Dorothea Lange Wife of sharecropper in town to sell crop at tobacco auction, Douglas Georgia 1938

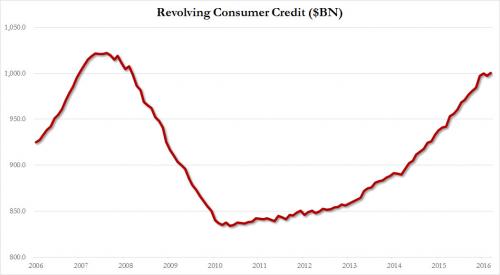

On top of auto and student loans, both already well over $1 trillion. Get a fork and turn ’em over.

• US Credit Card Debt Tops $1 Trillion For The First Time In A Decade (ZH)

Unlike last month’s unexpectedly week consumer credit report, which saw a plunge in revolving, or credit card, debt moments ago the Fed, in its latest G.19 release, announced that there were few surprises in the February report: Total revolving credit rose by $2.9 billion, undoing last month’s $2.6 billion drop – the biggest since 2012 – while non-revolving credit increased by $12.3 billion, for a total increase in February consumer credit of $15.2 billion, roughly in line with the $15 billion expected. However, while in general the data was uneventful, there was one notable milestone: in February, following modest prior revisions, total revolving/credit card debt, has once again risen above the “nice round number” of $1 trillion for the first time since January 2007… where it now joins both auto ($1.1 trillion) and student ($1.4 trillion) loans, both of which are well above $1 trillion as of this moment.

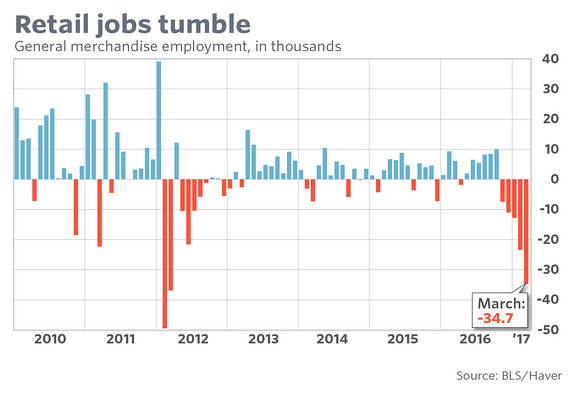

It IS a recession.

• Store Wars: US Retail Sector Is Shedding Jobs Like It’s A Recession (MW)

The U.S. retail industry is shedding jobs at an unparalleled pace outside of recession and stands to lose many more as the industry continues to shrink its physical footprint, a response to the shift in consumer shopping habits away from purchasing in stores and malls in favor of e-commerce. The U.S. retail sector lost 60,600 jobs in February and March, the worst two months for the sector since the tail end of 2009, according to Labor Department data. The category called general merchandise stores – Target, J.C. Penney and the like – has shed jobs for five consecutive months. Media reports have tallied more than 3,500 store closures for 2017, with retailers including J.C. Penney, Sears, Macy’s and others announcing that they are shutting doors and making job cuts.

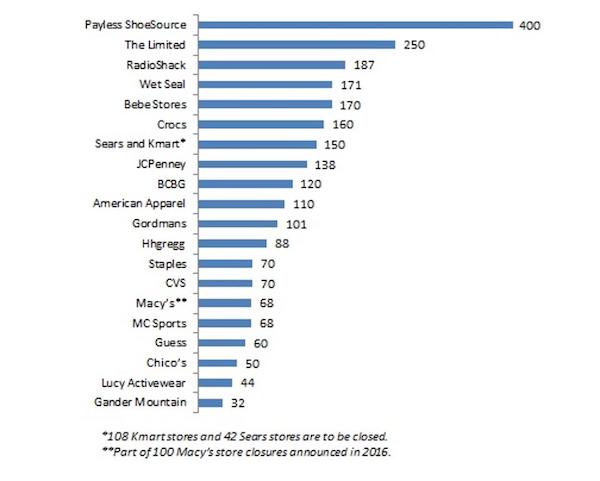

Ralph Lauren has outlined the next phase of its turnaround effort, which includes shutting stores and cutting jobs. Bankruptcies and liquidations have also picked up, with Payless ShoeSource just this week announcing nearly 400 store closures. Wet Seal, Aeropostale, Sports Authority, and Hhgregg are among the many other retailers that have either filed for bankruptcy or liquidated. The current state of retail, which is weighed by less foot traffic, more promotions, and increased competition, particularly from Amazon.com, suggests that additional closures are on the horizon. The U.S. simply has too many stores, according to a report from Cowen & Company titled “Retail’s Disruption Yields Opportunities – Store Wars!,” which found that up to 2,000 stores should close.

“[W]e expect online penetration of apparel to increase to 35% to 40% from 20%, yielding closures of 20% at oversized chains,” the report said. Cowen analysts say there are about 1,200 malls in the U.S. and they represent about 15% of retail square footage. Cowen anticipates that up to about 20%, or 240 malls, will close or be repurposed, with anchor store closures and the rise of digital among the primary drivers.

The Amazon bubble. Killing off America’s last remaining meeting places.

• Apparel Retailers Lead The Charge Out Of Brick-And-Mortar (Forbes)

This week, Payless ShoeSource filed for bankruptcy, joining many other U.S. apparel brands, including The Limited and Wet Seal, that have sought Chapter 11 protection in recent months. These three chains alone will shutter almost 1,000 stores. Fung Global Retail & Technology estimates that all of the major U.S. store closures announced so far this year total 2,507. That total is just for announcements made in the three months through April 4, 2017, yet it already dwarfs the 1,674 store closures we recorded across major U.S. chains in all of 2016. Closures are impacting multiple sectors: electronics is represented by RadioShack, furniture and appliances by Hhgregg, office products by Staples and healthcare by CVS. Apparel, however, is leading the charge out of brick-and-mortar. We calculate that apparel retailers and department stores account for 2,060 (82%) of the 2,507 closures announced so far this year.

What can we infer from this surge in store closures? We see three principal takeaways: Weak demand for apparel persists. The most obvious conclusion from the recent bankruptcy filings is that apparel retailers continue to feel the impact of subdued consumer demand. American shoppers have been flush with cash thanks to low gas prices, but they have chosen to spend on cars and their homes rather than on fashion. The latest retail sales data from the U.S. Census Bureau show that apparel specialist stores saw a 1% year-over-year decline in sales in February. There is little reason to think shoppers will switch back to apparel as interest rates rise and if fuel prices creep up.

Second, pure-play retailing is fashionable again. Amid all the talk of omnichannel retailing and Internet pure plays opening brick-and-mortar stores, we are now seeing a trend of retailers going the opposite way, moving from operating stores to selling only online. Bebe is one such retailer that is planning to become an Internet pure play. The Limited considered a similar plan but is no longer selling online after filing for bankruptcy. Third, more retailers are facing reality. Not all store closures are being forced by bankruptcies. J.C. Penney and Macy’s, for instance, are slimming down their store networks in order to prepare for the future. We expect more retailers to join them in recognizing a need for fewer stores. Accordingly, we do not expect this year’s store-closure count to stop at 2,507.

Just in time economy?!

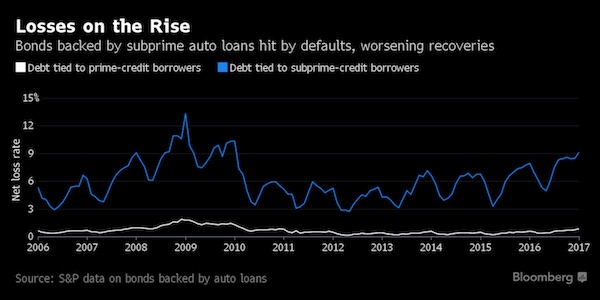

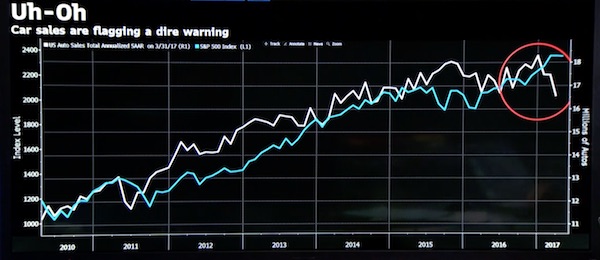

• Wall Street Is Making It Harder to Buy a Car (BBG)

On countless occasions in recent years, the U.S. auto industry has relied on cheap and easy credit from Wall Street to get it through rough patches. Not this time. With both bad loans and interest rates on the rise, financial institutions are becoming more selective in doling out credit for new-car purchases, adding to the pressure for automakers already up against the wall with sliding sales, swelling inventories and a used-car glut. “We’ve been having a party for a few years and it was fun,” said Maryann Keller, an industry consultant in Stamford, Connecticut. “Now lenders are getting back to basics.” Many figure they have to. For one thing, subprime borrowers have been falling behind on their car-loan payments at a rate not seen since just after the 2008 financial crisis.

Delinquencies for auto debt of all stripes have been climbing, with the value of those behind for at least 30 days swelling to $23.3 billion in December, a 14% jump from a year earlier, according to the Federal Reserve. This helps explain why 10% of senior bank-loan officers said they expect to pull back on extending credit to car buyers this year, according to a Fed survey. Expectations are that terms will toughen for loans the vast majority of Americans need to buy new vehicles as the Fed boosts benchmark rates. “There are only so many people wanting a new car and only so much capital available,” said Daniel Parry, CEO of Praxis Finance and co-founder of Exeter Finance, a subprime lender. “Manufacturers and lenders will have to reset to reduced volume levels.”

The reset has already started, with auto sales dipping in each of the first three months of the year. In March, the annualized pace, adjusted for seasonal trends, slowed to 16.6 million from 16.7 million a year earlier, according to Autodata Corp. Analysts had projected it would accelerate to about 17.2 million. Now Goldman Sachs economists figure there’s only demand for about 15 million per year, they said in an April 4 report. The industry set a record by selling 17.6 million cars and trucks in 2016 and has been on a seven-year growth streak. But General Motors, Ford and others had to pile on discounts and incentives to keep the expansion going, with both their finance arms and third-party lenders giving them a boost with easy credit. “This has come full circle,” Keller, the consultant, said. “We’ve created an auto market of 17.5 million vehicles based on accommodating credit. There will be consequences.”

Whaddaya think? Yup, weather.

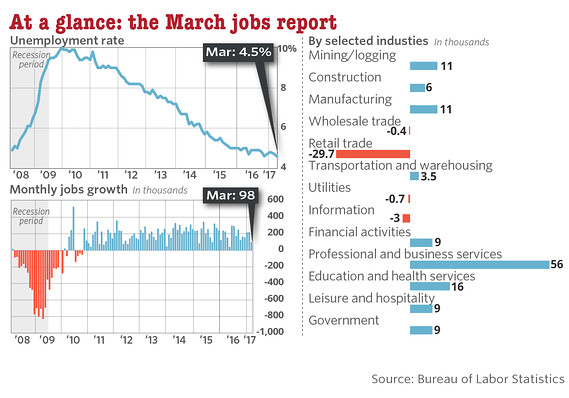

• US Jobs Growth Slumps To 98,000 In March (MW)

The U.S. created just 98,000 new jobs in March to mark the smallest gain in almost a year, a sign the labor market is not quite as strong as big hiring gains earlier in 2017 suggested. The unemployment rate, meanwhile, fell to 4.5% from 4.7% and touched a nearly 10-year low despite the slowdown in hiring. U.S. stocks ended the session pretty much where they started as investors sifted through the March employment report. The U.S. had added more than 200,000 jobs in January and February, but hiring in weather-sensitive industries such as construction was helped by unusually high temperatures in the dead of winter.

Many economists were skeptical the recent pace of job creation was sustainable after a six-year hiring boom that chopped the unemployment rate in half and ignited growing complaints among companies about a shortage of skilled workers to fill open jobs. As a result, economists polled by MarketWatch had estimated the number of new jobs created in March would taper off to 185,000 in the third month of Donald Trump’s young presidency. Instead the decline was even steeper, speared by plunging employment in a beleaguered retail industry. “The 200,000-plus numbers reported for job gains in January and February always seemed a bit outlandish,” said Steven Blitz, chief U.S. economist at TS Lombard. Added economist Harm Bandholz of UniCredit: “Most of this is weather related and correct for exaggerated strengths seen earlier in the year.”

It’s going so well, get me come shades.

• Millions Of Americans Desperate To Trade Part-Time Work For Full-Time (MW)

Millions of Americans don’t want to work part-time. The U.S. economy added just 98,000 jobs in March, the smallest gain in nearly a year, after adding more than 200,000 jobs in January and February. Economists predicted that the number of jobs created in March would hit 180,000, so the actual figures fell far short of that. Unemployment fell to a 10-year-low of 4.5% in March from 4.7% in February, but the “real” unemployment rate that includes part-time workers who would rather work full-time and job hunters who gave up searching for work was 8.9%, although this was also down from 9.2% in February. Part-time work is still a contentious alternative for many workers. On Thursday, Amazon said it will create 30,000 part-time jobs in the U.S. over the next year, nearly double the current number. Of those, 25,000 will be in warehouses and 5,000 will be home-based customer service positions.

Amazon said in January it would create 100,000 full-time jobs over the next 18 months, according to a separate announcement made in January. Last year, Amazon’s world-wide workforce grew by 48% to 341,400 employees. In the U.S., it has over 70 “fulfillment centers” and 90,000 full-time employees. There were some 5.6 million involuntary part-time workers in March 2017, little changed from the month before, but down from 6.4 million a year earlier, according to the Bureau of Labor Statistics. That number is up from 4.5 million in November 2007, but way off a peak of 8.6 million in September 2012. These figures are almost entirely due to the inability of workers to find full-time jobs, leaving many workers to take or keep lower-paying jobs, according to the Economic Policy Institute, a nonprofit think-tank in Washington, D.C. And 54% of the growth in these involuntary part-time jobs between 2007 and 2015 were in retail, leisure and hospitality industries, the EPI said.

[..] Perhaps not surprisingly, involuntary part-time workers tend to earn less than their voluntary part-time counterparts. Approximately 40% of involuntary part-time workers report a total family income of less than $30,000, compared with just 18% of the latter and 29% of the population as a whole, according to an earlier report published in 2015 by Rutgers University. More than four out of every five involuntary part-time workers says it’s hard to save for retirement and about seven out of every 10 say they earn less money than they and their family need to get by and pay bills.

It’s too late to gently deflate.

• Toronto Real Estate Is In A Bubble Of Historic Proportions (Rosenberg)

The concerns about froth in Toronto’s housing market are not likely to subside given the sticker-shock from the latest report from the Toronto Real Estate Board. As per the March report, the average single-detached house in the Greater Toronto Area (GTA) sold for $1,214,422 last month up from $910,375 in March of last year – that is a 33% YoY surge, and follows a 16% run-up over the prior 12 months. Whatever the term is for an acceleration in an already parabolic curve, well, that is what we have on our hands today. And it isn’t just detached homes seeing this degree of rapid price appreciation — the benchmark single-family home selling price was up 29% YoY, the benchmark townhouse price was up 28% and the condo/apartment composite was up 24%. This is a bubble of historic proportions.

Not only to have home prices in the GTA now absorb an unprecedented 13 years of median family income, but to have 30%-ish run-ups against a backdrop of a 2% inflation rate, wages that are barely going up 2% as well, and nominal GDP growth of around 4%. This should put 30% into some sort of perspective when we conclude that what we have on our hands is a near three standard deviation event. That alone qualifies as a bubble — if you don’t like that term, then call it a giant sud. In the past, Toronto home prices went up at an annual rate of 4% in real terms, in the past year they have surged by nearly 30%. [..] it goes without saying that if the name of the game is to tame the flame then have the foreign investor share the blame. A tax on foreign transactions, as was already done in Vancouver, seems like a pretty good idea.

And the government can at the very least use the revenues to either provide greater tax incentives to build and/or provide tax relief for the low/mid income entry-level buyer who is struggling to cobble together the funds for a down payment. So yes, in this sense, I would be advocating a Robin Hood style of economic policy. Indeed, what may be needed is a very progressive tax on foreign buying of local residential real estate in the bid to cool demand and reverse the exponential surge in home prices – a surge that is creating tremendous social problems by crowding out young families (or individuals) from chasing the homeownership dream (a typical response is for these folks is to go out and buy a condo instead, but the reality is that average prices here have also skyrocketed 24% in the past year and are in a bubble of their own).

Everyone says that the Bank of Canada cannot raise interest rates to curb the excess demand because of the deleterious effect this would have on the economy writ large (for example, taking the Canadian dollar back up to or above 80 cents which would thwart our export competitiveness which has become a longstanding role of the central bank). Be that as it may, the home price surge in the GTA over the past year has impaired homeowner affordability to such an extent that it is basically the equivalent of the Bank of Canada having raised rates 150 basis points – actually a 200 basis point increase if you were to look at what home prices have done to affordability ratios over the past two years …

“Where home prices are in Toronto, they absorb 13 years of average family income. That is completely abnormal. We’ve never seen this before.”

• Rosenberg: Toronto Housing Bubble ‘On Par With What We Had In The US’ (BNN)

Gluskin Sheff Chief Economist David Rosenberg is joining the growing chorus of calls for government intervention into the Toronto housing market. In an interview on BNN, Rosenberg, who correctly called the U.S. housing bubble in 2005, said the massive deviation from historical norms has him drawing comparisons between the two situations. “This bubble is on par with what we had in the States back in ’05, ’06, ’07,” he said. “We have to actually take a look at the situation. The housing market here is in a classic price bubble. If you don’t acknowledge that, you have your head in the sand.” Rosenberg warned unchecked increases in home prices are becoming a social issue. “It’s not an equity, it’s not a bond – it’s where people live,” he said. “Where home prices are in Toronto, they absorb 13 years of average family income. That is completely abnormal. We’ve never seen this before.”

Rosenberg said he’d be singing a different tune if price increases were running in line with any of the usual economic fundamentals, such as job growth, rising incomes, or nominal GDP growth. “We’re out of equilibrium, and when we’re out of equilibrium, or there’s some sort of market failure, are there grounds there for government intervention? I think even the most ardent libertarian would say ‘yes,’” he said. Rosenberg said there are a trio of levers the government can pull to cool down the market. Authorities can address supply, which he said has already been “kiboshed.” Interest rates can be raised, but Rosenberg doesn’t believe the Bank of Canada will do that. Or new policy can be drafted to address the prevalence of speculation.

“These are not prices driven by the local fundamentals – this is the foreign buyer coming in,” Rosenberg said. “Toronto has really emerged as a first-class city, not just politically, not just culturally and economically, but also in terms of being a major financial centre. But if you’re going to ask me at this stage, ‘do we need to approach taxation of this capital coming in differently to curb the demand?’ [That’s] absolutely right.”

In a word: YES.

• Could Europe Copy America’s Supersized Corporate Debt? (BBG)

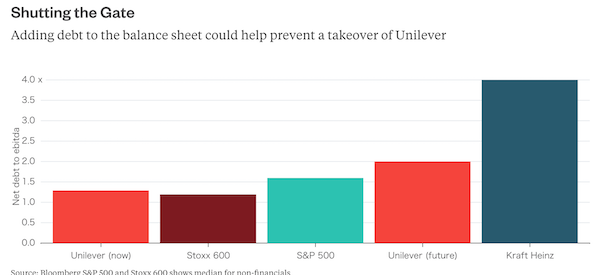

Unilever CEO Paul Polman must have had one eye focused across the Atlantic when he unveiled his revamp of the consumer goods giant this week. And not just because erstwhile suitors 3G Capital, Kraft Heinz and Warren Buffett will have been watching. In an effort to appease shareholders, Polman also ripped a couple of pages from any U.S. CEO’s post-crisis playbook: load more debt on the balance sheet and buy back lots of your own shares. So Unilever will lift its net debt to Ebitda ratio from 1.3 to 2 and buy back 5 billion euros ($5.3 billion) of stock.In Europe, that counts as relatively bold. Faced with anemic economic growth since the global financial crisis, non-financial companies here have typically been reluctant to take on more debt, as the chart below shows.

They’re also far less likely to buy back stock: U.S. corporations repurchased more than $530 billion of stock last year. In Europe the total was a fraction of that.Polman seems to have belatedly recognized the obvious: having a lightly geared balance sheet makes a company vulnerable to a takeover. That’s especially true if the buyer is holding dollars and your stock is priced in relatively cheap euros or pounds.

Of course there’s an argument what Polman is doing is common sense. Debt is cheap compared to equity, so Unilever’s balance sheet is simply becoming more efficient. Having more debt shouldn’t pose a problem for Unilever as its earnings power is considerable. People still need to buy soap and deodorant, even in a recession.Still, this sets a rather uncomfortable precedent. Polman rebuffed Kraft Heinz’s $143 billion bid in part because he’s no fan of financial engineering. It would be a shame if other European companies now drew the conclusion that to remain independent they need to indulge in some financial engineering of their own. Especially if they load up on too much debt just as the current economic cycle starts to look long in the tooth.

She’s crystal clear.

• Syrian Gas Attack is a Lie: “Stop Your Governments!” – Russia (FR)

On April 7th, US warships delivered an illegal blow to a Syrian airbase in Homs. Their justification was the recent “chemical weapon” attack on behalf of the Syrian government in Idlib. The Kremlin condemned the strike as an act of aggression against a sovereign state, and a violation of international law. Meanwhile, at the UN, representatives of Western governments attempt to push through a resolution that is based on information taken out of thin air. It includes the removal of Assad, whether or not he was behind the attack.

It is noteworthy, that the only real source of information on what took place, are the videos made by the White Helmets, an infamous propaganda organisation as it pertains to the Syrian civil war. In this clip, Maria Zakharova calls on Western respresenatives/ journalists to hear Russia, and what it has to say. The attack against the Syrian government, much like the Ghouta gas attack in 2013, which precipitated the Syrian civil war, is a giant facade for the military industrial warhawks in the US, to put their money where their mouth is.

“Putin has a cool mind and we may anticipate that the Russian response will come at a time of his choosing and in a manner that is appropriate to the seriousness of the U.S. offense. Look for this before the end of the month.”

• US Missile Strikes in Syria Cross Russian ‘Red Lines’ (RI)

My days as apologist for Donald Trump’s backsliding on his electoral campaign promise of a new direction in foreign policy are over. From being the solution, he has become an integral part of the problem. And with his bigger than life ego, petulance and stubbornness, Commander-in-Chief Trump is potentially a greater threat to world peace than the weak-willed Barack Obama whom he replaced. Trump has ignored Russian calls for an investigation into the alleged chemical gas attack in Idlib province before issuing conclusions on culpability, as happened within hours of the event. He has accepted a narrative that is very possibly a false flag produced by anti-government rebels in Syria, disseminated by the White Helmets and other phony NGO’s paid from Washington and London.

He ordered the firing of 50 or more Tomahawk missiles against a Syrian Government air base in Homs province, thereby crossing all Russian “red lines” in Syria. Until this point, the Kremlin has chosen not to react to all signs coming from Washington that Trump’s determination to change course on Russia and global hegemony was failing. The wait-and-see posture antedated Trump’s accession to power when Putin overruled the dictates of protocol and did not respond to Obama’s final salvo, the seizure of Russian diplomatic property in the U.S. and the eviction of Russian diplomats. The Russians also looked the other way when the new administration continued the same Neocon rhetoric from the tribune of the UN Security Council and during the visits of Vice President Pence, Pentagon boss Mattis and Secretary of State Tillerson to Europe.

However, the missile attack in Syria is a game changer. The pressure on Vladimir Vladimirovich Putin to respond in kind is now enormous. Putin has a cool mind and we may anticipate that the Russian response will come at a time of his choosing and in a manner that is appropriate to the seriousness of the U.S. offense. Look for this before the end of the month. In the meantime, we who have been hoping for a change of direction, for the rooting out of the Neocons and Liberal hawks directing the Deep State should drop what we are doing, and help form a grass roots political statement that Donald Trump and the political establishment will hear loud and clear.

A mass letter-writing campaign to Congress and the White House? A march on Washington? One way or another, the White House must be told that arranging foreign policy moves out of purely domestic calculations, such as likely happened yesterday puts the nation’s very existence at risk. Acting tough, striking out at Russia and its allies, is not the way to form a coalition to pass a tax reform act. The same may be said of an alternative reading of the missile attack yesterday: that it was intended as a message to visiting Chinese President Xi that should there be no joint action to restrain North Korea, the United States will act alone and with total disregard for international law. Either logic in the end is a formula for suicide.

I predict very large demonstrations, and quite possibly more violent ones. This could well be the end of Tsipras, and of SYRIZA; there’s no credibility left. They should have fought for the people.

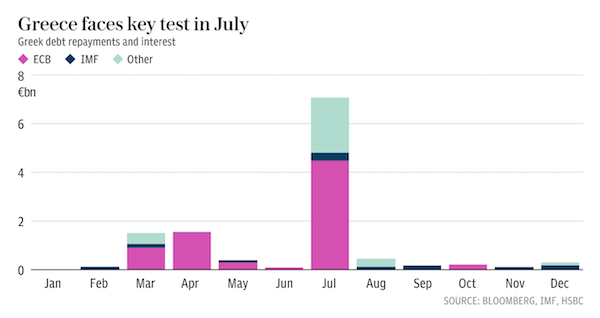

• Greece On Course To Avoid Debt Default As Athens Agrees Pension Cuts (Tel.)

Greece is on course to avoid a debt default this summer after creditors reached a deal with Athens on reforms including pension cuts and tax changes that will continue until the end of the decade. Jeroen Dijsselbloem, who leads the group of eurozone finance ministers, said creditors had reached an agreement in principle on the “size, sequencing and timing” of Greek reforms. The agreement also paves the way for the IMF to join the country’s third, €86bn bail-out programme. The Eurogroup chief said “significant progress” had been made in all areas, with debt inspectors expected to return to Greece shortly to “put the last dots on the ‘i’s and to reach a full staff-level agreement as soon as possible”.

A final agreement among finance chiefs will unlock a fresh tranche of rescue funds, enabling Athens to pay back around €6bn to creditors in July, including the ECB. “We’ve solved all the big issues,” said Mr Dijsselbloem. “The big blocks have now been sorted out and that should allow us to speed up and go for the final stretch.” The measures, which include controversial cuts to pensions and a widening of the tax base, amount to 2pc of Greek GDP in 2019 and 2020. Greece will be able to implement “parallel expansionary measures” if the economy is strong enough, said Mr Dijsselbloem. He said discussions on medium-term debt relief would not be discussed at a political level until a full agreement is reached and approved by the Greek government, which has a slim majority.

The pension cuts are likely to spark a fresh wave of protests across the country. Euclid Tsakalotos, the Greek finance minister, said austerity measures would be legislated “in the coming weeks”. “There are things that will upset the Greek people,” he said. Mr Tsakalotos said the government would also adopt stimulus measures in parallel, which will be “activated” if Athens meets its fiscal targets. Gerry Rice, a spokesman at the IMF, welcomed the “important progress” made in recent weeks, but said it still needed “satisfactory assurances” on debt sustainability before the Fund would seek board approval to participate in Greece’s third rescue programme.

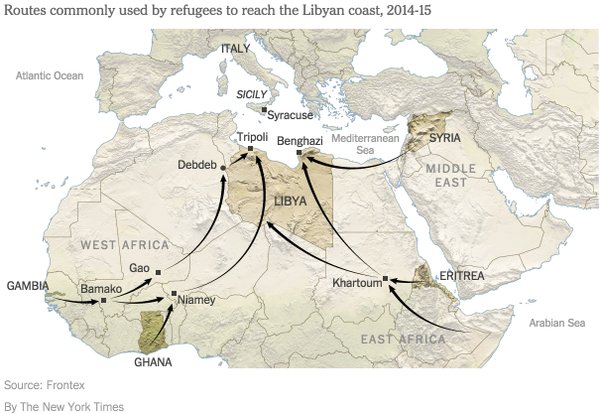

There is so much in the way of international law and UN conventions to protect refugees, but none of it has any meaning in Brussels.

• Letting People Drown Is Not A European Value (EUO)

595. A nice round number, right? It refers to the dead and missing in the central Mediterranean, mostly between Libya and Italy, in the first three months of 2017. The known dead died from drowning, exposure, hypothermia, and suffocation. Horrible, agonising deaths. 24,474. This is a nicer number. It refers to the women, men, and children who made it safely to Italy this year, all of them plucked from flimsy, overcrowded boats by European vessels. Many were rescued by teams from nongovernmental organisations patrolling international waters just off Libya, where most migrant boats depart. Those groups – including Doctors Without Borders (MSF), Migrant Offshore Aid Station (MOAS), SOS Mediterranee, Proactiva Open Arms, Sea-Watch and others – are now being accused of encouraging boat migration. Or worse, of collusion with people smugglers.

The EU border agency, Frontex, has suggested that the presence of rescue operations by nongovernmental groups is a pull factor, encouraging people to take the dangerous journey in hopes of rescue. A prosecutor in Catania, Sicily, has opened an inquiry into the funding streams for these groups, indicating a suspicion that they may be profiting illicitly from the movement of people in search of safety and better lives. This is the latest cruel twist in the EU’s response to boat migration from Libya. It reflects concern over increasing numbers of people embarking from Libya, the strain on the reception system in Italy and beyond, and the rise of xenophobic populism in many EU countries. But blaming the lifesavers ignores history, reality, and basic morality.

As MSF’s Aurelie Ponthieu explained, the NGO group rescuers are not “the cause but a response” to an ongoing human tragedy. Even before the significant increase in numbers in 2015, tens of thousands of people have been risking their lives in unseaworthy boats in the Mediterranean for decades; almost 14,000 have died or been reported missing since 2011. After the October 2013 Lampedusa tragedy, in which 368 people lost their lives, there was increased talk among organisations about mounting rescue missions in the central Mediterranean. In 2015, that became a reality, in large part because the end of the Italian navy’s humanitarian rescue mission Mare Nostrum and the gaps in its poor replacement by the EU border agency Frontex. People embark on these dangerous journeys for myriad reasons; they are fleeing persecution, violence, and poverty, and moving toward freedom, safety, and opportunity.

Both pull and push factors are always in play when people are on the move. Insofar as more freedoms, liberties, and policies grounded in respect for human rights – including vital rescue-at-sea operations – serve as pull factors, these should not be sacrificed in the name of limiting migration. The presence of EU vessels just off Libyan waters has changed the dynamic of boat migration. There is more hope of rescue, and smugglers have adopted even more unscrupulous tactics like using inflatable (throw-away) Zodiacs instead of wooden boats and providing only enough fuel to reach international waters. But to question the humanitarian imperative of rescue at sea is to discard our most basic respect for life. And the logic of those who criticise the rescue operations as a pull factor is that the groups should stop rescuing people and let them drown to discourage others from coming.