DPC Luna Park, Coney Island 1905

A very smart way to look at it.

• An Economy Based On Property Has Much To Fear (Independent)

Believe it or not, the Bank of England isn’t just a bunch of bowler-hatted types stuck behind desks in Threadneedle Street. It has agents up and down the country interviewing business people on how their companies are faring: what goods are selling well, whether they’re hiring or firing, that sort of thing. The monthly bulletins that result rarely get reported, but are useful because they layer anecdotal evidence on top of the regular run of dry economic stats. Superficially, October’s feedback had much to cheer – order books are swelling in most sectors, employment is expected to increase, and access to credit has improved. But it is striking how much of this positive stuff is related, directly or indirectly, to the property market.

Business services firms – accountants, lawyers and the like – are growing because of an increase in construction deals; manufacturing and retail sales are being kept afloat by sales of kitchens, bathrooms and furniture thanks to people moving house; business investment is growing as firms spend more on doing up their premises or moving to new sites. Property, property, property. Exporters, meanwhile, were gloomy, with all, from farmers to manufacturers, complaining of eurozone weakness, Russian belligerence and war in the Middle East. That means we will be reliant on the domestic economy for years to come. With this still clearly so dominated by the world of bricks and mortar, one has to wonder, what would happen if interest rates start to rise? Disaster, that’s what. The Bank’s other document release yesterday – the minutes to the Monetary Policy Committee’s last meeting on rates – show a continuing doveish slant. Good job, too.

Read more …

No, prices vs income shuts out potential buyers. So either significantly raise wages or drop prices, and stop whining.

• Lenders Facing Soaring Costs Shutting Out U.S. Homebuyers (Bloomberg)

Clem Ziroli Jr.’s mortgage firm, which has seen its costs soar to comply with new regulations, used to make about three loans a day. This year Ziroli said he’s lucky if one gets done. His First Mortgage Corp., which mostly loans to borrowers with lower FICO credit scores and thick, complicated files, must devote triple the time to ensure paperwork conforms to rules created after the housing crash. To ease the burden, Ziroli hired three executives a few months ago to also focus on lending to safe borrowers with simpler applications. “The biggest thing people are suffering from is the cost to manufacture a loan,” said Ziroli, president of the Ontario, California-based firm and a 22-year industry veteran. “If you have a high credit score, it’s easier. For deserving borrowers with lower scores, the cost for mistakes is prohibitive and is causing lenders to not want to make those loans.”

Federal regulations, enacted after the collapse of the subprime market spurred the financial crisis, are boosting mortgage costs this year. Most lenders are responding by providing home loans only to borrowers with near perfect credit, shutting out creditworthy Americans whose loan files are too expensive to review and complete. If banks commit compliance errors in issuing a loan that goes bad, they have to buy it back at a loss from Fannie Mae or Freddie Mac. During the housing boom between 2004 and 2007, lenders provided about $2 trillion in subprime loans, many to unqualified borrowers. So-called liar loans didn’t require borrowers to provide pay stubs or tax returns to document earnings. Teaser rates as low as 1% offered on mortgages soared when they reset a few years later.

The share of subprime mortgages for which borrowers either provided little documentation of their assets or none at all rose to 38% in 2007 from 32% in 2003, according to a paper published by the Federal Reserve. Almost one in four of those mortgages defaulted by 2008 compared with one in five of fully documented subprime loans. Wall Street firms securitized pools of the loans called collateralized debt obligations and sold them to investors. They also created so-called synthetic CDOs that were derivative instruments designed to mirror the performance of the loan pools. “What started the crisis were these loans that were designed to fail, loans that weren’t underwritten at all,” said Julia Gordon, director of housing finance and policy at the Washington-based Center for American Progress, which has ties to the Democratic Party. “No one quite realized that these loans were then at the bottom of this giant pyramid scheme, where the Wall Street derivative products that were based off of them would just come crashing down and take the whole economy with them.”

Read more …

Sorry, Barry, but that’s as wrong as can be. It should very much be this hard, or prices will never find their ‘natural’ floor.

• It Shouldn’t Hurt This Much to Get a Mortgage (Barry Ritholtz)

Under normal circumstances, approving my mortgage application should be a no-brainer: High income, no debt, good credit score. The missus also makes a good income, has an almost-perfect credit score and has been working for the same business for 28 years. But these are not normal circumstances. Let me jump to the end: Yes, we got our mortgage. We put 20% down, bought a house that appraised for more than the purchase price and got a 3.25% rate on a mortgage that resets after seven years. We moved in last month.

But the process was surreal. Indeed, it was such a bizarre experience that I started hunting for explanations from people in the industry about why mortgage lending has gone astray. I spoke to numerous experts, many of whom spoke only on background. Today’s column is about what I learned. By just about any measure, credit is tighter today than it has been in decades. Although former Federal Reserve Chairman Ben Bernanke’s inability to refinance a mortgage is merely anecdotal, consider instead the gauge CoreLogic developed. It used 1998 as a baseline and considered six quantitative measurements to evaluate how loose or easy mortgage lending is. By those metrics, this is the tightest credit market for mortgage lending in at least 16 years.

Read more …

I like my take from yesterday better: French hookers are cheaper than British ones.

• Paying For Bad Habits: Hookers And Drugs Lift UK’s EU Bill (Guardian)

Listening to EU officials describe how Britain pays its annual EU contribution brings to mind George W Bush being questioned about one of his administration’s budgets. Flicking the pages before assembled journalists he said: “There’s a lot of pages, a lot of lines and a lot of numbers.” To all but a few, the addings up and subtractings that go on in Brussels make little more sense. One of the few things that does seem clear is that Britain is paying for its bad habits. Brussels needs more cash this year to cope with overspent budgets. And while it might seem unfair to tax a country for needing a bigger crutch than others in the EU club, relatively speaking, the UK’s GDP has jumped courtesy of new estimates of the nation’s consumption of drugs and use of prostitutes. The EU applies its complex calculation of how much member states should pay into its coffers largely on GDP levels. The bigger the national income, the bigger the contribution. So far, so simple.

However, earlier this year the UK’s GDP was given a £10bn boost after officials calculated that sex work generated £5.3bn for the economy in 2013, with another £4.4bn coming from the sale of cannabis, heroin, powder cocaine, crack cocaine, ecstasy and amphetamines. Other countries have been affected too after the EU calculated how much of their hidden economies should be brought on the books. Greece faces a larger contribution despite losing a fifth of is national income since 2009. Italy is another victim, though arguably it has only included a fraction of the mafia’s business in its GDP calculations. More importantly, Britain is paying more because this year it is simply bigger than 18 months ago while other countries have stood still or contracted. Like soldiers in a lineup who find themselves volunteering for toilet duty after everyone else has taken a step back, the UK Treasury is paying for being one of the few among the EU’s 27 economies to strengthen this year.

Read more …

A glitch in the posturing process?!

• UK Chancellor Osborne’s Choice Of Words Is Sounding Alarm Bells (Guardian)

George Osborne is clearly worried. Going into a pre-election war-gaming huddle with his advisers, the economic numbers that once sang a happy tune and are so crucial to victory, now sound a little discordant. It seems churlish to strain for the bum notes in the latest GDP figures. All parts of the economy are growing, with the exception of agriculture. And growing more strongly than they are in any of the major European economies. But it is the chancellor’s words that set off the alarm bells. He said: “If we want to avoid a return to the chaos and instability of the past, then we need to carry on working through our economic plan that is delivering stability and security.” Adopting the word “chaos” is at once interesting and alarming. He seems to be saying that any other path than the one he has chosen will bring with it a swirling storm of instability. Billing himself as Lord Protector, Osborne risks overstating his case, especially when the GDP numbers are so strong.

Growth is moderating, but most surveys report that businesses remain confident about the recovery and continue to hire more staff. As a result, unemployment continues to fall. So what can he be worried about? There is the three months of restrained housing market activity. If it’s true, and we don’t fully understand the link, that much of the recovery is connected to the increase in property buying, then any slowdown is a cause for concern. Except the chancellor wanted the housing market to cool. And his policies are largely the reason banks are refusing to dole out loans after he gave regulators instructions in April to clampdown on risky mortgage lending. A slowdown in housebuilding was also a logical knock-on effect, given that a majority of homes are constructed by a private building sector keen to maintain its extraordinary profit levels.

We know he is worried about the slowdown in exports, which didn’t take off four years ago, as he had expected. The eurozone’s impending recession is largely to blame, but a lack of support to exporters, particularly multimillion-pound credit insurance, has also proved a barrier. However, the crucial issue is the government’s finances, which have worsened this year despite the strong recovery. For a man with the electoral cycle stamped on his DNA, it is tragic that businesses and workers are not paying much extra tax.

Read more …

What do Detroiters think of this?

• A Mystery Bidder Offers $3 Million for 6,000 of Detroit’s Worst Homes (BW)

Three million dollars can barely buy a new townhouse in Brooklyn these days, but it could be enough to purchase a bundle of more than 6,000 foreclosures up for auction in Detroit. The cost of dealing with the many blighted buildings included in the Detroit mega-auction means a $3.2 million bid received last week—roughly the minimum allowable bid of $500 per property—will likely prove too high to turn a profit. “I can’t imagine that you are going to make money on this,” says David Szymanski, chief deputy treasurer of Wayne County, which is selling the properties. So it’s all the more mysterious that the auction, opened with little fanfare earlier this month, has attracted any bidder at all. Still, at least one unidentified party is willing to pay $3.2 million to take control—and responsibility—for scores of dilapidated homes. In fact, winning the bid could cost the lucky winner a small fortune beyond the auction price.

Finding a way to deal with Detroit’s blight is critical for the city’s future. A task force has already called for immediately tearing down 10% of all structures. The group surveyed the condition of every Detroit property and identified neighborhoods at a tipping point at which stripping them of blight could keep certain areas from slipping away entirely. “I had cancer 12 years ago, and this is exactly like cancer,” Szymanski says. “If you don’t get it all, it’s going to come back.” Wayne County has become a major owner of blighted properties, which it can seize when owners fall behind on taxes. The scale of its distressed holdings is unprecedented. When Szymanski joined the treasurer’s office four years ago, he called the treasurer of Cuyahoga County in Ohio to compare notes. His counterpart, whose domain includes Cleveland and was a bellwether during the housing crisis, asked: “Are you sitting down? We are foreclosing on 4,500 properties.” Szymanski says he replied: “I hope you’re laying down.” At the time, Wayne County had 42,000 properties in foreclosure.

Read more …

Throw ’em out!

• Spanish Accuse Goldman, Blackstone Of Hiking Rent For Poor (Independent)

The London investment arms of Goldman Sachs and Blackstone were accused last night of jacking up the rents of Madrid’s poorest people after they bought thousands of the city’s council flats. Many, unable to afford their new terms, have now been threatened with eviction or moved out. During the financial crisis, the city was advised by the accountants PwC to sell off swathes of its social housing in order to raise desperately needed funds. It sold 5,000 flats to investors including Goldman and Blackstone. Nothing changed in the tenants’ rents until their leases ran out, when, in many cases, the charges shot up dramatically. Reuters interviewed over 40 households who have been thrown into difficulties by the rent rises. They include Jamila Bouzelmat, a mother of six who lives in a four-bed flat now owned by Goldman and a Spanish property firm. She said her family had been paying €58 (£46) a month rent from her husband’s €500 unemployment benefit. But in April, her new landlords suddenly took €436 from her account.

Ms Bouzelmat said she only discovered the problem when she tried to pay an electricity bill: “We went to take money out and there wasn’t a cent left in the bank,” she explained. 1 in 5 adults in Madrid are unemployed. Goldman and Blackstone are entirely within their rights to charge market-price rents. However, a number of lawsuits have now been launched by local politicians against the councils that sold the homes. The problem is particularly bad in Spain because it already had one of the smallest stocks of social housing in Europe. Now 15 per cent of it has been sold off to London banks and private equity firms, there is even less. Goldman’s properties had about 400 households on reduced rents, often negotiated individually with the council and set for up to two years. Goldman referred inquiries to Encasa Cibeles, the local firm set up to manage the flats. A spokesperson said: “Evictions occur in an extremely small number of cases.”

Blackstone’s tenants have been on longer leases but most have been paying below-market rents. As leases approach expiry, rates have risen 40%. Blackstone referred inquiries to Fidere, the local estate management company, which said “some people have lost the public subsidy they received from the council”. It is negotiating with the 2% of its tenants in that situation.

Read more …

There’s always another politician to put on the payroll.

• Bank Breakup Plan Hits More EU Hurdles as Danes Reject Idea (Bloomberg)

Denmark won’t back a proposal to split Europe’s biggest banks as the region’s first country to enforce bail-in rules questions the value of more regulation. “With all the legislation now in place there really shouldn’t be more worries,” Business Minister Henrik Sass Larsen said in an interview yesterday at the parliament in Copenhagen. A proposal by Michel Barnier, the European Union’s financial services chief, to break up systemically important banks has resurfaced with local regulators trying to defend national interests, according to a document obtained by Bloomberg News. Italy, which holds the EU’s rotating presidency, said it was looking for “concrete options for the way forward” after registering “strong concerns” among member states, the document showed. “With the regulation we’ve put in place, we’re fully covered,” Larsen said, characterizing the notion that more may be needed as obsolete. The proposal for reforming bank structures has come under attack on multiple fronts since Barnier presented it in January.

In addition to a narrowly defined proprietary-trading ban, Barnier set out EU-wide standards for splitting up the most systemically important banks that would push certain kinds of derivatives and other trading activities into separately capitalized units. Barnier’s plans require approval from national governments and the European Parliament to take effect, with talks set to continue into next year. Britain’s Jonathan Hill, who will replace Barnier as financial services commissioner on Nov. 1, has said he will “take forward work” on the proposal. Larsen’s position shows some EU nations back industry efforts to block further regulation. Christian Clausen, the president of the European Banking Federation and the chief executive of Nordea Bank AB, said this week plans to add rules to the existing framework are “going beyond reason.” Clausen said he plans to have a “serious talk” with the European Commission and parliament to prevent further regulatory tightening.

Read more …

Think Berlin.

• Citigroup Bets ECB Will Do QE as Morgan Stanley Sees Odds at 40% (Bloomberg)

Economists are at odds over whether the European Central Bank will do “whatever it takes” to revive inflation in the euro area. More than two years after President Mario Draghi promised to pull out all the stops to protect the euro from a swirling debt crisis, ECB-watchers are split over whether the central bank will buy government bonds to aid the struggling economy. In making forecasts for the possible deployment of full-blown quantitative easing, the pressures of weak growth and sliding inflation are being balanced against Germany’s aversion to purchasing sovereign debt and practical considerations such as how and whether it would work. Draghi said earlier this month that the ECB will use further unconventional monetary policy instruments if needed to support recovery. Goldman Sachs sees one-in-three odds of QE, Morgan Stanley views the chances at 40% and JPMorgan is at 50-50. By contrast, HSBC, Barclays and Bank of Americahave sovereign QE as part of their central scenarios. Citigroup even says it could happen before the end of this year.

Here then is a handy round-up, gleaned from reports and interviews, of where economists at major banks stand. Huw Pill, Goldman Sachs: “Sovereign QE is not part of our baseline scenario, which is for economic activity to go sideways and inflation to remain low. We think the current gloom and doom about the euro area outlook is overdone.” Joerg Kraemer, Commerzbank: “We were one of the first banks to predict at the end of August that the ECB would buy government bonds on a generous scale, envisaging this happening at the start of next year rather than this year.” “It has become far more likely that the bank will act before the end of this year. Concerns about the economy that have triggered the drop in equity prices make it ever more likely that the ECB will have to lower its optimistic growth forecast for 2015 of 1.6%.” “This fact plays into the hands of those on the ECB Council in favour of relaxing the reins, as does our expectation that the end of the bank stress test will not in fact sound the all-clear for weak lending. Long-term inflation expectations have dropped sharply.”

Read more …

Gutted like a fish.

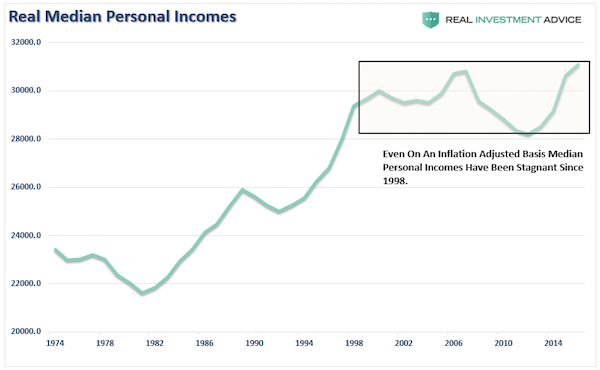

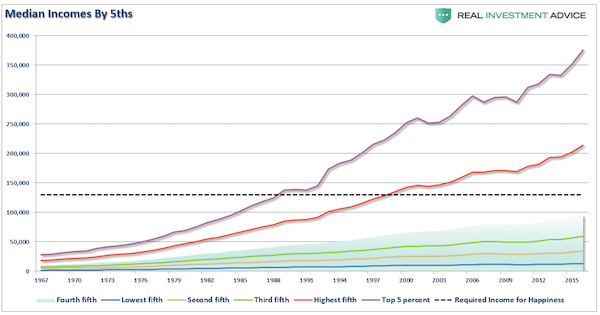

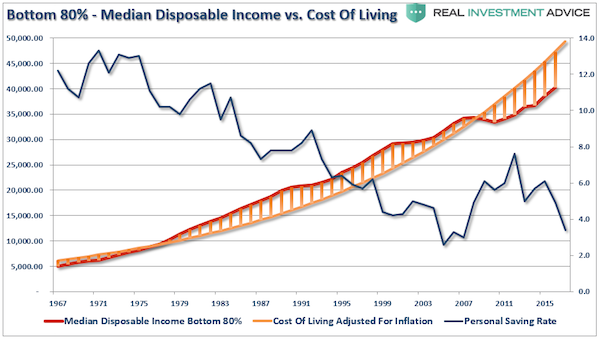

• 50% Of American Workers Make Less Than $28,031 A Year (Snyder)

The Social Security Administration has just released wage statistics for 2013, and the numbers are startling. Last year, 50% of all American workers made less than $28,031, and 39% of all American workers made less than $20,000. If you worked a full-time job at $10 an hour all year long with two weeks off, you would make $20,000. So the fact that 39% of all workers made less than that amount is rather telling. This is more evidence of the declining quality of the jobs in this country. In many homes in America today, both parents are working multiple jobs in a desperate attempt to make ends meet. Our paychecks are stagnant while the cost of living just continues to soar.

And the jobs that are being added to the economy pay a lot less than the jobs lost in the last recession. In fact, it has been estimated that the jobs that have been created since the last recession pay an average of 23% less than the jobs that were lost. We are witnessing the slow-motion destruction of the middle class, and very few of our leaders seem to care. The “average” yearly wage in America last year was just $43,041. But after accounting for inflation, that was actually worse than the year before… American paychecks shrank last year, just-released data show, further eroding the public’s purchasing power, which is so vital to economic growth.

Average pay for 2013 was $43,041 — down $79 from the previous year when measured in 2013 dollars. Worse, average pay fell $508 below the 2007 level, my analysis of the new Social Security Administration data shows. Flat or declining average pay is a major reason so many Americans feel that the Great Recession never ended for them. A severe job shortage compounds that misery not just for workers but also for businesses trying to profit from selling goods and services. Average pay declined in 59 of the 60 levels of worker pay the government reports each October.

Read more …

In Canada? Really? What part of the dream is that?

• The American Dream Is Still Possible, Just Not in the US (Daily Bell)

Although there are no firm statistics on the number of Americans living outside the US, the US State Department estimates that somewhere between 3 and 6 million Americans now live offshore. I think this is a low estimate and the number is clearly growing. I now live in Canada but often travel back to the United States. Driving through Customs near Buffalo is usually not a big ordeal but it does involve a time-wasting delay much like visiting the post office or any other US government bureaucracy. But governments should police their borders, as this is one of the few legitimate functions of a central government. Still, whenever I’m there I do notice the America I grew up in and once knew has really changed since 9/11. The trend toward a more militarized and aggressive police force continues to quicken. I know most Americans accept this as part of the consequences of the War on Terror just as they do the loss of financial privacy, increased fines and asset seizures.

The Canadian government recently warned citizens to be careful when taking cash to the US because of the risk of police taking their cash for hyped-up offenses. Did you know that in the last 13 years, over $2.5 billion has been stolen by law enforcement in almost 62,000 cash seizures? I have to say that as an American, I’m outraged at the situation and always on guard when in the USSA. I fear many Americans who don’t travel internationally might have become somewhat immune to the intrusive, arbitrary nature of today’s American government and its institutions. Here in Canada, law enforcement is almost always professional and courteous and even the bureaucrats are friendly and helpful, which simply amazes me. So to my American family, friends and business associates, I want you to know it is still possible to achieve the American Dream of a simple life with opportunity for wealth creation, fun, freedom and good times without an overly intrusive, threatening government … just not in the United States.

Read more …

Rosy’s started living up to his nickname.

• Rosenberg Says No Recession Until At Least 2016 (MarketWatch)

It’s going to take a little bit more than Ebola, eurozone pessimism and a rising U.S. dollar to turn David Rosenberg into a bear. The chief economist and strategist at Gluskin Sheff, in his economic commentary, points out the leading economic indicator released Thursday showed a 0.8% monthly advance and a 6.3% year-over-year gain in September. This rate, he says, is consistent with annual real GDP just under 4.5%. Plus, the one-month diffusion index jumped to a four-year high of 90%. Usually, within six months of a recession, the year-over-year trend turns negative while the diffusion index falls below 30%.

“Looking at the situation another way, based on where both the YoY LEI trend and the diffusion indices are now, and tracing them through the classic business cycle, we are at least two years away from the next recession,” he says. What does that mean for stocks? “The reality is that bear markets do not just pop out of the air,” he said. “They are caused by tight money, recessions, or both. These conditions do not apply, nor will they until 2016 at the earliest.”

Read more …

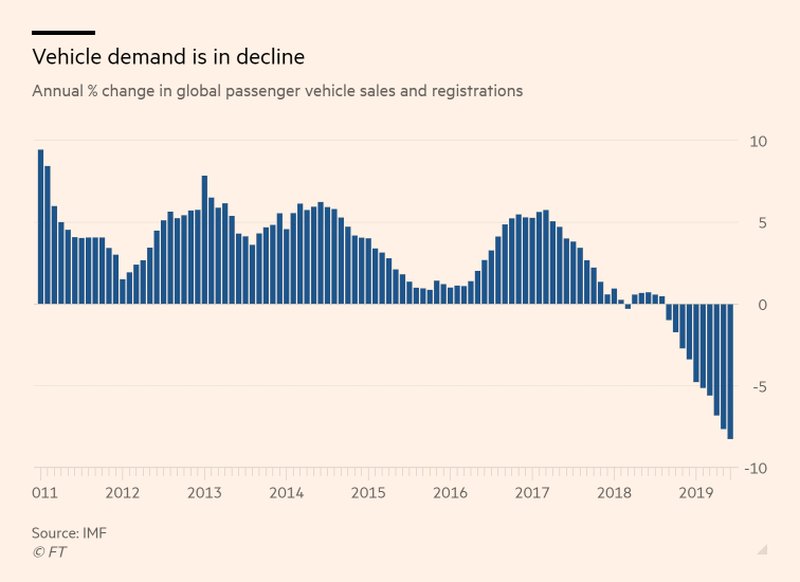

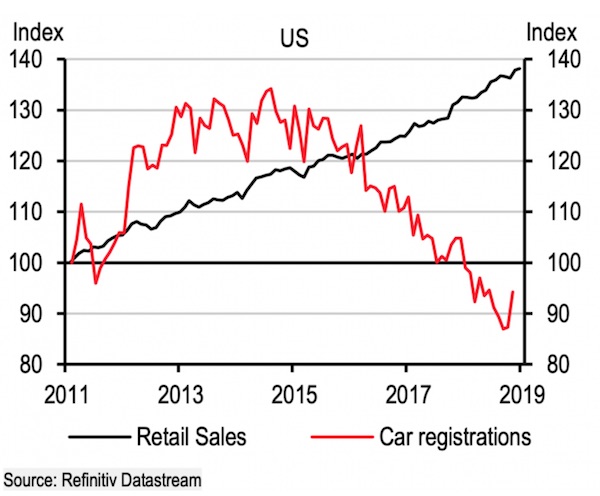

That’s a lot of cars planned for and produced, that are not going to be sold.

• China Auto Market Growth To Shrink by 50% This Year: Industry Head (Reuters)

Growth in China’s auto market, the world’s biggest, will halve to 7% this year weighed down by a slowing economy, the head of an industry body said on Saturday. “Personally, I think growth this year can reach 7%,” Dong Yang, secretary general of the China Association of Automobile Manufacturers (CAAM), told reporters on the sidelines of an industry conference in Shanghai. “The economy is slowing. The auto industry would reflect that but typically lags the economic cycle by a bit.” CAAM had forecast China’s auto market, which grew by 13.9% last year, to expand at 8.3% in 2014. Dong said CAAM will not make any official revisions to its forecast. [..] Nissan has said its China sales fell by 20% in September from a year earlier, the third straight month of decline, due to sluggish sales of light commercial vehicles and increased competition in the passenger car segment. During the first nine months of the year, overall vehicle sales in China rose 7% from the same period a year earlier, according to CAAM data.

Read more …

Jeff Bezos has issues.

• Blood In The Water As Amazon Magic Fades (Reuters)

Amazon.com’s once fairy-tale ride on Wall Street has hit its most jarring bump yet. The company that for years enthralled investors with improbable growth and earned one of the technology sector’s highest valuations drew widespread ire after a spectacular results letdown on Thursday. Amazon missed expectations across the board – on margins, on its net loss and on revenue. An unaccountably poor 7% to 18% revenue growth forecast for the typically strongest holiday quarter was the final straw for some. Coming just three months after a big letdown in July, the warning may represent a tipping point for investors who are already wary of a triple-digit price-earnings ratio and a persistent unwillingness to throttle back spending.

“They’re becoming much too distracted in all these other efforts” outside core businesses like online retailing and web services, said Matthew Benkendorf, portfolio manager at Vontobel Asset Management. Benkendorf unloaded his Amazon holdings a year ago and said he would be skeptical of future involvement even if the stock falls further. “They are their own worst enemy to success,” he said. “They really need to do some soul searching and get focused.”

Read more …

Not a bad analysis.

• Putin Accuses U.S of Blackmail, Weakening Global Order (Bloomberg)

The U.S. is behaving like “Big Brother” and blackmailing world leaders, while making imbalances in global relations worse, Russia’s president said. Current conflicts risk bringing world order to collapse, Vladimir Putin told the annual Valdai Club in the Black Sea resort of Sochi. The Cold War’s “victors” are dismantling established international laws and relations, while the global security system has become weak and deformed, with the U.S. acting like the “nouveau riche” as global leader, he said. “The Cold War has ended,” Putin said. “But it ended without peace being achieved, without clear and transparent agreements on the new rules and standards.” Russia has clashed with the U.S. over conflicts from Syria to Ukraine, sending relations between the two countries to levels not seen since Soviet times. Putin, whose nation is on the brink of recession because of U.S. and European sanctions over Ukraine, also offered asylum to fugitive American government intelligence contractor Edward Snowden in 2013.

“Global anarchy” will grow unless clear mechanisms are established for resolving crises, Putin told the invited group of foreign and Russian academics and analysts. The U.S.’s “self-appointed” leadership has brought no good for other nations and a unipolar world amounts to a dictatorship, he said. “The United States does not seek confrontation with Russia, but we cannot and will not compromise on the principles on which security in Europe and North America rests,” State Department spokeswoman Jen Psaki said in response today in Washington. Psaki said the U.S. was committed to upholding Ukraine’s sovereignty and territorial integrity while continuing to cooperate with Russia on other issues, including destroying nuclear stockpiles and Syria’s chemical weapons cache.

“Our focus is on continuing to engage with Russia on areas of mutual concern, and we’re hopeful that we’ll be able to continue to do that,” Psaki said, “while we still certainly have disagreements on some issues.” Putin also attacked globalization, which he said has “disillusioned” many countries and risks hurting trust in the U.S. and its allies. More nations are trying to escape dependence on the dollar as a reserve currency by forming alternative financial systems, according to the Russian leader. Russia doesn’t want to restore its empire or have a special place in the world, Putin said. While it’s not seeking superpower status in international relations, it wants its interests to be respected, he said.

Read more …

Progress!

• NPR Slashes Number Of Environment Reporters To One Part-Timer (HuffPo)

National Public Radio is down to just one environment reporter, and he’s only covering the beat part time, InsideClimate News reported Friday. As of early 2014, NPR had three reporters and an editor on the environment beat. Now they have one person, science reporter Christopher Joyce, holding down coverage of the issue, and his stories span a broad range of issues beyond the environment. The other three environment staffers have left NPR or moved to other beats. While other reporters could, of course, fill in with environment coverage, as needed, InsideClimate’s analysis of NPR’s archives finds that the number of environment stories has declined:

The number of content pieces tagged “environment” that NPR publishes (which include things like Q&As and breaking news snippets) has declined since January, according to an analysis by InsideClimate News, dropping from the low 60s to mid-40s every month. A year-to-year comparison shows that the outlet published 68 environment stories in September 2013 and 43 in September 2014. Last month, about 40% of that content was climate-related due to NPR’s cities project, as well as the media-intensive People’s Climate March and the UN climate summit in New York City. The rest was a mix of stories on agriculture and food, land conservation, wildlife, pollution and global health.

Read more …

Key line: “90,122 deaths in Montserrado alone by Dec. 15. Of these, the authors estimate 42,669 cases and 27,175 deaths will have been reported by that time.” Less than a third of deaths to be reported.

• Ebola Epidemic In Africa To Explode Without Rapid, Substantial Aid (Lancet)

The Ebola virus disease epidemic already devastating swaths of West Africa will likely get far worse in the coming weeks and months unless international commitments are significantly and immediately increased, new research led by Yale researchers predicts. The findings are published in the Oct. 24 issue of The Lancet Infectious Diseases. A team of seven scientists from Yale’s Schools of Public Health and Medicine and the Ministry of Health and Social Welfare in Liberia developed a mathematical transmission model of the viral disease and applied it to Liberia’s most populous county, Montserrado, an area already hard hit. The researchers determined that tens of thousands of new Ebola cases — and deaths — are likely by Dec. 15 if the epidemic continues on its present course. “Our predictions highlight the rapidly closing window of opportunity for controlling the outbreak and averting a catastrophic toll of new Ebola cases and deaths in the coming months,” said Alison Galvani, professor of epidemiology at the School of Public Health and the paper’s senior author.

“Although we might still be within the midst of what will ultimately be viewed as the early phase of the current outbreak, the possibility of averting calamitous repercussions from an initially delayed and insufficient response is quickly eroding.” The model developed by Galvani and colleagues projects as many as 170,996 total reported and unreported cases of the disease, representing 12% of the overall population of some 1.38 million people, and 90,122 deaths in Montserrado alone by Dec. 15. Of these, the authors estimate 42,669 cases and 27,175 deaths will have been reported by that time.

Much of this suffering — some 97,940 cases of the disease — could be averted if the international community steps up control measures immediately, starting Oct. 31, the model predicts. This would require additional Ebola treatment center beds, a fivefold increase in the speed with which cases are detected, and allocation of protective kits to households of patients awaiting treatment center admission. The study predicts that, at best, just over half as many cases (53,957) can be averted if the interventions are delayed to Nov. 15. Had all of these measures been in place by Oct. 15, the model calculates that 137,432 cases in Montserrado could have been avoided. There have been approximately 9,000 reported cases and 4,500 deaths from the disease in Liberia, Sierra Leone, and Guinea since the latest outbreak began with a case in a toddler in rural Guinea in December 2013.

Read more …

Reality is likely three times worse here as well.

• ‘Official’ Number of Ebola Cases Passes 10,000, With 5,000 Deaths (BBC)

The number of cases in the Ebola outbreak has exceeded 10,000, with 4,922 deaths, the World Health Organization says in its latest report. Only 27 of the cases have occurred outside the three worst-hit countries, Sierra Leone, Liberia and Guinea. Those three countries account for all but 10 of the fatalities. Mali became the latest nation to record a death, a two-year-old girl. More than 40 people known to have come into contact with her have been quarantined. The latest WHO situation report says that Liberia remains the worst affected country, with 2,705 deaths. Sierra Leone has had 1,281 fatalities and there have been 926 in Guinea.

Nigeria has recorded eight deaths and there has been one in Mali and one in the United States. The WHO said the number of cases was now 10,141 but that the figure could be much higher, as many families were keeping relatives at home rather than taking them to treatment centres. It said many of the centres were overcrowded. And the latest report also shows no change in the number of cases and deaths in Liberia from the WHO’s previous report, three days ago.

Read more …