Jack Delano Foggy night in New Bedford, Massachusetts 1941

“..given the palpable sense of investor uneasiness lately, weakness on the social landscape bears watching.”

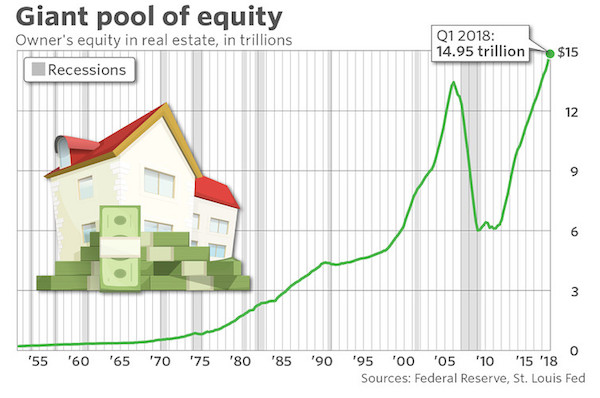

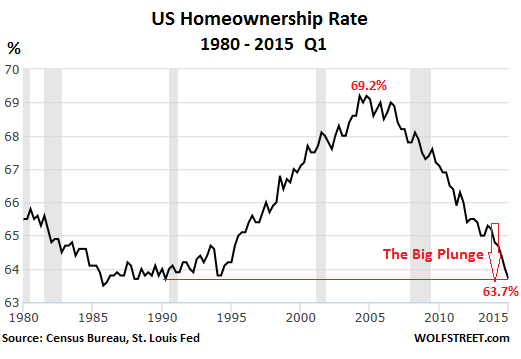

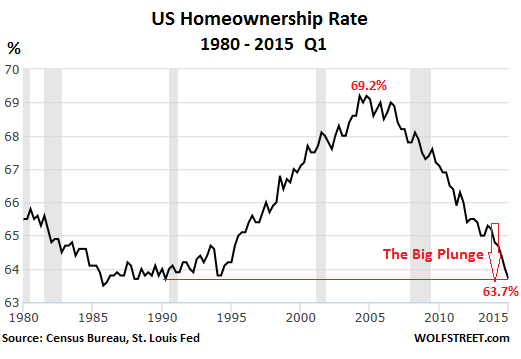

• Death Of The American Dream As A Big Bubble Readies To Pop (MarketWatch)

Retail appetite for risk may be drying up, if last week’s unsettling action in the sexy social-media corner of the market is any indication. Sure, Friday ended with a strong push for the major indexes, but that didn’t erase the sting of a stretch that saw 20% post-result drops for Twitter, LinkedIn and Yelp. Broad market bellwethers they ain’t, of course. That doesn’t, however, mean this double-digit blip should be shrugged off like a wayward Pacquiao punch. When the frothy names get rocked, market mood tends to change. It’s too early to draw any ghastly conclusions, but given the palpable sense of investor uneasiness lately, weakness on the social landscape bears watching.

The flip side is that dip-buyers over the past few years have generally pounced when their faves wobble. This is also something to keep an eye on as the week pushes forward. A rebound, and it’s business as usual. Further weakness, and it’s beware the unravel. At this point, there’s no bounce in the making for that social-media trio ahead of the bell. And the rest of the market is poised to open in the red, with the must-watch jobs report due at the end of the week. Big-picture, those fretting about the potential for a tech bubble might want to gird against what’s about to happen to the American Dream. Again. The “smart money” is signaling trouble ahead in housing.

Read more …

Recession looming. Remind me, in what quarter was the growth 5%?

• US Trade Deficit Soars To Worst Since 2008; Q1 GDP To Be Negative (Zero Hedge)

After shrinking notably in Feb, March’s US Trade deficit exploded. Against expectations of a $41.7bn deficit, the US generated a $51.4bn deficit – the worst since Oct 2008 and the biggest miss on record. Exports rose just $1.6bn while imports soared $17.1bn with the goods deficit with China soaring from $27.3bn to $37.8bn in March. Ironically, just as the “harsh winter” was found to lead to a GDP boost due to a surge in utility spending, so the West Coast port strike which was blamed for the GDP drop, was actually benefiting the US economy as it lead to a plunge in imports. In March, however, the pipeline was cleared, and US imports from China soared by over $10 billion to $38 billion. End result: prepare for upcoming Q1 GDP downgrades into negative territory, which with a Q2 GDP of 0.8% (per the Atlanta Fed) means the US is this close to a technical recession.

The increase in imports of goods mainly reflected increases in consumer goods ($9.0 billion), in capital goods ($4.0 billion), and in automotive vehicles, parts, and engines ($2.7 billion). A decrease occurred in petroleum and products ($1.1 billion). The goods deficit with China increased from $27.3 billion in February to $37.8 billion in March. From the report: The U.S. monthly international trade deficit increased in March 2015 according to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau. The deficit increased from $35.9 billion in February (revised) to $51.4 billion in March, as imports increased more than exports. The previously published February deficit was $35.4 billion. The goods deficit increased $14.9 billion from February to $70.6 billion in March. The services surplus decreased $0.6 billion from February to $19.2 billion in March.

Read more …

And that’s just the beginning.

• 3 Out Of 4 US Retirees Receive Reduced Social Security Benefits (MarketWatch)

Growing numbers of workers expect to rely heavily on Social Security as a major source of income in retirement, but almost three-quarters of current retirees are receiving reduced benefits, according to two new reports. According to a recent Gallup survey, 36% of adults who are not yet retired expect Social Security to be a “major source” of retirement income. That figure is roughly 10 percentage points higher than a decade ago and higher than any response in the past 15 years. Of course, the best way to maximize Social Security is to delay claiming benefits until “full retirement age,” which is climbing gradually to 67, or beyond. A person due to receive a benefit of $1,000 at a full retirement age of 66 would receive only $750 at age 62 (the earliest age at which most people can claim benefits) – and $1,320 at age 70.

But that math isn’t stopping many workers from claiming benefits early. Among the 37.9 million Americans receiving Social Security retirement benefits as of December 2013, fully 73% were receiving reduced benefits “because of entitlement prior to full retirement age,” according to a new report from the Social Security Administration. Relatively more women (75.4%) than men (70.3%) received reduced benefits. The findings come at a time when the Social Security program itself is straining to meet demands and when many workers are anxious about the size of their nest eggs. Currently, the Social Security Administration is tapping the interest on the program’s trust funds to pay beneficiaries and, soon, will begin drawing down the assets themselves.

At the moment, the trust fund is scheduled to run out in 2033, after which Social Security recipients would receive about 75% of their benefits. Against that backdrop, a recent Wells Fargo/Gallup survey found that only 28% of non-retired investors are very confident they will have enough savings at the time they decide to retire. An additional 48% are somewhat confident. The latest Gallup survey concludes: “To the degree [workers’] savings are not sufficient to fund their retirement, [they] will have to make up the shortfall somehow. The guaranteed Social Security benefit is an obvious way to do that, if not by also seeking part-time work or scaling back their standard of living considerably.”

Read more …

“..disproportionately Black or Hispanic..”

• One In Five US Adults Have No Credit Score, Can’t Borrow Money (MarketWatch)

One in 10 U.S. adults is invisible to much of the American economy because they have no credit report or score, a new report by the Consumer Financial Protection Bureau has found. Those 26 million adults — disproportionately Black or Hispanic — have virtually no chance to borrow money or use credit cards. And another 19 million adults have credit reports so “thin” that they are unscoreable by traditional methods, and also left behind by the credit system. Together, that means 45 million Americans — one in five adults — have no traditional credit score. “Today’s report sheds light on the millions of Americans who are credit invisible,” said CFPB Director Richard Cordray.

“A limited credit history can create real barriers for consumers looking to access the credit that is often so essential to meaningful opportunity — to get an education, start a business, or buy a house. Further, some of the most economically vulnerable consumers are more likely to be credit invisible.” The CFPB found that 188.6 million American adults have credit records that can be scored using traditional models, or 80% of the population. Most of the Americans left behind by traditional scoring methods are young. Over 10 million of the estimated 26 million credit invisibles are younger than 25, the CFPB found.

The findings are consistent with other recent studies about the “credit invisibles.” FICO, which created the most widely-used formula for credit scoring, told The Wall Street Journal last month that 25 million Americans have no credit events on file and an additional 28 million have thin files. VantageScore, which offers an alternative to FICO scores, said last year that 30-35 million Americans don’t have a traditional credit score. Among those with thin files, the CFPB said the group was evenly split between those who have an insufficient credit history and those who lack a recent credit history.

Read more …

Much has to shift to other states.

• California’s Drought Could Upend America’s Entire Food System (ThinkProgress)

On April 1, California Governor Jerry Brown stood in a field in the Sierra Nevada Mountains, beige grass stretching out across an area that should have been covered with five feet of snow. The Sierra’s snowpack — the frozen well that feeds California’s reservoirs and supplies a third of its water — was just 8% of its yearly average. That’s a historic low for a state that has become accustomed to breaking drought records. In the middle of the snowless field, Brown took an unprecedented step, mandating that urban agencies curtail their water use by 25%, a move that would save some 500 billion gallons of water by February of 2016 — a seemingly huge amount, until you consider that California’s almond industry, for example, uses more than twice that much water annually. Yet Brown’s mandatory cuts did not touch the state’s agriculture industry.

Agriculture requires water, and large-scale agriculture, like that in California, requires large amounts of water. So when Governor Brown came under fire for exempting farmers from the mandatory cuts — farmers use 80% of the state’s available water — he was unmoved. “They’re not watering their lawn or taking long showers,” he told ABC’s “The Week”. “They’re providing most of the fruits and vegetables of America to a significant part of the world.” Almonds get a lot of the attention when it comes to California’s agriculture and water, but the state is responsible for a dizzying diversity of produce. Eaten a salad recently? Odds are the lettuce, carrots, and celery came from California. Have a soft spot for stone fruit? California produces 84% of the country’s fresh peaches and 94% of the country’s fresh plums. It produces 99% of the artichokes grown in the United States, and 94% of the broccoli.

As spring begins to creep in, almost half of asparagus will come from California. “California is running through its water supply because, for complicated historical and climatological reasons, it has taken on the burden of feeding the rest of the country,” Steven Johnson wrote in Medium, pointing out that California’s water problems are actually a national problem — for better or for worse, the trillions of gallons of water California agriculture uses annually is the price we all pay for supermarket produce aisles stocked with fruits and vegetables. Up to this point, feats of engineering and underground aquifers have made the drought somewhat bearable for California’s farmers. But if dry conditions become the new normal, how much longer can — and should — California’s fields feed the country? And if they can no longer do so, what should the rest of the country do?

Read more …

MUST SEE! Brilliant exposé.

• Steve Keen Explains Why Austerity Policies Are Naïve (EIUk)

In an exclusive interview with Every Investor, Professor Steve Keen from Kingston University has warned that politicians who promote austerity economics are naïve. The economist, who was one of the few who predicted the Great Recession, warned last year that the US and UK economies wouldn’t make a sustainable recovery due to the problem of high levels of private debt – public debt being more a symptom than a cause of this economic malaise. In this interview he gives a detailed explanation as to why the austerity-heavy economic policy of the Conservatives (and the Liberal Democrats), and the austerity-lite version from Lab is naïve and will lead not to economic growth but to economic stagnation.

Indeed, while not endorsing any political party, he does acknowledge that the economic policies of the SNP and Greens make more sense. This is a video that needs to be watched. It will give you insights that most professional economists appear to lack. (Hence, their evident surprise at news that the UK and US are slowing down). It should also encourage investors to be in ‘risk-off’ mode, which seems very sensible given likely market volatility that will follow the election and the grave economic news that we can expect this year.

Read more …

Germany violates a lot of EU agreements. It could face huge fines.

• Germany’s Record Trade Surplus Is A Bigger Threat To Euro Than Greece (AEP)

Germany’s current account surplus is out of control. The European Commission’s Spring forecasts show that it will smash all previous records this year, reaching a modern-era high of 7.9pc of GDP. It will still be 7.7pc in 2016. Vague assurances that the surplus would fall over time have once again come to nothing. The country is now the biggest single violator of the eurozone stability rules. It would face punitive sanctions if EU treaty law was enforced. Brussels told Germany to do its “homework” a year ago, but recoiled from taking any action. We will see if Jean-Claude Juncker’s commission does any better this time. If not, cynics might justifiably conclude that big countries play by their own rules in Europe, and that Germany can defy all rules. The EMU punishment machinery is highly political, in any case.

The story of the EMU debt crisis is that the authorities persistently enforce a creditor agenda rather than macro-economic welfare (an entirely different matter). This is the fifth consecutive year that Germany’s surplus has been above 6pc of GDP. The EU’s Macroeconomic Imbalance Procedure states that the Commission should launch infringement proceedings if this occurs for three years in a row, unless there is a clear reason not to. There are few extenuating circumstances in this case. Germany’s surplus is not caused by a one-off shock. The surplus remains huge even if adjusted for lower energy import costs. It is a chronic structural abuse, rendering monetary union unworkable over time, and is surely more dangerous for eurozone unity than anything going on in Greece. “The European Commission should stop pulling its punches: Germany should be fined,” said Simon Tilford, from the Centre for European Reform.

“Their surplus should be treated in the same way as the southern deficits were treated earlier, as a comparable threat to eurozone stability. What is so worrying is that the surplus would normally be falling rapidly at this stage of the economic cycle,” he said. Germany’s jobless rate is at a post-Reunification low of 4.7pc. It should therefore be enjoying a surge of consumption. This it is not happening because the rebalancing mechanism is jammed. What this shows is the EMU remains fundamentally out of kilter, and doomed to lurch from crisis to crisis even if there is a recovery. Any rebound in southern Europe will lead to the same build-up in intra-EMU trade imbalances, and therefore in the same offsetting capital flows, vendor-debt financing, and asset bubbles that led to the EMU crisis in the first place.

Read more …

Major strikes for more pay.

• It’s Not Greek ATMs Running Out of Cash. It’s Germany’s (Bloomberg)

European travelers have contended for weeks with the possibility that Greece’s dwindling finances might lead to empty ATMs. They should have concerned themselves instead with Germany. While cash machines in Athens are still operating without any trouble, striking couriers in Berlin this week stopped filling ATMs, leading to a crunch for those trying to make withdrawals. And the open-ended labor dispute with a local security company means there’s no end in sight. “That all depends on how the company reacts,” said Andreas Splanemann, a spokesman for the Ver.di union representing the security personnel. “There are now a lot of cash machines that are empty.” Berlin’s strike is the latest in a series of walkouts that have riled a nation more accustomed to mocking the labor strife which has so often beset neighboring France.

A strike by train drivers that began Tuesday is paralyzing travel and clogging highways throughout Germany. That action follows a March walkout by pilots at Deutsche Lufthansa AG that led to flight cancellations for 220,000 people. “It’s really annoying, especially if you’re pressed for time,” Batgerel Militz, a Berlin student, said as she unsuccessfully tried to withdraw cash at two banks. She finally got lucky at the third – just in time to catch her delayed train. “Probably because of the train strike,” she said with a laugh. Joking aside, Germany is seeking to curb the influence of smaller unions by drafting a law that would limit companies’ labor representation to one union per group of employees. The measure is currently winding its way through the Bundestag, the country’s lower house of parliament.

In the case of the passenger train strike, which is set to run through May 10, the walkout was called by the GDL union, which represents 19,000 train drivers, switch-yard engineers and conductors. The GDL is far smaller than the larger EVG, which has about 213,000 members staffing Germany’s rail network. The Lufthansa strike crippled travel because it was called by pilots. “They can strike more readily if they do so with solely their own goals in mind,” said Stefan Heinz, an academic specializing in labor politics at Berlin’s Free University. “They can get more out of it for their group.” While Germans still strike less than the French, those who’ve walked out recently in Germany often hold posts that have a wider ripple effect across society.

Read more …

“The responsibility lies exclusively with the institutions [EU and IMF] and failure to agree between them..”

• Greek Government Takes Aim At Creditors Over Stalled Bailout Talks (Guardian)

Greece’s government has blasted its creditors for holding back progress on bailout talks, laying the blame squarely on differences between the European Union and the International Monetary Fund. Racheting up the pressure on the two bodies, the anti-austerity Syriza government said conflicting strategies and opposing views were not only impeding negotiations but injecting “a high level of danger” into the talks at a time when the country’s finances had hit rock bottom. “Serious disagreements and contradictions between the IMF and European Union are creating obstacles in the negotiations and a high level of danger,” said a senior government source. The official added that both lenders were digging in their heels on divergent issues, effectively enforcing “red lines everywhere”.

While the IMF was refusing to compromise on labour deregulation and pension reform but was relaxed on fiscal demands, the EU was insistent that primary surplus targets be met while being much more conciliatory about structural changes. The official insisted: “In such circumstances, it is impossible to have a compromise. The responsibility lies exclusively with the institutions [EU and IMF] and failure to agree between them”. Speaking exclusively to the Guardian, the Greek health minister, Panagiotis Kouroumblis, said creditors were constantly moving the goalposts. “They are not only implacable, the feeling that they give us is that they are impossible to satisfy,” he said. “They ask for 10 things to be done and then come back the next day and ask for another 10 more. As much as we would like, that’s not going to lead to compromise.”

The warnings came as the European commission slashed its forecast for Greece’s growth rate this year, predicting the economy would expand by a mere 0.5%, compared with the 2.5% it had projected barely three months ago. The downgrade was the clearest sign yet that the stalled negotiations have thrown the country, last year believed to be emerging from its worst recession on record, back into reverse. Talks aimed at unlocking desperately needed rescue funds – €7.2bn (£5.3bn) from the last bailout has been held up as both sides haggle over reforms – have been beset by problems since the far-left Syriza leader Alexis Tsipras assumed power in January. The EC said Greece’s economic recovery had been hit by the political tumult that had plagued the country in the four months since the previous government was forced to call snap polls. “In the light of the persistent uncertainty, a downward revision has been unavoidable,” said the EU’s monetary affairs commissioner, Pierre Moscovici.

Read more …

“The IMF won’t compromise on labor deregulation and pension reforms, while the European Commission is insisting on fiscal targets being met..”

• Greece Says Compromise Not Possible Under Current Conditions (Bloomberg)

Greece blamed international creditors for the failure to achieve a breakthrough in bailout talks, saying a deal won’t be possible until they agree on a common set of demands. A Greek official said that the European Commission and the IMF are confronting the country with too many red lines and need to better coordinate their message. Greek bonds and stocks tumbled on Tuesday as optimism that an interim deal was close gave way to angst that the country isn’t moving fast enough to guarantee the continued flow of bank liquidity and bailout funds. Euro region finance ministers are next scheduled to meet on May 11, with Germany’s Wolfgang Schaeuble saying earlier he’s “skeptical” that an agreement can be reached by then.

Greece’s new line of argument focuses on what it says are divisions among the international creditors. The IMF won’t compromise on labor deregulation and pension reforms, while the European Commission is insisting on fiscal targets being met, said the official, who spoke on condition of anonymity because the talks are confidential. The commission is also refusing to consider a debt write down, he said. Greece is sending mixed signals about just how much money it has left. While officials say they’re confident of making payments to the IMF this week and next, one policy maker signaled last month that the country may struggle to keep its finances afloat beyond the end of this month.

Read more …

What’s the use of threatening Greece even further?

• Debt Talks On Hold Until Greece Agrees Reforms, Warns Moscovici (FT)

Greece’s eurozone creditors will not discuss how to get the country’s sovereign debt back on a sustainable path until Athens agrees to a new economic reform programme that would release €7.2bn in desperately needed bailout funds, the EU’s economic chief said on Tuesday. The talks over the reform programme, which have intensified in recent days, are at the centre of a three-month stalemate between eurozone creditors and the new radical leftist Greek government. The Syriza administration in Athens has resisted many of the reforms in the existing bailout programme but needs the funding to fill its rapidly dwindling coffers.

Pierre Moscovici, the European commissioner for economic affairs, said debt issues “can only be discussed after we have agreed a reform programme”. His statement reflects resistance in eurozone capitals to any form of “haircut” on Greek sovereign debt, which is now mostly held by EU governments and institutions. Mr Moscovici’s comments come as the IMF has suggested eurozone creditors may need to write down some of their Greek bailout loans to ensure the country’s debt levels begin to decline more sharply. Officials involved in the talks said the IMF was not seeking large-scale debt relief immediately.

Instead, it was warning that any concessions to Athens that allowed the government to post lower budget surpluses — the likely trajectory of the current talks — would require debt relief to make up the difference. “Six months ago, we all concluded there was no need for debt relief,” said one senior official. “But if there’s a significant relaxation of the programme [targets], the IMF will want to see some debt relief.” Without a return to sustainable debt levels — or a larger bailout from the eurozone to ensure Athens can continue to pay its bills — the IMF may be forced under its rules to withhold its share of the current bailout tranche, which amounts to about half of the €7.2bn being negotiated.

Read more …

“..if Varoufakis was to leave public office and his life in the public eye, Greece would be the poorer for it, perhaps in more ways than one.”

• Varoufakis’ First 100 Days: All Style, No Substance? (CNBC)

Negotiations with lenders over the future of Greece’s €240 billion bailout have been ongoing since Greece’s leftwing government came to power. And although Greece was given a four-month extension to its bailout in February, little has been achieved in terms of reforms. As talks dragged on into April, euro zone officials began to moan openly about Greece’s stance – and Varoufakis himself as he was in charge of negotiations — and the fact it was, as the Eurogroup’s President Jeroen Djisselbloem put it “wasting time.”The lack of progress raised concerns that Greece’s might not be able to find the money for upcoming loan repayments and whether it could avoid default and a potentially very messy exit from the euro zone.

Talk also turned to whether Varoufakis could lose his job as a way for show Greece to show its European partners that it was serious about reforms – serious enough to sack its own champion finmin. Instead, he was sidelined last Tuesday, keeping his job as finance minister but taken away from the frontline during negotiations – a move that one euro zone official said had helped negotiations to progress.Getting no love from either his euro zone counterparts or his own government, Varoufakis was verbally attacked and threatened with violence by anarchists in the Exarchia area of Athens, a neighborhood popular with anti-government protesters.

Varoufakis came out uscathed from the scuffle, but whether he can survive the blows and bruises of life in Greece’s tumultuous political landscape is yet to be seen. Just this weekend , the Greek finance ministry was denying reports that Varoufakis had offered to resign. Whether the reports are true or not, if Varoufakis was to leave public office and his life in the public eye, Greece would be the poorer for it, perhaps in more ways than one.

Read more …

Risky for Syriza, it threatens to go against its election promises.

• Greece To Finalise Airports Deal ‘Immediately’ (Reuters)

Greece will finalise “immediately” a €1.2 billion deal with Fraport to run regional airports and reopen bidding for a majority stake in Piraeus port, a senior privatisations official said on Tuesday. The asset sales had been in doubt after Prime Minister Alexis Tsipras’ leftist-led government took power in January but may be the latest concessions offered by his government to try to secure more bailout cash from international creditors. The Greek finance, shipping and economy ministries involved in the sales declined to comment. “The issue of regional airports will be concluded immediately,” the official at Greece’s privatisations agency HRADF told Reuters on condition of anonymity, noting that an announcement could be expected by May 15.

Tsipras’ government is trying to renegotiate a 240-billion-euro bailout and has said it would review the sales, though various Greek officials have offered contradictory statements on the fate of both the airports and the Piraeus deals. Fraport and Greek energy firm Copelouzos had agreed with the privatisation agency in 2014 that it would run the airports in tourist destinations including Corfu, striking one of Greece’s biggest privatisation deals since the start of the debt crisis. Under the terms of the deal, the German-Greek group was expected to spend about €330 million in the first four years to upgrade the airports, that will be leased for 40 years.

On Tuesday, the privatisations official said Athens would invite shortlisted investors to submit by July binding offers for a 51% stake in Greece’s biggest port with the option to raise their stake to 67% over five years. “We will reopen the process in the coming days,” the official said. China’s Cosco Group, which already manages two of Piraeus port’s cargo piers, is among five preferred bidders. Greek port workers are due to stage a 24-hour strike on Thursday to protest against the privatisations of Piraeus and Thessaloniki ports, saying the government has rolled back on its pre-election pledges.

Read more …

“I agree with you, Dodd-Frank isn’t perfect.” She paused, then spoke very slowly and emphatically: “It should have broken you into pieces.”

• Why Elizabeth Warren Makes Bankers So Uneasy, and So Quiet

The rollback of financial regulation is stalled. Income inequality is a campaign issue. Americans are still angry about the financial crisis. Things aren’t shaping up the way the big banks expected, and an important reason is one laser-focused senator from Massachusetts.

Let’s assume that when he woke up on the morning of Dec. 12, Michael Corbat, CEO of Citigroup, was feeling pretty good. The day before, the House of Representatives had passed a bill that would save his bank and others lots of money and headaches. The trouble was, Elizabeth Warren, the senior senator from Massachusetts, was getting ready to speak on the Senate floor. She had his bank on her mind. What Warren wanted to talk about was an item tucked into page 615 of a 1,603-page spending package: the repeal of section 716 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Known as the swaps push-out rule, section 716 required banks to set up separate subsidiaries, not backed by the government, to trade certain derivatives.

If the rule stood, it would generate huge administrative costs for the big banks. Citi had fought hard on this. The bank’s lobbyists had worked on lawmakers and helped draft language for the repeal. Getting it into a big spending package Congress was sure to pass was a coup. In the ongoing wars between Wall Street and the forces of government regulation, this repeal was a big win for the banks. “Today I am coming to the floor not to talk about Democrats or Republicans,” Warren began her speech, “but to talk about a third group that also wields tremendous power in Washington—Citigroup.” With that, Warren turned Citi into exactly the kind of villain so many people suspect lurks in the backrooms of the Capitol.

In one particularly striking moment, she connected nine top government officials—including Treasury Secretary Jacob J. Lew—directly to the megabank. She invoked Teddy Roosevelt, her favorite trust-busting president, who took on the big corporations of his day. “There is a lot of talk coming from Citigroup about how Dodd-Frank isn’t perfect,” Warren continued. “So let me say this to anyone who is listening at Citi. I agree with you, Dodd-Frank isn’t perfect.” She paused, then spoke very slowly and emphatically: “It should have broken you into pieces.”

Read more …

Will Beijing take on all debt to the shadow system?

• China Mulls New Monetary Tool That ‘The World Has Never Seen’ (Caixin)

China’s central bank is considering lending to policy banks through a new tool so they can buy bonds issued by local governments, a person close to the regulator says. The loans would have a maturity of at least 10 years, the source said. Other details of how this would work remain unclear, but the tool will be unlike anything the bank has used before, he said. “It will be a new monetary tool the world has never seen,” the person said. “The format does not matter, and all possible means could be taken.” He said the regulator will use the new instrument to provide China Development Bank (CDB) and perhaps other policy banks with capital so they can buy bonds that local governments have issued.

The Ministry of Finance has said local governments can issue 1 trillion yuan ($160 billion) worth of bonds this year to repay their old debts — in other words allowing them to swap existing debts, which are mostly bank loans, for bonds that have longer maturities and cost less. The problem is that commercial banks are not interested in the bonds. Banks are “not at all interested” in buying such bonds because “their yields are too low and there is no liquidity,” a source from a joint-stock bank said. He said the bank he works for bought some local-government bonds only because its branches want to maintain a good relationship with local governments.

Xu Hanfei at Guotai Junan Securities said the interest rates of bank loans to local-government financing platforms — commercial vehicles that local governments used to circumvent a previous restriction that barred them from borrowing directly — are usually around 8%, and so are the yields of these platforms’ bonds. With local-government bonds, he said, the yields are usually halved. “Commercial banks do not want to buy local-government bonds … because the yields can hardly cover their capital cost,” a source from a bank’s financial-market division said. “There are many more assets that promise much better returns than local-government bonds. Why bother exchanging them for the bonds?”

Read more …

The war crazies.

• CFR Says China Must Be Defeated And TPP Is Essential To That (Zuesse)

Wall Street’s Council on Foreign Relations has issued a major report, alleging that China must be defeated because it threatens to become a bigger power in the world than the U.S. This report, which is titled “Revising U.S. Grand Strategy Toward China,” is introduced by Richard Haass, the CFR’s President, who affirms the report’s view that, “no relationship will matter more when it comes to defining the twenty-first century than the one between the United States and China.” Haass gives this report his personal imprimatur by saying that it “deserves to become an important part of the debate about U.S. foreign policy and the pivotal U.S.-China relationship.” He acknowledges that some people won’t agree with the views it expresses.

The report itself then opens by saying: “Since its founding, the United States has consistently pursued a grand strategy focused on acquiring and maintaining preeminent power over various rivals, first on the North American continent, then in the Western hemisphere, and finally globally.” It praises “the American victory in the Cold War.” It then lavishes praise on America’s imperialistic dominance: “The Department of Defense during the George H.W. Bush administration presciently contended that its ‘strategy must now refocus on precluding the emergence of any potential future global competitor’—thereby consciously pursuing the strategy of primacy that the United States successfully employed to outlast the Soviet Union.”

The rest of the report is likewise concerned with the international dominance of America’s aristocracy or the people who control this country’s international corporations, rather than with the welfare of the public or as the U.S. Constitution described the objective of the American Government: “the general welfare.” The Preamble, or sovereignty clause, in the Constitution, presented that goal in this broader context: “in order to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity.” The Council on Foreign Relations, as a representative of Wall Street, is concerned only with the dominance of America’s aristocracy.

Their new report, about “Revising U.S. Grand Strategy Toward China,” is like a declaration of war by America’s aristocracy, against China’s aristocracy. This report has no relationship to the U.S. Constitution, though it advises that the U.S. Government pursue this “Grand Strategy Toward China” irrespective of whether doing that would even be consistent with the U.S. Constitution’s Preamble. The report repeats in many different contexts the basic theme, that China threatens “hegemonic” dominance in Asia. For example: “China’s sustained economic success over the past thirty-odd years has enabled it to aggregate formidable power, making it the nation most capable of dominating the Asian continent and thus undermining the traditional U.S. geopolitical objective of ensuring that this arena remains free of hegemonic control.”

Read more …

Kiev left Eastern Ukraine alone, no cash in ATMs, no pensions payments, no benefit payments. There’s only one alternative.

• Forget Tanks. Russia’s Ruble Is Conquering Eastern Ukraine (Bloomberg)

As a wobbly cease-fire keeps eastern Ukraine’s warring factions apart, Russia’s ruble is conquering new territory across the breakaway republics. In Donetsk, the conflict zone’s biggest city, supermarkets have opened ruble-only checkout counters to serve the fighters in camouflage lining up along pensioners. Bus and tram tickets come with a conversion from Ukraine’s hryvnia to the Russian currency. Gas-station workers are paid in rubles because that’s what their rebel customers use to fuel their armored jeeps. “There are no problems in shops, they all accept rubles,” said Natalya, 36, a hairdresser buying groceries for her parents, who declined to give her surname for fear of reprisals. “They don’t always have small change, but they can give you chewing gum or a cigarette lighter instead.”

The ruble’s creeping advance shows how the troubled regions are slipping further from the government’s grasp, even as a peace accord brokered by Germany, France and Russia calls for the nation of more than 40 million to remain whole. Separatist officials haven’t yet made their currency plans clear. The precedent in ex-Soviet countries from Georgia to Moldova shows that similar shifts can help entrench pro-Russian insurgents. “The increasing use of the ruble is yet another sign Russia’s going to keep de facto sovereignty over the territory it and the separatists control,” said Cliff Kupchan, Eurasia Group chairman in New York. “If the sides implement the latest truce, which is unlikely, perhaps both the hryvnia and the ruble will be used. If not, it will be all ruble.”

Ukraine is the one place in the world where the ruble’s 46% plunge against the dollar in 2014 didn’t make it any less attractive, considering a 48% drop in the hryvnia, the world’s worst performer for the last two years. The Russian currency has staged a partial recovery in 2015, with April its best month on record. It advanced 0.4% on Tuesday. And the ruble has been welcomed in Donetsk, where most shops and businesses now accept it. Hryvnias are no longer available from cash machines in rebel-held territory, forcing locals to go to other parts of Ukraine to withdraw money.

Read more …

There’s not nearly enough appreciation in the west for what Russia suffered, and achieved, in WWII. Russia mourned more dead than all other countries combined.

• Moscow’s Last Stand: How Soviet Troops Defeated Nazis For First Time In WW2 (RT)

In October 1941 Hitler launched an offensive on the Russian capital codenamed Operation Typhoon. It was supposed to crush Moscow in a so-called double pincer – two simultaneous attacks from the north and south. The Soviet troops vigorously fought back, disrupting Hitler’s plans for a quick operation. The Battle of Moscow eventually lasted through January 1942 and ended in the first battlefield defeat of the Nazi army. The battle was one of the bloodiest and lethal struggles in world history and was later considered to be a decisive turning point in the fight against Nazi troops. Memories of that battle are still fresh for WW2 veteran Gennady Drozdov, 98, who was assigned to the 4th Guards Mortar Regiment at that time.

“During the Battle of Moscow, in December 1941, there was a raid on the hinterlands of the Nazi German troops. We came so close we could see the position of their troops, their machine gun, in particular, and its operators,” Drozdov told RT. “On our command the division fired a salvo, missiles flew over our heads – we completed our task and returned to the base.” The weather seemed to be on the side of the Soviet army, as autumn brought heavy rains, and then winter caught the Nazis unawares with exceptionally freezing temperatures. While the epic battle raged on, Moscow residents had to “survive all the horrors of war: hunger, cold, devastation, loss of family and the loved ones,” according to Rimma Grachyova, who was seven years old when the war broke out. “Most frightening of all was the bombing – daily bombings that continued incessantly,” the woman recalls.

“At first we would shelter in the “Park Kultury” underground station that was not far from our house. Then our family decided that if it was our fate to die we would die together and we wouldn’t run from it. There were five kids in our family.” “We helped the front as much as we could. We’d collect scrap metal from courtyards. I’d knit socks and mittens together with grown-ups, as I knew how. We wrote letters too. We also sang for the wounded in hospitals,” the 80-year-old witness said, sharing her childhood experience. Almost one million Soviet soldiers died during the defense and counter-offensive operations, which included the construction of three defensive belts in the Moscow region, as well as deployment of reserve armies. The outcome of the Battle of Moscow saw German troops pushed back nearly 200 km from the capital, becoming the first-ever blow to the Wehrmacht’s reputation as an invincible army.

Read more …