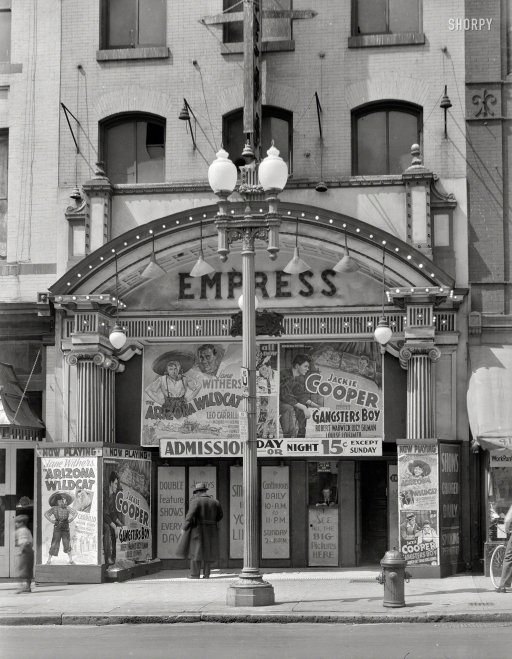

David Myers Theatre on 9th Street, Washington, DC July 1939

For me, the quote of the day is this one: “If there’s a periphery of the eurozone’s periphery, that’s Naples.”. The city of Napoli hosts ECB boss Mario Draghi and the heads of Europe’s central banks this week in some very posh former Bourbon family royal palace, and the contradictions involved couldn’t be more striking.

Napoli is home to an immense amount of poverty and misery, and the advent of the EU and the euro has done absolutely nothing to make life in the city any better. Quite the contrary. And there’s not a single thing in sight that holds any promise of alleviating the deepening Italian downfall. Therefore things can, and will, only get worse from here.

And that’s not just true for Italy, or Napoli. It’s true for all of Europe. That is not because Mario Draghi hasn’t spent enough money, or too much of it, or that he’s spent it in the wrong places. It’s because Napels is not Berlin or Frankfurt, or even Milan in the much richer north of Italy. And because Italy is not Germany, and Greece is not Finland, and trying to force all of them into one and the same economic mold can only possibly end in the poor getting poorer.

Unless there would be a massive wealth transfer from rich to poor, from north to south, but that’s never been in the cards. The intention was always to make the EU a tide to lift all boats, or even, in the wildest dreams, a boat to lift all tides. That intention has failed in dramatic fashion. But not one single one of the architects and present day leaders is ready to fess up to their failures.

Almost 15 years after the euro was introduced, the battlefields are littered with dead and wounded bodies. And the only answer that comes from Brussels is to strengthen the – financial and political – army. The only answer that comes from Brussels is that Europe, including Italy, Greece, Spain, needs more Brussels, more centralized control.

And Napoli is not the only place that can lay claim to the title “periphery of the eurozone’s periphery”. Spain and Greece have unemployment numbers just like Napoli, only for them it’s in their entire countries. All have had youth unemployment at well over 50% for years now, a sort of real life version of throwing your babies away with the bathwater. And all have regions and cities where things are much worse still.

Oh well, at least Bloomberg has a poetic headline for once:

Draghi Takes ECB to Land of Gomorrah as Naples Prays

As Europe’s central bankers gather in Naples to discuss the state of the region’s economy, the city stands as a stark warning of just how bad things can get. “If there’s a periphery of the eurozone’s periphery, that’s Naples,” said economist Riccardo Realfonzo, a former councilman of the Southern Italian city. “The gap between the debate at the Royal Palace in Capodimonte and everyday life can’t be filled with just monetary policy.”

In Naples “there is a hunger for bread and justice, hope and future, work, legality and planning,” local Catholic Archbishop Crescenzio Sepe on Sept. 19 told the faithful gathered in the city’s medieval cathedral for the ritual of the so-called miracle of San Gennaro, the patron saint.

Last year, Naples scored the highest among Italy’s main cities on the misery index, a gauge which combines unemployment and deflation. With a reading of 26.7% it stood above Greece. Much like Greece, Naples, hard hit by Italy’s longest recession on record, risked default this year after a court rejected plans to cut municipal debt of about €1 billion ($1.3 billion). [..] Naples’ 2013 gross domestic product per capita was one-third less than Italy’s average and its unemployment was more than double the national average at 25.8%.

The outlook for the future is far from rosy after Italy entered a new recession in the second quarter and the government was forced to cut the country’s growth forecast. Finance Minister Pier Carlo Padoan said yesterday 2014 GDP is seen shrinking 0.3%, compared with an April forecast of a 0.8% expansion. The government also sees GDP growing just 0.6% next year, compared with a previous estimate of 1.3%.

In that setting, or rather overseeing it from a heavily guarded and inaccessible palace, enjoying the best food and wine freshly printed money can buy, Europe’s central bank bosses are planning their next moves.

And still the only answer is more Brussels. Where Mario Draghi now wants to start buying up Greek and Cypriot junk loans, simply because that’s all they have left to sell. That’s where we stand today. We’re back to toilet paper as the only thing that represents any value.

And, you know, if a country like Spain, with 25% unemployment, can get investors to nevertheless buy its bonds with real yields below zero, maybe there is some – although doomed – logic somewhere in Draghi’s ideas. If you distort and pervert values enough so nobody knows what anything is worth anymore, and you still have all these big funds needing to roll over their ‘investments’, you have them trapped, or at least temporarily.

The question is, for how long?

European Bond Yields Go Negative

Record-low interest rates in Europe have flipped bond investing on its head. Some bond buyers, typically paid for lending out their money, have begun paying borrowers to look after their cash. In September, yields on two-year Irish government debt dipped below zero for the first time, just four years after the country needed a €67.5 billion ($85.6 billion) bailout to avert a banking-system collapse. At the height of the eurozone’s debt crisis, Ireland’s two-year bonds were yielding more than 14%.

Now, they are yielding about minus 0.01%. Yields move inversely to prices. The sharp drop in Ireland’s borrowing costs marks a rapid return of investor confidence, but the recovery is also part of a wider theme in Europe: central-bank policy pushing interest rates ever lower, and in some cases, turning bond yields negative.

[..] “We think negative yields will spread, because the impact of the ECB’s rate cut is ongoing,” said Mr. Bayliss. Yields will continue their decline as short-term debt matures and cash is reinvested, he added. “You’re going to see more countries and longer maturities in the negative-rate camp,” he said. Given that backdrop, one way investors can boost returns is by buying longer-dated bonds. Spanish government debt maturing in July 2017, for instance, yields roughly 0.5%, according to Tradeweb.

By instead lending to Spain for 10 years, yields jump to about 2%. Another way to snag higher yields is to buy riskier bonds with lower credit ratings. Ben Bennett, a credit strategist at Legal & General Investment Management, says that with investment-grade corporate bonds yielding so little the only way to get a reasonable return in Europe is by lending to junk-rated companies or by buying junior bonds that are first to take a hit if a company defaults on its debt. “This should work out fine if the ECB’s policies kick-start the European economy, but they don’t have a very successful track record in recent years,” Mr. Bennett said.

They sure don’t. And that’s not even Draghi’s fault, he’s just a clown. The entire structure of the EU is to blame. Draghi won’t be able to buy any toilet paper unless Merkel gives in. But the EU economy has now started to drag down Germany as well, so she will have to choose to protect her own people first. Which is precisely where the EU fails, that that is still possible.

In the US California can’t say screw Kansas. In the EU, that is an option. The richer nations only signed up to the project to get richer off it. The same as the poorer. Nobody ever gave any thought to what should be done is everybody got poorer, and if they did, it certainly wasn’t put into written words. So Germany CAN elect to put itself first, and try to boost its economy at the expense of Spain. And that’s what it’ll do, especially after the recent rise of anti-euro sentiments.

Sentiments that will crop up and grow in ever more places in ever stronger ways. Because there is no way to save the pan-European ideals within the settings laid out inside the EU. You can’t turn Spain into Germany overnight, for the same reason that you can’t demand the Spanish turn to beer and bratwurst from one day to the next.

There is not one reason why Europe couldn’t be a looser organization of nation states, each with their own currency if that works better for them, but still with many ties defined by those things that do indeed bind them. The thing is, France has close ties to Spain, they share the same border, and France has similar ties to Germany, but Germany and Spain don’t have those ties.

It’s much easier to resolve regional differences within a country the size of France or Spain that it is within a 28-member EU. The differences have become too overwhelming. People from Finland vote on issues in Greece, but they have no idea about those issues. While the Greeks sink into desolation:

60% Of Greeks Live At Or Below Poverty Line

Three in every five Greeks, or some 6.3 million people, were living in poverty or under the threat of poverty in 2013 due to material deprivation and unemployment, a report by Parliament’s State Budget Office showed on Thursday. Using data on household incomes and living conditions, the report – titled “Minimum Income Policies in the European Union and Greece: A Comparative Analysis” – found that “some 2.5 million people are below the threshold of relative poverty, which is set at 60% of the average household income.” It added that “3.8 million people are facing the threat of poverty due to material deprivation and unemployment,” resulting in a total of 6.3 million people.

In the medium term, Europe will fall to bits. It’s inevitable. The crumbling of the walls could only be prevented by overall increasing wealth, but the very structure of the Union doesn’t allow for that to happen. And neither does the global economy.

As for the cheap loans and the yields on peripheral sovereign bonds, the money that investors have out there will flee in a massive move to the global financial center, the US, as soon as interest rates there are raised. Which is another major reason why they indeed will be raised. Come to daddy.

And the EU will go from the lofty ideal of a peacemaker to the reality of being a cause for unrest and then war. It has already made that switch, but nobody notices yet.

Draghi Takes ECB to Land of Gomorrah as Naples Prays (Bloomberg)

As Europe’s central bankers gather in Naples to discuss the state of the region’s economy, the city stands as a stark warning of just how bad things can get. “If there’s a periphery of the eurozone’s periphery, that’s Naples,” said economist Riccardo Realfonzo, a former councilman of the Southern Italian city. “The gap between the debate at the Royal Palace in Capodimonte and everyday life can’t be filled with just monetary policy.” In Naples “there is a hunger for bread and justice, hope and future, work, legality and planning,” local Catholic Archbishop Crescenzio Sepe on Sept. 19 told the faithful gathered in the city’s medieval cathedral for the ritual of the so-called miracle of San Gennaro, the patron saint.

Last year, Naples scored the highest among Italy’s main cities on the misery index, a gauge which combines unemployment and deflation. With a reading of 26.7% it stood above Greece, according to Bloomberg calculations. Much like Greece, Naples, hard hit by Italy’s longest recession on record, risked default this year after a court rejected plans to cut municipal debt of about €1 billion ($1.3 billion). Nor do its troubles end there. Located in one of Italy’s poorest and most crime-ridden areas, Naples’ 2013 gross domestic product per capita was one-third less than Italy’s average and its unemployment was more than double the national average at 25.8%. The city is also prey to periodic garbage crises caused by overflowing landfills and saw its transport system come to a halt last year amid strikes and fuel shortages.

• European Bond Yields Go Negative (WSJ)

Record-low interest rates in Europe have flipped bond investing on its head. Some bond buyers, typically paid for lending out their money, have begun paying borrowers to look after their cash. In September, yields on two-year Irish government debt dipped below zero for the first time, just four years after the country needed a €67.5 billion ($85.6 billion) bailout to avert a banking-system collapse. At the height of the eurozone’s debt crisis, Ireland’s two-year bonds were yielding more than 14%. Now, they are yielding about minus 0.01%. Yields move inversely to prices. The sharp drop in Ireland’s borrowing costs marks a rapid return of investor confidence, but the recovery is also part of a wider theme in Europe: central-bank policy pushing interest rates ever lower, and in some cases, turning bond yields negative.

Germany, the Netherlands, Austria, Finland, Belgium and France had already seen their two-year borrowing costs drop below zero amid a move by the European Central Bank to start charging eurozone banks for keeping deposits at the ECB. That policy shift is encouraging lenders to look for cheaper ways to park their surplus cash. If “you buy short-dated Irish or French paper and pay less [than depositing at the ECB], you’re improving your net income, even if the yields are still negative,” said Jonathan Bayliss, a managing director for global government bonds at Goldman Sachs Asset Management in London. Ireland’s drop into negative territory came after the ECB on Sept. 4 cut benchmark interest rates by 0.1 percentage point to 0.05% and overnight deposit rates by the same amount to minus 0.2%, in a fresh bid to revive the region’s stalling economy. The ECB said it intends also to buy bonds backed by loans such as residential mortgages in an attempt to boost lending, potentially further weighing on yields.

Read more …

Nice image.

• Trading The Euro: A Seat On The Titanic? (CNBC)

With the European Central Bank set to meet on Thursday, currency strategists are weighing up whether to join a crowded trade and short the euro or whether to go long and get comfortable with what has been described as a “seat on the Titanic.” The common currency – shared by the 18 nations in the region – has been a one-way trip south this year with the ECB expanding its balance sheet while central banks in the U.S. and the U.K. have been looking to reverse their ultra-easy policies. The currency has depreciated 8.22% year-to-date against a greenback that has recently hit a four-year high against a basket of currencies. The euro is on course for its worst yearly drop since 2005 and September marked its biggest monthly fall since February 2013.

Ranko Berich, the head of market analysis at Monex Europe, a U.K.-based foreign exchange company, believes that the euro could be set for a major collapse. “A long position on the euro might as well be a seat on the Titanic,” he said in a note on Tuesday. Meanwhile, John Higgins, the chief markets economist at Capital Economics, has given a forecast of $1.15 for the euro by the end of 2016. “We suspect (the euro) will drop further as the monetary policies of the (Federal Reserve) and the ECB continue to diverge by more than widely envisaged,” he said in a research note late Tuesday.

Read more …

• Mario Draghi Pushes For ECB To Accept Greek And Cypriot ‘Junk’ Loans (FT)

Mario Draghi is to push the European Central Bank to buy bundles of Greek and Cypriot bank loans with “junk” ratings, in a move that is set to exacerbate tensions between Germany and the bank. Mr Draghi, ECB president, will this week unveil details of a plan to buy hundreds of billions of euros’ worth of private-sector assets – the central bank’s latest attempt to save the euro zone from economic stagnation. The ECB’s executive board will propose that existing requirements on the quality of assets accepted by the bank are relaxed to allow the euro zone’s monetary guardian to buy the safer slices of Greek and Cypriot asset backed securities, or ABS, say people familiar with the matter. Mr Draghi’s proposal is designed to make the program of buying ABS, which are bundles of loans sliced and diced into packages, as inclusive as possible.

If it is backed by the majority of members of the ECB’s governing council, the central bank would be able to buy instruments from banks of all 18 euro zone member states. However, the idea is likely to face staunch opposition in Germany, straining already tense relations between the ECB and officials in the euro zone’s largest economy. Bundesbank president Jens Weidmann, who also sits on the ECB’s policy-making governing council, has already objected to the plan to buy ABS, which he says leaves the central bank’s balance sheet too exposed to risks. Wolfgang Schäuble, Germany’s finance minister, has also voiced his opposition, saying purchases would heighten concerns about potential conflicts of interest between the ECB’s role as monetary policymaker and bank supervisor.

Read more …

Inevitable.

• Factories Slashing Prices Toughens Draghi’s Deflation Battle (Bloomberg)

Euro-area manufacturing expanded at the slowest pace in 14 months, according to today’s report. The gauge stood at 50.3 in September, just above the 50 mark that divides expansion from contraction, and below a preliminary estimate of 50.5. Euro-area factories cut prices in September by the most in more than a year and German manufacturing shrank, underlining the mounting challenge facing Mario Draghi. The European Central Bank president is on a mission to avert deflation as the euro region’s economic landscape deteriorates. Purchasing Managers’ Indexes from Markit Economics showed manufacturing activity also contracted in France, Austria and Greece, with a gauge for the 18-nation region pointing to almost stagnant output. As the euro area’s economic weakness spreads to countries in the region’s core, the ECB will face increased scrutiny tomorrow when it unveils details of an asset-purchase plan.

The fresh round of stimulus comes against a backdrop of weak inflation and stuttering growth, with geopolitical uncertainty and high unemployment weighing on confidence and demand. “ It is very hard to put any positive spin” on the data, said Howard Archer, chief European economist at IHS Global Insight in London. “Clutching at straws, the best that can be said is that it indicates that the manufacturing sector is still growing.” Euro-area manufacturing expanded at the slowest pace in 14 months, according to today’s report. The gauge stood at 50.3 in September, just above the 50 mark that divides expansion from contraction, and below a preliminary estimate of 50.5. The euro slid after the German report and extended its decline after euro-area data were published. Today’s PMI data make for a “gloomy reading,” said Chris Williamson, chief economist at Markit in London. “The weakening manufacturing sector will intensify pressure on the ECB to do more to revive the economy and no doubt strengthen calls for full-scale quantitative easing.”

A manufacturing gauge for Germany, once Europe’s export-led powerhouse economy, slid to 49.9 last month, the lowest level in 15 months, with new orders falling at the fastest pace since 2012. By contrast, factory activity in Italy returned to growth, with expansions also registered in Spain, the Netherlands and Ireland. In the euro area, new orders fell for the first time since June 2013 due to weak domestic demand and waning exports, Markit said, casting doubt on forecasts that the industry will pick up toward the end of the year. There’s “negative momentum in manufacturing activity, especially in Germany where the pace of slowdown is rather pronounced,” said Marco Valli, chief euro-area economist at UniCredit SpA in Milan. “The data flags clear downside risks to the ECB staff’s growth forecast.”

Read more …

• Germany A Fresh Source Of Weakness As Eurozone PMI Falls (MarketWatch)

Activity in the eurozone’s manufacturing sector slowed more sharply than first estimated in September, with Germany joining France in contraction, while Italy staged a surprise revival. Fresh signs that the currency area’s economy remains mired in stagnation, with manufacturers cutting prices for the first time since April, will likely add to pressure on the European Central Bank to take more dramatic stimulus measures to boost demand and inflation. The headline measure from data firm Markit’s monthly survey of purchasing managers at more than 3,000 manufacturers fell to 50.3 from 50.7 in August, an indication that activity barely increased. A reading above 50.0 for the Purchasing Managers Index indicates an expansion in activity, while a reading below that level signals a contraction. The final measure was slightly below the preliminary estimate of 50.5 released in September, and the lowest in 14 months.

In a setback for the currency area’s recovery hopes, Germany’s manufacturing sector was a fresh source of weakness, with its PMI falling to a 15-month low and indicating that activity declined — albeit very marginally. “In a sign of spreading economic malaise, Germany, Austria and Greece all joined France in reporting manufacturing downturns in September,” said Chris Williamson, Markit’s chief economist. Williamson said the surveys suggest the currency area’s “northern industrial heartland has succumbed to the various headwinds of weak demand within the euro area, falling business and consumer confidence, (and) waning exports due to the Ukraine crisis and Russian sanctions.” The surveys suggest that manufacturing activity won’t soon revive, with new orders declining for the first time in 15 months, and export orders rising at the slowest pace since July 2013.

Read more …

• Germany Fights On Two Fronts To Preserve The Eurozone (MarketWatch)

The European Court of Justice announced Sept. 22 that hearings in the case against the European Central Bank’s (ECB) bond-buying program known as Outright Monetary Transactions (OMT) will begin Oct. 14. Though the process is likely to be lengthy, with a judgment not due until mid-2015, the ruling will have serious implications for Germany’s relationship with the rest of the eurozone. The timing could hardly be worse, coming as an anti-euro party has recently been making strides in the German political scene, steadily undermining the government’s room for maneuver. The roots of the case go back to late 2011, when Italian and Spanish sovereign bond yields were following their Greek counterparts to sky-high levels as the markets showed that they had lost confidence in the eurozone’s most troubled economies’ ability to turn themselves around. By summer 2012 the situation in Europe was desperate.

Bailouts had been undertaken in Greece, Ireland and Portugal, while Italy was getting dangerously close to needing one. But Italy’s economy, and particularly its gargantuan levels of government debt, meant that it would be too big to receive similar treatment. In any event, the previous bailouts were not calming financial markets. As Spain and Italy’s bond yields lurched around the 7% mark, considered the point where default becomes inevitable, the new president of the European Central Bank, Mario Draghi, said the ECB was willing to do whatever it took to save the euro. In concert with the heads of the European governments, the ECB developed a mechanism that enables it to buy unlimited numbers of sovereign bonds to stabilize a member country, a weapon large enough to cow bond traders.

Draghi never actually had to step in because the promise of intervention in bond markets convinced investors that eurozone countries would not be allowed to default. But Draghi’s solution was not to everyone’s taste. Notable opponents included Jens Weidmann, president of the German Bundesbank. Along with many Germans, Weidmann felt the ECB was overstepping its jurisdictional boundaries, since EU treaties bar the bank from financing member states. Worse, were OMT ever actually used, it essentially would be spending German money to bail out what many Germans considered profligate Southern Europeans.

Read more …

No.

• China’s Latest Property Rescue Package: Will It Work? (CNBC)

The latest steps to rescue China’s sagging property sector are among the most high-profile yet, but don’t expect a market turnaround, economists say. Late Tuesday, the People’s Bank of China and China Banking Regulatory Commission announced measures to support housing sales and increase lending to cash-strapped property developers. “These measures are substantial enough to improve sentiment and sales on the property market,” Louis Kuijs, chief China economist at RBS wrote in a note. “[But] we do not expect this package to lead to a rapid recovery of the real estate sector… given the inventories of unsold housing and additional large volumes of housing in construction but not finished hanging over the market,” he said. New measures include granting second-home buyers that have paid off their first mortgage access to lower mortgage rates and lower down-payment requirements.

Now they’re eligible for a 30% discount on mortgage rates, an offer previously limited to first-home buyers. Down payment levels were also cut to 30% from 60-70%. In addition, banks were asked to support the funding needs of “quality” developers, increase their access to the bond market and introduce pilot programs for REITs. An acceleration in China’s property market downturn in recent months intensified concerns about slowing economic growth. New home prices fell for the fourth straight month in August, down 1.1% from the month before, after dipping 0.9% in July, according to Reuters’ calculations of figures released by the National Bureau of Statistics. Many analysts have cited the cooling property sector as a major risk for the economy. The sector accounts for about 15% of gross domestic product and is linked to some 40 industries from furniture to steel.

Read more …

And surging.

• Dollar-Yen Breaches 110 For First Time Since 2008 (CNBC)

The dollar hit a new high six-year high against the yen on Wednesday, breaching 110 for the first time since August 2008. The currency pair reached 110.08 in early Asian trading, prompting a Japanese government spokesperson to say that authorities will monitor the yen’s movement carefully. The greenback has strengthened more than 8% against the yen since early August, driven by the Federal Reserve’s tightening monetary policy and recent weakness in the Japanese economy. Japanese policymakers welcome a weaker yen, which boosts exports, but the rapid move is worrying. Japan is stuck with a chronic trade deficit; a major yen depreciation raises the cost of buying materials abroad, squeezing corporate earnings. The dollar-yen could rise slightly further, but will stabilize soon, according to Eisuke Sakakibara, former vice finance minister of Japan.

“Although Japanese economy is currently somewhat weaker than anticipated, it’s still doing fairly well,” said Sakakibara, also known as Mr Yen for his influence on Japan’s currency when he was in office from 1997 to 1999. “Continued weakness of the yen is unlikely; this is clearly the strength of the U.S. dollar. The market has already incorporated the strength of the U.S. dollar so I wouldn’t think dollar-yen will go beyond 112 or 113 – It will be in range trading between 107 and 112 in my view,” he added. There have been increasing calls for policymakers to take further action to prop up the Japanese economy, which has been hit hard by a sales tax hike introduced in April. Fresh data on Tuesday showed a mixed reading – retail sales rose 1.2% on year in August, while household spending fell an annual 4.7%. The Bank of Japan (BOJ) is due to meet next week and many analysts have penciled in a move from the central bank to ease monetary policy further. But Sakakibara believes BOJ governor Haruhiko Kuroda will reserve his ammunition for now.

Read more …

Oops.

• Japan Stunned After Massive $617 Billion “Fat Finger” Trading Error (ZH)

A few days ago, Bloomberg had a fascinating profile of the person, pardon degenerate Pachinko gambler, who goes under the name CIS, and who is the “mystery man who moves the Japanese market.” In a nutshell, CIS, a momentum day trader and living proof of survivorship bias in finance (because for every CIS who has, allegedly, made it some 999,999 have failed) has amassed a fortune that he says now exceeds 16 billion yen after having traded 1.7 trillion yen in his career, generating an after tax profit of 6 billion yen in 2013 alone. Of course, the numbers are likely wildly fabricated for pageview purposes becuase as Bloomberg itself admits, “CIS didn’t offer a complete accounting of his investing returns and his wealth for this story, and some of his claims can’t be verified.”

That said, it is indeed the case that Japan has increasingly become a cartoon market in which while days can go by without a single trade taking place in its rigged bond market, where the BOJ has soaked up all the liquidity, when it comes to equities, it has become a free for all for “Mr. Watanabes” who have never taken finance, accounting or economics, but who know all about heatmaps and chasing momentum, and as a result, in a rising market/tide environment, have all grown ridiculously rich. The problem, of course, is that what some may call a market is anything but, and has become a fragile playground for a few technicians who move massive sums of money from Point A to Point B, hoping to outsmart the few remaining others, while in the process earning the rents that the BOJ is eagerly handing out by injecting liquidity at a pace that dwarfs what the Fed did for the past 2 years.

The other problem is that it is a merely of time before everything crashes into a pile of smoldering rubble thanks to the unprecedented fragility that is now embedded in every market, although most likely in Japan first. Which leads us to what just happened in Japan when as Bloomberg reports, stock orders amounting to a whopping $617 billion (yes Bilion with a B) or more than the size of Sweden’s economy, were canceled in Japan earlier today, for reasons unknown although the early culprit is that this was one of the biggest trading errors of all time. Of course, since this trade was noted, and DKed, one can assume that a major whale was on the losing end of the trade: recall that this is precisely what happened to Goldman time and again, when some errant algo caused the firm to lose millions on several occasions in 2012 and 2013. There is one tiny difference: this time it was not Goldman, and the total amount was not a few paltry million but over half a trillion dollars!

Read more …

Creative accounting shouldn’t be this transparent.

• Fall In UK Living Standards Deeper Than Thought (Guardian)

The UK’s fall in living standards has been worse than previously thought, the TUC claimed, after new figures showed a bigger squeeze on households’ disposable incomes. The Office for National Statistics published sweeping updates to its previous estimates on the economy on Tuesday that suggested Britain recovered from the recession three-quarters sooner than initial estimates. Its move to new ways of measuring GDP put the size of the economy at 2.7% above its pre-crisis peak in 2008, compared with the previous estimate of 0.2%. But the TUC said the figures also revealed that the toll taken by years of falling real wages was greater than previously thought, as estimates of household disposable income were revised to show it further off its previous peak.

For 2013, real household disposable income per capita, described by the TUC as “the most comprehensive measure of living standards”, was 2.6% below its peak according to the latest data. It was £16,881 in 2013 down from a peak of £17,324 in 2007. On the previous figures, the measure had been 1.8% off the peak, standing at £15,764 in 2013 down from a peak of £16,060 hit in 2009.The TUC general secretary, Frances O’Grady, said: “While the size of the economy has been revised up, household incomes have been revised down. It turns out the UK’s living standards crisis is even worse than we thought.” “This is set to be the first full parliament since the second world war when the government leaves office with people’s pay packets worth less than when they came into power. There is something deeply wrong when the economy is growing, but the people who do all the work face ever shrinking pay and falling living standards.”

Read more …

Love it!

• Drugs, Hookers, New GDP Measuring Make UK Economy Look Better (Guardian)

Britain’s economy was bigger and grew faster than previously thought over the second quarter, according to official figures that measure GDP in a new way. The economy also recovered sooner than previously thought from the recession. The Office for National Statistics (ONS) said the economy expanded 0.9% over April to June as both the dominant services sector and construction enjoyed strong growth. That beat economists’ forecasts for GDP growth to hold at a previous estimate of 0.8%. But at the same time the ONS revised down the first quarter figure to 0.7% from 0.8%, leaving the estimate of year-on-year growth at 3.2%. The size of the economy was also upgraded as the ONS moved to a new European-wide way of measuring GDP and incorporated other changes.

Under the new method, illegal activities such as drug dealing and prostitution are included and other activities are accounted for differently, including research & development and military spending. Explaining the figures, the ONS said: “The new data are based on the most far-reaching set of improvements to the national accounts in the last 15 years or so.” The ONS left full-year GDP growth in 2013 unrevised at 1.7%. But it said the changes meant that UK GDP recouped lost ground from the downturn sooner than previously thought. “The new data show that during the recent downturn the economy shrank by 6.0%, rather than the 7.2% previously estimated. GDP was also estimated to have exceeded its pre-financial crisis levels in Q3 2013, three quarters sooner than previously estimated. However, overall, the average absolute quarter-on-quarter revision between 1997 and 2014 Q2 was 0.16%age points,” statisticians wrote alongside the data.

Read more …

They, too, are Wall Street banks.

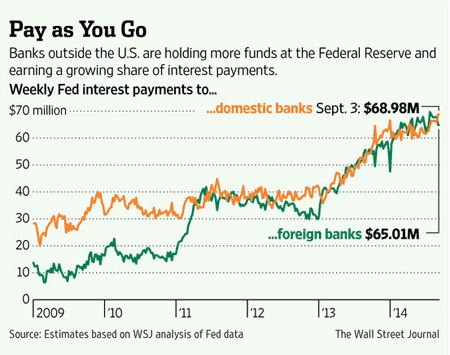

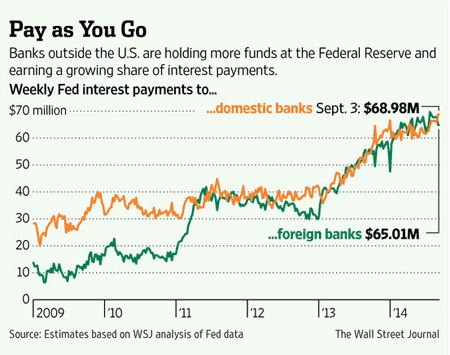

• Fed Rate Policies Aid Foreign Banks (WSJ)

Banks based outside the U.S. have been unlikely beneficiaries of the Federal Reserve’s interest-rate policies, and they are likely to keep profiting as the Fed changes the way it controls borrowing costs. Foreign firms have received nearly half of the $9.8 billion in interest the Fed has paid banks since the beginning of last year for the money, called reserves, they deposit at the U.S. central bankaccording to an analysis of Fed data by The Wall Street Journal. Those lenders control only about 17% of all bank assets in the U.S. Moreover, the Fed’s plans for raising interest rates make it likely banks will see those payments grow in coming years. Though small in relation to their overall revenues, interest payments from the Fed have been a source of virtually risk-free returns for foreign banks. Large holders of Fed reserves include Deutsche Bank, UBS, Bank of China and Bank of Tokyo-Mitsubishi, according to bank regulatory filings. U.S. banks including JP Morgan, Wells Fargo and Bank of America are also big recipients of Fed interest payments, according to the filings.

“It is a small transfer from U.S. taxpayers to foreign taxpayers,” said Joseph Gagnon, a former Fed economist at the Peterson Institute for International Economics. The transfer, he added, was a side effect of Fed policy, not a goal. Behind the payments is a complex interplay between new government regulatory policies and new methods the Fed has developed to control short-term interest rates. The Fed has pumped nearly $3 trillion into the banking system since the 2008 financial crisis, increasing banks’ reserves, in efforts to stabilize markets and boost economic growth. Since 2008, it has paid banks interest of 0.25% on those reserves. The Fed affirmed this month that the rate it pays on reserves will be the primary tool it uses to raise short-term borrowing costs from near zero when the time comes, likely next year. In part because regulatory requirements discourage domestic banks from holding more cash reserves than they need, many of the reserves created by the Fed are held by foreign banks.

In the past, the Fed influenced interest rates by increasing or reducing money in the banking system through small amounts of short-term bond trades with banks. This caused the Fed’s benchmark federal funds rate to rise or fall, influencing other borrowing costs across the economy, such as those on mortgages, credit cards and business loans. Because there is so much money in the financial system now, that old method won’t work and the Fed plans to rely primarily on adjusting the interest rate on reserves to change the fed funds rate and other borrowing costs. The interest payments totaled $4.7 billion so far this year and $5.1 billion last year, and will increase over time as the Fed raises rates. The Fed remits most of its profits to the U.S. Treasury, and the rising cost of the interest payments could put downward pressure on the amount the central bank sends to taxpayers each year, the Fed has said.

Read more …

The U.S. government is borrowing about $8 trillion a year.

• If Something Rattles This Ponzi, Life In America Will Change Overnight (MS)

I know that headline sounds completely outrageous. But it is actually true. The U.S. government is borrowing about $8 trillion a year, and you are about to see the hard numbers that prove this. When discussing the national debt, most people tend to only focus on the amount that it increases each 12 months. And as I wrote about recently, the U.S. national debt has increased by more than a trillion dollars in fiscal year 2014. But that does not count the huge amounts of U.S. Treasury securities that the federal government must redeem each year. When these debt instruments hit their maturity date, the U.S. government must pay them off. This is done by borrowing more money to pay off the previous debts. In fiscal year 2013, redemptions of U.S. Treasury securities totaled $7,546,726,000,000 and new debt totaling $8,323,949,000,000 was issued. The final numbers for fiscal year 2014 are likely to be significantly higher than that. So why does so much government debt come due each year?

Well, in recent years government officials figured out that they could save a lot of money on interest payments by borrowing over shorter time frames. For example, it costs the government far more to borrow money for 10 years than it does for 1 year. So a strategy was hatched to borrow money for very short periods of time and to keep “rolling it over” again and again and again. This strategy has indeed saved the federal government hundreds of billions of dollars in interest payments, but it has also created a situation where the federal government must borrow about $8 trillion a year just to keep up with the game. So what happens when the rest of the world decides that it does not want to loan us 8 trillion dollars a year at ultra-low interest rates? Well, the game will be over and we will be in a massive amount of trouble.

Read more …

• French Policy Stupor Sends Bearish Equity Bets Soaring (Bloomberg)

French stocks have beaten euro-area stocks for six years. Options traders are betting 2014 will be different. With a budget deficit poised to rise and economic growth running at half the region’s rate, investor sentiment on the CAC 40 Index is deteriorating. Options protecting against swings in the equity gauge cost the most since April 2013 relative to the Euro Stoxx 50 Index, data compiled by Bloomberg show. French stocks slid in the last three months, completing their first quarterly loss in more than two years. International investors are losing patience because policy measures in Europe’s second-largest economy have failed to keep up with those in Spain, Portugal or Ireland, said Yves Maillot, head of European equities for Natixis Asset Management in Paris.

“Being bearish on French stocks is definitely a sentiment story,” Maillot said by phone. “Reforms have only just begun in France and there is still so much to do.” A Bank of America Corp.’s European fund-manager survey conducted last month showed a net 38% of respondents see France as the country they most want to be underweight in the coming year, meaning they plan to own less of the shares than are represented in equity benchmarks. That’s the most in Europe. About 18% are overweight euro-area stocks, an improvement from a month earlier, the survey showed.

Read more …

• 60% Of Greeks Live At Or Below Poverty Line (Ekathimerini)

Three in every five Greeks, or some 6.3 million people, were living in poverty or under the threat of poverty in 2013 due to material deprivation and unemployment, a report by Parliament’s State Budget Office showed on Thursday. Using data on household incomes and living conditions, the report – titled “Minimum Income Policies in the European Union and Greece: A Comparative Analysis” – found that “some 2.5 million people are below the threshold of relative poverty, which is set at 60% of the average household income.” It added that “3.8 million people are facing the threat of poverty due to material deprivation and unemployment,” resulting in a total of 6.3 million people.

The State Budget Office’s economists who drafted the report argued that in contrast with other European countries “which implement programs to handle social inequalities, Greece, which faces huge phenomena of extreme poverty and social exclusion, is acting slowly.” They added that there is high demand for social assistance, while its supply by the state is “fragmented and full of administrative malfunctions.” In that context “the social safety net is inefficient, while there is no prospect for the recovery of income losses resulting from the economic recession in the near future,” the report noted, reminding readers that the measure of the minimum guaranteed income “arrived in Greece belatedly.”

Read more …

• Maybe This Is Why Carmen Segarra Drove the Fed Nuts (Bloomberg)

We’ve lost something in our human nature since – we’re guessing – the conclusion of the Second World War. Certainly since Vietnam. It’s the willingness to be firm, to say things no one wants to hear, in person. We lost the muscle that allows us to say “no” to something because it might risk upsetting someone, even if it’s the right thing to do, because people are petty and insecure, and no matter the substance of the message that goes along with “no,” it will be how you say “no” that overshadows why you say “no.” “No” means anything negative: I disagree. You are wrong. You didn’t do what you said you would. You’re late and wasted my time. This is central to why Carmen Segarra was fired from the New York Federal Reserve, the dirty laundry from it all now scattered about Wall Street’s front yard for all the neighbors to see. Beyond the other elements to the conflict that resulted in the termination of a woman who did the job she was hired to do, but didn’t do it the way Jennifer Aniston would have done it, lies human nature.

It’s now human nature to play nice. Above all, be nice. It will be referred to as being “professional” or being “collegial.” We’d always thought that risking screwing something up because of a preoccupation with hurting someone’s feelings was being unprofessional. There are those other elements that might explain why Segarra was fired besides the nice quotient, but it’s almost impossible to believe her termination had anything to do with job performance. Like most except Goldman Sachs, we hate to disagree with the New York Fed, but what Ivy League- and Sorbonne-educated international lawyer secretly records herself doing a crappy job for 46 hours? After reading the Pro Publica story and listening to the parallel radio version produced by “This American Life,” we came away asking why, exactly, someone at the New York Fed or any regulator would be afraid of, or intimidated by, the bank or industry they regulate so much that they’d sacrifice Segarra or anyone else in her position. We had to know to help us understand.

Michael Lewis knows his way around Wall Street a little, so we asked him. His column on all this hit the same day as the news. He came up with some of the other, more practical elements. “The simple answer is that it’s become standard practice for Fed employees to go to work for Wall Street firms, so the last thing they want to do is to alienate those firms and come across as people who don’t ‘get it,’” Lewis wrote to us in an e-mail. “When you ask a person making $150,000 a year to control a person making $1.5 million a year, you are asking for trouble,” he wrote. “To that, add the problem that the typical Fed regulator is in the awkward position of having to be educated about whatever the Wall Street firm has dreamed up.”

Read more …

• The Rational Complacency Of Financial Markets (Roubini)

There appear to be good reasons why global markets so far have reacted benignly to today’s geopolitical risks. What could change that? Several scenarios come to mind. First, the Middle East turmoil could affect global markets if one or more terrorist attacks were to occur in Europe or the US – a plausible development, given that several hundred Islamic State jihadis are reported to have European or US passports. Markets tend to disregard the risks of events whose probability is hard to assess, but that have a major impact on confidence when they do occur. Thus, a surprise terrorist attack could unnerve global markets. Second, markets could be incorrect in their assessment that conflicts such as that between Russia and Ukraine, or Syria’s civil war, will not escalate or spread. The Russian president Vladimir Putin’s foreign policy may become more aggressive in response to challenges to his power at home, while Syria’s ongoing meltdown is destabilising Jordan, Lebanon and Turkey.

Third, geopolitical and political tensions are more likely to trigger global contagion when a systemic factor shaping the global economy comes into play. For example, the mini-perfect storm that roiled emerging markets earlier this year – even spilling over for a while to advanced economies – occurred when political turbulence in Turkey, Thailand, and Argentina met bad news about Chinese growth. China, with its systemic importance, was the match that ignited a tinderbox of regional and local uncertainty. Today – or soon – the situation in Hong Kong, together with the news of further weakening in the Chinese economy, could trigger global financial havoc. Or the Federal Reserve could spark financial contagion by exiting zero rates sooner and faster than markets expect. Or the eurozone could relapse into recession and crisis, reviving the risk of redenomination in the event that the monetary union breaks up.

The interaction of any of these global factors with a variety of regional and local sources of geopolitical tension could be dangerously combustible. So, while global markets arguably have been rationally complacent, financial contagion cannot be ruled out. A century ago, financial markets priced in a very low probability that a major conflict would occur, blissfully ignoring the risks that led to the first world war until late in the summer of 1914. Back then, markets were poor at correctly pricing low-probability, high-impact tail risks. They still are.

Read more …

He was initially sent home with antibiotics?! WTF?

• First Ebola Case Is Diagnosed in the US (Bloomberg)

The first case of deadly Ebola diagnosed in the U.S. has been confirmed in Dallas, in a man who traveled from Liberia and arrived in the U.S. on Sept. 20, the Centers for Disease Control and Prevention said. The man is being kept in isolation in an intensive care unit. He had no symptoms when he left Liberia, then began to show signs of the disease on Sept. 24, the CDC said yesterday. He sought medical care on Sept. 26, was hospitalized two days later at Texas Health Presbyterian and is critically ill, said Thomas Frieden, director of the CDC. Frieden said the agency is working to identify anybody who had contact with the man and track them down. “There is no doubt in my mind that we will stop it here,” he said at a press conference in Atlanta.

The CDC has a team of epidemiologists on the way to Texas, he said. The team will follow anyone who has had contact with the man for 21 days. If they develop any symptoms, they’ll immediately be isolated, and public health officials will trace their contacts. The diagnosis was first confirmed by a Texas lab based on samples of the man’s blood and confirmed by the CDC. The man was traveling to the U.S. to visit family here and was staying with them. He was exposed to only a “handful” of people during the time when he had symptoms, including family members and possibly some community members, according to Frieden, who said there was little risk to anyone on a flight with the man.

Read more …

Good article.

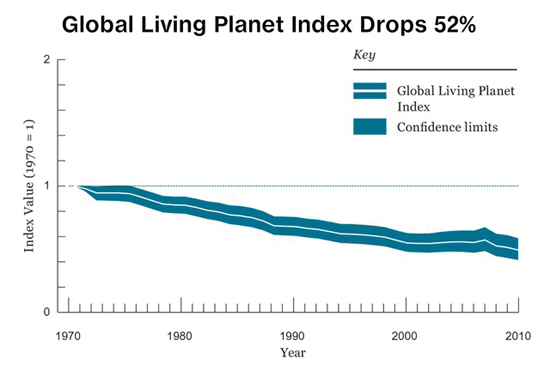

• In Less Than 2 Human Generations, 50% Of World Wildlife Is Gone (Bloomberg)

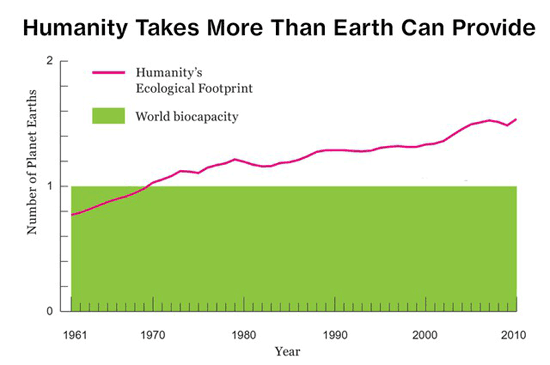

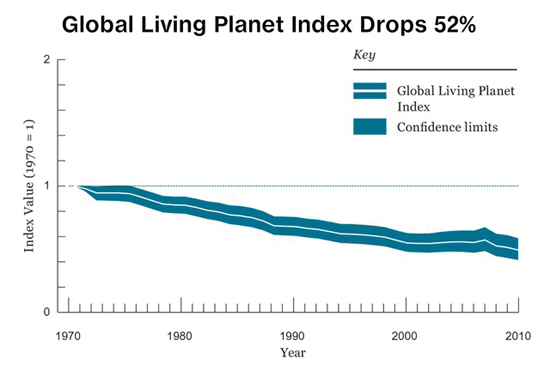

If animals were stocks, the market would be crashing. The chart below shows the performance of an index that tracks global animal populations over time, much like the S&P 500 tracks shares of the biggest U.S. companies. The Global Living Planet Index, updated today by the World Wildlife Foundation, tracks representative populations of 3,038 species of reptiles, birds, mammals, amphibians and fish. To say the index of animals is underperforming humans is an understatement. More than half of the world’s vertebrates have disappeared between 1970 and 2010. (In the same period, the human population nearly doubled.) The chart starts at 1, which represents the planet’s level of vertebrate life as of 1970.

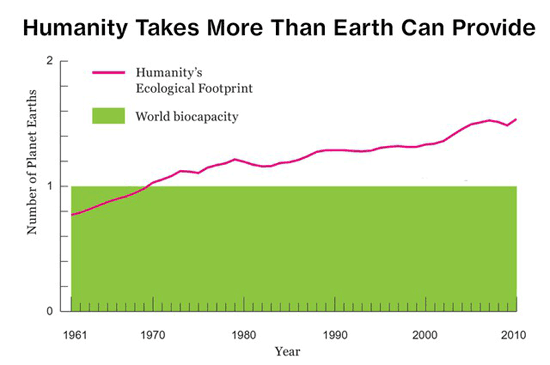

It makes sense that the WWF is framing of biodiversity loss as an index that may look more familiar to financial analysts than environmentalists. The research group’s message is as much economic as environmental: Not only do animal populations represent valuable natural systems that economies rely on, in many cases they are actual tradable goods, like stocks of wild fish. “In less than two human generations, population sizes of vertebrate species have dropped by half,” writes WWF Director General Marco Lambertini. “We ignore their decline at our own peril.” Humans are currently drawing more from natural resources than the Earth is able to provide. It would take about 1.5 planet Earths to meet the present-day demands that humanity currently makes on nature, according to the WWF. If all the people of the world had the same lifestyle as the typical American, 3.9 planet Earths would be needed to keep up with demand.

The report reads like one of the “alarm bells” U.S. President Barack Obama referenced in his climate change speech last week. Unfortunately, according to the WWF, the effects of climate change are only starting to be felt; most of the degradation of the past four decades has other causes. The biggest drivers are exploitation (think overfishing) responsible for 37% of animal population decline, habitat degradation at 31%, and habitat loss at 13%. Global warming is responsible for 7.1% of the current declines in animal populations, primarily among climate-sensitive species such as tropical amphibians. Latin American biodiversity dropped 83%, the most of any region. But the toll from climate change is on the rise, the WWF says, and the other threats to animal populations aren’t relenting. For social and economic development to continue, humans need to take better account of our resources. Because right now, life on Earth is not a bull market.

Read more …