Vilhelm Hammershoi Woman Seen from the Back 1888

Tried hard to find a nonpartial view, but that just gets harder all the time.

• White House Says It Will Refuse To Cooperate With Impeachment Inquiry (R.)

The White House said on Tuesday it would refuse to cooperate with an “illegitimate, unconstitutional” congressional impeachment inquiry, setting Republican President Donald Trump on a collision course with the Democratic-led U.S. House of Representatives. Hours after the administration abruptly blocked a key witness in the Ukraine scandal from testifying to congressional panels, White House lawyer Pat Cipollone criticized the decision by lawmakers to proceed with an impeachment inquiry without a full House vote. “You have designed and implemented your inquiry in a manner that violates fundamental fairness and constitutionally mandated due process,” he said, adding House Democrats had left Trump “no choice.”

“To fulfill his duties to the American people, the Constitution, the Executive Branch and all future occupants of the Office of the Presidency, President Trump and his administration cannot participate in your partisan and unconstitutional inquiry under these circumstances,” he said. [..] White House lawyer Cipollone described the probe as “a naked political strategy” that violated Trump’s due process rights and was designed to reverse the 2016 presidential election and influence the November 2020 election. “Your transparent rush to judgment, lack of democratically accountable authorization, and violation of basic rights in the current proceedings make clear the illegitimate, partisan purpose” of the inquiry, he said.

Brilliant both from Michael Every of Rabobank and the South Park crew.

“Like the NBA, we welcome the Chinese censors into our homes and into our hearts. We too love money more than freedom and democracy.”

• Oh My God, They Killed CNY! You Bastards (Every)

”The upcoming ‘Top Gun 2’ stars Tom Cruise, still trying to look like he did in the 1980s, but no longer able to do all his own stunts: which is just like US foreign policy “ [..] the most honest commentary on where we now stand under globalisation comes not from the eschatological of intellectuals or politicians telling us democracy is under threat and free trade is great, not spotting Marxist and populist criticism that the two are linked; instead it comes from the scatology of ‘South Park’.[..] the most honest commentary on where we now stand under globalisation comes not from the eschatological of intellectuals or politicians telling us democracy is under threat and free trade is great, not spotting Marxist and populist criticism that the two are linked; instead it comes from the scatology of ‘South Park’

So is the US flailing or retreating like the Romans? No. It is focusing on its mighty financial weapons and physically fighting where it can achieve what matters most…if one is not thinking about Iran, but China. As Trump underlined: “WE WILL FIGHT WHERE IT IS TO OUR BENEFIT, AND ONLY FIGHT TO WIN.” Where does it benefit most fighting, globally? Three guesses… The greatest likelihood is still that if Trump gets past his latest tipping point then at some (tipping) point soon markets are going to cry “Oh my God, they killed CNY!” as the Chinese currency collapses.

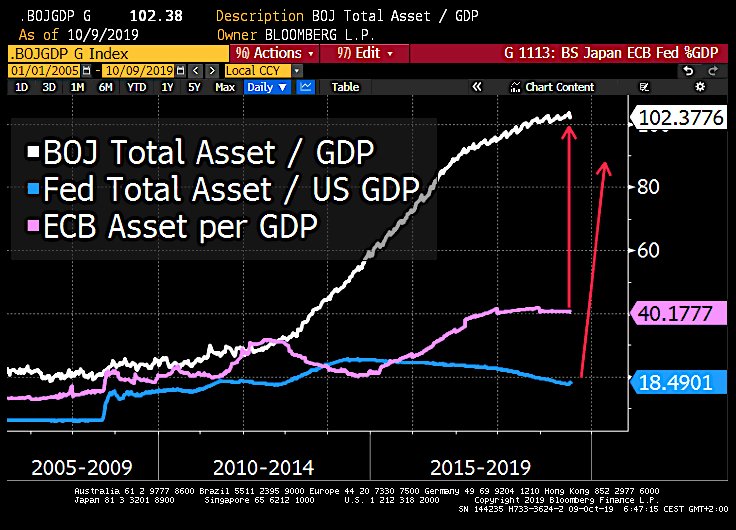

As Big As Japan.

• Powell Says The Fed Will Start Expanding Its Balance Sheet ‘Soon’ (CNBC)

The Federal Reserve will soon start growing its balance sheet again, a response in part to the jolt to overnight lending markets in September, Chairman Jerome Powell said Tuesday. How the Fed will go about expanding the securities it holds will be explained in the coming days, though Treasury bill purchases will be involved, the central bank chief said during a speech in Denver, though Powell stressed the approach shouldn’t be confused with the quantitative easing done during and after the financial crisis. “This is not QE. In no sense is this QE,” he said in a question and answer session after the speech.

On monetary policy more broadly, Powell stuck to his recent script: He and his fellow policymakers view the economy as being strong but susceptible to shocks, particularly from a global slowdown, trade and geopolitics like a potentially messy Brexit. He said the Fed stands committed to supporting the recovery but is data dependent and not on a preset course of cutting rates. The Fed has reduced its benchmark rate twice in 2019 and is expected to approve a third cut late this month.

The EU likes this.

• Boris Johnson Facing No-Deal Brexit Cabinet Rebellion (R.)

British Prime Minister Boris Johnson is facing a new rebellion from his cabinet over concerns of a no-deal Brexit, with a group of cabinet ministers poised to resign, The Times newspaper reported on Wednesday. Culture Secretary Nicky Morgan, British Minister for Northern Ireland Julian Smith, Justice Secretary Robert Buckland, Health Minister Matt Hancock and Attorney General Geoffrey Cox are all on a “resignation watch list”, according to The Times report An unnamed cabinet minister cited by the newspaper said that a “very large number” of Conservative members of parliament will quit if it comes to a no-deal Brexit.

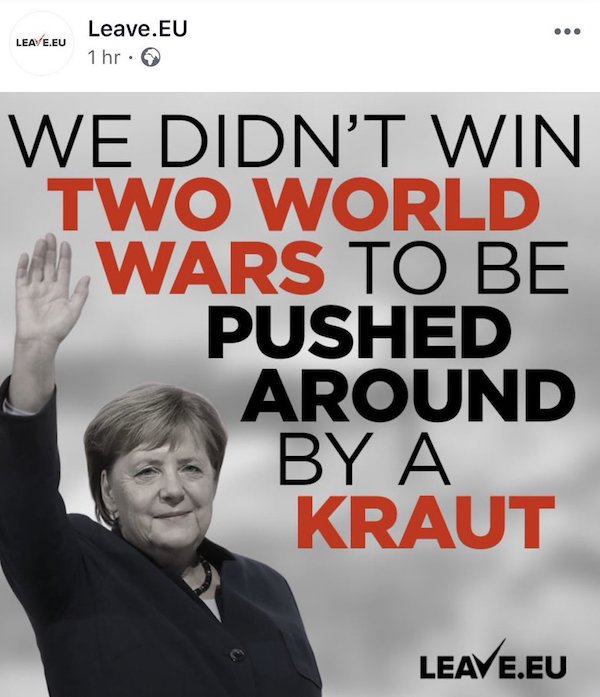

The Times said that ministers had warned Johnson in a cabinet meeting about the “grave” risk of the return of direct rule in Northern Ireland and raised concerns about Dominic Cummings, Johnson’s most senior adviser. “Cabinet will set the strategy, not unelected officials. If this is an attempt to do that then it will fail”, the report quoted another cabinet minister as saying. The report comes as the European Union accused Britain of playing a “stupid blame game” over Brexit after a Downing Street source told Reuters a deal was essentially impossible because German Chancellor Angela Merkel had made unacceptable demands.

“What’s at stake is not winning some stupid blame game,” Tusk wrote in a tweet directed at the prime minister.”

• EU May Offer To Extend Deadline For Brexit Deal To June (G.)

The European Union is poised to extend Brexit talks into as late as next summer after the European council and commission presidents dismissed Boris Johnson’s strategy as a “blame game”. A “range of dates” will now be in play at the meeting of European leaders next week but sources suggested the natural cut-off date would be June. With an extension of the UK’s EU membership now looking inevitable, other diplomatic sources suggested an unlikely outlier for an end date could even be ahead of a possible general election so as to force the Commons into accepting a deal. “But politicians like to keep things off their plates for as long as possible and so pushing it longer seems more realistic,” a senior EU diplomat said.

The negotiations over a deal are said to be effectively dead in Brussels after Downing Street’s extraordinary claims over the substance of a phone call between the German chancellor, Angela Merkel, and the UK prime minister. Merkel was said by an unnamed UK source to have told Johnson that Northern Ireland had to stay in the EU’s customs union. The official claimed that as a consequence a deal looked “essentially impossible, not just now but ever”. Tusk, the European council president, gave an insight into the frustration at the anonymous briefings over the Merkel call, the alleged content of which described by senior politicians in Berlin as “improbable”. The chancellor’s spokesman declined to comment on “confidential conversations”.

“What’s at stake is not winning some stupid blame game,” Tusk wrote in a tweet directed at the prime minister. “At stake is the future of Europe and the UK as well as the security and interests of our people. You don’t want a deal, you don’t want an extension, you don’t want to revoke. Quo vadis? [Where are you going?]” [..] In Berlin Detlef Seif, the point person on Brexit for Merkel’s party, the CDU, rejected the account given by Downing Street of the call between the two leaders. He said: “In my mind it is completely improbable that the phone call between Merkel and Johnson took place in the way it has been reported in the British media. “It would run counter to all the principles the German government has followed for the last three years, namely that the negotiations are led by the European commission.

“It brings to light, in stunning clarity, Brexiters’ deluded political understanding of the UK’s place in the world.”

“..without it we will remain stuck in the delusional, revivalist politics of a banana monarchy.”

• Brexit Is A Necessary Crisis, Reveals Britain’s True Place In The World (G.)

Today much of the capital in Britain is not British and not linked to the Conservative party – where for most of the 20th century things looked very different. Once, great capitalists with national, imperial and global interests sat in the Commons and the Lords as Liberals or Conservatives. Between the wars, the Conservatives emerged as the one party of capital, led by great British manufacturers such as Stanley Baldwin and Neville Chamberlain. The Commons and the Lords were soon fuller than ever of Tory businessmen, from the owner of Meccano toys to that of Lyons Corner Houses.

After the second world war, such captains of industry avoided the Commons, but the Conservative party was without question the party of capital and property, one which stood against the party of organised labour. Furthermore, the Tories represented an increasingly national capitalism, protected by import controls, and closely tied to an interventionist and technocratic state that wanted to increase exports of British designed and made goods. A company like Imperial Chemical Industries (ICI) saw itself, and indeed was, a national champion. British industry, public and private, was a national enterprise.

Since the 1970s things have changed radically. Today there is no such thing as British national capitalism. London is a place where world capitalism does business – no longer one where British capitalism does the world’s business. Everywhere in the UK there are foreign-owned enterprises, many of them nationalised industries, building nuclear reactors and running train services from overseas. When the car industry speaks, it is not as British industry but as foreign enterprise in the UK. The same is true of many of the major manufacturing sectors – from civil aircraft to electrical engineering – and of infrastructure. Whatever the interests of foreign capital, they are not expressed through a national political party. Most of these foreign-owned businesses, not surprisingly, are hostile to Brexit.

[..] Brexit is a necessary crisis, and has provided a long overdue audit of British realities. It exposes the nature of the economy, the new relations of capitalism to politics and the weakness of the state. It brings to light, in stunning clarity, Brexiters’ deluded political understanding of the UK’s place in the world. From a new understanding, a new politics of national improvement might come; without it we will remain stuck in the delusional, revivalist politics of a banana monarchy.

High time. But is asking questions about CrowdStrike impeachable?

• Time To Reassess CrowdStrike’s Credibility (Kelly)

Days before the Senate voted to confirm Brett Kavanaugh last year, a former FBI assistant director appeared on MSNBC to suggest the Supreme Court nominee had a major credibility problem. “This is not…an investigation about the sexual allegations, I think it really has moved toward credibility,” Shawn Henry, an NBC News analyst, told Nicolle Wallace on October 1, 2018. “At this point now, there are very clear allegations, and subsequent to the judge’s testimony, people have come out who appear to be credible who…appear to be contradicting his testimony sworn before the United States Senate.” Henry, clearly reciting Democratic talking points to imply Kavanaugh perjured himself before the Senate Judiciary Committee during his September showdown with Christine Blasey Ford, also referred to Ford as a “victim” and claimed that the FBI’s investigation into Kavanaugh’s testimony had “fallen short.”

Henry was presented to viewers as the channel’s “national security analyst,” but there was one title the network overlooked: Shawn Henry is a top executive for CrowdStrike, the cybersecurity firm hired by the Democratic National Committee to investigate the infamous hack of its email system in early 2016. Perhaps not coincidentally, the firm determined that the Russians were behind the intrusion. CrowdStrike’s June 2016 assessment remains the sole source of evidence to supply the pretext of the government’s Russian election interference claim; later, it would help bolster the Trump-Russia collusion fable. [..] Henry, the president of CrowdStrike’s Washington operation, is a regular contributor to both MSNBC and NBC News programs. (His affiliation with CrowdStrike, however, is never mentioned.)

Although he hasn’t worked for the FBI since 2012, Henry often weighs in as an FBI “expert,” opining on a variety of political issues from government shutdowns to the Kavanaugh debacle. Curiously, his views always come down on the side opposite of Donald Trump and the Republican Party. In March 2017, Henry—who worked for Robert Mueller’s FBI during Barack Obama’s first term—participated in a post-inauguration forum to discuss the implications of Russia’s “hacking” the 2016 presidential election. The panel also featured former Hillary Clinton campaign manager John Podesta and Marc Elias, the general partner at Perkins Coie, a politically-influential law firm based in D.C.. It was a symbolic trio. Perkins Coie hired CrowdStrike in the spring of 2016 on behalf of the DNC.

Instead of going directly to the FBI or other law enforcement agency about the breach, Democratic party leaders, working through Perkins Coie, retained CrowdStrike to find the culprits. Very cozy. But that wasn’t Perkins Coie’s only involvement in the Russia-hacked-the-election plotline. The law firm also hired Fusion GPS—who in turn hired British political operative Christopher Steele to author his infamous dossier—on behalf of the Clinton campaign and the DNC around the same time Perkins retained CrowdStrike. According to disclosure reports, the DNC paid Perkins Coie $7.2 million during the 2016 election cycle: The PAC also paid CrowdStrike more than $400,000 during the same time period. (The DNC has paid CrowdStrike nearly $80,000 so far this year.)

#I’mWithHer.

• Jeffrey Epstein Accuser Expands Lawsuit Against Estate, Alleged Enablers (R.)

A New York woman who said Jeffrey Epstein began grooming her for sex when she was 14 and later raped her expanded her lawsuit against his estate, naming several women who allegedly enabled the financier’s abuses and seeking to block the estate from shielding his assets from victims. In her amended complaint filed on Tuesday, Jennifer Araoz accused four women by name who once worked with Epstein of misconduct, and added more than 20 corporate defendants associated with the late financier. Araoz, 32, wants “justice not just against Mr. Epstein’s estate, but the network of enablers that surrounded him, and the network of corporate interests that surrounded him,” her lawyer Daniel Kaiser told reporters on a conference call.

“Every penny of his estate should be available to satisfy the claims of victims,” he added. Epstein, 66, died by hanging himself in his Manhattan jail cell on Aug. 10, two days after signing a will and putting his estimated $577 million estate into a trust. Kaiser said it would be obvious to any judge that this was a fraudulent effort to keep his money away from victims. The four women include Ghislaine Maxwell, Epstein’s longtime confidante; Lesley Groff, a former secretary; Cimberly Espinosa, a former executive assistant; and Rosalyn Fontanilla, a former maid who died in October 2016. All but Fontanilla are named as defendants.

Araoz accused the defendants of conspiring to identify and procure a steady stream of underage girls for Epstein to sexually abuse. The defendants “participated with and assisted Epstein in maintaining and protecting his sex trafficking ring, ensuring that approximately three girls a day were made available to him for his sexual pleasure,” the amended complaint said.

It’s already started.

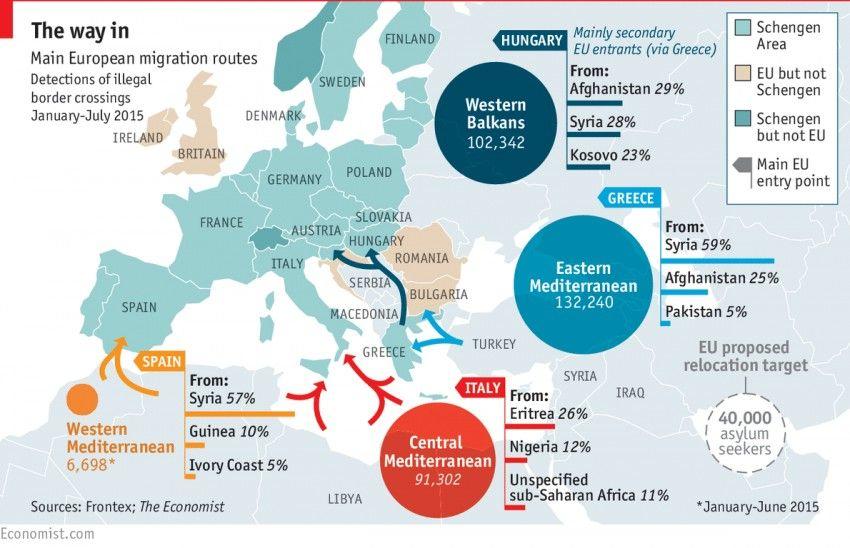

• Refugee Explosion “Greater” Than 2015 To Hit Europe – German Minister (ZH)

The German government is warning that a number of indicators suggest Europe could be on the brink of witnessing a new refugee crisis explode on its borders. Germany’s Interior Minister Horst Seehofer said early this week that refugees and migrants are set to flood Europe on a scale even bigger that the peak of the 2015 crisis. “We must do more to help our European partners with controls on the EU external borders. We have left them alone for too long,” he told Germany’s Bild am Sonntag newspaper after returning from a visit to Greece and Turkey, where he inspected the renewed refugee crisis first hand. “If we do not do that we will once again face a refugee wave like in 2015 or maybe even greater,” Seehofer warned ominously.

Seehofer further said that if the EU doesn’t unite to find “strength to solve this problem problem” it faces total “loss of control” if and when the next major crisis hits. At the height of the crisis three years ago, which was driven by the vastly destabilizing wars in Syria and Libya, and by the turmoil left in the wake of the Islamic State caliphate in western Iraq, there were near weekly mass drownings and accidents involving migrants attempting to traverse the Mediterranean, as well as fires and unrest at makeshift refugee camps in France and Greece. It further created turmoil in the domestic politics of multiple EU countries, with a number of right-wing populist figures and parties coming to power on anti-illegal immigration platforms.

And now, with Turkey on the brink of a major military incursion into northeast Syria, the Middle East is about to witness a major new conflagration resulting in potentially millions of new refugees being pushed out of the Turkey-Syria border region. Coupled with that, Turkey’s President Erdogan recently threatened to release one million refugees on Europe if he can’t have his so-called ‘safe zone’ which is to reach some 30km deep (19 miles) inside Syrian territory. He threatened early last month: “We will be forced to open the gates. We cannot be forced to handle the burden alone,” while demanding that European countries give political support to the controversial plan that would end in annexing UN member Syria’s sovereign territory.