Dorothea Lange Abandoned cafe in Carey, Texas 1937

“To not one of those improvements does the land monopolist, as a land monopolist, contribute, and yet by every one of them the value of his land is enhanced.”

• A Nation of Landowners – But For How Long? (M.)

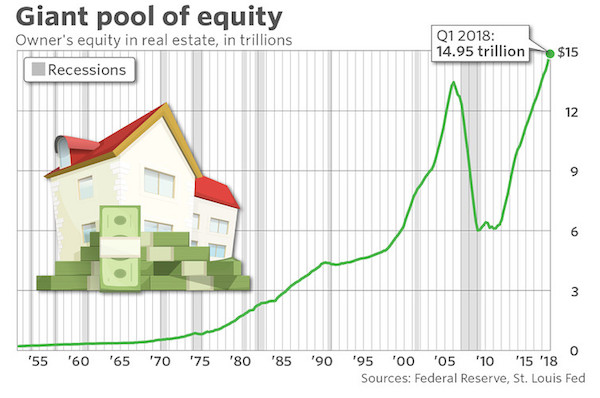

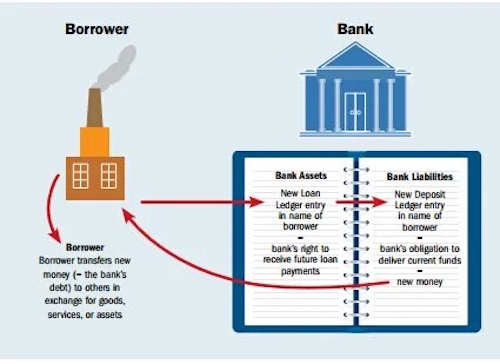

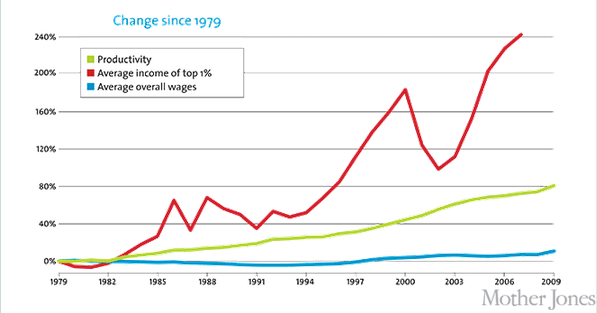

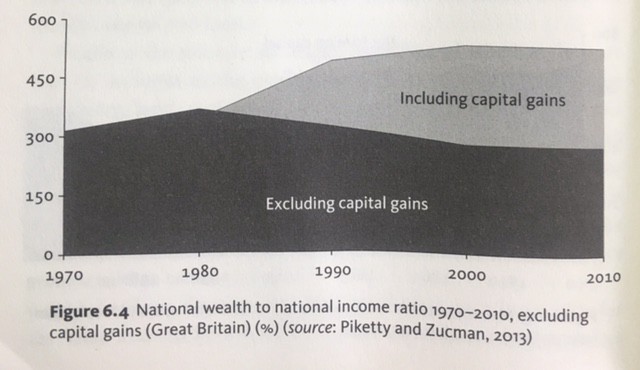

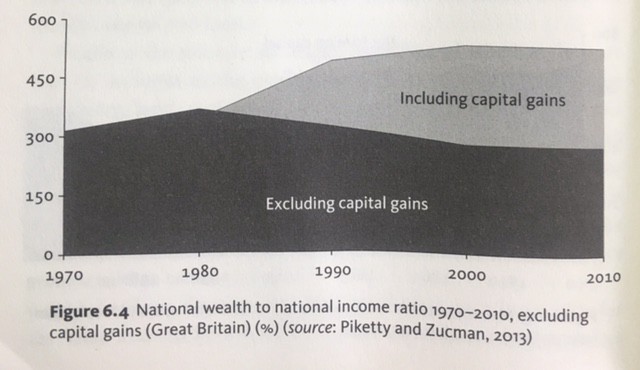

Land occupies a unique position in the economy because it is essential for any activity and, given its fixed supply, an increase in demand for it can only increase its price. Meanwhile finance, which facilitates that demand, has been available in ever-greater abundance since the deregulation of mortgage lending in the 1970s and 1980s. The interaction between the inelastic supply of land and the highly elastic supply of mortgage lending lies at the heart of the house price boom over the past few decades. But while the finance part of the story is relatively new (before the 1970s mortgages were harder to get and lending restricted by the conservative practices of the building societies), the land question has been around for centuries.

Ever since Henry VIII seized the monastery lands in the early 16th century a market has been evolving in land as a privately-owned tradable commodity. What is crucial to the contemporary housing debate, and what this book illustrates brilliantly, is how the control of land is, or has at least been allowed to become, fundamental to economic and political power relations. Because land is permanent and immovable, those who own the exclusive rights to its use are able to siphon off the value of any economic output that is dependent on it. The value of a piece of land therefore reflects the level of activity conducted on or around it, as well as any speculation arising from expectations about its potential future use. This price does not reflect the efforts or ingenuity of its owner, and so it does not reward productive activity but rather penalises it in the form of rent.

This ability of landowners to extract economic rent from productive activity, or the unearned increment, was once at the centre of political discourse. It was an issue that troubled classical economists ranging from Adam Smith to Karl Marx. As the industrial revolution advanced in the 18th and 19th centuries, productivity levels improved, and so the owners of land began to enjoy the fruits of the community’s labour. A land reform movement gathered momentum towards the late 19th century and the writings of the American economist Henry George advocating a land value tax attracted a following. In 1909, a young Winston Churchill (then 35, and a Liberal) decried the land monopolist’s free ride in what remains one of the best descriptions of the dilemma:

“Roads are made, streets are made, services are improved, electric light turns night into day, water is brought from reservoirs a hundred miles off in the mountains and all the while the landlord sits still. Every one of those improvements is effected by the labour and cost of other people and the taxpayers. To not one of those improvements does the land monopolist, as a land monopolist, contribute, and yet by every one of them the value of his land is enhanced.”

Churchill was careful to stress that it was the system he was attacking not the landowner himself (‘We do not want to punish the landlord. We want to alter the law’). But the law was as it was because landowners controlled parliament and indeed the Liberals’ plan for a land value tax in the People’s Budget, in support of which Churchill had been speaking, was thrown out by the House of Lords.

Read more …

How to kill a city part 832.

• Middle-Class, Even Wealthy Americans Sliding Inexorably Into The Red (MW)

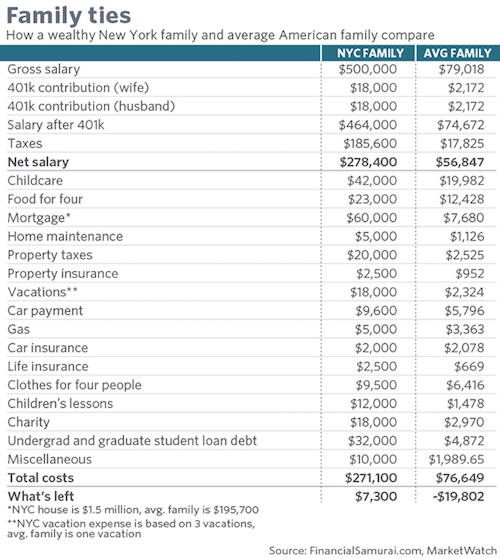

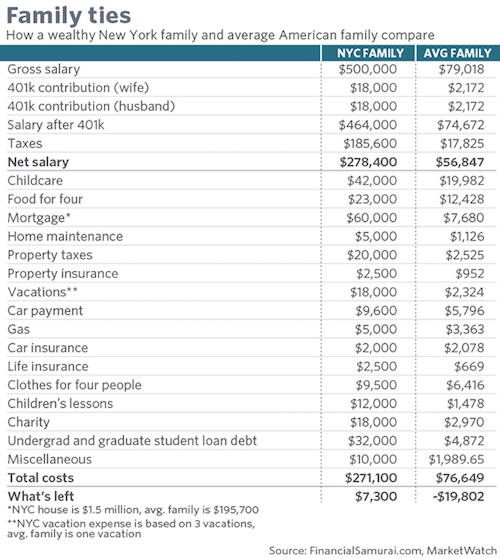

Not even a high six-figure salary is enough to keep New York City families out of the red. But spare a thought for the average American family, whose costs easily outpace the average income. A recent analysis from Sam Dogen at his personal finance website Financial Samurai showed how difficult it is for high earners to escape the rat race in New York City, one of the priciest places to live in the world. He analyzed a mock budget for an imaginary family of four in which the two 35-year-old breadwinners each make $250,000 a year. After factoring in taxes, 401(k)contributions, home and child care costs, the family was left with just $7,300 for the year — as if they were living “paycheck to paycheck.”

Perhaps nobody is crying for lawyers making $500,000 a year or even $250,000, but the analysis shows just how easy it is for spending habits to take a high salary and turn it into table scraps. Dogen said pressure from peers to spend more is a big contributing factor, adding “everywhere I go, and I’ve been all over the world, high income earners are secretly feeling the same squeeze.” “They are unhappy, getting divorces, and always comparing themselves to wealthier and wealthier people,” he said. “Heck, even a friend who is worth over $200 million after founding and taking public a company feels like he needs to continue working because he has to ‘keep up with the Zuckerbergs.’”

So how would the average American family fare by the same lifestyle? MarketWatch crunched the numbers and found they would be racking up approximately $27,000 in debt a year if they spent the average of what Americans spend on the same activities. This vast difference in economic stability comes even after adjusting for cheaper housing costs and lowering the number of vacations to one a year — the average in the U.S.

Read more …

Beware of any central bank announcements made the day after Christmas.

• Italy’s Monte Paschi Bailout Has Some ECB Supervisors Grumbling

When the European Central Bank declared Banca Monte dei Paschi di Siena solvent last December, the first step toward a state-funded rescue, some members of the 19-nation Supervisory Board weren’t fully on board. Confronted with what they saw as a political agreement to bail out the world’s oldest lender, dissenters went along with the consensus despite their concerns about the bank’s health…[..] To make sense of the Monte Paschi debate, you have to start with a 2014 law known as the Bank Recovery and Resolution Directive, which sets out the EU’s bank-failure rules. The law assumes that if a firm needs “extraordinary public financial support,” this indicates that it’s failing and should be wound down. In that process, investors including senior bondholders can be forced to take losses.

An exception, known as a precautionary recapitalization, is allowed for solvent banks if a long list of conditions is met. As the name suggests, this tool isn’t intended to clear up a bank’s existing problems, such as Monte Paschi’s mountain of soured loans. This temporary aid is allowed to address a capital shortfall identified in a stress test. Daniele Nouy, head of the ECB Supervisory Board, reiterated in an interview on Monday that Monte Paschi and other Italian banks in line for a bailout are “not insolvent, otherwise we would not be talking about precautionary recapitalization.” Not everyone is convinced the bank, whose woes date back many years, qualifies for this special treatment.

“It is unclear if Monte Paschi meets the BRRD’s exemption criteria, and their use has the appearance of promoting national political concerns over a stricter reading of the newly established European rules,” said Simon Ainsworth at Moody’s. “The plan could risk damaging the credibility of the resolution framework, especially given that it would mark its first major test case.” The ECB’s decision on Monte Paschi’s solvency and capital gap was announced by the lender the day after Christmas. The ECB published an explanation of the precautionary recapitalization process a day later, but said little else publicly. On Dec. 29, the Bank of Italy issued a statement that broke down the €8.8 billion rescue into its parts. Solvency in the case of a precautionary recapitalization is determined based on two criteria, the ECB said: the bank meets its legal minimum capital requirements, and it has no shortfall in the baseline scenario of the relevant stress test.

Read more …

I’ve been talking about falling oil demand for so long that when other bring it up now it seems all new again.

• NY Fed: “Oil Prices Fell Due To Weakening Demand” (ZH)

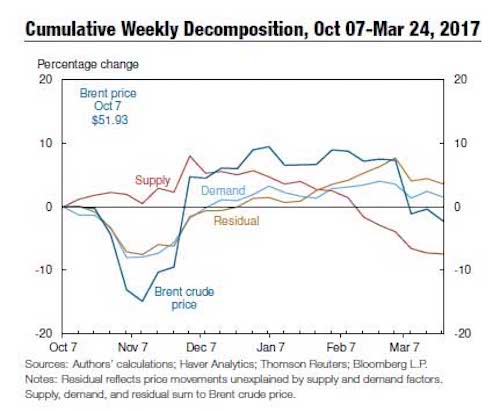

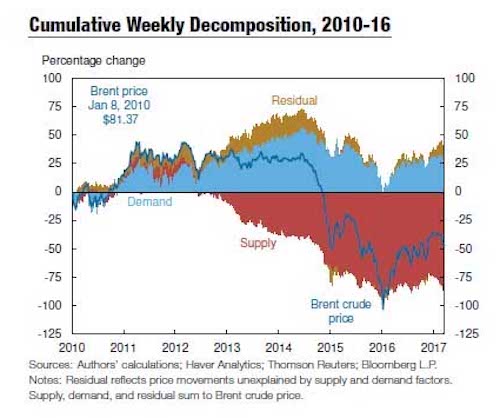

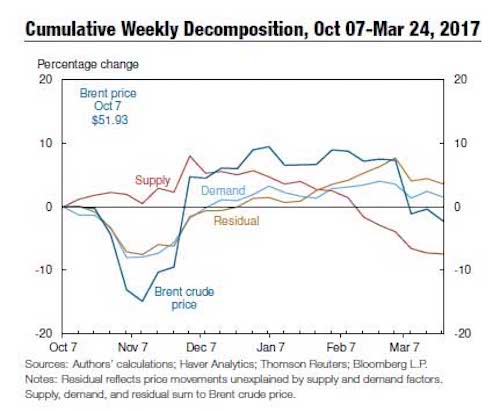

[..] one aspect of price formation that is rarely mentioned is demand, which is generally assumed to be unwavering and trending higher with barely a hiccup. The reason for this somewhat myopic take is that while OPEC has control over supply, demand is a function of global economic growth and trade (or lack thereof) over which oil producers have little, if any control. And yet, according to the latest oil price dynamics report issued by the Fed, it was declining global demand that pushed prices lower in the most recent, volatile period. As the New York Fed report in its March 27 report, “Oil prices fell owing to weakening demand” and explains as follows: “A decline in demand expectations together with a decreasing residual drove oil prices down over the past week.”

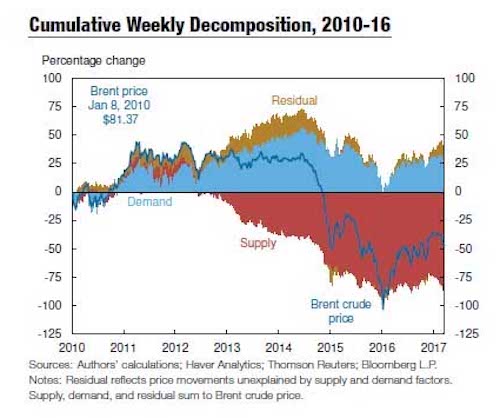

While there was some good news, namely that “in 2016:Q4, oil prices increased on net as a consequence of steadily contracting supply and strengthening, albeit volatile, global demand” offsetting the “modest decline in oil prices during 2016:Q3 caused by weakening global demand expectations and loosening supply conditions,” the Fed’s troubling finding is that the big move lower since 2014 has been a function of rising supply as well as declining demand: Overall, since the end of 2014:Q2, both lower global demand expectations and looser supply have held oil prices down. And while this trend appeared to have reversed in 2016:Q2 and 2016:Q4, recent indications suggest that demand may once again be slowing, which in turn has pressured oil prices back to levels last seen shortly after OPEC’s Vienna deal.

It is curious that according to the NY Fed, at a time when OPEC vows it is cutting production, the Fed has instead found “loose” supply to be among the biggest contributors to the latest decline in oil prices. But what may be concering to oil bulls is that as the decomposition chart below shows, while oil demand was solidly in the green ever since Trump’s election victory, in recent weeks it appears to have also tapered off along with the supply contribution to declining oil prices. This seems to suggest that along with most other “animal spirits” that were ignited following the Trump victory, only to gradually fade, oil demand, and thus price, may be the next to take another leg lower unless of course Trump manages to reignite the Trumpflation trade which, however, over the past month appears to have completely faded.

Read more …

“Indeed, Bharara never mustered the courtesy to respond to Bowen’s offers to aid his office.”

• Why Did Preet Bharara Refuse to Drain the Wall Street Swamp? (Bill Black)

The New York Times’ editorial board published an editorial on March 12, 2017, praising Preet Bharara as the “Prosecutor Who Knew How to Drain a Swamp.” I agree with the title. At all times when he was the U.S. Attorney for the Southern District of New York (which includes Wall Street) Bharara knew how to drain the swamp. Further, he had the authority, the jurisdiction, the resources, and the testimony from whistleblowers like Richard Bowen (a co-founder of Bank Whistleblowers United (BWU)) to drain the Wall Street swamp. Bowen personally contacted Bharara beginning in 2005.

“You were quoted in The Nation magazine as saying that if a whistleblower comes forward with evidence of wrongdoing, then you would be the first to prosecute [elite bankers]. I am writing this email to inform you that there is a body of evidence concerning wrongdoing, which the Department of Justice has refused to act on in order to determine whether criminal charges should be pursued.” Bowen explained that he was a whistleblower about Citigroup’s senior managers and that he was (again) coming forward to aid Bharara to prosecute. Bowen tried repeatedly to interest Bharara in draining the Citigroup swamp. Bharara refused to respond to Bowen’s blowing of the whistle on the massive frauds led by Citigroup’s senior officers.

Bharara knew how to drain the Wall Street swamp and was positioned to do so because he had federal prosecutorial jurisdiction over Wall Street crimes. Whistleblowers like Bowen, who lacked any meaningful power, sacrificed their careers and repeatedly demonstrated courage to ensure that Bharara would have the testimony and documents essential to prosecute successfully some of Wall Street’s most elite felons. Bharara never mustered the courage to prosecute those elites. Indeed, Bharara never mustered the courtesy to respond to Bowen’s offers to aid his office. [..] Bharara knew how to drain the Wall Street swamp. He had the facts, the staff, and the jurisdiction to drain the Wall Street swamp. Bharara refused to do so.

Read more …

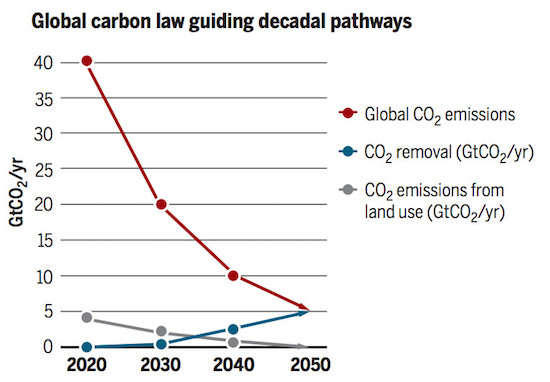

We all realize that this is never ever going to happen, right?!

• A Detailed “Roadmap” For Meeting The Paris Climate Goals (Vox)

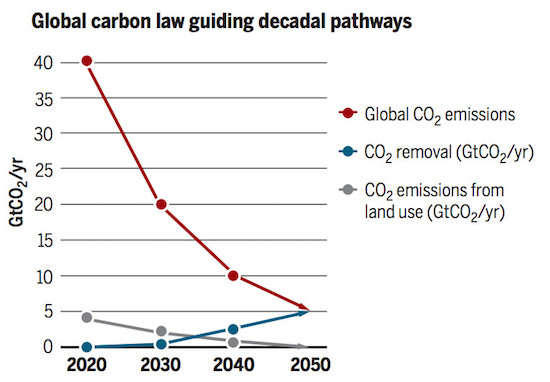

To hit the Paris climate goals without geoengineering, the world has to do three broad (and incredibly ambitious) things: 1) Global CO2 emissions from energy and industry have to fall in half each decade. That is, in the 2020s, the world cuts emissions in half. Then we do it again in the 2030s. Then we do it again in the 2040s. They dub this a “carbon law.” Lead author Johan Rockström told me they were thinking of an analogy to Moore’s law for transistors; we’ll see why. 2) Net emissions from land use — i.e., from agriculture and deforestation – have to fall steadily to zero by 2050. This would need to happen even as the world population grows and we’re feeding ever more people. 3) Technologies to suck carbon dioxide out of the atmosphere have to start scaling up massively, until we’re artificially pulling 5 gigatons of CO2 per year out of the atmosphere by 2050 — nearly double what all the world’s trees and soils already do.

“It’s way more than adding solar or wind,” says Rockström. “It’s rapid decarbonization, plus a revolution in food production, plus a sustainability revolution, plus a massive engineering scale-up [for carbon removal].” So, uh, how do we cut CO2 emissions in half, then half again, then half again? Here, the authors lay out a sample “roadmap” of what specific actions the world would have to take each decade, based on current research. This isn’t the only path for making big CO2 cuts, but it gives a sense of the sheer scale and speed required:

2017-2020: All countries would prepare for the herculean task ahead by laying vital policy groundwork. Like: scrapping the $500 billion per year in global fossil fuel subsidies. Zeroing out investments in any new coal plants, even in countries like India and Indonesia. All major nations commit to going carbon-neutral by 2050 and put in place policies — like carbon pricing or clean electricity standards — that point down that path. “By 2020,” the paper adds, “all cities and major corporations in the industrialized world should have decarbonization strategies in place.”

2020-2030: Now the hard stuff begins! In this decade, carbon pricing would expand to cover most aspects of the global economy, averaging around $50 per ton (far higher than seen almost anywhere today) and rising. Aggressive energy efficiency programs ramp up. Coal power is phased out in rich countries by the end of the decade and is declining sharply elsewhere. Leading cities like Copenhagen are going totally fossil fuel free. Wealthy countries no longer sell new combustion engine cars by 2030, and transportation gets widely electrified, with many short-haul flights replaced by rail.

Read more …

Brexit hardly seems Britain’s biggest problem. It’s the gutting of an entire society that is.

• In UK Access To Justice Is No Longer A Right, But A Luxury (G.)

Laws that cost too much to enforce are phoney laws. A civil right that people can’t afford to use is no right at all. And a society that turns justice into a luxury good is one no longer ruled by law, but by money and power. This week the highest court in the land will decide whether Britain will become such a society. There are plenty of signs that we have already gone too far. Listen to the country’s top judge, Lord Thomas of Cwmgiedd, who admits that “our justice system has become unaffordable to most”. Look at our legal-aid system, slashed so heavily by David Cameron and Theresa May that the poor must act as their own trial lawyers, ready to be skittled by barristers in the pay of their moneyed opponents. The latest case will be heard by seven supreme court judges and will pit the government against the trade union Unison. It will be the climax of a four-year legal battle over one of the most fundamental rights of all: the right of workers to stand up against their bosses.

In 2013, Cameron stripped workers of the right to access the employment tribunal system. Whether a pregnant woman forced out of her job, a Bangladeshi-origin guy battling racism at work, or a young graduate with disabilities getting aggro from a boss, all would now have to pay £1,200 for a chance of redress. The number of cases taken to tribunal promptly fell off a cliff – down by 70% within a year. Citizens Advice, employment lawyers and academics practically queued up to warn that workers – especially poor workers – were getting priced out of justice. But for Conservative ministers, all was fine. Loyal flacks such as Matthew Hancock (then employment minister) claimed those deterred by the fees were merely “unscrupulous” try-ons, intent on “bullying bosses”. Follow Hancock’s logic, and with all those time-wasters weeded out, you’d expect the number of successful tribunal claims to jump. They’ve actually dropped.

Read more …

“Do they covet our Chick-fil-A chains and Waffle Houses? Our tattoo artists? Would they like to induce the Kardashians to live in Moscow? Is it Nascar they’re really after?”

• The Curse of the Thinking Class (Jim Kunstler)

Let’s suppose there really is such a thing as The Thinking Class in this country, if it’s not too politically incorrect to say so — since it implies that there is another class, perhaps larger, that operates only on some limbic lizard-brain level of impulse and emotion. Personally, I believe there is such a Thinking Class, or at least I have dim memories of something like it. The farfetched phenomenon of Trumpism has sent that bunch on a journey to a strange land of the intellect, a place like the lost island of Kong, where one monster after another rises out of the swampy murk to threaten the frail human adventurers. No one back home would believe the things they’re tangling with: giant spiders, reptiles the size of front-end loaders, malevolent aborigines! Will any of the delicate humans survive or make it back home?

This is the feeling I get listening to arguments in the public arena these days, but especially from the quarters formerly identified as left-of-center, especially the faction organized around the Democratic Party, which I aligned with long ago (alas, no more). The main question seems to be: who is responsible for all the unrest in this land. Their answer since halfway back in 2016: the Russians. I’m not comfortable with this hypothesis. Russia has a GDP smaller than Texas. If they are able to project so much influence over what happens in the USA, they must have some supernatural mojo-of-the-mind — and perhaps they do — but it raises the question of motive. What might Russia realistically get from the USA if Vladimir Putin was the master hypnotist that Democrats make him out to be?

Do we suppose Putin wants more living space for Russia’s people? Hmmmm. Russia’s population these days, around 145 million, is less than half the USA’s and it’s rattling around in the geographically largest nation in the world. Do they want our oil? Maybe, but Russia being the world’s top oil producer suggests they’ve already got their hands full with their own operations? Do they want Hollywood? The video game industry? The US porn empire? Do they covet our Chick-fil-A chains and Waffle Houses? Our tattoo artists? Would they like to induce the Kardashians to live in Moscow? Is it Nascar they’re really after?

My hypothesis is that Russia would most of all like to be left alone. Watching NATO move tanks and German troops into Lithuania in January probably makes the Russians nervous, and no doubt that is the very objective of the NATO move — but let’s not forget that most of all NATO is an arm of American foreign policy. If there are any remnants of the American Thinking Class left at the State Department, they might recall that Russia lost 20 million people in the dust-up known as the Second World War against whom…? Oh, Germany.

Read more …

“The Turkish nationalist opposition leader, Devlet Bahçeli, has gone even further, claiming that several Greek islands are under occupation and reacting furiously when Kammenos visited the far-flung isle of Oinousses. “Someone must explain to this spoiled brat not to try our patience,” he railed. “If they [the Greeks] want to fall into the sea again, if they want to be hunted down, they are welcome, the Turkish army is ready. Someone must explain to the Greek government what happened in 1922. If there is no one to explain it to them, we can come like a bullet across the Aegean and teach them history all over again.”

• Tensions Flare As Greece Tells Turkey It Is Ready To Answer Any Provocation (G.)

Fears of tensions mounting in the Aegean and eastern Mediterranean Seas reignited after the Turkish president raised the prospect of a referendum on accession talks with the EU and the Greek defence minister said the country was ready for any provocation. Relations between Ankara and European capitals have worsened before the highly charged vote on 16 April on expanding the powers of the Turkish president, Recep Tayyip Erdogan. Western allies have argued that a vote endorsing the proposed constitutional change would invest him with unparalleled authority and limit checks and balances at a time when they fear the Turkish leader is exhibiting worrying signs of authoritarianism. Erdogan has been enraged by recent bans on visiting Turkish officials rallying “yes” supporters in Germany and the Netherlands.

Highlighting growing friction between Ankara and the bloc, he raised the spectre of a public vote on EU membership at the weekend. “We have a referendum on 16 April. After that we may hold a Brexit-like referendum on the [EU] negotiations,” he told a Turkish-UK forum attended by the British foreign secretary, Boris Johnson. “No matter what our nation decides we will obey it. It should be known that our patience, tested in the face of attitudes displayed by some European countries, has limits.” The animus – reinforced last week when the leader said he would continue labelling European politicians “Nazis” if they continued calling him a dictator – has also animated tensions between Greece and Turkey, and Erdogan’s comments came hours after the Greek defence minister said armed forces were ready to respond in the event of the country’s sovereignty and territorial integrity being threatened.

“The Greek armed forces are ready to answer any provocation,” Panos Kammenos declared at a military parade marking the 196th anniversary of Greece’s war of liberation against Ottoman Turkish rule. “We are ready because that is how we defend peace.” Although Nato allies, the two neighbours clashed over Cyprus in 1974 and almost came to war over an uninhabited Aegean isle in 1996. Hostility has been rising in both areas, with the Greek Cypriot leader Nicos Anastasiades recently voicing fears of Turkey sparking a “hot incident” in the run-up to the referendum. “I fear the period from now until the referendum in Turkey, as well as the effort to create a climate of fanaticism within Turkish society,” he told CNN Greece. Turkey’s EU negotiations have long been hindered by Cyprus, and talks aimed at reuniting its estranged Greek and Turkish communities are at a critical juncture but have stalled and are unlikely to move until after the referendum.

But it is in the Aegean where tensions, matched by an increasingly ugly war of words, have been at their worst. After a tense standoff over eight military officers who escaped to Greece after the abortive coup against Erdogan last July – an impasse exacerbated when the Greek supreme court rejected a request for their extradition – hostility has been measured in almost daily dogfights between armed jets and naval incursions of Greek waters by Turkish research vessels. Both have prompted diplomats and defence experts to express fears of an accident at a time when experienced staff officers and pilots have been sidelined in the purges that have taken place since the attempted coup. The shaky migration deal signed between the EU and Turkey to thwart the flow of refugees into the continent has only added to the pressure.

Read more …

The falling dollar is setting up Turkey for dictatorship. The world will come to regret this.

• Erdogan Races Against the Dollar in Campaign for Unrivaled Power (BBG)

Turkish President Recep Tayyip Erdogan has lambasted friend and foe alike in a campaign for vast new powers, but his political fate may hang on the one thing he’s stopped carping about: the price of money. With the April 16 vote on strengthening the presidency too close for pollsters to call, Erdogan is no longer berating the central bank and commercial lenders over borrowing costs they’ve pushed to a five-year high. He’s betting any measures taken to arrest the lira’s plunge will pay off at the ballot box. The lira’s value versus the dollar is more than just a pocketbook issue in Turkey, where millions of voters still remember the abrupt devaluations that ravaged their livelihoods in past decades and view the exchange rate as the most important indicator of the nation’s economic health.

Turkey’s trade deficit is the biggest of all top 50 economies relative to output and most of its imports and foreign debt are priced in dollars, so sharp declines in the lira can be ruinous for legions of entrepreneurs like Ramazan Saglam, who owns a print shop in a working-class neighborhood of Ankara. “I bitterly recall when the dollar jumped in 1994 and 2001 – my business collapsed both times,” Saglam said. “I’m supporting the new presidential system wholeheartedly because I don’t want to go bankrupt again.” Saglam nodded at the big red banner billowing from his second-story window to illustrate his point. The Chinese cloth and South Korean ink he used to make it were all bought with dollars, as was the American printer that produced Erdogan’s image and the slogan, “Yes. For my country and my future.”

Given the choice between paying more for credit to buy supplies and keeping the lira in check, he said he’d choose sound money every time. Supporters of the proposed constitutional changes say handing Erdogan sweeping new authority is the only way to achieve the stability that society craves and businesses need to thrive. But opponents say approving the referendum is an invitation to dictatorship, particularly since Erdogan, already the most dominant leader in eight decades, jailed or fired more than 100,000 perceived enemies after rogue army officers attempted a coup in July. “Everybody on the street tracks the exchange rate on a daily basis and Erdogan wins support as long as Turkey can keep the lira stable,” said Wolfango Piccoli, the London-based co-president of Teneo Intelligence, a political risk advisory firm. “But the challenge here is the external backdrop. They can’t really predict what’s coming.”

Read more …

The US must cease labeling the PKK a terrorist organization. Or stop backing the Kurds in Syria. Can’t have both.

• Tillerson Will Not Meet Turkey Opposition In Ankara Visit This Week (R.)

U.S. Secretary of State Rex Tillerson will not meet members of Turkish opposition groups during a one-day visit to Ankara this week where talks with President Tayyip Erdogan will focus on the war in Syria, senior U.S. officials said on Monday. Thursday’s visit comes at a politically sensitive time in Turkey as the country prepares for a referendum on April 16 that proposes to change the constitution to give Erdogan new powers. A senior State Department official said Tillerson will meet with Erdogan and government ministers involved in the fight against Islamic State in Syria. “It is certainly something we are very acutely aware of and the secretary will be mindful of while he is there,” one State Department official told a conference call with reporters, referring to political sensitivities ahead of the referendum.

American officials expect Erdogan and others to raise the case of U.S.-based cleric Fethullah Gulen, whom the government accuses of orchestrating a failed coup last July. The focus of the Ankara talks is the U.S.-led offensive to retake Raqqa from Islamic State and to stabilize areas in which militants have been forced out, allowing refugees to return home, officials said. A major sticking point between the United States and Turkey is U.S. backing for the Syrian Kurdish YPG militia, which Turkey considers part of the Kurdistan Workers’ Party that has been fighting an insurgency for three decades in Turkey. But the United States has long viewed Kurdish fighters as key to retaking Raqqa alongside Arab fighters in the U.S.-backed Syrian Democratic Forces (SDF). “We are very mindful of Turkey’s concerns and it is something that will continue to be a topic of conversation,” a second U.S. official said.

Read more …

Fire sale. The minister actually called these practices ‘cannibalistic’, and rightly so. And that’s not even the best of it. A Greek paper details how a Greek bank, Alpha Bank, lends the money to German investors to buy up Greece’s Public Power Corp. That is about as close to cannibalism as you can get. Economic warfare 101.

• Troika Pushes Greece To Sell Up To 40% Of State-Controlled Power Utility (R.)

A Greek minister on Monday accused international lenders of reneging on a 2015 bailout deal by trying to force a fire-sale of its main electricity utility PPC to serve “domestic and foreign business interests.” Under terms of a 2015 bailout deal for Greece worth up to €86 billion, Public Power Corp. (PPC) is obliged to cut its dominance in the Greek market to below 50% by 2020. Although it is not clearly specified in the deal, lenders want Greece to sell some of PPC’s assets. PPC, which is 51% owned by the state, now controls about 90% of the country’s retail electricity market and 60% of its wholesale market. Greece last year launched power auctions to private operators as a temporary mechanism and has proposed that PPC team up with private companies to help achieve this target. But lenders doubt the effectiveness of the measure.

“What they want is that power production infrastructure of up to 40% – PPC’s coal-fired production- is sold. This is what they want right know, which is beyond the (2015) deal,” Interior Minister Panos Skourletis, a former energy minister, told Greek state television. Skourletis on Monday accused the lenders pressing the country to sell-off PPC units at a very low price to serve European and domestic competitors. “It is an assault which has set its sights on PPC’s assets to pass it on to specific European and domestic business interests at a humiliating price,” Skourletis said in an Op-Ed penned for the Efimerida Ton Syntakton daily.

Read more …

More warfare, more cannibalism. Airports also ‘privatized’, ‘reformed’. Alpha Bank is also the largest lender in this case. Nice partners too: “..the International Finance Corporation (€154.1 million), a member of the World Bank Group [..] is also the sole provider of euro interest rate hedging swaps..”

• Fraport Greece Signs Funding Deal With 5 Lenders (K.)

Five leading financial institutions have signed a long-term financing agreement with German-Greek consortium Fraport Greece, which will soon be managing, operating, upgrading and maintaining 14 regional Greek airports under a 40-year concession contract. The agreement is for total financing of 968.4 million euros. The lenders are Alpha Bank (participating with €284.7 million), the Black Sea Trade & Development Bank (€62.5 million), the European Bank for Reconstruction & Development (€186.7 million), the European Investment Bank (€280.4 million), and the International Finance Corporation (€154.1 million), a member of the World Bank Group.

IFC is also the sole provider of euro interest rate hedging swaps to help Fraport Greece hedge potential fluctuations in interest rates through the term of the loan. Over two-thirds of the total amount (€688 million) will be used to cover the upfront payment (of €1.234 billion) due to state sell-off fund TAIPED upon the airports’ delivery, while €280.4 million will be used to finance upgrading work at the 14 airports. Meanwhile, Fraport Greece recently announced a capital increase raising the company’s total capital to €650 million, most of which will go toward the upfront payment.

Read more …

But domestic credit is still collapsing. And so is the economy, of course.

• Contraction Of Credit Continues Unabated In Greece (K.)

Bank of Greece figures revealed on Monday a further contraction in the financing of the Greek economy last month, a result of the general uncertainty hanging over the economy and the drop deposits at the country’s banks. The total funding of the economy was down 2% YOY in February, from -1.5% in January, while the monthly net flow of total financing was negative by €801 million, against a negative flow of €1.261 billion in January. The main factor in that decline was the drop in funding to the state, as the annual rate concerning the general government sector posted a 3.7% contraction in February against a 0.1% increase in January. In the private sector it was negative by 1.6% as funding shrank by a net €101 million. The image was somewhat different for enterprises as there was an €82 million monthly increase in the net flow of funding last month, compared with a €643 million decline in January. However, the flow of credit to private clients and nonprofit organizations dipped by €153 million or 2.7% in February.

Read more …

Wise old genius. “As soon as three Greeks get together, they start talking of who’s going to be the leader..”

• Mikis Theodorakis: ‘In Tough Times, Greeks Become Heroes or Slaves’ (GR)

“During tough times, a Greek can become a hero or a slave,” said legendary Greek composer Mikis Theodorakis in an interview published in Proto Thema Sunday newspaper. The 92-year-old musician, who is also an emblematic figure of the Greek Left, spoke about Greece’s current state, the leftist government, the main opposition party and the bailout agreements. Theodorakis said that he is not shocked about the current condition Greece is in because, historically, the country has been through turmoil several times. He said the Greek spirit, like a light, shines through at the end because Greeks have an inner harmony that prevails. However, Theodorakis said, this is a hard period for Greece and this time he is afraid for the future of the country: “When the Greek is with his back against the wall, he becomes a hero or a slave.”

When asked to compare the current state of the nation with the times of the German Occupation, Theodorakis said that what Greece is going through now is worse: “I don’t remember people going through the trash to find food. I don’t remember elderly people waiting in line to get a cabbage.” Theodorakis spoke in length about the time (2012) opposition leader Alexis Tsipras and leftist legend Manolis Glezos approached him and asked him to join SYRIZA and win the upcoming elections. He said he refused to join because the young candidate did not have a plan on how to get Greece going without supervision and financial aid from the EU and the IMF. He described Greece as a train rolling on tracks laid by the EU and the IMF.

“I told him ‘if you’re planning to come to power without having a plan to change the tracks and provide Greek people with what they need, then you are opportunists and you will only succeed in destroying the country and humiliating the Greek Left’,” the composer said about Tsipras. “With great sadness, I believe that the current plight of the country confirms exactly what I said to Alexis Tsipras, here in my house, in the meeting that I mentioned earlier,” Theodorakis said. The composer said that Greeks have a lust for power: “As soon as three Greeks get together, they start talking of who’s going to be the leader,” he said characteristically.

Read more …

A new issue has come to light: where are the NGOs picking up the refugees?

• Nearly 1,200 Migrants Picked Up Off Libya, Heading To Italy (R.)

Humanitarian ships rescued almost 1,200 migrants who were crossing the Mediterranean Sea at the weekend on an array of small, tightly packed boats, Doctors Without Borders said on Sunday. A young woman was found unconscious on one of the vessels and later died, the group said. Some 412 people were crammed onto a single wooden boat, while the others were picked up from huge inflatable dinghies, which had set sail from the coast of Libya. The weekend rescues mean that about 22,000 mainly African migrants have been picked up heading to Italy so far this year, while around 520 have died trying to make the crossing.

An Italian prosecutor said last week that humanitarian ships operating off Libya were undermining the fight against people smugglers and opening a corridor that is ultimately leading to more migrant deaths. The chief prosecutor of the Sicilian port city of Catania, Carmelo Zuccaro, said he also suspected that there may be direct communication between Libya-based smugglers and members of charity-operated rescue vessels. NGOs deny any wrongdoing, saying they are simply looking to save lives, but they are facing criticism in Italy, which has taken in about half a million migrants since the start of 2014.

Read more …

Italy thinks George Soros is sponsoring this.

• Italy Calls For Investigation Of NGO Supported Migrant Fleet (Dm.)

Italian authorities are calling for monitoring of the funding of an NGO fleet bussing migrants into the EU from the North African coast after a report released the European Border and Coast Guard Agency has determined that the members of the fleet are acting as accomplices to people smugglers and directly contributing to the risk of death migrants face when attempting to enter the EU. The report from regulatory agency Frontex suggests that NGOs sponsoring ships in the fleet are now acting as veritable accomplices to people smugglers due to their service which, in effect, provides a reliable shuttle service for migrants from North Africa to Italy. The fleet lowers smugglers’ costs, as it all but eliminates the need to procure seaworthy vessels capable making a full voyage across the Mediterranean to the European coastline.

Traffickers are also able to operate with much less risk of arrest by European law enforcement officers. Frontex specifically noted that traffickers have intentionally sought to alter their strategy, sending their vessels to ships run by the NGO fleet rather than the Italian and EU military. On March 25th, 2017, Italian news source Il Giornale carried remarks from Carmelo Zuccaro, the chief prosecutor of Catania (Sicily) calling for monitoring of the funding behind the NGO groups engaged in operating the migrant fleet. He stated that “the facilitation of illegal immigration is a punishable offense regardless of the intention.” While it is not a crime to enter the waters of a foreign country and pick them migrants, NGOs are supposed to land them at the nearest port of call, which would have been somewhere along the North African coast instead of in Italy.

The chief prosecutor also noted that Italy is investigating Islamic radicalization occurring in prisons and camps where immigrants are hired off the books. Italy has for some months been reeling under the pressure of massive numbers of migrants who have been moving from North Africa into the southern states of the European Union. In December 2016, The Express cited comments made by Virginia Raggi, the mayor of Vatican City, stating that Rome was on the verge of a “war” between migrants and poor Italians. The wave of migrants has also caused issues in southern Italy, where the Sicilian Cosa Nostra has declared a “war on migrants” last year amid reports that the Italian mafia had begun fighting with North African crime gangs who entered the EU among migrant populations.

Read more …