DPC League Island Navy Yard, Philadelphia. USS Brooklyn spar deck 1898

I think Trump should start inviting Dave over to the White House. You know, just listen. Reagan’s budget director knows how things work.

• Trump Will Create a Debt Crisis Like Never Before – David Stockman (Fox)

While President Trump is expected to tout his administration’s accomplishments one month into his term during a speech before a joint session of Congress Tuesday night, former Reagan Budget Director David Stockman said he doesn’t see much progress being made. “I’ve thrown in the towel because he’s not paying attention and he’s not learning anything and he’s making ridiculous statements,” Stockman told the FOX Business Network’s Neil Cavuto. During the address, Trump is expected to talk about the new budget blueprint, which Stockman said doesn’t add up. “We don’t need a $54 billion increase in defense when the budget already is ten times bigger than that of Russia. We don’t need $6 trillion of defense spending over the next decade because China is going nowhere except trying to keep their Ponzi scheme together.”

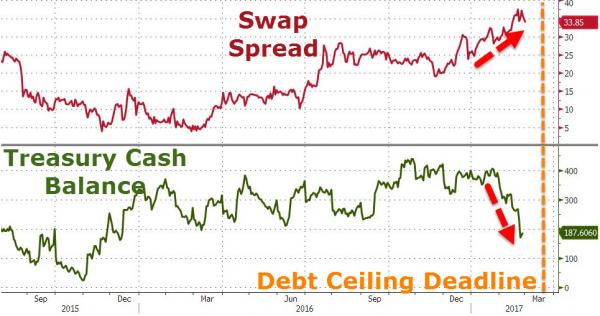

President Trump will also talk about the GOP replacement for Obamacare. Stockman said he wasn’t sold on Speaker Ryan’s plan. “If you look at the Ryan draft that came out over the weekend, it’s basically Obamacare-like. It’s not really repealing anything,” he said. “It’s basically reneging and turning the Medicaid expansion into a block grant, turning the exchanges into tax credits [and] it’s still going to cost trillions of dollars.” Last week, Trump’s Treasury Secretary Steven Mnuchin, told FOX Business the administration is “focused on an aggressive timeline” to produce a tax reform plan by August, but in Stockman’s opinion, tax reform won’t happen this year. He also warned that the administration’s run up against the debt ceiling this summer could lead to a debt crisis. “I don’t think we will see the tax cuts this year at all,” he said. “There is going to be a debt ceiling crisis like never before this summer and that’s what people don’t realize. They’ve burned up all the cash that Obama left on the balance sheet for whatever reason.”

“..the question is not what could go wrong since it is guaranteed that all these liabilities will implode at some point. And when they do, it will bring misery to the world of a magnitude that no one could ever imagine.”

• The End Of A 100 Year Global Debt Super Cycle Is Way Overdue (EC)

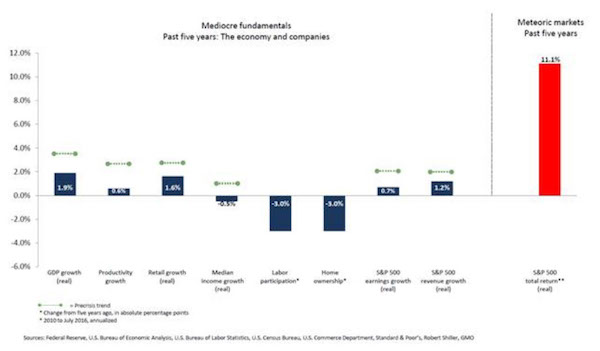

Central banks are designed to create debt, and since 1913 the U.S. national debt has gotten more than 6800 times larger. But of course it is not just the United States that is in this sort of predicament. At this point more than 99% of the population of the entire planet lives in a nation that has a debt-creating central bank, and as a result the whole world is drowning in debt. When people tell me that things are going to “get better” in 2017 and beyond, I find it difficult not to roll my eyes. The truth is that the only way we can even continue to maintain our current ridiculously high debt-fueled standard of living is to grow debt at a much faster pace than the economy is growing. We may be able to do that for a brief period of time, but giant financial bubbles like this always end and we will not be any exception.

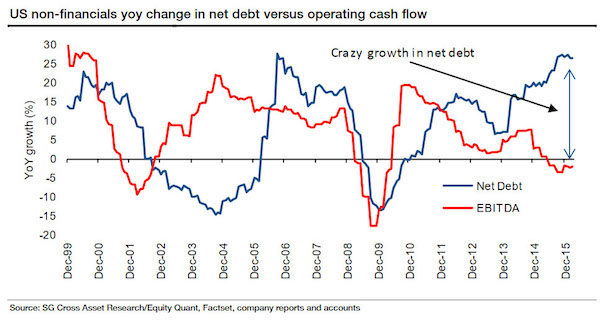

Barack Obama and his team understood what was happening, and they were able to keep us out of a horrifying economic depression by stealing more than nine trillion dollars from future generations of Americans and pumping that money into the U.S. economy. As a result, the federal government is now $20 trillion in debt, and that means that the eventual crash is going to be far, far worse than it would have been if we would have lived within our means all this time. Corporations and households have been going into absolutely enormous amounts of debt as well. Corporate debt has approximately doubled since the last financial crisis, and U.S. consumers are now more than $12 trillion in debt. When you add all forms of debt together, America’s debt to GDP ratio is now about 352%. I think that the following illustration does a pretty good job of showing how absolutely insane that is…

If your brother earns $100,000 in annual income and borrowed $10,000 on his credit card, he could consume $110,000 worth of stuff. In this example, his debt to his personal GDP is just 10%. But what if he could get more credit year after year and reached a point where his total debt reached $352,000 but his income remained the same. His personal debt-to-GDP ratio would now be 352% If he could borrow at super low interest rates, maybe he could sustain the monthly loan payments. Maybe? But how much more could he possibly borrow? What lender would lend him more? And what if those low rates began to rise? How much debt can his $100,000 income cover? Essentially, he has reached the end of his own debt cycle.

The United States is certainly not alone in this regard. When you look all over the industrialized world, you see similar triple digit debt to GDP figures. When this current debt super cycle ultimately ends, it is going to create economic pain on a scale that will be unlike anything that we have ever seen before. The following comes from King World News…

“That is the inevitable consequence of 100 years of credit expansion from virtually nothing to $250 trillion, plus global unfunded liabilities of roughly $500 trillion, plus derivatives of $1.5 quadrillion. This is a staggering total of $2.25 quadrillion. Therefore, the question is not what could go wrong since it is guaranteed that all these liabilities will implode at some point. And when they do, it will bring misery to the world of a magnitude that no one could ever imagine. It is of course very difficult to forecast the end of a major cycle. As this is unlikely to be a mere 100-year cycle but possibly a 2000-year cycle. It is also impossible to forecast how long the decline will take. Will it be gradual like the Dark Ages, which took 500 years after the fall of the Roman Empire? Or will the fall be much faster this time due to the implosion of the biggest credit bubble in world history? The latter is more likely, especially since the bubble will become a lot bigger before it implodes.”

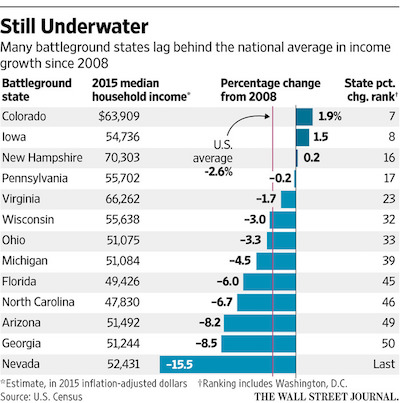

The next two items struck me as a combination: income goes up (take that with a truckload of salt), but spending goes down. Confidence indicator?!

• US Personal Income Climbs 0.4% In January, More Than Expected (RTT)

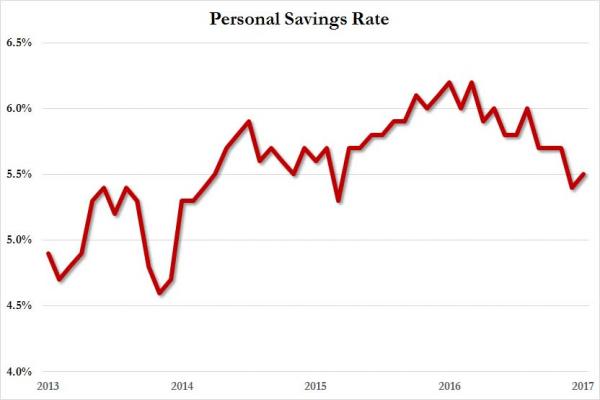

While the Commerce Department released a report on Wednesday showing a slightly bigger than expected increase in U.S. personal income in the month of January, the report also showed that personal spending rose by less than expected. The report said personal income climbed by 0.4% in January after rising by 0.3% in December. Economists had been expecting another 0.3% increase. Disposable personal income, or personal income less personal current taxes, rose by 0.3% for the second straight month. Real spending, which is adjusted to remove price changes, actually fell by 0.3% in January after rising by 0.3% in December. With income rising faster than spending, personal saving as a percentage of disposable personal income ticked up to 5.5% in January from 5.4% in December. A reading on inflation said to be preferred by the Federal Reserve showed that core consumer prices were up 1.7% year-over-year in January, unchanged from the previous month.

What made Americans stop spending? I thought Trump made them feel so good?

• US Real Personal Spending Crashes Most Since 2009 (ZH)

While the key number analysts were looking for in today’s Personal Spending data was the PCE Price Index, both headline and core, which rose by 1.9% and 1.7% respectively, the latter coming in as expected, just shy of the Fed’s 2.0% inflation target, the internals on US incomes and spending were just as notable. Here, the silver lining of a rise in incomes (+0.4% MoM vs +0.3% exp) was dashed by a disappointingly slow growth in spending (+0.2% vs +0.5% prev). With incomes rising more than spending, the savings rate predictably ticked up from multi year lows, rising from 5.4% to 5.5% in January.

On the income side, the increase in personal income was almost entirely from service-producing industries wages, which increased by $22.5BN, while Goods-producing was higher by just $4 billion. Additionally, Social Security transfer benefits added another $9 billion. However, for the ‘average joe’, facing a rising cost of goods, real personal spending plunged 0.3% in January: the biggest drop since September 2009.

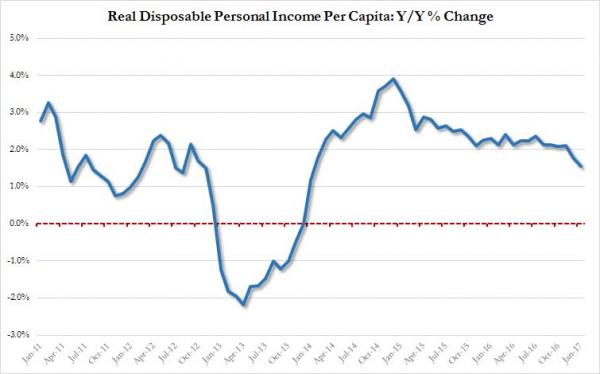

Finally, as a result of surging inflation, and disposable incomes suddenly unable to keep up, the real annual growth in disposable income per capita fell to just 1.5%, the weakest in over 3 years and a red flag for those calling for another renaissance for US consumers.

It’s about the Fed.

• Will Trump Build A Wall Protecting US Banks From Global Rules? (Davies)

As President Trump struggles to staff his administration with sympathisers who will help transpose tweets into policy, the exodus of Obama appointees from the federal government and other agencies continues. For the financial world, one of the most significant departures was that of Daniel Tarullo, the Federal Reserve governor who has led its work on financial regulation for the last seven years. It would be a stretch to say that Tarullo has been universally popular in the banking community. He led the charge in arguing for much higher capital ratios, in the US and elsewhere. He was a tough negotiator, with a well-tuned instinct for spotting special pleading by financial firms. But crocodile tears will be shed in Europe to mark his resignation.

European banks, and even their regulators, were concerned by his enthusiastic advocacy of even tougher standards in Basel 3.5 (or Basel 4, as bankers like to call it), which would, if implemented in the form favoured by the US, require further substantial capital increases for Europe’s banks in particular. In his absence, these proposals’ fate is uncertain. But Tarullo has also been an enthusiastic promoter of international regulatory cooperation, with the frequent flyer miles to prove it. For some years, he has chaired the Financial Stability Board’s little-known but important Standing Committee on Supervisory and Regulatory Cooperation. His commitment to working with colleagues in international bodies such as the FSB and the Basel Committee on Banking Supervision, to reach global regulatory agreements enabling banks to compete on a level playing field, has never been in doubt.

Already, some of those who criticised him most vocally in the past are anxious about his departure. Who will succeed him? The 2010 Dodd-Frank Act created a vice-chair position on the Federal Reserve Board – which has never been filled – to lead the Fed’s work on regulation. Will that appointee, whom Trump now needs to select, be as committed as Tarullo to an international approach? Or will his principal task be to build a regulatory wall, protecting US banks from global rules? We do not yet know the answers to these questions, but Fed watchers were alarmed by a 31 January letter to Fed chair Janet Yellen from Representative Patrick McHenry, the vice-chairman of the House committee on financial services. McHenry did not pull his punches. “Despite the clear message delivered by President Donald Trump in prioritising America’s interest in international negotiations,” McHenry wrote, “it appears that the Federal Reserve continues negotiating international regulatory standards for financial institutions among global bureaucrats in foreign lands without transparency, accountability, or the authority to do so. This is unacceptable.”

In her reply of 10 February, Yellen firmly rebutted McHenry’s arguments. She pointed out that the Fed does indeed have the authority it needs, that the Basel agreements are not binding, and that, in any event, “strong regulatory standards enhance the stability of the US financial system” and promote the competitiveness of financial firms. But that will not be the end of the story. The battle lines are now drawn, and McHenry’s letter shows the arguments that will be deployed in Congress by some Republicans close to the president. There has always been a strand of thinking in Washington that dislikes foreign entanglements, in this and other areas. While Yellen’s arguments are correct, the Fed’s entitlement to participate in international negotiations does not oblige it to do so, and a new appointee might argue that it should not.

Nice piece. What you see when you take a step back. And this is from WaPo.

• Once Again, Trump Succeeded Where He Was Supposed To Fail (WaPo)

There’s a confusion at the heart of every presidential address to Congress. It’s supposed to be a grave occasion of solidarity around the principles of our shared republic, but it has the cheesy and disingenuous air of a campaign event. The address combines the solemnity of ceremony with mindless hyperpartisan hoopla — the shouting and booing, the symbolic gimmickry and, above all, the absurd tradition of signifying one’s agreement or displeasure by either standing to applaud or remaining seated after every phrase of the speech. The address is designed for a traditional Democratic or Republican president. He’s meant to embolden his party and browbeat the opposition, with a few light gestures at unity and consensus. His allies are supposed to look gleeful and applaud his every gesture; his opponents are supposed to sit glumly on their hands and show the nation that they, at least, aren’t engaging in this misguided hysteria.

The address is designed, in other words, for a more or less ideologically coherent speech. But Donald Trump, as everybody knows, doesn’t care about ideological coherence. His ideas don’t fall along recognizable philosophical lines, with the result that his audience of lawmakers, ready to boo or cheer in the usual ways, often seemed unsure how to respond. Once again, then, Trump succeeded in a setting where nearly everybody — including me — thought he would fail. The Democrats looked especially awkward. So much of their detestation of Trump arises not from policy differences but from horror at his gaucherie and bizarre rhetorical excesses. But none of that is relevant in a State of the Union-style address. Subtract the issues of Obamacare repeal, immigration and the president’s hard-line policies on domestic security — the latter two of which don’t lend themselves to clear ideological allegiances — and much of what Trump had to say could have been said by any Democratic president.

Even on the topic of health care, Trump offered several proposals that, taken on their own, most Democrats probably wouldn’t object to, hence making it rather difficult for them to do what they would have preferred to do, namely glower at the president’s let-them-eat-cake obstructionism. What were Democrats supposed to do when, for instance, Trump vowed “to make child care accessible and affordable, to help ensure new parents have paid family leave, to invest in women’s health, and to promote clean air and clear water, and to rebuild our military and our infrastructure”? I guess … we’ll applaud? Clap, clap? Republicans, meanwhile, found themselves applauding for something not very unlike President Obama’s stimulus plan of 2009. “To launch our national rebuilding,” Trump said, “I will be asking the Congress to approve legislation that produces a $1 trillion investment in the infrastructure of the United States — financed through both public and private capital — creating millions of new jobs.”

I’m not sure what “financed through both public and private capital” means, but Trump’s jobs plan sounded to my ear like some socialist Five-Year Plan from the 1970s — making it all the more entertaining to watch congressional Republicans cheering like football fans who misheard the penalty call. I wonder if Tuesday night’s address was a kind of adumbration of Trump’s presidency — his adversaries deprived of half their reasons for hating him, his allies stupidly wondering what happened to their principles, the nation’s commentators once again explaining why the president succeeded when he was supposed to fail, and voters reluctantly appreciating this hyperactive agitator who — for all his problems — at least keeps things interesting.

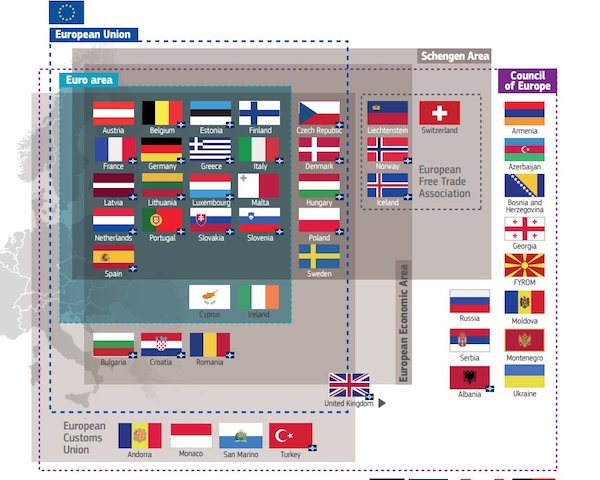

Give Greece full access to all European finance tools while it’s in the eurozone, or at some point it won’t be.

• Greece’s Latest Drama Imperils Banks’ Baby Steps Toward Recovery (BBG)

Since the last eruption of Greece’s long-running crisis in 2015, banks in Europe’s most troubled economy have shored up capital, staunched losses and set up a plan to reduce their mountains of bad debt. Now, fresh tensions over the country’s bailout are putting that progress at risk. About 1.3% of deposits were pulled from the banks in January, while bad loans crept higher, an increase Bank of Greece Governor Yannis Stournaras blamed on borrowers using the deadlock with creditors as an excuse to avoid making their payments. Greek officials are meeting in Athens this week with representatives of the euro area and IMF to set out the policies Greece must undertake to unlock more loans. The government foresees an accord in March or early April, but the scale of pending issues raises concerns they may be politically hard to sell at home.

“The longer it takes for the impasse to be concluded, the more damaging it will be for the banks,” said Federico Santi, an analyst with Eurasia Group. The biggest lenders – Piraeus Bank, National Bank of Greece, Eurobank and Alpha Bank – made headway since 2015, when 26% of total deposits fled on concern Greece might abandon the single currency. That run was only halted when the banks were shut for three weeks, controls were placed on withdrawals and the movement of money abroad and Greece agreed to an €86 billion bailout, its third since 2010. A €14.4 billion recapitalization in November 2015 by the government-owned Hellenic Financial Stability Fund and private investors strengthened the banks’ balance sheets. The HFSF – funded through euro-area loans – remains the largest investor in all but one of the banks.

For the first time since 2010, three of the four are expected to report an annual profit when they announce results starting next week. Crucially, the banks are embarking on a three-year plan, overseen by regulators, to shrink their bad loans. [..] Until the banks begin offloading this bad debt, there’s scant chance they’ll be able to provide businesses with the credit they need to grow. “These NPLs are clogging the wheels of the entire economy,” said Paris Mantzarvas, an analyst at Athens-based Pantelakis Securities.

“I’m the most popular European politician in Greece.”

• Juncker: Greek Prime Minister Loves Me Deeply, And So Do Greeks (KTG)

European Commission President Jean-Claude Juncker said on Wednesday he is the most popular European politician in Greece during a joint press conference with European Parliament President Antonio Tajani in Brussels, following the presentation of the Commission’s “White Paper” on the future of the EU. Asked by a journalist why he does not comment on France’s domestic politics where presidential hopeful Marine Le Pen has announced a referendum for an exit from the EU if elected, when he had intervened dynamically against the position of Greek Premier Alexis Tsipras when he announced a referendum in 2015, Juncker replied:

“You’re the only person in Europe who believes I was among those who criticized the Greek prime minister. The Greek prime minister loves me deeply, and so do Greeks. I’m the most popular European politician in Greece. You should have known that, if you have seen by relationship with the Greek prime minister, who I greatly value. Just as I have deep sympathy or even love for the Greek people.” He then pointed at Commission spokesman Margaritis Schinas and said he is briefed by him on daily developments in Greece. Concerning Le Pen, Juncker said he doesn’t want to become part of her propaganda.

[..] Outlining the five options of Europe’s future, Juncker acknowledged the existential struggle the EU is facing due to crises over Brexit, migration and the eurozone. He said it was not a “definitive view” from the Commission but a way to “make clear what Europe can and cannot do.” Among others, Juncker said: “The future of Europe should not become hostage to elections, party political or short term views of success.” “However painful Brexit may be, it will not stop the EU as it moves forward into the future.” “Summit after summit we promise we will bring down the unemployment figures, particular youth unemployment … but the EU budget provides only 0.3% of European social budgets: 99.7% is with the national governments.” “We must make clear what Europe can and cannot do.” “Permanent Brussels-bashing makes no sense because there is no basis for it.”

It’s falling apart in his hands.

• Jean-Claude Juncker Sets Five Paths For EU’s Future (BBC)

European Commission President Jean-Claude Juncker has revealed his five future “pathways” for the European Union after Brexit. His white paper looks at various options, from becoming no more than a single market to forging even closer political, social and economic ties. The 27 leaders of EU countries will discuss the plans, without Britain, at a summit in Rome later this month. The meeting will mark the EU’s 60th anniversary. Germany’s foreign minister, Sigmar Gabriel, has already responded to dismiss the idea of the EU purely being a single market.

Path one: ‘Carrying on’ – The remaining 27 members stick on the current course, continuing to focus on reforms, jobs, growth and investment. There is only “incremental progress” on strengthening the single currency. Citizens’ rights derived from EU law are upheld.

Path two: ‘Nothing but the single market’ – The single market becomes the EU’s focus. Plans to work more on migration, security or defence are shelved. The report says this could lead to more checks of people at national borders.Regulation would be reduced but this could create a “race to the bottom” as standards slip, it says. It becomes difficult to agree new common rules on the mobility of workers, so free movement of workers and services is not fully guaranteed.

Path three: ‘Those who want to do more’ – If member countries want to work more with others, they can. Willing groups of states can form coalitions on key areas, such as defence, internal security, taxation and justice. Relations with outside countries, including trade negotiations, remain managed at EU level on behalf of all member states.

Path four: ‘Doing less, more effectively’ – The EU focuses on a reduced agenda where it can deliver clear benefits: technological innovation, trade, security, immigration, borders and defence. It leaves other areas – regional development, health, employment, social policy – to member states’ own governments.EU agencies tackle counter-terrorism work, asylum claims and border control. Joint defence capacities are established. The report says all this would make a simplified, less ambitious EU.

Path five: ‘Doing much more together’ – Feeling unable to meet the today’s challenges alone or as part of the existing group, EU members agree to expand the union’s role. Members agree “to share more power, resources and decision-making across the board”. The single currency is made central to the project, and EU law has a much larger role.

Great piece of history from my place of birth. Well, bit bloody…

• They Really Knew How to Do Populist Revolts in 1672 (BBG)

Johan de Witt, the boy wonder who effectively ran the Republic of the Seven United Netherlands from 1653 to 1672, was an early believer in inbox zero. In his office in the westernmost corner of the Binnenhof, the complex of buildings in The Hague that is still the nerve center of the Dutch government, Johan worked until his desk was empty: the official letters that he had read aloud during the meeting, the envelopes from relatives, friends and other contacts, his list of decisions taken and his notes from the last meeting. He didn’t go home until everything had been dealt with. As soon as a note was finished, he scattered sand over the lines to dry the ink, and he hung it on a wall-mounted wire – many of Johan’s surviving letters have holes in them. This hanging stack, called a lias, also had the advantage that everything was arranged nicely together and finished work wasn’t in the way.

When Johan was finished, the clerks could go to work copying everything according to his strict instructions. That’s my translation of a passage from Dutch journalist-turned-historian Luc Panhuysen’s 2005 double biography of De Witt and his older brother and right-hand-man, Cornelis. The book is titled “De ware vrijheid,” which means “the true freedom,” Johan de Witt’s term for the two decades during which he managed his country on behalf of its merchant class, and the noble House of Orange had no say. The brilliant, hard-working, hyper-organized Johan used that freedom to build what in modern parlance we might call a meritocratic technocracy, bent on globalization and economic growth. For a while, it was spectacularly successful. It didn’t end well, though! The brothers were killed not far from the Binnenhof in August 1672 and cut to pieces by an angry mob, with body parts finding their way to buyers as far away as England.

In these days of populist revolts against globalizing technocratic elites, the De Witts’ story seemed like it might be worth revisiting. That, and it provided a great excuse to walk around The Hague on Tuesday with the erudite and engaging Panhuysen, who has gone on to write books about the “disaster year” of 1672 and the long-running conflict, beginning the same year, between Dutch prince (and eventual English king) William III and French King Louis XIV. “What Johan and Cornelis de Witt had to deal with was that they were regular civilian boys who at the same time had to govern and exude authority,” Panhuysen said. Political opponents could say: “God sent us the House of Orange to break us free from the Spanish. Who are these De Witt brothers?”

The De Witt boys weren’t self-made men – their father was a successful wood merchant who bought his way into government – but Johan in particular did rise to the top largely on merit. He was a brilliant mathematician, a translator and elaborator of the geometry of Rene Descartes. A government report that he wrote on annuity pricing is now seen as one of the founding documents of both actuarial science and financial economics. In 1650, at age 25, Johan was chosen as raadpensionaris – a sort of city manager – of his hometown of Dordrecht, the oldest city in Holland, which was by far the richest and most powerful of the seven Dutch provinces. In 1653, representatives of Holland’s other cities asked him to become the province’s raadpensionaris, sometimes translated as grand pensionary. After taking 10 days to think it over, he accepted.

The secret of life will never cease to fascinate.

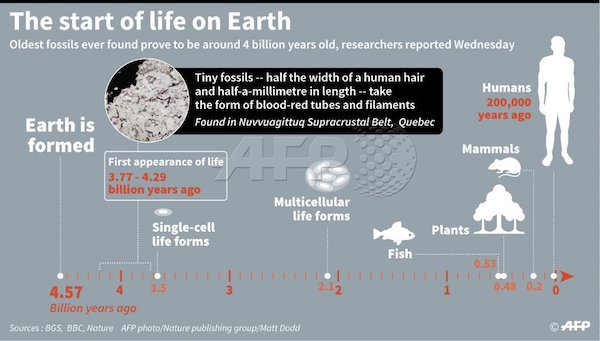

• World’s Oldest Fossils -4 Billion Years- Found In Canada (G.)

Scientists say they have found the world’s oldest fossils, thought to have formed between 3.77bn and 4.28bn years ago. Comprised of tiny tubes and filaments made of an iron oxide known as haematite, the microfossils are believed to be the remains of bacteria that once thrived underwater around hydrothermal vents, relying on chemical reactions involving iron for their energy. If correct, these fossils offer the oldest direct evidence for life on the planet. And that, the study’s authors say, offers insights into the origins of life on Earth. “If these rocks do indeed turn out to be 4.28 [bn years old] then we are talking about the origins of life developing very soon after the oceans formed 4.4bn years ago,” said Matthew Dodd, the first author of the research from University College, London.

With iron-oxidising bacteria present even today, the findings, if correct, also highlight the success of such organisms. “They have been around for 3.8bn years at least,” said the lead author Dominic Papineau, also from UCL. The team says the new discovery supports the idea that life emerged and diversified rapidly on Earth, complementing research reported last year that claimed to find evidence of microbe-produced structures, known as stromatolites, in Greenland rocks, which formed 3.7bn years ago. However, like the oldest microfossils previously reported – samples from western Australia dating to about 3.46bn years ago – the new discovery is set to be the subject of hot debate.

The discovery of the structures, the authors add, highlights intriguing avenues for research to discover whether life existed elsewhere in the solar system, including Jupiter’s moon, Europa, and Mars, which once boasted oceans. “If we look at similarly old rocks [from Mars] and we can’t find evidence of life, then this certainly may point to the fact that Earth may be a very special exception and life might just have arisen on Earth,” said Dodd. Published in the journal Nature by an international team of researchers, the new study focuses on rocks of the Nuvvuagittuq supracrustal belt in Quebec, Canada.

When I read things like this: ‘A live shark is worth over a million dollars in tourism revenue over its lifespan’, I lose all hope. It’s valuing nature in dollars that dooms it. And then you get this from the guys trying to save it.

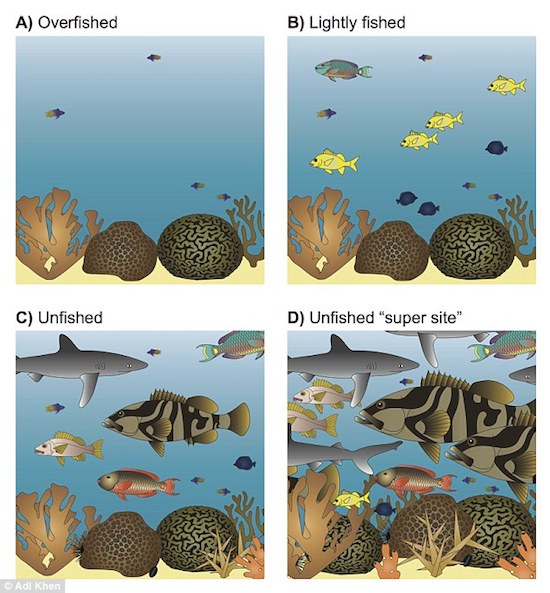

• Overfishing Wipes Out 90% Of Caribbean Predatory Fish (DM)

While predatory fish are key to the Caribbean’s ecosystem and coastal economy, researchers have worryingly found that 90% have been wiped out by over-fishing. But experts say there is hope for Caribbean reefs yet, as they have identified large reefs, known as ‘supersites’, which can support huge numbers of predatory fishes. If the dwindling fish species are reintroduced, they could help repair the damage inflicted by over-fishing. ‘A live shark is worth over a million dollars in tourism revenue over its lifespan because sharks live for decades and thousands of people will travel and dive just to see them up close,’ said study coauthor and marine biologist Dr Abel Valdivia. ‘There is a massive economic incentive to restore and protect sharks and other top predators on coral reefs.’

The University of North Carolina team’s work suggests that supersites – reefs with many nooks and crannies on their surface that act as hiding places for prey – should be prioritised for protection. Other features that make a supersite are the amount of available food, size of the reef and proximity to mangroves. ‘On land, a supersite would be a national park like Yellowstone, which naturally supports an abundance of varied wildlife and has been protected by the federal government,’ said coauthor and marine biologist Professor John Bruno. The team surveyed 39 reefs across the Bahamas, Cuba, Florida, Mexico and Belize to determine how many fish had been lost.

They compared fish biomass on pristine sites to fish biomass on a typical reef. They then estimated the biomass in each location and found that 90% of predatory fish were gone due to over-fishing. What they didn’t expect to find was a ray of hope – a small number of reef locations that, if protected, could help the predatory fish populations recover. ‘Some features have a surprisingly large effect on how many predators a reef can support,’ said study coauthor Dr Courtney Ellen Cox. For example, researchers believe that the Columbia Reef within the fisheries closures of Cozumel, Mexico, could support an average of 10 times the current level of predatory fish if protected.