Brassaï Couple on a bench, Paris 1932

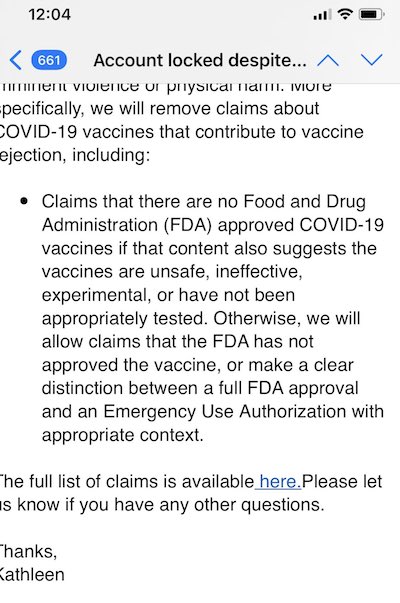

Just how crazy is this? You can say that the vaccines are not approved, but not that they haven’t been appropriately tested?

Hodkinson

The spike protein in the Covid-19 vaccine binds to the ACE2 receptors. Dr. Roger Hodkinson explains to me how the covid vaccine may affect male and female fertility

Full video: https://t.co/ugiLMX1Mkn pic.twitter.com/7Eu8rBuIXT

— Taylor Hudak (@_taylorhudak) May 28, 2021

“It’s literally criminal.”

• Suppressing Data On Ivermectin Cost ‘Half A Million Lives’ – Kory (WT)

In a recent Zoom call, Dr. Pierre Kory of the Front Line COVID-19 Critical Care Alliance outlined numerous details showing the World Health Organization (WHO) knowingly suppressed data on the effectiveness of ivermectin against the virus in order to benefit the vaccine interests of Big Pharma. “It’s criminal,” Kory said. “It’s literally criminal.” The drug “could have saved half a million lives this year if it had been approved.” The WHO, Kory contends, is simply taking part in the tactics of a time-worn “Disinformation Playbook.” The term was coined by the Union of Concerned Scientists 50 years ago to describe the strategies corporations have developed over decades to “attack science when it goes against their financial interests.”

It consists of five parts:

The Fake – Conduct counterfeit science and try to pass it off as legitimate research.

The Blitz – Harass scientists who speak out with results reviews inconvenient for industry.

The Diversion – Manufacture uncertainty about science where little or none exists.

The Screen – Buy credibility through alliances with academia or professional societies.

The Fix – Manipulate government officials or processes to influence policy inappropriately.In the full Zoom call, since removed by YouTube but available on Bitchute, Kory describes how the five tactics have been deployed against the scientific findings on ivermectin. One example is the corruption of leading medical journals, whose editors refuse to allow ivermectin studies to advance to peer review. The most egregious institutional participant, however, is the WHO. Kory is the lead author of a scientific review of the studies on ivermectin worldwide, which was published in the May-June edition of The American Journal of Therapeutics. As reported on the FlCCC website, there have been a total of 56 trials involving 469 scientists and 18,447 patients. Of these, 28 were randomized control trials (RCT), the type of trial considered highly authoritative in the medical community.

Together these have shown an 85 percent improvement as a preventative against the disease when taken before exposure. There has been a 78 percent patient improvement when administered early and a 46 percent improvement when delivered late. A 74 percent improvement in mortality was found and a 66 percent improvement across multiple areas in the 28 randomized control trials. Within only 10 days of publication the paper on ivermectin was rated number 13 most-read among the more than 200,000 other scientific publications that appeared during that time, Kory reports. Out of the 17.7 million papers that have been tracked by the rating source since it began, the ivermectin study is already ranked 246.

I’ll take ivermectin instead.

• Inhaled Nanobodies Could Be New Secret Weapon Against Severe Covid (RT)

In search of ways to complement jabs or to treat patients who can’t be vaccinated, scientists have tested inhalable anti-Covid nanobodies on hamsters, saying they’re effective in fighting the virus by targeting its spike protein. The promising new findings came courtesy of researchers from the University of Pittsburgh School of Medicine, marking the first time nanobodies have been tested for inhalation treatment of the coronavirus disease. Nanobodies are similar to monoclonal antibodies, widely used in certain cancer treatments, but are smaller in size and boast a lower cost of production, which may prove key to a global rollout should the treatment gain regulatory approval in future. The researchers previously identified some 8,000 nanobodies which they whittled down to just one highly effective or “ultra potent” version called Nb21, which they then bioengineered to better slot together with the SARS-CoV-2 spike protein.

Their aerosolized nanobody, named Pittsburgh inhalable Nanobody-21 (PiN-21), is said to have reduced the number of infectious virus particles in the test subject hamsters’ nasal cavities, throats and lungs by a million-fold. “We are very excited and encouraged by our data suggesting that PiN-21 can be highly protective against severe disease and can potentially prevent human-to-human viral transmission,” said co-senior author Yi Shi. The study says that hamsters who inhaled PiN-21 at the time of infection experienced no Covid-19 related weight loss, compared to the control group, which received a placebo and lost 16% of their initial body weight within a week of infection. This would be the equivalent to an adult human losing 20lbs (9kg) in one week, it said. Test subjects who inhaled PiN-21 experienced milder changes in lung structure and severely reduced inflammation following infection than the placebo group.

‘an extraordinary amount of computer power’, ‘databases of Chinese communications, the movement of lab workers and the pattern of the outbreak of the disease around the city of Wuhan.”

• US Sitting On ‘Raft’ Of Unexamined Virus Intel (ZH)

Hours after President Biden promised to release the ‘full report’ from US Intelligence community’s 90-day examination of where COVID-19 originated – unless there’s something he’s unaware of… …the New York Times reports, there’s things he’s unaware of. Namely, ‘a raft of still-unexamined evidence that required additional computer analysis that might shed light on the mystery,” according to anonymous senior administration officials. In other words, the US government has been sitting on a large collection of intelligence in perhaps the most important investigation into an economy-wrecking global pandemic, as China destroyed evidence and has refused to cooperate with international probes.

According to the report, Biden’s call for the new investigation was in response to the ‘new’ evidence. While officials declined to describe the new evidence, they are hoping to apply ‘an extraordinary amount of computer power’ to analyze what the Times speculates may be ‘databases of Chinese communications, the movement of lab workers and the pattern of the outbreak of the disease around the city of Wuhan.” Biden’s call was also meant to spur American allies and intelligence agencies to scour their own evidence, such as “intercepts, witnesses or biological evidence — as well as hunt for new intelligence,” to assess whether the Chinese government covered up what happened.

Astute readers will note that the NYT substitutes its own facts, framing any lab release as of course “accidental,” and suggesting that Biden only dismissed the lab origin theory “until the Chinese government this week rejected allowing further investigation by the World Health Organization.” In reality, plenty of evidence existed which the entire leftist establishment and their media surrogates flatly branded a ‘debunked conspiracy theory’ after then-President Trump promoted it, while the World Health Organization (WHO) and US Centers for Disease Control (CDC) parroted CCP propaganda that the virus could have only emerged via ‘natural origin’ (as opposed to the Chinese lab manipulating bat coronaviruses in the same city that the pandemic started).

Two can play that game.

• Fort Detrick Base Is Full Of Suspicions – China (RT)

Beijing has called on the US to provide an explanation for a respiratory disease in northern Virginia and a large-scale outbreak of e-cigarette disease in Wisconsin after Washington launched a new probe into Covid-19’s origins. Speaking on Thursday, Chinese Foreign Ministry spokesman Zhao Lijian asked the US to reflect on its own role in the pandemic and not “dump” responsibility on China alone. Citing the 33 million Covid-19 cases in the US and 600,000 deaths, Zhao asked “How safe is your conscience?” “I also want to emphasize that the Fort Detrick base is full of suspicions. There are more than 200 biological laboratories in the United States spreading around the world. How many secrets are there?”

The spokesman said that there was an unexplained respiratory disease in northern Virginia in July 2019 and a large-scale outbreak of e-cigarette disease in Wisconsin. “When will the US release detailed data and information on relevant cases to the international community? The United States owes an explanation to the international community.” The Maryland-based US Fort Detrick center hosts a biolab which has become a hot topic on China’s Twitter-like Weibo. In 2019, the Centers for Disease Control and Prevention decided to issue a “cease and desist order” to halt operations at the germ lab over safety concerns.

Zhao’s comment comes after US President Joe Biden said on Wednesday that he was giving intelligence agencies 90 days to pinpoint the origins of Covid-19. Biden said his administration would continue to push China to “participate in a full, transparent, evidence-based international investigation and to provide access to all relevant data and evidence.” Reinforcing a statement from the Chinese Embassy in Washington, DC on Wednesday evening, Zhao called on the US to stop “ignoring facts and science” and refrain from “repeatedly clamoring to reinvestigate China.”

Good idea.

• Rand Paul: “Fauci Cannot Investigate Himself; Get Him Under Oath” (SN)

Senator Rand Paul, who has spearheaded the renewed push to investigate the origin of the coronavirus pandemic, has called for Dr Fauci to be placed under oath and made to testify about the murky ‘gain of function’ research he was involved with funding at the Wuhan Institute of Virology. Paul also urged that Fauci “needs to be excluded from the investigation” because he is too deeply involved in the whole thing. Appearing on Fox News, Paul spoke about the funding that Fauci and the NIH supplied to China. “Well, sure it’s a lot. And there are some reports that it added up to millions over time. But the other thing he said was that there was no gain of function in the application. There are scientists who looked at the application and who absolutely and categorically disagree with him,” Paul noted.

“The other evidence that we have is Dr. Shi from the Wuhan lab published a paper that is clearly about gain of function and it that she thanks her group and Dr. Fauci for funding that paper. So there are a lot of contradictions going on,” Paul added. “I think Dr. Fauci should be made to testify under oath about the money that was given to the lab,” Paul said, adding “The good news is yesterday I passed an amendment on the Senate floor that says no more gain of function money can be sent to China.” “The bottom line, he cannot investigate himself. If he was responsible for giving this money. He has every incentive to cover it up and not reveal the truth about it because if the pandemic did come from the lab, he would have great culpability in this,” Paul further emphasised.

The Senator, who continues to receive death threats after being so vocal against Fauci, added that “he can’t be investigating this, nor can any of his people that he picks be investigating this. He needs to be excluded from the investigation.” “This is very important because this could happen again,” Paul warned, adding “I mean, they are experimenting with the SARS virus, which is 15 times more deadly than COVID-19. COVID-19 kills 1%… more than 3 million people. If SARS got out of the lab, that could be 50 million people. This is a very important task ahead of us. We have 11 labs in our country that do this kind of research.”

Is Rand Paul now the only honest politician left alive on Earth ? pic.twitter.com/fYvgCQ6Syy

— ProKlausSchwab (1 of us needs jailed) (@ProKlausSchwab) May 27, 2021

Just how crazy is this? Does anyone find it normal?

• California Launches Largest US Covid Vaccine Lottery Yet (G.)

California has become the latest state to offer a vaccine lottery to incentivize getting the coronavirus vaccine – launching the nation’s most valuable single prize draw: $1.5m. The state’s governor, Gavin Newsom, announced on Thursday that residents will be eligible for a total of $116.5m in prize money giveaways, a windfall aimed at getting millions more vaccinated before the nation’s most populous state fully reopens next month. The state’s reopening is pegged for 15 June, and on that day a drawing will be held to award 10 vaccinated people the top prize. Another 30 people will win $50,000 each, with those drawings starting 4 June. Anyone 12 and older who has received at least one shot will be eligible. And the next 2 million people who get vaccinated will get $50 gift cards.

The state estimates about 12 million Californians 12 and older have not been vaccinated. About 63% of the 34 million eligible have gotten shots, though the pace has slowed markedly in recent weeks as infection rates have plummeted to record lows. Ohio this week announced the first $1m winner of its “Vax-a-Million” contest, as well as the first child to win a full college scholarship. The scheme saw more than 2.7 million adults register for a chance to win. Colorado and Oregon also offered $1m prizes. New York is raffling 50 full scholarships to children 12 to 17 to public universities and colleges in the state, selecting 10 winners each of the next five Wednesdays. That California is turning to cash prizes to encourage vaccinations marks a major turnaround from earlier this year, when Californians clamored for shots, with some driving or waiting in line for hours to get one.

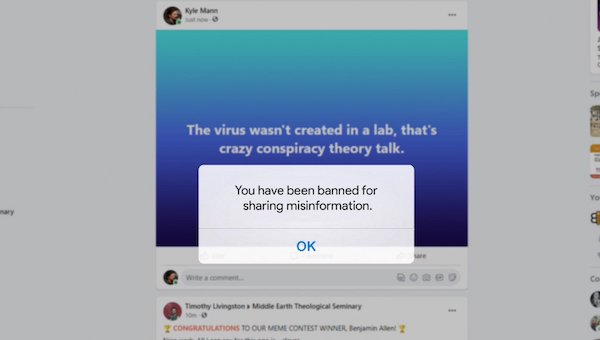

Babylon Bee is on a roll.

• Facebook Now Banning Anyone Who Says Virus Wasn’t Created In Wuhan Lab (BBee)

Facebook has updated its community standards today, declaring that anyone who says the COVID-19 virus wasn’t developed in the lab in Wuhan will be banned for sharing fake news. Mark Zuckerberg, may he live forever, announced the change from his royal throne today to a group of reporters gathered in his royal throne room. “Hear ye, hear ye!” Zuckerberg announced. “From henceforth, anyone saying the virus wasn’t created in a lab shall be banned! While previously, those who said the virus was created in a lab were hanged, this royal decree hereby reverses the order, and now, those who deny the obvious truth that it was created in a lab shall be declared anathema and sentenced to die!”

Zuckerberg’s royal scribes then began scrubbing the old rule from the giant Community Standards tablets displayed in the throne room and chiseling the updated rule on top. “So it is written, and so it is done!” announced Zuckerberg. And the people rejoiced and began feasting upon the lamb, and sloths, and carp, and anchovies.

Amazon as the great defender of the minimum wage. Gutsy.

• Bezos Weaponizes The Washington Post Homepage (DP)

A few years after Amazon CEO Jeff Bezos bought the Washington Post, he said it was because it “is the newspaper in the capital city of the most important country in the world” and “has an incredibly important role to play in this democracy.” Now, with more and more legislators scrutinizing his company’s business practices, his newspaper is playing that role — as an advertising platform in defense of Amazon. On Tuesday, hours after the Washington Post reported that the D.C. attorney general is bringing an antitrust lawsuit against Amazon, the front page of the Post’s website was festooned with native ads from Amazon portraying itself as a devoted supporter of a higher federal minimum wage.

The Post ads, which appeared almost like editorial content, are part of a broader campaign by Amazon highlighting its support for a $15 minimum wage. Left unsaid: Amazon only begrudgingly agreed to a higher wage for its own workers after serious public shaming. The company has also continued to bankroll corporate lobbying groups that are leading the fight against a minimum wage hike, and the Washington Post editorial board has campaigned against a $15 wage. Amazon’s ad spending with the newspaper is nothing new: The company has disclosed spending $40.5 million with the Washington Post since 2013 on advertising and digital content, including $8.1 million last year, according to its proxy statements.

The company’s latest ad on the Post homepage was designed to make the tech giant look progressive in advance of the company’s annual meeting on Wednesday and the news that it’s acquiring legendary film studio MGM. If you were casually glancing at the Post page Tuesday, you may not have realized the Amazon language was an advertisement, since portions of it were included in the Washington Post masthead banner. Text boxes in the banner said: “Since 2018, Amazon has paid at least $15/hour. It’s time to raise the $7.25 federal minimum wage.” Corey Quinn, chief cloud economist at The Duckbill Group, noted Tuesday that “these ads aren’t clearly marked as ads, and that crosses a line.”

[..] Of course, as the Washington Post headline noted when Amazon announced it would raise its minimum wage to $15, it did so “following criticism” — most prominently from Sen. Bernie Sanders, Ind.-Vt., who launched a petition to Bezos in August 2018, demanding that he pay his workers “a living wage and improve working conditions at Amazon warehouses all across the country.” Sanders also introduced the “Stop BEZOS Act,” legislation to put a 100-percent tax on government benefits received by workers at large companies, after a report by the New Food Economy found that thousands of Amazon workers were on food stamps.

“His budget and tax hikes are headed to the gutter. Beyond infrastructure, it’s unclear if Biden can pass anything.”

• Biden’s Budget Assumes a Massive Retroactive Capital Gains Tax (Mish)

Biden seeks to hike the top rate on capital gains to 43.4% from 23.8% for households with income over $1 million. He also wants to make the increase retroactive and force capital gains realization at death as well. The WSJ reports Biden’s Budget Said to Assume Capital-Gains Tax Rate Increase Started in April. • Leaders of six biggest U.S. banks, testified to Congress Thursday warning against a retroactive change. • Sen. Mark Warner (D., Va.), wants to maintain a lower tax rate for capital gains than for ordinary income. • Lawmakers from farm states, including Sen. Jon Tester (D., Mont.) and Rep. Cindy Axne (D., Iowa) have objected to the changes on capital gains at death. Biden wants to make it retroactive so that millionaires cannot accelerate gains now. And he wants to make gains taxable at death to prevent heirs from holding.

In short, Biden wants his tax hikes now and later too. He continues to appease the Progressives. Treasury Secretary Janet Yellen says the budget is sustainable because long-term yields are below the rate of inflation, conveniently held there by the Fed. The budget also assumes no recession for at least another 9 years despite the fact they happen about every 5 years on average. Finally, Biden’s budget not only assumes retroactive tax hikes but those hikes will bring in more money than the nonpartisan congressional budget office assumes. Meanwhile, Enough is Enough, a Democratic Governor Courageously Says “No More Taxes”

There is bipartisan support for about $900 billion in infrastructure spend, far short of the $2.3 trillion Biden seeks. There is no bipartisan support for tax hikes. Moreover, Biden cannot afford to lose a single Democrat Senator on any issue, but the net impact of all his tax and budget proposals suggests he has lost at least 3 Senators. His budget and tax hikes are headed to the gutter. Beyond infrastructure, it’s unclear if Biden can pass anything.

“Banks can continue to lend money at interest in order to cover their costs, and make a reasonable profit, but they should not be permitted to create new money at interest..”

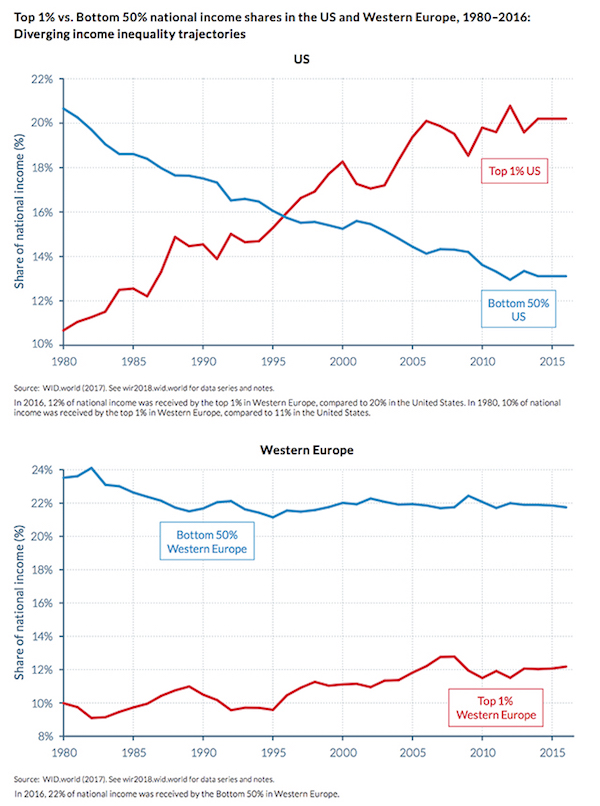

• Socialism for 1% Capitalism 99% (Braund)

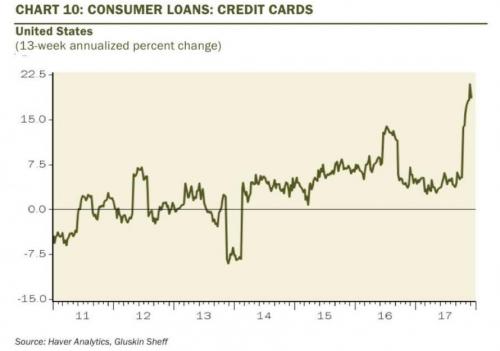

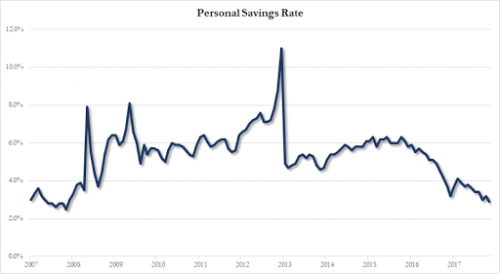

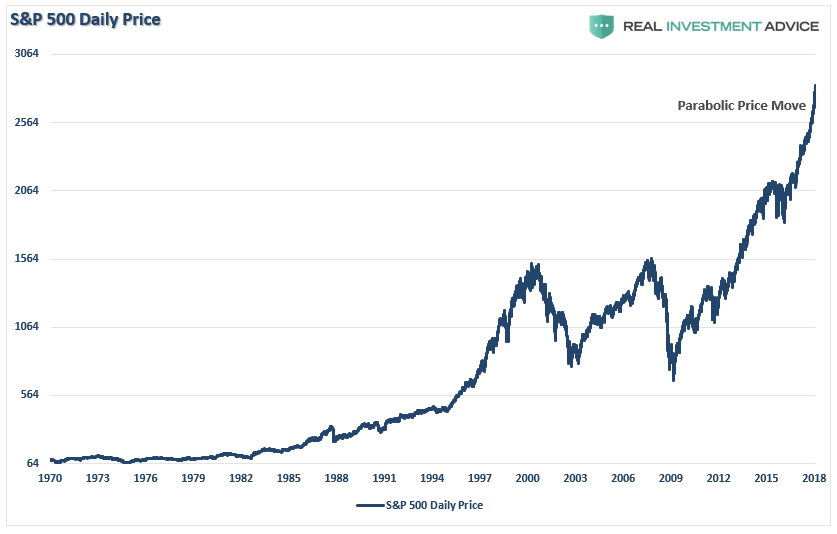

Banks create money by making loans to their customers. This method accounts for around 97 per cent of the money in circulation. Nearly all money is created as debt, repayable at interest. This means that all loans have to be repaid with money also created as debt and loaned at interest. No wonder the economy struggles, when the system of money creation heaps cost upon unnecessary cost. And no wonder the banks generate such enormous profits. This system, known as fractional reserve banking, is an integral part of the nexus of unearned wealth: Banks’ shareholders earn dividends from the super-profits extracted by the process of money creation; banks loan money to their own investment arms to finance speculative activities which undermine the real economy and then pay themselves unwarranted bonuses from the proceeds; and money issued as debt helps drive up asset prices, especially land, through the housing market and the market for commercial property.

Not only does the system of money issue skew the economy in favour of the already wealthy, it places an unnecessary burden on genuine entrepreneurs by charging them for the use of money. Money is not wealth, but it is required to pay for land, labour and capital. Why should enterprising businesspeople pay a premium for the use of money, when without it business is impossible? It gets worse: Through the activities of credit card companies, banks try to cover up their economic misdemeanours by lending money for consumption to those unable to earn enough to get by. This creates an impression that the economy is in good health because people keep spending. In fact, UK personal debt, at £1,452bn is roughly equivalent to the country’s GDP.

If they are to remain in private ownership, banks must be obliged to work under a revised system of full reserve banking: they should only lend money which they can fund from deposits and reserves. If the money supply needs to be increased, new money can be issued through banks by a central authority. Banks can continue to lend money at interest in order to cover their costs, and make a reasonable profit, but they should not be permitted to create new money at interest, and they should be required to compete for business by offering the best possible savings and borrowing rates to their customers. The current system of money issue widens the gap between rich and poor by concentrating its lending for investment on large corporations, while charging the economically excluded exorbitant rates on borrowing for consumption. It conspires against an optimal supply of money by ensuring that the quantity of money in circulation never reflects the amount of wealth being created, thus introducing instability into the economy and driving the damaging cycle of boom and bust.

More Babylon Bee.

• CNN Hires Trump As News Anchor To Recover Lost Viewers (BBee)

In order to bring back the viewers it’s lost since the 2020 election ended, CNN is rehiring the biggest draw for its audience: former President Trump, who will host all the news segments every night on prime time.

“What we’ve discovered since the election is people only watched our station to see Trump, so we’re hiring him to anchor our programs,” said Bob CNN, owner and founder of the cable news station. “This will finally get our ratings out of the dump.” During his first night on the job, Trump simply yelled about election fraud for two hours. “Very sad, very pathetic, worst-run election in history, maybe ever! Worse than North Korea!” he said to an audience of millions, CNN’s largest in many months.

“Frankly, any ballot cast against me is suspect. You really believe that someone would walk into an election booth and look at me and Sleepy Joe and choose Sleepy Joe? No. Can’t happen. Fake news. Not good. Sad!” After this, the rest of the hosts for the night just yelled about Trump yelling about election fraud. According to Trump, the deal was “the biggest deal in the history of television, maybe ever.” Rumors indicate that Trump was given a majority share in the company, billions of dollars, and unlimited Diet Coke. According to insiders, the headquarters of CNN will also be moved to Mar-a-Lago as part of the deal. After the announcement, CNN’s ratings skyrocketed, and they’re finally outperforming the WNBA, soccer, and Saturday Night Live.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.