Paul Klee Cat 1939

What you’re watching is not real.

• Dow Surges 670 Points But Stock Market Is On The Brink Of A Breakdown (MW)

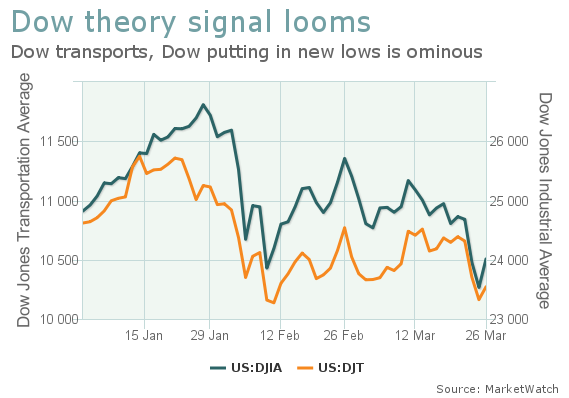

The stock market surged on Monday—and it really needed to. U.S. stocks are coming off the biggest weekly decline in more than two years, and the aftermath of that drop has market technicians warning that major indexes are on the verge of a full-fledged, technical breakdown. “The extent of the deterioration in equities is very much a concern given the combination of near-term technical damage, along with the decline in longer-term momentum after having reached record overbought conditions into late January,” wrote Mark Newton at Newton Advisors, in a Monday research note. Here are some levels that the market is trying to defend or retake after last week’s withering action:

A Dow Theory sell signal was close to forming. According to MarketWatch columnist Mark Hulbert there are a number of steps, but as of Friday, the market had just to see the Dow Jones Transportation Average close below its Feb. 9 low of 10,136.61 to trigger that sell signal after the Dow Jones Industrial Average DJIA, on Friday closed below its February low. On Monday, the transports closed up 2.1% at 10,373.21.

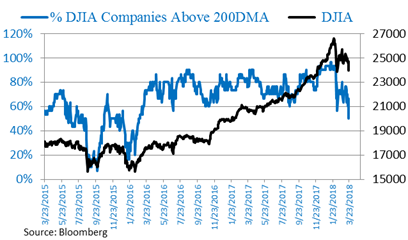

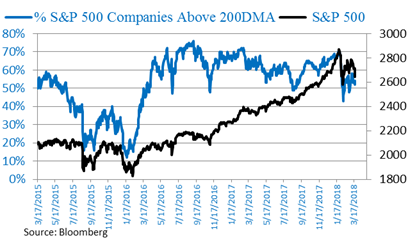

According to data from Michael O’Rourke, chief market strategist at JonesTrading, a little more than half of Dow components were trading below their 200-day moving averages, which hadn’t happened since 2015. Meanwhile, about 50% of the S&P 500 components were trading above their 200-day moving averages, with a break below indicating “notable technical damage has been done to this market,” O’Rourke wrote.

All obvious.

• Trump Sends To-Do List to China on Trade (WS)

Negotiations – led on the US side by Treasury Secretary Steven Mnuchin and US Trade Representative Robert Lighthizer, and on the Chinese side by Liu He, a newly anointed vice premier and President Xi Jinping’s top economic adviser – about how to address the gigantic China-US trade imbalance have quietly begun, the infamous “people with knowledge of the matter” told the Wall Street Journal. On Saturday, Mnuchin called Liu, which was confirmed by the Treasury Department. A spokesman said that they “also discussed the trade deficit between our two countries and committed to continuing the dialogue to find a mutually agreeable way to reduce it.” Now Mnuchin is considering a trip to Beijing to pursue the negotiations, one of these people told the Wall Street Journal.

And last week, according to these people, Mnuchin and Lighthizer sent Liu a to-do list on trade with specific items the White House wants China to undertake, including:

• A reduction of the 25% tariffs that China imposes on US-made cars

• Increased purchases by China of US-made semiconductors. China would need to shift these purchases from Japanese and South Korean manufacturers, which aren’t going to be happy

• Reduce subsidies to state-owned enterprises

• Provide more regulatory transparency

• Ease restrictions on US companies in China, particularly requirements that they operate as joint ventures in which the US company’s ownership may be limited to 51%

• Giving US financial firms greater access to the Chinese market.Clearly, in leaking these negotiations and the existence of this to-do list to the financial press, the White House is hoping to calm the markets, because the last thing it wants is to preside over a stock market plunge, though the stock market has all the best reasons to swoon, and the US-China trade situation isn’t needed to accomplish that.

“Trump’s new War Cabinet of John Bolton, Mike Pompeo, Gina Haspel and Mad Dog Mattis is arguably the most interventionist, militarist, confrontationist and bellicose national security team ever..”

• America’s State Wreck Gathers Steam Part 2 (Stockman)

Last week the Donald’s incipient trade war got Wall Street’s nerves jangling, but that wasn’t the half of what’s coming. To wit, Trump has now essentially formed a War Cabinet and signed a Horribus spending bill that is a warrant for fiscal meltdown. Indeed, the two essentially comprise a self-fueling doom loop which means Washington’s descent into fiscal catastrophe is well-nigh unstoppable; it’s all over except for the screaming in the bond pits. That is, Trump’s new War Cabinet of John Bolton, Mike Pompeo, Gina Haspel and Mad Dog Mattis is arguably the most interventionist, militarist, confrontationist and bellicose national security team ever assembled by a sitting President.

We cannot think of a single country that has even looked cross-eyed at Washington in recent years where one or all four of them has not threatened to drone, bomb, invade or decapitate its current ruling regime. That means Imperial Washington’s rampant War Fever owing to the Dem-left declaration of war on Russia and Putin is now about to be drastically intensified by the complete victory of the neocon-right in the Trump Administration. The result will be sharpened confrontation, if not actual outbreak of hostilities, across the full spectrum of adversaries – Iran, Russia, China, Syria and North Korea – and an escalating tempo of military operations and procurement to implement the policy.

At the same time, the Donald’s pathetic Fake Veto maneuver on Friday cemented the special interest lobbies’ absolute control over domestic appropriations. Of course, Chuckles Schumer and Nancy Pelosi crowed loudly about the $63 billion annual domestic spending increase they got in return for the Donald’s $80 billion defense add-on, but the victory was not partisan; it belonged to the Swamp creatures who suckle the politicians of both parties and own the appropriations committees lock, stock and barrel.

TV was just a first step in creating opinions from scratch. We can do much more than that now. Will we still curtail Facebook, Google?

• Integrity Has Vanished From The West (Paul Craig Roberts)

Among Western political leaders there is not an ounce of integrity or morality. The Western print and TV media is dishonest and corrupt beyond repair. Yet the Russian government persists in its fantasy of “working with Russia’s Western partners.” The only way Russia can work with crooks is to become a crook. Is that what the Russian government wants? Finian Cunningham notes the absurdity in the political and media uproar over Trump (belatedly) telephoning Putin to congratulate him on his reelection with 77% of the vote, a show of public approval that no Western political leader could possibly attain. The crazed US senator from Arizona called the person with the largest majority vote of our time “a dictator.” Yet a real blood-soaked dictator from Saudi Arabia is feted at the White House and fawned over by the president of the United States.

The Western politicians and presstitutes are morally outraged over an alleged poisoning, unsupported by any evidence, of a former spy of no consequence on orders by the president of Russia himself. These kind of insane insults thrown at the leader of the world’s most powerful military nation—and Russia is a nation, unlike the mongrel Western countries—raise the chances of nuclear Armageddon beyond the risks during the 20th century’s Cold War. The insane fools making these unsupported accusations show total disregard for all life on earth. Yet they regard themselves as the salt of the earth and as “exceptional, indispensable” people.

Think about the alleged poisoning of Skirpal by Russia. What can this be other than an orchestrated effort to demonize the president of Russia? How can the West be so outraged over the death of a former double-agent, that is, a deceptive person, and completely indifferent to the millions of peoples destroyed by the West in the 21st century alone. Where is the outrage among Western peoples over the massive deaths for which the West, acting through its Saudi agent, is responsible in Yemen? Where is the Western outrage among Western peoples over the deaths in Syria? The deaths in Libya, in Somalia, Pakistan, Ukraine, Afghanistan? Where is the outrage in the West over the constant Western interference in the internal affairs of other countries? How many times has Washington overthrown a democratically-elected government in Honduras and reinstalled a Washington puppet?

The corruption in the West extends beyond politicians, presstitutes, and an insouciant public to experts. When the ridiculous Condi Rice, national security adviser to president George W. Bush, spoke of Saddam Hussein’s non-existent weapons of mass destruction sending up a nuclear cloud over an American city, experts did not laugh her out of court. The chance of any such event was precisely zero and every expert knew it, but the corrupt experts held their tongues. If they spoke the truth, they knew that they would not get on TV, would not get a government grant, would be out of the running for a government appointment. So they accepted the absurd lie designed to justify an American invasion that destroyed a country.

Diplomats are stationed abroad to make communication possible. This does not help.

• Western Allies Expel Scores Of Russian Diplomats Over Skripal Attack (G.)

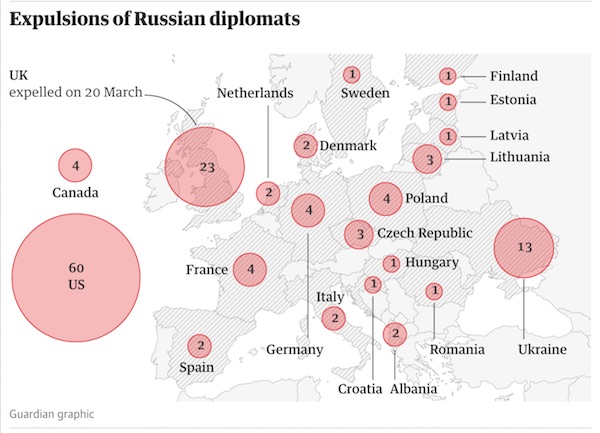

The US has ordered the expulsion of 60 Russian officials who Washington says are spies, including a dozen based at the United Nations, and told Moscow to shut down its consulate in Seattle, which would end Russian diplomatic representation on the west coast. The EU members Germany, France and Poland are each to expel four Russian diplomats with intelligence agency backgrounds. Lithuania and the Czech Republic said they would expel three, and Denmark, Italy and the Netherlands two each. Estonia, Latvia, Croatia, Finland, Hungary, Sweden and Romania each expelled one Russian. Iceland announced it would not be sending officials to the World Cup in Russia.

Ukraine, which is not an EU member, is to expel 13 Russian diplomats, while Albania, an EU candidate member, ordered the departure of two Russians from the embassy in Tirana. Macedonia, another EU candidate, expelled one Russian official. Canada announced it was expelling four diplomatic staff serving in Ottawa and Montreal who the Canadian government said were spies. A pending application from Moscow for three more diplomatic posts in Canada is being denied. Australia confirmed that it too would expel two Russian diplomats who were in the country as undeclared intelligence officers, giving them seven days to leave.

Someone will find some for them.

• New Zealand Says It Would Expel Russian Spies … But It Can’t Find Any (G.)

New Zealand’s prime minister, Jacinda Ardern, and foreign affairs minister, Winston Peters, say they would expel Russian spies from the country, if there were any. More than 100 Russian diplomats alleged to be spies in western countries have been told to return to Moscow, in response to the use of a chemical weapon in the attempted murder of Sergei Skripal, a former Russia/UK double agent, and his daughter, Yulia, in Salisbury, England on 4 March. The New Zealand government has condemned the attack and supports the international action, but says there are no such “Russian intelligence agents” in the country.

The Russian ambassador to New Zealand was summoned to a meeting “to reiterate our serious concern” over the Salisbury attack. “While other countries have announced they are expelling undeclared Russian intelligence agents, officials have advised there are no individuals here in New Zealand who fit this profile. If there were, we would have already taken action,” said Ardern. She said New Zealand will review what further action it can take to support the international community over the attack. “We remain steadfast with our international partners in our shared concern about the Salisbury nerve agent attack,” Ardern said.

There are tw0 such whistleblowers now. Here’s no. 1:

• Whistleblower Questions Brexit Result, Says Campaigners Broke Election Law (R.)

A whistleblower at the heart of a Facebook data scandal on Monday questioned the result of Britain’s 2016 Brexit referendum as his lawyers presented evidence that they said showed the main campaign for leaving the EU had broken the law. With just a year until Britain is due to leave the European Union, two whistleblowers – one from the British political consultancy Cambridge Analytica and one from the Vote Leave group – have alleged that Brexit campaigners funded their campaign illegally. By doing so, they have pulled Brexit into a scandal that has forced Mark Zuckerberg to apologise for how Facebook handled users’ data, and raised questions about how Donald Trump’s 2016 campaign employed data.

Vote Leave officials on Monday denied breaking election rules and said they were facing an attempt to undermine Brexit by smearing their reputations. The whistleblowers’ law firm, London-based Bindmans, released 53 pages of selected evidence on Monday. In a legal opinion, Bindmans said there was a prima facie case that Vote Leave broke election spending limits by donating to an allied group known as BeLeave, with which it was working closely.

And this is no. 2:

• Brexit Referendum Campaign Accused of Breaking Spending Rules (BBG)

Campaigners for Brexit may have conspired to break spending limits in the U.K.’s 2016 referendum on European Union membership, according to allegations by a whistle-blower who worked for one of the Leave groups. Vote Leave, the main pro-Brexit campaign, gave money to a smaller campaign group, BeLeave, and then helped direct how it was spent, according to a 50-page legal opinion by attorneys from London’s Matrix Chambers. The lawyer are acting on behalf of people who flagged potential violations in the campaign.

If that 625,000-pound ($889,000) donation had been included in Vote Leave’s accounts, it would have taken the group over its 7 million-pound spending limit. “It’s important that it’s the will of the people and not the bought will of the people that is expressed at the ballot box,” Tamsin Allen told reporters at a briefing Monday afternoon in London. Allen is a lawyer for Shahmir Sanni, a BeLeave campaigner who argues the rules were broken.

No. 2 was outed as gay by his own government as revenge for being a whistleblower. His family in Pakistan has hired security.

• Theresa May Stands By Adviser Who Outed Brexit Whistleblower (G.)

Theresa May has insisted her political secretary, Stephen Parkinson, “does a very good job”, as he faces mounting pressure over the outing of the Brexit whistleblower Shahmir Sanni. Sanni said he had endured one of the “most awful weekends” of his life after telling the Observer how Vote Leave channelled money through BeLeave, a group linked to Cambridge Analytica, to get around electoral law. On Friday Sanni was outed as gay by Parkinson, one of May’s closest advisers and a former Vote Leave official, with whom Sanni had a relationship during the campaign. Privately, some Conservative MPs believe Parkinson should stand down. “He’ll have to go,” said one backbencher.

The Labour MP Ben Bradshaw challenged the prime minister in the House of Commons on Monday about what Downing Street said was a “personal statement” by Parkinson. “How is it remotely acceptable that when a young whistleblower exposes compelling evidence of law-breaking by the leave campaign, implicating staff at No 10, one of those named instead of addressing the allegations issues an officially sanctioned statement outing the whistleblower as gay and thereby putting his family in Pakistan in danger?” he said. “It’s a disgrace, prime minister, you need to do something about it.”

As sure as death and taxes.

• Underfunded Public Pensions To Persist (R.)

Investment returns have been uneven and funding levels have yet to recover. Many pension funds have meanwhile attempted to boost returns by loading up on alternative investments to levels unheard of a decade earlier. “Some just cannot grow their way out of it. We have had several years of stellar (stock market) returns and it barely improved the underfunding situation,” said Mikhail Foux, municipal credit analyst at Barclays in New York. The benchmark S&P 500 U.S. stock index has tripled in the past nine years, driven in part by unprecedented zero interest rate policies and massive monetary stimulus from central banks around the globe aimed at combating the deepest recession in a generation.

But pension returns struggled to match the broad market, and recent wobbles in U.S. equities have fed fears of another downturn. “Now what happens when markets are falling 10 to 15%?” Foux asked. In 2007, a year before the crisis began, the median funded level was 92% for state retirement and 97% for local plans, according to Wilshire Funding Studies. That fell to 68% for states and 72% for local governments by 2016, the most recent data. A lower funded ratio indicates the overall soundness of a pension fund is weaker and more money is required to meet future obligations.

Best description yet of Stormy. Big announcements and an empty interview. Presidents showing their virility makes them more popular, not less. Ask France.

• Hood Ornament Buffer (Jim Kunstler)

Newsflash: President Donald J. Trump had sex with a whore twelve years ago. Let that sink into your limbic lobes, you poor, opiated, Facebook-addled, morbidly-obese, fly-over nation of lumbering, deplorable, gun-gripping, Jesus-haunted voters. A hoor! Do you hear? Wait a minute, you say. Stormy Daniels is no such thing, She’s an actress in, and director of, adult films, an auteur, if you like, at least a sex worker, toiling in the rolling mills of eros, sweating and grunting as much as any Mahoning Valley steel worker, or hood ornament buffer on the Tesla assembly line. And anyway, three times over the years she denied having sex with that man, at least once in writing, though last night on CBS’s Sixty Minutes she stated that she actually did have sex with the Golden Golem of Greatness.

In which case, she may be some kind of a lyin’ hoor… or savior of a nation yearning to cast off the loathsome rule of this odious president-by-mistake. The Sixty Minutes make-up and costume crew knocked themselves out coming up with her on-camera look Sunday night: WalMart Shopper. That reddish blouse, for instance, which did not display Stormy’s… er… assets in the usual way (i.e., an enticing fleshy slot descending into deep milky realms of mystery), but just innocently swimming around in there like a couple of frolicking dolphins confined in an above-the-ground backyard pool. Who wouldn’t want to jump in and swim with them? Maybe not the undistractible Anderson Cooper, who did ferret out many interesting particulars of that one romantic encounter: Stormy accepted Trump’s invitation for dinner… in his hotel suite. Just the two of them, ahem.

They watched a TV show about sharks. It apparently lacked aphrodisiac punch. So he showed her a magazine with his picture on the cover, perhaps to get the point across that he was a really important person in case she didn’t already know. She said she ought to take it and spank him with it. He concurred, dropped trou, and presented the rear of his tighty-whitey small-clothes to facilitate that proposal. After that ice-breaker, he said, “I really like you!” and “You remind me of my daughter” — instantly be-sliming the proceedings with overtones of incest. Stormy went to the bathroom and emerged to find Trump perched on the bed. “Here we go,” the thought popped into her head, she says. But she didn’t say “no.”

Not going to happen. Paris was just meant to make you feel good.

• Meeting Paris Agreement Targets Will Take Massive Cuts in Emissions (BBG)

Meeting the Paris accord’s temperature targets will take massive cuts to greenhouse gas emissions within 15 years, but won’t require them to be reduced to zero, according to a new study published Monday in the journal Nature Climate Change. If those targets—between 1.5 to 2ºC (2.7 to 3.6ºF)—are overshot, the consequences would likely require both drastic cuts to emissions and geoengineering efforts to remove carbon from the atmosphere, according to the paper by Katsumasa Tanaka at the National Institute for Environmental Studies in Japan and Brian O’Neill at the U.S. National Center for Atmospheric Research. “If we overshoot the temperature target, we do have to reduce emissions to zero. But that won’t be enough,” Tanaka said in a statement.

“We’ll have to go further and make emissions significantly negative to bring temperatures back down to the target by the end of the century.” Tanaka’s team began looking at both the accord’s temperature goals and requirement that countries “achieve net-zero greenhouse gas emissions in the second half of this century,” according to the statement. The scientists created scenarios that would achieve both the temperature goals and emissions guidelines. The group concluded to do so would necessitate cutting emissions 80% by 2033 to meet the 1.5 degree target or about 66% by 2060 to meet the 2 degree mark. “In both these cases, emissions could then flatten out without ever falling to zero,” according to the statement.

[..] The United Nation’s Intergovernmental Panel on Climate Change is working on a report which is expected to conclude that geoengineering will be needed to meet the 1.5 degree goal. Recognizing this difficulty, Tanaka and O’Neill looked at the possibility the targets would be missed. If the 1.5-degree mark is missed, emissions would have to fall to zero by 2070 and then be negative for the rest of the century. In the 2-degree scenario emissions would have to drop to zero by 2085 and then stay negative for a shorter period of time to get back below 2 degrees. Both scenarios would require removing carbon from that atmosphere. The researchers also looked at scenarios reducing emissions to zero by 2060 and 2100. In the first case, the temperature rose 2 degrees before declining. In the second instance, it rose above that mark by 2043 and stayed there for 100 years or more.

Yes, of course. We’ll cover the ocean in plastic, just as we do our food. And then ourselves.

• Ultra-Thin Sun Shield Could Protect Great Barrier Reef (AFP)

An ultra-fine biodegradable film some 50,000 times thinner than a human hair could be enlisted to protect the Great Barrier Reef from environmental degradation, researchers said Tuesday. The World Heritage-listed site, which attracts millions of tourists each year, is reeling from significant bouts of coral bleaching due to warming sea temperatures linked to climate change. Scientists from the Australian Institute of Marine Biology have been buoyed by test results of a floating “sun shield” made of calcium carbonate that has been shown to protect the reef from the effects of bleaching. “It’s designed to sit on the surface of the water above the corals, rather than directly on the corals, to provide an effective barrier against the sun,” Great Barrier Reef Foundation managing director Anna Marsden said.

The trials on seven different coral types found that the protective layer decreased bleaching of most species, cutting off sunlight by up to 30 percent. “It (the project) created an opportunity to test the idea that by reducing the amount of sunlight from reaching the corals in the first place, we can prevent them from becoming stressed which leads to bleaching,” Marsden said. Researchers from a breadth of disciplines contributed to the project, which was headed by the scientist who developed the country’s polymer bank notes. “In this case, we had chemical engineers and experts in polymer science working with marine ecologists and coral experts to bring this innovation to life,” Marsden said.

Yeah, just great. The entire deterioration process of teh planet is fast accelerating.

• Brazil Senate Considers Lifting Ban On Sugarcane Production In Amazon (G.)

A bill being rushed through Brazil’s senate would lift a ban on the cultivation of sugarcane for ethanol fuel in the Amazon, driving more deforestation and making it harder for the country to meet its commitments under the Paris Climate Deal. The bill, which has been roundly condemned by environmentalists, companies and even Brazil’s union of sugarcane producers (UNICA), marks the latest move by a conservative congress to unravel Amazon protections. Five former environment ministers have also criticised it. “This is another setback that should not thrive,” said one, José Carvalho. Under a 2009 decree, sugar cane production is not allowed in the Amazon biome.

Allowing the highly-profitable crop to be raised on deforested land in the region would push out other crops and encourage more deforestation, said Marcio Astrini, public policy coordinator for Greenpeace in Brazil. It could be “one of the biggest disasters for the forest,” he said. The bill was first introduced in 2011 by Flexa Ribeiro, a senator for the centre-right Brazilian Social Democratic party in the Amazon state of Pará, and suddenly put up for a vote on Tuesday afternoon. It would allow ethanol production on vaguely-defined areas of Amazon land, including “altered areas” and “general land”. If approved on Tuesday and given presidential sanction, it could become law. Brazil’s ethanol fuel is seen as a clean fuel alternative to gasoline by millions of motorists. According to UNICA, 27m cars in Brazil, 73% of the total can use either gasoline or ethanol, as can 4m motorbikes.