot topic during bank earnings calls this week, and it’s clear that the potential for losses is snowballing the longer prices remain low. Wells Fargo’s energy reserves of $1.2 billion are enough to cover 7% of the $17 billion of the bank’s outstanding oil and gas loans.

JPMorgan Chase boosted energy loan-loss reserves by $550 million last year and said it will add another $750 million if oil stays at $30 for 18 months. Citigroup increased reserves by $250 million and that will go up by an additional $600 million in the first half of 2016 if oil prices remain at $30. If oil falls to $25, that number may double. Lenders are walking a tightrope between helping their clients stay afloat and looking out for their own bottom line. Borrowers with risky credit typically put up their oil and gas properties as collateral for their loan. Historically, lenders managed to get all of their money back, even in bankruptcy, by liquidating the assets. However, foreclosing on a troubled borrower comes with the risk that the properties will sell for less than is owed to the bank.

With no credibility left, Fed options are limited.

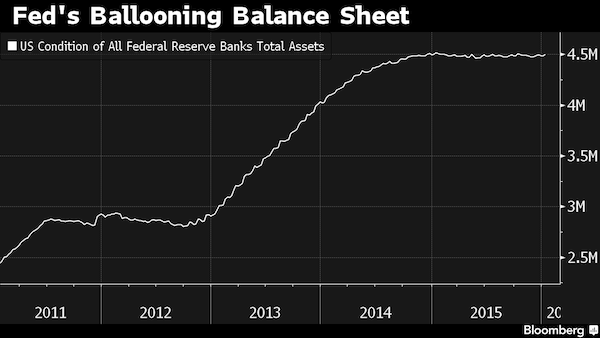

• With Liftoff Done, the Fed Revisits a $4.5 Trillion Quandary (BBG)

Federal Reserve officials who spent months debating their first interest-rate increase in almost a decade are turning next to the thorny question of what to do with a balance sheet equivalent to the size of Japan’s economy. A month after liftoff, turmoil in global financial markets has pushed out expectations for more rate hikes and raised concern about what tools are available to fight the next downturn. Vice Chairman Stanley Fischer has suggested the $4.5 trillion balance sheet could be maintained as a way to hold down longer-term Treasury yields while the short-term policy rate was lifted. Fischer’s idea – discussed in a Jan. 3 speech partly on strategies for pulling the short-term rate away from zero – was taken up in more practical terms by New York Fed President William C. Dudley Friday.

Reinvesting maturing bonds and putting off a reduction in the balance sheet until the federal funds rate is raised somewhat higher “makes sense,” Dudley said. “Having more ‘dry powder’ in the form of higher short-term interest rates seems more desirable than less dry powder and a smaller balance sheet,” he said. Fed Chair Janet Yellen made similar comments in her Dec. 16 press conference, meaning the three most senior officials still view the central bank’s vast holdings of debt as an active policy tool rather than a relic of the financial crisis that needs to be shrunk as soon as possible. “Dudley’s view is if we get to choose our tool” to tighten policy, “then we are going to choose interest rates,” said Michael Hanson, senior economist at Bank of America.

That’s the safer choice, Hanson said, because officials are highly uncertain what shrinking the balance sheet would do to financial markets. The preference to maintain trillions in bond holdings for months to come, however, isn’t likely to be popular with all Federal Open Market Committee participants. Richmond Fed President Jeffrey Lacker favors an “expeditious” unwinding of the Fed’s bond holdings. The Fed’s balance sheet swelled to $4.5 trillion in 2014 from about $900 billion in 2008 on purchases of Treasuries and mortgage-backed securities, during three stages of a strategy known as quantitative easing.

IPO looks silly.

• Saudi Aramco – $10 Trillion Mystery At The Heart Of The Gulf State (Guardian)

The possible selloff of at least part of Aramco, previously considered the country’s crown jewel, has stunned the global energy and investment sectors as much as locals. One Wall Street report claimed an American financial adviser was forced to stop his car because he was laughing so much from sheer incredulity when the Aramco float news broke. But plans for an initial public offering by what may be most secretive – but almost certainly the most valuable – company in the world have been confirmed by its chairman, Khalid al-Falih. “We are considering … a listing of the main company and obviously the main company will include upstream,” he said last week, thereby indicating that the flotation plan could give access to the country’s 260bn barrels of oil reserves and 263 trillion cubic feet of gas.

Among the more than 100 oil and gas fields controlled by Aramco – which began life as the California-Arabian Standard Oil Company in 1933 – are Ghawar, the world’s largest onshore oil location, plus Safaniya, the biggest offshore field in the world. The scale of the Aramco empire dwarfs every other corporation in the world. Its oil assets alone are 10 times more than those held by the world’s largest publicly quoted oil company, ExxonMobil. If the Texas-based business has a stock market value of $400bn, that would make Aramco’s oil assets potentially worth $4tn. Energy analysts admit they find it impossible to accurately calculate the exact worth of a company that boasts of producing 9.5m barrels of oil a day – one in every eight of the world’s production.

But some estimates go as high as $10tn. That is 10 times the combined value of Apple and Alphabet (the new parent company of Google). They know Aramco has huge oil and gas reserves, a raft of refineries and other business interests, but details are scant. The company does not publish its accounts or even its revenues, never mind its profits.

Panic should have started long ago.

• Market Meltdown Rattles Canadian Investors, Panic Sets In (BBG)

A record losing streak in the loonie, plunging bond yields and about $150 billion wiped out in the stock market have left Canadian investors hanging by a thread. Panic is starting to set in. “The word fear is finally starting to come up,” said Martin Pelletier, managing director and portfolio manager at TriVest Wealth Counsel in Calgary. “Clients and people are starting to panic. It’s sinking in, but no one knows what to do.” North American stock markets wrapped up one of their most turbulent weeks in recent memory Friday as oil prices and the dollar plunged further. The commodity-sensitive loonie plumbed depths not seen since 2003 as it fell for an 11th-straight day, losing 0.81 of a U.S. cent to close at 68.82 cents US.

The benchmark Standard & Poor’s/TSX Composite Index dropped 262.57, or 2.13%, to 12,073.46 — its lowest close since June 2013 — after rebounding more than 165 points on Thursday. Yields on five-year government bonds fell to a record low of 0.511% Wednesday as speculation builds the Bank of Canada will cut interest rates next week. Canada’s economy, heavily weighed toward resource industries, has been rocked by concerns about the slowdown in China that has pushed the price of West Texas Intermediate crude below $30 for the first time since 2003. Prices for Canada’s heavy crude, which trades at a discount to the U.S. benchmark, have sunk to around $15 a barrel.

The February contract for WTI crude fell $1.78 to US$29.42 on Friday, while February natural gas fell four cents to US$2.10 per mmBTU. “Right now … people are looking at oil and saying the price of oil is dropping, ergo the economic outlook doesn’t look good. I think it’s as simple as that,” said Ian Nakamoto, director of research at 3Macs. “If oil rallies like it did (Thursday), I think the markets rise here.” But Nakamoto isn’t betting we’ve seen the bottom for oil just yet. “One thing we do know is the supply is greater than demand, so structurally it looks likes prices still have further to go here on the downside.”

What independent central bank?

• German Lawmakers Urge Merkel To Tell Draghi: End Record-Low Rates (BBG)

Lawmakers allied with German Chancellor Angela Merkel say it’s time for the ECB to outline an exit strategy from record-low interest rates and she should tell Mario Draghi so. As Merkel hosted the ECB president for a private meeting in Berlin on Friday, German banks, her party bloc and Bundesbank head Jens Weidmann are pushing for Draghi to explain how he’ll get out of quantitative easing. Designed to counter “economic malaise” as Europe’s debt crisis recedes, the policy is seen by critics as hurting German savers and retail investors, who tend to prefer low-risk investments. “I trust that the chancellor will clearly address the concerns related to the ECB’s policy” when she hosts Draghi at the chancellery, said Alexander Radwan, a member of the German parliament’s finance committee and lawmaker from Merkel’s party bloc.

Merkel should help to ensure “that Europe recognizes the limits of central-bank policy,” he said. While ECB policy is out of Merkel’s hands, low borrowing costs for the 19 euro-area nations are adding to dissatisfaction among members of her party, whose loyalty is already strained by euro-area bailouts and a record influx of refugees to Germany. Draghi argues that the central bank’s €1.5 trillion bond-buying program is needed to try to revive inflation and he’s pledged to do more if prices don’t pick up. Merkel and Draghi held what Steffen Seibert, Merkel’s chief spokesman, described as an “informal and confidential” meeting. The chancellor’s office declined to comment on what they discussed.

That reticence hasn’t stopped Wolfgang Schaeuble, Merkel’s finance minister since 2009 and one of her key allies, from publicly prodding the ECB and portraying its policies as a threat to financial stability. Monetary policy has fueled a tendency toward “exaggeration in financial markets,” with liquidity spurring nervousness “that’s materializing in China now,” Schaeuble said in Brussels on Thursday. “I will not deny that the low interest rates are worrying us,” Antje Tillmann, the finance-policy spokeswoman of Merkel’s party bloc, said in an interview. Germany can manage the low-rate environment only in the short term “and I hope therefore that this will change. I believe Mr. Draghi knows that we’re waiting for this.” Weidmann warned on Tuesday in Paris that low rates over an extended period squeeze bank profits and risk fueling financial bubbles.

Help for refugees will have to come from the people, not government or business. That’s why our AE for Athens Fund works. No side issues.

• The Business Case For Helping Refugees (Gillian Tett)

Last year Hamdi Ulukaya, a Kurdish entrepreneur who created the billion-dollar US-based Chobani yoghurt empire, travelled to Greece to see the swelling refugee crisis with his own eyes. Unsurprisingly, he was horrified by the human suffering that he witnessed, particularly as he shares a cultural affinity with many of the refugees — he grew up near the Syrian border in Turkey, before moving to the US as a student. But Ulukaya was also appalled by something else: the hopelessly bureaucratic and old-fashioned nature of the organisations running the aid efforts. “The refugee issue is being dealt with using [methods from] the 1940s and it’s in the hands of the UN and mostly government and you don’t see a lot of private sector and entrepreneurs involved,” he told me last week.

“I decided we have got to hack this — we have got to bring another perspective into this issue, there are technologies that can be used.” So Ulukaya decided to act. Last year he established a foundation, Tent, to channel financial aid and innovation efforts into refugee work. He also declared that he would give half his fortune to refugee causes (he has made an eye-popping $1.4bn from his wildly popular Chobani yoghurts in recent years). And he has stepped up efforts to hire as many refugees as he can at his yoghurt plants, where they currently account for 30 per cent of the total workforce, or 600 people. “There are 11 or 12 languages spoken in our factories,” says Ulukaya. “We have translators 24 hours a day.”

Now, however, Ulukaya wants to take his campaign further. At next week’s World Economic Forum (WEF) meeting in Davos, he will call on other CEOs to join a campaign to channel corporate money, lobbying initiatives, services and jobs to refugees. Five companies have already signed up: Ikea, MasterCard, Airbnb, LinkedIn and UPS — and Ulukaya says more are poised to join. I daresay some FT readers will shrug their shoulders at this; indeed, as a journalist, part of me feels a little cynical. Over the past couple of years, there has been a string of philanthropy initiatives from American billionaires. And this year’s WEF meeting is likely to produce another wave of pious pledges, not least because many corporate elites will be arriving in Switzerland keenly aware that they need to do more to quell a popular backlash over income inequality.

But what makes Ulukaya’s move unusual — and admirable — is his unashamed embrace of the refugee cause. And that illustrates a bigger point: the voice of business has been extraordinarily muted, if not absent, from this wider policy debate. To be sure, some companies, such as American Express, Starbucks, Google and Uniqlo, have made donations to humanitarian groups involved in helping refugees. Others have offered practical services: Daimler, for example, has provided buildings and medical devices. Most companies, however, have avoided getting too embroiled in the issue, preferring to concentrate on less political causes such as medical aid. “With few exceptions, the business community has been absent from the debate about how to best deal with the refugee crisis, not only in the short term but, importantly, in the long term,” says Ioannis Ioannou, a professor at London Business School.

More talk of a ‘coalition of the willing’. More division in Europe.

• Schäuble Proposes Special EU Tax On Gasoline To Finance Refugee Costs (Reuters)

German Finance Minister Wolfgang Schaeuble has proposed the introduction of a special tax on gasoline in European Union member states to finance refugee-related costs such as strengthening the continent’s joint external borders. Schaeuble’s proposal drew criticism from members of his own conservative party, the Christian Democratic Union (CDU), as well as from the Social Democrats (SPD), junior partner in Chancellor Angela Merkel’s ruling coalition. “I’ve said if the funds in the national budgets and the European budget are not sufficient, then let us agree for instance on collecting a levy on every liter of gasoline at a specific amount,” Schaeuble told Sueddeutsche Zeitung newspaper in an interview published on Saturday.

“We have to secure Schengen’s external borders now. The solution of these problems must not founder due to a limitation of funds,” the veteran politician said. Asked if all EU countries should increase their payments to Brussels to finance joint refugee-related costs, Schaeuble said: “If someone is not willing to pay, I’m nonetheless prepared to do it. Then we’ll build a coalition of the willing.” Schaeuble gave no details on how high the extra levy on gasoline should be and whether Brussels or the EU member states would be in charge of collecting it. Schaeuble’s was met with criticism across the party political spectrum. “I’m strictly against any tax increase in light of the good budgetary situation,” said CDU deputy Julia Kloeckner who wants to win a regional election in the western state of Rhineland-Palatinate in March.

When describing dead bodies they know nothing about, AP chooses to go with “most likely migrants”. Whereas, obviously, they’re at least as likely to be refugees. They know it, we know it, but the bias is too strong to overcome. Plus, it’s like saying all refugees are migrants. And if you repeat it often enough… Does any of you people ever think about the lack of respect for the dead you promote?

• Five Bodies Wash Up On Shore Of Samos (AP)

Five people, most likely migrants, have been found dead off the eastern Greek island of Samos, Greek authorities report. The Greek coast guard has recovered the bodies of two men and three women, and are trying to recover the sixth in rough seas, a coast guard spokeswoman told AP. No vessel has been recovered yet. The rescue operation continues, said the spokeswoman, who was not authorized to be identified because of the continuing operation. Samos, which lies very close to the Turkish coast, is one of the main points of entry for migrants, most refugees from Syria and Iraq.