Horacio Coppola Avenida de Mayo entre Bolívar y Perú, Buenos Aires 1936

All suspended accounts are on the right.

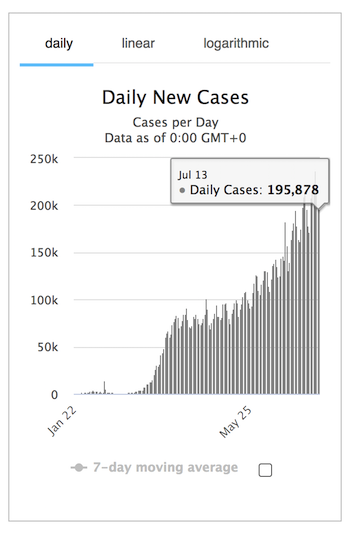

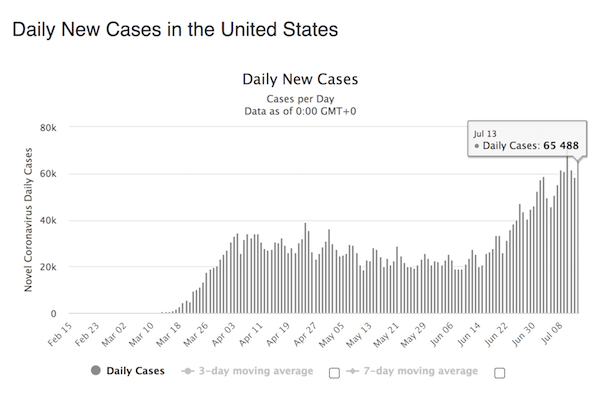

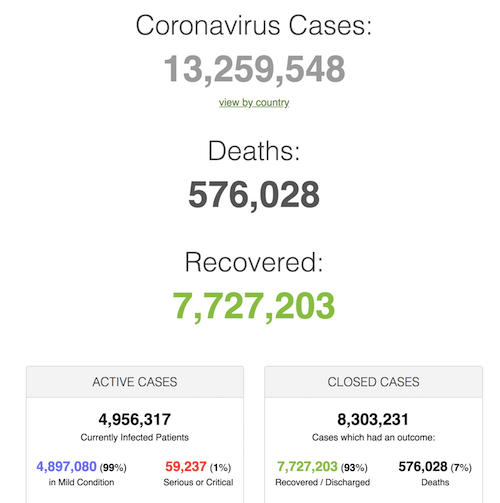

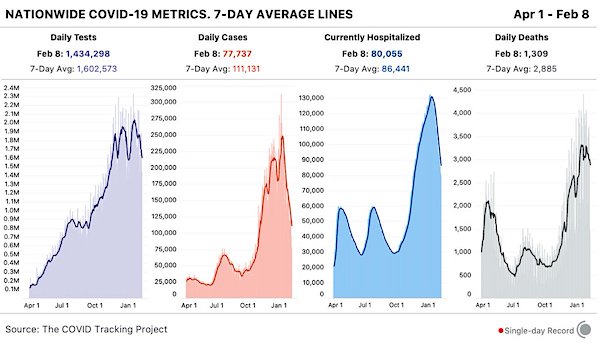

U.S. COVID update: Lowest number of new cases since Oct.

NOTE: Don’t miss John Day MD’s guide for COVID prevention and treatment that I published earlier yesterday: Treat Your Own COVID.

It could save your life.

Look, Prof Devi Sridhar is chair of global public health at the University of Edinburgh, and he doesn’t manage one word on the government failing to boost their citizens’ immune systems. It’s all about masks and gloves and testing and borders and messaging. You know, the stuff that attracts attention AFTER people have been infected.

Nobody has a chance in the face of all this myopia.

• Five Ways The Government Could Have Avoided 100,000 Covid Deaths (G.)

First, the UK had no border policies in place for months. [..] The second fatal flaw in the UK’s response happened on 12 March, when the government made the fatal decision to stop community testing [..] Third, the government made another harmful decision in March when it delayed the first lockdown. [..] The fourth error was the lack of appropriate personal protective equipment for many health and social workers [..] Finally, the UK has continually lacked both clear leadership and messaging, which are vital in a pandemic. Rather than leading from the front, the government seems to only follow public opinion and polling.

The Pfizer vaccine. Google translate.

• 14 Nursing Home Residents Test Positive For B117 Despite Vaccination (DF)

In an old people’s and nursing home in Belm in the Osnabrück district, there was an outbreak of the British Corona variant despite the vaccination. In 14 seniors the virus is B.1.1.7. – although all residents had been vaccinated for the second time on January 25, the district announced. The home, all employees and their families have been quarantined. The board of directors of the German Foundation for Patient Protection, Brysch, called on the Ministry of Health to closely monitor nursing homes after the second vaccination. Otherwise there would be no reliable data on the danger the mutation posed for the high-risk group. So far there have only been asymptomatic or mild courses of the disease in the residents, which could be a positive effect of the vaccination, said the press spokesman for the Osnabrück district.

Again: no vaccine has been approved yet, just emergency authorized. But this is based on vaccination passports. Let’s have a legal expert explain it.

• Israel and Greece Sign Deal To Allow Vaccinated Tourists To Travel (EN)

Israel and Greece agreed on Monday to pave the way for vaccinated tourists to travel between their two countries in an effort to boost their economies amid the coronavirus pandemic. Israeli Prime Minister Benjamin Netanyahu and Greek Prime Minister Kyriakos Mitsotakis announced the agreement in Jerusalem on Monday. The deal is designed to allow tourists with vaccination certificates to move between the countries “without any limitations, no self-isolation, nothing,” Netanyahu said at a press conference.

Both economies have large sectors devoted to tourism, an industry devastated by travel restrictions during the 11-month pandemic. The announcement comes at a time of tough new travel restrictions elsewhere around the world as governments grapple with variants of the virus. The United Nations World Tourism Organisation says international arrivals fell 74% last year, wiping out $1.3 trillion (€1 trillion) in revenue and putting up to 120 million jobs at risk. A UNWTO expert panel had a mixed outlook for 2021, with 45% expecting a better year, 25% no change and 30% a worse one.

No proper research, emergency authorization, of course you’re going to run into gigantic problems. We haven’t seen nothing yet.

• Why Moderna’s COVID-19 Vaccine Shipments To Canada Have Been Delayed (Star)

Moderna’s delivery of COVID-19 vaccines to Canada has hit delays because the company has encountered problems with its European supply chain and restrictions on exports of vaccine supplies, the Star has learned. A senior federal source with knowledge of the file told the Star that Moderna is trying to source the material needed to produce its vaccine, and to meet demand for materials needed to package the vaccines. The source said the company’s own supply for materials has been affected by the European Union’s attempt to control how much material is exported before its member states are supplied with vaccine. In a written statement to the Star, Moderna’s country manager for Canada, Patricia Gauthier, confirmed the company’s effort to scale up production in Switzerland is a factor in delayed deliveries to countries outside of the United States.

The statement said Moderna has provided revised short-term delivery guidance “outside of the U.S., including to the government of Canada based on the ramp up trajectory of drug substance manufacturing in Switzerland.” It also suggested no problems are occurring with its packaging process. “Fill and finish activities continue as planned,” the statement said. “Moderna remains focused on operating at the highest level of quality to ensure the safety of the vaccine.” Moderna also confirmed its contract with Canada specifies “delivery volumes per quarter,” and said it will “meet its contractual commitments for the first quarter and the following quarters in order to deliver 40 million doses by the end of the third quarter.” It said its strategic collaboration with Lonza in Switzerland — which started mass production of Moderna vaccines this year — aims to manufacture up to 1 billion doses of its COVID-19 vaccine per year.

Cuba has a hard time getting the ingedients for its vaccines. Embargo, don’t you know.

• Cuba’s COVID-19 Vaccines Serve the People, Not Profits (CP)

Cuba’s socialist approach to developing vaccines against COVID-19 differs strikingly from that of capitalist nations of the world. Cuba’s production of four vaccines is grounded in science and dedicated to saving the lives of all Cubans, and to international solidarity. The New York Times’s running report on the world’s vaccine programs shows 67 vaccines having advanced to human trials; 20 of them are in the final phase of trials or have completed them. The United States, China, Canada, the United Kingdom, Germany, South Korea, and India have each produced many vaccines; most vaccine-manufacturing countries are offering one or two vaccines. Cuba is the only vaccine manufacturer in Latin America; there are none in Africa. The only state-owned entities producing the leading vaccines are those of Cuba and Russia.

Cuba’s Finlay Vaccine Institute has produced two COVID-19 vaccines. Trials for one of them, called Sovereign I, focus on protecting people previously infected with COVID-19. The antibody levels of some of them turned out to be low, and the vaccine might provide a boost. The other vaccine, Sovereign II, is about to enter final human trials. For verifying protection, these trials require tens of thousands of subjects, one half receiving the vaccine and the other half, a placebo vaccine. Cuba’s population is relatively small, 11 million people, too small to yield enough infected people in the short time required to test the vaccine’s protective effect. That’s why Sovereign II will be tested in Iran.

100 million doses of Sovereign II are being prepared, enough to immunize all 11 million Cubans, beginning in March or April. The 70 million remaining doses will go to Vietnam, Iran, Pakistan, India, Venezuela, Bolivia, and Nicaragua. Sovereign II “will be the vaccine of ALBA,” explained Venezuelan Vice President Delcy Rodríguez, referring to the solidarity alliance established in 2004 by Venezuelan President Hugo Chavez and Cuba’s Fidel Castro. “Cuba’s strategy in commercializing the vaccine represents a combination of what’s good for humankind and the impact on world health. We are not a multinational where a financial objective comes first,” says Vicente Vérez Bencomo, director of Cuba’s Finlay Vaccine Institute. Income generated by vaccine sales abroad will pay for health care, education, and pensions in Cuba just as happens with exports of medical services and medicines.

Cuba’s Center for Genetic and Biotechnological Engineering is developing two other COVID-19 vaccines; One, named “Mambisa” (signifying a female combatant in wars of liberation from Spain), is administered via the nasal route, just as is Cuba’s hepatitis B vaccine. The other vaccine, named “Abdala” (a character in a Jose Marti poem) is administered intramuscularly. The two vaccines are involved in early trials.

Austerity is that variant.

• A Very Dangerous Variant Of The Global Virus Is Spreading Again (Bilbo)

There is a new variant of the global virus spreading again after being subdued throughout 2020. This is a very dangerous variant and if it takes hold will guarantee massive human suffering, and, a further, substantial shift in national income towards the top-end-of-town. I refer to the creeping infestation that is starting to pop up claiming that austerity will be required to pay for all the “profligacy” associated with government approach to the pandemic. I have seen this virus in the wild and it is creepy and being spread by those who seem to want to gain attention as time passes them by. Overheating threats, austerity threats – it is all part of the economics establishment trying to remain relevant. A vaccine will not work. They need to be permanently isolated.

The Prospect Magazine article (January, 26, 2021) – In defence of austerity – written by a “former head of Treasury” The sub-title begins the twisted framing: “Free money is in vogue—but there’s no such thing” – the only cost of the Bank of England buying all the debt being issued by H.M. Treasury is the wear and tear on the computer keyboards that type in the numbers. The pandemic has exposed to an increasing number of people that there is ‘free money’. They are realising that numbers just appear in bank accounts. Perhaps this former official should watch the recent speech and subsequent Q&A from the Reserve Bank of Australia governor, Philip Lowe to the National Press Club in Canberra (February 3, 2020).

He was asked by a journalist in the Q&A: Could you please explain in the simplest terms, perhaps keeping in mind your audience outside of this room, when the RBA decides to purchase government bonds, as it’s doing, where does the RBA get that money from? Is it simply a matter of printing new money? How does it work? The Governor replied:

“Well, it’s not printing money. People think of it as printing money, because once upon a time if the central bank bought an asset, it might pay for that asset by giving you notes, you know, bank notes. I’d have to run my printing presses to do it. We don’t operate that way anymore, obviously because we live in an electronic world. When we buy a bond from a bank, the way we pay for that is credit. The banks, we’ll use Westpac, who’s the sponsor of today’s event as an example. If we bought a bond from Westpac, we would credit Westpac’s account at the Reserve Bank, and that creates the money electronically. That’s how a modern system works. And then Westpac could use that money hopefully to make some loans to some of its customers. But we can create money electronically, and that’s what we do these days …”

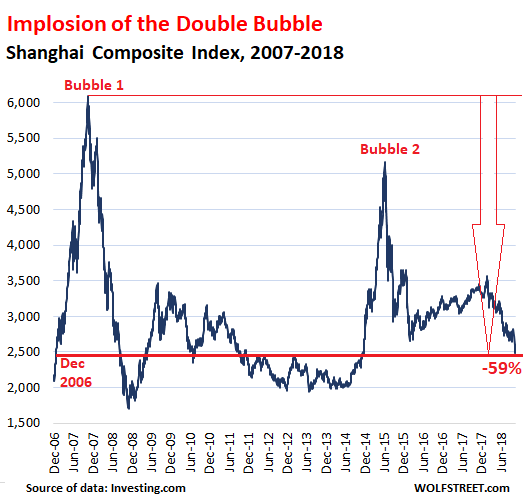

John takes a trip through all the bubbles. Read.

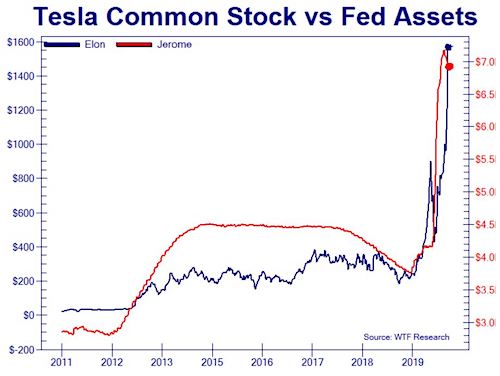

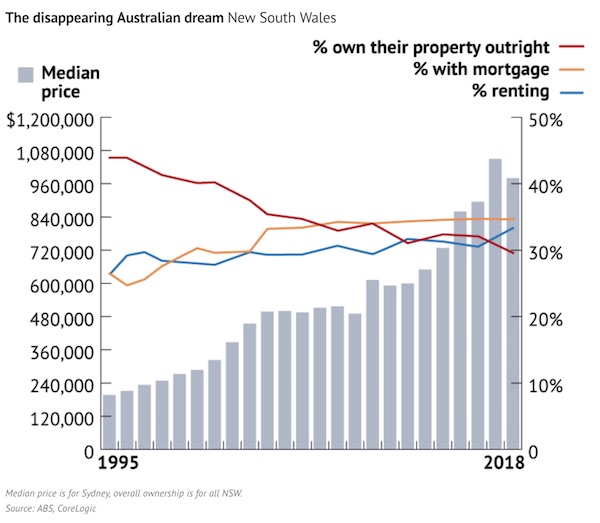

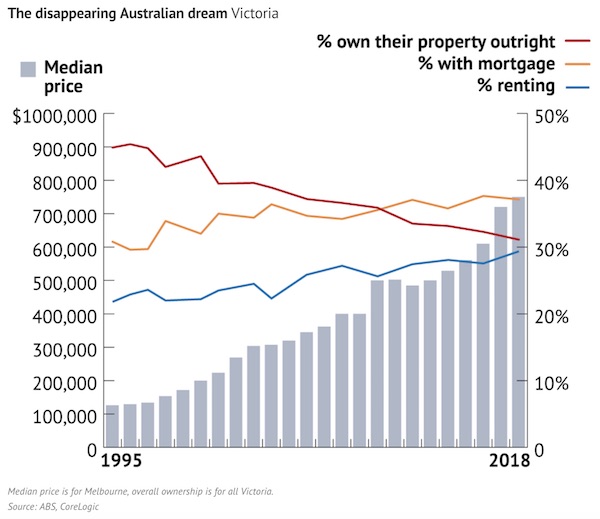

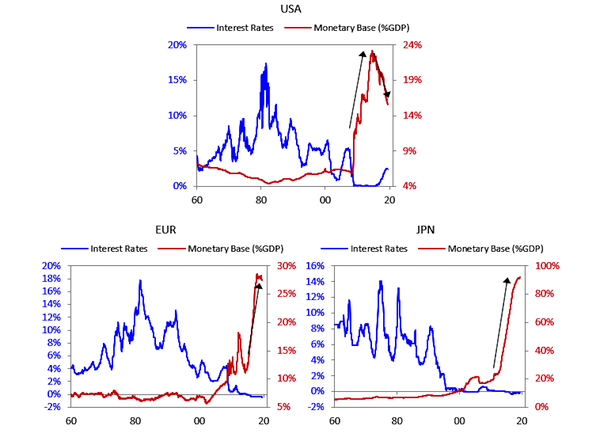

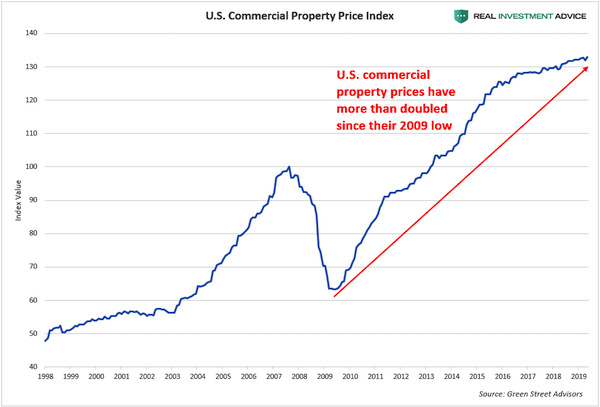

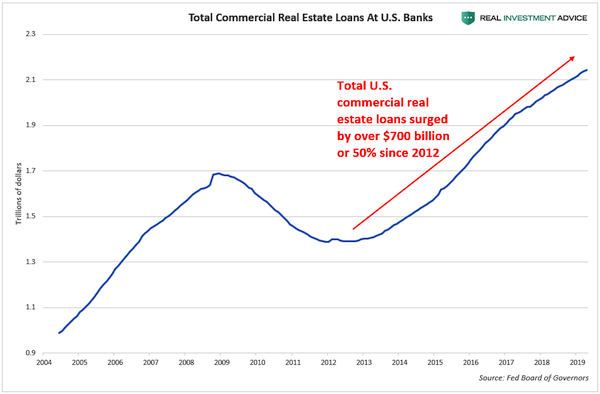

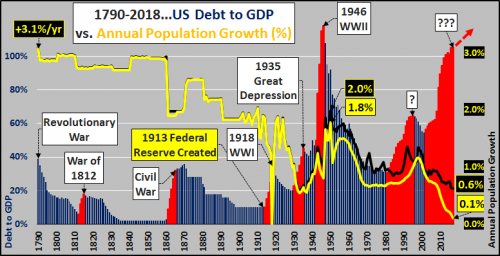

• Is This The Biggest Financial Bubble Ever? Hell Yes It Is (John Rubino)

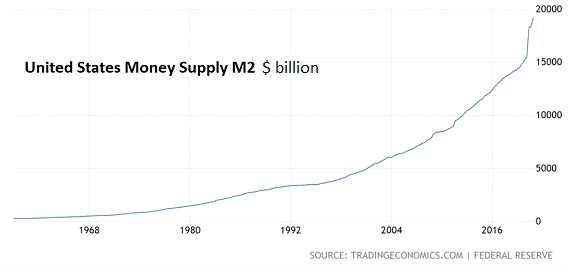

If you’re over 40 you’ve lived through at least three epic financial bubbles: junk bonds in the 1980s, tech stocks in the 1990s, and housing in the 2000s. Each was spectacular in its own way, and each threatened to take down the whole financial system when it burst. But they pale next to what’s happening today. Where those past bubbles were sector-specific, which is to say the mania and resulting carnage occurred mostly within one asset class, today’s bubble is spread across, well, pretty much everything – hence the term “everything bubble.” When this one pops there won’t be a lot of hiding places.

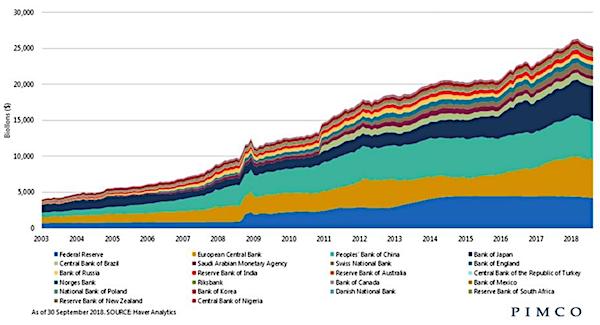

Most bubbles start when an influx of outside cash sends the price of something up dramatically. This captures the imagination of the broader investing public and the process takes on a life of its own, culminating in an orgy of bad decisions and eventually a wipe-out of the easy fortunes made on the way up. So to understand the everything bubble, let’s start at the beginning with that influx of outside money. This time it’s coming from the Federal Reserve in what can only be described as the mother of all print runs. M2, a medium-broad measure of the US money supply, has more than tripled so far in this century, and lately the arc has gone vertical, rising by nearly a third in just the past year.

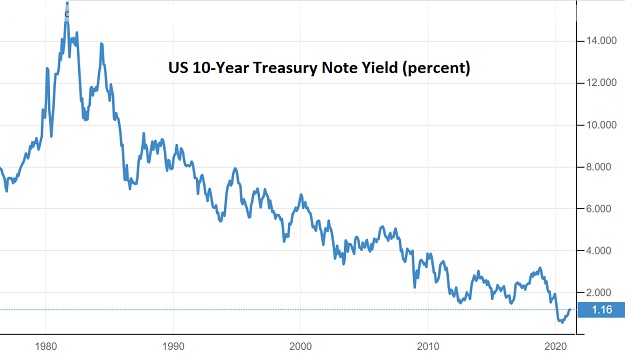

All this extra money has to go somewhere, so no surprise that it’s flowing in lots of different directions. Among the recipients: The bond and money markets, made up of instruments that pay interest, are in the aggregate far bigger than the world’s stock markets. And they’ve been booming, with interest rates falling steadily for four straight decades. Since bond prices are the reciprocal of bond yields, the next chart can be read as an epic bull market in bonds, one which has gained steam in the past year as massive currency creation has forced fixed income investors (who have to invest new cash somehow) to buy bonds regardless of what they yield.

Good Lord: “Democrats anticipate that the final package will be passed by both houses of Congress by mid-March.”

• House Democrats Reject Push To Lower Income Threshold For Stimulus Checks (F.)

After days of infighting, House Democrats on Monday night released details of proposed coronavirus relief measures that would put the ceiling for full $1,400 stimulus checks to Americans at the same income levels as previous payouts, rejecting calls from more centrist Democrats to lower the threshold. House Ways and Means Committee Chairman Rep. Richard Neal (D-Ma.) released a draft version of the bill Monday night proposing $1,400 stimulus checks for single earners making up to $75,000 and for joint filers earning up to $150,000. Some centrist Democrats had called for lowering the threshold to $50,000 per year for individuals and $100,000 per year for joint filers, causing outrage from progressives like Sen. Bernie Sanders (I-Vt.) and Rep. Alexandria Ocasio Cortez (D-Ny). Child and adult dependents will now be eligible, unlike the previous rounds of stimulus payments.

Responding to concerns that wealthy people would receive checks, the stimulus payments will phase out quicker, zeroing out when individual income reaches $100,000 and at $200,000 for households. Democrats last week passed a budget reconciliation measure, which allows them to pass a stimulus plan with a simple majority rather than the usual 60 votes required to overcome a filibuster in the Senate. As a result, the final bill will likely be subject to intense jockeying between Democrats because the party can’t afford to lose a single vote in the Senate without Republican support. The measure still has to pass the rest of the House and the Senate, where it meets resistance from centrist Joe Manchin (D-W.Va), who has been leading the charge to lower the income threshold. Democrats anticipate that the final package will be passed by both houses of Congress by mid-March.

Let’s do the opposite of everything she proposes, then we should be good.

• Yellen: US At Full Employment Next Year If Congress Passes Stimulus (CNBC)

The U.S. could return to full employment in 2022 if President Joe Biden’s $1.9 trillion coronavirus rescue package is passed, Treasury Secretary Janet Yellen said on Sunday. “There’s absolutely no reason why we should suffer through a long slow recovery,” Yellen said during an interview on CNN’s “State of the Union.” “I would expect that if this package is passed that we would get back to full employment next year.” Long-term unemployment is nearing a historical peak nearly a year since the pandemic began. Nearly 40% of unemployed workers have been out of work for six months, the Bureau of of Labor Statistics reported on Friday, with nearly 9 million fewer Americans working now than last February. The unemployment rate fell to 6.3% in January.

The pandemic-fueled unemployment rate will remain elevated for years to come without more federal support, Yellen said, citing an analysis from the Congressional Budget Office. Without additional stimulus, it could take until 2025 to send the unemployment rate back down to 4%. Yellen also said that former Obama economic adviser Larry Summer’s concerns over Biden’s stimulus plan posing risks to inflation are small compared to economic damage from failing to provide enough economic support during the pandemic. The U.S. has “the tools to deal with” the risk of inflation, Yellen said.

Democrats in Congress have moved to pass the stimulus plan within two weeks without GOP support, using a parliamentary procedure known as reconciliation. The plan is the first of two major spending initiatives Biden will seek and includes provisions like direct payments to Americans, weekly jobless benefits through September and funding for vaccines and testing. The second bill will focus on infrastructure reform, climate change and racial equity, among other things. “We have people suffering … through absolutely no fault of their own,” Yellen said. “We have to get them to the other side and make sure that this doesn’t take a permanent toll on their lives.”

Everything left is dangerous.

• Europe’s Debt Cancellation Would Mean Recognition of Insolvency (Lacalle)

More than 100 economists, led by French economist Thomas Piketty, creator of some of the most absurd proposals embraced by the extreme left, on Feb. 5 published an open letter in which they called for a cancellation of government debt in the hands of the ECB “in exchange for greater public investment”—which, by the way, would be paid with more issuance of public debt. Fascinating. Luís de Guindos, vice president of the ECB, has settled the controversy with two pieces of evidence. “The cancellation of debt [on the ECB balance sheet] is illegal … [and] does not make any economic or financial sense at all,” he explained in a speech, according to Europa Press. The first part is obvious. It is prohibited by the bylaws of the ECB. I will explain the lack of economic logic here.

A debt write-off or cancellation is evidence of the issuer’s insolvency. If, as the economists repeat, the solvency and credit credibility of the eurozone is not at stake, why ask for a cancellation? If, in addition, as Piketty and other defenders of massive state indebtedness maintain, deficits are not a problem and increasing debt is not a concern because it creates reserves, why cancel it? Let’s not forget that many of the parties that have embraced Piketty’s idea in Europe—Podemos, Syriza, and other European radical parties—filed a proposal to exit the euro in 2015 that they have never subsequently withdrawn or rejected. Podemos MEPs presented a resolution in Strasbourg for the European Union to prepare the mechanisms for the “orderly dissolution of the euro zone.” They also proposed to establish “the mechanisms that would allow a country integrated in the single currency to abandon it to adopt another currency,” according to Spanish newspaper Crónica Global.

So basically, radical parties in Europe demand that the ECB forgives their debt and prints more while keeping the option of leaving the euro. Call that baking the cake and eating it. Most eurozone states finance themselves today at negative rates or extremely low yields. It would be a mistake to think that these low interest yields are the consequence of good government fiscal policy. If the eurozone has low interest rates and low yields it’s because European taxpayers keep it solvent—mostly thanks to Germany’s financial solvency. European taxpayers uphold the credibility of the euro as a currency, and with this the ECB can carry out expansionary policies.

Piketty and colleagues open a dangerous option: direct monetization of all and any government spending Argentina-style. And do so ignoring that the euro is the only global reserve currency with redenomination risk, and that its credibility is maintained only because of the widespread confidence in the euro area’s commitment to repay its debts. A euro bond is an asset for many investors globally only because it’s supposed to be of the lowest risk. Opening the Pandora’s box of cancellations means its status as an asset disappears.

And then Biden wants to go break the deal that made that possible.

• No US Combat Deaths in Afghanistan Over Past Year (Antiwar)

For the first time since the US war in Afghanistan started in 2001, no US troops died in combat in the country for an entire year. The last US combat death took place on February 8th, 2020, when two US Army soldiers were killed in a firefight. This means since the US and Taliban signed a peace deal in late February of last year, no US troops have been killed by the group. But with the withdrawal deadline approaching, the Taliban is vowing to again turn their weapons on US soldiers if they stay in Afghanistan past May 1st. While the Biden administration has yet to make a formal announcement, the chances of a US withdrawal by May 1st seem slim. Last week, a congressionally mandated report was released that warned against the May 1st deadline, which could be all the excuse the US needs to stay.

Pentagon officials have said the deadline is uncertain and insist troops levels in Afghanistan remain “conditions-based.” US officials have been complaining about the amount of violence between the Taliban and the US-backed government. On Monday, Gen. Frank McKenzie, the head of US Central Command, said the level of violence is “too high” and that the Biden administration is taking “a close look at the way forward in accordance with the February 2020 peace agreement.” Since the US is not the only country with troops in Afghanistan, the US-Taliban deal paved the way for all foreign and NATO forces to leave the country. While the alliance has also not made a formal announcement, NATO officials told reporters that NATO troops will remain in Afghanistan beyond May 1st.

Get out the popcorn.

• As Trump Impeachment Trial Starts, Democrat Agenda Crashes Into Reality (JTN)

[..] And the emotionally charged case that Trump incited the Capitol riot with his Jan. 6 speech, has developed deep cracks. Less than a half dozen Republicans have shown any interest in conviction as the facts increasingly show the riot was not spontaneous but rather planned for days and weeks with fund-raising, training, and combat threats. Even the former Capitol Police chief has weighed in with a letter to Speaker Nancy Pelosi saying the attacks exhibited a “high level of coordination,” undercutting the Democrats’ spontaneous incitement narrative even further. The likelihood of Trump’s conviction has waned as the premeditation evidence mounts, and now Democrats once gleeful they could end the 45th president’s ability to ever hold office again are now pressing to get the trial over quickly as acquittal seems assured.

“It’s not clear to me that there is any evidence that will change anyone’s mind,” Hawaii’s Democratic Sen. Brian Schatz told Politico. Republican Sen. John Thune of South Dakota, often an opponent of Trump, acknowledged the obvious, observing, “Both sides would kind of like to wrap it up fairly quickly.” The Senate trial will start Tuesday with a debate over whether the event is even constitutional with Chief Justice John Roberts refusing to preside, Trump already out of office, and a legitimate debate over whether Trump’s speech was protected “free speech” as Democratic law professor John Turley has argued. Once a dream of Democrats, the trial is feeling more like a burden to them as other elements pose obstacles and challenges to the Biden agenda.

Even Biden himself has little interest in watching the trial, his chief spokeswoman said Monday. “I think it’s clear from his schedule and from his intention that he will not spend too much time watching the proceedings,” White House Press Secretary Jen Psaki said.

Expensive theater.

• It Cost Taxpayers $483 Million To Send National Guard Troops To DC (F.)

The federal government is projected to spend $483 million to keep National Guard troops in Washington, D.C., until mid-March, amid fears that former President Donald Trump’s impeachment trial may draw more violence. Pentagon press secretary John Kirby said Monday the price of sending National Guard troops to protect the area around the Capitol from January 6 to March 15 will total $483 million, $284 million for personnel and $199 million for operations. 5,000 troops are slated to remain in the city until March 15 as Trump’s Senate impeachment trial poses security concerns, Politico reported, including “mass demonstrations,” but it’s unclear if there is a specific threat. In the aftermath of the Capitol riots, 25,000 National Guard troops flooded Washington, D.C., for Biden’s inauguration in an effort to prevent further violence.

The majority of troops remaining in the city will do so voluntarily, according to Politico. Republican lawmakers have questioned the need for National Guard troops around the Capitol Hill complex. “We still have National Guardsmen out there, away from their families, away from their jobs, supplementing the police, and yet we can’t get a briefing on what is this dire threat that requires so many people. We still don’t have answers,” Rep. Michael Waltz (R-Fla.) told Fox News. Security forces were largely unprepared for the pro-Trump mob that breached the Capitol last month. National Guard troops were only called in after rioters stormed the building, and members of both parties are calling for investigations into security lapses surrounding the attack. But keeping thousands of troops in the city has been rocky: nearly 200 have contracted Covid-19, according to the Military Times.

Bit of a campaign going on, even the New York Times chimes in. 10 years too late.

• Assange Supporters Urge Joe Biden To Drop Prosecution (Ind.)

Media freedom groups and supporters of Julian Assange have asked the Biden administration to drop the US’s pursuit of the WikiLeaks’ founder, saying Donald Trump was opposed to the idea of a “free press”. In their first appeal to the US government since Joe Biden became president less than three weeks ago, more than 20 groups working to promote human right and a free media, wrote to the department of justice, asking it to drop the case against Mr Assange, saying they were fearful “the way that a precedent created by prosecuting Assange could be leveraged”.

“The indictment of Mr Assange threatens press freedom because much of the conduct described in the indictment is conduct that journalists engage in routinely — and that they must engage in in order to do the work the public needs them to do,” said the letter, signed by groups including Amnesty International, Human Rights Watch and the Freedom of the Press Foundation. “Journalists at major news publications regularly speak with sources, ask for clarification or more documentation, and receive and publish documents the government considers secret. In our view, such a precedent in this case could effectively criminalise these common journalistic practices.” There was no immediate response from the White House. But in a short statement released on Monday evening, a spokesperson for the department of justice, said: “We are continuing our efforts to seek the extradition of Julian Assange.”

[..] In their letter, the activists point out the Obama administration, of which Mr Biden was a key part, decided not to pursue the prosecution of Mr Assange. “The Trump administration positioned itself as an antagonist to the institution of a free and unfettered press in numerous ways. Its abuse of its prosecutorial powers was among the most disturbing,” the letter says. “We are deeply concerned about the way that a precedent created by prosecuting Assange could be leveraged—perhaps by a future administration—against publishers and journalists of all stripes.” The New York Times said the department had a deadline of Friday to file a brief in the British court if it wanted to continue to pursue the matter. The department is currently headed by a caretaker official, Monty Wilkinson, the acting attorney general. The letter was addressed to him.

War on Domestic Terror goes global.

• The -New Normal- War on Domestic Terror (CJ Hopkins)

If you enjoyed the Global War on Terror, you’re going to love the new War on Domestic Terror! It’s just like the original Global War on Terror, except that this time the “Terrorists” are all “Domestic Violent Extremists” (“DVEs”), “Homegrown Violent Extremists” (“HVEs”), “Violent Conspiracy-Theorist Extremists” (“VCTEs”), “Violent Reality Denialist Extremists” (VRDEs”), “Insurrectionary Micro-Aggressionist Extremists” (“IMAEs”), “People Who Make Liberals Feel Uncomfortable” (“PWMLFUs”), and anyone else the Department of Homeland Security wants to label an “extremist” and slap a ridiculous acronym on. According to a “National Terrorism Advisory System Bulletin” issued by the DHS on January 27, these DCEs, HVEs, VCTEs, VRDEs, IMAEs, and PWMLFUs are “ideologically-motivated violent extremists with objections to the exercise of governmental authority [and] perceived grievances fueled by false narratives.”

They are believed to be “motivated by a range of issues, including anger over Covid-19 restrictions, the 2020 election results, police use of force,” and other dangerous “false narratives” (e.g., the existence of the “deep state,” “herd immunity,” “biological sex,” “God,” and so on). “Inspired by foreign terrorist groups” and “emboldened by the breach of the US Capitol Building,” this diabolical network of “domestic terrorists” is “plotting attacks against government facilities,” “threatening violence against critical infrastructure” and actively “citing misinformation and conspiracy theories about Covid-19.” For all we know, they might be huddled in the “Wolf’s Lair” at Mar-a-Lago right now, plotting a devastating terrorist attack with those WMDs we never found in Iraq, or generating population-adjusted death-rate charts going back 20 years, or posting pictures of “extremist frogs” on the Internet.

The Department of Homeland Security is “concerned,” as are its counterparts throughout the global capitalist empire. The (New Normal) War on Domestic Terror isn’t just a war on American “domestic terror.” The “domestic terror” threat is international. France has just passed a “Global Security Law” banning citizens from filming the police beating the living snot out of people (among other “anti-terrorist” provisions). In Germany, the government is preparing to install an anti-terror moat around the Reichstag. In the Netherlands, the police are cracking down on the VCTEs, VRDEs, and other “angry citizens who hate the system,” who have been protesting over nightly curfews.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.