Fred Stein Evening, Paris 1934

Let’s go break some records, shall we?

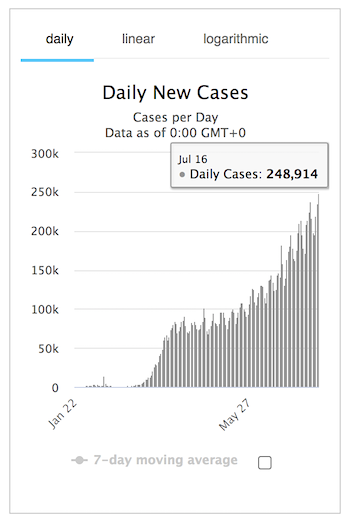

Second wave watch: Israel, Japan, Australia, Hong Kong

These countries are on second wave watch

(2/2) pic.twitter.com/uTs7qNQMJf

— Jim Bianco (@biancoresearch) July 16, 2020

Taleb

https://t.co/EInncilzkK https://t.co/kTc5bnOvI1

— Nassim Nicholas Taleb (@nntaleb) July 16, 2020

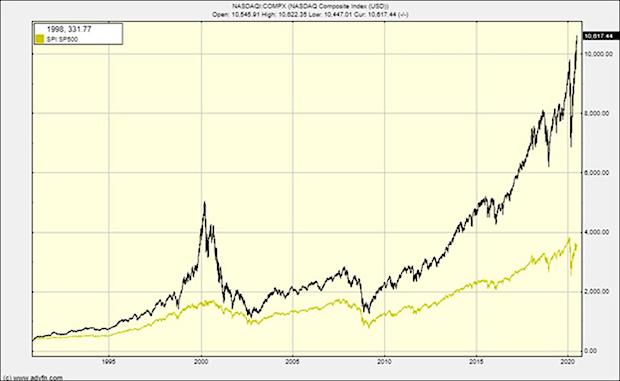

“It won’t be hard to see it coming because if the Nasdaq goes vertical it will be hard to miss.”

• Welcome To The End Game (F.)

If this chart doesn’t make you think the crash is coming soon, then probably nothing will: The Nasdaq is on its final run and is going vertical, a classic end of bubble move. This is trader heaven and turns into speculator hell for those who think that markets do grow to the skies. It could go up a long way in price but it won’t go for long in time. It could last to Christmas, it could fold tomorrow, but my feeling is that unless this bubble is cut down by the Fed, the final move will be large and quick. You can refer to the dotcom crash for the general shape of what looks possible next.

The attempts by the government to pump up the economy with new money is resulting in it going straight into equities and straight into the tip of the equity spear, the giant high beta story stocks. This is a malfunction of the QE mechanism that supports asset prices and slowly trickles the benefits of this support down the pyramid of wealth. Now the game is up because the new money is going straight into this bubble of financial assets that are spiralling up out of control. If we now get a Nasdaq bull vertical that is the end of the chapter of the process, it will be followed by a devastating crash as everyone dashes to the exit in a blaze of wealth destruction.

The Federal Reserve needs to get a lid on this fast and it appears to be trying to by tapering its balance sheet, but the bubble is still fizzing and if it does not stop soon it will do what bubbles generally do, erupt then collapse. The final eruption before collapse looks to be underway and we should only hope it doesn’t happen. If it does enter the terminal bubble phase and then collapse, it will be the second blow to the U.S. and world economy, which repeats the 1930 narrative of the one-two punch of twin crises. In the Great Depression it was “stock market crash” followed by “banking crisis.” Here it will be “lockdown” followed by “stock market crash.”

Immune response differs greatly from one person to the next.

• Immune Response To Coronavirus Could Be a Matter of Life And Death (SCMP)

Differences in the way people’s immune systems respond to being infected with the coronavirus could be a matter of life or death, according to a new study. When the human body comes under attack from a virus, the immune system produces T cells to tackle it. These mostly come in two forms: “helpers”, which organise the defence response, and “killers”, which are told how and where to fight. The killers destroy virus cells with toxic chemicals, but to do the job effectively requires precise coordination with the helper cells. In many patients who became seriously ill with Covid-19, this teamwork was missing, according to researchers from the Hospital of the University of Pennsylvania in the United States led by associate professor of medicine Dr Nuala Meyer.

According to their study, published in Science magazine on Wednesday, there are “three ‘immunotypes’ associated with poor clinical trajectories versus improving health”. The team found that in some patients there was a disproportionately large number of helper cells while the generation of killer cells was suppressed. This meant that while there was a lot of “horn blowing” about the threat posed by the virus, there were too few fighters to tackle it effectively. The second immunotype encompassed those people whose immune systems produced a much higher number of killer cells, meaning they were better armed to destroy the invaders, but not enough helper cells to coordinate the fight. As a result, they suffered significantly from Covid-19 but managed to survive it, the study said.

At the other end of the spectrum were those who failed to produce enough T cells of either kind, meaning they lacked the firepower to destroy the invasive cells and were therefore the most at risk of dying. The US study looked at 125 patients, making it the largest of its kind yet conducted. Although the scientists were unable to fully explain the different immune system responses, they suspected it might be linked to the patients’ general health at the time of infection. While most of the Covid-19 patients in the study had received more or less the same treatments, the researchers said doctors might need to consider a more tailored approach. “The findings promote the idea of tailoring clinical treatments or future immune-based clinical trials for patients whose immunotype suggests a greater potential benefit,” they said.

However, a doctor at a hospital treating Covid-19 patients in Beijing, who asked not to be named, said such a system was already in place. He said that while the reasons for different immune responses remained unclear, frontline doctors had been observing huge differences in the way people reacted to treatment methods since the early days of the coronavirus outbreak in China. A treatment that might work wonders for one person, could kill another, he said. “Too many helper T cells can lead to a storm [of inflammation],” he said. “Some drugs can suppress this signal before they raise havoc.”

We know nothing. When will we acknowledge that?

• My Patient Caught COVID19 Twice. So Long To Herd Immunity Hopes? (Vox)

“Wait. I can catch Covid twice?” my 50-year-old patient asked in disbelief. It was the beginning of July, and he had just tested positive for SARS-CoV-2, the virus that causes Covid-19, for a second time — three months after a previous infection. While there’s still much we don’t understand about immunity to this new illness, a small but growing number of cases like his suggest the answer is yes. Covid-19 may also be much worse the second time around. During his first infection, my patient experienced a mild cough and sore throat. His second infection, in contrast, was marked by a high fever, shortness of breath, and hypoxia, resulting in multiple trips to the hospital.

Recent reports and conversations with physician colleagues suggest my patient is not alone. Two patients in New Jersey, for instance, appear to have contracted Covid-19 a second time almost two months after fully recovering from their first infection. Daniel Griffin, a physician and researcher at Columbia University in New York, recently described a case of presumed reinfection on the This Week in Virology podcast. It is possible, but unlikely, that my patient had a single infection that lasted three months. Some Covid-19 patients (now dubbed “long haulers”) do appear to suffer persistent infections and symptoms. My patient, however, cleared his infection — he had two negative PCR tests after his first infection — and felt healthy for nearly six weeks.

I believe it is far more likely that my patient fully recovered from his first infection, then caught Covid-19 a second time after being exposed to a young adult family member with the virus. He was unable to get an antibody test after his first infection, so we do not know whether his immune system mounted an effective antibody response or not. Regardless, the limited research so far on recovered Covid-19 patients shows that not all patients develop antibodies after infection. Some patients, and particularly those who never develop symptoms, mount an antibody response immediately after infection only to have it wane quickly afterward — an issue of increasing scientific concern. What’s more, repeat infections in a short period are a feature of many viruses, including other coronaviruses.

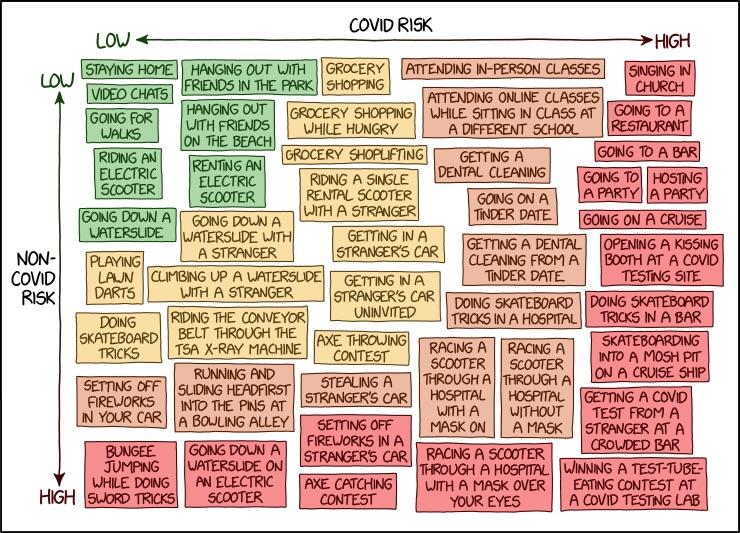

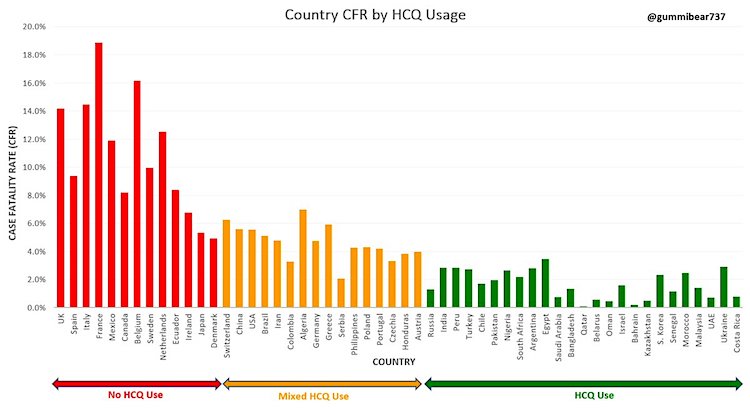

A Twitter thread that looks into a whole slew of reports on HCQ.

• My Hydroxychloroquine Deep Dive (GB)

Gotta start with this chart many of you have seen by now In early June after months of following articles, treatment protocols, declarations, etc. I was curious about how the countries lined up. For the most part, it’s accurate

Image It’s not perfect as HCQ was also used in Belgium and Spain and later in Italy, but the idea is that Western Europe as a whole never embraced the ‘treat early and often’ strategy. Mostly they tried it with sick patients, didn’t work..moved on They mainly followed the WHO position. I wanted to address the chart first, because its not a work of great science. It was meant to provoke thought and discussion. Along the way, some saw it as proof. It’s not, but it does make you say “hmm..” In this thread, I’m going to try and go much deeper into the data.

Sometimes I think maybe it’s just too simple, that people want it to be more complicated for them to believe it.

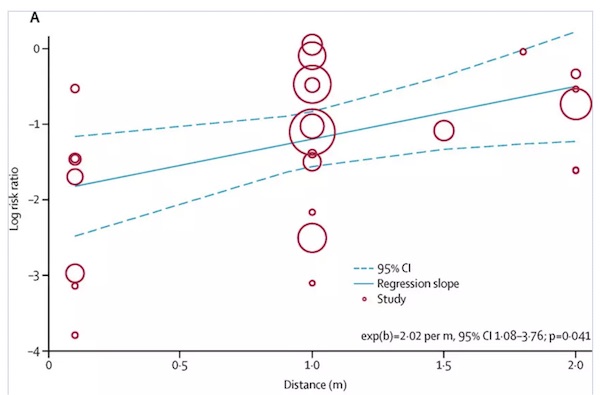

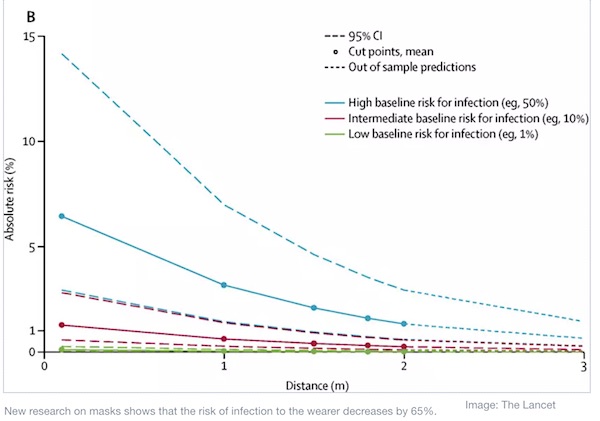

By the way, pieces like this should always mention the risk cuts when two people in an interaction both wear a mask.

And all the things you see about wearing masks outdoors? BS. Unless you’re in prolonged close interaction.

• A Mask Cuts Your COVID-19 Risk By 65% (WEF)

Social distancing and wearing a mask prevent you from spreading COVID-19, but they also protect you from getting it, two experts explain in a new video discussion of coronavirus transmission. A range of new research on face coverings shows that the risk of infection to the wearer decreases by 65%, says Dean Blumberg, chief of pediatric infectious diseases at the University of California, Davis Children’s Hospital. “On the issue of masks, I’d like to restart—because we’ve learned a lot,” Blumberg says. “We’ve learned more due to research and additional scientific evidence. What we know now is that masks work and are very important.” Blumberg and William Ristenpart, a professor of chemical engineering, appeared on a recent livestream devoted to explaining how the coronavirus spreads and how to prevent transmission.

In their comments and answers to questions from viewers, Blumberg and Ristenpart repeatedly made the point that research continues to support the fundamental methods to prevent spreading COVID-19: Wear masks, maintain social distance, and keep social interactions outdoors whenever possible. There are two primary methods of coronavirus transmission, Blumberg and Ristenpart explain. The first is via droplets a carrier expels, which are about one-third the size of a human hair but still large enough that we can see them. Masks create an effective barrier against droplets. “Everyone should wear a mask,” Blumberg says. “People who say, ‘I don’t believe masks work,’ are ignoring scientific evidence. It’s not a belief system. It’s like saying, ‘I don’t believe in gravity.’

“People who don’t wear a mask increase the risk of transmission to everyone, not just the people they come into contact with. It’s all the people those people will have contact with. You’re being an irresponsible member of the community if you’re not wearing a mask. It’s like double-dipping in the guacamole. You’re not being nice to others.” The second major coronavirus transmission method is via the aerosol particles we expel when we talk. Those are about 1/100th the size of a human hair and are more difficult to defend against. Social distancing and staying outdoors, where there is more air flow, are helpful, Blumberg and Ristenpart say. “Studies in laboratory conditions now show the virus stays alive in aerosol form with a half-life on the scale of hours. It persists in the air,” Ristenpart says. “That’s why you want to be outdoors for any social situations if possible. The good air flow will disperse the virus. If you are indoors, think about opening the windows. You want as much fresh air as possible.”

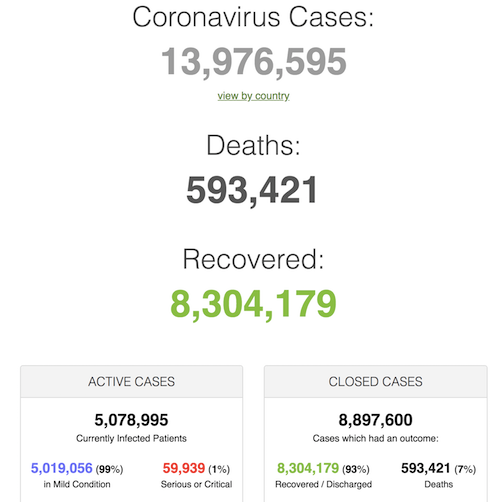

More stories about refrigerated trucks outside morgues.

• Georgia Hospital Worker Sounds Alarm (NPR)

The emergency room overflowed with patients. Then, the next wave arrived. This time on stretchers. “They were lined up along the walls in the ER,” a health care worker inside a Navicent Health-owned hospital in middle Georgia told GPB News. “We never have had an influx like that. Since the Fourth of July, it has just exploded.” Staff members did what they always do. They tended to patients as best they could. For the sickest patients, staff searched for available beds in nearby hospitals. In previous weeks, the health care worker said, COVID-19 patients typically got transported to medical centers about 70 miles north to Atlanta or 160 miles east to Savannah. This week, there was no room. Desperate, the health care worker said, administrators began checking available hospitals in Kentucky, Tennessee, Alabama, North Carolina, South Carolina and Florida.

The distance stretched more than 850 miles north to south, from Louisville, Ky., down to Orlando, Fla. “When you have to start shipping patients out of state, it’s bad,” the worker said. “When the hospitals are full, that’s when it becomes really dangerous for everybody.” The Navicent employee approached GPB News late Wednesday, saying hospital systems are not providing an accurate reflection of what staffers are seeing inside the walls of medical centers overrun with patients. The employee spoke on condition of anonymity for fear of getting fired, and NPR is not identifying the Navicent hospital where the employee works to maintain that person’s anonymity. “People will never understand if we do not tell the truth about how bad it really is,” the employee said. “That’s what makes us so angry.”

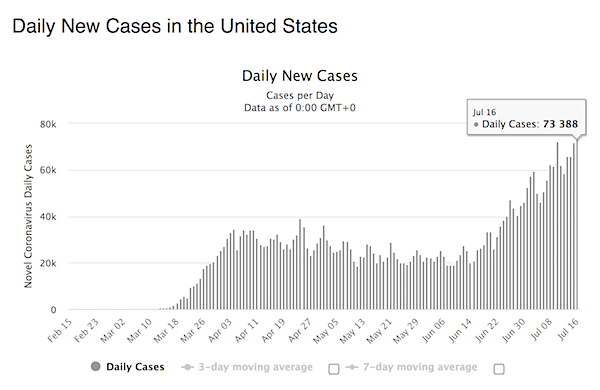

Tired of being stuck at home, Georgians headed to beaches and bars, to hair salons and restaurants. Many flaunted not wearing masks as if the virus were gone. For some, it was their own personal way of telling the government to shove its restrictive policies. Public health officials warned of opening too fast, too soon – that you can’t wish a virus away. Georgia has seen coronavirus cases skyrocket as residents have gone about business as usual in recent weeks. Cases have topped 127,000, and more than 3,000 lives have been taken. Just three weeks ago, the overall cases stood at 69,000.

End of July.

• Unemployment Increase Set To End As Jobless Claims Climb (NYP)

A boost in unemployment pay is about to run out for people who lost their jobs due to the coronavirus pandemic — as jobless claims pass 51 million. The $600-per-week federal supplement in unemployment insurance is a flashpoint ahead of talks next week on a new coronavirus relief bill. Republicans including Senate Majority Leader Mitch McConnell oppose extending the boost — though there are hints of a potential compromise. The supplement for weekly unemployment was intended to ensure that most people kept the same income if they were temporarily out of work, but it officially runs out at the end of July. If it’s taken away, people would only get weekly benefits from state governments, which range from less than $250 a week in Arizona and Louisiana to over $1,200 with dependents in Massachusetts.

Many people have returned to work as states allow businesses to reopen, but another 1.3 million Americans applied for first-time unemployment benefits last week. From the start, Senate Republicans objected to the boost resulting in some jobless people earning more than 100 percent of their prior pay due to varying state rates, saying it created an incentive not to work. McConnell (R-Ky.) said this month that extending the boost won’t be in a new bill. “We’re hearing it all over the country that it’s made it harder actually to get people back to work,” he said. White House economic adviser Larry Kudlow is pushing for a “back to work” bonus to replace the unemployment bump. But signaling room for compromise, Treasury Secretary Steven Mnuchin, the top Trump administration negotiator on past packages, said last week a priority was changing the provision to ensure “no more” than 100 percent of pre-pandemic pay was awarded.

It’s obvious the industry will not return, or at least for a very long time. So why bail it out?

• Key US Lawmakers Back Unions’ Call For New Airline Bailout (R.)

Key U.S. House Democrats are backing a push by airline unions for a new round of government bailouts to keep workers employed in the face of tens of thousands of possible layoffs this fall, according to a letter encouraging other colleagues to sign on. In March, Congress approved $32 billion for the aviation industry to keep workers on payroll through Sept. 30, but as air travel demand remains depressed in the pandemic, airlines have warned of furloughs in October, prompting union calls for a six-month extension of aid. Airlines for America (A4A), a trade group representing major U.S. airlines, said Thursday it is not actively seeking new government assistance but would accept new bailout funds as long as no new strings were attached.

Under the first package, airlines agreed to limits on share buybacks and executive compensation, and issued warrants on a portion of the funds that the government can exchange for shares. If Congress enacts labor’s proposal, “we would support our workforce’s decision to pursue a simple and clean extension of the grants as long as no additional or extraneous conditions are required,” an A4A spokeswoman said. Airlines also agreed not to force any job cuts before October, giving them time to assess the pace of a recovery. Now over 60,000 airline workers at American Airlines and United Airlines alone are facing furlough warnings. Delta is hoping to avoid furloughs after about 17,000 employees volunteered for buyouts, though Chief Executive Ed Bastian said in a memo on Friday that the airline is still overstaffed in some areas based on its network and demand projections.

To be continued.

• AG Barr: US Companies Kowtow To China (JTN)

Attorney General William Barr on Thursday condemned U.S. businesses for compromising American principles while chasing profits from China. Barr during a speech at the Gerald R. Ford Presidential Museum in Michigan warned about the Asian super power’s ambitions and the tactics it uses to achieve its aims. “The People’s Republic of China is now engaged in an economic blitzkrieg — an aggressive, orchestrated, whole-of-government (indeed, whole-of-society) campaign to seize the commanding heights of the global economy and to surpass the United States as the world’s preeminent technological superpower,” Barr said.

“It is clear that the PRC seeks not merely to join the ranks of other advanced industrial economies, but to replace them altogether,” he said. “If you are an American business leader, appeasing the PRC may bring short-term rewards. But in the end, the PRC’s goal is to replace you.” The attorney general said that while doing business with China has failed to soften the country’s authoritarian regime, it has had negative results as some American businesses seek to appease China in order to retain the ability to do business there. “As this administration’s China Strategy recognizes, ‘the [Chinese Communist Party’s] campaign to compel ideological conformity does not stop at China’s borders.’

Rather, the CCP seeks to extend its influence around the world, including on American soil,” he said. “All too often, for the sake of short-term profits, American companies have succumbed to that influence—even at the expense of freedom and openness in the United States.” Barr pointed to Hollywood for taking actions to appease the Chinese regime. He also called out technology companies, saying that organizations “such as Google, Microsoft, Yahoo, and Apple have shown themselves all too willing to collaborate with the CCP.” “The American people are more attuned than ever to the threat that the Chinese Communist Party poses not only to our way of life, but to our very lives and livelihoods,” he said. “And they will increasingly call out corporate appeasement.”

And in the midst of it all, they insist on keeping the twice-yearly idiotic move between Brussels and Strasbourg going. You don’t want to know what that costs.

• So Much Money, So Little Time To Find Deal At EU Summit (AP)

As European Union leaders start pouring in early for a two-day summit starting Friday, all realize that rarely so much has been on the line. The 27-nation bloc is battered by the coronavirus pandemic, much of its economy in need of a massive aid injection and its countries riven by disputes ranging from the respect for basic democratic principles to the need for tough controls on spending. “The crisis brought about by this pandemic, with all of its economic and social consequences, is the most severe we have had to face since the Second World War,” European Council President and summit host Charles Michel said Thursday.

To make sure their nations bounce back, the 27 leaders will be assessing an overall budget and recovery package spread over seven years estimated at around 1.75 trillion to 1.85 trillion euros. “Does 1.75 trillion euros ($2 trillion) seem like a lot of money to you? Believe me, it does to the European heads of state or government too,” Michel said. It has certainly been enough to end a rut of five remote videoconference summits that yielded little to bring sides closer together and forced everyone to come in person to the urn-shaped Europa summit center for at least two days of summiteering. On the eve of Friday’s opening, French President Emmanuel Macron will already be huddling with Italian Prime Minister Giuseppe Conte to find the best way to help nations most affected by the crisis.

Chancellor Angela Merkel of Germany, which holds the rotating EU presidency and is seen as holding the key to a successful outcome, already had video conference talks with Michel. “An agreement is not guaranteed — to the contrary,” said an EU official involved in the talks. He spoke on condition of anonymity because the talks were ongoing. “There are still important differences.” The members were already fighting bitterly over the seven-year, 1-trillion-euro EU budget when COVID-19 was still a local story in Wuhan, China, late last year.

Then the virus hit the EU head on and estimations are now that the economy of the 19 countries that use the euro currency will contract by 8.7% this year. It sent the EU into a panic as it was at a loss on how to coordinate policies of its member states early on. Now, the EU’s executive is proposing a 750-billion-euro recovery fund, partly based on common borrowing, to be spent as loans and grants to the most needy countries. The group of the four so-called frugal countries, led by the Netherlands, is questioning the need for grants and also wants strict governance criteria, including the possibility of veto, on how the money will be spent. There are also questions on which nations should be the main beneficiaries.

Why even bother denying anymore?

• Russia Rejects UK’s Claims Of Hacking & Election Meddling (RT)

Contradictions in the words of the UK’s top diplomat were pointed out by the Russian Foreign Ministry’s spokeswoman, Maria Zakharova. Raab’s statement “was so ambiguous and inconsistent that it was practically impossible to understand,” she said. With London confirming that it has no proof against Russia, but still threatening retaliatory measures, “there’s a feeling that we have a new loop of the ‘highly likely’ tactics.” “Highly likely” was the phrase used by then-UK Prime Minister Theresa May to blame Russia for the chemical poisoning of double agent Sergei Skripal in Salisbury back in 2018. Two years later, London hasn’t provided any convincing evidence to back the claim.

Raab’s “almost certain” will apparently become the new go-to formula for the UK authorities, but the tactics of blaming Russia for internal problems in Britain will remain the same, Zakharova said. The Russian Embassy in London called it a purely propagandist step, noting that it never received any notes of protest from the British parties regarding the hacking claims. As for Raab’s threats of retaliation, an embassy spokesman said that “any unfriendly steps towards Russia won’t be left without a proper and adequate response.” The hacking claims were an attempt to “tarnish the reputation of the Russian vaccine” against the coronavirus, CEO of Russian Direct Investment Fund (RDIF) Kirill Dmitriev said.

Those behind the slur are “scared of [the vaccine’s] success because the Russian vaccine could potentially be the first on the market and it potentially could be the most effective,” he explained. It’s no coincidence that those accusations were made just after the announcement that the state regulators will be approving the Russian vaccine in August, Dmitriev added. Besides, stealing data from the UK would have made no sense for Moscow, as a Russian firm, R-Pharm, will be producing the British vaccine made by Oxford-based AstraZeneca. “No secrets are needed. Everything is already given to R-Pharm,” Dmitriev said.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

McEnany

Case Study in Media Bias:

I said: “The science is very clear on this…the science is on our side here. We encourage our localities & states to just simply follow the science. Open our schools.”

But leave it to the media to deceptively suggest I was making the opposite point! https://t.co/vlxk3zRsgh

— Kayleigh McEnany (@PressSec) July 16, 2020

LarryElder

Wow, you need to see this!@larryelder @rubinreport pic.twitter.com/u6MIWAqe1O

— PragerU (@prageru) July 16, 2020

Who on earth made this? And how? 2020 The Movie.

This is absolutely spectacular. pic.twitter.com/s5DxlxlkFo

— Dave Rubin (@RubinReport) July 16, 2020

Support the Automatic Earth in virustime.