Giotto Legend of St Francis, Exorcism of the Demons at Arezzo c.1297-1299

Imagine if the MSM had refused to report on Watergate. That is what is happening now. And this is starting to feel a whole lot worse than that. Not sure “folly” covers it.

• Declassified FBI Spreadsheet Exposes Folly Of Steele Dossier (JTN)

An FBI spreadsheet that evaluated the credibility of Christopher Steele’s dossier found almost no corroborating evidence from official intelligence reporting, leaving analysts to grope after flimsy sources like a Democratic operative, a Russian propaganda news site and U.S. news media story leaks that amounted to circular reporting.In one entry, FBI analysts tried to evaluate one of Steele’s most lurid claims — later debunked — that Trump was videotaped committing lewd sex acts with prostitutes at the Ritz Carlton Hotel in Moscow. “There is no confirmation that Trump stayed here,” they found. “There is no ‘Presidential Suite’ currently listed.”

[..]Another entry encapsulated much of the FBI’s assessment of Steele’s reporting: It seemed based on Internet rumors that could never be corroborated.”Other than open source speculation, the only reporting that mentions this is the Steele Reporting from 5 July 2016 and 2 August 2016,” the analysts wrote about a claim in the dossier that the Russian spy agency known as the FSB had a “pervasive and sophisticated” operation focused on Trump. Other entries dinged the Steele dossier for sloppiness like misspellings of key names, or for making claims that were debunked by official travel records like passport entry records.

“There doesn’t appear to be any record of Trump visiting Baku or the presidential palace,” one entry read, knocking down a claim the future president visited the former Soviet republic of Azerbaijan. Added another: “There is no record of Trump personally organizing a Congressional Delegation (CODEL) visit to Baku.”Likewise, one of the most famous claims of the now-discredited dossier — that Trump lawyer Michael Cohen flew to Prague in summer 2016 to help cover up a Russia-Trump plot — was debunked by analysts. “The CROSSFIRE HURRICANE team has been unable to verify travel by Cohen to the Czech Republic in August 2016,” analysts wrote.

With little formal intelligence reporting to back anything Steele had offered the FBI, analysts often turned to suspect sources, such as biased actors connected to the Democratic National Committee or leaked news media stories that could be traced back to Steele and his boss, Fusion GPS co-founder Glenn Simpson. “On September 23, 2016 Yahoo News published an article claiming Carter Page was under investigation by the FBI and US intelligence due to his ties with Russia,” analysts wrote, citing that source as the only piece of evidence corroborating former Trump adviser Carter Page’s alleged meeting with a senior Russian official. The FBI later determined the meetings never happened.

They are hoping to bury it all after the election.

FBI agents getting paid by the press for leaks.

• Steele Dossier: Media Reports On FBI Reports Of Media Reports (sundance)

CBS News Catherine Herridge has obtained a 94-page spread sheet showing dates of media reports, dates of Steele reports on the same material, and the FBI effort to verify or validate the circular process. In essence this is evidence of the process we initially shared almost three years ago; only now we know the names. Former SSCI staffer Dan Jones, former Wall Street Journal reporter Glenn Simpson, and Simpson’s crew at Fusion-GPS, pitched and planted phony Trump-Russia evidence with the media and simultaneously gave those fake points to Chris Steele to supplement the dossier. Using the same method of Ezra Klein’s “JournOList” replication, Dan Jones and Fusion-GPS paid the journalists to run the stories.

Steele then used the same information from Jones and Fusion in his Dossier and cited the planted media reports; as evidence to substantiate. The Dossier is then provided to the FBI. The journalists then provide *indulgences* to the FBI as part of the collaboration. The FBI, specifically Lisa Page, Peter Strzok and public information office Mike Kortan, then leak the outcomes of the FBI Dossier investigative processes to the same media that have reported on the originating material. It is all a big circle of planting and laundering the same originating false material; aka a “wrap up smear.” Michael Isikoff highlighted the level of how enmeshed media is with the Fusion team in February 2018 when he admitted his reporting was being used by the DOJ and FBI to advance the political objectives of the intelligence community.

Additionally, FBI investigator Peter Strzok and FBI attorney Lisa Page were shown in their text messages to be leaking stories from the Clinton Investigation, the Trump investigation and the Mueller investigation to journalists at Politico, The Wall Street Journal and Washington Post. FBI Deputy Director Andrew McCabe was busted by the Inspector General leaking stories to the media and then lying about it to INSD and IG investigators. FBI Director James Comey admitted to leaking stories to the New York Times, and even hired his friend Andrew Richman (off-the-books), gave him access to FBI and NSA databases, and then leaked information to Richman along with another friend Benjamin Wittes at Lawfare blog.

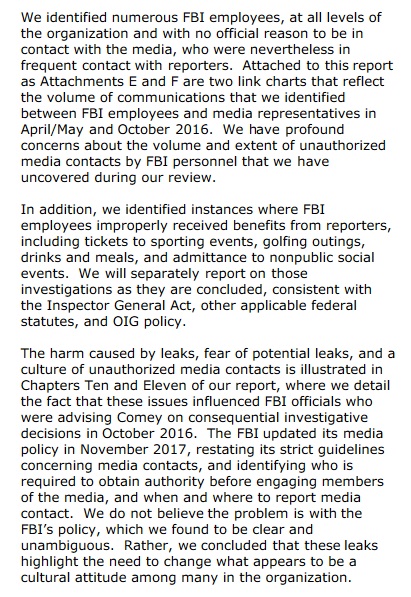

Lest we forget, the IG report on how the FBI handled the Clinton investigation revealed that dozens of FBI officials were actually taking bribes from the media for information: IG REPORT – “We identified numerous FBI employees, at all levels of the organization and with no official reason to be in contact with the media, who were nevertheless in frequent contact with reporters. Attached to this report as Attachments E and F are two link charts that reflect the volume of communications that we identified between FBI employees and media representatives in April/May and October 2016. We have profound concerns about the volume and extent of unauthorized media contacts by FBI personnel that we have uncovered during our review.”

” In notes also released last week, Brennan describes telling Obama about the “alleged approval by Hillary Clinton on July 28 of a proposal from one of her foreign policy advisers to villify [sic] Donald Trump by stirring up a scandal claiming interference by Russian security services.”

• Team Obama Invented The Whole Russiagate Scandal (NYP)

In mid-2016, the FBI got word that Russian intelligence believed Hillary Clinton’s campaign was planning to frame Donald Trump as colluding with Russia’s Vladimir Putin to hack her computers. Yet somehow, the crack agents never connected the dots when handed the Steele “dossier” commissioned and paid for by the Clinton campaign that claimed Trump was colluding with Putin. Instead, the Justice Department used that dossier as a pretext to spy on at least Trump aide Carter Page as it investigated the clearly spurious charges. Justice also distorted the facts about Page’s past relations with the CIA to suggest he had a history of working with Russian agents when his actual record involved turning them in. Meanwhile, it buried the fact that Steele’s main source was himself a suspected Russian agent.

Nor did it connect the dots to another “Russiagate” lead, the third-hand rumors passed along by a Clinton-allied diplomat that supposedly implicated another Trump aide, George Papadopoulos. The news of the 2016 intel comes from Director of National Intelligence John Ratcliffe’s gradual release of Russiagate records — which show that the true scandal was the investigation itself. Maybe the Russian analysis was mistaken. But the info should have prompted far greater skepticism on all the Clinton-connected “dirt” on Trump, none of which ever panned out, despite years of investigation. From Justice to the CIA, the Obama administration politicized a host of nonpartisan institutions to stain the Trump campaign and then sabotage the Trump administration. And, with selective leaks to major media, the plotters managed to convince much of the country.

The info was credible on its face: US intelligence “obtained insight” into the Russian analysis using highly classified methods (which are redacted in the now-public documents). The Russians had determined that Clinton wanted to blame Trump for the hacking of Democratic National Committee e-mails to distract from the growing scandal over her use of a non-secure home-brew server for official business as secretary of state. The US intel community found it was authentic Russian analysis, though it couldn’t judge the veracity of the claim. And President Barack Obama was briefed on it, per his CIA director, John Brennan. In notes also released last week, Brennan describes telling Obama about the “alleged approval by Hillary Clinton on July 28 of a proposal from one of her foreign policy advisers to villify [sic] Donald Trump by stirring up a scandal claiming interference by Russian security services.”

“All of this recent evidence happens to tie in to other earlier facts, from the Clinton campaign lying about funding the dossier to Steele misrepresenting his sources and his conclusions.”

• The Truman Show Election: The Public Is Left In The Dark (Turley)

As news emerged that United States Attorney John Durham uncovered some serious and possibly criminal conduct in the Russia investigation, Democrats demanded that he not release his report before the election. Indeed, the federal rules tell prosecutors to avoid timing “investigative steps or criminal charges for the purpose of affecting an election, or for the purpose of giving an advantage or disadvantage to any candidate or political party.” However, major cases often do affect elections, and they are not sealed in amber until the votes are counted. The investigation by Durham is focused on conduct in the election four years ago. His subjects of scrutiny are not candidates on this ballot but rather federal officials involved in the investigation of potential collusion between Russia and the Donald Trump campaign in 2016.

This proved to be unfounded. Ultimately, there was no evidence of collusion, let alone anyone who committed crimes related to collusion. Indeed, disclosed evidence shows the FBI was told early on that the allegations were not only dubious but possibly disinformation from Russia. In recent weeks, we learned that the primary source used by Christopher Steele in his now infamous dossier was believed to be an agent of Russia. Recent declassified material also showed that in 2016, then CIA director John Brennan had briefed President Obama on an alleged plan by Hillary Clinton to tie then candidate Trump to Russia as “a means of distracting the public from her use of a private email server.” The handwritten notes from Brennen would seem extremely serious on their face. Indeed, the allegation was sufficiently serious to brief the president.

It reflected intelligence reports given to the FBI and then director James Comey. When asked last week about the report, Comey simply said it did not “ring a bell.” What rings his bell is precisely what the investigation by Durham could reveal. All of this recent evidence happens to tie in to other earlier facts, from the Clinton campaign lying about funding the dossier to Steele misrepresenting his sources and his conclusions. There are arguments for delaying the release of the report by Durham this close to the election. But there is a lack of assurances that we would ever know the findings after the election. If Democrats control both chambers of Congress, it is unlikely they will have hearings on the report. Democrats on the intelligence committees have said they want the investigations into 2016 to end so we can all “look ahead rather than back.” If Biden becomes the next president, the Justice Department could shut down or curtail the investigation, or even classify its final report as privileged.

“Criminal liability may even extend into the news media itself — though they may only be named as unindicted co-conspirators.”

• What’s Behind No-Show Joe (Jim Kunstler)

Something even stranger and more sinister than the Covid-19 virus is creeping across the USA: Joe Biden’s Flying Dutchman campaign which, like the ghost-ship of legend, plies the vasty electoral seas with a skeleton crew and no hope of ever landing. Late last week, the candidate blew into Yuma, AZ, for a rare, joint appearance with veep pardner Kamala Harris and, guess what, absolutely no civilians (i.e. voters) showed up at the event, though the local TV news had publicized it. Weird, a little bit? Face it: we’re living in the days of fantastic high-tech information mischief. Virtually all of the traditional news media, plus the powerful new social media, plus the news media of foreign lands, and scores of other embeds in the federal bureaucracy, are behind the story that Ol’ White Joe and his understudy, Ms. Harris, are way ahead in the polls.

Do you ask yourself, as I must, whether this is all a gigantic psy-op? And why would it be? All right, I know that many readers are cross-eyed to the point of nausea over the Barr-Durham investigation, especially the failure to deliver indictments before the election. The complete absence of leaks from that outfit has been crazy-making itself for many. But I take that as a sign of the profound seriousness of the investigation. Durham’s crew is methodically making a case for the worst and largest seditious conspiracy in US history. It requires the most extreme care. They are not going to blow it by allowing any suspicion that it is being used as a campaign ploy on behalf of Mr. Trump.

Sometime after the election and before the 20th of January, a great big hammer is going to come down on the people who organized the RussiaGate op and many of its spinoffs. As the late Tom Petty observed, the waiting is the hardest part, and not only for those in the Counter-resistance who have already connected the felonious dots based on publicly available documents, but also for the targets of the Barr-Durham RussiaGate probe, the Resistance itself — the long log of Obama Admin officials, Clinton campaign minions, and even senators who worked to prevent Donald Trump’s election by foul means and then tried to disable and overthrow him when it didn’t work, in order to cover up their criminal culpability.

You understand that the targets of Barr and Durham are almost all lawyers, Democratic Party-connected lawyers, that is. And so, what they are doing in the shadows of Joe Biden’s ghost campaign is attempting to mount a last-ditch lawyers’ assault on their antagonists, who have regained control of a rogue Justice Department. Thus: Lawfare. If RussiaGate was the most dastardly crime of government against itself ever in US history, then the final result will be the most awful roundup and prosecution of disgraced former officials ever seen in the history of the world’s great nations. Criminal liability may even extend into the news media itself — though they may only be named as unindicted co-conspirators.

“Should you remain silent, you will be complicit in a coup d’état.”

In August, two retired military officers published a piece in Defense One which literally encouraged America’s top military leadership to have the 82nd airborne to descend on Washington in the event of a disputed election and escort President Trump out of office. “In the Constitutional crisis described above, your duty is to give unambiguous orders directing U.S. military forces to support the Constitutional transfer of power,” they write. “Should you remain silent, you will be complicit in a coup d’état.” In other words, the military must prevent a coup by staging one of their own. Thankfully, the Pentagon publicly condemned John Nagl’s and Paul Yingling’s musings.

In some regards it is unremarkable in a nation with millions of military veterans that two of them would have some kind of Clockwork Orange-style MSNBC viewing party and put crayon to paper long enough to come up with this violent fantasia. However, the problem isn’t so much that Nagl and Yingling gamed out this scenario – every election that I can remember for the last 30 years has featured fringe voices expressing concern that the current occupant will refuse to leave. The real problem is that, for once, a respectable media outlet went ahead and published it. If anything, the Defense One op-ed was just the most explicit example of the anti-Trump coup pornography that’s become a staple of mainstream media.

And when the media is not baselessly fretting Trump will refuse to leave office, they’re outrageously and falsely characterizing Trump and his administration in ways that justify his violent removal. The Washington Post recently ran an “analysis” in the business section, quoting a bunch of academics warning that Trump was leading America into autocracy. The article ended with this kicker quote from a Swedish political scientist, Staffan I. Lindberg at Sweden’s University of Gothenburg: “‘if Trump wins this election in November, democracy is gone’ in the United States, [Lindberg] says. He gives it about two years. ‘It’s really time to wake up before it’s too late.’”

“..all of the individuals charged in the plot had been under intense scrutiny by the Federal Bureau of Investigation months prior to the scheme being hatched..”

• Kidnapping Dissent: The Whitmer Plot and the End of Freedom (MPN)

Stoked for decades by an extremist capitalist oligarchy which has slowly and methodically disabled the levers of democracy to achieve its interests, the latent racial tensions that haunt America’s collective psyche are being exploited in ways never before possible with the advent of online disinformation mashups, like QAnon, Antifa, BLM and others along the spectrum of modern-day social media constructs. As we near the 2020 presidential election, the skeletons in America’s closet are being dressed in the latest fashion and paraded before a terrified citizenry, whose health and peace of mind is under siege as a result of the pandemic crisis while simultaneously bombarded with apocalyptic scenarios of societal collapse and civil war, like the alleged conspiracy to kidnap and murder Michigan governor Gretchen Whitmer as part of a larger plan to storm the Michigan State Capitol with hundreds of armed men.

But, considering the fact that all of the individuals charged in the plot had been under intense scrutiny by the Federal Bureau of Investigation months prior to the scheme being hatched, it is not surprising that suspicions of entrapment by the FBI have begun to swirl around the high profile case, which was filed before the U.S. District Court of Western Michigan last Tuesday.

[..] Prior to the 2018 midterm victory that put her in the governor’s mansion, Whitmer had served in the Michigan state Senate from 2006 until 2014. More recently, she had assumed the role of interim Ingham County prosecutor in 2016 after the serving prosecutor had to resign over a lurid sex scandal. Whitmer beat Republican Bill Schuette to take the governorship and after just one year in office, she came into the national spotlight for the first time when she was selected to deliver the Democrats’ response to the Trump’s last State of the Union address in February, which also coincided with the start of the FBI’s investigation into her would-be kidnappers.

In August, Whitmer again garnered national attention amid speculation that Democratic presidential candidate Joe Biden was going to choose her as his running mate. By then, the FBI had compiled hours of conversations between the ragtag crew of convicted criminals and U.S. Marines, who in June, allegedly targeted Governor Whitmer as part of a grand plan to storm the Michigan State Capitol with 200 men and take hostages before the upcoming presidential election. The group’s motivation is said to come from Whitmer’s “unilateral” lockdown policies, extending the state’s coronavirus emergency measures beyond the original April 30 cut-off date through executive order.

The move elicited an immediate reaction from conservatives in the state and the very influential Koch-funded Mackinac Center, which filed an injunction against the governor’s executive action in May. After challenges to the governor’s orders were struck down in lower courts, the Republican-majority Michigan Supreme Court last week added fuel to the fire by ruling Whitmer’s executive orders to be unconstitutional and setting off a firestorm of controversy on the same day FBI agents murdered Eric Mark-Matthew Allport in Detroit and just before the FBI decided to submit their affidavit against the Whitmer plotters.

Never let a good crisis go to waste.

• IMF Seizes on Pandemic to Pave Way for Privatization in 81 Countries (MPN)

The enormous economic dislocation caused by the COVID-19 pandemic offers a unique opportunity to fundamentally alter the structure of society, and the International Monetary Fund (IMF) if using the crisis to implement near-permanent austerity measures across the world.76 of the 91 loans it has negotiated with 81 nations since the beginning of the worldwide pandemic in March have come attached with demands that countries adopt measures such as deep cuts to public services and pensions — measures that will undoubtedly entail privatization, wage freezes or cuts, or the firing of public sector workers like doctors, nurses, teachers and firefighters.

The principal cheerleader for neoliberal austerity measures across the globe for decades, the IMF has recently (quietly) begun admitting that these policies have not worked and generally make problems like poverty, uneven development, and inequality even worse. Furthermore, they have also failed even to bring the promised economic growth that was meant to counteract these negative effects. In 2016, it described its own policies as “oversold” and earlier summed up its experiments in Latin America as “all pain, no gain.” Thus, its own reports explicitly state its policies do not work.

“The IMF has sounded the alarm about a massive spike in inequality in the wake of the pandemic. Yet it is steering countries to pay for pandemic spending by making austerity cuts that will fuel poverty and inequality,” Chema Vera, Interim Executive Director of Oxfam International, said today. “These measures could leave millions of people without access to healthcare or income support while they search for work, and could thwart any hope of sustainable recovery. In taking this approach, the IMF is doing an injustice to its own research. Its head needs to start speaking to its hands.”

Wouldn’t many say that so they look like good citizens?

• CDC: 85% of COVID19 Patients Report ‘Always’ Or ‘Often’ Wearing A Mask (JS)

An underreported, recently-published CDC study adds to the pile of evidence that cloth masks or other forms of mandated face coverings only contribute negatives to our COVID-19 problem. The study also displays — despite the constant accusations of widespread misbehavior from public health officials — that Americans are adhering to mask wearing, but mask wearing is not doing us any good. The CDC study, which surveyed symptomatic COVID-19 patients, has found that 70.6% of respondents reported “always” wearing a mask, while an additional 14.4% say they “often” wear a mask. That means a whopping 85% of infected COVID-19 patients reported habitual mask wearing. Only 3.9% of those infected said they “never” wear a face covering.

The study offers insight into the reality that tens of thousands of Americans are acquiring COVID-19 on a daily basis despite overwhelming adherence to mask wearing. Masks simply aren’t working to “slow the spread” or “stop the spread.” The study also dismisses “public health experts’” claims from individuals such as Dr. Anthony Fauci and others that Americans are not following the guidance being disseminated by the CDC and other disease control agencies. Americans are following the CDC guidance. It’s just not working.

These trials all have problems.

• Johnson&Johnson Covid19 Vaccine Study Paused Due To Unexplained Illness (STAT)

The study of Johnson & Johnson’s Covid-19 vaccine has been paused due to an unexplained illness in a study participant. A document sent to outside researchers running the 60,000-patient clinical trial states that a “pausing rule” has been met, that the online system used to enroll patients in the study has been closed, and that the data and safety monitoring board — an independent committee that watches over the safety of patients in the clinical trial — would be convened. The document was obtained by STAT. Contacted by STAT, J&J confirmed the study pause, saying it was due to “an unexplained illness in a study participant.” The company declined to provide further details.

“We must respect this participant’s privacy. We’re also learning more about this participant’s illness, and it’s important to have all the facts before we share additional information,” the company said in a statement. J&J emphasized that so-called adverse events — illnesses, accidents, and other bad medical outcomes — are an expected part of a clinical study, and also emphasized the difference between a study pause and a clinical hold, which is a formal regulatory action that can last much longer. The vaccine study is not currently under a clinical hold. J&J said that while it normally communicates clinical holds to the public, it does not usually inform the public of study pauses. The data and safety monitoring board, or DSMB, convened late Monday to review the case.

J&J said that in cases like this “it is not always immediately apparent” whether the participant who experienced an adverse event received a study treatment or a placebo. Though clinical trial pauses are not uncommon — and in some cases last only a few days — they are generating outsized attention in the race to test vaccines against SARS-CoV-2, the virus that causes Covid-19. Given the size of Johnson & Johnson’s trial, it’s not surprising that study pauses could occur, and another could happen if this one resolves, a source familiar with the study said. “If we do a study of 60,000 people, that is a small village,” the source said. “In a small village there are a lot of medical events that happen.”

Fairy tales.

• Economists Are More Like Storytellers Than Scientists (Benack)

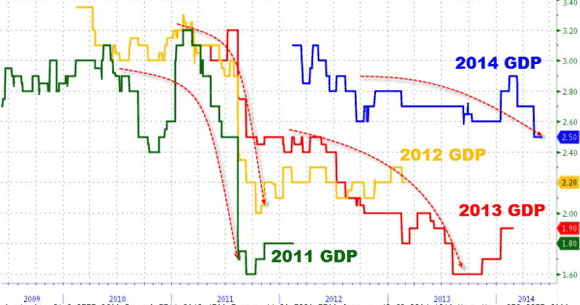

When you listen to an economist, chances are you’ll hear a lot of statistics. Federal Reserve Chairman Jerome Powell’s speech at the National Association for Business Economics on Oct. 6 is a case in point. In the first two minutes alone he referred to a dizzying range of economic indicators: growth, unemployment rate, personal consumption expenditures inflation, labor force participation, productivity gains, real wage gains and so on. But if you watch the speech, you may notice that he rarely cites the actual numbers. That’s because Powell, and economists generally, tend to be more interested in the direction in which the numbers are going rather than the numbers themselves. Is unemployment high or low? Is the Dow up or down? Is GDP growth trending upward or downward?

In other words, Powell is telling you a story. And although economists have historically wanted their field to be associated with the so-called hard sciences – a conjuring act exemplified by the Nobel Memorial Prize in Economic Sciences – I’ve come to see it as having a lot more in common with literature, especially novels, than physics or chemistry. As a literary scholar researching economics and its history, I have found that being aware of the similarities between economists and novelists helps us to better evaluate the claims they make. Both are telling stories. Understanding that empowers us to judge the credibility of what they’re saying for ourselves. The notion that economics shares a lot with fiction may seem counterintuitive. That feeling is not incidental.

Ever since the inception of economics in the late 1800s, economists have sought to associate their discipline with the very opposite of fiction: the natural sciences. Unlike economics, which deals with human relationships, the hard sciences study phenomena in the natural world. As such, a claim by a natural scientist reflects a different kind of truth than one by an economist. For example, the law of gravity describes an immutable physical fact; the law of supply and demand describes a relationship between people. What we know as mainstream economics today began with the concept of marginal utility, which posits that individuals make purchases by considering how much happiness they will derive from each additional unit of a good or service.

What attracted many economists to the concept was that it provided a way to make economics more mathematical. The concept of marginal utility allowed economists to turn sensations into quantities. Happiness was imagined as a pile of many little units of pleasure, which some economists actually believed could be physically measured. Francis Y. Edgeworth even conceived of a “psychophysical machine” to do precisely that in his beautifully titled book “Mathematical Psychics.” This is to say that, in the 19th century, the resemblance of economics to the natural sciences fooled even some of its own practitioners.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

“Medieval man was a cog in a wheel he did not understand; modern man is a cog in a complicated system he thinks he understands.”

– Nassim Nicholas Taleb

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars for Paypal and Patreon.