August Strindberg Alpine Landscape I 1894

Creative accounting is subject to inherent limits.

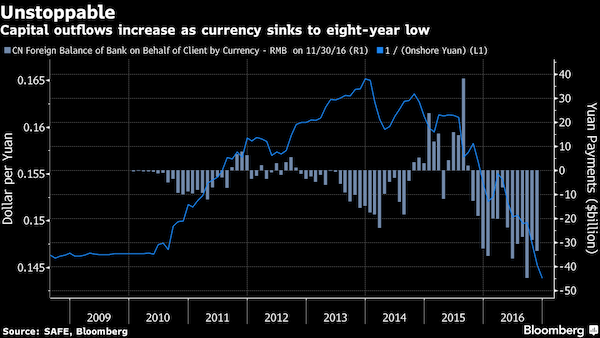

• Multiple Contraction : Stock Market Warning Siren is Blaring (WS)

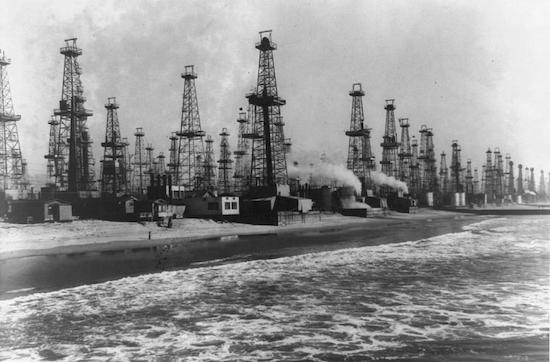

“Adjusted” earnings growth is 10.2% year-over-year in the second quarter, according to FactSet, based on the 91% of the companies in the S&P 500 that have reported results. The energy sector was a key driver, with 332% “adjusted” earnings growth from the oil-bust levels of a year ago. The sectors with double-digit earnings growth: information technology (14.7%), utilities (10.8%), and financials (10.3%). The rest were single digit. Earnings in the consumer discretionary sector declined. Revenues grew 5.1%, also led by the energy sector. At the beginning of Q2 last year, the WTI grade of crude oil traded at $35 a barrel. In Q2 this year, WTI ranged from $42 to $53 a barrel.

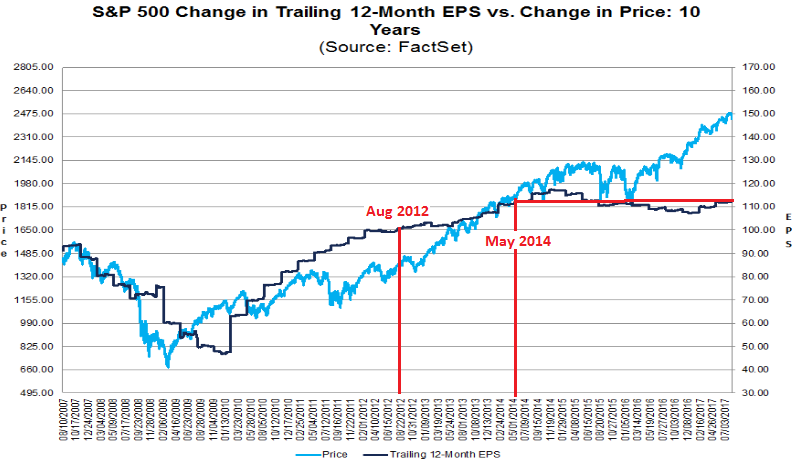

So the Wall-Street hype machine is cranking at maximum RPM to propagate the great news that earnings are soaring, and that this is the reason why stocks should also be soaring, and forget everything else. The hype machine carefully avoids showing the bigger picture which is dismal for earnings and ludicrous for stock valuations. Aggregate earnings per share (EPS) for the S&P 500 companies on a trailing 12-months basis rose for the second quarter in a row. That’s the foundation of the Wall Street hype. But here’s the thing with these EPS: they’re now back where they had been in… May 2014. Yep. More than three years of earnings stagnation. No growth whatsoever, even for “adjusted” earnings. In fact, on a trailing 12-month basis, aggregate EPS of the S&P 500 companies are down about 5% from their peak in Q4 2014.

And yet, over the same three-plus years of total earnings stagnation, the S&P 500 index has soared 34%. This chart shows those “adjusted” earnings per share for the S&P 500 companies (black line) and the S&P 500 index (blue line). I marked August 2012 as the point five years ago, and May 2014. And these are not earnings under the Generally Accepted Accounting Principles (GAAP). FactSet uses “adjusted” earnings for its analyses. These are the earnings with the bad stuff “adjusted” out of them by management to manipulate earnings into the most favorable light. Not all companies report “adjusted” earnings. Some only report GAAP earnings and live with the consequences. But others put adjusted earnings into the foreground, and that’s what Wall Street dishes up.

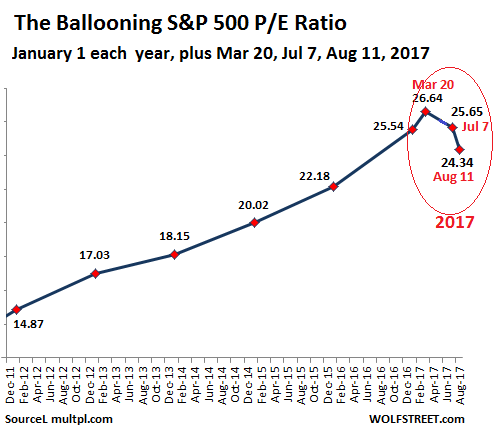

[..] This is the peculiar situation of today: On average, these companies have stagnating earnings per share propped up by “adjusting” these earnings and by financial engineering. The price-earnings multiple (P/E ratio) for stagnating companies should be low. In January 2012, the P/E ratio for the companies in the S&P 500 index was 14.9. And that was high. As of Friday, the aggregate P/E ratio is 24.3:

Brussels keeps Europe from recovering. A continent of zombies.

• Is The Euro Crisis Really Over? (Lacalle)

This week we have read that Brussels has certified “the end of the crisis”. In an uncomfortably triumphant statement, the group welcomed the fact that Europe had emerged from the crisis and returned to growth “thanks to the decisive action of the European Union”. Really? Thanks to the “decisive action” of the European Union the “economy is back in shape”? It is true that the communique says that “much remains to be done to overcome the legacy of the crisis years”, but if we can say something about the European crisis is that the “decisive” action of the European Union has not helped to end the crisis, but has perpetuated and silenced it. The European economy is not “in shape”.

According to the Bank of International Settlements and Merrill Lynch, Europe has more zombie companies today than before the crisis, 9% of large listed non-financial corporations are considered walking dead, ie generating operating profits that do not cover their financial costs, in spite of all-time low-interest rates and an unprecedented monetary stimulus. And that is among the big companies, where the business results of the Eurostoxx remain below 2008. If we go to SMEs, the European Union has higher rates of bankruptcies and losses than in 2008, yet the tax burden on companies has increased. In fact, if anything can be said of the European business fabric is that it has been devastated by taxes.

The European Union has continued to hamper the high-productivity sectors to support the so-called national champions and zombies, that large amount of low-value added conglomerates, ridden by high debt and poor margins. While the United States saw the astronomical takeoff of technology giants and corporate profits growing at double digit rates, the EU decided to put obstacles to growth, and today, in the Eurostoxx 100, we have the same collection of dinosaurs that we had a decade ago. European banks, at the end of 2016, had more than €1 trillion in non-performing loans, a figure that represents 5.1% of total loans compared to 1.5% in the US or Japan. Europe has gone from financial crisis to financial crisis, and recently we have had new episodes in Italy, Spain and Portugal.

Theory: Xi will not put up a real fight if he’s not certain he can win (Deng Xiao Ping’s stance on US).

• US Is The Real Trade Protectionist – China State Media (CNBC)

Trump is expected to issue the so-called Section 301 investigation under the 1974 Trade Act later on Monday to investigate Chinese trade practices that force U.S. firms operating in China to turn over intellectual property, multiple outlets reported. China will retaliate in such a case, said the Communist Party-linked Global Times, which is known for its nationalist slant. “The Trump administration should have second thoughts about putting pressure on China on trade and avoid a full-blown trade war,” said the newspaper, adding that the Beijing “should make use of the WTO mechanism to sue the U.S. for trade protectionism.” “The trade policies of the Trump administration have been widely criticized. Although filing a lawsuit with the WTO is time-consuming, it is highly likely that China would win,” it said.

The latest news about a U.S. probe into Chinese trade practices could lead to steep tariffs and comes as Trump is pressing for China’s cooperation in reining in North Korea’s nuclear program. “The U.S. now is walking softly and carrying a huge stick in regards to what it wants. Here, this is tactically nothing more than ‘We need your support with North Korea,’ part and parcel, that’s it. The symbolism of this is just politics and game play,” Frank Troise, managing director at SoHo Capital, told CNBC’s “The Rundown.” China has repeatedly said the two issues were not related, with the Global Times calling the link “illogical” in its Sunday night editorial. Commentaries in state media normally provide insight into government thinking beyond typically thin official statements.

Neil Howe is an interesting voice, and that’s only partly because Steve Bannon likes his work.

• Fourth Turning: “It’s Going To Be A Rollercoaster Ride” (ZH)

[..] .. although 9/11 changed America’s attitude towards the rest of the world, I think that the stock market boom and celebrity circus that’s here in the United States really hadn’t changed very much. And I don’t think you really had a shift, a fundamental shift, in America’s perception of themselves as a people, as their own country, to a fundamental degree until 2008. Also, 2001, as we explained to many people at the time, was simply too early. Every turning starts when each generation is beginning to move into a new phase of life. Back in 2001 boomers were not yet retiring, millennials were still—maybe the first one of them was barely graduating from high school.

So, this was not what we expected. 2008 really did coincide with the generational maturity of the turning, so to speak. And I think that, in terms of the basic shift in our efficacy of the social system, I think 2008 was a bigger change.” The crisis also ushered in an era where central banks exhibit total control of markets, which has created an “artificial quality,” Howe said. “The economic emergency that occurred in 2008-2009 really catapulted us into by far the biggest economic emergency we’ve been in since the early 1930s. And, arguably, we are still living out the consequences of that with complete change in central bank policy, monetary policy, with sustaining these record low interest rates and arguable very high valuations in financial markets—almost anything pushed by that—and people still wondering how we’re going to get out from under that.

The constant discussion is when are central banks going to pull back on their balance sheets and actually go back to the old normal? So, I think there is the sense, even in this the booming markets that we see today, that there is this artificial quality: people think that there’s something wrong about this. We have not re-righted where we were. We are not letting price discovery and actual markets function the way they did before then. So, I do believe that 2008 was the beginning of a whole new regime. And I also believe that the political dysfunction, the sense of political dysfunction—created during the two turns of the Obama presidency and, obviously, also into the Trump presidency—of government completely grinding to a halt is going to have some very powerful repercussions in the years shortly to come.”

Anarchy in the UK.

• Conspiracy or Chaos? (Jim Quinn)

Alan Moore, the renowned graphic novel writer, and author of the dystopian classic V for Vendetta, politically identifies as an anarchist. His view that all political states are an outgrowth of anarchy, with the biggest gang taking control and dictating how things will be run, is manifested in V for Vendetta. As an anarchist, you can understand why he is doubtful of conspiracy theories and an all-powerful entity controlling the world. He believes in a chaotic world competing gangs position themselves to gain power and control.

“We live in a badly developed anarchist situation in which the biggest gang has taken over and have declared that it is not an anarchist situation – that it is a capitalist or a communist situation. But I tend to think that anarchy is the most natural form of politics for a human being to actually practice.”- Alan Moore

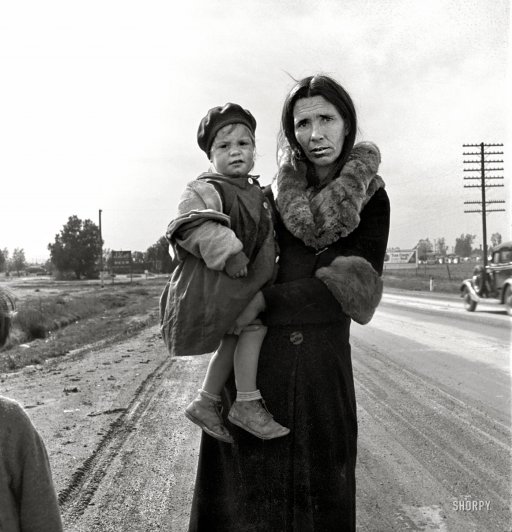

The Guy Fawkes mask from V for Vendetta has been adopted by anarchist groups around the world, including: Anonymous, WikiLeaks, and the Occupy protestors. Moore’s positive view of the Occupy movement was based on his belief ordinary people had the right to reclaim what had been taken from them by criminal bankers. The initial impetus for the Occupy protests was the destruction of Main Street USA by Wall Street sociopaths, who not only escaped prosecution for their crimes, but were bailed out by the taxpayers they had pillaged and further enriched as captured politicians enabled them to get even bigger. Millions were evicted from their homes and lost their jobs. Middle class families have seen their real income continue to stagnate, while bankers, corporate executives, and politicians have reaped billions in bonuses, stock gains, and payoffs, provided by central bankers in their back pocket.

“I can’t think of any reason why as a population we should be expected to stand by and see a gross reduction in the living standards of ourselves and our kids, possibly for generations, when the people who have got us into this have been rewarded for it – they’ve certainly not been punished in any way because they’re too big to fail. I think that the Occupy movement is, in one sense, the public saying that they should be the ones to decide who’s too big to fail. As an anarchist, I believe that power should be given to the people whose lives this is actually affecting.” – Alan Moore

Basic argument: technological growth beats economic growth. But why argue this using social housing and libraries?

• Forget GDP – There’s More To Britain’s Wealth Than Its Bank Balance (Baggini)

How is this possible? Because “a lot of improvements in standard of living come not through what we normally consider as growth, but through technological improvements”. This is a concrete example of real growth without what is normally understood by economic growth. If we can grasp this, we can see why the argument about whether indefinite growth is environmentally sustainable is bogus. Orthodox economics says that it is essential if the world’s worst-off are to escape their poverty. Critics argue for zero or even negative growth, claiming that this is the only way to ensure we don’t deplete the planet’s resources. Both are wrong. Real wealth is created not just by exploiting more resources and increasing society’s cash pot but by exploiting the same or fewer resources better.

The whole question of GDP growth is a red herring if we are interested in real wealth. What matters is that we do more with the resources we have. Building a better future depends on seeing this clearly. Take the need to reduce inequality, which many now accept is urgent. To do this it is assumed we need to reduce the income gap between rich and poor. But real equality is increased simply by making it possible for the less well-off to do more with the money they have. Social housing was, and could again be, an example of that. Take two people, one of whom earns £30k a year and the other £15k. To close the real wealth gap between the two does not necessarily require increasing the income of the latter. Providing them with a decent council flat at low rent effectively allows their disposable income to equalise.

The basic principle here is that what matters most is giving people the resources they need to live better, which doesn’t necessarily require giving them more cash. This has in effect been the principle behind all sorts of socially levelling initiatives. Local authorities didn’t give local people free books, they gave them the use of libraries. They didn’t give them cars, they gave them bus passes. We need to relearn the wisdom of these policies, and update them for the modern age. In an era where car ownership is not rare, what about low-cost car clubs? Why shouldn’t more people be able to borrow laptops and tablets from libraries as well as books and DVDs?

“Half of all antibiotics globally are now consumed in China alone.”

• Factory Farming, Antibiotics Use In Asia Creating Global Health Risks (G.)

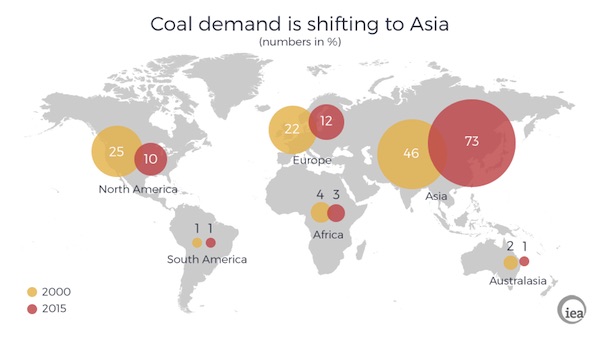

The use of antibiotics in factory farms in Asia is set to more than double in just over a decade, with potentially damaging effects on antibiotic resistance around the world. Factory farming of poultry in Asia is also increasing the threat of bird flu spreading beyond the region, with more deadly strains taking hold, according to a new report from a network of financial investors. Use of antibiotics in poultry and pig farms will increase by more than 120% in Asiaby 2030, based on current trends. Half of all antibiotics globally are now consumed in China alone. The Chinese meat and animal feed producers New Hope Group and Wen’s Group are now among the 10 biggest animal feed manufacturers in the world. The growth of Asian meat production in intensive units is also producing a rise in greenhouse gas emissions from the food chain, with emissions likely to rise by more than 360m tonnes, the equivalent of running 100 coal-fired power plants for a year.

There are knock-on impacts such as deforestation, as China’s need for animal feed is responsible for more than a third of Brazil’s soybean production. The report, Factory Farming in Asia: Assessing Investment Risks, comes three years after a meat scandal in China, in which suppliers to McDonalds, KFC and others were found to be using dirty meat and products past their sell-by date. It also comes in the midst of a growing food scandal in Europe, which has required the recall of millions of eggs tainted with harmful chemicals, and as concerns have been aired over the impact of Brexit on imports of farm products to the UK. Asian food companies have rapidly expanded their meat production in response to growing populations and the tastes of the rising middle class, but this expansion has come to the detriment of food safety.

They’re being shot at. And the Italian Foreign Minister calls that “a welcome readjustment” and a “positive process”.

• More NGOs Follow MSF In Suspending Mediterranean Migrant Rescues (R.)

Two more aid groups have suspended migrant rescues in the Mediterranean, joining Doctors Without Borders, because they felt threatened by the Libyan coastguard. Save the Children and Germany’s Sea Eye said on Sunday their crews could no longer work safely because of the hostile stance of the Libyan authorities. Doctors Without Borders – or Medecins sans Frontieres – cited the same concern when it said on Saturday it would halt Mediterranean operations. “We leave a deadly gap in the Mediterranean,” Sea Eye’s founder Michael Busch Heuer warned on Facebook, adding that Libya had issued an “explicit threat” against non-government organisations operating in the area around its coast. Libyan coastguard boats have repeatedly clashed with NGO vessels on the edge of Libyan waters, sometimes opening fire.

The coastguard has defended such actions, saying the shooting was to assert control over rescue operations. “In general, we do not reject (NGO) presence, but we demand from them more cooperation with the state of Libya … they should show more respect to the Libyan sovereignty,” coastguard spokesman Ayoub Qassem told Reuters on Sunday. Tension has also been growing for weeks between aid groups and the Italian government, which has suggested some NGOs are facilitating people smuggling, while Italy is trying to enhance the role of the Libyan coastguard in blocking migrant departures. This month, Italy began a naval mission in Libyan waters to provide technical and operational support to its coastguard, despite opposition from factions in eastern Libya that oppose the U.N.-backed government based in Tripoli.

[..] Italian Foreign Minister Angelino Alfano said in a newspaper interview on Sunday that Libya’s growing role in controlling its waters was curbing people trafficking and producing a welcome “readjustment” in the Mediterranean. MSF’s decision to halt its rescue operations was part of this positive process, he told the newspaper La Stampa.

There’s propaganda and then there’s reality. You decide who you believe.

• Syrian Refugees Can Return To Aleppo… And Do So In Their 100,000s (RT)

Aleppo, a city retaken by Damascus from rebels in December last year, has become a major destination for displaced Syrian returning home in 2017 as numbers of returnees to Syria spills over 600,000, according to the UN. Over the first seven months of 2017, over 600,000 displaced Syrians returned home, the International Organization for Migration (IOM) said Friday, citing its own figures as well as those of the UN Migration Agency and partners on the ground. The returnees are overwhelmingly internally-displaced people, but 16% returned to Syria from other nations, primarily Turkey. The number almost matched that recorded in the whole of 2016. An estimated 67% of returnees went to government-controlled Aleppo Governorate, with the provincial capital itself being the primary destination.

Among other places where refugees went in significant numbers, according to ICO, is Al-Hasakah Governorate, the north-eastern province dominated by Kurds. The city of Aleppo – the largest in Syria prior to the conflict – was retaken by the government army last year, aided by Russia, with hostilities ending in mid-December. For years before that, it was divided between two parts, held respectively by government forces and by a disjointed collection of militant groups, including hardcore jihadists. The battle for the city ended with a ceasefire deal, which allowed remaining rebel forces and their families leave Aleppo and go to Idlib governorate, which currently remains a rebel stronghold.

Earlier an increasing number of refugees returning to their homes in Syria was reported by the UN Refugee Agency (UNHCR), which said more than 440,000 internally-displaced persons and 31,000 refugees in other countries had done so over the first six months of 2016. Aleppo and other government-controlled governorates like Hama, Homs and Damascus were mentioned as destinations for the returnees. [..] The situation is far from rosy of course, according to IOM. The number of people forced to leave their homes in 2017 still outweighs that of returnees, with over 808,000 people estimated to be displaced. Around 10% of those who returned in 2016 and 2017 have ended up fleeing their homes again. Almost 20% of the returnees have no secure supply of food and access to water and health services is a problem for some 60%, a testament to the damage the Syrian war has taken on its civilian infrastructure.

Love it. Absolute must read, the whole article. Very rich.

• Do Elephants Have Souls? (NA)

The birth of an elephant is a spectacular occasion. Grandmothers, aunts, sisters, and cousins crowd around the new arrival and its dazed mother, trumpeting and stamping and waving their trunks to welcome the floppy baby who has so recently arrived from out of the void, bursting through the border of existence to take its place in an unbroken line stretching back to the dawn of life. After almost two years in the womb and a few minutes to stretch its legs, the calf can begin to stumble around. But its trunk, an evolutionarily unique inheritance of up to 150,000 muscles with the dexterity to pick up a pin and the strength to uproot a tree, will be a mystery to it at first, with little apparent use except to sometimes suck upon like human babies do their thumbs.

Over time, with practice and guidance, it will find the potential in this appendage flailing off its face to breathe, drink, caress, thwack, probe, lift, haul, wrap, spray, sense, blast, stroke, smell, nudge, collect, bathe, toot, wave, and perform countless other functions that a person would rely on a combination of eyes, nose, hands, and strong machinery to do. Once the calf is weaned from its mother’s milk at five or whenever its next sibling is born, it will spend up to 16 hours a day eating 5% of its entire weight in leaves, grass, brush, bark, and basically any other kind of vegetation. It will only process about 40% of the nutrients in this food, however; the waste it leaves behind helps fertilize plant growth and provide accessible nutrition on the ground to smaller animals, thus making the elephant a keystone species in its habitat. From 250 pounds at birth, it will continue to grow throughout its life, to up to 7 tons for a male of the largest species or 4 tons for a female.

Of the many types of elephants and mammoths that used to roam the earth, one born today will belong to one of three surviving species: Elephas maximus in Asia, Loxodonta africana (savanna elephant) or Loxodonta cyclotis (forest elephant) in Africa. There are about 500,000 African elephants alive now (about a third of them the more reticent, less studied L. cyclotis), and only 40,000 – 50,000 Asian elephants remaining. The Swedish Elephant Encyclopedia database currently lists just under 5,000 (most of them E. maximus) living in captivity worldwide, in half as many locations — meaning that the average number of elephants per holding is less than two; many of them live without a single companion of their kind.

For the freeborn, if it is a cow, the “allomothers” who welcomed her into the world will be with her for life — a matriarchal clan led by the oldest and biggest. She in turn will be an enthusiastic caretaker and playmate to her younger cousins and siblings. When she is twelve or fourteen, she will go into heat (“estrus”) for the first time, a bewildering occurrence during which her mother will stand by and show her what to do and which male to accept. If she conceives, she will have a calf twenty-two months later, crucially aided in birthing and raising it by the more experienced older ladies. She may have another every four to five years into her fifties or sixties, but not all will survive.