Salvador Dali The ghost of Vermeer of Delft which can be used as a table 1934

Meanwhile in the real world that central bankers don’t want you to see:

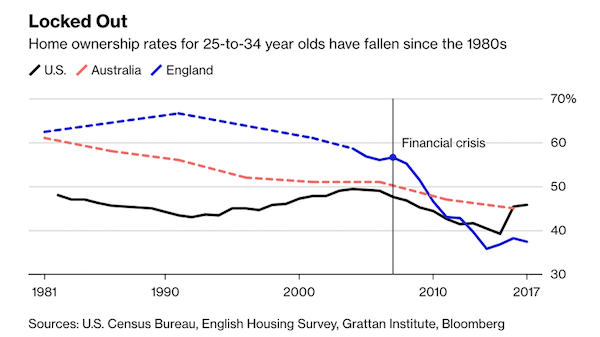

• US Housing Market In Freefall As New Buyers Can’t Afford A Home (ZH)

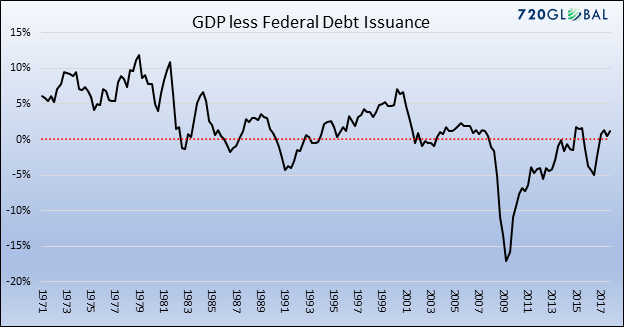

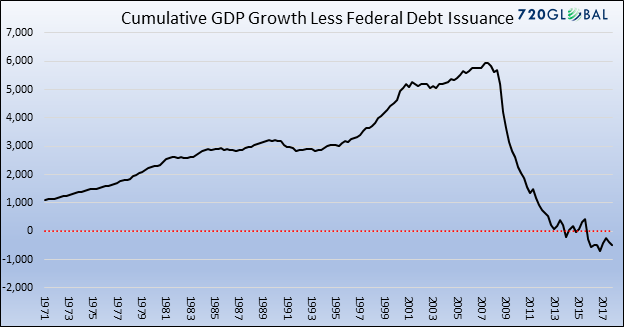

[..] with consensus expecting a tiny rebounding in January following December’s sharp drop, the deterioration in the US home market continued, and January existing home unexpectedly dropped 1.2% (exp. +0.2%), to 4.94 million, missing expectations of a rebound to 5.00 million. After December’s revision higher to 5.00 million, the January SAAR of 4.94 million was the first sub-5MM print since 2015, while the parallel pending home sales series confirms even more weakness is in store. Needless to say, it is very troubling that Americans are unable to afford home purchases with the 30% mortgage at just 4.5%, and suggests that even if inflation picks up, the Fed may have no choice but to keep rates flat to avoid a housing market crash.

As usual, NAR chief economist Larry Yun was optimistic, saying that he does not expect the numbers to decline further going forward. “Existing home sales in January were weak compared to historical norms; however, they are likely to have reached a cyclical low. Moderating home prices combined with gains in household income will boost housing affordability, bringing more buyers to the market in the coming months.” One wonders what “gains in household income” he is talking about. Meanwhile, properties are failing to sell as the slowdown spreads: Properties remained on the market for an average of 49 days in January, up from 46 days in December and 42 days a year ago. Thirty-eight percent of homes sold in January were on the market for less than a month.

“Vancouver [..] saw home sales fall about 40% in January from the same month a year earlier.”

• Canadians Continue To Plunder Equity From Their Homes (ZH)

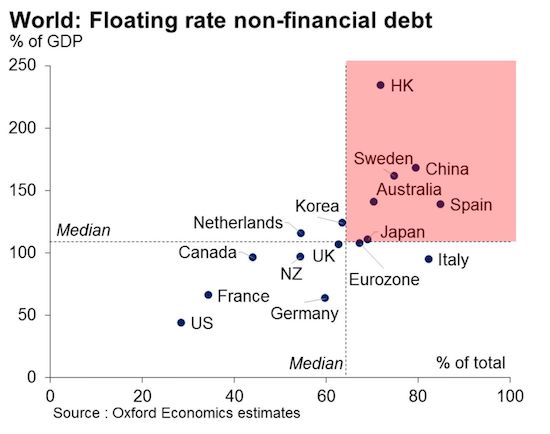

Canadians are accelerating the rate at which they borrow cash against their homes, despite the fact that the real estate market is slumping in the country. This exposes the country’s financial system to obvious vulnerabilities, according to rating company DBRS and Bloomberg. Home equity lines of credit in Canada reached a record $184.5 billion (USD) as of October 31, which equates to 11.3% of total household credit. This is the highest share since mid 2015, according to a report released last Thursday. Canadians are drawing on their home’s equity to fund everything from home renovations to car purchases. And they’re doing it so quickly that borrowing has grown faster than mortgages since 2017.

Analyst Robert Colangelo, who published the report on Thursday, commented: “The flexibility of Helocs could increase financial system vulnerabilities. In the event of a correction, borrowers could find themselves with a debt load that exceeds the value of their home, which is often referred to as negative equity.” Obviously, home equity lines of credit can decrease visibility for lenders to identify credit problems as consumers use the equity in their homes to consolidate high interest loans and unsecured debt into one lump sum at a lower rate. Out of all of the Canadian banks, Toronto Dominion bank has the largest exposure to Helocs at about 39%, followed by Royal Bank of Canada which has 18% exposure. Other large banks are averaging 11% exposure, according to the report.

And the timing for Helocs to grow couldn’t be worse. Toronto’s real estate market continues to feel pain. Sales of new homes in the city fell to the lowest in almost 2 decades in 2018 and a glut of unsold condominiums continue to pile up, according to a Building Industry and Land Development Association report released February 1. Vancouver, still feeling the deflationary effects of a foreign real estate bubble popping, saw home sales fall about 40% in January from the same month a year earlier.

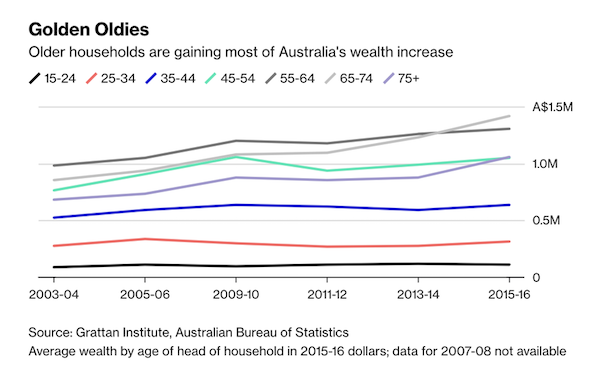

People aged 65-74: A$566,000 wealthier in 2015-16 than the same age group was 12 years earlier. People aged 25-34: A$38,000.

That could topple a lot more than only a government.

• Bursting Of Australia’s Housing Bubble Could Topple The Government (ZH)

In one of the world’s most developed economies, soaring costs for housing and education are rapidly widening the wealth-distribution gap between the younger and older generations amid the backdrop of one of the longest economic expansions in the country’s history. As younger workers grapple with the notion that they may never be able to afford a home, a backlash is stirring in the political arena, as younger voters embrace progressive (some would say “socialist”) politicians. No, we’re not talking about the US. We’re talking about Australia. After six years of tumultuous Liberal rule, the Labour Party is hoping to wrest back control of the government during elections later this year.

And it sees tackling this intergenerational divide as the best way to do it. And combating the country’s increasingly unaffordable housing bubble is a key plank of its proposals. The party has pledged to curb tax breaks for property investors that helped drive up home prices (alongside an influx of foreign capital). Labor leader Bill Shorten has promised to scrap tax refunds worth A$5 billion ($3.6 billion) a year for share investors. The benefits are already being seen in the polls, where Labour is seeing a slight advantage. After 27 years of uninterrupted economic growth, Australians are struggling with the fact that the wealthy have enjoyed the bulk of the economic benefits.

While Australia has avoided recession for 27 years, the spoils have not been shared evenly as older people capture a greater share of the nation’s wealth. According to the Grattan Institute, households headed by people aged 65-74 were on average A$566,000 wealthier in 2015-16 than the same age group was 12 years earlier. That far outstrips growth in other bands and compares with just A$38,000 for the 25-34 age group. [..] While Sydney’s median house price is still more than A$900,000 [..] prices have already fallen 12% since their mid-2017 peak.

Doesn’t she want to run down the clock?

• EU Expects May to Request Three-Month Delay to Brexit (BBG)

The European Union expects U.K. Prime Minister Theresa May to be forced to request a three-month delay to Brexit, two EU officials said. Discussions between the two sides suggest May will ask for an extension to the two-year negotiating period if the British Parliament backs the Brexit deal but it isn’t signed off until an EU summit on March 21-22. That is emerging as the EU’s current plan. The EU sees this as a “technical extension” to give British Parliament time to pass necessary legislation related to its departure from the bloc. Anything longer than three months would put the U.K. under pressure to take part in European elections on May 23-26, something that both sides are keen to avoid.

May is racing against the clock to change a controversial part of her deal, known as the “backstop,” in a way that would be acceptable to both the U.K. Parliament and the EU. However, with just five weeks to go until the U.K.’s scheduled departure from the EU and talks at an impasse, ministers and lawmakers in her own party are threatening to vote against her next week to give Parliament control of the process. The prime minister has repeatedly spoken out against a delay, saying she wants to take the U.K. out of the EU as scheduled at the end of March. She’s never completely ruled it out, however. Any postponement would have to be requested by the U.K. and accepted by all the remaining 27 EU governments.

EU officials say the three-month extension would happen under their most optimistic scenario. The risk remains that the U.K. could leave the bloc March 29 without a deal. Alternatively, May could be forced to contemplate a longer delay if she can’t get backing for the agreement, according to one official.

Chances that Parliament will vote her deal through are slim.

• Theresa May Warned Dozens Of Tories Could Rebel Over No-Deal Brexit (BBC)

Dozens of normally loyal Conservative MPs could rebel against the government in a bid to prevent a “no-deal” Brexit, Downing Street has been warned. Leaders of the Brexit Delivery Group of both Leavers and Remainers say MPs may back alternatives if Mrs May’s reworked deal cannot command a Commons majority. Co-chairman Andrew Percy told the BBC more than 30 may try to block no deal. The government says “productive” talks in Brussels aimed at addressing MPs’ concerns continue “urgently”. The UK remains on course to leave the European Union on 29 March. But the government has repeatedly refused to rule out the possibility of the UK leaving without a formal deal, in the event that Mrs May cannot get MPs to approve the deal she negotiated with Brussels in time.

Many MPs fear that scenario would be damaging to business and cause chaos at ports. However, Brexiteers in the European Research Group (ERG) of Conservative MPs insist the “no-deal” option must be preserved as negotiating leverage in Brussels. Mr Percy told the BBC members of his group were becoming “tired” of the ERG’s refusal to back the prime minister. In a letter to government whips, he and co-chairman Simon Hart write: “Not only does this risk damaging the national interest, but also… we are putting in jeopardy the very thing many colleagues have spent decades campaigning for; our exit from the European Union.”

The wonders of strip-mining social programs.

• Record Surplus Gives UK Pre-Brexit Boost (G.)

Britain has recorded the biggest-ever monthly surplus in public finances since the early 1990s, putting the government on a strong footing in the run-up to Brexit, now less than 40 days away. In a rare piece of positive economic news for Philip Hammond as he prepares for his spring statement next month, income from taxes outstripped public spending by £14.9bn, the biggest January surplus since records began in 1993. Although January is typically a surplus month for the exchequer because of seasonal trends in the payment of taxes, the Office for National Statistics said last month’s surplus was £5.5bn larger than a year ago. Income and capital gains tax receipts increased by 14%, twice the average growth rate earlier in the year.

Combined, the income from self-assessed income taxes and capital gains tax receipts was £21.4bn, the highest in January since comparable records began in 2000. The data comes after several disappointing months for the chancellor, as borrowing came in worse than forecast. Government borrowing for the first 10 months of the financial year has, however, fallen almost by half, as tax receipts have been much stronger than expected. The exchequer has borrowed about £21.2bn this year so far, £18.5bn lower than at the same point a year ago, and the lowest since the 10 months to January 2001. The latest update means the government could be on track to reduce the deficit – the gap between spending and tax income – close to its target of £25.5bn set by the Office for Budget Responsibility, which is 39% less than in 2017-18.

Who in the party will defend Corbyn?

• Anti-Semitism Is Cover For A Much Deeper Divide In UK Labour Party (Cook)

The announcement by seven MPs from the UK Labour Party on Monday that they were breaking away and creating a new parliamentary faction marked the biggest internal upheaval in a British political party in nearly 40 years, when the SDP split from Labour. On Wednesday, they were joined by an eighth Labour MP, Joan Ryan, and three Conservative MPs. There are predictions more will follow. With the UK teetering on the brink of crashing out of the European Union with no deal on Brexit, the founders of the so-called Independent Group made reference to their opposition to Brexit. The chief concern cited for the split by the eight Labour MPs, though, was a supposed “anti-semitism crisis” in the party.

The breakaway faction seemingly agrees that anti-semitism has become so endemic in the party since Jeremy Corbyn became leader more than three years ago that they were left with no choice but to quit. Corbyn, it should be noted, is the first leader of a major British party to explicitly prioritise the rights of Palestinians over Israel’s continuing belligerent occupation of the Palestinian territories. Luciana Berger, a Jewish MP who has highlighted what she sees as an anti-semitism problem under Corbyn, led the charge, stating at the Independent Group’s launch that she had reached “the sickening conclusion” that Labour was “institutionally racist”. She and her allies claim she has been hounded out of the party by “anti-semitic bullying”.

[..] The timing of the defections was strange, occurring shortly after the Labour leadership revealed the findings of an investigation into complaints of anti-semitism in the party. These were the very complaints that MPs such as Berger have been citing as proof of the party’s “institutional racism”. And yet, the report decisively undercut their claims – not only of endemic anti-semitism in Labour, but of any significant problem at all. That echoed an earlier report by the Commons home affairs committee, which found there was “no reliable, empirical evidence” that Labour had more of an anti-semitism problem than any other British political party. Nonetheless, the facts seem to be playing little or no part in influencing the anti-semitism narrative. This latest report was thus almost entirely ignored by Corbyn’s opponents and by the mainstream media.

Macron gambles that he can silence the Yellow Vests with antisemitism smear.

• Macron Calls Anti-Zionism A Form Of Antisemitism (Ind.)

Emmanuel Macron has declared anti-Zionism a form of antisemitism as he ramps up France’s crackdown on racism against Jewish people. Speaking at the 34th annual dinner of the Representative Council of Jewish Institutions of France, Mr Macron said a surge in antisemitic attacks in his country had not been seen since World War Two. He promised a new law to tackle hate speech on the internet and said France would adopt the definition of antisemitism set by the International Holocaust Remembrance Alliance (IHRA). The IHRA definition does not use the phrase “anti-Zionism” but does say denying the Jewish people their right to self-determination “e.g., by claiming that the existence of a State of Israel is a racist endeavour,” is antisemitic.

Some critics of Israel, its occupation of territory internationally recognised as Palestinian, and its isolation of the Gaza Strip, say they risk being unfairly branded antisemitic, although the IHRA definition says: “criticism of Israel similar to that levelled against any other country” is not. Mr Macron’s words were well received from the World Jewish Congress which said: “This is just the beginning of a long road ahead. Adopting this definition of anti-Semitism must be followed by concrete steps to encode into law and ensure that this is enforced.”

Stop suing the banks. Sue their execs instead.

• Philadelphia Sues Seven Big Banks For Bond Collusion (RT)

The city of Philadelphia is suing Bank of America and six other major banks for conspiring to manipulate the rates of municipal bonds, illegally making millions of dollars while depriving the city of funds for public services. Pennsylvania’s largest city, with over 1.5 million residents, filed the complaint late on Wednesday in the federal court in Manhattan. The city accuses Bank of America, Barclays, Citigroup, Goldman Sachs, JP Morgan Chase, Royal Bank of Canada and Wells Fargo of colluding to manipulate rates of variable-rate demand obligations (VRDO), of which Philadelphia has issued over $1.6 billion-worth. The fees the banks collected, in violation of federal antitrust laws, have deprived Philadelphia and other jurisdictions of critical funding for public services, the lawsuit claims.

According to the court documents, the banks are already being criminally investigated by the Department of Justice’s antitrust division, while the US Securities and Exchange Commission (SEC) has contacted four of the defendants with questions about their conduct. The lawsuit claims that phone and email records will show that the banks agreed not to compete with each other for VRDO remarketing services between February 2008 and June 2016, resulting in artificially high rates and banks collecting fees “for doing, essentially, nothing.”

Similar lawsuits are already being litigated in Massachusetts, California, Illinois and New York, accusing major banks of conspiring to “robo-reset” the rates of state VRDOs without any considerations for the local markets or investor demand, violating the requirement to market and price the bonds at the lowest possible interest rates. Plaintiffs in those four lawsuits are seeking to recover over $1 billion in fees, ranging from $100 million in Massachusetts and $349 million in Illinois to $719 million in California, while the New York numbers have not been made available yet.

Some things are impossible to properly summarize in a few lines. Read the whole thing at Epoch Times.

And again: the US needs a Special Counsel for this. The FBI cannot be a state within the state.

• FBI Lawyer Reveals Infiltration In Trump Campaign (ET)

A key player in the FBI’s counterintelligence investigation of Donald Trump and his 2016 presidential campaign was Trisha Anderson, who, at the time, was the No. 2 lawyer at the agency’s Office of General Counsel. Despite having no specific experience in counterintelligence before coming to the FBI, Anderson was, in some manner, involved in virtually all of the significant events of the investigation. Anderson told members of the House Judiciary and Oversight committees in August last year during closed-door testimony that she was one of only about 10 people who had known about the Trump–Russia investigation prior to its official opening.

A transcript of Anderson’s testimony, which was reviewed for this article, reveals that she had read all of the FBI’s FD302 forms detailing information that the author of the Steele dossier, former British spy Christopher Steele, had provided to high-ranking Department of Justice (DOJ) official Bruce Ohr. Anderson also told lawmakers that she personally signed off on the original application for a warrant to spy on former Trump campaign adviser Carter Page without having read it. The FBI relied heavily on the unverified information in the Steele dossier—which was paid for by the Clinton campaign and the Democratic National Committee—to obtain the FISA warrant.

Anderson also was part of a small group of FBI personnel who got to read then-FBI Director James Comey’s memos about conversations he had with President Donald Trump. Besides the investigation into Trump, Anderson also was involved in the FBI’s investigation of Hillary Clinton for sending classified information using a private server. Anderson’s testimony reveals that she received the original referral from the inspectors general for both the State Department and Intelligence Community on Clinton after hundreds of classified emails had been found on her server. Her testimony also raises questions as to whether then-Attorney General Loretta Lynch had a conflict of interest.

Get the impressions Stone’s getting bored sitting at home.

• Judge Imposes Sweeping Gag Order On Roger Stone (MW)

A judge imposed a sweeping gag order on Roger Stone, the former political adviser to President Donald Trump, after he created an Instagram post of the judge presiding over his criminal case next to an image that appeared to show the crosshairs of a gun. Stone told the judge at a hearing Thursday he made an “egregious error.” The new gag order prevents Stone from making any public comments on the case or investigation other than to solicit funds for his legal defense. If Stone violates the new gag order, his bond will be revoked and he’ll be detained. “There will not be a third chance,” District Judge Amy Berman Jackson said.

I had no idea.

• Hungary Takes ‘Hundreds Of Venezuelan Refugees With Hungarian Ancestry’ (Ind.)

Hungary has accepted around 300 refugees from crisis-hit Venezuela, according to media reports from the country – surprising observers of its usually anti-immigration government. The refugees, who are thought to have Hungarian ancestry, are understood to have been welcomed into the country with the tacit support of the Orban administration and the help of the Hungarian Charity Service of the Order of Malta. The news has come as a surprise in the conservative central European state, given the anti-immigration stances and refugee crackdowns of premier Viktor Orban.

“We are speaking about Hungarians and we do not consider Hungarians migrants,” Mr Orban’s chief of staff, Gergely Gulyas, told a press conference in response to the report. Confirming that the programme began in April 2018, he added: “They, like any other Hungarian, have a right to return home.” A controversial law passed by the Orban government last year restricted the activities of NGOs and charities that provide assistance to migrants. The law was de facto targeted at those groups helping people arriving by land from the Middle East and Africa. The Hungarian opposition seized on the latest developments, claiming the government was acting hypocritically.

He got it back in October apparently, so no big immediate change.

And Center Alliance Senator Patrick having asked for the passport only so Julian can give himself up to the UK police doesn’t help either.

• Julian Assange Gets A New Australian Passport (SMH)

A Department of Foreign Affairs and Trade official confirmed in a Senate estimates hearing on Thursday that Mr Assange’s 2018 application for a new passport had been accepted. Consular and Crisis Management Division first assistant secretary Andrew Todd said, “Mr Assange does have an Australian passport”. [..] The department is understood to have issued Mr Assange with his new passport in October. A DFAT official at an estimate’s hearing in October said Mr Assange’s passport application had “not been rejected”. But absolute confirmation that he has actually received a new passport did not come until Thursday’s heading. DFAT officials told the estimates hearing they had no knowledge of legal proceedings against Mr Assange in the United States.

Documents show Mr Assange’s UK-based lawyer, Jennifer Robinson, applied for a new passport on his behalf in mid-2018. DFAT replied that it was of the belief that Mr Assange’s entitlement to a passport may be affected by ongoing legal proceedings in the United Kingdom. “Specifically, we understand you may be the subject of an arrest warrant in connection with a ‘serious foreign offence’ within the meaning of section 13 of the Australian Passports Act 2005,” DFAT replied. “In order to progress your application, we require confirmation that section 13 is not enlivened by your circumstances. To this end, we ask that you provide us with confirmation that section 13 no longer applies to you. Until this time, your passport application will remain on hold.”

Centre Alliance senator Rex Patrick, who has pursued Mr Assange’s right to a passport in recent estimates hearings, said that, given Mr Assange’s failing health, the best thing would be for him to leave the Ecuador embassy and face the British justice system over breaching his bail conditions. After that, he should return to Australia, Senator Patrick said.

“Nearly four in 10 children in the city have asthma, while the rate of ovarian cancer is 64% higher than the rest of Pennsylvania and lung cancer rates are 24% higher..”

• US Cities Burn Recyclables After China Bans Imports (G.)

The conscientious citizens of Philadelphia continue to put their pizza boxes, plastic bottles, yoghurt containers and other items into recycling bins. But in the past three months, half of these recyclables have been loaded on to trucks, taken to a hulking incineration facility and burned, according to the city’s government. It’s a situation being replicated across the US as cities struggle to adapt to a recent ban by China on the import of items intended for reuse. The loss of this overseas dumping ground means that plastics, paper and glass set aside for recycling by Americans is being stuffed into domestic landfills or is simply burned in vast volumes. This new reality risks an increase of plumes of toxic pollution that threaten the largely black and Latino communities who live near heavy industry and dumping sites in the US.

About 200 tons of recycling material is sent to the huge Covanta incinerator in Chester City, Pennsylvania, just outside Philadelphia, every day since China’s import ban came into practice last year, the company says. [..] Some experts worry that burning plastic recycling will create a new fog of dioxins that will worsen an already alarming health situation in Chester. Nearly four in 10 children in the city have asthma, while the rate of ovarian cancer is 64% higher than the rest of Pennsylvania and lung cancer rates are 24% higher, according to state health statistics. The dilemma with what to do with items earmarked for recycling is playing out across the US. The country generates more than 250m tons of waste a year, according to the EPA, with about a third of this recycled and composted.

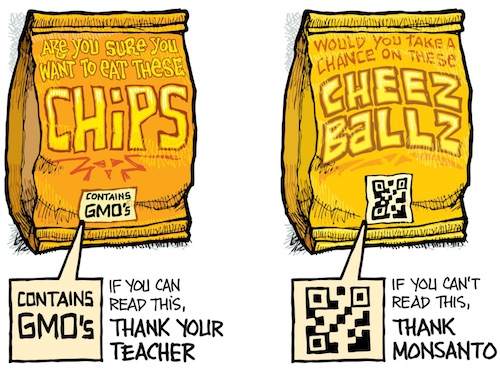

Monoculture ‘R’ Us. You add it all up, the soil is poisoned, the food is poisoned, vertebrates are disappearing, insects are going gone, and how much longer for the human species?

• World Food Supply Under ‘Severe Threat’ From Loss Of Biodiversity (G.)

The world’s capacity to produce food is being undermined by humanity’s failure to protect biodiversity, according to the first UN study of the plants, animals and micro-organisms that help to put meals on our plates. The stark warning was issued by the Food and Agriculture Organisation after scientists found evidence the natural support systems that underpin the human diet are deteriorating around the world as farms, cities and factories gobble up land and pump out chemicals. Over the last two decades, approximately 20% of the earth’s vegetated surface has become less productive, said the report, launched on Friday. It noted a “debilitating” loss of soil biodiversity, forests, grasslands, coral reefs, mangroves, seagrass beds and genetic diversity in crop and livestock species. In the oceans, a third of fishing areas are being overharvested.

Many species that are indirectly involved in food production, such as birds that eat crop pests and mangrove trees that help to purify water, are less abundant than in the past, noted the study, which collated global data, academic papers and reports by the governments of 91 countries. It found 63% of plants, 11% of birds, and 5% of fish and fungi were in decline. Pollinators, which provide essential services to three-quarters of the world’s crops, are under threat. As well as the well-documented decline of bees and other insects, the report noted that 17% of vertebrate pollinators, such as bats and birds, were threatened with extinction. Once lost, the species that are critical to our food systems cannot be recovered, it said. “This places the future of our food and the environment under severe threat.”

“The foundations of our food systems are being undermined,” wrote Graziano da Silva, the director general of the Food and Agriculture Organisation, in an introduction to the study. “Parts of the global report make sombre reading. It is deeply concerning that in so many production systems in so many countries, biodiversity for food and agriculture and the ecosystem services it provides are reported to be in decline.” Agriculture was often to blame, he said, due to land-use changes and unsustainable management practices, such as over-exploitation of the soil and a reliance on pesticides, herbicides and other agro-chemicals. Most countries said the main driver for biodiversity loss was land conversion, as forests were cut down for farm fields, and meadows covered in concrete for cities, factories and roads. Other causes include overexploitation of water supplies, pollution, over-harvesting, the spread of invasive species and climate change.