Martin Luther King, Jr. following his 1963 arrest in Birmingham

Martin Luther King Jr. Day. He’s been dead long enough that everyone feels safe, if not entitled to, appropriating his name and celebration. But who in America today truly lives up to his legacy and message? Not many. The screwed up scenes at a high school, and the way media and individuals react to it, make that abundantly clear. There are many voices calling for serious harm to, if not murder of, a group of schoolchildren, voices who will in their very next breath seek to take possession of Dr. King’s name.

It’s time for all Americans, and not just Americans either, to find a nice bright mirror and face the beams in their own eyes. All sides focus on promoting hate of the others, and really, that is the opposite of what Dr. King said. How could you forget? You don’t solve anything be demanding other people change, you solve things only by changing yourself. You have no more right to hate Trump and his supporters than they have of hating you, or anyone else.

MLK: “a slogan ‘Power for Poor People’ would be much more appropriate than the slogan ‘Black Power.’”

Lost in the chorus of politicians, pundits and media personalities who are praising MLK is the core message that he was pushing before he was felled on the balcony of the Lorraine Motel. King evolved in his thinking; instead of seeking Civil Rights for “African-Americans”, he made the fatal decision to fight for economic justice for all. King realized that the infringements against “black” folks in America were interconnected to the injustices felt by marginalized people throughout the world. That awakening is the reason he traveled to Memphis, by standing up for striking sanitation workers, he was hoping to form a bridge between poor folks irrespective of their skin color.

The establishment love people who lead sectional movements—those who seek exclusive justice are doing the work of the status quo—what they will not abide are those who try to unify the oppressed and inspire collective actions. King paid with his life for having the courage to pursue inclusive justice. After he was murdered, institutions of power—from government, academia to mainstream media and beyond—kicked in, stealthy erased King’s legacy and replaced it with disinformation. What has taken place over the past fifty years is a systematic and coordinated effort to blacken his narrative and dilute the power of his message. What MLK fought for, and ultimately died on behalf of, was for equality and fairness for all. By narrowing the scope of his cause and containing his sacrifice to only as a struggle for “black” people, opinion leaders successfully ghettoized him in an effort to lessen his appeal to a broader constituency.

[..] “One unfortunate thing about [the slogan] Black Power is that it gives priority to race precisely at a time when the impact of automation and other forces have made the economic question fundamental for blacks and whites alike. In this context a slogan ‘Power for Poor People’ would be much more appropriate than the slogan ‘Black Power.’” This was a quote from King in August of 1967, eight months before he was executed.

All for it. But who’s impartial and strong enough to do it?

• A Call to Reinvestigate American Assassinations of the 1960s (CN)

To mark Martin Luther King Jr. Day a group of academics, journalists, lawyers, Hollywood artists, activists, researchers and intellectuals, including two of Robert F. Kennedy’s children, are calling for new investigations into four assassinations of the 1960s. On the occasion of Martin Luther King Jr. Day, a group of over 60 prominent American citizens is calling upon Congress to reopen the investigations into the assassinations of President John F. Kennedy, Malcolm X, Martin Luther King Jr., and Senator Robert F. Kennedy.

* We call upon Congress to establish continuing oversight on the release of government documents related to the presidency and assassination of President John F. Kennedy, to ensure public transparency as mandated by the JFK Records Collection Act of 1992. The House Committee on Oversight and Government Reform should hold hearings on the Trump administration’s failure to enforce the JFK Records Act.

* We call for a major public inquest on the four major assassinations of the 1960s that together had a disastrous impact on the course of American history: the murders of John F. Kennedy, Malcolm X, Martin Luther King Jr. and Robert F. Kennedy. This public tribunal, shining a light on this dark chapter of our history, will be modeled on the Truth and Reconciliation process in post-apartheid South Africa. The inquest — which will hear testimony from living witnesses, legal experts, investigative journalists, historians and family members of the victims — is intended to show the need for Congress or the Justice Department to reopen investigations into all four assassinations.

* On Martin Luther King Jr. Day, we call for a full investigation of Reverend King’s assassination. The conviction of James Earl Ray for the crime has steadily lost credibility over the years, with a 1999 civil trial brought by Reverend King’s family placing blame on government agencies and organized crime elements. Following the verdict, Coretta Scott King, the slain leader’s widow, stated: “There is abundant evidence of a major, high-level conspiracy in the assassination of my husband.” The jury in the Memphis trial determined that various federal, state and local agencies “were deeply involved in the assassination … Mr. Ray was set up to take the blame.” Reverend King’s assassination was the culmination of years of mounting surveillance and harassment directed at the human rights leader by J. Edgar Hoover’s FBI and other agencies.

* We call for a full investigation of the Robert F. Kennedy assassination case, the prosecution of which was a mockery of a trial that has been demolished by numerous eyewitnesses, investigators and experts — including former Los Angeles County Coroner Dr. Thomas Noguchi, who performed the official autopsy on Senator Kennedy. The forensic evidence alone establishes that the shots fired by Sirhan Sirhan from in front of Senator Kennedy did not kill him; the fatal shot that struck RFK in the head was fired at point–blank range from the rear. Consequently, the case should be reopened for a new comprehensive investigation while there are still living witnesses — as there are in all four assassination cases.

I looked this one up: Chinese population in 1961 was about 670 million. Today it’s more than twice that. That would seem to say birth rates have halved.

• The Number Of Births In China Hit Its Lowest Level Since 1961 (CNBC)

The number of babies born in China in 2018 was the lowest the country has seen in nearly 60 years, according to Chinese financial services firm Wind Information. China on Monday reported that there were 15.23 million births last year — the lowest since 1961 when 11.87 million births were reported, data on Wind showed. Last year’s birth figure was 11.6 percent lower than 17.23 million in 2017, according to Wind. The release of China’s latest birth data puts the country’s population at 1.395 billion in 2018, the Associated Press reported, citing data by the National Bureau of Statistics. That means the population grew 3.81 percent compared to a year earlier, according to the news wire. AP also reported that the Chinese government estimated that its population will peak in 2029 at 1.442 billion, and then start to decline in the year after that.

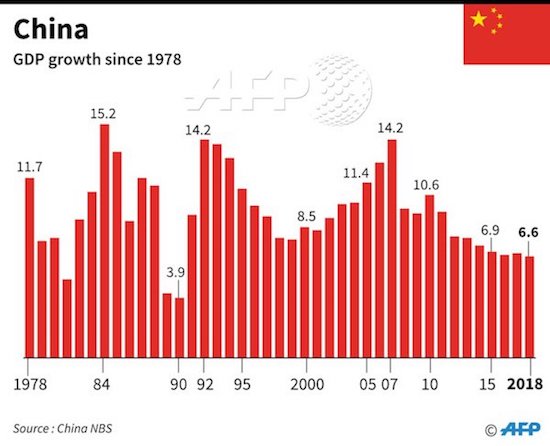

And that’s just official numbers. Economics professor Xiang Songzuo put it as low as 1.67% in December.

• China Economic Growth Lowest In 28 Years (MW)

China’s economic expansion languished to its slowest pace in nearly three decades last year, as a bruising trade fight with the U.S. exacerbated weakness in the world’s second-largest economy. The 6.6% growth rate for 2018 reported Monday is the slowest annual pace that China has recorded since 1990. The economic downturn, which has been sharper than Beijing expected, deepened in the final months of 2018, with fourth quarter growth rising 6.4% from a year earlier. Adding to the gloom was the trade conflict with Washington. The uncertain outlook for Chinese exporters caused companies to delay investing and hiring and in some cases even to resort to layoffs–a practice that is often discouraged by China’s stability-obsessed Communist Party rulers. The official jobless rate ticked up to 4.9% last month from 4.8% in November.

In the southern technology and export-manufacturing center of Shenzhen, for instance, many private makers of electronics, textiles and auto parts furloughed workers more than two months before the Lunar New Year holiday, which begins in February, according to business owners and local officials. The neighboring city of Guangzhou saw growth slump to 6.5% last year–well short of the 7.5% annual target set by the city government–as trade tensions hit the city’s manufacturing sector hard. Some economists and investors have said China’s economy is far more anemic than the government’s 6.6% rate of expansion for 2018. They note the government’s move on Friday, just ahead of Monday’s data release, to cut the 2017 growth rate to 6.8% from 6.9%, which they said provides a slightly lower base, giving a slight boost to the fresh 2018 data.

Consumer spending in general is slowing in China. That’s the biggest danger for its economy.

• China Real Estate Sales Growth Slows Down (R.)

Growth in property investment in China cooled to the second slowest pace in 2018 in December, adding to signs of a further slackening in the real estate market in a blow to a key driver economic growth. Real estate investment, which mainly focuses on the residential sector but includes commercial and office space, rose 8.2 percent in December from a year earlier, down from 9.3 percent in November, according to Reuters calculations based on data released by National Bureau of Statistics (NBS) on Monday. That was just ahead of the slowest pace of growth last year at 7.7 percent recorded for October. For the full year, property investment increased 9.5 percent from the year-earlier period, down from 9.7 percent in January-November.

In December, property sales by floor area, a major indicator of demand, rose a touch by 0.9 percent from a year earlier, the first gain in four months and compared with November’s 5.1 percent drop. For 2018, property sales by area rose a modest 1.3 percent from a year earlier, official data showed. Analysts say a continued downturn in sales on the back of tight government controls to curb speculation could add to the growing pressure on the world’s second-largest economy. The real estate sector is a key pillar of the economy, so any further weakness in sales could influence the pace and scope of fresh stimulus measures expected from Beijing this year.

It took decades to negotiate the Good Friday Agreement, after 1000s of lives were lost. May should not be allowed to touch it.

• Theresa May ‘Considers Amending Good Friday Agreement’ To Break Deadlock (Ind.)

Theresa May is considering an attempt to amend the Good Friday Agreement in a bid to break the Brexit deadlock and win support for a negotiated exit deal, it has been reported. Ministers believe the move could avoid the UK having to commit to a backstop as part of the prime minister’s “plan B”, The Daily Telegraph reported on Sunday. The EU has insisted on a backstop measure to ensure an open border remains between Northern Ireland and the Republic after the UK leaves the bloc. Ms May has been forced to find alternatives to her original Brexit deal after it was crushed in the Commons on Tuesday.

Under the PM’s plan, it is reported, London and Dublin would either agree a new set of principles or add words to the Good Friday Agreement in order to guarantee an open border. The 1998 peace deal effectively brought an end to the Troubles after years of failed talks, and established a power-sharing structure to accommodate unionist and nationalist politicians. It follows separate reports that Ms May planned to pitch to the Irish government a bilateral treaty that would remove the need for the backstop so hated by many Conservative MPs; the arrangement would see the UK enter into a temporary customs union with the EU, and Northern Ireland agree to abide by European rules on goods until a subsequent deal was reached.

Parliament demanded a Plan B today. May has none. She speaks 1530 GMT.

• May Tries To Break Brexit Deadlock By Winning More EU Concessions (R.)

British Prime Minister Theresa May on Monday will try to crack the deadlock over Brexit by setting out proposals in parliament that are expected to focus on winning more concessions from the European Union. With just over two months left until the United Kingdom is due to leave the European Union on March 29 there is no agreement in London on how and even whether it should leave the world’s biggest trading bloc. After her Brexit divorce deal was rejected by 402 lawmakers in the 650-seat parliament last week, May has been searching for a way to get a deal through parliament.

Attempts to forge a consensus with the opposition Labour Party failed so May is expected to focus on winning over 118 rebels in her own party and the small Northern Irish party which props up her government with concessions from the EU. In a sign of just how grave the political crisis in London has become, the Daily Telegraph reported that May was even considering amending the 1998 Good Friday Agreement which ended 30 years of violence in Northern Ireland. The Daily Telegraph said EU sources cast May’s plan a non-starter as a renegotiation of such a significant international treaty would require the consent of all the parties involved in Northern Ireland. May told British ministers she would focus on securing changes from Brussels designed to win over rebel Conservatives and the Northern Irish DUP, The Times said.

May will make a statement in parliament at about 1530 GMT and put forward a motion in parliament on her proposed next steps on Brexit, though some lawmakers are planning to wrest control of Britain’s exit from the government. After May’s motion is published, lawmakers will be able to propose amendments to it, setting out alternatives to the prime minister’s deal.

Time to send her away. She’s a dead end.

• No Solutions To Irish Backstop In May’s Brexit Call With Cabinet (G.)

Theresa May is expected to reject calls to forge a cross-party consensus on Brexit when she lays out her plan B to parliament on Monday, choosing instead to back new diplomatic efforts in Brussels to renegotiate the Irish backstop. The prime minister held a conference call with her bitterly divided cabinet from the country retreat of Chequers on Sunday evening. Cabinet sources said the consensus on the 90-minute call was to renew efforts to find acceptable changes to the backstop arrangement but that the conversation was light on specifics. One said there were “no actual solutions” proposed during the call. “It is difficult to know – as ever – what she will do,” another said. “But the broad agreement is on the need to bring DUP and Tory rebels on board.”

Despite her claim in the wake of last week’s significant defeat in parliament that she would speak to “senior parliamentarians” from all parties to seek a compromise, government sources insisted her overriding priority was to prevent a historic split in the Tory party. Several senior Conservative MPs have suggested they could form a breakaway party if May opted to support a customs union – one of Labour’s central demands, which is also backed by Tory supporters of a Norway-style soft Brexit. Whitehall sources said the prime minister’s chief of staff, Gavin Barwell, had counselled her to consider a customs union after last week’s catastrophic defeat, when her deal was rejected by an overwhelming majority of 230 votes. But when the government tables a formal statement on Monday, setting out its next steps, it is instead expected to focus on seeking changes to the Irish backstop in order to win over Jacob Rees-Mogg’s European Research Group and the DUP.

Party before country.

• Bizarre Turn Of Events Could Push May’s Brexit Deal Through After All (Ind.)

Yvette Cooper is in many ways the alternative leader of the opposition. The Labour MP who chairs the home affairs select committee will table a bill in the House of Commons on Monday, under the catchy title of the European Union (Withdrawal) (No 3) Bill, which could be decisive in breaking the Brexit deadlock. It could lead to parliament being forced to make a straight choice between Theresa May’s deal and postponing Brexit in order to hold a new referendum. If that is what happens, I think there would be a small majority for the prime minister’s deal. The importance of Cooper’s bill is that it changes the default setting in law. At the moment, if parliament fails to act, the UK will leave the EU on 29 March.

Cooper’s bill says that, if a deal has not been approved by 7 March, the government would be required to seek an extension of the Article 50 deadline. That would mean asking the EU to postpone the UK’s departure until the end of this year – and EU leaders have said they would agree to an extension if it were to hold another referendum. This would transform the situation in the House of Commons. Jacob Rees-Mogg and the rest of the cohort of Conservative MPs who want to leave without a deal would have to think again. At the moment they are happy to vote everything down, knowing that this gets them what they want. But Cooper’s bill would take what they want off the table. They would then have to choose between the prime minister’s deal and putting off Brexit for at least nine months.

They would still get to call themselves Macedonians. Insult and injury. Tsipras should be very careful.

• Clashes in Athens Over Neighbour’s Name Change (BBC)

Protesters have clashed with police in the Greek capital Athens at a big rally to oppose the government’s deal with Macedonia on changing its name. Police fired tear gas at some of those attending a protest which attracted tens of thousands to the city. The deal, which is yet to be approved, designates Greece’s northern neighbour as Republic of North Macedonia. The name Macedonia is sensitive for many Greeks who say it implies a claim on the Greek province of the same name. Years of wrangling finally brought an agreement last June between Greece’s left-wing Prime Minister Alexis Tsipras and his Macedonian counterpart. A vote on the deal, which aims to end a 28-year row between the nations, is set to take place in the Greek parliament this week.

The dispute dates back to 1991 and the break-up of Yugoslavia. Macedonia was a Yugoslav republic and adopted the name Macedonia when it became an independent nation. Greece has long argued the use of the name implied a territorial claim and cultural appropriation. At the UN the country was formally known as the Former Yugoslav Republic of Macedonia (Fyrom). [..] Greek nationalists argue that the name Macedonia can only refer to the Greek province of the same name. The dispute has led to Greece to blocking Macedonia’s hopes of joining Nato and the EU. Under the deal, the country’s language would be Macedonian and its people known as Macedonians (citizens of the Republic of North Macedonia). The move has met with sharp resistance in both countries because nationalists believe it erodes their identity.

EPA

They’re not going to solve the issue by themselves, they can’t help it.

• World’s 26 Richest People Own As Much As Poorest 3.8 Billion (G.)

The growing concentration of the world’s wealth has been highlighted by a report showing that the 26 richest billionaires own as many assets as the 3.8 billion people who make up the poorest half of the planet’s population. In an annual wealth check released to mark the start of the World Economic Forum in Davos, the development charity Oxfam said 2018 had been a year in which the rich had grown richer and the poor poorer. It said the widening gap was hindering the fight against poverty, adding that a 1% wealth tax would raise an estimated $418bn (£325bn) a year – enough to educate every child not in school and provide healthcare that would prevent 3 million deaths. Oxfam said the wealth of more than 2,200 billionaires across the globe had increased by $900bn in 2018 – or $2.5bn a day.

The 12% increase in the wealth of the very richest contrasted with a fall of 11% in the wealth of the poorest half of the world’s population. As a result, the report concluded, the number of billionaires owning as much wealth as half the world’s population fell from 43 in 2017 to 26 last year. In 2016 the number was 61. Among the findings of the report were: • In the 10 years since the financial crisis, the number of billionaires has nearly doubled. • Between 2017 and 2018 a new billionaire was created every two days. • The world’s richest man, Jeff Bezos, the owner of Amazon, saw his fortune increase to $112bn. Just 1% of his fortune is equivalent to the whole health budget for Ethiopia, a country of 105 million people. • The poorest 10% of Britons are paying a higher effective tax rate than the richest 10% (49% compared with 34%) once taxes on consumption such as VAT are taken into account.