John Vachon Trucks loaded with mattresses at San Angelo, Texas Nov 1939

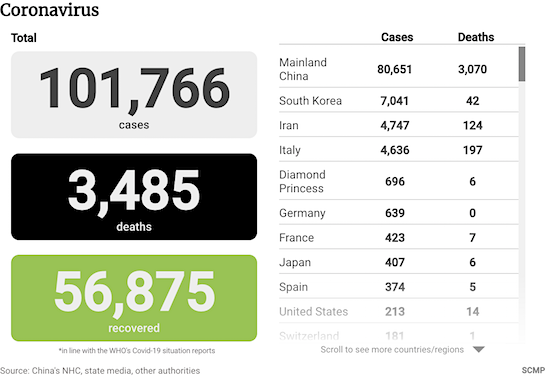

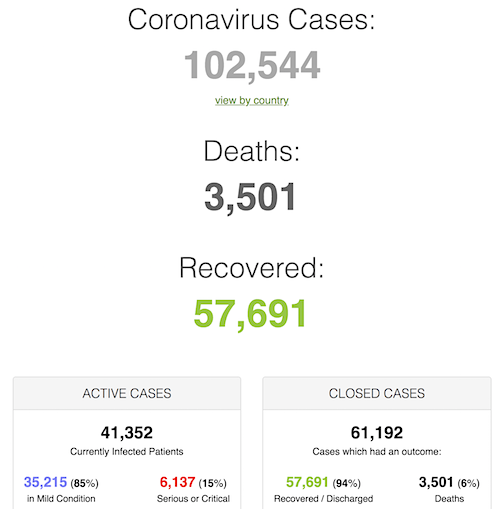

• Cases 102,544 (+ 3,616 from Tuesday’s 98,928)

• Deaths 3,501 (+ 111 from yesterday’s 3,390)

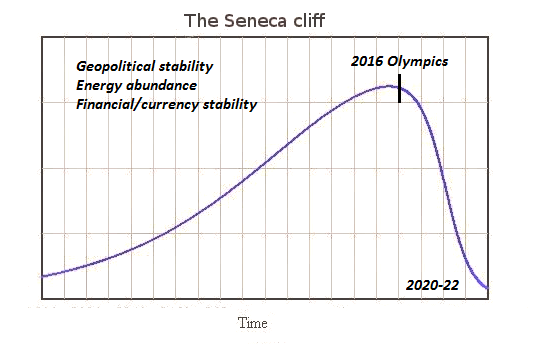

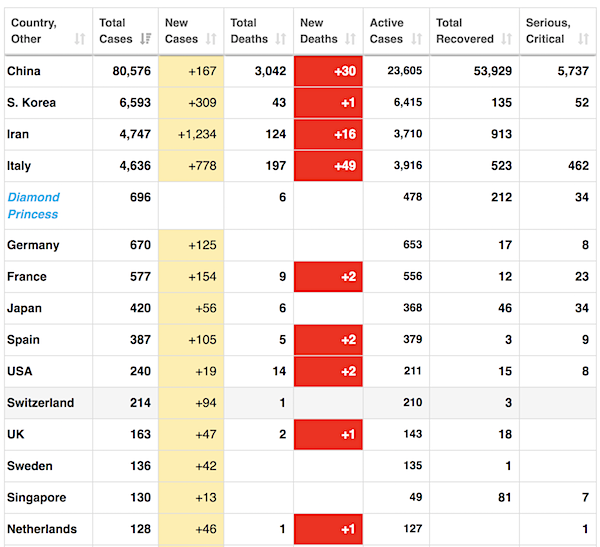

In my view, this from Worldometer last night contains the most relevant information. If China is phase one, South Korea, Iran (+25% cases) and Italy are phase 2. Their increases in cases and deaths continues unabated. Which countries will be phase 3? We’ll know next week.

Some countries look odd. We’ve seen before that South Korea has a relatively low death rate and a very low recovery rate. The US has a lot of deaths compared to its cases, which appears to point to many unreported cases. Germany has zero deaths with 692 cases. Not overly credible.

Overall death rate is 3.5%, that will go down further. If only countries would get serious about their testing. But if you don’t test, you don’t find cases. Tempting.

From SCMP:

From Worldometer:

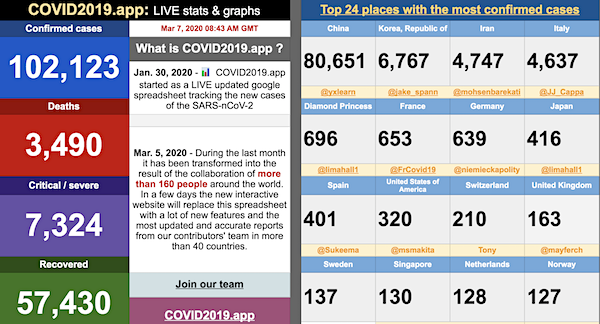

From COVID2019.app:

"This is the most frightening disease I've ever encountered in my career."

Richard Hatchett, the doctor leading efforts to find a vaccine for coronavirus, says it is much more lethal than normal flu. pic.twitter.com/1tjJ2ed0Hq

— Channel 4 News (@Channel4News) March 6, 2020

He makes it sound much easier than it is. America comes together only for war. Not for disease.

“After Pearl Harbor, the US banned the sale of rubber tires overnight in preparation for the war effort. With the #COVID19 crisis bearing down, James K. Galbraith calls for the same type of rapid response.”

• How America Can Beat COVID-19 (Galbraith)

When the Japanese attacked Pearl Harbor, the United States was surprised and unprepared, but it was quickly freed of its illusions. The same does not hold true for the COVID-19 epidemic. The attack is underway and our defenses are down – but so far our illusions remain intact. That will soon change as the infection rate and death toll rise, while the stock market sinks. Global supply chains have been disrupted by events in China, and India has just banned the export of certain generic drugs. Medical masks are already in short supply, and everyday items such as hand sanitizer have become difficult to find. The heavily globalized, consumer- and finance-driven US economy was not designed for a pandemic.

The country’s medical system has it even worse. America has vast health-care capacity, but millions of people are uninsured, underinsured, undocumented, or simply reluctant to go to the doctor or emergency room, owing to the cost of co-payments, deductibles, and uncovered fees. In a pandemic – where every infected person is a threat to the entire population – this is a formula for disaster. Everyone must be able to come forward, get tested, and receive free treatment without fear of consequences – including the very poor, the homeless, and the undocumented. US medical personnel are not equipped, and facilities are not designed to manage a potential explosion of people needing isolation and specialized care.

Hospital beds and quarantine units may be required where outbreaks overwhelm local capacity, and moving sick, infectious people over distances to available open beds is a risky policy. Effective training for those caring for the quarantined is critical; otherwise, the virus will spread among support staff. Medical supplies such as test kits and hazard suits must also be delivered where and when they are needed. [..] the government must empower the Centers for Disease Control and the Federal Emergency Management Agency to tell Americans precisely what is happening and to give clear, credible instructions. Direct, regular mass communication from competent scientific professionals, rather than from politicians and the media, can help to maintain calm, promote low-risk behavior, and avoid panics.

Furthermore, the Centers for Medicare & Medicaid Services should be authorized to cover the full costs of testing and treating COVID-19 cases, with no exceptions and no legal risks. Making tests and treatment “affordable” is not enough; the disease cannot be isolated by economic class. In a pandemic there is no acceptable alternative to making care universal and free of cost.

This is a global issue, not an American one.

• Don’t Test, Don’t Tell: The Bureaucratic Bungling of COVID-19 Tests (Ben Hunt)

As I write this essay on March 5th, there are more confirmed coronavirus infections in Harris County, Texas (five) acquired by Americans who traveled to Egypt than there are confirmed cases within the entire country of Egypt (three). Why? Because Egypt has only tested a few hundred people in this country of 100 million. There are more confirmed coronavirus infections in the city-state of Singapore (three) acquired by Singaporeans who traveled to Indonesia than there are confirmed cases in the entire country of Indonesia (two). Why? Because Indonesia has only tested a few hundred people in this country of 265 million. With the exception of South Korea and Italy (and perhaps Australia and the UK), pretty much every nation in the world has adopted some form of Don’t Test, Don’t Tell.

The offenders include rich countries like the United States and Japan, vast countries like Indonesia and India, communist countries like China and Vietnam, theocracies like Iran and Saudi Arabia, oligarchies like Russia and Nigeria, social democracies like Germany and France. Don’t Test, Don’t Tell knows no geographic or ideological boundary. And so you might ask: is this a difficult or expensive test to make? Is there some fundamental reason of technology or economics why a country might find itself forced to pursue a policy of Don’t Test, Don’t Tell? Nope. It’s a relatively simple test to develop and administer in vast quantities. There are probably half a dozen university and industry labs in Jakarta or Nairobi, much less Moscow or Chicago, that could crank out a few thousand test kits per week if they wanted to. Or rather, if they were allowed to.

Now that doesn’t mean that you can’t screw up the coronavirus test if you really set your mind to it. And in fact, that’s exactly what the CDC did in January, when they rejected the World Health Organization’s proposed test panel for SARS-CoV-2 (the official name for this particular novel coronavirus which causes the disease COVID-19) in favor of a gold-plated test panel of the CDC’s own design. After all, why just test for SARS-CoV-2 when you could also test for other SARS and MERS viruses? Unfortunately, with complexity came error, and these initial CDC triple-test kits had a flaw in one of the multiple tests, ruining the entire test. Now the CDC is producing a solo test for the SARS-CoV-2 virus, but this fiasco set us back weeks in test-kit supply.

So if it’s not a difficult or expensive test to make, why are so many countries pursuing a policy of Don’t Test, Don’t Tell? The answer, of course: to maintain a political narrative of calm and competence.

Don’t tell Rick Santelli.

• Coronavirus Matters, The Stock Market Doesn’t (IC)

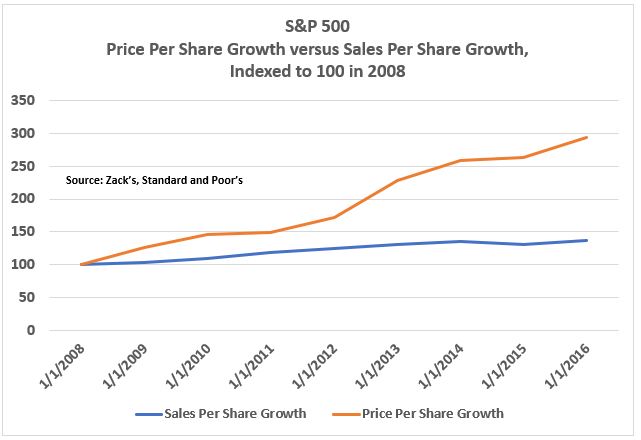

Before a new strain of coronavirus began sprinting around the world, all these problems with the stock market may have seemed abstract. But they are now extremely concrete. Think about what we could have done to prepare for this moment, if we’d been less mesmerized by little numbers on screens and paid more attention to the reality right in front of us. One aspect of reality is that some diseases are extremely contagious and can kill you. That’s why everyone in America would be far better off right now if we had robust, universal health care, even the people who had to sell some of their shares in Apple to help pay for it. Likewise, scientists have been warning for decades about exactly this kind of infectious disease.

One of their suggestions was for the U.S. government to help pay to improve the public health infrastructure in poorer countries. We may all quite soon regret not doing this, even if it would have required making Amazon pay a tax rate greater than 1.2 percent and hence denting their stock price. And if we’d been less transfixed by what corporations were doing, we could have realized what they can’t do. In the imaginary world of economic textbooks, a huge pharmaceutical company would have poured tens of billions into developing the capacity to more quickly perfect and manufacture vaccines in huge volumes, so that the omniscient stock market would reward them for their prescience. Here on Earth, the stock market would have punished any company that took such a big risk with an uncertain payoff.

Yet we couldn’t see that the only way to better prepare for the new coronavirus would have been with much greater government action. And there are pernicious effects of our stock market love affair that are even more subtle. When deciding what to do with their lives, young people learn what to value from adults, and what adults have been telling them is that what’s valuable is corporate wealth. Imagine how much better we’d all feel now if 1,000 of America’s smartest financial engineers had heard instead that the most important, respected thing they could do was become an epidemiologist. But instead of investing in genuine wealth, the kind of wealth that keeps us alive, we preferred to chase the phantom wealth of the stock market. Now as the phantom wealth dissolves, we may come face to face with our decision to be poor in what truly matters.

“The surgical mask supply went from being 90% U.S.-made to being 95% foreign-made in literally one year..”

• Not Enough Face Masks Are Made In America To Deal With Coronavirus (NPR)

Mike Bowen’s been a very busy man. He’s executive vice president of Texas-based Prestige Ameritech, one of the few manufacturers of respirators and surgical face masks still making them in the United States. “I’ve got requests for maybe a billion and a half masks, if you add it up,” he says. That’s right — 1.5 billion. Since the coronavirus started spreading in January, Bowen says he’s gotten at least 100 calls and emails a day. “Normally, I don’t get any,” he says. [..] His company simply can’t keep up with demand. 3M — one of the biggest mask makers — is in the same predicament. It says it’s stepping up production at its factories around the world, but it can’t fulfill all the new orders.

The World Health Organization this week warned against hoarding and panic-buying of critical protective gear. “Without secure supply chains, the risk to health care workers around the world is real,” WHO Director-General Dr Tedros Adhanom Ghebreyesus said. “Industry and governments must act quickly to boost supply, ease export restrictions and put measures in place to stop speculation and hoarding.” Concern about shortages of face masks used by doctors and nurses is prompting hospitals around the world to clamor for medical supplies as the coronavirus continues its infectious spread. In response, the Trump administration is looking at ways to rapidly expand domestic production, but the economics of the face-mask business makes that difficult.

This is a cycle familiar to Bowen. During what he calls “peacetime,” when there are no outbreaks, there are few buyers of masks. During an epidemic, there’s suddenly limitless demand. [..] Prestige Ameritech, for example, owns a limited number of machines that assemble, sew and shape the masks. A decade ago, it ramped up production in response to the swine flu outbreak by buying more machines and hiring 150 new workers. “We made a really big mistake,” Bowen says of that decision. It took about four months to build the new machines, which are as long as a school bus and cost as much as $1 million. By the time they were ready, the swine flu crisis had ended, demand vaporized, and Prestige Ameritech almost went bankrupt.

“One day — and it is literally almost like one day — it just quits. The demand is over, the phones stop ringing,” Bowen says. To make matters worse, the hospitals and medical supply companies suddenly had a glut of masks; they stopped buying for months. That was a business headache. But the recent shortages also show how a lack of steady orders can create a sudden national security risk. The seeds of that problem, says Bowen, can be traced back 15 years. That’s when many mask factories moved overseas, where masks could be made at a fraction of Bowen’s costs. Most notably, he says, Kimberly-Clark, which used to be one of the industry leaders, moved its operations. “The surgical mask supply went from being 90% U.S.-made to being 95% foreign-made in literally one year,” Bowen says.

Makes sense if 95% comes from China.

• US Excludes Chinese Face Masks, Medical Gear From Tariffs (R.)

The U.S. Trade Representative’s office in recent days granted exclusions from import tariffs for dozens of medical products imported from China, including face masks, hand sanitizing wipes and examination gloves, filings with the agency showed on Friday. Many of the exclusion requests for medical products appear to have been expedited amid the rapidly spreading coronavirus outbreak, with approvals granted just over one month past a Jan. 31 application deadline. Requests to exclude other products from President Donald Trump’s Section 301 tariffs on Chinese goods have taken months.

Apple’s requests for exclusions on products from AirPod headphones to the HomePod smart speaker filed on Oct. 31 are still pending. Medline International Inc has already received exclusions on 30 products ranging from surgical gowns to face masks and medicine cups, most of which the company applied for at the end of January. A number of the exclusions were granted on Thursday, USTR documents showed. The products were included in a fourth round of tariffs on Chinese goods imposed by Trump on Sept. 1, 2019, amid heated U.S.-China trade negotiations.

The PPT looks old and tired.

• Virus Concerns Drag Down Wall Street, But Indexes Eke Out Weekly Gains (R.)

U.S. stocks fell on Friday as fears of economic damage from the spread of the coronavirus intensified, though Wall Street’s major indexes ended well above their session lows. The S&P 500 posted its 10th decline in 12 sessions as moves to contain the virus crippled supply chains and prompted a sharp cut to global economic growth forecasts for 2020. Since its record closing high on Feb. 19, the benchmark index has lost more than 12%, wiping out $3.43 trillion from its market capitalization, according to S&P Dow Jones Indices. Even so, for the week the S&P 500, along with the Dow Jones Industrial Average and the Nasdaq, posted a modest gain as stocks on Friday pared losses late in the session.

Comments from Federal Reserve officials about the possibility of using other tools in addition to interest rate cuts to blunt the economic impact of the coronavirus helped stocks ease declines, said Alicia Levine, chief strategist at BNY Mellon Investment Management in New York. Nonetheless, “it’s very unclear what the economic impact will be,” Levine said. Yields on long-dated U.S. Treasuries fell to record lows as investors fled to bonds, whose prices move inversely to their yields. The drop in Treasury yields weighed heavily on shares of financial companies, which tumbled 3.3%. The S&P 500 banks index dropped 4.7%, bringing its total decline for the week to more than 8%.

Shares of cruise operators Carnival Corp and Royal Caribbean Cruises Ltd slid after Reuters reported that the administration of President Donald Trump was considering ways to discourage U.S. travelers from taking cruises. Carnival shares fell 2.6%, and Royal Caribbean shares dropped 1.2%. “The decline today is all about the efforts to contain the spread of the virus,” said Emily Roland, co-chief investment strategist at John Hancock Investment Management in Boston. “The measures being taken could dampen commerce and consumer activity, and markets are responding to that.”

These days, it’s as American as apple pie.

• Americans Divided On Party Lines Over Risk From Coronavirus (R.)

Americans who now find themselves politically divided over seemingly everything are now forming two very different views of another major issue: the dangers of the new coronavirus. Democrats are about twice as likely as Republicans to say the coronavirus poses an imminent threat to the United States, according to a Reuters/Ipsos poll conducted this week. And more Democrats than Republicans say they are taking steps to be prepared, including washing their hands more often or limiting their travel plans. Poll respondents who described themselves as Republicans and did not see the coronavirus as a threat said it still felt remote because cases had not been detected close to home and their friends and neighbors did not seem to be worried, either.

“I haven’t changed a single thing,” Cindi Hogue, who lives outside Little Rock, Arkansas, told Reuters. “It’s not a reality to me yet. It hasn’t become a threat enough yet in my world.” Many of the U.S. cases that have been reported so far have been in Washington state and California, more than 1,000 miles away from Arkansas. Politics was not a factor in her view of the seriousness of the virus, Hogue said. Other Republican respondents interviewed echoed that sentiment. But the political divide is nonetheless significant: About four of every 10 Democrats said they thought the new coronavirus poses an imminent threat, compared to about two of every 10 Republicans.

19 crew members, 2 passengers. There are over 1,000 crew aboard.

• 21 People On Grand Princess Cruise Ship Test Positive – Pence (NBC)

Vice President Mike Pence said Friday that 21 people aboard a cruise ship that’s being held off the coast of California have tested positive for the coronavirus. The California Air National Guard had delivered 46 tests to the Grand Princess, which has been offshore since Wednesday. Of the 46 passengers tested, Pence said 21 people, 19 employees and two passengers, had tested positive. Twenty-four tested negative, and one was inconclusive, Pence said. There are over 3,500 people on board the ship, which is anchored near San Francisco. All passengers will be brought into port in the U.S. over the weekend and tested, said Pence, who is leading the Trump administration’s response to the outbreak.

“Those who need to be quarantined will be quarantined. Those who require additional medical attention will receive it,” he said. Officials said crew members are likely to be quarantined aboard the ship, while passengers could be quarantined at military bases. Pence spoke shortly after President Donald Trump, touring Centers for Disease Control and Prevention headquarters in Atlanta, told reporters that he’d rather people be kept on the ship because otherwise they’ll add to the country’s coronavirus statistics. “I like the numbers being where they are. I don’t need to have the numbers double because of one ship that wasn’t our fault. And it wasn’t the fault of the people on the ship either, ok? It wasn’t their fault either and their mostly Americans,” Trump said. But, he added, he would abide by what Pence and his team of “great experts” decide.

The word “tumble” makes it sound almost light. The incredible lightness of collapse.

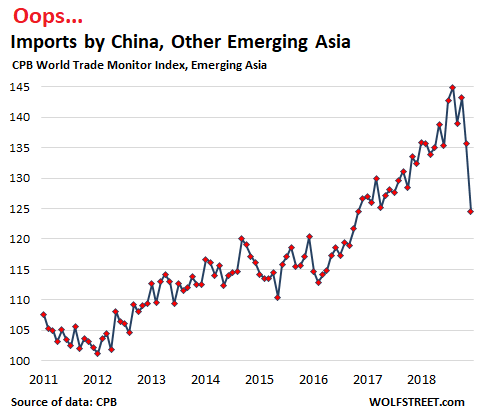

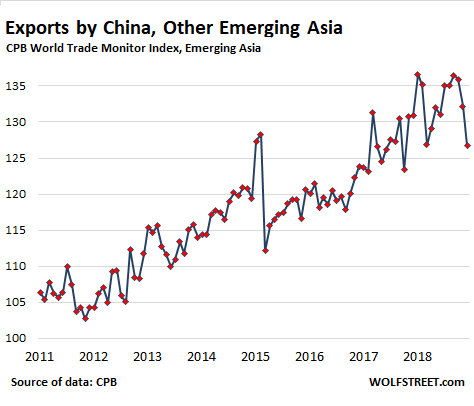

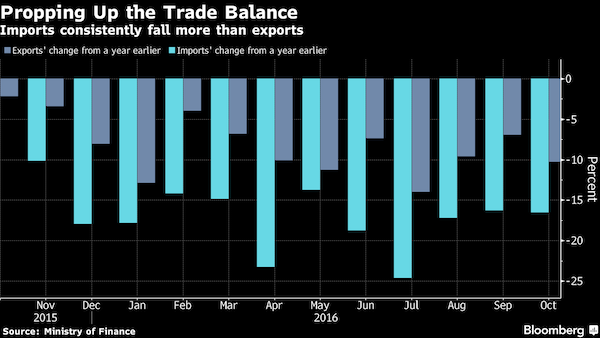

• China January-February Exports Tumble, Imports Slow (R.)

China’s exports contracted sharply in the first two months of the year, as the fast spreading coronavirus outbreak caused massive disruptions to business operations, global supply chains and economic activity. Imports also fell but were better than analyst expectations. The gloomy trade report is likely to reinforce fears that China’s economic growth halved in the first quarter to the weakest since 1990 as the epidemic and strict government containment measures crippled factory production and led to a sharp slump in demand. Overseas shipments fell 17.2% in January-February from the same period a year earlier, customs data showed on Saturday, marking the steepest fall since February 2019.

That compared with a 14% drop tipped by a Reuters poll of analysts and a 7.9% gain in December. Imports sank 4% from a year earlier, better than market expectations of a 15% drop. They had jumped 16.5% in December, buoyed in part by a preliminary Sino-U.S. trade deal. China ran a trade deficit of $7.09 billion for the period, reversing an expected $24.6 billion surplus in the poll. Factory activity contracted at the fastest pace ever in February, even worse than during the global financial crisis, an official manufacturing gauge showed last weekend, with a sharp slump in new orders. A private survey highlighted similarly dire conditions.

What on earth is he up to now? Anyway, Hunter will be a major issue.

• Romney To Vote For Subpoena Seeking Hunter Biden Ukraine Records (Pol.)

Sen. Mitt Romney will vote in favor of a subpoena seeking records about the work Joe Biden’s son Hunter did for the Ukrainian energy firm Burisma, a spokeswoman for the Utah Republican said on Friday. Romney’s decision comes after several days of expressing dismay over the Senate Homeland Security Committee’s investigation targeting the Bidens, even suggesting on Thursday that the panel shouldn’t even be looking into the issue. But after securing certain commitments from the committee’s chairman, Sen. Ron Johnson (R-Wis.), Romney has decided to support the subpoena when the panel votes on it next Wednesday — all but ensuring it will be issued. “Senator Romney has expressed his concerns to Chairman Johnson, who has confirmed that any interview of the witness would occur in a closed setting without a hearing or public spectacle,” Romney’s spokeswoman Liz Johnson said.

“He will therefore vote to let the chairman proceed to obtain the documents that have been offered.” Romney has said in recent days that the committee’s investigation into the Bidens has the “appearance” of being politically motivated, given Biden’s resurgence in the Democratic presidential primary. Romney was the only Republican who voted to convict President Donald Trump in his impeachment trial last month, saying he believed Trump violated his oath of office when he pressured the Ukrainian government to investigate the Bidens. “There’s no question the appearance is not good,” Romney told reporters on Thursday, later adding: “I would prefer that investigations are done by an independent, nonpolitical body.”

The Trump campaign would be willing to spend bigly to make Biden the Dem candidate. But they get him for free. Then again, the Dems can’t be dumb enough to run with him, can they?!

• Biden Racks Up Endorsements As Sanders Goes On The Attack (R.)

Two former presidential rivals endorsed Joe Biden on Friday in the latest sign that the Democratic establishment is coalescing around the former vice president to stop the candidacy of Bernie Sanders, who ratcheted up attacks on his rival ahead of crucial contests next week. Former Massachusetts Governor Deval Patrick and John Delaney, a former Maryland congressman – both onetime 2020 candidates – backed Biden, as did a slew of other Democratic officials in states soon to hold nominating contests. Sanders, who is desperate to regain some momentum after Biden’s strong ‘Super Tuesday’ showing this week, launched a full-throated attack on his rival, assailing Biden over his record on trade, abortion, gay rights and Social Security.

The pair contest six Democratic nominating contests on Tuesday, including the big prize of Michigan, with 125 of the 1,991 delegates needed to win the nomination at stake. Sanders, a U.S. senator from Vermont who was until recently the front-runner in the party’s race to face Republican President Donald Trump in November, now trails in delegates. A big win for Biden in Michigan would deliver another major blow to Sanders’ hopes of becoming the nominee. Ahead of Michigan’s primary, the state’s lieutenant governor, Garlin Gilchrist II, backed Biden, as did part of the state’s United Food and Commercial Workers Union, and former U.S. Senator Carl Levin. Four other states will hold primary elections on Tuesday: Idaho, Mississippi, Missouri and Washington state. North Dakota will hold caucuses.

At a news conference in Phoenix, Arizona, on Friday, Sanders dug deep into Biden’s 40-year record. He criticized Biden for having opposed the rights of gay people to serve in the U.S. military and for voting against federal funding for abortions, stances the former vice president has since rejected. “I was there on the right side of history, and my friend Joe Biden was not,” Sanders said. Sanders also lambasted Biden for supporting trade deals he said had been “a disaster for Michigan” and accused Biden of trying in the past to cut Social Security, the government-run pension and disability program. Biden, who denies ever advocating cuts to Social Security, snapped back in a tweet on Friday: “Get real, Bernie. The only person who’s going to cut Social Security if he’s elected is Donald Trump. Maybe you should spend your time attacking him.”

Warren’s exit meant that what had been hailed as the most diverse field of candidates in U.S. history narrowed to a race for the nomination between two white, septuagenarian men. Tulsi Gabbard, a congresswoman from Hawaii with virtually no chance of winning, is the only other remaining Democratic candidate. On Friday, the Democratic National Committee, which oversees the party’s presidential debates, released new qualifying thresholds for the next debate in Arizona on Mar. 15. Candidates will need at least 20% of delegates awarded so far, essentially excluding Gabbard, who has won less than 1 percent.

No report will be accepted that doesn’t call the crew incompetent. If they had been American, they’d be labeled heroes.

• Ethiopian Draft Report Blames Boeing For 737 MAX Plane Crash (R.)

A draft interim report from Ethiopian crash investigators circulated to U.S. government agencies concludes the March 2019 crash of a Boeing 737 MAX was caused by the plane’s design, two people briefed on the matter said Friday. Unlike most interim reports, this one includes a probable cause determination, conclusions and recommendations, which are typically not made until a final report is issued. The U.S. National Transportation Safety Board has been given a chance to lodge concerns or propose changes, the people said, declining to be identified because the report is not yet public.

[..] According to Bloomberg News, which first reported the contents of the interim draft, the conclusions say little or nothing about the performance of Ethiopian Airlines or its flight crew and that has raised concern with some participants in the investigation. The Ethiopian interim report contrasts with a final report into the Lion Air crash released last October by Indonesia which faulted Boeing’s design of cockpit software on the 737 MAX but also cited errors by the airline’s workers and crew. Ethiopian Airlines flight 302 crashed in an open field six minutes after take-off from Addis Ababa, the Ethiopian capital, killing 157 passengers and crew. The Boeing 737 MAX has been grounded worldwide for nearly a year after the two fatal crashes.

Under rules overseen by the United Nations’ Montreal-based aviation agency, ICAO, Ethiopia should publish a final report by the first anniversary of the crash on March 10 but now looks set to release an interim report with elements that would normally be included in the final report.

Russia prohibits itself from a first strike. The US does not.

• Starting A Nuclear Conflict Now ‘A Political Option’ For US – Moscow (RT)

The US is expanding its nuclear capability with new types of low-yield weapons, and Moscow believes US strategists now consider launching a nuclear strike as a viable option in a conflict. The US has made adjustments to its nuclear posture and has been introducing low-yield nuclear warheads to its arsenal, including those that can be launched from submarines. Russia sees such developments with great concern, the spokesperson for the Russian Foreign Ministry Maria Zakharova told journalists on Friday. The developments make Moscow believe that the American leadership “has made a decision to consider a nuclear conflict as a viable political option and are creating the potential necessary for it.”

She rejected US justification of the upgrade by pointing the finger at Russia, and called on Washington to adhere to nuclear non-proliferation and reduction goals, saying that the path of “unrestricted growth of military strength,” which it was pursuing, was “a road to a dead end”. Unlike Russia, the US never made a formal commitment not to be the first to use nuclear weapons in a conflict. Russia’s nuclear doctrine says it may use nuclear weapons in response to a conventional attack that threatens the existence of Russia as a sovereign state, but otherwise the nuclear option would only be used in response to an attack with weapons of mass destruction.

Erdogan aims to use his Russian contacts against the US, and vide versa. He now lost Russia, Putin will never allow him his Idlib sanctuary for terrorists. So expect him to fly to Washington soon.

• Ceasefire In Syria’s Idlib Comes At A Cost For Turkey’s Erdogan (R.)

After six hours of talks with Vladimir Putin, a somber Erdogan announced an accord which cements territorial gains by Russian-backed Syrian forces over Turkish-backed rebels. Returning from Russia, Erdogan said his deal with Putin will lay the ground for stability in Idlib and protect civilians who could otherwise become refugees in Turkey, after months of fighting that has displaced nearly a million people. “The ceasefire brings about important gains,” he said. The agreement, if it holds, does stem the advances of forces loyal to President Bashar al-Assad, easing Ankara’s greatest fear – an influx of Syrians fleeing bombardment in Idlib and clamoring to cross its border and join 3.6 million Syrian refugees already in Turkey.

But by freezing the front lines, and agreeing joint Russian-Turkish patrols on a major east-west highway running through Idlib, the deal consolidates Assad’s recent battlefield victories and allows Russia to deploy deeper into Idlib than before. “The Syrian army was stopped, but not repelled. That is perhaps Turkey’s biggest loss,” said Ozgur Unluhisarcikli of the German Marshall Fund. Assad’s progress in weeks of fierce combat includes taking full control of the other main highway running through Idlib, the north-south road linking the capital Damascus to Aleppo and other important Syrian cities. In Moscow, Thursday’s deal was widely seen as a triumph for Putin and Assad at Erdogan’s expense. “The agreement is unexpectedly more favorable to Russia and Damascus…,” said former pro-Putin lawmaker Sergei Markov. “Russia is winning on the battlefield and that’s why it’s winning on the diplomatic front.”

An odd couple for many. But Tucker, other than RT, is the only one talking to Roger Waters.

If you read us, please support us. It’s the only way the Automatic Earth can survive. Donate on Paypal and Patreon.