Fred Stein Streetcrossing, Paris 1935

Currency manipulation?

• To Make America Great Again, Trump Will Have To Make the Dollar Weak Again (MW)

If Donald Trump really wants to Make America Great Again, he’s going to have to Make the Dollar Weak Again first. So argued hedge fund manager Mathew Klody of MCN Capital Management at this week’s Grant’s investment conference in New York. He made an intriguing case. If Klody’s right, Trump may just be blowing smoke when he talks about tariffs and border-adjustment taxes. And, most importantly, if Klody is right, we should also buy foreign currencies, especially those issued by emerging markets. Sooner or later, the president will need to drive down the dollar, and for those based in the U.S. that will drive up foreign currencies. Mexican pesos, anyone? This is not far-fetched. Research Affiliates, the smart investment advisers in Newport Beach, Calif., argue that emerging market currencies are among the most attractive asset classes available to investors.

They’re expecting those currencies to produce returns in U.S. dollars of inflation plus about 3.5% a year over the next decade, with far less volatility than stocks. Incidentally, if Klody’s analysis is right, Trump should also, logically, be good for gold. The collapse of American manufacturing towns, and the old industrial middle class, has gone hand in hand with a staggering 40-year rise in the dollar, Klody observed. It is standard economics that as your currency rises, your exports become more expensive and less competitive in foreign markets. Meanwhile, the reverse happens at home: Imports from overseas get cheaper and cheaper compared with domestic production. Klody noted that since the mid-1970s, the U.S. dollar has quadrupled in price — yes, really — when measured against the Federal Reserve’s broad basket of foreign currencies.

It may be mere coincidence that during that same period, imports have surged, and the U.S. has lost its global dominance in many areas of manufacturing. MCN Capital’s Klody notes that during the period that the dollar soared, workers’ share of domestic income has plummeted.From the 1940s through the early 1970s, the working man and woman got a pretty consistent 50% of national domestic income.Since the mid-1970s, it’s collapsed to around 43%. And, yes, that’s happened under most political regimes (the Clinton-Gingrich-dot-com years in the 1990s being an exception).That, of course, is a big reason why Trump won. Klody himself came from a small town in Pennsylvania that used to be a classic American industrial boomtown. And now, according to the town’s mayor, it looks like a deserted bomb site.

Tyler: “The above, simply summarized: the Fed has given Trump just enough rope to hang himself with; and since all that matters now is how effective the President will be in passing his political agenda – which is not looking good- should Trump fails, the one of two possible outcomes that is most likely is the one where the “curve bear flattens or inverts”, prompting the next, long overdue, recession. “

• The Fed Gave Trump Just Enough Rope To Hang Himself With – Deutsche (ZH)

Aleksandar Kocic: “The subtext of the last week’s Fed “package” is a compromise motivated by a desire to extend the comfort zone and to hedge their position against possible fiscal irresponsibility, while, at the same time, not stand in the way to any possible fiscal stimulus (or its absence) by hiking too aggressively…. Depending on the interplay between degree of political resolve and the Fed actions we could see two distinct paths of resolution of the existing tensions in the mid- or long-run. Last week, the Fed delivered what appears as a dovish hike, in all likelihood to be followed with two hikes more in 2017 and three in 2018. Such a choice of the Fed action was a compromise driven by the developments in the labor market and the key events in Europe, on one side, combined with the risk associated with the approval of the fiscal stimulus, on the other.

The subtext of this compromise can be interpreted as being motivated by the Fed’s desire to extend the comfort zone and to hedge their position against possible fiscal irresponsibility, while, at the same time, not stand in the way to any possible fiscal stimulus by hiking too aggressively. Despite all the efforts not to create more uncertainty, this is likely to create at least mild ambiguity regarding the long-run. A Fed which is not in a standby position waiting for the fiscal package to arrive and kick in is going to be supportive for USD and higher real rates. The March FOMC “package” (in terms of rate hike, dots, rhetoric and Q&E) implies effectively a real rate rise and is most likely bearish for breakevens, which could diminish the effect of the border tax on the trade deficit and, as such, reduce the impact on growth potential.

In addition, having higher real rates increases the costs of borrowing and possibly creates political resistance against deficit expansions and structural steepening of the curve. On top of that, given what we saw in the last weeks, this suggests that the political process around the budget plan and the Legislative package already expected by the market is going to be anything but smooth, which is adding further doubts about its success and timing. Depending on the interplay of politics and policy – degree of political resolve and the Fed actions – we could see two distinct paths of resolution of the existing tensions in the mid- or long-run.

On one hand, it appears that the Fed is removing uncertainty around the terminal rate, while on the other, politics is creating a binary outcomes which could have a dramatically different effect on long rates. In that context, we are facing a future with bifurcating back end of the curve. Either political bottlenecks clear and the stimulus gets approved and goes full force leading to higher growth potential with subsequent rise in price levels and structural steepening of the curve, or political tensions effectively sabotage either its arrival or content (or both), and the curve initially bear flattens or even twists with rate shorts capitulation accelerating the rally of the back end.”

Find a -nearly- deserted island to live on.

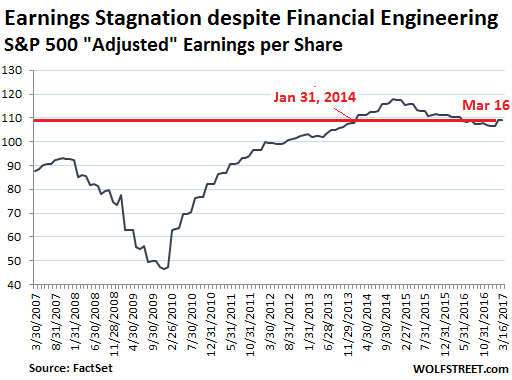

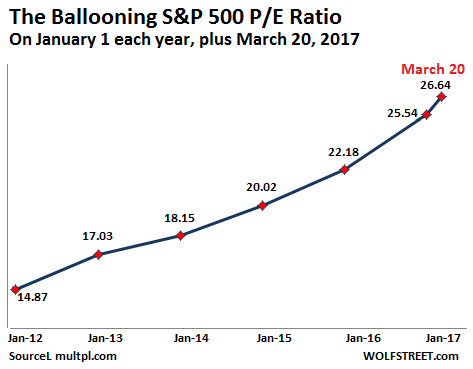

• S&P 500 Companies Blow $1.7 Trillion On Making Earnings Look Less Bad (WS)

The S&P 500 index, closing today at 2,373, hovers near its all-time high. Total market capitalization of the 500 companies in the index exceeds $20 trillion, or 106% of US GDP. In the three-plus years since the end of January 2014, the index has soared 33%. And yet, over these three-plus years, even with financial engineering driven to the utmost state of perfection, including $1.7 trillion in share buybacks and despite “ex-bad-items” accounting schemes that are giving even the SEC goosebumps – despite all these efforts, the crucial and beautifully doctored “adjusted” earnings-per-share, perhaps the single most manipulated metric out there, has gone nowhere. “Adjusted” earnings per share are back where they’d been at the end of January 2014. It’s a sad sign when not even financial engineering can conjure up the appearance of earnings growth.

Companies report earnings in two ways: 1) All companies report as required under GAAP (our slightly inconvenient Generally Accepted Accounting Principles). These earnings are often a loss or way too small and shrinking, instead of growing, and hence not very palatable. 2) So most companies also report pro-forma, ex-bad-items, “adjusted” earnings, based on the companies’ own notions of what matters. Analysts and the media hype that metric. This is just a method of reporting the same results in a more glamorous manner. Then there’s financial engineering. Companies borrowed heavily over the past few years and used those funds to purchase their own shares. This hollowed out equity and left companies with piles of debt.

Over the past three years, companies blew $1.7 trillion on share buybacks. This money was not invested in productive activities that would have expanded the company and the economy, and generated cash flow to service this debt. All it did was reduce the number of shares outstanding. This has the effect of increasing earnings per share (EPS) though the company didn’t actually make more money. Add this system of share buybacks to the system of “adjusting” earnings per share via reporting schemes, and the result should be a miracle of soaring “adjusted” EPS. But no.

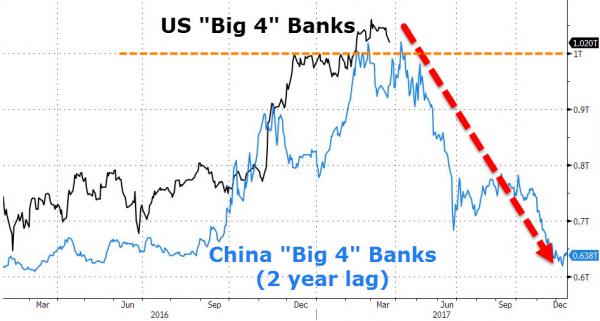

“..surged 30% since Donald Trump was elected president..”

• US “Too Big To Fail” Banks Top $1 Trillion – What Happens Next? (ZH)

For the first time ever, the market cap of America’s “Big Four” banks topped $1 trillion having surged 30% since Donald Trump was elected president. While to some this is cause for celebration, we note that the last time a nation’s “big four” banks topped $1 trillion in market cap did not end well… As Bloomberg notes, the four biggest U.S. banks were worth the most on record versus China’s “Big Four” this month, as JPMorgan, Wells Fargo, Bank of America, and Citigroup were worth over $250 billion more than Industrial & Commercial Bank, China Construction Bank, Bank of China, and Agricultural Bank of China combined. The four Chinese banks, the world’s most profitable, were worth about the same as the U.S. foursome as recently as June. However, as the chart shows, while the American quartet’s combined market value closed above $1 trillion for the first time last month, China achieved that goals in June 2015… and it did not end well.

Too late now.

• Australia’s Central Bank Warns Of Growing Risks In Housing, Debt (CNBC)

Australia’s central bank saw growing risks in the nation’s hot housing market when it left rates steady earlier this month, underlining the case against further easing in policy. Minutes of its March meeting showed the Reserve Bank of Australia (RBA) was generally optimistic about the economy as it transitioned away from a decade long boom in mining investment. However, board members felt there had been a “build-up of risks” in the housing market as borrowing for investment fueled brisk price rises in Sydney and Melbourne. Home prices accelerated at an annual pace of 11.7% in February, with Sydney running red-hot at 18.4%, data from property consultant CoreLogic showed. Governor Philip Lowe has repeatedly argued that cutting rates further could encourage a renewed borrowing binge by households who are already heavily indebted, outweighing any economic benefits.

With wages growing at record lows, debt was outpacing incomes and threatening to weigh on consumer spending. Data out recently showed retail sales grew at a tepid pace for a third straight month while the outlook for capital expenditure remained uninspiring. The RBA noted tighter supervision had contributed to “some” strengthening in lending standard by the banks, which has also been raising rates on some mortgage products recently. Analysts suspect even stricter standards are likely to be imposed by regulators in coming weeks. Housing affordability, or the lack of it, has become a hot-button issue for the conservative government of Malcolm Turnbull which has promised measures to ease the problem in its May budget. The RBA’s angst over housing has convinced financial markets there will be no more cuts in interest rates, already at all time lows of 1.5%.

They’re too scared too crack down on anything. Housing can bring down the entire Oz economy by now.

“I don’t use the B-word. I refuse to use the B-word..”

• Australia Bank Regulators To Unleash New Crackdown On Lenders (AFR)

Regulators are preparing to impose a fresh wave of constraints on the banks to slow investor lending growth, crack down on interest-only loans, and force buyers to stump up more equity on purchases as they scramble to manage a rampant property boom. Warning that financial and economic risks have grown in recent months, particularly across east coast property markets, the nation’s top financial regulators and Treasurer Scott Morrison unleashed co-ordinated calls for fresh restraint from banks. “Watch this space,” declared Australian Prudential Regulation Authority chairman Wayne Byres on Monday, speaking just hours after Mr Morrison urged APRA and the Australian Securities and Investments commission to use “the levers that they have”. Leaping house price growth over recent months in Sydney and Melbourne, as well as a tsunami of new apartment stock due to hit the market in coming months are creating a wall of uncertainty over the financial stability of the housing market.

That’s being exacerbated by concerns over heavily indebted households’ ability to withstand a rising global interest rate environment at a time of record-low wages growth. In a sign of growing tensions between members of the Council of Financial Regulators – which includes APRA, ASIC, Treasury and chaired by the Reserve Bank – Mr Byres pointedly refused to describe the property market as being in a “bubble”, saying use of the term was “superficial” and “binary”. “I don’t use the B-word. I refuse to use the B-word,” Mr Byres said. “We are in it – we are not in it. If we are in it we’re all going to be ruined – if we are not in it we’re going to be right. It’s too simplistic.” By contrast, Greg Medcraft, ASIC’s chairman, bluntly repeated his view that the market was in a bubble. “I have been saying for a while that I thought it was a bubble and other people are catching up now. “Clearly the issue is if you raise interest rates that’s a big tool but then you affect the whole economy.”

Hike rates into this.

• Toronto Home Prices May Jump 25% This Year – TD (BBG)

Toronto’s housing market is likely to stay strong for the rest of the year, with home prices jumping as much as 25%, amid hints that speculators are fueling demand and posing a potential risk to the economy, TD Economics Chief Economist Beata Caranci said. A “strong Toronto home-price forecast is not a vote of confidence in market fundamentals,” Caranci wrote Monday in a note to clients. “It’s getting harder to ignore warning signs that market demand pressures are increasingly reflecting speculative forces.” Residential prices in Canada’s largest metropolitan region are forecast to grow 20 to 25% this year, up from a previous estimate of 10 to 15%, according to the report by TD Economics, part of Toronto-Dominion Bank.

Toronto-area prices have climbed 19% in the past 12 months, the fastest clip since the 1980s, when a frenzied housing market resulted in year-over-year increases of 55%, Caranci said. “Evidence is building that speculative forces are growing deeper roots, which raises the risk that prices will move closer to the top end of that forecast in the absence of policy measures,” Caranci wrote. As for next year, higher mortgage rates and fewer affordable properties will likely cut the growth rate to 3 to 5%, though a lack of clarity on housing speculation makes predictions difficult, Caranci said. A housing market driven by speculators seeking a quick profit boosts the risk of rapidly unwinding price gains at the same time homebuyers are contending with larger debt burdens, she said.

Seen this movie so many times before.

• Canada Real Estate: This Is Going To Blow Sky High (Bergin)

Originally, I thought this would be a bit of a joke. There were billboards in all the Toronto subway cars advertising the Canadian Real Estate Wealth Expo – learn how to become a millionaire. I thought this was so ridiculous, it may be fun. What better way to experience the top of the housing market than watching Tony Robbins and Pitbull along with a bunch of US real estate professionals explain how Toronto real estate is the path to riches. Prices were originally $150 per ticket, but I was able to buy for $50. While it deeply bothers me that I paid $50 to these shameless (amoral) self-promoters, I thought it would be worth it to witness, in person, the top of the housing market. I had thought, there can’t be that many people stupid enough to attend this, but I was very wrong – 15,000 people were there! I was blown away. Bubbles are largely psychological. This crowd was tangible proof of that.

15k people in one spot listening to Americans explain why real estate in Toronto is an exceptional investment. The whole experience was horrifying. The crowd was very well-dressed, middle- to upper-middle class (from appearances), and super excited to hear how much money could be made if you just buy real estate (most of them clearly already owned). The first real segment of the expo was a panel of Canadian developers and real estate agents giving their views on the market. It actually started off a touch bearish, which surprised me. Two of the panelists were saying that prices are exceptionally high and no market goes up forever. With that slight bit of caution thrown out there, it became a real estate FOMO-building talk.

There are, apparently, two very important things to know when dealing with real estate. First, you have to face your fear; this fear is to be ignored and then you should ‘just do it’ and ‘buy now’. The next step is find what you can afford and then buy it. Ignore all ‘non-doers’, don’t overanalyze or focus on the numbers, just fucking buy. To allay fears the speakers are actually quite clever as they shift between a long to short term focus when it suits. For example, now is a great time to buy because short-term the market is on fire. If, however, markets cool then you just hold because it always goes up long-term – and you are a savvy long-term buyer, aren’t you? By showing no scenario where you can lose I can see how this pitch works on the susceptible.

The second important factor in real estate is financing. Not everyone has money, so what can they do? The answers were shocking. Be ‘creative’ was the first response. Pool your money, borrow from friends and family, own just 5% of a house, get the money however you can and just do it – remember, it only goes up. Other financing suggestions were get cozy with a lender and they will ‘bend the rules’ for you! The fact that the biggest condo developer in Canada (Brad Lamb) said lenders will bend (but not break, apparently) rules to get you financing in front of 15k people with most people smiling and nodding was shocking. So there you go – when it comes to Toronto real estate, just do it (using borrowed money any way you can get it).

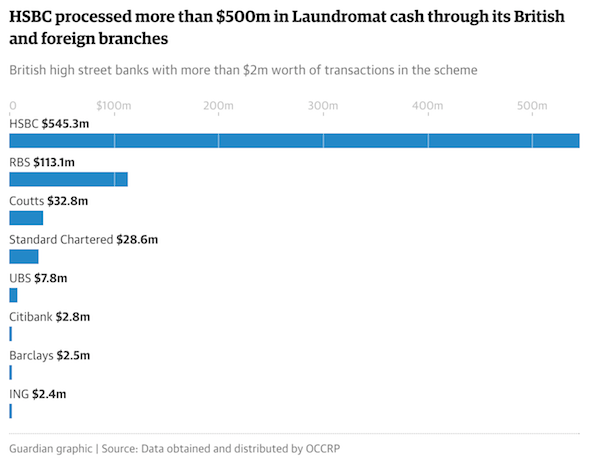

Well, actually, it’s HSBC again. And a few minor conspirators.

• British Banks Handled Vast Sums Of Laundered Russian Money (G.)

Britain’s high street banks processed nearly $740m from a vast money-laundering operation run by Russian criminals with links to the Russian government and the KGB, the Guardian can reveal. HSBC, the Royal Bank of Scotland, Lloyds, Barclays and Coutts are among 17 banks based in the UK, or with branches here, that are facing questions over what they knew about the international scheme and why they did not turn away suspicious money transfers. Documents seen by the Guardian show that at least $20bn appears to have been moved out of Russia during a four-year period between 2010 and 2014. The true figure could be $80bn, detectives believe. One senior figure involved in the inquiry said the money from Russia was “obviously either stolen or with criminal origin”.

Investigators are still trying to identify some of the wealthy and politically influential Russians behind the operation, known as “the Global Laundromat”. They estimate a group of about 500 people were involved. These include oligarchs, Moscow bankers, and figures working for or connected to the FSB, the successor spy agency to the KGB. Igor Putin, the cousin of Russia’s president, Vladimir, sat on the board of a Moscow bank which held accounts involved in the fraud. British-registered companies played a prominent role in this extensive money-laundering network. The real owners of most of the firms used in the scheme remain secret, however, because of the anonymity provided by controversial offshore laws.

The Global Laundromat banking records were obtained by the Organized Crime and Corruption Reporting Project (OCCRP) and Novaya Gazeta from sources who wish to remain anonymous. OCCRP shared the data with the Guardian and media partners in 32 countries. The documents include details of about 70,000 banking transactions, including 1,920 that went through UK banks and 373 via US banks.

More of this interview with Steve in a few days, hopefully.

• What Central Banks Get Wrong About Economic Equilibrium (BBG)

In today’s “Morning Must Read,” Bloomberg’s Tom Keene highlights comments on economic equilibrium models. He speaks with Kingston University Economics Professor Steve Keen on “Bloomberg Surveillance.”

“What can go wrong awaits in markets, banks, currencies, and the immense dark pools of counterparty obligations that amount to black holes where notions of value are sucked out of the universe.”

• Full Speed Ahead for Murphy’s Law (Jim Kunstler)

In the 1950s, finance made up about 5% of the economy. It’s mission then was pretty simple and straightforward: to manage the accumulated wealth of the nation (capital) and then allocate it to those who proposed to generate greater wealth via new productive activities, mostly industrial, ad infinitum. It turned out that ad infinitum doesn’t work in a world of finite resources — but the ride had been so intoxicating that we couldn’t bring ourselves to believe it, and still can’t. With industry expiring, or moving elsewhere (also temporarily), we inflated finance to nearly 40% of the economy. The new financialization was, in effect, setting a matrix of rackets in motion.

What had worked as capital management before was allowed to mutate into various forms of swindling and fraud — such as the bundling of dishonestly acquired mortgages into giant bonds and then selling them to pension funds desperate for “yield,” or the orgy of merger and acquisition in health care that turned hospitals into cash registers, or the revenue streams on derivative “plays” that amounted to bets with no possibility of ever being paid off, or the three-card-monte games of interest rate arbitrage played by central banks and their “primary dealer” concubines. Some of what I’ve listed above may be incomprehensible to the blog reader, and that is because these rackets were crafted to be opaque and recondite.

The rackets continue without regulation or prosecution because there is an unstated appreciation in government, and in the corporate board rooms, that it’s all we’ve got left. What remains of the accustomed standard of living in America is supported by wishing and fakery and all that is now coming to a climax as we steam full speed ahead into Murphy’s law: if something can go wrong, it will. When all of America comes to realize that President Trump doesn’t know what he’s doing, it will make last November’s national nervous breakdown look like a momentary case of the vapors. What can go wrong awaits in markets, banks, currencies, and the immense dark pools of counterparty obligations that amount to black holes where notions of value are sucked out of the universe. There is so much that can go wrong. And then it will. And then maybe that will prompt us back to consider being a nation again.

Sometimes I think we’re going to live to see Noah’s next ark.

• Earth Is A Planet In Upheaval Breaking Into ‘Uncharted Territory’ (G.)

The record-breaking heat that made 2016 the hottest year ever recorded has continued into 2017, pushing the world into “truly uncharted territory”, according to the World Meteorological Organisation. The WMO’s assessment of the climate in 2016, published on Tuesday, reports unprecedented heat across the globe, exceptionally low ice at both poles and surging sea-level rise. Global warming is largely being driven by emissions from human activities, but a strong El Niño – a natural climate cycle – added to the heat in 2016. The El Niño is now waning, but the extremes continue to be seen, with temperature records tumbling in the US in February and polar heatwaves pushing ice cover to new lows.

“Even without a strong El Niño in 2017, we are seeing other remarkable changes across the planet that are challenging the limits of our understanding of the climate system. We are now in truly uncharted territory,” said David Carlson, director of the WMO’s world climate research programme. “Earth is a planet in upheaval due to human-caused changes in the atmosphere,” said Jeffrey Kargel, a glaciologist at the University of Arizona in the US. “In general, drastically changing conditions do not help civilisation, which thrives on stability.” The WMO report was “startling”, said Prof David Reay, an emissions expert at the University of Edinburgh: “The need for concerted action on climate change has never been so stark nor the stakes so high.”

[..] 2016 saw the hottest global average among thermometer measurements stretching back to 1880. But scientific research indicates the world was last this warm about 115,000 years ago and that the planet has not experienced such high levels of carbon dioxide in the atmosphere for 4m years. 2017 has seen temperature records continue to tumble, in the US where February was exceptionally warm, and in Australia, where prolonged and extreme heat struck many states. The consequences have been particularly stark at the poles. “Arctic ice conditions have been tracking at record low conditions since October, persisting for six consecutive months, something not seen before in the [four-decade] satellite data record,” said Prof Julienne Stroeve, at University College London in the UK. “Over in the southern hemisphere, the sea ice also broke new record lows in the seasonal maximum and minimum extents, leading to the least amount of global sea ice ever recorded.”

Ah, look at all the lonely people

Where do they all come from?

All the lonely people

Where do they all belong?

• Three-Quarters Of Older People In The UK Are Lonely (G.)

Almost three-quarters of older people in the UK are lonely and more than half of those have never spoken to anyone about how they feel, according to a survey carried out for the Jo Cox commision on loneliness. The poll by Gransnet, the over-50s social networking site, also found that about seven in 10 (71%) respondents – average age 63 – said their close friends and family would be surprised or astonished to hear that they felt lonely. Gransnet is one of nine organisations – including Age UK, the Alzheimer’s Society and the Silver Line helpline for older people – working to address the issue of loneliness in older people, which is the current focus of the commission, set up by Cox before her murder last June. They are urging individuals and businesses to look for signs of loneliness and refer people to organisations that can help.

But they also want people to take time to speak to neighbours, family, old friends or those they encounter randomly. The chairs of the cross-party commission, the Labour MP Rachel Reeves and Conservative MP Seema Kennedy, said there was a stigma around loneliness that must be tackled. “We all need to act and encourage older people to freely talk about their loneliness,” they said. “Everyone can play a part in ending loneliness among older people in their communities by simply starting a conversation with those around you. “How we care and act for those around us could mean the difference between an older person just coping, to them loving and enjoying later life.” Almost half (49%) of the 73% who described themselves as lonely in the online poll said they had been so for years, 11% said they had always felt lonely and 56% said they had never spoken about their loneliness to anyone.

Pure Greek tragedy. But you can’t leave 2.5 million people untreated.

• Greek Public Hospitals Stretched Further As Access Granted To Uninsured (K.)

A change in legislation last April has given access to the public health system to some 2.5 million Greeks who did not have social insurance but has also put a financial strain on hospitals, whose funding has not increased. Treating uninsured patients cost public hospitals in Athens €57.2 million last year. Across Greece, €23.5 million was spent on providing free lab tests to about 204,000 people. “Our experience shows that the number of uninsured people coming to the hospitals is increasing,” the vice president of the Athens-Piraeus Hospital Doctors’ Association, Ilias Sioras, told Kathimerini. “But the hospitals do not have adequate funds.” State funding is at €1.1 billion this year, the same as in 2016.

If Erdogan gets desperate enough he’ll pull the plug and turn this into a Europe supports terrorism narrative. Woe Greece.

• Sharp Increase In Refugees Reaching Aegean Islands From Turkey (K.)

New arrivals to the eastern Aegean islands of Lesvos, Chios and Samos have raised the number of migrants landing in Greece from neighboring Turkey since last Thursday to 566, government figures showed on Monday. The figure represents a significant increase compared to arrivals in the rest of March and for the whole of February. In the past four days, 195 migrants landed on Lesvos, 341 on Chios and 30 on Samos. More than 14,000 migrants remain stuck on the islands of the eastern Aegean awaiting the outcome of their applications for asylum or deportation. The majority are living in overcrowded reception facilities where conditions have been described as “unacceptable” and “inhumane” by human rights groups.