Vincent van Gogh Landscape with House and Ploughman 1889

MattOBranain: My rough sketch while trying to listen on a difficult audio feed. At front two Counsels for #Assange, to right behind them Gareth Perice, then from right John Shipton, @GabrielShipton, @Stella_Assange, behind them @ChrisLynnHedges. Also saw @CraigMurrayOrg and @suigenerisjen.

Trump Haley

TRUMP ON NIKKI HALEY: “I settled her about three months ago! You’re not supposed to lose your home state and she’s doing it BIGLY.” pic.twitter.com/RRfkG8babt

— Benny Johnson (@bennyjohnson) February 21, 2024

Mike Benz

https://twitter.com/i/status/1759722356975530158

Thomas

God bless Justice Thomas! pic.twitter.com/OEmQcgpb3j

— Tom Fitton (@TomFitton) February 20, 2024

Tucker Boris

TUCKER: “Boris Johnson calls me a tool of the Kremlin or something. So I put in a request for an interview with Boris Johnson. Finally one of his advisors gets back to me and says he will talk to you but it's going to cost you a million dollars.”

— Benny Johnson (@bennyjohnson) February 20, 2024

Rogan Phil

https://twitter.com/i/status/1760025164677558690

“..the victim of his ‘crime’ (journalism) is a state rather than a person–the definition of a political offense, which the US-UK extradition treaty explicitly forbid..”

• Assange ‘Too Ill’ To Attend Last Chance UK Appeal Against US Extradition (RT)

Wikileaks founder Julian Assange is “too ill” to attend his appeal against the UK’s decision to extradite him to the US, his lawyers have said. The US wants him on 17 charges of espionage tied to WikiLeaks’ publication of State Department and Pentagon files in 2010. Assange, 52, has been held largely in solitary confinement in the Belmarsh maximum security prison in England since 2019, when Ecuador revoked his asylum at American insistence. The Australian-born publisher had requested to appear in court personally, but was unable to do so due to poor health, according to his lawyers. “The world is watching,” Assange’s wife Stella said outside the court house. She accused the US of abusing the legal system to “hound, prosecute and intimidate” and argued that the US “plotted to murder” her husband – referring to revelations that the CIA sought to kill Assange in 2017, when he sheltered in the Ecuadorian embassy in London.

“What’s at stake is the ability to publish the truth and expose crimes when they’re committed by states,” Stella Assange told the dozens of demonstrators gathered outside the Royal Courts of Justice in London on Tuesday. Protesters carried Australian flags and signs that said “Free Julian Assange” and “drop the charges.” The Australian parliament passed a motion, supported by the country’s Prime Minister Anthony Albanese, calling for Assange’s release from British captivity in the run up to the appeal. “The outrageous part of the UK’s years-long ‘trial’ to condemn Julian Assange to die in an American dungeon is that the victim of his ‘crime’ (journalism) is a state rather than a person–the definition of a political offense, which the US-UK extradition treaty explicitly forbid,” NSA whistleblower Edward Snowden said on X (formerly Twitter).

Activists outside the court chanted “US, UK, hands off Assange” and “There is only one decision – no extradition,” among other slogans. This week’s hearing will decide whether Assange will be allowed to appeal the 2022 decision by the UK government to extradite him to the US. His attorneys have argued that the extradition would amount to punishment for political opinions and violate the European Convention on Human Rights.

If the appeal fails, Assange will apply to the European Court of Human Rights and seek a Rule 39 order to stop the extradition while it considers the case, Stella Assange has said. In 2010, WikiLeaks published the US military’s Iraq and Afghanistan “war diaries,” as well as a trove of State Department cables. One of the videos, later known as “collateral murder,” showed a US helicopter killing 11 people in Iraq, including two Reuters journalists. Suspecting the Swedish “sexual assault” case was a pretext for the US to arrest him – correctly, as it later emerged – Assange sought asylum in Ecuador, which has no extradition treaty with Washington. He spent the next seven years in the country’s embassy in London, blocked from leaving by the British authorities.

CNN on the explosive Pompeo/CIA plot to kill Julian Assange which aired in court today

— Stella Assange #FreeAssangeNOW (@Stella_Assange) February 20, 2024

Kafla indeed.

• President Trump’s Kafkaesque Civil Trial in New York State (Calabresi)

Donald Trump has been ordered to pay a $355 million fine and has been barred from doing business in New York State for three years. Judge Arthur Engoron ordered Trump to pay essentially all of his cash reserves of $400 million, which fine if upheld would force Trump to sell some of his real estate holdings to raise cash to live on. Once interest is added on the total fine will rise to $450 million. This is all on top of an $83.3 million fine Trump must pay for allegedly defaming the writer E. Jean Carroll. The fines in total could deprive Trump of between 11% and 13% of his wealth. Trump’s adult sons Donald Jr. and Eric have also been fined, and they are barred from doing business in New York State for two years. Ivanka or Melania Trump could legally run the Trump businesses for the next two years, but Judge Engoron appointed retired U.S. District Judge Barbara Jones to continue in her role as an “independent monitor” of the Trump business empire but expanded her authority to review financial disclosures before they are submitted to third parties.

Judge Jones can hire an independent director of compliance, and she has the authority to compel Trump to sell some or even all of his businesses down the road. This is all punishment for Trump allegedly committing fraud by falsely inflating and deflating the value of his real estate assets to pay lower state taxes and to receive more favorable loans from banks. The New York State laws used to go after Trump have NEVER been used in this way, historically, and while Trump may owe some back state taxes, if Judge Engoron is right, not a single bank claimed that it had been defrauded by Trump in the loans it had made to him. This is truly a victimless crime. Bankers took the stand at Trump’s civil trial testifying that they would have gladly made loans to Donald Trump given his extraordinary success as a businessman. It must also be noted that the banks that made loans to Trump did not take his assessment of the net worth of his assets at face value but made their own independent assessments of the value of Trump’s assets.

This is apparently standard practice in the New York State real estate market where borrowers often overstate the value of their assets. The bottom line is that a never before used New York State penalty has been twisted into a tool for a grossly excessive fine and more seriously the completely inappropriate appointment of Judge Jones as an “independent monitor” who can micromanage the Trump business, which she is not competent to do, and to even order the dissolution of the Trump Business in New York State. This outcome was pursued by Letitia James, a politically ambition Democrat, who is the Attorney General of New York State, and who hopes to win a future Democratic primary for Governor of or Senator from New York State.

Ms. James and Judge Engeron have essentially turned a vaguely worded New York State law into a modern day Bill of Attainder targeted at Donald Trump both for political gain and because they despise his political views and desperately want to call his truthfulness into question as he runs for President of the United States in 2024. In doing this, the have violated Trump’s First Amendment right to freedom of speech and of the press; his Fifth Amendment right not to be deprived of liberty or property without due process of law; his Fifth Amendment right not to have property taken away from him except for a pubic use with just compensation being paid; his Eighth Amendment right not to be made to pay an excessive fine; his Article IV, Section 2 right as a citizen of Florida to do make and enforce contracts in New York on the same terms as are other New Yorkers; and his Fourteenth Amendment right to be free to pursue an occupation without unnecessary and burdensome regulation.

The civil fraud judgment against Donald Trump is a travesty and an unjust political act rivaled only in American politics by the killing of former Treasury Secretary Alexander Hamilton by Vice President Aaron Burr. If the New York State appellate courts do not reverse this judgment, the U.S. Supreme Court MUST grant cert on this case and reverse Judge Engeron’s outrageous decisions. National, presidential politics will be permanently altered if a local State’s legal system can be used in this way against candidates for President of the United States. This case raises a national issue of profound importance and if the New York State appellate courts do not address it, the U.S. Supreme Court MUST!

O’Leary

https://twitter.com/i/status/1759969359282463085

“..every day, Trump is being hit by roughly $90,000 in just interest increases.”

• Pay to Play: Trump Faces a Staggering Cost for Appeal (Turley)

In the wake of the massive judgment against Donald Trump, many in New York are celebrating the prospect that the former president could be forced to sell off his property just to be able to appeal the $355 million judgment against him. While Trump has good grounds to object to this excessive fine, he still has to come up with close to a half billion dollars just to make his arguments to the New York Court of Appeals. In order to file an appeal, the courts require a deposit for the full amount of the damages or a bond covering the full amount. Even with escrow options, the call for cash or collateral can be enough to put some executives in a fetal position. It can be challenging enough for many companies drained from years of litigation. For Donald Trump, the demand for $355 million plus $100 milion in interest could force a fire sale on properties to pony up just the deposit.

Many of us have been critical of the ruling of Manhattan Supreme Court Justice Arthur Engoron who imposed the astronomical fine despite finding that Trump’s “victims” not only did not lose a single dollar but made handsome profits. Indeed, these banks testified that they wanted to continue to do business with Trump as a “whale” client, but Engoron is now barring them from doing so. Putting aside the merits of this judgment, the threshold deposit rule magnifies the unfairness of this New York law that does not require that anyone actually lose money to claim hundreds of millions from a company. One can argue that, if upheld, any insolvency is the fault of the company. However, this rule can force insolvency just to seek review of a judgment. For Trump, even this fine would only amount to roughly 14-17% of his wealth. The addition of the recent $83.3 million in damages imposed in a separate New York courtroom for defamation would bring the demand to over half a billion dollars in deposits with interest.

So, by making the fine so large, Engoron not only makes an appeal difficult, but could guarantee that Trump will lose tens of millions even if his judgment is dramatically reduced or tossed out. On top of this looming penalty, however, he already owes the writer E. Jean Carroll $83.3 million in damages from a separate defamation case that concluded in January. His legal fees are also mounting as he battles four criminal cases at the federal and state level. There is already speculation of whether Trump will have to leverage or sell his iconic properties at distressed prices. He has 30-days to ante up with the court and buyers could use that deadline to their advantage. The added amount is due to another New York provision imposing a massive 9 percent interest rate on judgments. That means that every day, Trump is being hit by roughly $90,000 in just interest increases.

Trump could secure a bond, but such a guaranty would come at its own premium price. However, a bonding company requires a defendant to put up 10% for the total and would lose that amount even if he prevailed. That is a roughly $45 million cost just to secure the right to an appeal. In this case, the cost could be higher given the judgment and the bar on Trump doing business for three years in New York. The expectation is that Trump can make the deposit or secure a bond to avoid what some gleefully called a “fire sale” on this properties. The deposit is now being celebrated as an added indignity and penalty. However, as New Yorkers cheer this moment, many business are likely wondering “but for the grace of God go I.” Undervaluing or overvaluing property is a common practice, particularly in real estate. That is why representations, like the one made by the Trump Corporation, come with a warning that estimates are their own and that the banks need to make their assessments.

Faced with high crime and high taxes, the spectacle in Manhattan is only likely to accelerate the exodus of businesses and high-earners from the city. That prospect has already alarmed Gov. Kathy Hochul who declared “business people have nothing to worry about, because they’re very different than Donald Trump and his behavior.” That sounds a lot like “you are fine so long as you are not Trump.” Yet, that is not reassuring to businesses who want a legal system that is based on something other than selective and arbitrary enforcement. Attorney General Letitia James campaigned on bagging Trump without even bothering to name the offense. She also sought to dissolve the National Rifle Association. The line between doing business and a public execution appears to be the dubious discretion of Letitia James. That is not the type of assurance that most businesses would accept in risking billions in investment. Despite the high taxes and falling services in New York, the city remained a draw for business as a commercial and legal center. The experience and objectivity of courts in dealing with business disputes was a selling point for companies.

That has been shattered by the James campaign and the Engoron ruling. Telling business to just “don’t be like Trump” is more menacing than consoling. Letitia James is now the face of New York corporate law — it is the “face that launched a thousand ships” . . . toward Florida. Businesses can get lower taxes, lower crime, better schools, and a better regulatory environment in virtually any other state. Fewer are likely to want to come for the shows, but stay for the disgorgement. Shark Tank’s Kevin O’Leary said Monday that he would “never” invest in New York after this absurd judgment. Creating an ad hoc business code for Trump undermines the city’s reputation as a premier jurisdiction for corporate and tax law. If the rate of exit increases, it will impact not just employees working for these companies (like the Trump companies) but the vast network of supporting businesses, including law firms. As New York politicians campaigning on “eat the rich” platforms, the confiscatory Trump judgment leaves many in the city wondering if they could be the next course.

“The US I knew was a very strong and inclusive society, welcoming towards foreigners. They used to be multicultural and multireligious. Now I see a lot of paranoia and a lot of xenophobia in the US..”

• US ‘in Decline’ Today Due to ‘Ignorance, Arrogance’ – Pakistani Senator (Sp.)

The reasons why the United States failed in Afghanistan and Iraq and is “in decline” today are its “ignorance and arrogance,” the chairman of the defense committee of the Senate of Pakistan, Mushahid Hussain Sayed, told Sputnik. “The US policy towards certain countries in Asia is sometimes based on the combination of ignorance and arrogance. Arrogance, because they are a big country, because they think of themselves as a superpower, they think they know it all. But they don’t. They don’t know the culture and the values of other countries. And also ignorance, because they don’t understand the people of these places. This is why they failed in Afghanistan, this is why they failed in Iraq,” Sayed said in an interview.

These are the same reasons why the US is “in decline” now and has been like that for some time, he added. The senator explained that he used to live in the US, received a masters degree from one of the most respected US universities in Washington — Georgetown, and worked in the US Congress as an intern. However, the country had changed a lot since then and the US he knew “was different.” “The US I knew was a very strong and inclusive society, welcoming towards foreigners. They used to be multicultural and multireligious. Now I see a lot of paranoia and a lot of xenophobia in the US. They call the Chinese threat, the Russian threat, the Islamic threat … That’s nonsense. They are returning to the 50s. So for me the modern US is a very strange, exclusive and divisive America,” the senator said.

In October 2001, a US-led coalition launched an invasion of Afghanistan. However, the Taliban took power in Afghanistan in August 2021, triggering the collapse of the US-backed government and accelerating Washington’s troop pullout. On August 31 of the same year, US forces completed their withdrawal from the country, ending the 20-year-long military presence. In March 2003, the US-led coalition invaded Iraq without a UN Security Council resolution. Consequently, the total of excess deaths related to the war amounted to 654,965 as of October 2006, according to The Lancet journal’s survey. The US troops withdrew from Iraq in December 2011. Despite that, to date, the US and coalition forces remain a notable military presence in the country, with military bases.

“Inside Russia, it has been obvious for a long time that in or out of prison, Navalny alive was politically insignificant; now even less. The new western propaganda is as ineffectual for Russians as Navalny was himself.”

• What Happened To Alexei Navalny This Time Round (Helmer)

Since a pack of lies about Alexei Navalny won last year’s Oscar for the best documentary film of the year when he was alive, there’s no doubt he can win another Oscar when he’s dead. But alive or dead, the prize-winning propaganda of Navalny’s story bears no resemblance to the truth. This is what happens in wartime, especially when the side which is losing the war on the battlefield – that’s the US, NATO and the Ukraine – claims to be winning the war of words against Russia. The Navalny story is now in two parts: Part 1, the Novichok in his airport cup of tea, in his hotel water bottle, and then in his underpants which causes Navalny’s collapse, but fails to be detected by Russian doctors in Omsk, by German doctors in Berlin and Munich, and then by Swedish and French state laboratories. Part 2, Navalny’s sudden death after he had taken a walk in the IK-3 penal colony in the village of Kharp, in the Russian Arctic region of Yamalo-Nenets.

The first part took 62 reports in this archive to expose the faking; the most telling evidence of this came from Navalny himself in the documented tests of his blood, urine and hair. According to these data, Navalny’s collapse was the outcome of an overdose of lithium, benzodiazepines, and other drugs. Part 2 of the Navalny story began last Friday, February 16, with the Federal Penitentiary Service (FSIN) announcement, followed by an official telegramme to his mother in Moscow, that he had died just after two in the afternoon, Yamalo-Nenets time; that was just after noon Moscow time. Two hours later the Russian media began carrying the official announcement. The wording of the last line of the announcement is significant. “The causes of death are being established”, the FSIN statement said. Causes — plural.

In the UK coroner’s court practice, what this means is that there is likely to have been a sequence of causation, medically speaking, with the first or proximate cause of death identified as heart, brain, or lung injury or failure; and the second, intervening or contributory cause of death such as biochemical factors, including prescription drugs in lethal combination; mRNA anti-Covid vaccination triggering fatal blood clots; or homicidal poisons. For example, in the case of the alleged Russian Novichok death of Dawn Sturgess in England in 2018, the evidence is of British government tampering with the post-mortem reports to add Novichok when it wasn’t identified at first. In Navalny’s case, poisoning on the order of President Vladimir Putin has already been announced as the cause of Navalny’s death without evidence at all. The delay time required for the complicated processes of forensic pathology and toxicology to establish the evidence has been reported in the Anglo-American media to signify cover-up and body snatching. Meduza, an oppositionist publication in Riga, reports that “a doctor who advised Navalny’s associates” has said that blood clotting was “an unlikely cause of death” – this is medically false.

In speculation of poisoning as cause of death, there is at least as much likelihood that Navalny, his team, and their CIA and MI6 handlers devised a repeat of the August 2020 Tomsk operation; decided when Navalny met with his lawyer at the prison on February 14; but implemented two days later without the resuscitation Navalny himself was expecting. The Anglo-American propaganda warfare army is already pronouncing the contributory Cause 2– Putin did it — as the cause of Navalny’s death. If the Russians announce the proximate Cause 1 as cardiac arrest or brain aneurism, without a Cause 2, they won’t be believed. In the short term, Cause 2 cannot be established with credibility in Russia since it took the British government ten years, 2006-2016, to fabricate their story of Russian polonium poisoning in the Alexander Litvinenko case. In the Russian Novichok cases in England, it has so far taken six years of court, police and pathologist proceedings, 2018-2024, without outcome, and another two years will follow.

The problem for readers to interpret what has happened is that the Anglo-American propaganda warfare machine is better at what it does than the Russian side. But then when it comes to war with guns, not words, the Russian side is far superior, as can be seen in the Ukraine right now. Accordingly, the Kremlin has decided to concentrate on the main fight. Inside Russia, it has been obvious for a long time that in or out of prison, Navalny alive was politically insignificant; now even less. The new western propaganda is as ineffectual for Russians as Navalny was himself.

Nap Navalny

https://twitter.com/i/status/1760094451521970418

“Nowhere outside the U.S. can you find as many American politicians in one place as at the Munich Security Conference this year.”

• The US Is Planning for the Aftermath of Ukraine War (van den Ende)

According to the Rand Corporation, there are two scenarios for the United States: “after” the less favorable war or “after” the more favorable war. The prominent think tank for U.S. policymaking recently published a long report on the so-called aftermath of the war in Ukraine. Washington and its NATO allies have to admit that the U.S. is losing another proxy war together with its satellite states of Europe. Previously they lost in Afghanistan (after more than 20 years, a second Vietnam), also recently in Syria and Iraq, and now in Ukraine. Even so-called “Russia experts” in Europe admit that Ukraine is losing. “I do not rule out that Ukraine will lose the war this year. Europe has misjudged the Russian army,” says Belgian “Russia expert” Joris van Blade to De Standaard. Russia has the initiative again and the Russian people are not going to stop the war, he thinks. “We have missed historic opportunities to make Europe safer.”

According to the Rand study, two scenarios are possible: a so-called “hardline” or a “softline” postwar. Of course, the U.S. prefers a softline postwar outcome, where they still have room for manipulation and possible coup d’état and Balkanization (partition) of Russia just like they did in former Yugoslavia. According to Rand, the U.S. military presence in Europe has increased to around 100,000 personnel since the start of Russia’s Special Military Operation in February 2022. The United States deployed attack aviation from Germany to Lithuania; Patriot air defense systems from Germany to Slovakia and Poland; and F-15 tactical fighters from the United Kingdom to Poland. In addition, European countries are sending F-16s to Romania, as the Netherlands recently indicated. These F-16s are capable of attacking Russian cities. Washington characterized these deployments as part of a wartime surge to deter Russia from expanding its aggression beyond Ukraine to attack U.S. allies in Europe.

Leaders in Europe are almost hysterical. One after another, they proclaim that Russia is going to invade Europe, starting with Moldova, the Baltic States, and Poland. The Netherlands, Germany, and France are warning their people to expect an attack from Russia, as is Sweden, which recently joined NATO. The population is being frightened by the unhinged rhetoric of their politicians. Conscription must be reactivated and Germany even has a concept ready to recruit migrants (about 1.5 million serviceable men) and entice them to get a passport. European leaders are also concerned about the upcoming elections in the U.S. after Republican contender Donald Trump made comments suggesting he would quit NATO and let Europe fend for itself. They are worried that the U.S. might abandon them. During a recent NATO conference in Brussels, a lot of war rhetoric was spoken. “We live in an era where we have to expect the unexpected,” said Dutch NATO Admiral Rob Bauer. Meanwhile, the Danish and German defense ministers have warned of a potential war with Russia within five years.

The U.S. and European leaders assume the “hardline” scenario is likely in the next few years. They proclaim through their mouthpieces in the corporate-controlled news media that Russia is becoming much more “risk-acceptant”. Therefore, it is calculated that a hardline approach may increase NATO’s ability to deter purported Russian aggression. It’s that time of year again for the hawkish Munich Security Conference, in Bavaria, Germany. This is the forum where President Putin provoked alarm when he gave his famous speech in 2007, making it clear that the unipolar world was over and a multipolar world would emerge in the foreseeable future. Putin’s prognosis caused much chagrin for Western leaders. This year’s theme at Munich is animated by Trump’s supposed undermining of NATO.

The appeal for support from the U.S. has become more urgent among some European politicians. Ukraine lacks weapons and ammunition, they openly say. Russia is sometimes five times superior on the battlefield. In addition, a U.S. support package worth around $60 billion was approved by the Senate last week but the Republican-dominated House of Representatives could reject it – and so far it looks like it will. Europe, in turn, would not be able to fill this gap and, therefore, Ukraine will lose the proxy war for the U.S. and the West. In addition to the presence of Ukrainian President Vladimir Zelensky, the European leaders and lobbyists will also use the opportunity in Munich to lobby Republican Senators and Representatives to support Ukraine (with money). Nowhere outside the U.S. can you find as many American politicians in one place as at the Munich Security Conference this year.

2 articles, one topic. Germany steals a Russian company.

• How The Rosneft Refinery In Germany Is Being Expropriated (Helmer)

This is how the war in the Ukraine doesn’t end, not for the Germans and the Poles. So long as they can, they plan to steal or destroy Russian assets west of what used to be Kievan Ukraine; and mobilize the US military bases in both countries to reinforce and defend their larcenies. The German political party which promises to continue this war for the employment of German workers and the enrichment of German executives and shareholders will win the next election, replacing the Social Democratic Party and the Greens as the party of war. The post-Ukraine strategy of the Stavka starts here — To Berlin! On Friday last, the Russian language edition of the German state medium Deutsche Welle (DW) published a report of German and Polish government plans for the expropriation of PCK, the Rosneft crude oil refinery at Schwedt in northern Germany, and the Rosneft network of operating assets in Germany, Poland, and Austria.

The German assets of Rosneft, the Russian state oil production company under worldwide sanctions, had been placed under what the German government called “fiduciary management” by an “independent” state regulator in September 2022. This was announced at the time as a temporary arrangement to comply with the sanctions, renewable every six months, but leaving undisturbed the Russian ownership of the assets. This scheme was renewed at six monthly intervals, as Rosneft has reported. There was nothing independent about the BNA or what it has been doing every six months. BNA stands for the Federal Network Agency — Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen. It claims to be “an independent higher federal authority with its main office in Bonn operating within the scope of business of the Federal Ministry for Economic Affairs and Climate Action (BMWK) and the Federal Ministry for Digital and Transport (BMDV). We have been responsible for Germany’s essential electricity, gas, telecommunications and postal infrastructures for over 20 years.”

“Within the scope of” is a German fig leaf for “under control”. “Our task,” BNA says, is “to ensure fair and non-discriminatory competition for all market participants. Our success and our expertise in regulation led to the energy and rail sectors also being placed under our responsibility.” This was not what the government of Chancellor Olaf Scholz intended when it commenced its takeover of Rosneft and assigned BNA the role of camp guard. BNA described what it was doing to “safeguard security of supply in Germany…on the basis of the Energy Security of Supply Act (section 17 EnSiG) until 15 March 2023. This basis enables the fiduciary to take action to keep the business running in accordance with its importance for the functioning of society in the energy sector. The fiduciary management may be extended under certain conditions… The decision to introduce fiduciary management was prompted by…by the sanctions imposed on Russia…The fiduciary management means that the original owner no longer has authority to issue instructions.”

“The German government is running out of time: on March 10, when the next decision on the transfer of Rosneft Deutschland under the so-called trust management of the state expires..”

• Germany Nationalizes Rosneft Deutschland, Poland Will Help (Andrei Gurkov)

Expropriation of Rosneft’s German assets is becoming increasingly likely. Warsaw is ready to provide oil to the Schwedt refinery and replace supplies from Kazakhstan. But what about compensation? The nationalization of Rosneft’s German assets is becoming more and more likely, and new signals from Poland reinforce this impression. The German government is running out of time: on March 10, when the next decision on the transfer of Rosneft Deutschland under the so-called trust management of the state expires. Berlin, apparently, no longer wants to extend this regime introduced in September 2022 for six months, because they seek a stable, not temporary, solution to the fate of the oil refinery in Schwedt — PCK Raffinerie Schwedt. This is exactly the case, although Rosneft has other assets in Germany.

But in this refinery, the state-owned Russian concern actually owns 54%, and maintaining Moscow’s control over a strategically important enterprise seems to the German authorities to be too much of a risk, especially against the background of the growing threat from Russia. After all, PCK Raffinerie Schwedt provides petroleum products to a significant part of East Germany and, above all, to the capital of the country, Berlin, with its approximately four million inhabitants. The intention of the German government to put an end to the legally suspended state of the plant has clearly strengthened after the recent elections in Poland. They brought to power a pro-European coalition, which German politicians trust much more than the previous Polish government. Relations between the two countries are currently warming rapidly, as evidenced by the talks between the new Polish Prime Minister Donald Tusk and German Chancellor Olaf Scholz in Berlin on February 12.

Therefore, the visit of Vice Chancellor and Minister of Economy of Germany Robert Habeck to Warsaw the next day, February 13, played an important, and perhaps decisive role in determining the next concrete steps with regard to Rosneft Deutschland. “Poland has helped a lot in the past to provide oil to the east of Germany,” the German minister recalled after the talks and made it clear that in the event of the expropriation of Rosneft, the supply of the plant in Schwedt would improve, since the Polish side is ready to significantly increase the pumping of oil through its territory towards Germany from the port of Gdansk. According to the Reuters news agency, citing an informed source, Warsaw assured Berlin even before Habeck’s arrival that it would be able, if necessary, to completely replace the volumes of Kazakh oil currently flowing to Schwedt.

Some explanations are needed here. Until 2023, this refinery, built six decades ago in the GDR on the border with Poland, operated exclusively on oil coming from the USSR and then from Russia via the Druzhba oil pipeline. In response to the full-scale Russian aggression against Ukraine, the European Union imposed an embargo on Russian oil transported by tankers, but not on supplies via the Druzhba pipeline system, since several Eastern European EU members are still heavily dependent on them. However, the German government decided for its part to completely abandon Russian oil. Since last year, the Schwedt plant has been supplied with oil purchased on the world market in three ways. From the German Baltic port of Rostock via a longstanding and not very powerful pipeline that was originally laid down as a backup — through the Polish port of Gdansk, from where oil is pumped through Poland using the westernmost segment of the Druzhba, and from Kazakhstan in transit through the Russian territory on the same Druzhba.

Germany strongly emphasizes its desire to increase oil purchases in Kazakhstan, cooperation with which is becoming more intensive. However, there are fears that in the event of the nationalization of Rosneft’s German assets, Moscow will block the Druzhba oil pipeline as a retaliatory measure and thereby [stop] the supply of Kazakh oil. [..] It is noteworthy that articles in the German media about Robert Habeck’s negotiations in Warsaw, and in general about the future of Rosneft Deutschland, in effect do not consider the option of Rosneft selling this company and its assets. This is despite the letter with such a proposal, as the economic newspaper Handelsblatt wrote in early February, from the head of the Russian concern Igor Sechin to the German government. But Berlin, the publication concluded, “has placed its bet on expropriation.”

“..the regional backlash threatens to undermine US diplomacy, unravel Arab normalization deals with Israel, and jeopardize US business interests throughout West Asia..”

• As Ramadan Approaches, Israel Threatens War On Lebanon (Harb)

Tel Aviv’s mounting threats to destroy Beirut as it has done to Gaza, coupled with growing Israeli public support for aggressive military action against Lebanon, have spiked tensions on the northern battlefront in recent days. Furthermore, the precarious game at play in Washington – which has done absolutely nothing to impede Israeli occupation forces from launching an assault on Rafah and uprooting more than a million Palestinians from their last refuge on the Egyptian border – is driving the war to a volatile, dangerous brink. Adding fuel to this already incendiary mix are two critical factors. First, Israel’s targeted strikes on Lebanese civilians, exemplified by the recent attacks in Nabatiyeh and Al-Sowanah, have provoked a stern response from Hezbollah Secretary-General Hassan Nasrallah, who vowed retribution, declaring that “the price of civilian blood will be blood.”

Second is the approaching month of Ramadan, a sacred period observed by hundreds of millions of Muslims worldwide, which adds a transnational dimension to these developments. Fasting Muslims from Indonesia to Morocco will grow increasingly frustrated with Washington’s inaction in preventing genocide and the displacement of over two million Palestinians in Gaza, many of whom are on the brink of starvation. Despite US assurances that it is pressuring Israel to mitigate casualties, the relentless onslaught has resulted in an appalling daily death toll of around 300, with nearly 29,000 lives lost, and over 60 percent of homes and infrastructure decimated. When Nasrallah declared that “for every drop of blood shed in Gaza and the entire region, the primary responsibility falls on [US President Joe] Biden, [US Secretary of State Antony] Blinken, and [US Secretary of Defense Lloyd] Austin,” his words resonated deeply – not only within the Islamic world but with millions globally – calling for an end to the war by halting the influx of American weapons to the Israeli military.

The US State Department has received multiple warnings from diplomats in the region of the growing resentment toward Washington for its complicity in Israel’s genocidal campaign. Despite its tone-deaf attempts to adjust its stance and emphasize a need to protect Palestinian civilians, the regional backlash threatens to undermine US diplomacy, unravel Arab normalization deals with Israel, and jeopardize US business interests throughout West Asia. Speaking to The Cradle, sources close to the Axis of Resistance in Lebanon said the next fortnight carries the potential for a catastrophic escalation, particularly if Israel intensifies its military aggression during Ramadan and advances its plans to displace Palestinians from Rafah.

Additionally, the discontent among Israeli settlers displaced by Lebanese resistance operations along the northern border poses further risks, with officials in Tel Aviv contemplating drastic measures to ensure calm, including potential military action – a preview of which southern Lebanese civilians have recently witnessed. The discontent among northern settlers grows as they grapple with the new security dynamics in the aftermath of the Hamas-led Al-Aqsa Flood operation on 7 October. Extending over 100 kilometers from Naqoura to the Shebaa Farms and penetrating 5 to 10 kilometers deep, this border strip has seen the displacement of thousands of settler families.

“..They want us to pay a price without Israel committing to a thing..”

• The Resistance Has a Plan for Israel (Alastair Crooke)

In a speech on Tuesday, Hizbullah leader Seyed Nasrallah said that the Party will continue the border offensive until at least the Gaza massacre stops. The war in Gaza however, is far from over. And Nasrallah warned that even were a ceasefire to be reached in Gaza, “should the enemy perform any action, we will return to operating according to the rules and formulas that existed before. The purpose of the resistance is to deter the enemy, and we will react accordingly”. Israel’s Defence Secretary Gallant has underlined that contrary to international consensus expectations, he too expects the war in Lebanon to continue. Gallant said the military has stepped up its attacks against Hizbullah by one level out of ten: “The Air Force planes flying currently in the skies of Lebanon have heavier bombs for more distant targets. Hizbullah went up half a step, whilst we, a full one … We can attack not only at 20 kilometres [from the border], but also at 50 kilometres, and in Beirut and anywhere else”.

It is not clear what ‘red line’ Hizbullah would have to cross for Israel to significantly escalate its response to much higher levels; Israeli leaders have suggested that an attack on a strategic site; or an attack leading to major civilian casualties; or a substantive barrage on Haifa might constitute the breaking point. Nonetheless, with three military divisions rather than the usual one now deployed in the north of Israel, the IDF has more forces poised for action on the northern border than it has preparing for an incursion into Rafah – at this point. It is clear, as Chief of Staff Halevy has specified, that Israel is “preparing for war” against Hizbullah (more than preparing for Rafah). Is the threat to Rafah a bluff to put pressure on Hamas to concede on the deal and hostages? One way or another, both Israel’s political and military chiefs are adamant: The IDF will incurse into Rafah – ‘at some point’. The qualitatively different Hizbullah’s strike on Safed on Israel’s northern regional command HQ on Wednesday – which that resulted in 2 dead and 7 further casualties – is being treating in Israel as the gravest attack since the start of the war, with Ben Gvir calling it a “declaration of war”. Subsequent Israeli attacks killed 11 people, including six children, in a barrage of strikes on villages across southern Lebanon, in retribution for the Safed blitz – with the fierce exchange of fire still continuing.

The ‘Safed Strike’ deep into the Galilee very likely was intended to signal that Hizbullah is not about to capitulate to western demands that it provide Israel with a ceasefire that is intended to facilitate evacuated Israelis to return to their homes in the north. As Nasrallah confirmed in a scathing attack on those external (Western) mediators who serve only as Israel’s lawyers, and neglect to address the massacres in Gaza: “It is easier to move the Litani River forward to the borders, than to push back Hezbollah fighters from the borders, to behind the Litani River … They want us to pay a price without Israel committing to a thing”. In these circumstances, Nasrallah clarified that residents of northern Israel will not return to their homes – warning that even more Israelis risk being displaced: “‘Israel’ must prepare shelters, basements, hotels and schools to house two million settlers who will be evacuated from northern Palestine, [were Israel to expand the war zone].”

“..The inaction of Putin, China, and Iran has steeled the American neoconservatives in their agenda of American hegemony..”

• The Ever Expanding War (Paul Craig Roberts)

As I previously wrote, the Israeli/American intention is to expand the war against Hamas to Lebanon, Syria, and Iran. The expansion has begun. The latest news is that Israel has struck deep into Lebanon: “War Expands With Massive Israeli Airstrikes 60km Deep Into Lebanon.” The Arabs, likely restrained by Putin, have once again sat on their butts while Israel picks them off one by one. Only the Houthis but not a single Arab or Muslim country came to Hamas’ help. Consequently, the Arabs sat sucking their thumbs while Gaza and Hamas were destroyed. The arabs accepted Israel’s genocide of the Palestinian people. Evil prevails when it is left unopposed. If Hezbollah, Syria, the Iraqi militias, and Iran had joined Hamas’ attack, Israel today would not exist. Having missed their chance, they will now be knocked off one at a time by Israel and Washington.

Already before Israel is finished with Palestine, Israel has attacked with missiles and jet fighters deep into Lebanon. It appears that the Israeli-Washington strategy is to attack Lebanese cities to set off civil war between the Lebanese army and the Hezbollah militia so that Israel can take advantage of civil war in Lebanon to drive Hezbollah out of southern Lebanon and take possession of the water resources that Israel covets. When Hezbollah is finished, Washington and Israel will wipe out the Iraqi militias and attack Syria, a section of which containing the oil fields Washington already occupies. The Russians left the liberation of Syria unfinished. Syria has the Russian air defense system but apparently is not permitted to use it against Washington and Israel. Once Iraqi militias and Syria are out of the picture, Iran, sitting there on its huge number of missiles, doing nothing, will be next.

When Iran falls, the CIA’s Jihadists will be released into the Russian Federation, Central Asia, and China’a troublesome province. The inaction of Putin, China, and Iran has steeled the American neoconservatives in their agenda of American hegemony. As Putin, XI, and Iran seem determined to sit out conflicts that not only affect them but are directed against them, Washington will continue to run over red lines until a war is forced. Putin has been deceived, betrayed, demonized, and given the West’s cold shoulder for two decades, and he still wants to negotiate with those who have thrashed him? Negotiation with a government that has proven it doesn’t keep the agreements is a form of reality denial. As the evidence indicates, the Western world is in moral and social collapse, so its destruction will be no loss. The question is whether the values the Christian West once stood for will find expression elsewhere.

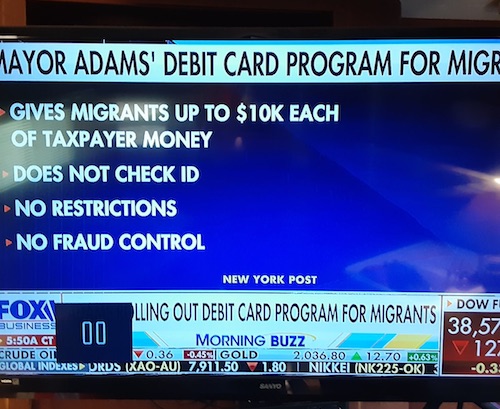

Pretty crazy..

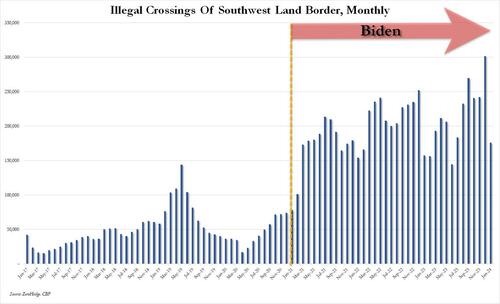

• 10 Million Illegals Have Entered The US Under Biden (ZH)

A record 7.3 million illegal aliens have crossed the southwest border under President Biden’s watch, a number which according to Fox News.is greater than the population of 36 individual states. That figure is sourced from the U.S. Customs and Border Protection, which has already reported 961,537 Southwest land border encounters in the current fiscal year, which runs from October through September, and if the current pace of illegal immigration does not slow down, fiscal year 2024 will break last year’s record of 2,475,669 southwest border encounters — a number that by itself exceeds the population of New Mexico. The total number of southwest land border encounters since Biden assumed office in 2021 is 7,298,486, CBP data shows.

That number is larger than the population of 36 U.S. states including: Alabama, Alaska, Arkansas, Colorado, Connecticut, Delaware, Hawaii, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Vermont, West Virginia, Wisconsin and Wyoming. In fact, the only states that are not in danger of being “replaced” are the blue ones. Compared to the largest U.S. states, the 7.3 million number is about 18.7% of California’s population of 39 million, 23.9% of the state of Texas and its 31 million residents, 32.3% of the population of Florida and 37.3% of New York. It’s more than half the size of Pennsylvania, Illinois and Ohio. As Fox News graphically describes, were the number of illegal immigrants who entered the United States under President Biden gathered together to found a city, it would be the second-largest city in America after New York.

Shockingly, that total does not include an estimated additional 1.6 million illegals who entered the US at other locations, nor 1.8 million known “gotaways” who evaded law enforcement, which would make the total bigger than the population of New York. Taken together, over 10 million migrants have crossed into the U.S. illegally during the Biden administration, a record Biden’s critics assert could only be achieved by intentionally refusing to enforce the law. “This unprecedented surge in illegal immigration isn’t an accident. It is the result of deliberate policy choices by the Biden administration,” said Eric Ruark, Director of Research for Numbers USA, a nonprofit that advocates for immigration restrictions.

Mass immigration is completely destroying our country. Why is no one doing anything about it? Because they’re afraid of ending up like Lydia Brimelow. pic.twitter.com/B5B0bh6t5O

— Tucker Carlson (@TuckerCarlson) February 20, 2024

“..renewables can’t power modern civilization is because they were never meant to. One interesting question is why anybody ever thought they could.”

• Germany Retreats Into The Middle Ages As Its Economy Declines (Henry Johnston)

Bloomberg recently foretold the end of Germany’s days as an industrial power in an article that begins with a depiction of the closing of a factory in Dusseldorf. Stone-faced workers preside with funereal solemnity over the final act – the fashioning of a steel pipe at a rolling mill – at the century-old plant. The “flickering of flares and torches” and “somber tones of a lone horn player” lend the scene a decidedly medieval atmosphere. Intentional or not in their inclusion of such evocative detail, the Bloomberg writers offer potent imagery for Germany – not only because the country is regressing economically but because its elites are increasingly guided by an atavistic force: the abandonment of reason. As hard economic realities lay bare the futility of its utopian energy plan and the consequences of numerous terrible decisions mount, Germany is experiencing what Swedish essayist Malcom Kyeyune calls “narrative collapse.”

The peculiar offspring of this, Kyeyune argues, is a turn toward ritual, superstition, and taboo. It is a malaise afflicting the entire West, but Germany is suffering a particularly acute case. Kyeyune defines this as an occurrence “when social and political circumstances change too rapidly for people to keep up, the result tends to be collective manias, social panics, and pseudo-religious revivalist millenarianism.” The abandonment of reason can be conceived of in various ways. Quite a lot of ink has already been spilled about the irrationality behind Germany’s fantastically improbable climate policy. Indeed, the quasi-religious verve with which this program has been rolled out speaks to something of a loosening of the country’s moorings. But as we will see shortly, the problem goes far beyond an attachment to unattainable policy goals. Prominent German business executive Wolfgang Reitzle argued that for the government to deliver on its climate and energy policy, capacities for wind and solar power would have to be more than quadrupled, while storage and back-up capacities would have to be massively increased.

Such a plan is “neither technically feasible nor affordable for a country like Germany,” Reitzle argues. What it is then, he concludes, “is simply insanity.” Michael Shellenberger, in a piece for Forbes magazine in 2019, points out that the initial impetus for seeking to transition to renewables emerged from the idea that human civilization should be scaled back to sustainable levels. He cites German philosopher Martin Heidegger’s 1954 landmark essay ‘The Question Concerning of Technology’ and subsequent work by the likes of Barry Commoner and Murray Bookchin as espousing what emerged in the 1960s as a much more austere vision for the future of civilization. Shellenberger concludes that the reason why “renewables can’t power modern civilization is because they were never meant to. One interesting question is why anybody ever thought they could.”

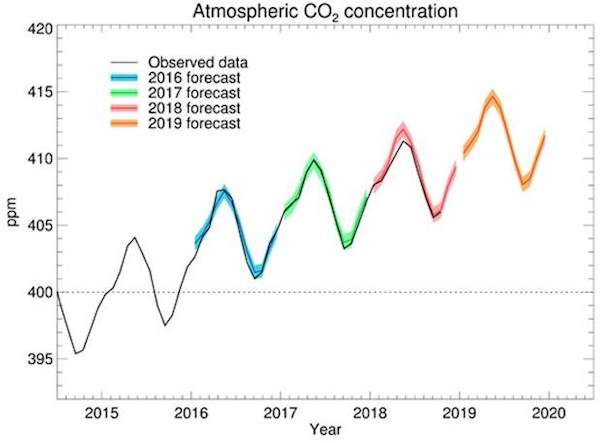

“..temperature doesn’t follow CO2—instead, CO2 follows temperature, which, itself, is due to solar activity.”

• Fixation on CO2 Ignores Real Driver of Temperature (ET)

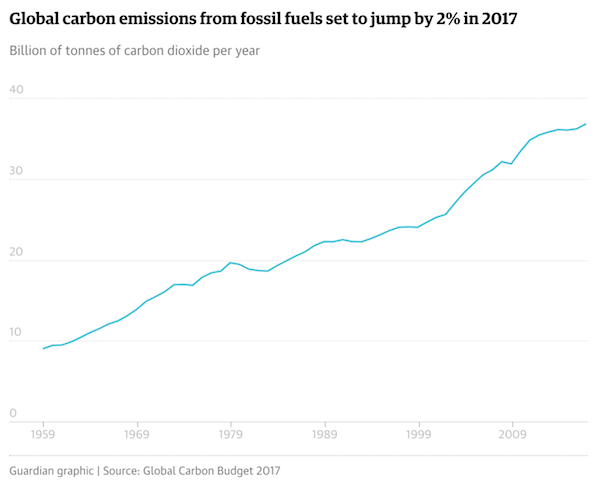

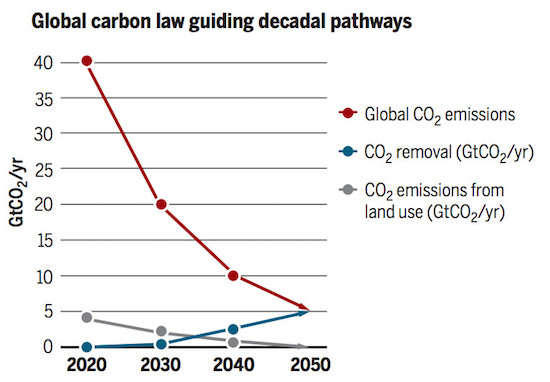

Each year from 2023 to 2030, climate change sustainable development goals will cost every person in economies such as the United States $2,026, the U.N. Conference on Trade and Development estimates. In lower-income economies, the per-person annual cost ranges from $332 to $1,864. In total, the global price tag comes to about $5.5 trillion per year. Separately, a report from the left-aligned nonprofit Climate Policy Initiative found that in 2021 and 2022, the world’s taxpayers spent $1.3 trillion each year on climate-related projects. It also found that the “annual climate finance needed” from 2031 to 2050 is more than $10 trillion each year. “Anyone who willfully denies the impact of climate change is condemning the American people to a very dangerous future,” President Joe Biden said on Nov. 14, 2023, while announcing $6 billion in new investments through the Inflation Reduction Act (IRA). “The impacts we’re seeing are only going to get worse, more frequent, more ferocious, and more costly.”

At its signing in August 2022, President Biden said the IRA “invests $369 billion to take the most aggressive action ever—ever, ever, ever—in confronting the climate crisis and strengthening our economic—our energy security.” A report from Goldman Sachs put the dollar amount much higher, stating, “Critical funding for this next energy revolution is expected to come from the IRA, which will provide an estimated $1.2 trillion of incentives by 2032.” The trillions of dollars being poured into new initiatives stem from the goals set by the United Nations’ Paris Agreement’s legally binding international treaty to “substantially reduce global greenhouse gas emissions” in the hope of maintaining a temperature of no more than 1.5 degrees Celsius above pre-industrial levels.

But any decrease in carbon dioxide (CO2) emissions won’t have an effect for hundreds to thousands of years—even under the most restrictive circumstances, according to some experts. “If emissions of CO2 stopped altogether, it would take many thousands of years for atmospheric CO2 to return to ‘pre-industrial’ levels,” the Royal Society states in a report on its website. The organization describes itself as a “fellowship of many of the world’s most eminent scientists.” “Surface temperatures would stay elevated for at least a thousand years, implying a long-term commitment to a warmer planet due to past and current emissions,” the report states. “The current CO2-induced warming of Earth is therefore essentially irreversible on human timescales.”

A frequently asked questions page on NASA’s website holds the same position. “If we stopped emitting greenhouse gases today, the rise in global temperatures would begin to flatten within a few years. Temperatures would then plateau but remain well-elevated for many, many centuries,” NASA states. And, other scientists say, that’s because CO2 isn’t the culprit in the first place. “CO2 does not cause global warming. Global warming causes more CO2,” said Edwin Berry, a theoretical physicist and certified consulting meteorologist. He called Royal Society’s position on CO2 “pure junk science.” Ian Clark, emeritus professor for the Department of Earth and Environmental Sciences at the University of Ottawa, agreed that if all greenhouse gas emissions ceased today, the Earth would continue warming—but not because of CO2. He said that contrary to popular opinion, temperature doesn’t follow CO2—instead, CO2 follows temperature, which, itself, is due to solar activity.

Vaxx

https://twitter.com/i/status/1760000991980593608

Cat perfume

We didn’t see anything pic.twitter.com/mrgEeBexGU

— Why you should have a cat (@ShouldHaveCat) February 20, 2024

Dinosaur Size

https://twitter.com/i/status/1760025082657706403

Blink an eye

Here's what happens in the universe when you blink your eye pic.twitter.com/HrgNEkXgZC

— Historic Vids (@historyinmemes) February 20, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.