M. C. Escher� Development II �1939

As I said would happen a few weeks ago. Inevitable. But what a curious choice of headline for Reuters. The docs are related to the probe, not to Russia.

• Trump Orders More Russia-Related Probe Documents To Be Declassified (R.)

U.S. President Donald Trump has directed the Justice Department to immediately declassify more information related to the investigation into possible election meddling by Russia, the White House said on Monday. Trump’s demands mark his latest effort to turn up the heat on the Justice Department, whom he and his Republican allies have accused of running a tainted probe into Russian interference in the 2016 U.S. presidential election. Among the documents Trump ordered the Justice Department and the director of national intelligence to make public are 20 additional pages of FBI surveillance warrant applications related to his former campaign adviser Carter Page.

Trump also ordered the release of FBI interview reports with Justice Department official Bruce Ohr related to the Russia probe, and FBI interview reports related to the Page surveillance warrant applications, White House spokeswoman Sarah Sanders said in a statement. Finally, Trump directed the Justice Department to release, without redactions, text messages relating to the Russia probe from former FBI Director James Comey, former FBI Deputy Director Andrew McCabe and other officials, including FBI agent Peter Strzok.

Trump fired Comey in May 2017, originally citing the Russia probe, and then saying that the firing was not “because of the phony Russia investigation.” McCabe was fired in March by Attorney General Jeff Sessions. Strzok was also recently fired, and has been criticized for sending texts disparaging Trump as a presidential candidate.

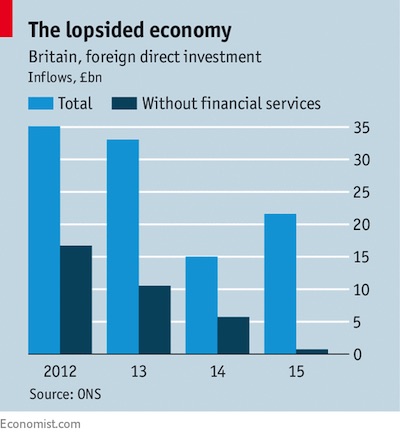

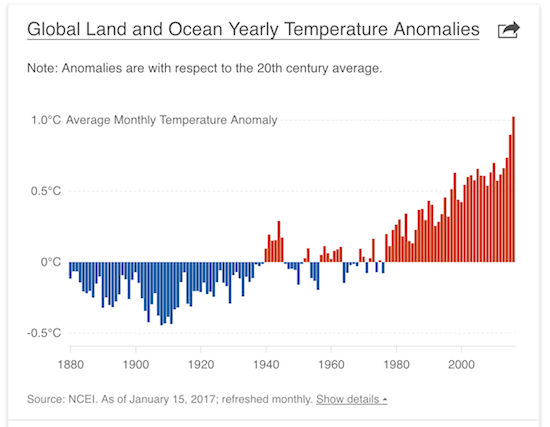

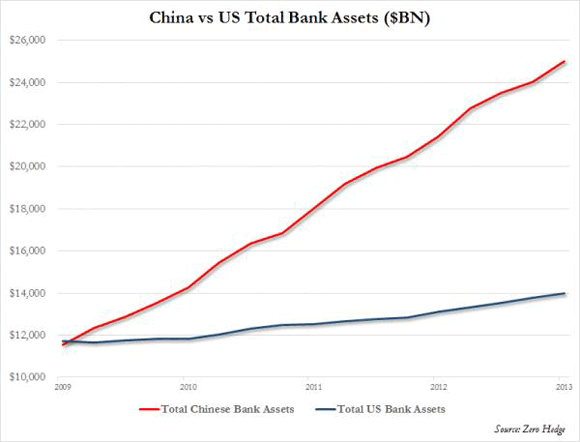

Look at that graph. And keep looking.

• David Stockman Exposes The “$20 Trillion Elephant In The Room” (ZH)

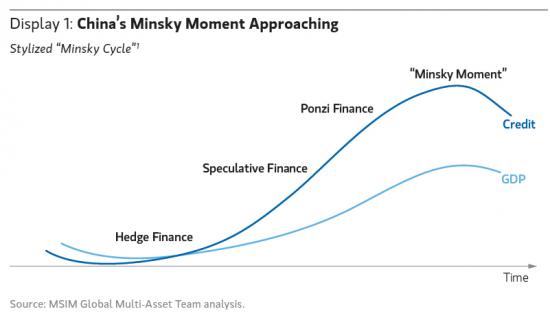

In a recent interview with Sprott Media in Vancouver, Stockman reiterated that he remains a skeptic, particularly in an era where central banks (thanks to their $20-trillion-plus aggregate balance sheet) have destroyed price discovery and contributed to the blowing of a debt bubble that – when it finally pops – will make the aftermath of the financial crisis appear tame by comparison. Stockman begins his interview by clarifying that he would be optimistic about the long-term prospects for growth and markets if it wasn’t for this $20 trillion ‘elephant in the room’.

“I am an optimist, I truly am – if it weren’t for the fact that central banks are totally out of control. So my talk centered on the Great $20 trillion elephant in the room, which is the balance sheets of all the central banks in the world, in excess of what it probably should be in a rational stable historically prudent world”. As central banks have bought up assets, they’ve repressed interest rates, rigged equity prices and provided the fuel for the explosion of debt that has occurred over the past 20 years, Stockman said.And when the music finally stops – as they say – it will be the central banks that bear the brunt of the blame.

“And it’s that $20 trillion, built up over the last two decades, that has basically distorted everything – falsified prices, repressed interest rates, caused an explosion of debt. Twenty years ago there was $40 trillion of debt in the world today there is $250 trillion worth of debt in the world. The leverage of the world has gone from 1.3 times which is stable…to 3.3 times, which basically means the world has created a huge temporary prosperity by burying itself in debt.

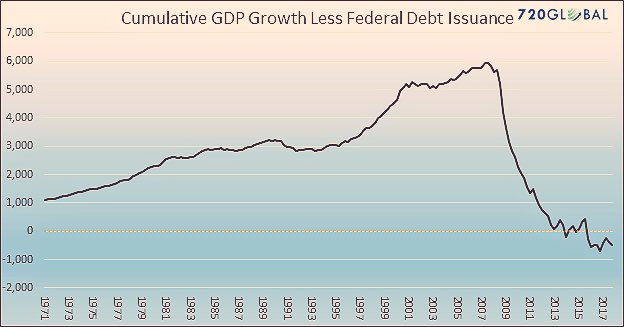

Same difference.

• An Economic Recovery Based Around High Debt Is Really No Recovery (G.)

Rickard Nyman and Paul Ormerod have compared economic forecasting by humans and machines in both the US and the UK, and come up with some stark conclusions. At the start of 2008 the survey of professional forecasters in the US failed to predict that within a year their country would be in a deep recession. Had US policymakers relied on machine-learning algorithms they would have been much better prepared for the trouble ahead. Even more impressive results using machine learning were obtained for the UK. There’s more, however. Nyman and Ormerod sift through all the economic and financial variables that might have been responsible for causing the downturn and come up with a conclusion that explodes the myth that overspending governments were to blame.

“The evidence suggests quite clearly that public sector debt played no causal role in generating the Great Recession” they say. “In contrast, the ratio of private sector debt to GDP does appear to have played a significant role, especially in the UK.” In truth, the idea that state profligacy caused the Great Recession has never been credible. What really happened was that the expansion of the global marketplace led to cheap goods flooding the west. Inflationary pressure abated and that persuaded central banks to cut interest rates. Financial deregulation meant the only remaining constraint on excessive borrowing – high interest rates – was removed – and so credit was cheap and readily available. The private sector loaded up on debt, which was fine so long as the assets on the other side of the balance sheet were going up in value. When the markets turned, things went pear-shaped very quickly.

Excellent example.

• Four Lessons (Not) Learned From The Financial Crisis (F.)

Let’s say you know three people: Alexandra, Meg and Melanie. Alex owes Meg $5, and Meg owes Melanie $5. Further say that they have run into financial trouble. You, the government, believe that if this is not addressed then it could have terrible consequences for the rest of the macroeconomy. So you decide to come to the rescue by paying the $5 . . . but to whom? You have three choices, each of which costs exactly $5: i. Give the money to Alexandra, who passes it to Meg, who passes it on to Melanie. All debts are retired and the economy returns to financial health. ii. Give the money to Meg, who passes it on to Melanie. They both return to economic health, while Alexandra remains saddled with debt. iii. Give the money to Melanie, who then becomes viable once again. Alexandra and Meg remain weighed down.

Guess which one we did? The one that bailed out Wall Street while leaving Main Street indebted. This has two huge consequences. One, higher levels of debt reduce spending and therefore represent a drag on the economy. Second, they increase “financial fragility,” or the likelihood of system-wide insolvency. If the second part sounds like the financial crisis, it should. Fortunately, however, we have avoided such a consequence. Reuters suggests that the structure of debt has changed in a positive way and we should be especially thankful for the low unemployment rate which has meant that people have not had difficulty making payments.

But data from the Bank for International Settlements (displayed below) show two things: 1) the ratio appears to be making an upward turn and 2) it remains much closer to the dangerous levels of the 2000s than those of the New Economy of the 1990s. It was precisely that 2000s level that raised red flags to analysts like Steve Keen, who went on to be recognized as the economist who most accurately forecast the financial crisis. Incidentally, he’s worried again.

It should have been resolved years ago.

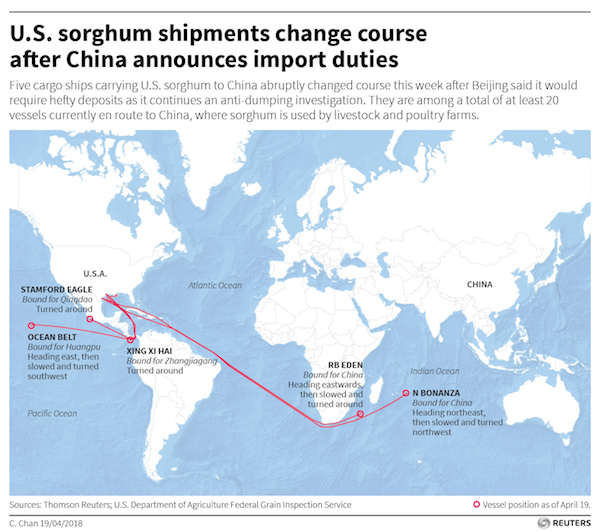

• Trump Is ‘A Symptom And Not The Cause’ Of The Trade War With China (CNBC)

George Yeo, Singapore’s former foreign minister, said at the conference that the “big story” here was the rise of China. The trade war is but one manifestation in the tensions between the world’s two largest economies which could go on for years, he added. There’s a growing anxiety in the U.S. about China’s rise, said Yeo, who is currently chairman of logistics company Kerry Logistics Network. He pointed to how former White House Chief Strategist Steve Bannon said it was an “economic war” and not a trade war. “For Peter Navarro, it’s Death by China,” Yeo added, referring to Trump’s trade advisor and fierce China critic, who wrote a book of that title. “It’s not difficult for an economic war to become a political war to become a real war,” he said.

Both superpowers need to find some kind of “accommodation” in this multi-polar world, Rodrik stressed. China may say that it knows how to manage its economy, and the West needs to recognize Asia’s largest economy has its own model. “On the other hand, I think China will need to understand that it has been a free rider on the system created by the U.S., of openness, and it would have to provide a certain amount of … policy space for the Europeans and the Americans too,” he said, adding that this would be an example of “peaceful co-existence.” “China is playing the long game,” Rodrik said, and the question is how the world can accommodate such a new power. “I view Trump really as a temporary phenomenon, there are deeper issues,” he concluded.

Oil on fire.

• UK Will Shift Brexit Stance In Its ‘Darkest Hour’ Claim EU Officials (G.)

The British government will have to experience its “darkest hour” and stare into the abyss of a no-deal Brexit before it will cave in to Brussels demands, senior EU diplomats have predicted. Ahead of a summit of EU leaders in Salzburg, diplomats in Brussels privately warned that Theresa May still needed to make a significant shift on her red lines for a deal to be possible, with the Irish border issue remaining a major hurdle in the talks. The stark prediction came as a French government official said that the president, Emmanuel Macron, wanted to nail down the key terms of the future deal now, rather than allow any ambiguous drift on the major issues after 29 March 2019.

That was at odds with the UK environment secretary, Michael Gove, who had claimed over the weekend that any deal with the EU on the political declaration could be undone by MPs after Brexit, as he urged his Tory colleagues to support the Chequers proposals “for now”. Brussels wants credible assurances from May that any deal will not be unpicked by her successor. The prime minister was only to be given “a few minutes” to talk to leaders at a dinner on Wednesday night in Salzburg before the 27 talk among themselves the following day, in a sign of the low expectation that she will have anything significant to say until after the Conservative party conference.

Let’s hope someone pays attention.

• Christine Lagarde Warns Of ‘Dire Consequences’ Of Disorderly Brexit (G.)

The UK economy would rapidly start to contract in the event of a disruptive exit from the EU next spring, according to a stark International Monetary Fund report that highlights the recession risks of a no-deal Brexit. Christine Lagarde, the IMF’s managing director, added that there would be costs to the UK under any outcome that involves leaving the EU. Expressing the IMF’s growing concern at the possibility of an acrimonious divorce next March, Lagarde said: “If that happened there would be dire consequences. It would inevitably have consequences in terms of reduced growth, an increase in the [budget] deficit and a depreciation of the currency. “In relatively short order it would mean a reduction in the size of the economy.”

Lagarde said the IMF’s forecast of 1.5% growth next year was based on a smooth exit from the EU. Her remarks were seized upon by the chancellor, Philip Hammond, as evidence that the UK had to strike a deal that would safeguard jobs and prosperity. “As the IMF has said, no deal would be extremely costly for the UK as it would be for the EU,” Hammond said. “Despite contingency planning, it would put at risk the significant progress made over the past 10 years in repairing the economy.” No 10, however, pointedly refused to endorse Hammond’s gloomy predictions. When asked about what he had said, her spokesman referred to what Theresa May told the BBC in an interview broadcast earlier: “The PM said very clearly that she believes our best days are ahead of us and that we will have plans in place for us to succeed in all scenarios.”

All roads lead to Podesta.

• Monsters All the Way Down (Kunstler)

Robert Mueller’s fishing crew was out trawling for Manafort, a blubbery swamp mammal valued for its lubricating oil when, by happenstance, a strange breed of porpoise called a Podesta got caught up in the net. Turns out it was a traveling companion of the Manafort. Back in 2014, the pair swam all the way to a little country called Ukraine via the Black Sea where the Podesta used some Manafort SuperLube on then-president of Ukraine, Victor Yanukovych. The objective was to grease the wheel of NATO and the EU for Ukraine to become a member. But the operation went awry when Yanukovych got a better offer from the Eurasian Customs Union, a Russian-backed trade-and-security org.

And the next thing you know, the US State Department and the CIA are all over the situation and, whaddaya know, the Maidan Square in Kiev fills up with screaming neo-Nazis and Mr. Yanukovych gets the bum’s rush — and despite the major screw-up, the Manafort and the Podesta swim off with a cool few million in fees and return to the comforts of the swamp where they finally part ways. Mr. Mueller is apparently concerned about just what happened with those fees. Possibly the loot ended up getting washed and rinsed through an international banking laundromat, and somehow went unreported to the federal tax authorities.

Of course, the charge raises some interesting questions, such as: were Manafort and Podesta over in Ukraine as opportunistic freelancers, or were they part of phase one of a US government effort to get Ukraine to sign up for Team West against its old Uncle Russia, the manager of Team East? Kind of seems like that was exactly what they were doing, so it will be interesting to see whether Mr. Mueller may have stepped into a big pile of dog shit on his way to the Manafort plea session in federal court.

Please stop it.

• Vulnerable Migrant Groups Must be Removed from Greek Island – MSF (GR)

Greek authorities must remove children and other vulnerable groups from the Moria refugee camp on Lesvos as their physical and mental health is in danger, the Medecins Sans Frontieres (MSF) aid agency said on Monday. A total 615 migrants arrived on Lesvos island in the past three days, local authorities say, adding to the already overcrowded Moria migrant registration center and making living conditions hazardous to public health. The MSF suggests that at least the vulnerable groups (children, elderly, ill) must me moved to the mainland. Overall, there are 11,000 asylum seekers on Lesvos at the moment, with 9,000 of them at the Moria camp.

The policy of over-concentrating migrants and refugees in the Greek islands has led to more than 9,000 people — one third of them children — to be packed in the Moria camp, which has a maximum capacity of 3,000 people, MSF says. “Every week, Medecins Sans Frontieres teams see incidents of adolescents who have attempted suicide or make self-inflicted wounds. They also offer help in serious incidents of violence and self-harm. The lack of access to emergency medical care shows the significant gaps in the protection of children and other vulnerable groups,” the aid agency statement says.

Picked the story up yesterday on Twitter. Tyler doesn’t do the greatest write-up, but I can’t really repost the AP thing either. WikiLeaks was very clear in its reaction:

“”Mr. Assange did not apply for such a visa at any time or author the document. The source is document fabricator & paid FBI informant Sigurdur Thordarson who was sentenced to prison for fabricating docs impersonating Assange, multiple frauds & pedophilllia.”

Pointing to this 3-year old Iceland news article: https://grapevine.is/news/2015/09/25/siggi-the-hacker-gets-3-years-in-prison/.

“Thordarson distributed these docs to Scandinavian media outlets years ago who found them to be untrustworthy. Thorsdarson, a proven serial document fabricator & media hoaxer has been released, so the docs are being recycled yet again.”

Looks like AP was had. Why they run with it anyway is unclear. Due diligence, anyone? Yeah, they claim to have talked to FIVE different Wikileaks people, all anonymous of course. AP claims to have 1000s of docs, and this is the best they can get out of all that?

• WikiLeaks Slams AP “Assange Letter” As Fake, Denies He Sought Russian Visa (ZH)

For years international media outlets worked collaboratively with WikiLeaks to publish leaked files on subjects ranging from the Iraq and Afghan wars to Syria to State Department diplomatic cables, but now it’s WikiLeaks itself that media outlets are attempting to expose. An exclusive Associated Press story claims that WikiLeaks founder Julian Assange sought to obtain a Russian visa as his legal troubles and pressures from Western politicians grew. This comes after US officials have long sought to smear Assange as a Russian asset and the WikiLeaks organization as a whole as working with Russian intelligence.

The AP has published a letter it says is from a WikiLeaks laptop and penned by Julian Assange only days after the group made world headlines by publishing hundreds of thousands of US diplomatic cables in 2010, however WikiLeaks immediately disputed the authenticity of the letter. The AP story begins as follows: “Julian Assange had just pulled off one of the biggest scoops in journalistic history, splaying the innards of American diplomacy across the web. But technology firms were cutting ties to his WikiLeaks website, cable news pundits were calling for his head and a Swedish sex crime case was threatening to put him behind bars. Caught in a vise, the silver-haired Australian wrote to the Russian Consulate in London. “I, Julian Assange, hereby grant full authority to my friend, Israel Shamir, to both drop off and collect my passport, in order to get a visa,” said the letter, which was obtained exclusively by The Associated Press.

Amazon is scary.

How Amazon got to be so powerful, and what it means for our economy: pic.twitter.com/hCGsdUa5v2

— Bernie Sanders (@SenSanders) September 17, 2018