Edward Hopper Summer evening 1947

Tropical storm José is close behind, and the next one, Katia, is forming in the Gulf. Prayers. The Saffir-Simpson scale doesn’t go to 6, or Irma would be that. 5++ for now.

• Irma Becomes Most Powerful Hurricane Ever Recorded In Atlantic (G.)

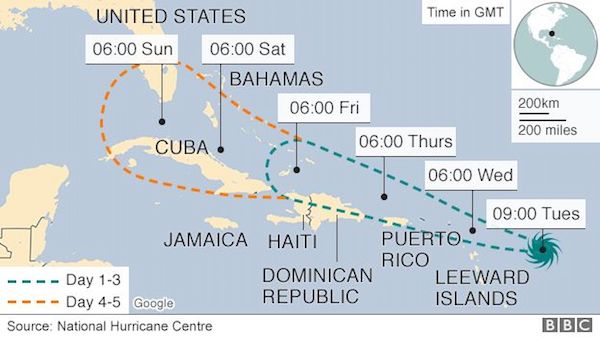

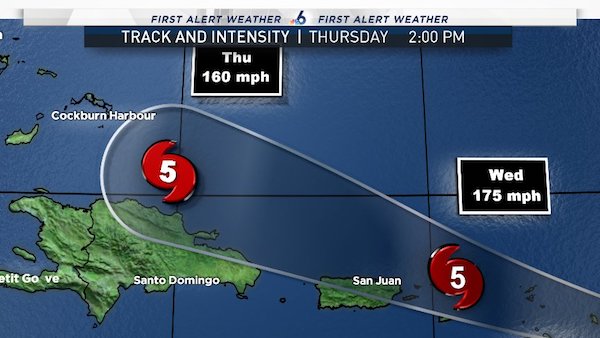

The most powerful Atlantic Ocean hurricane in recorded history bore down on the islands of the north-east Caribbean on Tuesday night local time, following a path predicted to then rake Puerto Rico, the Dominican Republic, Haiti and Cuba before possibly heading for Florida over the weekend. At the far north-eastern edge of the Caribbean, authorities on the Leeward Islands of Antigua and Barbuda cut power and urged residents to shelter indoors as they braced for Hurricane Irma’s first contact with land early on Wednesday. Officials warned people to seek protection from Irma’s “onslaught” in a statement that closed with: “May God protect us all.” The category 5 storm had maximum sustained winds of 185mph (295kph) by early Tuesday evening, according to the US National Hurricane Center (NHC) in Miami.

Category 5 hurricanes are rare and are capable of inflicting life-threatening winds, storm surges and rainfall. Hurricane Harvey, which last week devastated Houston, was category 4. Other islands in the path of the storm included the US and British Virgin Islands and Anguilla, a small, low-lying British island territory of about 15,000 people. US president Donald Trump declared emergencies in Florida, Puerto Rico and the US Virgin Islands. Warm water is fuel for hurricanes and Irma is over water that is one degree celsius (1.8F) warmer than normal. The 26C (79F) water that hurricanes need goes about 250 feet deep (80m), said Jeff Masters, meteorology director of the private forecasting service Weather Underground.

Four other storms have had winds as strong in the overall Atlantic region but they were in the Caribbean Sea or the Gulf of Mexico, which are usually home to warmer waters that fuel cyclones. Hurricane Allen hit 190mph in 1980, while 2005’s Wilma, 1988’s Gilbert and a 1935 great Florida Key storm all had 185mph winds.

‘piss in a fancy bottle scam’

• Australia: Classic Mortgage Ponzi Finance Model (News)

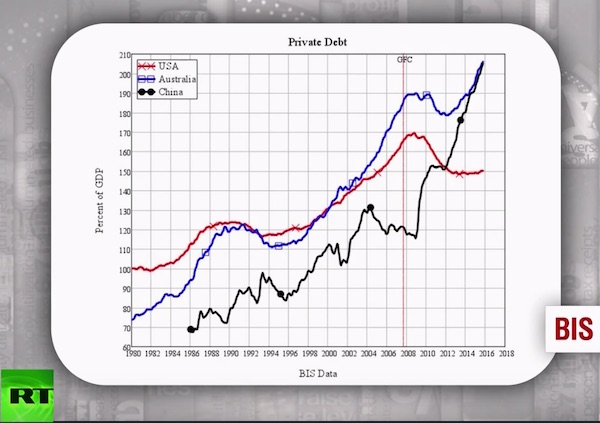

The Australian mortgage market has “ballooned” due to banks issuing new loans against unrealised capital gains of existing investment properties, creating a $1.7 trillion “house of cards”, a new report warns. The report, “The Big Rort”, by LF Economics founder Lindsay David, argues Australian banks’ use of “combined loan to value ratio” — less common in other countries — makes it easy for investors to accumulate “multiple properties in a relatively short period of time despite high house prices relative to income”. “The use of unrealised capital gain (equity) of one property to secure financing to purchase another property in Australia is extreme,” the report says. “This approach allows lenders to report the cross-collateral security of one property which is then used as collateral against the total loan size to purchase another property. This approach substitutes as a cash deposit.

“This has exacerbated risks in the housing market as little to no cash deposits are used.” The report describes the system as a “classic mortgage Ponzi finance model”, with newly purchased properties often generating net rental income losses, adversely impacting upon cash flows. “Profitability is therefore predicated upon ever-rising housing prices,” the report says. “When house prices have fallen in a local market, many borrowers were unable to service the principal on their mortgages when the interest only period expires or are unable to roll over the interest-only period.” LF Economics argues that while international money markets have until now provided “remarkably affordable funding” enabling Australian banks to issue “large and risky loans”, there is a growing risk the wholesale lending community will walk away from the Australian banking system.

“[Many] international wholesale lenders … may find out the hard way that they have invested into nothing more than a $1.7 trillion ‘piss in a fancy bottle scam’,” the report says. The report largely sheets the blame home to Australia’s financial regulators, the Australian Prudential Regulation Authority and the Australian Securities and Investments Commission. “ASIC and APRA have failed to protect borrowers from predatory and illegal lending practices,” it says. “Although ASIC has no official ‘duty of care’, APRA does, and will have some serious questions to answer in relation to systemic criminality within the mortgage market committed by the financial institutions they regulate. The evidence strongly suggests the regulators have done nothing to combat white-collar criminality in the mortgage market.”

Because the world doesn’t know what it is.

• The World Is Becoming Desperate About Deflation (Katsenelson)

The Great Recession may be over, but eight years later we can still see the deep scars and unhealed wounds it left on the global economy. In an attempt to prevent an unpleasant revisit to the Stone Age, global governments have bailed out banks and the private sector. These bailouts and subsequent stimuli swelled global government debt, which jumped 75%, to $58 trillion in 2014 from $33 trillion in 2007. (These numbers, from McKinsey, are the latest, but it’s fair to say they have not shrunk since.) There’s a lot about today’s environment that doesn’t fit neatly into economic theory. Ballooning government debt should have brought higher – much higher – interest rates. But central banks bought the bonds of their respective governments and corporations, driving interest rates down to the point at which a quarter of global government debt now “pays” negative interest.

The concept of positive interest rates is straightforward. You take your savings, which you amass by forgoing current consumption — not buying a newer car or making fewer trips to fancy restaurants — and lend it to someone. In exchange for your sacrifice, you receive interest payments. With negative interest rates, something quite different happens: You lend $100 to your neighbor. A year later the neighbor knocks on your door and, with a smile on his face, repays that $100 loan by writing you a check for $95. You had to pay $5 for forgoing your consumption of $100 for a year. The key takeaway: negative and near-zero interest rates show central banks’ desperation to avoid deflation. More important, they highlight the bleak state of the global economy. In theory, low- and negative interest rates were supposed to reduce savings and stimulate spending.

In practice, the opposite has happened: The savings rate has gone up. As interest rates on their deposits declined, consumers felt that now they had to save more to earn the same income. Go figure. Some countries resort to negative interest rates because they want to devalue their currencies. This strategy suffers from what economists call the fallacy of composition: the mistaken assumption that what is true of one member of a group is true for the group as a whole. As a country adopts negative interest rates, its currency will decline against others — arguably stimulating its export sector (at the expense of other countries). But there is absolutely nothing proprietary about this strategy: Other governments will do the same, and in the end all will experience lowered consumption and a higher savings rate.

Draghi seeks to protect Europe’s biggest banks, but he can’t. Not anymore.

• Mario Draghi Is Running Out Of Bonds To Buy (BBG)

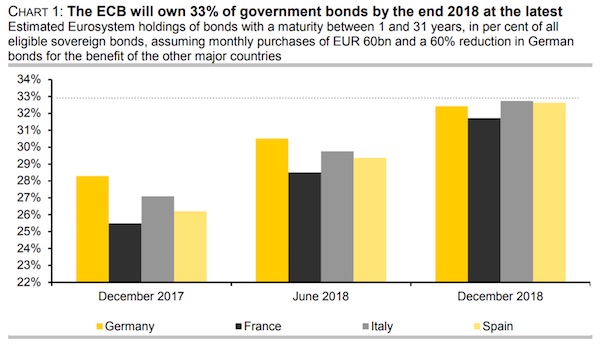

The European Central Bank may not have as much flexibility left in its bond-buying program as Mario Draghi insists. As the Governing Council kicks off discussion about the future of its asset purchases, the question that will loom large is how much wiggle room policy makers have to extend their 2.3 trillion-euro program ($2.7 trillion). Not much, according to two economists. They believe the ECB’s decision to wind down bond buying next year will be a matter of necessity rather a choice. “Bond scarcity is increasing in more and more countries,” says Louis Harreau, an ECB strategist at Credit Agricole CIB in Paris. “The ECB will be forced to reduce its QE regardless of economic conditions, simply because it has no more bonds to purchase.”

But working out how much space the central bank still has is fiendishly hard. That’s because the asset-purchase program is like a three-dimensional game of chess spread over bonds from 18 euro-area states. The 19th member, Greece, is excluded from the program. The first rule the ECB could trip over is the one that prohibits the accumulation of more than 33% of debt from a single country. Germany could hit this mark as early as spring if the current pace of purchases is maintained, says Commerzbank Chief Economist Joerg Kraemer. It’s long been a red line for Draghi and revisiting it now when the program is awaiting a review at the European Union’s highest court could be particularly tricky.

Yet some rules of the program are more malleable, giving the ECB potential leeway. The euro-area central banks have quotas to meet in buying each nation’s debt based on the size of their economies. But they can deviate from those capital-key guidelines and have done so for months now. A good example is Germany, where debt-buying last month hit the lowest level since the program started more than two years ago. According to Harreau, the ECB could deviate from the capital key by a total of €5 billion a month, twice the amount they do now. That could ease the strain for some countries, but would still require the program to be wound down by the end of next year, he says.

By the time Brexit is reality, they’ll need to lay them off anyway.

• Banks Moving Jobs From London Post-Brexit Need To Act Fast – Bundesbank (CNBC)

Frankfurt and Dublin are emerging as the clear favorites for post-Brexit relocation among U.K.-based banks, according to a top official at Germany’s central bank. “From the discussions I have, it is my clear impression that Dublin and Frankfurt are the two cities where there is most interest (from City lenders). We have received quite a number of applications,” Andreas Dombret, an executive board member at the German Bundesbank, told CNBC on Tuesday. “We encourage the banks to finalize their thinking, especially the ones that have not done so, and to really think where they want to move and how they want to move … Let’s all not try to walk through the same narrow door in the 11th hour,” he added. Britain’s financial services industry has been quietly preparing for Brexit given that it’s likely to lose its EU passporting rights – these are special licenses that allow U.K.-based banks to sell their services across the whole of the EU.

The negotiations between London and Brussels are still ongoing and it remains unclear how many employees will have to be moved from London to other European cities. At the moment, the disruption appears to be minimal compared to the overall size of the industry. But there are clear winners from the exit of some jobs from London with Frankfurt and Dublin perceived to be the top destinations for institutions that wish to continue working with clients across the EU. When asked whether vulnerable European banks could trigger a systemic crisis across the continent, Dombret said that such a prospect “doesn’t keep me up at night.” “I’m not that worried about a systemic crisis at all. There are regions, there are sectors and there are certain banks in certain countries which are more exposed than others but it is not a system wide or country wide issue,” he said.

An event that shapes an entire nation is negotiated by just one segment of its population. Not even a majority at that.

• UK PM May in Double Brexit Trouble (BBG)

U.K. Prime Minister Theresa May’s Brexit planning suffered a double blow as a top European Union official doubted that trade talks will start next month and the opposition Labour Party prepared to challenge key legislation. The EU’s deputy Brexit negotiator, Sabine Weyand, told German lawmakers that she’s skeptical officials will be able to begin discussing a trade deal in October, as they had hoped, according to two people present at the briefing. Her warning emerged as Labour announced it will seek to block May’s plan for a post-Brexit legal regime in London. May also has to contend with a leak of a draft plan for new immigration rules, which would end the free movement of workers on the day Britain leaves the EU, and impose restrictions on all but highly skilled workers from the region.

The 82-page document, obtained by The Guardian, said immigration should not just benefit the migrants, but “make existing residents better off.” The fresh trouble at home and abroad exposes how hard May is finding it to extricate the U.K. from the EU just days after the latest round of negotiations ended in acrimony with the two sides at odds over how much Britain should pay when it quits the bloc. [..] The EU has said it will not shift to discussing the sweeping new free-trade agreement that the U.K. wants until “sufficient progress” has been made on divorce issues – including the financial settlement, the rights of citizens and the border between Northern Ireland and the Irish Republic.

Labour is challenging the government’s argument that with a shrinking amount of time available, ministers should be handed the power to revise aspects of EU law without full parliamentary scrutiny. As May has no majority in Parliament, she’d be vulnerable to rebels from her own Conservative side, and some Tories, including former Attorney General Dominic Grieve, have already expressed reservations about this aspect of the bill. If amendments to the bill mean ministers have to get parliamentary approval for each regulation, they risk being held up by constant roadblocks.

In the hands of Congress now.

• Trump: I Will ‘Revisit’ DACA If Congress Can’t Legalize It (CNBC)

President Donald Trump on Tuesday night said he would “revisit” the Obama-era policy shielding hundreds of thousands of young people from deportation in six months if Congress cannot legalize it. It is unclear what action Trump would take if he decided to again address Deferred Action for Childhood Arrivals, the program that he said he would end Tuesday with a six-month delay. However, his tweeted comment appears to cloud his view on the issue after a day in which he and his administration vehemently criticized President Barack Obama’s authority to implement the policy. Trump’s decision set up a potential rush for lawmakers to pass a bill protecting so-called dreamers before the Trump administration’s deadline. It is unclear if the GOP-led Congress, members of which voted to sink similar legislation in the past, can do so in the near future as it faces multiple crucial deadlines to approve legislation.

In a statement earlier Tuesday, Trump said he looks forward “to working with Republicans and Democrats in Congress to finally address all of these issues in a manner that puts the hardworking citizens of our country first.” “As I’ve said before, we will resolve the DACA issue with heart and compassion — but through the lawful democratic process — while at the same time ensuring that any immigration reform we adopt provides enduring benefits for the American citizens we were elected to serve. We must also have heart and compassion for unemployed, struggling, and forgotten Americans,” Trump said. Trump allies like Attorney General Jeff Sessions urged him to end DACA, arguing it will be difficult to defend in court. “Simply put, if we are to further our goal of strengthening the constitutional order and rule of law in America, the Department of Justice cannot defend this overreach,” Sessions said Tuesday in announcing the move.

“They will eat grass but will not stop their [nuclear] programme as long as they do not feel safe.”

• Putin Warns of Planetary Catastrophe over North Korea (G.)

The Russian president, Vladimir Putin, has warned that the escalating North Korean crisis could cause a “planetary catastrophe” and huge loss of life, and described US proposals for further sanctions on Pyongyang as “useless”. “Ramping up military hysteria in such conditions is senseless; it’s a dead end,” he told reporters in China. “It could lead to a global, planetary catastrophe and a huge loss of human life. There is no other way to solve the North Korean nuclear issue, save that of peaceful dialogue.” On Sunday, North Korea carried out its sixth and by far its most powerful nuclear test to date. The underground blast triggered a magnitude-6.3 earthquake and was more powerful than the bombs dropped by the US on Hiroshima and Nagasaki during the second world war. Putin was attending the Brics summit, bringing together the leaders of Brazil, Russia, India, China and South Africa.

Speaking on Tuesday, the final day of the summit in Xiamen, China, he said Russia condemned North Korea’s provocations but said further sanctions would be useless and ineffective, describing the measures as a “road to nowhere”. Foreign interventions in Iraq and Libya had convinced the North Korean leader, Kim Jong-un, that he needed nuclear weapons to survive, Putin said. “We all remember what happened with Iraq and Saddam Hussein. His children were killed, I think his grandson was shot, the whole country was destroyed and Saddam Hussein was hanged … We all know how this happened and people in North Korea remember well what happened in Iraq. “They will eat grass but will not stop their [nuclear] programme as long as they do not feel safe.”

History does talk. Jimmy Carter was replaced with “We came, we saw, he died.”

• Diplomacy With North Korea Has Worked Before, and Can Work Again (N.)

The 1994 agreement was the United States’ response to a regional political crisis that began that year when North Korea announced its intention to withdraw from the Nuclear Non-Proliferation Treaty (NPT), which requires non-nuclear states to agree never to develop or acquire nuclear weapons. Although it had no nuclear weapon, North Korea was producing plutonium, an action that almost led the United States to launch a pre-emptive strike against its plutonium facility. That war was averted when Jimmy Carter made a surprise trip to Pyongyang and met with North Korea’s founder and leader at the time, Kim Il-sung (he died a few months later, and his power was inherited by his son, Kim Jong-il). The framework was signed in October 1994, ending “three years of on and off vilification, stalemates, brinkmanship, saber-rattling, threats of force, and intense negotiations,” Park Kun-young, a professor of international relations at Korea Catholic University, wrote in a 2009 history of the negotiations.

In addition to shutting its one operating reactor, Yongbyon, the North also stopped construction of two large reactors “that together were capable of generating 30 bombs’ worth of plutonium a year,” according to Leon V. Sigal, a former State Department official who helped negotiate the 1994 framework and directs a Northeast Asia security project at the Social Science Research Council in New York. Most important for the United States, it remained in the NPT. In exchange for North Korea’s concessions, the United States agreed to provide 500,000 tons a year of heavy fuel oil to North Korea as well two commercial light-water reactors considered more “proliferation resistant” than the Soviet-era heavy-water facility the North was using. The new reactors were to be built in 2003 by a US/Japanese/South Korean consortium called the Korean Peninsula Energy Development Organization, or KEDO. (The reactors, however, were never completed).

[..] First, the Agreed Framework led North Korea to halt its plutonium-based nuclear-weapons program for over a decade, forgoing enough enrichment to make over 100 nuclear bombs. “What people don’t know is that North Korea made no fissible material whatsoever from 1991 to 2003,” says Sigal. (The International Atomic Energy Agency confirmed in 1994 that the North had ceased production of plutonium three years earlier.) “A lot of this history” about North Korea, Sigal adds with a sigh, “is in the land of make-believe.” Second, the framework remained in effect well into the Bush administration. In 1998, the State Department’s Rust Deming testified to Congress that “there is no fundamental violation of any aspect of the framework agreement”; four years later, a similar pledge was made by Bush’s then–Secretary of State Colin Powell.

“Americans are saturated in lies about their country from birth..”

• The Bad Guys Are The Ones Invading Sovereign Nations (M.)

These are not the bad guys. The bad guys are the ones refusing to respect the sovereignty of North Korea or any other nation under the sun. The bad guys are the ones invading sovereign nations at will and slaughtering civilians with explosives dropped from flying killing machines. The fact that something so simple and so obvious is not universally known in America speaks to the phenomenal efficacy of its corporate media propaganda machine. Because of that propaganda machine, Americans sincerely think that the bad guys are the tiny little nations that America bullies in proxy conflicts to maintain global hegemony. They’re watching Star Wars and cheering for the stormtroopers.

Because of the neoconservative American supremacist doctrine that the US power establishment has espoused, America has given itself the authority to intervene in any government’s affairs at any time and for any reason. This doctrine of American supremacy is founded on the belief that the United States was selected by destiny to lead the world when it won the Cold War, a divine right of sorts to dominion over the entire planet. This is the real evil. The North Koreans aren’t the bad guys, and the South Koreans want to get along with them. They’re sick of being in a constant state of war, they want dialogue and diplomacy with North Korea by a nearly four to one margin, and they staged large protests against America’s missile defense system which at one point mobilized 8,000 riot police to remove protesters from a South Korean THAAD site.

These are the people who are actually putting their lives on the line with Seoul’s close proximity to the DMZ, and they want peace and de-escalation. They should be allowed to have that, but their US-backed government is talking about bringing American tactical nukes back to the Korean Peninsula. [..] Americans are saturated in lies about their country from birth, throughout their schooling and by every screen they interact with throughout their day; it’s a testament to their good will that the elites are forced to put on this Scooby Doo haunted house song and dance every time.

The Mussolini kind.

• Neoliberalism is a Form of Fascism (Cadelli)

The time for rhetorical reservations is over. Things have to be called by their name to make it possible for a co-ordinated democratic reaction to be initiated, above all in the public services. Liberalism was a doctrine derived from the philosophy of Enlightenment, at once political and economic, which aimed at imposing on the state the necessary distance for ensuring respect for liberties and the coming of democratic emancipation. It was the motor for the arrival, and the continuing progress, of Western democracies. Neoliberalism is a form of economism in our day that strikes at every moment and every sector of our community. It is a form of extremism. Fascism may be defined as the subordination of every part of the State to a totalitarian and nihilistic ideology.

I argue that neoliberalism is a species of fascism because the economy has brought under subjection not only the government of democratic countries but also every aspect of our thought. The state is now at the disposal of the economy and of finance, which treat it as a subordinate and lord over it to an extent that puts the common good in jeopardy. The austerity that is demanded by the financial milieu has become a supreme value, replacing politics. Saving money precludes pursuing any other public objective. It is reaching the point where claims are being made that the principle of budgetary orthodoxy should be included in state constitutions. A mockery is being made of the notion of public service. The nihilism that results from this makes possible the dismissal of universalism and the most evident humanistic values: solidarity, fraternity, integration and respect for all and for differences.

There is no place any more even for classical economic theory: work was formerly an element in demand, and to that extent there was respect for workers; international finance has made of it a mere adjustment variable. Every totalitarianism starts as distortion of language, as depicted accurately in George Orwell’s 1984. Neoliberalism has its Newspeak and strategies of communication that enable it to deform reality. In this spirit, every budgetary cut is represented as an instance of modernisation of the sectors concerned. If some of the most deprived are no longer reimbursed for medical expenses and so stop visiting the dentist, this is modernisation of social security in action.

The EU seeks to forcefully redefine ‘sovereignty’, like it did in Greece. That will not end well. Even if these countries gave in and admitted refugees, how would they be treated?

• European Top Court Dismisses Eastern States’ Challenge To Refugee Quota (DW)

The EU’s top court on Wednesday dismissed a challenge by eastern European members over the bloc’s mandatory refugee quota program. The ruling means that Hungary and Slovakia could face fines if they refuse to abide by the quota system. The ruling is a victory for EU immigration policy, which has divided the bloc as nearly 1.7 million people arrived from the Middle East and Africa since 2014. Poland, Slovakia, the Czech Republic and Hungary argue the mandatory quota system violates their sovereignty and threatens their societies. The legal challenge was also backed by Poland, which alongside Hungary has not taken in any asylum seekers. Slovakia and the Czech Republic have only taken in a few dozen asylum seekers. Only 24,000 of 160,000 refugees from frontline Mediterranean states like Greece and Italy have been transferred to other states under the EU’s refugee burden sharing policy agreed to in 2015.

Because they have farmland to spare?

• Plastic Film Covering 12% of China’s Farmland Contaminates Soil (BBG)

China will expand its agricultural use of environment-damaging plastic film to boost crop production even as authorities try to curb soil pollution, a government scientist said. Some 1.45 million metric tons of polyethylene are spread in razor-thin sheets across 20 million hectares (49 million acres) — an area about half the size of California — of farmland in China. Use of the translucent material may exceed 2 million tons by 2024 and cover 22 million hectares, according to Yan Changrong, a researcher with the Chinese Academy of Agricultural Sciences in Beijing. The plastic sheets, used as mulch over 12% of China’s farmland, are growing in popularity because they trap moisture and heat, and prevent weeds and pests. Those features can bolster cotton, maize and wheat yields, while enabling crops to be grown across a wider area.

“The technology can boost yields by 30%, so you can image how much extra production we can get — it can solve the problems of producing sufficient food and fiber,” Yan said in an interview at his office at the academy’s Institute of Environment and Sustainable Development in Agriculture. The downside is that polypropylene film isn’t biodegradable and often not recycled. Potentially cancer-causing toxins can be released into the soil from the plastic residue, known locally as “white pollution,” which is present at levels of 60-to-300 kilograms (132-to-661 pounds) per hectare in some provinces. [..] Regrettably, there are no viable alternatives to polyethylene that possess the same agronomic advantages. That means farmers are compelled to keep using it to boost production and income, said Yan, as he flicked through slides showing pollution in the northwest region of Xinjiang.

The material enables crops to be grown in both drier and colder environments. In Xinjiang, which accounts for almost 70% of the country’s cotton output, plastic mulch is used on all cotton farms; and across 93% of the country’s tobacco fields, he said. The film reduces water demand by 20-to-30%.