NPC Shad fishing on the Potomac 1920

It’s not just the next bubble in line: each bubble is crazier than the one before.

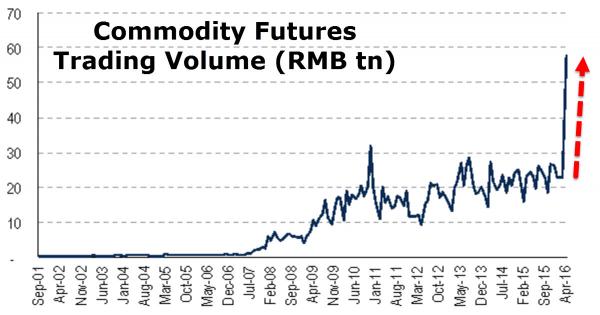

• China’s Commodity Futures Bubble Insanity (ZH)

The credit-fueled speculative bubble in China’s commodity market, as we detailed previously, exploded this week as the mainstream slowly comes to realize that the gains in industrial metals are not a “sign of strength in China’s and the world’s economic recovery” but merely the next rotation of fast-money slooshing from Chinese equities to Chinese corporate bonds to Chinese real estate and now to Chinese commodity futures… Trading in futures on everything from steel reinforcement bars and hot-rolled coils to cotton and polyvinyl chloride has soared this week, prompting exchanges in Shanghai, Dalian and Zhengzhou to boost fees or issue warnings to investors. Deutsche Bank details the total crazinesss…

The onshore China commodity markets this week traded (conservatively) $350bn notional, a 17x increase on the $20bn notional that traded on Feb 1st 2016 i.e. a month ago (is it coincidence that the notional is about the same as at the peak of the equity frenzy?).

My calculations are pretty basic; I’ve trawled the screens and chosen 32 commodities in agri, metals and coke/coal and done a quick (contracts x value)/CNY for a dollar amount. I have not used the largest day’s volume either (e.g. Deformed Bar, RBTA has traded close to $100bn, but I used closer to $60bn). Cotton (VVA Comdty) has been trading $15bn, up from $500mm in Feb. In the US, the long established cotton contract (CT1 Comdty) trades $600mm. China listed Sugar (CBA Comdty) has traded $14bn versus the US listed sugar beet at $850mm.

This is what insanity looks like!!

Deflation=slowing consumer spending=lower money velocity. Simple. But the only answer they can come up with is “We need some warm weather…”

• Where Have All Britain’s Shoppers Gone? (Observer)

Shopping is the national pastime. High streets, malls and retail parks have long been places people went for a day out, rather than on a mission to buy a particular item, and their spending helped lift the country out of recession. But a big drop in footfall – the number of people visiting high street and retail centres – over the past year has exposed fresh cracks in the high street, leaving retail chiefs wondering where all their customers have gone. Analysts are reporting declines in the number of shopper visits to high streets and shopping centres around the country of as much as 10% in some cities over the past year. Worries about the economic outlook, coupled with the rise of internet shopping, jitters about the EU referendum and more spending on eating out and leisure leave little cash left over for splurging in the shops.

“There is a lot of nervousness around [among retailers],” says Tim Denison, retail analyst at Ipsos Retail Performance. “People have had more disposable income but retailers have not been as successful as they could have been in taking their share. Instead any spare money has gone on leisure and holidays rather than pure retail spend.” According to Ipsos’s retail traffic index, overall footfall was down 0.9% in the first quarter of 2016 compared with the same period a year ago. But that headline masks the fact that some towns and cities are faring much worse than the national picture would suggest. The Ipsos data singles out Newcastle upon Tyne as the worst performer, with shopper numbers down a hefty 9.95% over the past year, closely followed by Stoke-on-Trent, down 8.1%. Other pockets of particular weakness were Chelmsford, Lincoln and Cambridge.

By comparison Ashford in Kent, Crawley in West Sussex and Epsom in Surrey were among the best-performing retail centres – the result, according to Denison, of wealth radiating out from London. Even in those towns, however, growth is not exactly rampant. Five of the top seven best-performing shopping centres were up less than 1% year on year. A number of retail chains have already blamed poor performance on declining numbers of shoppers. Poundland has pointed directly to the fact there are fewer people on the high street as a key reason behind its slowing sales. Last week value fashion retailer Primark revealed its first drop in UK underlying sales for 12 years, although boss George Weston said it was not yet time to press the panic button, given that chilly spring weather had weighed on all sales for all fashion retailers. “We need some warm weather and then we will know if there is a real problem on the high street,” he said.

“..the labor participation rate has fallen from a high of 67.3% in 2000 to 62.6% today. That 62.2% represents a 38-year low, which puts Bloomberg’s claim of a 42-year-low in joblessness in perspective.”

• Why America’s Impressive 5% Unemployment Rate Still Feels Like A Lie (Qz)

On Apr. 14, Bloomberg News announced that jobless claims in the US have reached their lowest level since 1973. “All other labor market data are telling us that the economy is creating a lot of jobs,” economist Patrick Newport told the outlet. “This is further confirmation that the labor market is strong.” That same day, thousands of fast food workers, airport workers, home care workers, and adjunct professors took to the streets across the country to protest brutal labor conditions and demand a $15 minimum wage. Most of these workers make far below $15 per hour. Some make as low as $7.25 per hour, the current federal minimum wage. Most lack benefits. Some, like adjunct professors, have contingent, temporary jobs, sometimes consisting of only one poorly paid course per year.

Many low-wage employees work two or even three jobs in an attempt to cobble together enough income to cover basic needs. According to the US Bureau of Labor, all of these workers are considered “employed.” They are viewed as part of the American economy’s success story, a big part of which is our 5% unemployment rate. As president Barack Obama boasted in February: “The United States of America right now has the strongest, most durable economy in the world.” Obama’s claims of a strong economy ring hollow for the many thousands of workers who say they cannot make enough to survive. But Obama’s claims of a strong economy ring hollow for the many thousands of workers—in professions ranging from those which require a GED to those which require a PhD—who say they cannot make enough money to survive.

And these people, at least, are working. Those who cannot find work at all tell an even grimmer story.] There are three main reasons the vaunted economic recovery still feels false to so many. The first is the labor participation rate, which plunged at the start of the Great Recession and discounts the millions of Americans who have been out of work for six months or more. The second is “the 1099 economy,” a term The New Republic’s David Dayen coined to refer to the soaring number of temps, contractors, freelancers, and other often involuntarily self-employed workers. The third is a surge in low-wage service jobs, coupled with a corresponding decrease in middle-class jobs.

Employment statistics in particular have a habit of eclipsing the real story. As any worker will tell you, it is not the number of jobs that matters most, but what kind of jobs are available, what they pay, and how that pay measures against the cost of living. The 5% unemployment rate, other words, is hiding the devastating story of underemployment, wage loss, and precariousness that defines life for millions of Americans. Since 2008, the labor participation rate has fallen from a high of 67.3% in 2000 to 62.6% today. That 62.2% represents a 38-year low, which puts Bloomberg’s claim of a 42-year-low in joblessness in perspective. The jobless number is “low” only because more people are no longer considered to be participating in the workforce.

“..the visage of an old age colony being hurtled toward the edge of a debt cliff by central bankers who have taken leave of their faculties does not bring the idea of economic recovery and growth immediately to mind.”

• The Lemmings Of Wall Street (Stockman)

I mistakenly took Squawk Box off mute this morning. It was just in time to hear one of the regular anchors – the one who makes Joe Kernen sound slightly insightful by comparison – forecast a pick-up in global growth on the grounds that “China is recovering”. Yes, the credit intoxicated land of the Red Ponzi just tied one on for the record books. During Q1 it generated new debt at a madcap annual rate of $4 trillion or nearly 40% of GDP. And that incendiary deposit of more unpayable debt, which came on top of the $30 trillion already smothering history’s greatest construction site and open air gambling den, did indeed goose China’s real estate prices, state company CapEx, infrastructure building and steel production. Call it fiat growth because even pyramid building adds to stated GDP, at first.

Even then, the overwhelming share of this explosion of new credit went to pay interest on the existing mountain of IOUs. Charles Ponzi could never have imagined a scam so audacious. Nor are the red suzerains of Beijing unique in the headlong dash toward the financial cliff. Except for the nicety that Japan’s 30-year and 40-year bonds are trading at a microscopic fraction this side of zero (0.3%), Kuroda and his tiny band of mad men at the BOJ have driven the entirety of Japan’s monumental public debt – which is now actually measured in the quadrillions of yen – into the netherworld of negative yield. Needless to say, the visage of an old age colony being hurtled toward the edge of a debt cliff by central bankers who have taken leave of their faculties does not bring the idea of economic recovery and growth immediately to mind.

The same can be said for the ECB’s $90 billion per month bond buying bacchanalia. Having made German bunds so scarce as to have eviscerated any semblance of yield and turned Italy’s sovereign junk into super-bluechips, the ECB will soon be slurping up the corporate bonds of any global company that can fog a BBB credit breathalyzer and plant an SPV within the borders of the EU-19. What happens when Draghi is finally stopped and the Big Fat Bid of the ECB and its fast money front-runners disappears? The hopeful CNBC anchor-lady didn’t say. And about what happens if he isn’t stopped, she didn’t say, either.

The fact is, Simple Janet has already proven the end game. Money printing central bankers can’t stop. Were they to allow financial prices to normalize and trillions of bad credit to be liquidated, the whole financial house of cards they have built around the planet would blow sky high. The “soft landing” case is a null set.

“The sole purpose of this “sober and serious” text, there can be no doubt, was to produce one conclusion – an alarming headline “finding” which, however dubious, can be repeated again and again in the weeks to come, until it lodges in the public consciousness.”

• A Pro-EU ‘Study’ Straight From The Ministry Of Truth (Tel.)

Earlier this month, the government published a leaflet strongly urging us to vote “Remain” in the European Union – and sent it to all 27m UK households. Not only did the multi-million pound cost of producing and distributing this leaflet undermine the carefully-negotiated spending rules relating to the referendum on June 23, designed to stop the campaign becoming a money-driven free-for-all. The text itself was blatant propaganda – full of statistical sleights of hand disguised as reasoned arguments, a master-class in passive aggressive manipulation. It turns out, though, this tawdry leaflet was just the start when it comes to “Remain” using taxpayer cash and “the government machine” to bolster its cause.

For last week, Chancellor George Osborne launched a thumping 200-page “Treasury study” into the long-term implications of leaving the EU, which “forecast a £4,300 fall in GDP per household” if we leave. For many millions of voters, that’s a scary number – around a quarter of today’s average disposable income. Once again, this huge Treasury document represents a clear breach of long-standing rules that Whitehall remains detached from political campaigning, rules of particular relevance during a knife-edge referendum contest. And, reading through it, one is constantly stuck by the grotesque extent to which, for all the scientific pretence, the “analysis” is deliberately skewed.

The sole purpose of this “sober and serious” text, there can be no doubt, was to produce one conclusion – an alarming headline “finding” which, however dubious, can be repeated again and again in the weeks to come, until it lodges in the public consciousness. Rather than Her Majesty’s Treasury, this document could have been produced by Orwell’s Ministry of Truth. Unusually for a newspaper pundit, perhaps, I’m a trained economist. And in all my many years of studying official economic documents – budgets, comprehensive spending reviews and the like – through all that sifting and weighing of fine-print, I’ve never come across methodology and assumptions so blatantly rigged.

Ergo: the ECB doesn’t understand what deflation is.

• ECB’s Nowotny Says Negative Rates Necessary To Avoid Deflation (Reuters)

The euro zone needs negative interest rates to avoid sliding into deflation, ECB Governing Council member Ewald Nowotny said in an Austrian newspaper interview, defending the policy against widespread criticism in Germany. The ECB kept the cost of borrowing for banks at zero on Thursday and will continue to charge them 0.4% for parking money at the central bank. A slew of German politicians have complained in recent weeks that low interest rates are hurting savers. But Nowotny defended the policy. “You have to discuss negative rates in a broad context,” the head of the Austrian central bank was quoted as saying by the newspaper Der Standard on Saturday.

They are part of the central bank’s efforts to stabilize Europe’s economic situation after a severe crisis, he said. “Now it is all about preventing Europe from dropping into deflation.” He said that he would welcome it if interest rates could be raised again “the sooner the better”, but that the conditions must be right. “This will happen as soon as the economy is doing better, business activity picks up and inflation gets higher.” Countering the criticism of low interest rates, Draghi himself said on Thursday that some of it could be seen as endangering its independence, which could delay investment and hence prolong its current policies.

Next step is demand for more austerity in Greece.

• Schaeuble Sees No Greece Debt Relief as Long as Debt Sustainable (BBG)

German Finance Minister Wolfgang Schaeuble said Greece doesn’t need debt relief now and won’t require an easing of its debt burden as long as the troika of creditors determines that debt sustainability is ensured. The European Stability Mechanism, the euro region’s financial backstop, will seek to lock in the favorable refinancing costs it’s passing on to Greece for an extended period of time, Schaeuble said in Amsterdam. While not part of the Greek program, these operations – if in place – would help ease pressure on Greece, he said. “The debt sustainability analysis determines whether measures are needed” to help the cash-strapped country, Schaeuble told reporters after a two-day meeting of EU finance ministers. “It is my conviction that this is not necessary for the coming years.”

Greece’s government bonds rose for a third day on Friday after euro-area finance ministers and the IMF signaled that a deal on the nation’s next bailout installment is in sight. Schaeuble said “we have no desire” to repeat the confrontation between Greece and its creditors from last summer. The nation’s government submitted a bill to parliament on Friday evening, overhauling the Greek pension system and raising income tax for middle and high earners. The bill, which also raises taxation on gambling and dividends, is part of a €5.4 billion belt-tightening package required by creditors for the conclusion of the bailout review. The government still has to negotiate with representatives of creditor institutions a set of contingency measures equal to 2% of Greek GDP, which will only be triggered if it fails to meet its budget targets. An agreement on the bailout package and the target for Greece to reach a primary surplus of 3.5% of GDP by 2018 “appear possible,” Schaeuble said.

He has little to fear unless and until the documents are released Wikileaks style. Once that is done, Juncker is not the biggest fish.

• Why Juncker Should Worry About Panama Papers (Politico)

[..] The European Council chose to forget or ignore that Juncker had long resisted attempts to improve banking transparency and improve cross-border taxation – which had given Luxembourg a particular competitive advantage over its neighbors. A lot now depends on the extent to which LuxLeaks and/or the Panama Papers erode Juncker’s defense that everything was legal and he was ignorant of any wrongdoing. If there was law-breaking, then the ex-prime minister is vulnerable to the charge that either he didn’t know what was going on and should have, or he knew what was going on and allowed it. He is vulnerable also to whispers that Luxembourg’s business and political community is so small and tightly knit that complete ignorance is implausible.

What is more difficult to guess – at this moment of shifting standards – is whether Juncker will be condemned for allowing practices in Luxembourg that though legal were morally questionable. (You do not have to be a tax lawyer to see that what Juncker calls “the logic of non-harmonization” was compounded by Luxembourg’s culture of secrecy/discretion, which meant that companies could keep secret their tax arrangements and individuals could hide their revenue.) It is entirely possible that the government leaders who put Juncker in place – and their successors – will stick to the view that bygones should be bygones and Juncker’s past policies should not affect his standing as Commission president.

But what I detect, in at least some parts of Europe, is a readiness to revisit the past and to apply the standards of the present — meaning that what was legally correct may yet be found morally unacceptable in the court of public opinion. Juncker may choose to argue that his Commission is at the vanguard of reform. But what if his past record embarrasses the likes of Margrethe Vestager, as she turns over tax rulings made by national authorities with multinational corporations? Or Jonathan Hill, as he advances his proposal for increasing the tax transparency rules applying to multinationals? Or Pierre Moscovici, arguing for measures against tax evasion and money-laundering? Is this a sinner who repents, an opportunist, or just a hypocrite?

Whether Juncker is credible will also be important in the context of the Commission’s attempt to enforce fiscal discipline in Greece (or anywhere else). How does the Commission argue for improving revenue collection while LuxLeaks and Panama Papers paint a picture of a Juncker-run Grand-Duchy promoting tax-avoidance?

The blind moving goalposts as they ‘see’ fit.

• EU Finmins To Focus On Spending Cap To Cut Morass Of Budget Rules (R.)

EU finance ministers agreed on Saturday to discuss whether they can regain some control over a morass of EU budget rules by focusing mainly on an annual spending cap as the best measure of compliance. Years of changes and additions to EU rules, called the Stability and Growth Pact, have made meeting targets extremely complex, prompting an attempt to simplify them, European Commissioner Vice President Valdis Dombrovskis told a news conference after the meeting of EU finance ministers. “We did not discuss how to change the Pact, just how to choose the indicators to assess the compliance with the Pact,” Dutch Finance Minister Jeroen Dijsselbloem said.

The Dutch, who currently preside over the EU, proposed that the ministers consider using a single indicator with which to judge budgetary compliance, called the expenditure rule. It already exists in EU law as one indicator to be used to judge the fiscal performance of an EU country, but has so far been more in the background. The focus until now was on the development of the structural budget balance, a measure that strips off changes to budget revenue and expenditure stemming from the phase of the business cycle as well as all one-offs. Because the structural deficit is a complex and volatile indicator, the Dutch instead proposed putting more emphasis on the expenditure rule, which says a government cannot increase annual spending more than its medium-term potential growth rate.

“It is directly in the hands of finance ministers. It gives us more guidance in the process of designing the budget. It says in advance what you have to do, and you have the control in your hands,” Dijsselbloem said. He said that while the structural deficit, which is the key indicator mentioned in EU economic legislation, was a valuable theoretical concept, it could not be directly controlled by finance ministers. “There was general agreement that we need an indicator that takes out all the cyclical elements and one-offs but preferably it should be more stable and not change all the time, and we could put more emphasis on indicators that we can actually directly influence as finance ministers,” he said.

Dijsselbloem said EU deputy finance ministers would further work on what measurement to use to better assess compliance and the ministers would return to the discussion in the third quarter of 2016. The aim of the EU budget rules, created in 1997, is to keep nominal budget deficits below 3% of gross domestic product and public debt below 60%. But as the rules were revised in 2005, 2011 and 2013 to take account of economic and political realities and to incorporate intergovernmental treaties, they became more and more complex. “The sheer number of indicators in the current framework poses a massive challenge for the national implementation of the fiscal framework,” the Dutch presidency said in a paper prepared for the ministers’ meeting. “It contains targets, upper limits and benchmarks for the nominal balance, structural balance, expenditure growth and debt development,” the paper said.

While Obama was talking up the special relationship.

• UK Issues Travel Warning For Southern US States (CNBC)

The U.K. government has updated foreign travel advice, warning British citizens about risks visiting America’s Southern states. Specifically the new advice draws attention to potential difficulties for lesbians, gays, bisexuals and transgenders. “The U.S. is an extremely diverse society and attitudes towards LGBT people differ hugely across the country,” the U.K. Foreign Office website says. “LGBT travelers may be affected by legislation passed recently in the states of North Carolina and Mississippi,” it said. North Carolina and Mississippi have introduced laws that negatively affect people in the LGBT community. The North Carolina “bathroom” law is a statewide policy banning individuals from using public bathrooms that don’t correspond to their sex as stated on their birth certificate.

Celebrities including Bruce Springsteen, Ringo Starr and Pearl Jam have canceled concerts there in protest. And tech giant PayPal has canceled a large-scale investment plan after the legislation was rubber stamped. In Mississippi a “religious liberties” law will take effect in July. That legislation again blocks cities from allowing transgender people to use public bathrooms for the sex they identify as. It also aims to protect dozens of forms of businesses and services from being prosecuted if they refuse to serve LGBT people. A similar transgender “bathroom bill” in the Tennessee state failed Monday after it was withdrawn by its sponsor.

By design.

• US Government Is a Major Counterparty to Wall Street Derivatives (Martens)

According to a study released by the Federal Reserve Bank of New York in March of last year, U.S. taxpayers have already injected $187.5 billion into Fannie Mae and Freddie Mac, two companies that prior to the 2008 financial crash traded on the New York Stock Exchange, had shareholders and their own Board of Directors while also receiving an implicit taxpayer guarantee on their debt. The U.S. government put the pair into conservatorship on September 6, 2008. The public has been led to believe that the $187.5 billion bailout of the pair was the full extent of the taxpayers’ tab. But in an astonishing acknowledgement on February 25 of this year, the Government Accountability Office, the nonpartisan investigative arm of Congress, issued an audit report of the U.S. government’s finances, revealing that the government’s “remaining contractual commitment to the GSEs, if needed, is $258.1 billion.”

This suggests that somehow, without the American public’s awareness, the U.S. government is on the hook to two failed companies for $445.6 billion dollars. And that may be just the tip of the iceberg of this story. The official narrative around the bailout of Fannie and Freddie is that they were loaded up with toxic subprime debt piled high by the Wall Street banks that sold them dodgy mortgages. While that is factually true, the other potentially more important part of this story is the counterparty exposure the Wall Street banks had to Fannie and Freddie’s derivatives if the firms had been allowed to fail.

The New York Fed’s staff report of March 2015 concedes the following: “Fannie Mae and Freddie Mac held large positions in interest rate derivatives for hedging. A disorderly failure of these firms would have caused serious disruptions for their derivative counterparties.” Exactly how big was this derivatives exposure and which Wall Street banks were being protected by the government takeover of these public-private partnerships that had spiraled out of control into gambling casinos? According to Fannie and Freddie’s regulator of 2003, OFHEO, “The notional amount of the combined financial derivatives outstanding of Fannie Mae and Freddie Mac increased from $72 billion at the end of 1993, the first year for which comparable data were reported, to $1.6 trillion at year-end 2001.”

“Unbelievable. A river on fire. Don’t let it burn the boat..”

• Australian Politician Sets River On Fire (AFP)

An Australian politician has set fire to a river to draw attention to methane gas he says is seeping into the water due to fracking, with the dramatic video attracting more than two millions views. Greens MP Jeremy Buckingham used a kitchen lighter to ignite bubbles of methane in the Condamine River in Queensland, about 220 kilometres (140 miles) west of Brisbane. The video shows him jumping back in surprise, using an expletive as flames shoot up around the dinghy. “Unbelievable. A river on fire. Don’t let it burn the boat,” Buckingham, from New South Wales, said in the footage posted on Facebook on Friday evening, which has been viewed more than two million times. “Unbelievable, the most incredible thing I’ve seen. A tragedy in the Murray-Darling Basin (river system),” he said, blaming it on nearby coal-seam gas mining, or fracking.

Australia is a major gas exporter, but the controversial fracking industry has faced a public backlash in some parts of the country over fears about the environmental impact. Farmers and other landowners are concerned that fracking, an extraction method under which high-pressure water and chemicals are used to split rockbeds, could contaminate groundwater sources. The Murray-Darling Basin is a river network sprawling for one million square kilometres (400,000 square miles) across five Australian states. But the industry has said the practice is safe and that coal seam gas mining is a vital part of the energy mix as the world looks for cleaner fuel sources.

Origin Energy, which operates wells in the region, said it was monitoring the bubbling. “We’re aware of concerns regarding bubbling of the Condamine River, in particular, recent videos demonstrating that this naturally occurring gas is flammable when ignited,” the company said in a statement to the Australian Broadcasting Corporation. “We understand that this can be worrying, however, the seeps pose no risk to the environment, or to public safety, providing people show common sense and act responsibly around them.” The Australian energy firm said the methane seeps could be due to several factors, including natural geology and faults, drought and flood cycles, as well as human activity including water bores and coal seam gas operations.

The planet’s future is its past: cockroaches and jellyfish. “We’re gradually destroying our planet’s ability to support our way of life..” Eh, gradually?!

• In This Jungle, Mowgli Might Not Have Any Playmates Left (CNBC)

In Disney’s live-action remake of “The Jungle Book,” young human Mowgli is still palling around with bears and panthers. In reality, however, the world has changed since Rudyard Kipling’s tales first hit shelves more than a century ago. Speaking figuratively, biodiversity’s bag of Skittles has not only gotten smaller, it now has fewer flavors. Just how different are things? One expert puts it this way: If Mowgli were around today, he would most likely be raised by cows, goats and chickens instead of wolves and panthers and orangutans. If he were really unfortunate, his compatriots could be even worse. “Maybe even rats and cockroaches, if things go badly,” said Charles Barber, former forest chief at the U.S. Department of State’s Bureau of Oceans and International Environmental and Scientific Affairs, in an interview with CNBC.

The problem, according to some scientific experts, is that humans have changed the world so dramatically that it has also altered the diversity of life on Earth. “Most of these changes represent a loss of biodiversity,” analysts wrote in the Millennium Ecosystem Assessment in 2005, a report that chronicled the effects of human activity on nature produced by the United Nations and the World Resources Institute, where Barber now works. Among the Millennium Assessment’s findings were that humans have “changed ecosystems more rapidly and extensively than in any comparable period in human history,” due to food, fresh water and fuel needs. The spillover from those changes has contributed to big gains in humanity’s development, but “have been achieved at growing costs in the form of the degradation of many ecosystem services,” researchers wrote at the time.

This means that “plants and animals are now sharing the planet with a whole lot of people,” Barber said, adding that “we’re dealing with a fantastically different world.” One measure of biodiversity loss is just how fast certain species are now disappearing. Organizations like the Center for Biological Diversity state that an “extinction crisis” is underway that is wiping out plants and animals at a breathtaking pace. The last few hundred years have borne witness to mass extinctions that occur much quicker than the so-called natural “background rate” of one to five species per year. The CBD estimates that “literally dozens” of species are dying every day, which could see 30-50% of endangered populations being wiped out by midcentury.

Today, scientists say nearly a quarter of all mammals and coniferous trees are threatened with extinction. [..] A recent report by the World Wildlife Fund found that between 1970 (the year Earth Day was born) and 2010, the number of mammals, birds, reptiles and fish fell by more than 50%. “We’re gradually destroying our planet’s ability to support our way of life,” said WWF CEO Carter Roberts, at the time the report was published.

If Brussels tries to push this through, it’ll mean the end of the EU. If it doesn’t, it’ll mean the refugee flow will start all over again and at the very least Schengen dies. Can’t win.

• Visa-Free Travel A Stumbling Block For Turkey and EU (DW)

The refugee deal between the European Union and Turkey is stalled on the complexities of visa liberalization. EU officials say they won’t sacrifice their principles, but will they follow through? Turkish and EU leaders appear optimistic: 78 million Turkish citizens will gain long-coveted visa-free travel to the Schengen zone by June. After all, they have to in order to prevent a controversial deal on deportations from crumbling. Ankara has threatened to withdraw from the EU-Turkey migrant deal if visa liberalization is not in place by the end of June, putting in jeopardy a plan on which the European Union has pinned all of its hopes for slowing the arrival of people fleeing conflict and poverty.

Under the deal, reached in March, Turkey agreed to take back irregular migrants and refugees who crossed the Aegean to Greece in exchange for the European Union’s taking in Syrian refugees directly, as well as financial aid, visa liberalization and the acceleration of Turkey’s EU membership talks. While several parts of the migration deal have come under criticism, Turkey’s long-running struggle to gain unfettered access to the European Union for its citizens raises its own questions and remains a major sticking point. The EU executive, the European Commission, will present its third visa-liberalization progress report on May 4, and, if Turkey fulfills all 72 criteria to bring the country into compliance with EU and international law, a legislative proposal will be put forward to transfer the country to the visa-free list.

Less than two weeks before May 4, the European Commission said this week that Turkey was making progress but had only met 35 of 72 criteria for visa-free travel. On Thursday, however, European Migration Commissioner Dimitris Avramopoulos told reporters that he believed all benchmarks would be met. In a troubling sign, Turkey and the EU appear unable to even agree on what criteria have been met so far, with Turkish Prime Minister Ahmet Davutoglu saying this week that his government had brought the number down to the “single digits.” He has vowed to push the remaining criteria through parliament. According to Angeliki Dimitriadi, a visiting fellow at the European Council on Foreign Relations in Berlin, a major issue is what the EU means by “implementing.”

“It’s unclear how we measure benchmarks,” Dimitriadi told DW. “Are we looking at the benchmark as laws being passed or looking for actual implementation of all 72 criteria? Questions remain whether they have fulfilled this on paper or in reality.” Noting that the technical aspects of meeting EU criteria -implementing biometric passports, for example – take time, Dimitriadi said it would be nearly impossible to meet the June deadline. “I would be extremely surprised if they succeeded, and it has nothing to do with Turkey,” she said. “Any country would have a problem.”

“..only a third of the children go to school – partly because of a lack of capacity, and partly because they are put to work by their parents.”

• Merkel Accused Of Turning Blind Eye To Plight Of Syrian Refugees In Turkey (O.)

Merkel and her European colleagues have been accused of pandering too much to Turkey, amid calls for stronger international criticism of its crackdown on the political opposition. On Saturday Can Dundar, one of two prominent Turkish journalists on trial for reporting that Turkey was supplying arms to Syrian rebels, said Merkel was betraying the principles of democracy and free speech. “When you arrive, we’ll be on trial – alongside several academics who signed a petition calling for peace,” Dundar wrote in Der Spiegel, the German weekly magazine. “Will you again leave, behaving as if none of this pressure exists? Or will you lend an ear to us, and those who stand with us, in support of free expression?”

There are also concerns that Merkel is undermining free speech in Germany, after she acceded to a request from Ankara to prosecute a German comedian who made fun of President Erdogan. By going ahead with the EU-Turkey deal, Merkel was also accused of turning a blind eye to the predicament of Syrians in Turkey; many are due to be deported back there on the basis that Turkey guarantees their rights. But, despite recent legislative changes, only a tiny minority of Syrians have the right to work in Turkey. The majority work in the black market and live in urban poverty, far from camps like the one Merkel visited – which house just 10% of Turkey’s 2.7 million Syrians. And some have been deported back to Syria, according to research by Amnesty International.

In the areas surrounding the camp, Syrians praised Merkel for her wider support for refugees in 2015 – but reminded her of the predicament of the majority who did not have homes provided for them by the Turkish state. “It’s true the camp in Nizip is very nice,” said Abu Shihab, Syrian manager of a sweatshop in Gaziantep that employs Syrian children. “But what about those who live outside the camps?” While Merkel’s visit to a child-protection centre highlighted her intention to help Syrian children, solving the humanitarian crisis requires a more concerted effort. In Gaziantep, surveys of refugees by the Syria Relief Network, a coalition of NGOs, suggest only a third of the children go to school – partly because of a lack of capacity, and partly because they are put to work by their parents.

We’re dead set to do much worse tomorrow than we did yesterday. So much for progress.

• Tomorrow, We Have A Chance To Stop The Death Of Innocents (Observer)

Rabbi Harry Jacobi was one of 10,000 Jewish children saved from Nazi-controlled territory on the eve of the Second World War by those who recognised their plight and the necessity to act. Born in Berlin, his family sent him to Amsterdam, as his uncle had agreed to sponsor him. It was assumed that he would be safe in the neutral Netherlands and he joined other children in the orphanage. In May 1940, the Nazis invaded the Netherlands and began their rapid march on the capital. On 15 May, a Dutch woman, Truus Wijsmuller, the head of the refugee committee, went straight to the orphanage, rounded up the children and had them bussed directly to the nearest port. There, on the docks, she nagged and cajoled and twisted arms until the captain of a cargo ship, De Bodegraven, finally agreed to take the children and set sail for Britain and safety.

No permission was sought or given; Wijsmuller and the ship’s captain simply ignored the red tape. The children were in danger and something had to be done. Ten minutes after they sailed, the radio announced that the Netherlands had capitulated. They survived the journey, although the boat was strafed by Nazi fighter planes, and at last arrived in Falmouth. There, they were held on the boat for three days while the authorities weighed up whether to let them in or not; three days of anxious uncertainty aboard a boat that the Nazis has reported sunk. Thankfully, permission was given to dock in Liverpool and Harry became one of the very lucky 10,000 children who avoided near-certain death, were welcomed to Britain and offered a secure future.

Ten thousand children. Hauntingly, just the same figure has surfaced recently in the discussions around tomorrow’s Commons debate on amendments to the immigration bill that calls on the UK to take a lead in protecting unaccompanied minors in Europe. Seventy-six years after Harry Jacobi’s rescue, the figure of 10,000 is the number of children that Europol has identified as having disappeared on our continent in the process of fleeing from danger and suffering elsewhere. Ten thousand children who will have disappeared into trafficking networks across Europe, forced into drug abuse, child labour, sexual exploitation. Independent medical assessments have found that nearly half of all unaccompanied minors carry a sexually transmitted disease, testament to the terrible dangers they face along the way to Europe.

Some will have died. In the past three months, two minors have died trying to reach their family members in the UK from Calais. These 10,000 are a small percentage of the 95,000 migrant children estimated to be alone in Europe. And the “Dubs amendment” to be debated tomorrow, named for Alf (Lord) Dubs, who has sponsored it and is himself a survivor of the Kindertransport, calls for the resettlement of only 3,000 in the UK. A tiny proportion of those at risk, but it’s a start in securing safe and legal routes out of danger. Anything is better than the appallingly unsafe and illegal routes currently creating such havoc.