G. G. Bain Police machine gun, New York 1918

The surging yen is fixing to kill Abe(nomics).

• Surging Yen Sends Nikkei Down 3.1% Amid Pan-Asia Sell-Off (CNBC)

Asian markets were sharply lower Monday, ahead of central bank meetings in the U.S. and Japan this week and amid jitters over the upcoming referendum on whether the U.K. would remain in the EU. Japan’s Nikkei 225 tumbled 3.09%, as fresh strength in the yen pressured stocks, with major exporters selling off. Shares of Toyota, Nissan, Honda and Sony traded down between 3.18 and 3.89%. The yen strengthened against the greenback ahead of the Bank of Japan’s two-day policy meeting starting June 15. Additionally, the yen is considered a safe-haven currency and increased concerns over the risk of a Brexit may be driving funds into the currency.

The currency pair traded at 105.98 as of 12:44 p.m. HK/SIN, compared with levels around 106.80 on Friday afternoon local time. “The BOJ … will likely delay a rate cut in the meeting, favoring a coordinated event when the government releases its fiscal stimulus package in Autumn,” said Stephen Innes, a senior foreign exchange trader at OANDA Asia Pacific. “This delay will likely appreciate the yen over the short term if the BOJ remains sidelined.”

“Revenue from trading stocks in China and Hong Kong could fall 30% to 50% in the first half from a year earlier..”

• Trading Floors Go Quiet Across Asia as Equity Desks Face the Ax (BBG)

Even by the boom-bust standards of Asia’s equity business, it’s been a turbulent 12 months. At this time last year, the industry was riding high as China’s stock market soared, volumes jumped to records and some of the biggest names in finance boosted hiring. Now, turnover is shrinking at the fastest pace since at least 2006 and banks are under growing pressure to either downsize their Asian equity desks, or exit parts of the business altogether. Investors and issuers are retrenching after Chinese shares crashed, the Federal Reserve tightened monetary policy and divisive political debates from the U.S. to Britain weighed on sentiment. Revenue from trading stocks in China and Hong Kong could fall 30% to 50% in the first half from a year earlier, according to senior executives at four firms.

Equity derivatives sales in Asia are on track to drop at least 50%, while prime brokerage is down roughly 20%, two of the executives said. “Because overall revenue is down, further cuts are likely across the industry,” said Taichi Takahashi at UBS in Hong Kong. “Some second-tier players will throw in the towel because their market share is shrinking.” Revenue for the industry in Asia slumped 32% to $2.6 billion in the first quarter from a year earlier, compared with a 20% drop worldwide, according to estimates from Coalition, a banking research firm. Regional equities headcount dropped by about 300, or 6%, Coalition figures show. Turnover on Asia’s 10 biggest exchanges has declined 69% from last year’s peak in May, the deepest slump over any period of the same length since Bloomberg began tracking the data in 2006.

It’s corporate PLUS local government.

• Growing Corporate Debt a ‘Key Fault Line’ In China’s Economy: IMF (R.)

China must act quickly to address mounting corporate debt, a major source of worry about the world’s second-largest economy, a senior IMF official said on Saturday. David Lipton, first deputy managing director of the IMF, warned in a speech to a group of economists in the southern city of Shenzhen that companies’ indebtedness is a “key fault line in the Chinese economy.” “Company debt problems today can become systemic debt problems tomorrow. Systemic debt problems can lead to much lower economic growth, or a banking crisis. Or both,” Lipton said, according to a copy of his prepared remarks provided to Reuters.

China, whose economy grew in 2015 at its slowest pace in a quarter of a century, has been grappling with rising debt levels and overcapacity. Last week, the People’s Bank of China warned in its mid-year work report that the government’s push to reduce debt levels and overcapacity could increase bond default risks and make it more difficult for companies to raise funds. Lipton said corporate debt in China stands at about 145% of GDP, a high ratio. He singled out state-owned enterprises, which he said accounted for about 55% of corporate debt but only 22% of economic output, according to IMF estimates.

The EU is not all bad. Don’t let China buy your assets with monopoly money.

• Chinese State-Owned Companies Face Greater Scrutiny Of EU Deals (R.)

Chinese state-owned companies seeking to buy European assets are going to face greater regulatory scrutiny following a landmark European Commission decision on a recent deal. In its review of a proposed joint venture between France’s EDF and state-owned China General Nuclear Power (CGN), the Commission – which has exclusive power over antitrust issues in the EU – ruled that CGN was not independent from China’s central administrator for state-owned enterprises, the State-owned Assets Supervision and Administration Commission (SASAC). As a result, it decided that it did have the power to decide whether the deal should be cleared.

It meant that the Commission didn’t only consider CGN’s own revenue but the combined revenue of all Chinese energy state-owned enterprises when considering whether the deal came under its jurisdiction. This approach automatically bumped CGN’s turnover above the minimum EU threshold for merger clearance, a warning shot for other Chinese state-owned enterprises (SOEs) who may be considering buying assets in Europe and were not anticipating needing to get a regulatory green light. The Commission generally only reviews a merger if each party to it has more than €250 million in sales in the EU as well as combined global sales of more than €5 billion. CGN’s turnover, alone, didn’t cross that €250 million threshold, but the Chinese energy SOEs as a whole do breach that level.

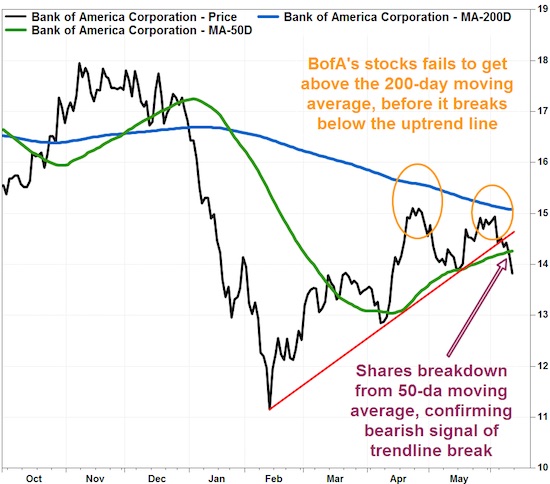

Negative rates hurt.

• Bank of America Shares Flash Bearish Signals Galore (MW)

The selloff in Bank of America stock Friday capped a week in which a number of bearish chart patterns were completed, implying potential for further declines to multi-month lows. The banking giant’s shares slumped 2.5% to close at $13.83 Friday. Volume of 89.6 million shares made them the most-actively traded on the NYSE, according to FactSet. The selloff comes as the yield on the 10-year Treasury note slumped to a three-year low of 1.639%, as part of a global bond rush that pushed yields on several government benchmarks to record lows. Lower long-term interest rates can hurt banks’ earnings, as they narrow the spread between what banks earn by funding longer-term assets, such as loans, with shorter-term liabilities.

Here are some of the bearish technical developments in BofA’s stock that have occurred this past week: • On Tuesday, the stock fell below an uptrend line, supported by three support points, that began at the Feb. 11 bottom. That suggests the short-term trend has flipped to negative. • The trendline breakdown occurred as the stock failed to get back above its 200-day moving average, which many see as a dividing line between shorter-term and longer-term trends. This indicates that the rally off the February low was just a minor bounce within a more dominant downtrend. • The stock closed Thursday below its 50-day moving average, which many use as a guide to the short-term trend. After the 50-day moving average held as support during the May pullback, the drop below it this week was a warning sign that the trendline break was for real.

Forgive me for thinking this is clear enough.

• About That US Economic Rebound… (ZH)

Following the steep drop in first quarter GDP which printed at 0.7% in the first revision, economists, strategists and pundits have once again put their collective hopes on another second-half rebound, with expectations for a Q2 rebound running high – the Atlanta Fed’s latest GDP nowcast stands at 2.5%. Unfortunately, this may once again be unwarranted. The reason: the collapse in retail spending which many had expected would be transitory and which has pressured discretionary consumer stocks in recent weeks, just refuses to go away. As we showed on Friday, both critical categories of retail sales (based on BofA credit and debit card spending data), there has been a dramatic collapse in both luxury …

… and home improvement related spending.

The math here is simple: without a strong rebound in spending, there simply can not be a strong rebound in GDP, period. Which, incidentally, is precisely what Goldman’s latest Current Activity Indicator – a real-time proxy for GDP – has found. Here is David Kostin in his latest US Weekly Kickstart: “The Goldman Sachs Economics US Current Activity Indicator (CAI) is a proxy for real-time GDP growth and the metric has slowed to 1.3%. Our economics colleagues expect GDP growth will accelerate to a 3.2% pace in 2Q and average 2.3% during 2H 2016.”

This was the lowest print in over five years. And here is why the Fed will not only not be hiking in June or July, or frankly any time soon. In fact, judging by this chart – and based on the recent collapse in global bond yields – the Fed’s next move will be to cut rates.

I’m -mostly- with David on this.

• David Stockman’s View of Trump vs. Clinton (BBG)

No, really, America’s problem is debt. And the western world’s problem is debt. And China, and Japan.

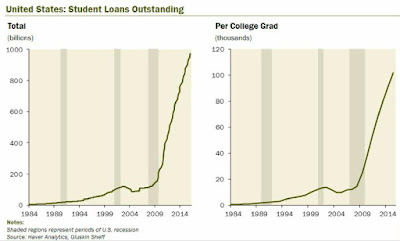

• US Student Loans Numbers Are Simply Mad (Gurdgiev)

If you like hockey stick charts, you’ll love these two covering U.S. student loans debt evolution over time:

The numbers are simply mad: total debt rose from around $100 billion ca 2006 to almost $1 trillion by the end of 2015. On a per capita of student population basis, same period rise was from around $16,000 per student to over $100,000 per student. More recent data, through May 2016 shows that average student debt is now at $133,000 and the total quantum of student loans outstanding is at over $1.2 trillion. Data from Bloomberg, through 2014, shows that Federal Government-originated student loans have increased 10-fold since 1990:

Source: Bloomberg, data from Collegeboard.org

“.. in Ferguson, Mo., the average household paid $272 in fines in 2012, and the average adult had 1.6 arrest warrants issued that year..”

• The US Has Already Reinstated Debtors’ Prisons (NY Times)

In the 1830s, the civilized world began to close debtors’ prisons, recognizing them as barbaric and also silly: The one way to ensure that citizens cannot repay debts is to lock them up. In the 21st century, the US has reinstated a broad system of debtors’ prisons, in effect making it a crime to be poor. If you don’t believe me, come with me to the county jail in Tulsa. On the day I visited, 23 people were incarcerated for failure to pay government fines and fees, including one woman imprisoned because she couldn’t pay a fine for lacking a license plate. [..] “It’s 100% true that we have debtor prisons in 2016,” says Jill Webb, a public defender. “The only reason these people are in jail is that they can’t pay their fines. “Not only that, but we’re paying $64 a day to keep them in jail — not because of what they’ve done, but because they’re poor.”

This is as unconscionable in 2016 as it was in 1830, and it is a system found across the country. In the last 25 years, as mass incarceration became increasingly costly, states and localities shifted the burden to criminal offenders with an explosion in special fees and surcharges. Here in Oklahoma, criminal defendants can be assessed 66 different kinds of fees, from a “courthouse security fee” to a “sheriff’s fee for pursuing fugitive from justice,” and even a fee for an indigent person applying for a public defender (I’m not kidding: An indigent person is actually billed for requesting a public defender, and if he or she does not pay, an arrest warrant is issued). Even the Tulsa County district attorney, Stephen Kunzweiler, thinks these fines are a ridiculous way to finance his office.

“It’s a dysfunctional system,” he says. A new book, “A Pound of Flesh,” by Alexes Harris of the University of Washington, notes that these modern debtors’ prisons now exist across America. Harris writes that in Rhode Island in 2007, 18 people were incarcerated a day, on average, for failure to pay court debt, while in Ferguson, Mo., the average household paid $272 in fines in 2012, and the average adult had 1.6 arrest warrants issued that year. “Impoverished defendants have nothing to give,” Harris says, and the result is a system that disproportionately punishes the poor and minorities, leaving them with an overhang of debt from which they can never escape.

I agree with Ambrose for once. On balance, what’s negative about the EU far outweighs the advantages.

“Brexit vote is about the supremacy of Parliament and nothing else..“ “Where we concur is that the EU as constructed is not only corrosive but ultimately dangerous..”

• Why I Am Voting To Leave The EU (AEP)

With sadness and tortured by doubts, I will cast my vote as an ordinary citizen for withdrawal from the European Union. Let there be no illusion about the trauma of Brexit. Anybody who claims that Britain can lightly disengage after 43 years enmeshed in EU affairs is a charlatan, or a dreamer, or has little contact with the realities of global finance and geopolitics. Stripped of distractions, it comes down to an elemental choice: whether to restore the full self-government of this nation, or to continue living under a higher supranational regime, ruled by a European Council that we do not elect in any meaningful sense, and that the British people can never remove, even when it persists in error. For some of us – and we do not take our cue from the Leave campaign – it has nothing to do with payments into the EU budget.

Whatever the sum, it is economically trivial, worth unfettered access to a giant market. We are deciding whether to be guided by a Commission with quasi-executive powers that operates more like the priesthood of the 13th Century papacy than a modern civil service; and whether to submit to a European Court (ECJ) that claims sweeping supremacy, with no right of appeal. It is whether you think the nation states of Europe are the only authentic fora of democracy, be it in this country, or Sweden, or the Netherlands, or France – where Nicholas Sarkozy has launched his presidential bid with an invocation of King Clovis and 1,500 years of Frankish unity. My Europhile Greek friend Yanis Varoufakis and I both agree on one central point, that today’s EU is a deformed halfway house that nobody ever wanted.

His solution is a great leap forward towards a United States of Europe with a genuine parliament holding an elected president to account. Though even he doubts his dream. “There is a virtue in heroic failure,” he said. I do not think this is remotely possible, or would be desirable if it were, but it is not on offer anyway. Six years into the eurozone crisis there is no a flicker of fiscal union: no eurobonds, no Hamiltonian redemption fund, no pooling of debt, and no budget transfers. The banking union belies its name. Germany and the creditor states have dug in their heels. Where we concur is that the EU as constructed is not only corrosive but ultimately dangerous, and that is the phase we have now reached as governing authority crumbles across Europe.

The Project bleeds the lifeblood of the national institutions, but fails to replace them with anything lovable or legitimate at a European level. It draws away charisma, and destroys it. This is how democracies die. “They are slowly drained of what makes them democratic, by a gradual process of internal decay and mounting indifference, until one suddenly notices that they have become something different, like the republican constitutions of Athens or Rome or the Italian city-states of the Renaissance,” says Lord Sumption of our Supreme Court.

Tusk driving the final nail in Cameron’s coffin?!

• EU Chief Says Getting Closer To Granting Turks Visa-Free Travel (R.)

The EU is getting closer to granting Turks visa-free travel to Europe, but talks on this will continue until at least October, EC President Donald Tusk said in an interview with German newspaper Bild published on Monday. Asked when Turks would be given visa freedom, Tusk said: “When they have fulfilled all of the conditions without exception.” He added: “The negotiations will certainly last until October but we’re getting ever closer.” The deal to give Turks visa-free travel in return for reducing the flow of illegal migrants to the bloc has been held up by a disagreement over Turkey’s anti-terror laws, which some in Europe see as too broad. Turkey says its needs the law to fight its multiple security threats. Last week Turkey said it expected a positive outcome in coming days in talks with the EU about visa-free travel for Turks.

Want to see collapse in action? Watch pension plans.

• Negative Rates Drive Major Changes At European Pension Funds (II)

In recent years European pension fund managers have been moving down the credit spectrum, wading into private markets, putting money into infrastructure and other illiquid assets; in short, doing almost anything to generate yield. But with negative interest rates strengthening their grip on Europe, many plan sponsors are realizing they can’t earn their way out of today’s dilemma. So even as they do what they can to diversify assets, pension funds are moving to curb their liabilities by limiting payouts to retirees, shifting to defined contribution-type models from defined benefit ones and taking other steps to make sure the money doesn’t run out. Consider Credit Suisse. The Zurich-based bank offers one of the more generous retirement plans in the country with the second-largest pension system in continental Europe.

But the pension fund, like most others in Switzerland, was blindsided by the Swiss National Bank’s January 2015 abandonment of its exchange rate ceiling, which sent the Swiss franc soaring and bond yields falling deeper into negative territory than anywhere in Europe. The Sf15.6 billion ($15.8 billion) fund saw its return plunge to 1.6% last year from 7.3% in 2014. Concerned that negative rates and ever-rising life spans put the financial health of the fund at risk, trustees late last year adopted a sweeping reform of the scheme that will gradually raise the retirement age, trim benefits for future retirees and shift workers with high salaries into a pure defined contribution savings plan for part of their incomes. “We do not want an underfunded situation,” says Matthias Hochrein, the plan’s chief operating officer.

In the Netherlands, which has Europe’s largest pension system by far in proportional terms, with assets worth nearly 184% of GDP, plans are also looking to tighten their belts. In recent weeks the country’s two largest plans -ABP, the €358 billion pension fund for civil servants, and PFZW, the €billion plan for health care workers- have warned that they may have to cut benefit payments to existing retirees next year because low interest rates have reduced their funding ratios to just a hair above 90%, the threshold that triggers mandatory remedial action.

Well, at least we still can for now.

• Frustrations of Telling the Truth (Paul Craig Roberts)

Some examples of the ‘abuse’ one gets when telling the truth: If I criticize the Israeli government for abusing Palestinians and stealing their country, the Israel Lobby accuses me of being an anti-semite who wants to repeat the holocaust. In the same batch of emails, anti-semites denounce me for being too easy on Israel and covering up for the Jewish conspiracy against mankind. When I write about the One Percent using the government to loot the economy, I receive emails blaming me because I worked for Reagan “who started it all by cutting tax rates for the rich.” These people have no conception of supply-side economics, its purpose, success, and the way it prepared the way for Reagan to negotiate the end of the Cold War. At one point in their lives they read a left-wing screed against Reagan, and that is the extent of their understanding. But they are full of blind hate.

When I write about Washington’s crimes against other countries, I receive emails asking me where I was during Iran-Contra and Grenada. Apparently, they think that a Treasury official can run the State Department and Pentagon. Some of the readers are so confused that they think Reagan overthrew Allende in Chile. Alllende was overthrown in 1973. Reagan was inaugurated in 1981. It is dispiriting that there actually are people this ignorant and so proud of it that they will accuse me of helping Reagan to overthrow Allende. When I point out the dangers of the reckless folly of Washington’s aggressions against Russia, China, and the independent Muslim world, superpatriots denounce me for being anti-American. There is a stratum of the US population that thinks that it is a criminal act to disbelieve the government or to question its judgment and motives. “You are with us or against us.”

When I document the death of the US Constitution and the rise of the American Police State, “law and order” conservatives admonish me that the police state only appies to terrorists and criminals and does not apply to law abiding citizens. They are convinced that Snowden and Assange are traitors, and no amount of evidence or reason can convince them otherwise. Neither can they be convinced that in the 21st century, law has become a weapon in the hands of government and no longer is a shield of the people. The Rule of Law in America is dead.

While you were looking the other way…

• Over 2,500 Migrants Rescued Off Italy Over Weekend (AFP)

More than 2,500 migrants seeking to reach Europe were rescued off the coast of Sicily over the weekend in 20 separate operations, the Italian coastguard said Sunday. Vessels from the Italian navy and coastguard took part in rescue operations, along with ships from volunteer and aid groups. Medical charity Doctors Without Borders said it had recovered one dead body from one of the migrant boats. Authorities said 1,348 migrants were picked up Saturday and 1,230 on Sunday. So far this year more than 48,000 people have been brought to the Italian coast after being pulled from boats trying to cross from Libya, according to the UN refugee agency. With the return of the good weather the rescue operations are expected to increase. For the time being the numbers arriving are similar to those seen last year and in 2014.