Edward Hopper The Circle Theater, New York 1936

Oliver Stone

"Obviously (Russia) is winning the war. They're actually kicking ass, but we don't know that in the west."

— Oliver Stone pic.twitter.com/jHygPKICWJ— Lord Bebo (@MyLordBebo) June 12, 2023

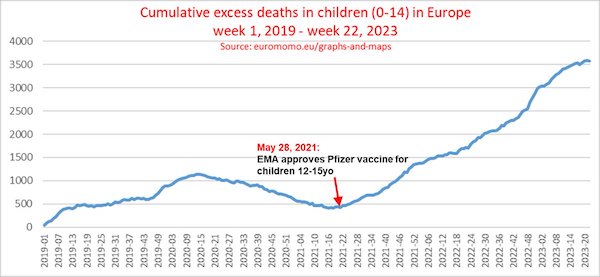

Ed Dowd

Former BlackRock Exec, Ed Dowd, says younger people began dying at a higher rate than older people in 2021, according to excess mortality data and the data shows the trend seems to be continuing.

Why is this not front page news in the US?pic.twitter.com/sYWQyhXz4x

— TexasLindsay™ (@TexasLindsay_) June 12, 2023

Sy Hersh Zelensky Embezzling $400 Million from US

Ritter

Blood clots

https://twitter.com/i/status/1668242537662803969

Insurance policy.

• Joe And Hunter Biden Caught On 17 Recordings With Burisma Owner (WE)

A top Senate Republican revealed Monday that an FBI informant said the Ukrainian oligarch involved in an alleged “criminal bribery scheme” with Joe and Hunter Biden also claimed to have 17 recordings of his conversations with the president and his son. Sen. Chuck Grassley (R-IA) revealed on the Senate floor that a largely unredacted version of the bureau’s FD-1023 confidential human source form said that “the foreign national who allegedly bribed Joe and Hunter Biden allegedly has audio recordings of his conversations with them — 17 such recordings.” The Republican senator said, “These recordings were allegedly kept as a sort of insurance policy for the foreign national in case he got into a tight spot.”

Mykola Zlochevsky, the Ukrainian owner of Burisma, was the “foreign national” involved in the alleged “criminal bribery scheme” detailed in the FBI form, and Zlochevsky referred to Joe Biden as the “big guy” during a conversation several years before the June 2020 date of the bureau document, according to sources familiar with the FBI record who described its contents to the Washington Examiner. Grassley added Monday that, according to the FD-1023, “the foreign national possesses 15 audio recordings of phone calls between him and Hunter Biden” and “two audio recordings of phone calls between him and the-Vice President Joe Biden.” The senator also said the FBI record “also indicates that then-Vice President Joe Biden may have been involved in Burisma employing Hunter Biden.”

The U.S. Attorney’s Office in Delaware is handling the ongoing federal criminal investigation into Hunter Biden. It is allegedly up to U.S. Attorney David Weiss, a Trump-appointed holdover, to decide whether to indict the president’s son. In February 2021, Joe Biden asked all Senate-confirmed U.S. attorneys appointed by Trump for their resignations, with Weiss a rare exception. “What is U.S. Attorney Weiss doing with respect to these alleged Joe and Hunter Biden recordings that are apparently relevant to the high-stakes bribery scheme?” Grassley asked Monday. Sources previously told the Washington Examiner that the Burisma owner discussed an alleged bribe of $5 million to Joe Biden and of $5 million to Hunter Biden, according to the paid FBI informant who said he heard this from Zlochevsky. The sources said Zlochevsky said he believed it would be difficult to unravel the alleged bribery scheme for at least 10 years because of the number of bank accounts involved.

Sen. @ChuckGrassley: “The foreign national who allegedly bribed Joe & Hunter Biden allegedly has audio recordings of his conversation[s], 17 such recordings. According to the 1023, the foreign national possesses 15 audio recordings of phone calls between him & Hunter Biden [and]… pic.twitter.com/HCcuqV7SUW

— Tom Elliott (@tomselliott) June 12, 2023

FLASHBACK: Remember this 2016 recorded call where VP Biden threatened Ukraine’s “physical security” to then President Poroshenko if he didn’t hide certain financial matters?

Biden was nervous about President Trump sniffing around & now we know why

Biden & Hunter took $5M bribes pic.twitter.com/s55iKc07Ku

— DC_Draino (@DC_Draino) June 12, 2023

https://twitter.com/i/status/1668308263350284293

“Now, the FBI has told me there are more 1023 forms. I will be granted access to these additional docs..”

• Comer Says Will View Additional FBI Documents on Possible Biden Crimes (Sp.)

US House Oversight Committee Chair James Comer said on Monday that he will be granted access to additional FBI documents that contain allegations of potential criminal activity by President Joe Biden in his previous capacity as vice president. Earlier this month, lawmakers on the Oversight Committee were granted access to an FD-1023 form, which is used by the FBI to record information from confidential human sources, that alleged then-US Vice President Joe Biden engaged in a bribery scheme involving a foreign national. “Now, the FBI has told me there are more 1023 forms. I will be granted access to these additional docs,” Comer said in a statement via Twitter. The document alleges that the president and his son Hunter received a total of $10 million to help end a probe into Ukrainian energy industry holding company Burisma, US Congresswoman Marjorie Taylor Greene said last week.

The head of Burisma purportedly told the FBI’s confidential source that the executive retained evidence of the payments to Joe and Hunter Biden, Greene said, characterizing the alleged actions as a “political bribery pay-to-play scheme.” There were two footnotes in the FD-1023 form made accessible to lawmakers that referenced other 1023s, Comer said on Sunday in an interview with Fox News. “There are a lot more of these than what the federal government wants to admit, and the question is, why hasn’t the federal government done anything about it?” Comer said. Biden called the allegations of a bribery scheme involving Burisma “a bunch of malarkey,” when asked about the situation on Thursday.

“Democrats were furious that Trump was less than enthusiastic about their plans to use Ukraine as a proxy to go to war with Russia.”

• The Democrats Versus Trump: A Bad Horror Movie? (Ron Paul)

The Democrats and Donald Trump reminds me of a bad horror movie, where the hapless protagonists only make the monster stronger with each attempt to eliminate it. So goes the Democrats’ endless attempts to finally rid America of the “scourge” of Donald Trump. Thanks to the Durham Report we now know they started even before Trump was elected president. Hillary Clinton’s campaign – with the full knowledge of the candidate and the sitting president, Barack Obama – cooked up a “dirty trick” to portray Trump as an agent of Russia in their effort to deny Trump the White House. When that didn’t work they weaponized the FBI, CIA and the rest of the “deep state” to undermine and hobble his presidency. They spied on Trump and his campaign staff using false information manufactured by the FBI.

When that didn’t work they impeached him under the false charge that he sought foreign assistance for his 2020 re-election bid. This time a spy, in the person of NSC staffer Alexander Vindman, was sent to listen in on Trump’s phone call with Ukrainian president Zelensky and then make all manner of false charges against Trump based on it. Democrats were furious that Trump was less than enthusiastic about their plans to use Ukraine as a proxy to go to war with Russia. Vindman, though an active-duty US military officer, was of Ukrainian background and was loyal to the country of his origin rather than the country of his citizenship. He also openly defied the military chain-of-command and his commander-in-chief. Trump’s lack of enthusiasm for their “Project Ukraine” infuriated Vindman and he sought his revenge against the US President.

When that didn’t work they impeached Trump again over the false charge that he led an “insurrection” against the US government on January 6, 2021. The more surveillance video we see of this “insurrection,” the more it looks like a false-flag operation cooked up perhaps by Nancy Pelosi and the rest of the Washington swamp to finally be rid of Trump. Hundreds of political prisoners have been held in solitary confinement on false accusations that they tried to overthrow the US government. When that didn’t work and Trump’s re-election numbers looked more and more favorable while Biden’s approval rating continued to linger in the political basement, the Democrats have now indicted him over some classified documents apparently discovered in his residence in Florida.

[..] Suddenly Donald Trump, who polling suggests would obliterate Joe Biden in a fair US election, faces 100 years in prison! Where else would you see the head of one political party arrest his main political opponent on cooked up charges? A banana republic! For those of us who love this country, it is truly shocking to see this abuse of power. But there’s one thing these dirty tricksters never seem to understand: the more false evidence and false charges they cook up against Trump, the stronger Trump becomes. With these outrageous and continuous attacks on Trump, the Democratic Party (and plenty of Republicans) has lost all credibility. When this plan fails, and it will, I am afraid to think what they might try next.

“..this is a prosecution entirely removed from recent history..”

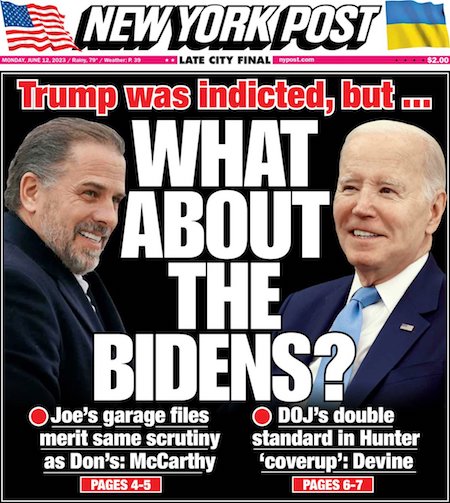

• Donald Trump’s Indictment Case has a Looming 2024 End Date (Turley)

When Special Counsel Jack Smith walked before cameras on Friday after the release of the Trump 44-page indictment against former President Donald Trump, he started with arguably his most difficult case to make. He declared “we have one set of laws in this country and they apply to everyone.” After years of scandal and documented political bias by key Justice officials, the line likely left many skeptical, assuming many were even watching. The indictment was clearly a pitch to the public that this is a prosecution entirely removed from recent history. We’re also meant to not think about the fact that the Biden Administration is charging the leading candidate opposing him in the upcoming election.

This indictment has merit, but the Justice Department lost the right to expect trust from the citizens years ago — long before the damning Inspector General’s Report and the recent report of Special Counsel John Durham. To make matters worse, the same suspects have surfaced to celebrate Trump’s expected demise — and remind the public of the perceived double standard in Washington. Peter Strzok, the FBI special agent who was fired over his anti-Trump bias in the Russian collusion investigation, cheered the indictment by tweeting a photo of handcuffs with Trump’s image. Strzok seems to think that it is a good thing for Smith to remind everyone of how he promised his colleague and lover Lisa Page that she did not have to worry about Trump being elected because they had an “insurance policy” to “stop it.”

Hillary Clinton went on social media to hawk her line of merchandize mocking the case against her for storing classified material on her personal server and then destroying tens of thousands of emails sought by the Congress. She sent out a picture mocking Trump while wearing her “But Her Emails” hat. With millions of Americans wondering why Trump is being charged but Clinton was given a pass, Clinton decided to do a victory lap. And hey, why not: James Comey is back. [..] In April, Trump pleaded not guilty to 34 felony counts brought by Manhattan District Attorney Alvin Bragg related to hush money payments made to porn star Stormy Daniels prior to the 2016 election. Nevertheless, Comey chose this month to declare that, in the 2024 election, “it has to be Joe Biden.” For critics, that is consistent with his views and actions before he was fired as FBI director.

After Trump was indicted in a raw political prosecution in New York, Comey also went public to declare it a “good day.” So in the court of public opinion, past history and hypocrisy may mean that few are swayed about whether they back Trump or not. Which leaves the criminal court. This indictment has some devastating elements, including an audiotape in which Trump tells two visitors about a highly classified attack plan on Iran while admitting that it remained classified. That tape directly contradicts his past claims of declassification and suggests that Trump was using the document as a type of trophy. There are also damaging statements from former staff and counsel alleging that Trump actively sought to conceal documents. Smith is now left in a battle not with Trump but time.

He already had 4 years to do it.

• Trump Promises “Final Battle” To “Demolish The Deep State” (SN)

During a speech in North Carolina this past weekend, President Trump promised to “demolish the deep state” in what will be “a final battle.” “We are a failing nation. We are a nation in decline. And now these radical left lunatics want to interfere with our elections by using law enforcement. It’s totally corrupt and we can’t let it happen,” Trump told the crowd. “This is the final battle,” he further urged, adding “With you at my side, we will demolish the Deep State, we will expel the warmongers from our government, we will drive out the globalists, we will cast out the communists, we will throw off the sick political class that hates our country.” Trump continued, “We will roll out the fake news media, we will expose the RINOs for what they are, we will defeat Joe Biden and we will liberate America from these villains once and for all.” “We’re going to liberate our country. The silent majority is rising, and under our leadership, the forgotten man or woman will never be forgotten again,” Trump vowed.

President Trump: “This is the final battle. With you at my side, we will demolish the Deep State, we will expel the warmongers from our government, we will drive out the globalists, we will cast out the communists, we will throw off the sick political class that hates our… pic.twitter.com/1MYe2w27JP

— MAGA War Room (@MAGAIncWarRoom) June 11, 2023

“..what is so striking in Mr. Kennedy’s performance so far is an absence of fakery. It’s more than refreshing, it’s… startling..”

• We’re Not Finished (Jim Kunstler)

[..] we need somebody to steer. Mr. Trump has volunteered to try doing it again. The first time, forces in every quarter of American power set out to bushwhack, sandbag, harass, hector, and hound him. In the process, they just about destroyed the rule of law. Then they simply dis-elected him surreptitiously, something you’re not supposed to say, but there it is, like so much meat on the table. Now they’re trying to hoo-rah him into jail. Whatever you think of his, er, complex personality, you must admire his perseverance through adversity. If he somehow manages to wriggle through the present obstacle course of Lawfare chicanery, his next term would be an extravaganza of retribution. The spectacle would provide much satisfaction but, in the end, it would just be a sideshow, and it is not the same thing as taking care of business.

“Joe Biden,” of course, the man who is not really even there, is only pretending to run for reelection, or at least a coterie around the Oval Office is pretending for him while they try to figure out what to do. They’re in an awful quandary. They hold all the levers of power and they have no other credible candidate, not a living soul, in their own official hatchery. Outside of that ghastly edifice, Robert F. Kennedy is making a determined flanking move, an end-run near the sidelines. The Democratic Party in all its florid and mendacious lunacy is pretending to not notice him, especially their praetorian news media that is the vector for America’s mass mental illness. Mr. Kennedy put it so simply in April when he announced a run to preside over the stupendous mess that is our government.

He said his mission is an experiment to see what happens when you tell Americans the truth. Hold that thought. How long has it been since you thought anything like that was possible? There’s a broad-based assumption across the land, derived from our fading prime artform, the movies, that Americans can’t handle the truth. Like so much else in our national life, that is probably erroneous… fake truth. And what is so striking in Mr. Kennedy’s performance so far is an absence of fakery. It’s more than refreshing, it’s… startling. Makes you blink, a little bit. Makes you remember what it’s like to not be lied-to incessantly. Makes you want to see more of it because it gives you strength when you thought you were finished. Get this now: our world is changing, and deeply, but we’re not finished.

“..right now the strategy that the Kiev regime appears to be using to clear the minefields is over the vehicles and bodies of its territorial defense units..”

• ‘Cynical’ Ukrainian Counteroffensive Takes ‘Horrific’ Casualties (Tweedie)

The Kiev regime appears to be cynically throwing men and machines against solid Russian defenses — but all may not be as it seems, a military commentator says. One week into the Ukrainian counteroffensive and the Ukrainian army has already lost thousands of casualties, along with up to 15 of the vaunted German Leopard 2 tanks, 13 M2 Bradley infantry fighting vehicles (IFVs) supplied by the US and five of the French AMX-10 RC light tanks. Security Analyst Mark Sleboda told Sputnik that Ukraine’s military chiefs were to blame for sending their troops into the killing fields. “Currently there is fighting along pretty much every line of engagement between Russia and Ukraine right now, except for the Kherson area where the recent flooding has made combat impossible,” Sleboda noted.

He said the Kiev regime was sending troops forward in NATO-supplied IFVs and armoured personnel carriers (APCs), supported by tanks and artillery — including US-made HIMARS rocket launchers. “But they’re doing it into echelon to Russian defenses that have been formed over months,” Sleboda stressed. “Five layers of defense, trenches, concrete fortifications, pillboxes, bunkers, tank obstacles like dragon’s teeth.” But he said that most significant was that Russian forces had “created mazes of minefields” which have taken a significant toll on attacking Ukrainian vehicles. “[..] it sounds rather cynical, but right now the strategy that the Kiev regime appears to be using to clear the minefields is over the vehicles and bodies of its territorial defense units,” Sleboda said. “And the horrific casualties that are resulting from this are pretty high.”

He said the Ukrainian plan right now appeared to be based on “hoping to punch a hole in the line somewhere.” “And then presumably a very large reserve force, supported by a the majority of the western main battle tanks, will seek to exploit that,” Sleboda ventured. “But then even so, to make it even through one line of defense and to face several lines more, each actually progressively more significant than the others, It seems a very bad situation.” But the security expert warned against complacency on the Russian side, saying he expected “something more cunning” from the Ukrainian armed forces.

“Once the waters recede from the destruction of the Kakhovka dam, I expect some kind of multiple pronged attack, including amphibious assaults against a lower Kakhovka reservoir towards Energodar and the Zaporozhye nuclear power plant,” he said. “But I would presume that Russia is also prepared to defend that there as well.” “NATO has been wargaming this out for half a year. This is the most hyped, announced offensive in world history,” Sleboda stressed. “I’m expecting that there has to be a curveball. It can’t be this straight up playing exactly into Russia’s defenses. There’s going to be something. We just haven’t seen it yet.”

We want peace, but first we want to kill some more people…

• Ukraine’s Counteroffensive To Last For Weeks Or Months – Macron (TASS)

Ukraine’s counteroffensive will last for several weeks or months and France hopes that it will help create conditions for future peace talks, French President Emmanuel Macron told a news conference on Monday. “Ukraine’s counteroffensive began several days ago. It has been thoroughly planned,” he said. “This counteroffensive will last for several weeks or months. We did our best to help it happen within the frames outlined by us since the conflict beginning: to punish Russia in order to stop its military effort, to help Ukraine resist and win back its territory, but to never attack Russia and avoid any forms of escalation of this conflict.”

He reiterated commitment to the long-term support for Kiev and expressed the hope that the Ukrainian army’s offensive operations will be successful as “the transition to the phase of talks in favorable conditions” will depend on that. “It is clear today that Ukraine will not be conquered, that the only peace that is acceptable today is the one which is based on international law and the sovereign choice of the Ukrainian people,” he stressed. “Our enduring support for Ukraine must continue for a long time, be it political, military, economic, humanitarian assistance or assistance linked with [Ukraine’] restoration.”.

“it’s easy enough not to meet stressed-out military service members and their families..”

• Americans in Pain (Mazzarino)

America’s War on Terror, launched in response to the September 11, 2001, attacks on the World Trade Center and the Pentagon, has had a staggering impact on our world. The Costs of War Project at Brown University, which I helped found, paints as full a picture as possible of the toll of those “forever wars” both in human lives and in dollars. The wars, we estimate, have killed nearly one million people, including close to 400,000 civilians in Afghanistan, Iraq, and Pakistan alone. Worse yet, they sickened or injured several times more than that — leading to illnesses and injuries that, we estimate, resulted in millions of non-battlefield deaths. And don’t forget that those figures include dead and wounded Americans, too. Most of us, however, have little awareness of any of this.

If you live outside the archipelago of American military bases that extends across this country and the planet — an estimated 750 of them outside the U.S. on every continent except Antarctica — it’s easy enough not to meet stressed-out military service members and their families. It’s easy enough, in fact, not to grasp just how America’s wars of this century rippled out to touch military communities. In recent times, those bases have become ever more difficult for the public to enter and often aren’t close to the cities where so many of us live. All of this means that, if you’re a civilian, the odds are you haven’t met the grieving spouses of the soldiers who never came home or the shaken children of the ones who did, forever changed, sometimes with amputated limbs or post-traumatic stress disorder (PTSD). I’m thinking of the ones with those far-off gazes and the pain they have to deal with in their heads, their limbs, their backs.

Personally, I find it overwhelmingly hard to write about such human-shaped holes in our disturbed world. That’s probably why the Costs of War Project has a 35-person (and counting) team of journalists, physicians, social scientists, and other experts to portion out the research and the pain that goes with it as they deal with the fact that the monumental death and injury counts they’ve produced are likely to be underestimates.

“Tucker will not be silenced by anyone … He is a singularly important voice on matters of public interest in our country, and will remain so.”

• Fox Sends Tucker Carlson Cease-and-Desist Letter (Axios)

Fox News has sent a cease-and-desist letter to Tucker Carlson as he ramps up a competing series on Twitter that drew a combined 169 million views for its first two episodes, Axios has learned. The contract battle between Fox and its former top host — who was taken off the air in April, after the network’s historic Dominion settlement — has mighty repercussions for the conservative media ecosystem. With “Tucker on Twitter,” Carlson and his growing production team are working to elevate Elon Musk’s social media site as a news platform. Fox is continuing to pay Carlson, and maintains that his contract keeps his content exclusive to Fox through Dec. 31, 2024. Carlson is making a First Amendment argument for posting on Twitter, and asserts that Fox has committed material breaches of his contract.

Carlson’s first two Twitter episodes were straight-to-camera monologues. He plans to keep iterating with longer, more varied episodes and the addition of guests, Axios is told. Justin Wells, Carlson’s executive producer, tweeted yesterday: “Next Episode of Tucker on Twitter coming Tuesday: Tucker’s response to the indictment of President Donald Trump. Harmeet Dhillon, a lawyer who represents Carlson along with Bryan Freedman, said in a statement to Axios: “Fox News continues to ignore the interests of its viewers, not to mention its shareholder obligations.” “Doubling down on the most catastrophic programming decision in the history of the cable news industry, Fox is now demanding that Tucker Carlson be silent until after the 2024 election,” the statement continued. “Tucker will not be silenced by anyone … He is a singularly important voice on matters of public interest in our country, and will remain so.”

“Biden wants a free hand to continue to give billions every week to finance the Ukraine proxy war, and he’s got that free hand now..”

• Debt Crisis Was Bipartisan Excuse to ‘Cut Social Spending,’ Not Defense Budget (Sp.)

Democrats and Republicans have used the recent debt ceiling stand-off as a pretext for cutting social spending while inflating the military budget. The latest threat of a US Treasury default due to wrangling over the budget between the Democrat-held White House and Republican-controlled Congress has been averted after House of Representatives Speaker Kevin McCarthy and President Joe Biden struck a deal on limited spending cuts. But economist Dr. Jack Rasmus told Sputnik that poverty alleviation programs were the casualty of that battle, while the Pentagon’s budget emerged unscathed and even boosted. “You’ve got to understand that both Democrats and Republicans, a majority of them in Congress, liked the debt ceiling situation because it allows them to put pressure on social programs’ spending,” Rasmus said.

“You know, defense spending is never affected by these deals. That always goes through. You can see it in this deal here, 11 percent in the first year increase in the Pentagon budget alone, not the other defense spending.” But the saga and its outcome was nothing new in Washington DC, the academic pointed out. “You go back to Obama in 2011, last time we had this, and the defense spending increase just blew right through. It had no effect. They only cut a trillion dollars out of social programs spending.” However, the Democratic leadership will be happy as the final budget deal does nothing to rein in their pet project of arming the Kiev regime for a proxy conflict with Russia.

“Biden wants a free hand to continue to give billions every week to finance the Ukraine proxy war, and he’s got that free hand now,” Rasmus said. “And both sides never even made an effort to do any cuts here on the defense side. So Biden got his blank check for raising Pentagon and war spending and financing Ukraine. And the Republicans got all the rest. “So Democrats got what they wanted, at least the corporate Democrats running the party. And the Republicans got a you know, a big bite of the apple of cutting social spending,” he added. “And they’re going to get another bite here when it comes later in the year for passing the budget for the next year.”

“..the US/NATO proxy war against Russia in Ukraine is simultaneously a war designed to interrupt the progress of China’s Belt and Road Initiative (BRI)..”

• How The BRI Train Took The Road To Shangri-La (Pepe Escobar)

It is important to recognize that the US/NATO proxy war against Russia in Ukraine is simultaneously a war designed to interrupt the progress of China’s Belt and Road Initiative (BRI). As we approach the 10th anniversary of the BRI, to be marked by the third Belt and Road Forum later this year in Beijing, it is clear the original Silk Road Economic Belt – announced by President Xi Jinping in Astana, Kazakhstan, in September 2013 – has traveled a long way. By January this year, 151 nations had already signed up to the BRI: No less than 75 percent of the world’s population that represents more than half of the global GDP. Even an Atlanticist outfit such as the London-based Center for Economic and Business Research admits that the BRI may increase global GDP by a whopping $7.1 trillion a year by 2040, dispensing “widespread” benefits.

Included in the Chinese Constitution since 2018, BRI constitutes the de facto overarching Chinese foreign policy framework all the way to 2049, marking the centenary of the People’s Republic of China. The BRI advances along several overland connectivity corridors – from the Trans-Siberian to the “middle corridor” along Iran and Turkiye and the China-Pakistan Economic Corridor (CPEC) all the way to the Arabian Sea. Meanwhile, on the waterways front, the Maritime Silk Road offers a parallel network from southeast China to the Persian Gulf, the Red Sea, the Swahili Coast, and the Mediterranean Sea. All that is mirrored by the Russian-driven Northern Sea Route, connecting the eastern and western sides of the Arctic, and reducing to and fro sailing time from Europe to Asia from one month to less than two weeks.

Such a massive Make Trade Not War project, centered on connectivity, infrastructure building, sustainable development, and diplomatic acumen – focusing on the Global South – could not but be interpreted by western elites as a supreme geopolitical and geoeconomic threat. And that’s why every geopolitical turbulence across the chessboard is directly or indirectly linked to BRI. Including Ukraine.

Meeting without Russia.

• US Attempts ’Divide and Conquer’ Strategy Against BRICS (Pepe Escobar)

Something extraordinary, at least on the surface, happened on the sidelines of the Shangri-La Dialogue in Singapore earlier this month – a somewhat pompous affair self-described as “Asia’s premier defense summit”. Intel heads of 24 nations met in de facto semi-secrecy, because in the end the event was duly leaked (Western spin qualified it as an “informal” meeting). Among the 24, the real deal comprised the US and all the other Five Eyes, plus representatives of two BRICS members, China and India. All the others were not identified with certainty or preferred to remain anonymous – presumably due to their “hanger on” status. Crucially, key BRICS member Russia was not represented. Reuters swore the information about the not-so-secret gathering came from five different – unnamed – sources.

A Southeast Asian diplomat independently confirmed the presence of the Five Eyes, China, India and Singapore – and that was it. The de facto sponsor of the meeting was Singapore’s Ministry of Defense. Things gets curioser and curioser when we examine the leak a bit closer. So many sources basically corroborating each other point to a concerted spin – practically on an official level. If this was meant to be really secret, as in the past, that would have been the case, with every involved lip conveniently sealed. So why leak it? Such spy vs. spy meetings, historically, take ages to prepare, especially one involving 24 nations and featuring superpower rivals US and China. That implies countless qualified sherpas redacting documents; very complicated logistics; an ultra-secure environment; and an extremely detailed script covering every intervention.

All of that must have been discussed in excruciating detail for months, side by side with putting together the larger agenda for the Shangri-La Dialogue: and all the while there were no leaks. And then what was leaked, after the meeting, was just that it happened. With only selected participating players fully identified. There’s absolutely nothing on substance. It beggars belief that the Five Eyes would openly discuss Western security fears and/or procedures openly with the Chinese, not to mention the other minor hangers-on. After all the Beijing leadership is fully aware the US-UK is engaged in full hybrid war against China, with the Five Eyes and containment mechanisms such as Quad and AUKUS in tow. The main reason for the leak is a dead giveaway when we see what US Think Tankland is spinning: the US was talking security with China and India behind Russia’s back. Translation: the US is trying to undermine the BRICS and the Shanghai Cooperation Organization (SCO) from the inside.

This is purely wishful thinking – because no one knows anything about the substance of the discussions. The meat of the matter was not leaked on purpose. The dead giveaway about the leak being engineered to undermine the BRICS – at least in the Western public sphere – would have to come from the usual suspects themselves: US think tanks, inserted in what the indispensable Ray McGovern, a former CIA analyst, christened as MICIMATT (Military-Industrial-Congressional-Intelligence-Media-Academia-Think Tank complex).

Olympos

VIDEO: The village of Olympos, north of the Greek island of Karpathos, is one of the few matriarchal societies in Europe where women are in charge. pic.twitter.com/jVfkJ5hFQq

— AFP News Agency (@AFP) June 12, 2023

Flees

This hits hard pic.twitter.com/XdaLeKnzTj

— illuminatibot (@iluminatibot) June 12, 2023

Mastiff

A Tibetan Mastiff pic.twitter.com/SLMWcZxSVx

— The Best (@Figensport) June 11, 2023

Octopus moonwalk

https://twitter.com/i/status/1668129343451680769

Cookie monster

A wonderful golden oldie from 1972 as Kermit and little Joey Calvan sing the alphabet on Sesame Street – with the addition of a special guest. pic.twitter.com/hS5a7uOdhD

— Michael Warburton (@MichaelWarbur17) June 12, 2023

The South Philippine Dwarf Kingfisher was first described 130 years ago and has eluded scientists for over 100 years because of its behavior. Thanks to Miguel David De Leon we get a glimpse of the beautiful bird that is sadly threatened with extinction

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.