NPC Minker Motor Co, 14th Street NW, Washington, DC 1922

“The reason why this is a war is that it is ultimately a zero-sum game – someone gains only because someone else will lose.”

• Currency Devaluations Are an Undeclared War (Bloomberg)

The global currency war is threatening to prove a silent killer. So says David Woo, head of global rates and currencies research at Bank of America Merrill Lynch in New York. While some question the existence of any conflict – arguing that falling exchange rates merely reflect efforts by central banks to spur lackluster domestic economies – Woo expresses concern. “There is a growing consensus in the market that an unspoken currency war has broken out,” he said in a report to clients this week. “The reason why this is a war is that it is ultimately a zero-sum game – someone gains only because someone else will lose.” The standard view on war-mongering is that by easing monetary policy, central banks from Asia to Europe are hoping to weaken their currencies to boost exports and import prices.

Trade rivals then retaliate, creating a spiral of devaluations as witnessed in the 1930s. Just this week, Reserve Bank of Australia Governor Glenn Stevens said “a lower exchange rate is likely to be needed” after he unexpectedly cut interest rates to a record low. With more than a dozen central banks injecting extra stimulus so far this year, currencies will be discussed when finance ministers and central bankers from the Group of 20 meet next week in Istanbul. For much of the past two years the G-20 has formally committed to refrain from targeting “exchange rates for competitive purposes.” That leaves Woo, a former IMF economist, declaring the war is one of “stealth” and warning the fallout from it is already roiling financial markets in a way undetected by most.

By measuring the volatility of currencies, which he calculates as the difference between the maximum and minimum exchange rate over a 26-week period, Woo estimates the dollar has been swinging about 20% against both the yen and the euro. In the past 15 years it was only higher following the collapse of Lehman Brothers in 2008. A second gauge of volatility that weighs currencies based on the gross domestic product of 20 major economies delivers the third-highest reading in two decades, topped only by the Asian crisis of 1997-98 and Lehman’s demise, he said.

“.. the Costa Rican central bank has just announced that they will be floating the Colon. Those of a squeamish disposition should certainly not try googling “floating colon”..”

• The PBOC – How To Fail In Business Without Really Flying (Russell Napier)

“Terrain seems a bit unstable…and there seems to be no sign of intelegent life anywhere” – Buzz Lightyear (Toy Story) “That wasn’t flying…that was falling with style” – Woody (Toy Story)

Another day, another central bank failure. In a world of currencies backed only by confidence, every failure is masqueraded as success. Like the ballet dancer who transforms the stumble into a pirouette, central bankers, knocked to the ground by market forces, smile and pretend that this was all part of the routine. Financial market participants, having bet everything on the promised omnipotence of central bankers, do indeed seem happy to see genius in every stumble. However a fall is a fall regardless of the style of the descent. So when will investors see that the earth is rapidly approaching and that style is just style? The key for investors today is to see behind the masquerade and the mask, the façade of those putting up a front behind a public face, and be able to tell the difference between the soaring flight of reflation and the perilous fall of deflation.

The more attitude you hear from policy makers, the more you can be sure it’s style compensating for the lack of real substance and that this is falling and not flying. And as the attitude becomes more high-handed, the lower the altitude gets. The attitude quotient is rising rapidly. Two weeks ago we noted the ‘flying’ undertaken by the Swiss National Bank as the market forced them to abandon their exchange-rate target. Deposit rates in Swiss Banks are now at such a low level that investors are better off converting deposits into bank notes and placing them under the bed. The Danish Central Bank has also instituted negative interest rates with the consequence that deposits in Denmark might also fly into paper. As the central bank managed to create over DKK106bn (US$16.3bn) in bank reserves, trying to stop a revaluation of their exchange rate last month, there will be no shortage of banknotes to go round should a ‘bank run’ from deposits to banknotes begin.

Taking interest rates so negative that they threaten a run on bank deposits should not be seen as success – it is failure. Creating bank reserves at that pace should not be seen as success – it is failure. The next failure may well be some government-inspired restriction on capital inflows. Well, you could call such restrictions, and risking the liquidity of banks, monetary success if you like, but then you probably also think it’s a success to throw the ball one yard from the touchline. Last week the Monetary Authority of Singapore was apparently “flying”, definitely not falling, when it cut interest rates and tried to devalue the SGD to defeat deflation. The Central Bank of Russia reduced interest rates while defending its exchange rate and, guess what, the currency fell. Most people, of course, would recognize that as simply falling, but as it was Russia you do have to ask did it just fall, or was it pushed ?

You may even have missed the news, that the Costa Rican central bank has just announced that they will be floating the Colon. Those of a squeamish disposition should certainly not try googling “floating colon” but, just take their word for it, the Colon will float. Elsewhere there were examples of more conventional falling, disguised as controlled flying, in the form of cuts in interest rates from Australia, Canada, Egypt, India, Pakistan, Peru and Turkey. The Turkish President has the perfect style for this sport and declared that interest rates had to fall as they were the cause and not the cure for inflation. As our hero himself remarked, ‘Buzz Lightyear to star command, I have an AWOL space ranger.’

“The decline of fiscal revenue is the top risk in China and will lead to a sharp slowdown in GDP’..’

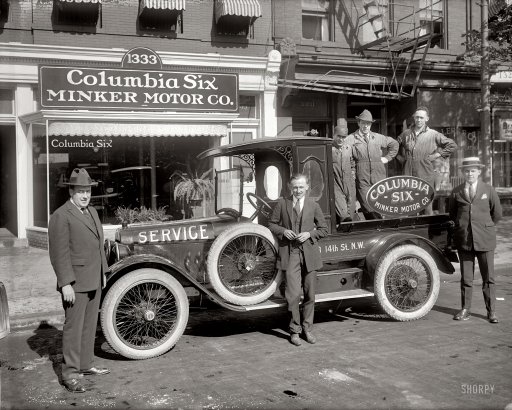

• The Diverging Fates of China’s Provinces (Bloomberg)

From the biting-cold northeast bordering Siberia to the humid southwest next to Thailand, China’s growth rates are diverging almost as much as its geography. While the world’s second-largest economy slowed to a 7.4% expansion last year – just squeaking into the communist government’s “about 7.5%” target range – regional data presents a fractured landscape more akin to Europe’s than the rising-tide-floats-all-boats numbers we’re used to from China. There’s still a Germany: the wealthier export-focused and high-end manufacturing coastal region spanning Jiangsu, Zhejiang and Fujian. All were within about half a percentage point of their 2014 growth goals. The emerging provinces of Chongqing and Guizhou – later developers than their coastal cousins – look OK, too.

Let’s mark them down as China’s Poland, with lower labor and land costs attracting factories and helping exports. Both posted plus-10-percent expansions last year. The population-heavy Hunan, Hubei and Henan — with a combined 219 million people – almost matched their growth targets, with investment sustaining these massive economies. They’re way too populous to fit our European analogy, though. There’s even an Iceland-like outperformer: Tibet. The vast, mountainous region – which is about 12 times the size of tiny Iceland – was the only one of China’s 31 provinces and municipalities to match its 2014 target, racing ahead at 12%. Government-led infrastructure investment is behind its boom. Then we come to the sick men. While an expansion of about 5% would be stellar by European standards, in China that’s a slump.

The coal-dependent northern province of Shanxi missed its expansion target by a full 4 percentage points last year. Three other heavy industry and commodities driven north-eastern provinces – Heilongjiang, Jilin, Liaoning – all lagged with expansions near 6%, below targets of 8 or 9%. While policymakers in Beijing don’t have to contend with Grexit-like threats, there are headaches ahead. “Given the sluggish economic growth and fiscal pressure from dropping land sales, local governments have become much less ambitious than before,” Deutsche Bank AG’s chief China economist Zhang Zhiwei wrote in a Jan. 30 note. “The decline of fiscal revenue is the top risk in China and will lead to a sharp slowdown in GDP” to 6.8% this quarter. Like Europe, the slowdown may prompt more monetary easing after this week’s reduction in banks’ reserve ratio requirements.

No good US jobs report without hidden secrets.

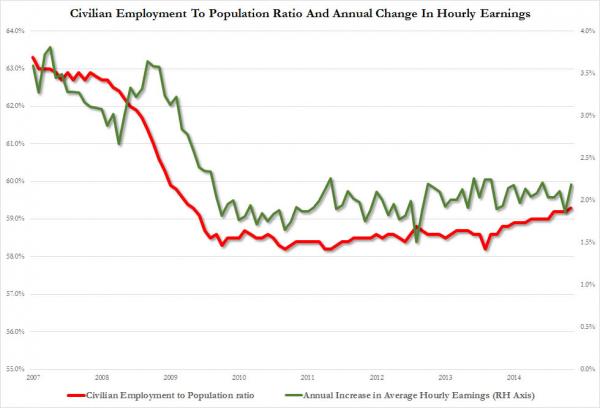

• Goldman Raises Alarm Over The Scariest Chart In The Jobs Report (Zero Hedge)

Following the January jobs report, Goldman’s chief economist Jan Hatzius appeared on CNBC but instead of joining Steve Liesman in singing the praises of the “strong” the report (which apparently missed the memo about the crude collapse), he decided to do something totally different and instead emphasize the two series that none other than Zero Hedge has been emphasizing for years as the clearest indication of what is really happening with the US labor market: namely the recession-level civilian employment to population ratio and the paltry annual increase in average hourly earnings. This is what Hatzius said:

“The employment to population ratio is still 4% below where it was in 2006. You can explain 2% of that with the aging of the population that still leaves quite a lot of room potentially, and the wage numbers are telling us we are just not that close, although we are getting closer.”

Closer to what? Why the most dreaded event for any FDIC-backed hedge fund in the world: the Fed not only ending some $3 trillion of liquidity injections but actively starting to remove liquidity by tightening monetary conditions and rising rates. Hatzius’ punchline: “I think the case for “patience” is still quite strong.” In other words, the US may be creating almost 300K jobs per month, but stocks are still not high enough. So how should one look at today’s BLS report: well, for political purposes the data is great – just look at those whopping revisions; but when it comes to the markets, please focus on the the unadjusted, ugly details beneath the headlines. Those which we have been showing for months and months.

Because there always has to be something that prevent the Fed from hiking, and killing Chuck Prince’s proverbial music, in the process ending Wall Street’s 6-year-old “dance” ever since the 666 S&P lows. At this rate soon Goldman Sachs will become a bigger “skeptical realist” than Zero Hedge. Finally, which chart is Hatzius talking about? The one below, showing the uncanny correlation between the US civilian employment to population ratio and the annual rate of increases in hourly earnings, and the fact that neither is capable of actually increasing under the “NIRP Normal” recovery.

And that’s how simple it is.

• Stop Squeezing Syriza. We Can’t Afford Another Wrong Turn In Europe (Guardian)

With Syriza having won Greece’s election on a platform to reject the Troika-imposed bailout, the eurozone has reached yet another fork in the road. Let us hope it does not take the wrong turn, again. Squeezing Syriza and humiliating Greece further, as appears to be the strategy in Germany and other powers in the EU, could be the straw that breaks the eurozone’s back. Cutting Greece any slack is opposed by a majority of Germans, even while support for Alexis Tsipras in Greece soared after his election as he fought for concessions on debt. Political space in the eurozone has shrunk to a point where it may no longer be possible to implement sensible economic policy. Which wrong turns did we take? How can we choose wisely this time?

At the outbreak of the crisis, EU leaders insisted on national solutions to what was essentially a European problem: the fragility of large often pan-European banks. This increased the final bill, as countries refused to bite the bullet and delayed recognising that their banks were bust. Even as leaders came under domestic fire for rescuing banks with taxpayer money, Greece’s fiscal problems provided a godsend distraction. Many northern Europeans promoted a narrative of “lazy Greeks” who had been “fiscally profligate”. While the unsustainability of Greek debt was recognised by many, intensive lobbying by German and French banks which owned large amounts of Greek bonds meant that the much-needed restructuring of this debt was vetoed. An ill-designed programme was imposed as condition of financial aid to Greece.

This was essentially a bailout of European banks at the expense of Greek citizens and European taxpayers. Even worse, the narrative of “lazy southerners” and a “fiscal crisis” promoted by Germany and EU institutions crowded out the reality of an untreated banking crisis. Ireland, having foolishly guaranteed its insolvent banks, was then forbidden from imposing losses on bank bondholders by the ECB. Private debt became public and the banking crisis became a fiscal one. Even though the failure to repair and restructure banks was the biggest problem in countries such as Spain, many were treated as though they had been fiscally irresponsible and prescribed austerity.

As bank uncertainty and fiscal cuts were biting and driving the eurozone into a deep recession, the narrative of a “fiscal crisis” became self-fulfilling as debt-to-GDP ratios climbed because of both bank rescues and collapsing GDPs. The problem was compounded by Angela Merkel and Nicolas Sarkozy threatening to push Greece out of the eurozone, which in turn made markets question the viability of the single currency and fuelled panic, driving Spanish and Italian spreads up to record levels. Thus the downward spiral of a badly misdiagnosed and deliberately miscommunicated problem, and a tragically ill-conceived treatment began. Bailing out the supposedly lazy southerners has stoked anti-EU sentiment in creditor economies like Germany, who want to see more, not less austerity in debtor economies. Suffering under Troika-imposed excessive austerity has fuelled the rise of anti-austerity parties such as Syriza and Podémos.

“The ECB bought Greek public debt from private banks for a fortune [..] private banks had found the cash to buy Greece’s public debt exactly from…the ECB. This is outright theft. ”

• Troika Trojan Horse: Will Syriza Capitulate In Greece? (Pepe Escobar)

The 2015 Greek tragedy is a sorry (financial) remix of the Trojan War. But now the troika (ECB, EC, IMF) has replaced Greece, and Greece is the new Troy. It is now crystal clear the ECB will pull no punches to turn Greece into a European failed state. The rationale: others – from Spain to even, in the near future, France – must not entertain funny ideas. Toe the austerity line, or we’ll get medieval on you. It was so predictable that the destiny of Athens – and in fact the euro – would ultimately rest in the hands of ECB Governor Mario ‘Master of the Universe’ Draghi, purveyor of the latest QE which in thesis will grant an austerity-ravaged Europe a little extra time to pursue ‘reforms’.

Some background is essential. The troika sold Greece an economic racket, but it’s the Greek people that are paying the price. Essentially, Greece’s public debt went from private to public hands when the ECB and the IMF ‘rescued’ private (German, French, Spanish) banks. The debt, of course, ballooned. The troika intervened, not to save Greece, but to save private banking. The ECB bought public debt from private banks for a fortune, because the ECB could not buy public debt directly from the Greek state. The icing on this layer cake is that private banks had found the cash to buy Greece’s public debt exactly from…the ECB, profiting from ultra-friendly interest rates. This is outright theft. And it’s the thieves that have been setting the rules of the game all along.

“The next showdown is scheduled for Feb. 11 in Brussels..”

• Greece Seeks Plan C After Eurogroup Rules Out Bridge Loan (Bloomberg)

Euro-area governments won’t grant Greece’s request for a short-term financing agreement to keep the country afloat while it renegotiates the terms of its financial support, said Jeroen Dijsselbloem, chairman of the bloc’s finance ministers’ group. “We don’t do” bridge loans, Dijsselbloem told reporters in The Hague on Friday, when asked about Greece’s request. “A simple extension is possible as long as they fully take over the program.” The European Union’s latest rebuff raises the stakes for Greece’s new government, which has already failed in its demands for a debt writedown. The next showdown is scheduled for Feb. 11 in Brussels, when Greek Finance Minister Yanis Varoufakis faces his 18 euro-area counterparts in an emergency meeting after Prime Minister Alexis Tsipras delivers a major policy speech on Sunday.

“After an aggressive start, which resulted in a reality check for the new government, I think they are becoming more pragmatic,” said Aristides Hatzis, an associate professor of law and economics at the University of Athens. “No matter what they say to their internal audience, what they do abroad matters most.” Varoufakis has said his government won’t accept any more cash under the terms of Greece’s existing bailout, leaving €7 billion euros of potential aid on the table, rather than complying with demands for more austerity attached to the country’s international bailout agreement.

“Practically speaking, our proposal is that there should be a bridging program between now and the end of May, which would give us space – all of us – to carry out these deliberations and in a short space of time come to an agreement” Varoufakis said after meeting German Finance Minister Wolfgang Schaeuble in Berlin on Feb. 5. The standoff risks leaving Europe’s most-indebted state without any funding as of the end of this month, following the Jan. 25 election victory of Tsipras’s Syriza party. “It will be a first step in how we want to proceed together in the next weeks, months,” Dijsselbloem said, as he cautioned that a discussion over the terms of the bailout program would mean “we no longer talk about a simple extension.”

Why does even the Guardian choose to speak of ‘Greece’s radical Syriza government’?

• Syriza Vows To Fight Pressure To Stick To Bailout Terms (Guardian)

Greece’s radical Syriza government has vowed to keep fighting pressure from its eurozone neighbours to stick to the strict terms of its bailout package as battle lines were drawn ahead of crunch debt talks next week. Eurozone finance ministers have called an emergency meeting for Wednesday night in Brussels to discuss the Greek crisis after a whistlestop tour of Europe by Yanis Varoufakis, Greece’s finance minister, made little headway. Germany wants Greece to arrive with a plan on the repayment of €240bn (£180bn) in bailout loans it received from the international community.

The special debt meeting will be followed on Friday by a summit of European leaders, the first with Alexis Tsipras, the Greek prime minister. But a government official ruled out accepting a plan based on the old bailout and said Varoufakis would ask for a bridge agreement to tide Athens over until it can present a new debt and reform programme. “We will not accept any deal which is not related to a new programme,” an official told Reuters news agency.

“It is … necessary that Greece is given the possibility to issue T-bills, beyond the (current) €15 billion threshold, in order to cover any extra needs..”

• Greece: We Want No More Bailout With Strings (Reuters)

Greece’s new leftist-led government, isolated in the euro zone and under pressure from the European Central Bank, said on Friday it wanted no more bailout money with strings attached from the EU and IMF. Instead, a government official said, it wanted authority from the euro zone to issue more short-term debt, and to receive profits that the European Central Bank and other central banks have gained from holding Greek bonds. The official said Greece was in effect asking for a “bridge agreement” to keep state finances running until Athens can present a new debt and reform program, “not a new bailout, with terms, inspection visits, etc.”.

“It is … necessary that Greece is given the possibility to issue T-bills, beyond the (current) €15 billion threshold, in order to cover any extra needs,” said the official, asking not be named. Finance Minister Yanis Varoufakis returned empty-handed from a tour of European capitals in which even left-leaning governments in France and Italy insisted Greece must stick to commitments made to the European Union and IMF and rejected any debt write-off. The Athens official made clear that the new government, which came to power on a wave of anti-austerity anger in elections last month, now wanted to forego remaining bailout money that had austerity strings attached: “Greece is not asking for the remaining tranches of the current bailout program – except the €1.9 billion that the ECB and the EU member states’ central banks must return.”

Euro zone finance ministers will discuss how to proceed with financial support for Athens at a special session next Wednesday ahead of the first summit of EU leaders with the new Greek prime minister, Alexis Tsipras, the following day. However, the chairman of the finance ministers said the following meeting of the Eurogroup on Feb. 16 would be Greece’s last chance to apply for a bailout extension because some euro zone countries would need to consult their parliaments. “Time will become very short if they (Greece) don’t ask for an extension (by then),” said Jeroen Dijsselbloem. The current bailout for Greece expires on Feb 28. Without it the country will not get financing or debt relief from its lenders and has little hope of financing itself in the markets.

Surprisingly positive piece from Der Spiegel, which just last week was very pro-Merkel. “..his left-wing government is already busy getting down to work. Many of its first moves have been the right ones.”

• Defiance and Charm: A Measured First Week for New Greek Leader (Spiegel)

Syriza’s victory in the recent Greek elections set off a wave of concern in Europe. But even as the new prime minister tries to woo other leaders, his left-wing government is already busy getting down to work. Many of its first moves have been the right ones. [..] Something has happened in Greece that has not happened like this anywhere else in Europe: A handful of neophyte politicians, intellectuals and university professors have taken over the government. It feels like a small revolution instead of a handover of duties. And that’s not only because many members of the previous administration deleted their hard drives and took their documents with them, or that there initially wasn’t even any soap in the government headquarters.

No, the new government has upended the rules of the Greek political system – and spurred into action a Europe that is still unsure how it should react to the rebels. In Athens you can also see the euphoria reflected in the city’s traffic, which is a yardstick for the crisis. The streets had often been half empty, because fewer people were traveling to work, the gasoline was expensive, the mood gloomy. But now the city center is just as clogged as before. The people are once again in motion. Even though only 36% of voters chose Syriza, 60% of Greeks are happy with new government’s first few days. If there were new elections, support for the party could grow and Tsipras could renounce his coalition partner. Although he may be entertaining that scenario privately, members of the government deny that it is in the cards. But to maintain this enthusiasm, Tsipras now needs to show a real accomplishment: an end of the German “austerity mandate.” Which means that he doesn’t merely need to convince the Greeks, he needs to conquer Europe.

“So either Tsipras turns 180 degrees or the euro area’s post-crisis, anti-contagion defenses will get their stiffest test.”

• It’s Merkel Legacy Moment (Bloomberg)

It’s a legacy moment for Angela Merkel. How the German chancellor navigates the two-front crisis emanating from Moscow and Athens could determine whether she rises to her role as Europe’s dominant leader or slips into history as a risk-averse manager who couldn’t hold the region together. “The immediacy and urgency of taming the dual Greek and Ukraine nightmares are defining moments for Europe and for Merkel,” said Bud Collier, professor at the John F. Kennedy Institute of Berlin’s Free University. “The stakes are enormous.” An abundance of caution is the complaint she’s faced from the moment Greece spawned the euro financial crisis – forcing needy nations to take their medicine and suffer for budgetary sins in the name of becoming more competitive. In return, she slowly brought her reluctant electorate along and pried open her government’s checkbook.

Now the Greeks are as fed up as the Germans. They elected Alexis Tsipras as prime minister on the promise the days of pension, wage and job cuts were over. They’re also trying to get under Merkel’s skin. Standing in Germany’s finance ministry, the stone behemoth that was Herman Goering’s headquarters in Adolf Hitler’s regime, Greek Finance Minister Yanis Varoufakis touched the most sensitive spot in Germany’s collective consciousness: “Germany must and can be proud that Nazism has been eradicated here, but it’s one of history’s most cruel ironies that Nazism is rearing its ugly head in Greece, a country which put up such a fine struggle against it.” Remarks like that may explain Merkel’s exasperation with the new leaders in Athens and why she’s waiting for them to come around to see things her way. If they don’t, neither she nor her allies have expressed much interest in a middle ground.

So either Tsipras turns 180 degrees or the euro area’s post-crisis, anti-contagion defenses will get their stiffest test. The next signals are likely at the EU’s Feb. 12 summit. Also on the agenda at that gathering is what to do about Putin. As with Tsipras, she’s not optimistic. Unlike with Greece, though, Merkel has few cards to play. She’s stuck between the U.S. and Russia, herding the EU’s 28 governments and is largely the point person because of geography. She has stopped seeing Putin as a rational actor, according to German government officials, but is the closest to an interlocutor that she has. As she arrives for talks in Moscow with French President Francois Hollande and the fighting intensifies, the united anti-Putin front is at risk amid dwindling options: tougher sanctions that many EU leaders are resisting, arming the government in Kiev or yielding to the breakup of Ukraine.

“About 117,000 home-mortgage accounts are in arrears, according to central bank figures, and the Free Legal Advice Centres group said last month that a “substantial spike” in repossessions may be on the way.”

• Irish Fighting Bankers Show It’s Not Just Greeks Protesting Debt (Bloomberg)

Byron Jenkins says he would rather destroy his home than hand it over to the banks. The former builder owes about €750,000 euros on his house in a Co. Kildare town about 40 miles west of Dublin. After 15 court appearances, he’s still fending off repossession. “All they’ll get back is a pile of bricks,” Jenkins said. “I’ve told them that.” Banks lodged 10,000 applications to foreclose on family homes in the year through September, a legal rights group said last month, four times as many as in the previous year. The legacy of western Europe’s worst real estate crash is entering a new phase, bringing with it a very Irish version of the backlash against the establishment sweeping Europe.

As Greeks turned to Alexis Tsipras to reverse five years of austerity, and anti-immigrant parties gain ground in countries like France and Sweden, in Ireland, homeowners are increasingly organizing resistance. Jenkins is part of a group of activists allied to the Land League, named after a 19th century organization that battled with landlords when Ireland was ruled from London. In the 21st century, the fight is against bankers. “We have been creating mayhem, if by mayhem you mean keeping people in their homes,” said Jerry Beades, a developer who has spent almost a decade in disputes with banks and financial regulators and is now leading the League. “We are reflecting the anger that’s out there about the level of debt that just can’t be serviced.” About 117,000 home-mortgage accounts are in arrears, according to central bank figures, and the Free Legal Advice Centres group said last month that a “substantial spike” in repossessions may be on the way.

“Aberdeen has been the focus of a classic oil boom..”

• The Biggest Loss for Scotland Since Independence Fail (Bloomberg)

In Aberdeen, a city built out of granite on Scotland’s North Sea coast, a diamond merchant checks the price of oil every day. Until recently, the dealer, Oscar Ozdaslar, had been accustomed to North Sea oil workers stopping in to buy 3,500-pound ($5,260) diamond rings and earrings in his store on Union Street. “This Christmas was very quiet compared to the Christmas before,” said Ozdaslar, 50. “The oil guys didn’t come in.” Just six months ago, Aberdeen was the economic linchpin of Scotland’s campaign to split from the U.K. as oil traded above $100 a barrel. In the wake of the independence referendum’s failure, it serves as a microcosm of how crude’s slump to nearer $50 is hurting cities from Calgary to Kuala Lumpur.

“Aberdeen has been the focus of a classic oil boom,” said Gordon Hughes, a professor of economics in the University of Edinburgh. “There’s no doubt that the city will go through a bad period now that it’s over.” What’s more, the North Sea basin is among the most expensive in the world from which to extract oil. About 20% of U.K. production is “uneconomic” at $50 a barrel, trade group Oil & Gas U.K. says. After rallying this week, brent for March settlement traded at $57.72 a barrel on the ICE Futures Europe exchange on Friday. BP CEO Bob Dudley said this week it feels like the 1980s when he was living in Aberdeen working as an artificial lift engineer for Amoco before it merged with BP. Prices fell about 70% in a few months after Saudi Arabia increased production and didn’t recover until 1990. Regions worldwide that depend on the industry are having an “enormous shock,” he said.

“We’ll actually be experiencing production increases over the next two years, notwithstanding low oil prices.”

• Oil Production Increases Ahead: Alberta Premier (CNBC)

The steep drop in oil prices will lead to some slowdown of economic activity in Alberta, Canada, and the deferral of large capital investments in its oil sands, but Alberta Premier Jim Prentice told CNBC Friday its economy is resilient and will weather the rout. “This will be a difficult time. We’re assuming this will carry on for next 18 months or so and that we’ll be in a low-price environment,” he said in an interview. “We expect there will be some falloff in conventional drilling activity, shale drilling activity as well, clearly, but at the end of the day our economy is resilient.” Canadian rig count is down 13 rigs from last week, to 381, according to Baker Hughes. It is down 240 rigs from last year. However, oil production is going to increase. “We’ll actually be experiencing production increases over the next two years, notwithstanding low oil prices.”

Most of the oil in the region comes from oil sands, which produce about 1.9 million barrels of oil a day. In fact, Alberta’s oil sands are the third-largest crude oil reserve in the world. The province has proven oil reserves of 170 billion barrels. Prentice expects to see economic to slow down in cities like Calgary, but said Alberta has a strong public balance sheet and strong companies. About 121,500 citizens are directly employed in Alberta’s mining, oil, and gas extraction sectors. “I think there will be some consolidation to strength as we work our way through this. And certainly there will be implications and we’re concerned about that and we’re planning for that,” he said. That said, while he’s seen a deferral of large capital investments on new increments of oil sands investments and a reduction in capital expenditure in traditional oil and gas activity, Prentice sees a light at the end of the tunnel. “This will be part of a cycle, and we’ll eventually see the other side of this.”

“..the final mission of any truly modern government must be to redirect the inventory of savings for the benefit of the rich (while, of course, claiming it is acting for the poor).”

• A Modest Proposal To Save The World (Charles Gave)

As such, it seems that the ultimate aim of policy must be to transfer the nation’s entire wealth to an ever smaller number of rich people, most of who work in finance. Perhaps this is as it should be, since as already noted, money and only money can create value. Hence, the final mission of any truly modern government must be to redirect the inventory of savings for the benefit of the rich (while, of course, claiming it is acting for the poor). Interestingly, Europe’s socialists and the Democrats in the US have the ideal political cover to carry out this important exercise. And this, of course, brings us to Greece and my own big solution.

The lack of final demand in that benighted country shows that Alexis Tsipras must manage an economy suffering from not enough government spending. In response, Athens should issue unlimited sums of perpetual zero coupon bonds, which will be bought by the ECB. Next, the Italian, French and Spanish governments should follow suit. The proceeds can be transferred to local government districts in order for civil servants to be hired in earnest. The effect would be to greatly boost the local GDP, by the amount of the salaries paid to the civil servants, while the debt-to-GDP ratio will fall accordingly. The Bundesbank will be happy. Of course, the simple minded (non-economist fellows) might wonder who will buy this paper.

The answer is simple: the authorities must slap a 100% reserve requirement on all products held by insurance companies, banks and pension funds, and ‘hey presto!’ bond issues will be oversubscribed. Of course, if the choice is between a zero coupon perpetual bond and shares in the stock market, I have no doubt that the Dow will be at 100,000 in no time. At the same time, since the only competition for the perpetual zeros will be cash, the use of bank notes will need to be outlawed. Some smart fellows have already started working on this highly progressive idea. The only thing that I do not understand is why it has not yet been adopted. It must be the fault of incompetent politicians, advised by poorly trained economists. There is no other explanation.

Again: the resistance to TTIP is not nearly strong enough.

• The TTIP US-EU Trade Deal -A Briefing (Guardian)

What’s the story? It’s been called the most contested acronym in Europe, a putative free-trade deal between the world’s two richest trading powers that will either unleash untold prosperity or economic and cultural ruin, depending on your point of view. The Transatlantic Trade and Investment Partnership (TTIP) is an ugly mouthful, and not just in name. The aim is not just to reduce tariffs between the EU and US but to remove regulatory barriers and standardise rules so that companies can access each other’s market more easily. It has the potential to be the biggest trade deal ever concluded. But there are formidable pitfalls and obstacles along the way. Europeans hope the talks, which embark on an eighth round this week after almost two years of deliberation, will result in access to financial services in the US.

Washington is resisting. The Americans are eyeing up the food markets that serve the EU’s 500 million mouths. Europeans are concerned this will bring lower US food standards to a continent that prizes its Italian hams and French champagnes. Above all, public scepticism to the trade accord is spreading across Europe, where growing numbers are suspicious of their political leadership and disenchanted by two decades of globalisation. The treaty has been in the works for 12 years, and came about as it became apparent that bigger global trade deals would be hard to achieve. Negotiations started in 2013 and involve at least 100 participants. [..]

The biggest problem with TTIP is that the most significant gains are to be made from an area that the public is queasiest about: deregulation. Negotiators know that just removing tariffs is the easy bit – and not worth nearly as much as reforming, reducing and/or harmonising the differing regulations that govern business and industry in the US. But one person’s regulation is another’s protection, and opponents of TTIP argue that it could threaten consumer protection, social rights, health, the environment and data protection. Some even fret that it could open the door to privatisation by allowing, for example, US health companies to run parts of Britain’s publicly owned National Health Service.

The Europeans have already secured the exclusion of audio-visual services to protect the French film industry, a neuralgic issue for leaders in Paris. The question is: will the long list of other exceptions that already include GM food and hormone-fed beef dilute the deal to make it less worthwhile? An even bigger stumbling block is another clunky acronym, ISDS (Investor State Dispute Settlement), which would allow businesses to sue governments for action that would hurt future profits. Supporters of the bill have argued that ISDS plays an essential role in ensuring smooth transatlantic negotiations. Critics fret that it would bypass national laws and subjugate the interest of governments to those of big business.

Fun with sketchy ‘science’.

• Pentagon 2008 Study Claims Putin Has Asperger’s Syndrome (USA Today)

A study from a Pentagon think tank theorizes that Russian President Vladimir Putin has Asperger’s syndrome, “an autistic disorder which affects all of his decisions,” according to the 2008 report obtained by USA TODAY. Putin’s “neurological development was significantly interrupted in infancy,” wrote Brenda Connors, an expert in movement pattern analysis at the U.S. Naval War College in Newport, R.I. Studies of his movement, Connors wrote, reveal “that the Russian President carries a neurological abnormality.” The 2008 study was one of many by Connors and her colleagues, who are contractors for the Office of Net Assessment (ONA), an internal Pentagon think tank that helps devise long-term military strategy.

The 2008 report and a 2011 study were provided to USA TODAY as part of a Freedom of Information Act request. Researchers can’t prove their theory about Putin and Asperger’s, the report said, because they were not able to perform a brain scan on the Russian president. The report cites work by autism specialists as backing their findings. It is not known whether the research has been acted on by Pentagon or administration officials. The 2008 report cites Dr. Stephen Porges, who is now a University of North Carolina psychiatry professor, as concluding that “Putin carries a form of autism.” However, Porges said Wednesday he had never seen the finished report and “would back off saying he has Asperger’s.”

Instead, Porges said, his analysis was that U.S. officials needed to find quieter settings in which to deal with Putin, whose behavior and facial expressions reveal someone who is defensive in large social settings. Although these features are observed in Asperger’s, they are also observed in individuals who have difficulties staying calm in social settings and have low thresholds to be reactive. “If you need to do things with him, you don’t want to be in a big state affair but more of one-on-one situation someplace somewhere quiet,” he said.

And what do they meet, of course? Denial.

• US Navy Sailors Search for Justice after Fukushima Mission (Spiegel)

On March 11, 2011, the American aircraft carrier USS Ronald Reagan received orders to change course and head for the east coast of Japan, which had just been devastated by a tsunami. The Ronald Reagan had been on its way to South Korea when the order reached it and Captain Thom Burke, who was in charge of the ship along with its crew of 4,500 men and women, duly redirected his vessel. The Americans reached the Japanese coastline on March 12, just north of Sendai and remained in the region for several weeks. The mission was named Tomodachi. The word tomodachi means “friends.” In hindsight, the choice seems like a delicate one. Three-and-a-half years later, Master Chief Petty Officer Leticia Morales is sitting in a café in a rundown department store north of Seattle and trying to remember the name of the doctor who removed her thyroid gland 10 months ago.

Her partner Tiffany is sitting next to her fishing pills out of a large box and pushing them over to Morales. “It was something like Erikson,” Morales says. “Or maybe his first name was Eric, or Rick. Oh, I don’t know. Too many doctors.” In the last year-and-a-half, she has seen oncologists, radiologists, cardiologists, blood specialists, kidney specialists, gastrointestinal specialists, lymph node experts and metabolic specialists. “I’m now spending half the month in doctors’ offices,” she says. “This year, I’ve had more than 20 MRTs. I’ve simply lost track.” She swallows one of the pills, takes a sip of water and smiles wryly. It was the endocrinologist who asked her if she had been on the Ronald Reagan. During Tomodachi? Yes, Morales told her. Why?

The doctor answered that he had removed six thyroid glands in recent months from sailors who had been on that ship, Morales relates. Only then did Morales make the connection between the worst accident in the history of civilian atomic power and her own fate. The Fukushima catastrophe changed the world. Nuclear reactors melted down on live television and twice as much radioactive material was released as during the Chernobyl accident in 1986. The disaster drove 150,000 people from their towns and villages, poisoned entire landscapes for centuries and killed hundreds of thousands of farm animals. It also led countries around the world to rethink their usage of nuclear energy. Fukushima is more than just a place-name, it is an historical event – and it would seem to have changed the life of Leticia Morales as well.

“It doesn’t make them happy – it’s a cover-up. We get so busy maintaining stuff, keeping it, making sure there’s a place for it. It’s not greed. It’s trying to fill up a hole that’s so big it will never be filled..”

• The Stuff Paradox: Dealing With Clutter In The US (BBC)

While more and more Americans struggle to make do with less due to economic hardship, others are making a conscious choice to shed their possessions. When Courtney Carver was diagnosed with multiple sclerosis in 2006, she took a long, hard look at her life and decided to focus on only the things that were really important. And that meant reducing the amount of “stuff” cluttering her space and her time. “At first it seemed completely overwhelming and not manageable,” she recalls. “Even the thought of decluttering my closet felt like this huge accomplishment, and paying off tens of thousands of dollars of debt felt impossible.” But Carver persevered and discovered that casting off her possessions also reduced her stress levels and she began to feel better. “I’m not saying crazy lifestyles cause illness, but they certainly exacerbate issues,” she says.

“Freeing up a lot of resources allows me to give more of my time and attention and money to things that I care about.” She began blogging about her experience and eventually left her advertising job in Salt Lake City, Utah, to launch a website BeMoreWithLess.com. Her Project 333 – how to pare down a wardrobe to just 33 items – has attracted a large online following and she has just launched a similar initiative to reduce food in the kitchen. The point is to free up time and mental energy that would otherwise be spent on the everyday preoccupation of eating and fashion. Of course minimalism itself is nothing new. Some of the ancient Greek philosophers were advocates, most religions extol the virtues of austerity and figures as diverse as the Russian novelist Leo Tolstoy and the Indian civil rights leader Mahatma Gandhi have preached the benefits of a simple life. But a recent survey reveals that 54% of Americans feel overwhelmed by clutter and 78% have no idea what to do with it. [..]

Bev Hitchins is the founder of Align, a professional decluttering service based in Alexandria, Virginia. She has never met some of her clients and often provides counselling online. “I work with people who are poised to make a change,” she says. “They realise they’re stuck and have to do something about it. One of the easiest ways to get unstuck is to declutter.” That’s because most people accumulate possessions for psychological reasons, she says. “People gather stuff to protect themselves. It’s an illusion though. It doesn’t make them happy – it’s a cover-up. We get so busy maintaining stuff, keeping it, making sure there’s a place for it. It’s not greed. It’s trying to fill up a hole that’s so big it will never be filled. “But there’s a tremendous transformation that goes on if they stay with the process. You can go into therapy or you can start decluttering.”

“I think when you make a film like American Sniper you have to be in decline.. You’re not a world leader any more..”

• American Sniper Is A Movie Hitler ‘Would Have Been Proud To Have Made’ (Ind.)

The British documentarian Nick Broomfield has said that the controversial biopic American Sniper is a film which Adolf Hitler would have been proud to have made. In an interview for The Independent Magazine, the award-winning filmmaker branded it an example of ‘American fascism’ that made him question his decision to live in the United States. “After you’ve watched a film like American Sniper, you think “My God, what the fuck am I doing here?” He went on to say: “I think Adolf would have been proud to have made it”. Directed by Clint Eastwood, American Sniper is a biopic of the Navy SEAL sniper Chris Kyle, played by Bradley Cooper. Based on Kyle’s memoir, the film tells the story of how he rose to legendary status within the armed forces by making 164 confirmed “kills” during four tours in Iraq.

The film has been a runaway success at the US box office. American sniper Chris Kyle had over a 100 ‘kills’ to his name American sniper Chris Kyle had over a 100 ‘kills’ to his name Asked whether he agreed with criticism of America Sniper as propagandist Broomfield – who is promoting his new documentary Tales of the Grim Sleeper – labelled it a product of a country locked in an existential struggle with its own history and future. “It’s been amazing watching the whole Obama thing. Just seeing how deep-rooted it [American fascism] is. That’s really what Tales of the Grim Sleeper is about: incredible racism that really goes back to slavery and the country has not in any way got over it. “I think when you make a film like American Sniper you have to be in decline,” he added.

“You’re holding on to your bootstraps and you’re turning inwards. You’re not a world leader any more. I think it makes people very insecure and they sort of retreat to their most basic fears .The fact that that film has been such a touchstone here is worrying.” [..] Broomfield’s new documentary, Tales of a Grim Sleeper, investigates the murders of over 150 prostitutes, mostly African-American, in South Central Los Angeles. It is Broomfield’s 30th documentary – a number of which have been set in the US. “If you were making films in the 1850s when the British Empire was pre-eminent, you would undoubtedly be more interested about making films in Britain, about British people,” he explained. “But I think, in a way, it’s about to change. People look to the United States for things that are about to happen in the future.”