Giambologna Colossus of the Apennines 1579-80 (35ft tall)

Biden’s bribe tapes

Leaked audio from days after the 2016 election, before Trump’s inauguration—Biden calls Poroshenko, then head of state of Ukraine, and threatens him with assassination if he cooperates with the incoming Trump administration. pic.twitter.com/j3dDzYU3gd

— Rodney Howard-Browne (@rhowardbrowne) July 16, 2022

Too early to say if the father was the intended target. But Putin can’t let cars be blown up near Moscow. He has to act.

• Car Blast Kills Daughter Of Russian Philosopher Dugin (RT)

A powerful explosion ripped apart an SUV near Moscow on Saturday night, instantly killing its driver. According to preliminary reports, the victim was identified as Darya Dugina, the daughter of a veteran Russian political commentator Alexander Dugin, who is often painted in the West as one of the Kremlin’s “ideological masterminds.” The incident took place on a highway some 20 kilometers west of Moscow around 21:35 local time, with witnesses saying that the blast rocked the vehicle right in the middle of the road, scattering debris all around. The crippled car, fully engulfed in flames, then crashed into a fence, according to photos and videos from the scene. Emergency services said one person was inside the car and was instantly killed by the blast and crash – a female whose body was reportedly recovered burned beyond recognition.

Authorities have yet to officially confirm the identity of the victim, but multiple Russian Telegram channels and media sources reported that the victim was 30-year-old Darya Dugina (Platonova). Her father, Alexander Dugin, was spotted at the scene soon after the incident, visibly shocked, according to several videos circulating on social media. Preliminary reports suggested that a home-made explosive device might have been involved, but investigators have yet to confirm the cause of the blast, or any possible motive in case of a foul play. Earlier on Saturday evening, Aleksandr Dugin was giving a lecture on “Tradition and History”at a traditional family festival in the Moscow region, while his daughter attended the event as a guest. Some unconfirmed reports suggested that Dugin initially planned to leave the festival alongside his daughter, but later decided to take a separate car, while Darya took his Toyota Land Cruiser Prado.

Darya Dugina was a political commentator and daughter of Professor Aleksandr Dugin – a veteran Russian philosopher known for his staunch anti-Western and “neo-Eurasian” views. Western media repeatedly painted Dugin as one of the driving forces behind President Vladimir Putin’s foreign policy over the past decade. Just in recent months, CBS dubbed him “the far-right theorist behind Putin’s plan,” while the Washington Post called him a “far-right mystical writer who helped shape Putin’s view of Russia.” n Russia, however, the supposed shadowy puppet master is largely considered to be a relatively marginal figure with some of his views deemed controversial even in nationalist circles. While he has served as an adviser to several politicians, Dugin never enjoyed official endorsement from the Kremlin.

Dugina

https://twitter.com/i/status/1561151146580152320

“A child asks his parent, “Why are there pyramids in Egypt?” The parent answers, “Because they were too big to take to Britain.“

• Modern Empires Keep Taking What They Want From ‘Lesser’ Powers (Kovalik)

There is an old joke which still has resonance. A child asks his parent, “Why are there pyramids in Egypt?” The parent answers, “Because they were too big to take to Britain.” Of course, many a true word is spoken in jest. Indeed, there is an apocryphal story that back in the day when Vladimir Lenin was in exile in London, he would enjoy taking friends to the British Museum and explaining to them how and from what far-flung lands all the antiquities there were stolen. One might have thought that these days of colonial plunder had ended, but one would be very wrong. Current examples abound. A notable one is, of course, the freezing by the US of $7 billion from the Afghanistan treasury – monies the US continues to hold even as it watches Afghans begin to die from starvation.

Apparently, the US believes that, after laying waste to Afghanistan through 20 years of war and, even before that by supporting the mujahideen terrorists, it is entitled to some compensation. This upside-down type of reasoning abounds in the minds of those in the West who simply believe they can take whatever they wish. Similarly, the US is now plundering Syria – another country utterly devastated in no small part by Washington-backed militants in a campaign to overthrow the elected president – of most of its oil, even as Syria suffers from severe energy blackouts. Thus, according to the Syrian Oil Ministry, “US occupation forces and their mercenaries,” referring to the US-backed Syrian Democratic Forces (SDF), “steal up to 66,000 barrels every single day from the fields occupied in the eastern region,” amounting to around 83 percent of Syria’s daily oil production.

According to the ministry’s data, the Syrian oil sector has incurred losses of “about $105 billion since the beginning of the war until the middle of this year” as a result of the US oil theft campaign. Additionally, the statement added that alongside the financial losses incurred by the oil sector were “losses of life, including 235 martyrs, 46 injured and 112 kidnapped.” One of the biggest heists the US has carried out is against Russia. After the launch of Russia’s military operation in Ukraine, the US seized an incredible $300 billion of Russian treasury funds which were deposited abroad. This was done, of course, without any due process, and to the great detriment of the Russian people – and with barely a critical word from Western pundits.

The US treatment of Venezuela abounds with other examples. As I write these words, the US is maneuvering to seize a commercial 747 airliner from Venezuela on the grounds that it once belonged to an Iranian airline which had some connection to Iran’s Revolutionary Guard Corps (which Washington has designated as terrorists) – which might sound like a tenuous justification, but the US really needs no reason. And this is simply the tip of the iceberg. The US has already seized Venezuela’s biggest single source of revenue – its US-based oil company CITGO – and is now in the process of selling off this company in pieces, even as Washington lifts restrictions on Venezuelan oil to shore up its own economy. The UK, meanwhile, has decided to keep over $1 billion in gold which Venezuela naively deposited in the Bank of England for safe-keeping. To add insult to injury, the US continues to criticize Venezuela for the hardships its people endure as a direct consequence of this plunder.

Botulinum toxin.

• Russian Soldiers In Ukraine Hospitalized With Severe Chemical Poisoning (RT)

Several Russian soldiers involved in the military operation in Ukraine have been hospitalized with severe chemical poisoning, the Russian Defense Ministry said on Saturday. Traces of Botulinum toxin Type B, which is an “organic poison of artificial origin,” have been discovered in samples taken from the servicemen, the ministry said, accusing Kiev of “chemical terrorism.” The Russian troops were “hospitalized with signs of severe poisoning” after being stationed near the village of Vasilyevka in Zaporozhye Region on July 31, the statement said. “The Zelensky regime has authorized terrorist attacks with the use of toxic substances against Russian personnel and civilians” following a string of military defeats in Donbass and other areas, the ministry insisted.

Moscow plans to send laboratory tests from the soldiers to the Organization for the Prohibition of Chemical Weapons (OPCW). Botulinum toxin, often called the “miracle poison,” is one of the most toxic biological substances known to science. Produced by the Clostridium botulinum bacteria, it blocks the release of the acetylcholine neurotransmitter, causing muscle paralysis. Botulinum toxin Type A has been used in medicine in small doses in recent decades, especially to treat disorders characterized by overactive muscle movement. It’s also well known in cosmetology under its shortened name, Botox. However, Botulinum toxin poses a major threat as a bioweapon due its ease of production and distribution, and the high fatality rate resulting from poisoning. Recovery is only possible after a lengthy period of intensive care.

Donbass residents

Not on CNN: #Donbass residents seek assurances from #Russian and Allied forces that #Ukrainian NeoNazis will not return. pic.twitter.com/nSEcRioPFK

— tim anderson (@timand2037) August 21, 2022

“How does she sleep at night?”

• Two Lives: Victoria and Victorine (Batiushka)

Victoria Jane Nuland was born in 1961 to Sherwin Nudelman, the son of Ukrainian Jewish immigrants, and a British-born mother, Rhona Goulston. Already in his teens Nudelman had changed his name to Nuland in order to carve out a career. With the British-named Victoria, an Anglo-Zionist was clearly in the making. Indeed, she duly studied at an elite private boarding school in Connecticut, whose alumni include many US politicians. Then she went to Brown University, where she studied Russian literature, political science and history. She married Robert Kagan, the future leading Jewish neocon. Her worldview relects exactly the folly of the US since 1990 under the influence of the neo-imperialist neocons and Blairite-Clintonian ‘liberal interventionists’.

This has resulted in mass poverty in the USA, as well as 9/11, and millions of deaths in wars and tensions outside the US with the Islamic world, Iran, Russia, China and anyone else that resists US imperialism. From 2003 to 2005, during the US rape of defenceless Iraq and the theft of its oil and gas, Mrs Kagan was a foreign policy advisor to the notorious Cheney. She must have many deaths on her conscience from that particular mess. The Iraq catastrophe led to terrorism and counterterrorism and disastrous new wars in Libya and Syria. Meanwhile, her husband was demanding an ever more warlike foreign policy against the background of US fears of the coming multipolar world, a world which it would no longer be able to dominate.

So Mrs Kagan, who yearned for permanent NATO expansion and the encirclement of Russia, was deeply involved in the US ‘regime-change’, that is, the plot to overthrow Ukraine’s democratically-elected government by violence in 2014. This led to America’s responsibility for the ensuing civil war that had killed at least 14,000 people, women and children among them, even before 24 February 2022 and had left Ukraine the poorest country in Europe. Her $5 billion coup in 2014 in the wretched Ukraine, a strategic candidate for NATO on Russia’s border, was implemented through Oleh Tyahnybok’s neo-Nazi Svoboda Party and the new Right Sector militia. We do not forget that it was Tyanhnybok who had delivered a speech praising Ukrainians for fighting Jews and ‘other scum’ during World War II.

In February 2014 their protests in Kyiv’s Maidan Square turned into running battles led by neo-Nazis and extreme right-wing forces that the US had financed and orchestrated. A mob led by the Right Sector militia marched on Parliament and the President and others fled for their lives. Facing the possible loss of its naval base in Sevastopol in the Crimea, Russia accepted the overwhelming result (a 97% majority) of an internationally-observed referendum in which Crimea voted to leave the Ukraine and rejoin Russia, of which it had been a part from 1783 to 1954. The Russian provinces of Donetsk and Luhansk in eastern Ukraine, part of Russia until the terrorist Communists had given them away to the Ukraine in 1922, similarly declared independence from Neo-Nazi Kiev. This starting a bloody war between US-backed separatists in Kiev and the local Eastern Ukrainian people.

Mrs Kagan wants an ever-more dangerous War with Russia and China to justify her militarist foreign policy and Pentagon budgets. She relies on her mythical version of Russian aggression and US ‘democratic’ intentions. She claims that Russia’s military budget, one-tenth of that of the US, is proof of ‘Russian confrontation and militarisation’. She wants ‘permanent bases along NATO’s eastern border’ and sees Russia’s desire to defend itself after so many successive (and failed) Western invasions as an obstacle to NATO’s expansionism. In short, the deluded Mrs Kagan has with others unleashed intractable violence, chaos and the risk of nuclear war. How does she sleep at night?

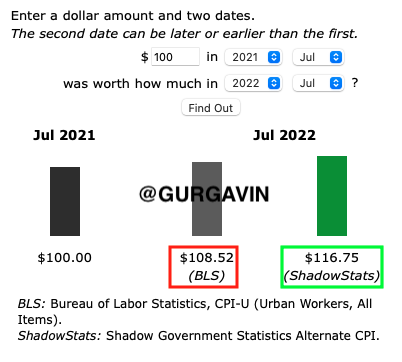

Feb 2022: $643.2 billion. Half of that was frozen. Now it’s back up to $580.6 billion. In assets that can’t be frozen.

• Russia Continues To Stockpile Forex Reserves (RT)

Russia’s international holdings have reached $580.6 billion as of August 12, according to data published by the country’s central bank on Thursday. Moscow has been boosting its reserves as a shield against sanctions. The central bank regularly publishes updates on its reserves with a one-week lag. International reserves consist of foreign-currency funds, special drawing rights with the IMF and monetary gold. Total reserves surged by $5.8 billion from the previous week, the regulator said, noting that the 1% rise was due to a positive market revaluation.

The historical maximum of $643.2 billion was recorded in February 2022. Russia lost access to roughly half of its foreign reserves in early March after they were frozen by Western central banks as part of sanctions introduced by the US and its allies in response to the conflict in Ukraine. Despite this, the Russian Finance Ministry said the country would be able to cope with sanctions thanks to its abundant reserves.

“..we’ve recruited 110,000 information volunteers..”

• UN Recruited Over 100,000 Digital First Responders to Push COVID Narrative (SN)

At the height of the pandemic, the United Nations recruited over 100,000 “digital first responders’ to push the establishment narrative on COVID via social media. The revelation actually slipped out in October 2020 during a World Economic Forum podcast called ‘Seeking a cure for the infodemic’, although it is only going viral on Twitter today. In the podcast, Melissa Fleming, head of global communications for the United Nations, explains how the COVID pandemic and lockdowns created a “communications crisis” in addition to a public health emergency. Fleming acknowledged that in order to fight so-called “misinformation” about the pandemic, the UN tapped up 110,000 people to amplify their messaging across social media.

“So far, we’ve recruited 110,000 information volunteers, and we equip these information volunteers with the kind of knowledge about how misinformation spreads and ask them to serve as kind of ‘digital first-responders’ in those spaces where misinformation travels,” Fleming stated. That was nearly 2 years ago. It is not known how many ‘digital first responders’ have been recruited up to this point. Similar efforts to create astroturf campaigns to push a specific message are nothing new, but when entities such as oil companies engage in it, they are lambasted for rigging the discussion. However, when globalist technocrats at the UN or the WEF do it, apparently it’s fine.

Last year, it was revealed that the British government used “propagandistic” fear tactics to scare the public into mass compliance during the first COVID lockdown, according to a behavioral scientist who worked inside Downing Street. Scientists in the UK working as advisors for the government admitted using what they later conceded to be “unethical” and “totalitarian” methods of instilling fear in the population in order to control behavior during the pandemic.

Epic from The Ethical Skeptic. “The following work is the result of thousands of hours of dynamic data tracking and research..”

• Houston, We Have a Problem – Part 1 of 3 (Ethical Skeptic)

Seven of the major eleven International Classification of Diseases codes tracked by the US National Center for Health Statistics exhibit stark increase trends beginning in the first week of April 2021 – featuring exceptional growth more robust than during even the Covid-19 pandemic time frame. This date of inception is no coincidence, in that it also happens to coincide with a key inflection point regarding a specific body-system intervention in most of the US population. These seven pronounced increases in mortality alarmingly persist even now.

The following work is the result of thousands of hours of dynamic data tracking and research on the part of its author. The reader should anticipate herein, a journey which will take them through the methods and metrics which serve to identify this problem, along with a deductive assessment of the candidate causal mechanisms behind it. Alternatives as to cause which include one mechanism in particular, that is embargoed from being allowed as an explanation, nor even mere mention in some forums. At the end of this process, we will be left with one inescapable conclusion. One which threatens the very fabric and future of health policy in the US for decades to come.

On March 21st 2021, a longtime mentor, friend, and business partner of mine, an otherwise healthy 68 year old male, unexpectedly suffered an autoimmune cascade which ended up shutting down his pancreas, liver, kidneys, and finally heart. He had just received his second dose of the Pfizer vaccine on that Thursday prior. Carl quickly descended into a coma, and then died on March 26th.1

On May 29th 2021, a rather odd signal began to develop in my regular Covid-19 tracking models. The change which alerted me resided inside the magnitude of the ‘Symptoms, signs and abnormal clinical and laboratory findings, not elsewhere classified (R00-R99)’ ICD death code group. About this time and as a result of this observation, I began to track R00-R99 deaths, along with eleven other ICD-10 death codes, non-natural cause deaths (suicide, overdose, assault, etc.), and finally a statistic called ‘Excess Non-Covid Natural Cause Deaths’. As the reader reviews the calculated trends featured inside each of these death categorizations, they should note that this was indeed both a prescient and sound decision.

On December 1st of 2021, attending a business meeting at client’s medical complex, passing through the facility I took notice that their large oncology department waiting room was slammed full with patients. This queue of persons awaiting their oncology appointments spilled out into the hallway and finally on into the building atrium.2 While tempted at first blush to pass this off as a result of patients and their physicians ‘catching up on deferred screenings’ and/or ‘Covid-limited office days/hours effect’, my prior observational lessons suggested that I hold-off on such a knee-jerk inference, at least until the CDC – National Center for Health Statistics data (three bullet point sources below) proved out over the coming months. This as well, proved to be a wise decision.

Is there even one country today with a Vit. D program? This article, too, does not define a satisfactory level. Why is it so hard?

• Insufficient Vitamin D Linked To Fourfold Increase In Covid-19 Mortality (IT)

Covid-19 patients with low vitamin D levels are more likely to suffer severe disease and death, according to a study by Irish scientists. Unvaccinated Caucasian adults with low vitamin D have higher mortality due to Sars CoV-2 pneumonia, according to the small-scale study by researchers at Connolly Hospital Blanchardstown and Technological University Dublin. This is not explained by confounders such as age or obesity and is not closely linked to inflammation, they say. Having an insufficient level of vitamin D was associated with a greater than fourfold increased mortality risk, according to the study, published in the journal Nutrients.

The study looked at the outcomes of 232 unvaccinated patients at Connolly hospital, all of whom had Covid-19 and required supplemental oxygen. Patients on steroid treatment were not recruited for the study in order, the authors say, to eliminate the effect their use might have on measures of both vitamin D and inflammation. The mortality rate among patients aged under 70 and who had “insufficient” vitamin D levels (less than 30 nanomoles per litre) was 11.8 per cent, compared to 2.2 per cent who had higher vitamin levels (greater than 30 nanomoles per litre). Among over-70s, the mortality rate for those with insufficient vitamin D levels was 55 per cent, compared to 25 per cent for those with high vitamin D levels.

“Unvaccinated Caucasian adults with a low vitamin D state have higher mortality due to Sars CoV-2 pneumonia, which is not explained by confounders and is not closely linked with elevated serum CRP (C-reactive protein, an indicator of inflammation),” the authors state. The authors say their data adds to a growing body of literature that appears to support a causal link between low vitamin D status and Covid-19 disease severity and death. Although the research was conducted only on unvaccinated patients, they say vitamin D supplementation may play a vital role in protecting both unvaccinated patients and patients in whom the effect of vaccination wanes. Vitamin D is available from sunlight and in foods such as fish, eggs and fortified cereals. About half the Irish population is deficient in the vitamin.

As NATO tries to get Zelensky in.

• China Backs African Union Bid To Join The Group of 20 (SCMP)

Beijing will support the African Union in its decades-long quest to join the G20, Chinese Foreign Minister Wang Yi said on Thursday, as China vies with other powers for influence on the continent. South Africa is the only representative of the continent in the Group of 20 despite the African Union pushing for inclusion since its creation in 1999. Indonesian President Joko Widodo said last month he would invite the African bloc, representing 55 countries and 1.4 billion people, to the G20 summit in Bali in November to help the continent’s bid. The G20 comprises 19 countries and the European Union. European Council president Charles Michel also voiced his support last month for the AU’s bid for the G20.

Wang’s pledge also came as Widodo told Bloomberg on Thursday that Chinese President Xi Jinping planned to attend the Bali summit in person, along with Russian leader Vladimir Putin. Xi could meet US President Joe Biden, who is also expected to attend the gathering. If so, it would be the first in-person meeting for the two leaders since Biden took office last year. Beijing and Washington are at odds on everything from Taiwan, Xinjiang, Hong Kong to Russia’s invasion of Ukraine. While the Biden administration has moved to expand its global alliances to counter China’s rise, Beijing has responded by focusing on shoring up ties with developing countries in Africa, Asia, and the South Pacific. A seat for the African Union at G20 is believed to be in Beijing’s interests in rallying support to counterbalance the US-led West.

Speaking at a virtual meeting with his African counterparts, Wang hailed African support for Beijing’s “one-China principle” and described their ties as “a pillar force” in defending the rights and interests of developing countries. “In the face of the various forms of hegemonic and bullying practices, China and Africa have stood with each other shoulder to shoulder,” he said. In a veiled swipe at US Secretary of State Antony Blinken’s trip to Africa early this month, he also tried to present Beijing as an alternative to Washington and defend his country’s expanding presence there. “What Africa wishes for is a favourable and amicable cooperation environment, not the zero-sum cold war mentality. What Africa would welcome is mutually beneficial cooperation for the greater well-being of the people, not major-country rivalry for geopolitical gains,” he said.

As the west disintegrates, east and south unite.

• Chinese Ambassador Outlines BRICS Vision (RT)

Russia and China remain key pillars of BRICS, an international alliance also comprising India, Brazil and South Africa, the Chinese ambassador to Moscow wrote in a guest opinion piece for Russia’s TASS news agency, published on Saturday. The two nations are the major “drivers” behind the development of the group, which is gradually becoming a leading force in the international arena, Zhang Hanhui, added. The BRICS countries account for 42% of the world’s population and 25% of the global economy, Zhang said, adding that they account for roughly half of global economic growth, meaning that “the value of cooperation within BRICS is constantly rising.”

The group of emerging economies is increasingly attracting the attention of other nations, the envoy said, noting that representatives of 50 countries took part in various BRICS+ events in the first half of this year alone. He also welcomed the development of the BRICS+ format, which allows other countries to join the group’s permanent members in certain discussions. Three such events this year were attended by the leaders of 13 non-BRICS states, Zhang said. International challenges, including the Covid-19 pandemic, the Ukraine conflict and rising tensions between major world powers, demand that Moscow and Beijing “strengthen their strategic cooperation,” the ambassador said, adding that BRICS should also “support efforts opposing hegemony and contribute to the establishment of real multilateralism” in international relations.

The ambassador pointed out that since the start of 2022, the BRICS nations have agreed on several initiatives in the field of economic digitalization and technology sharing. Beijing, which heads the group this year, has put forward a number of initiatives that would further enhance cooperation between members in the fields of innovation, he added. The Covid-19 pandemic also demonstrated the need for closer cooperation in medical research, the ambassador said, pointing to the need for sharing healthcare products with developing nations to help them overcome the pandemic. Zhang noted that in March, the BRICS countries launched a joint vaccine development center, offering joint research and development platforms to developing nations.

Hey, Khan! Talk to Putin!

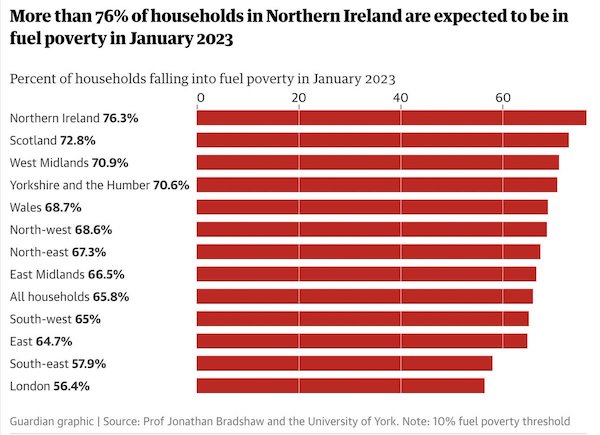

• Millions Could Be Left Without Heat And Food In Winter, London Mayor Warns (RT)

Millions of people in the UK could find themselves unable to put food on the table and heat their homes this coming winter if the government doesn’t intervene, London Mayor Sadiq Khan said on Saturday. “We’ve seen nothing like this before,” Khan wrote on Twitter, referring to soaring energy prices and record inflation of more than 10%. “We’re facing a winter where for millions it won’t be about choosing between heating or eating but tragically being able to afford neither,” he warned. “This can’t happen,” the mayor insisted, adding that the British government “needs to step in so that people can meet their basic needs.”

He accompanied the post with a data from the Auxilione energy consultancy, predicting that energy bills in the UK could increase by 80% in October, exceeding £3,600 ($4,292) per year on average. For comparison, the cap set by energy industry regulator, Ofgem, in October 2021 stood at £1,400 per year. Khan also spoke on the same issue on Friday while visiting a warehouse that distributes supplies to food banks in one of London’s boroughs. He gave assurances that his administration is“committed” to providing support for struggling Londoners, but called on the government to work harder, as there is “no sign of this rise in costs slowing down”.

“Ministers must act now to help prevent this cost of living crisis becoming a national disaster,” the mayor said. Economic difficulties caused by the Covid-19 pandemic in Europe have been further exacerbated by Western sanctions imposed on Moscow over the conflict in Ukraine and the subsequent decrease in Russian natural gas supplies to the EU.

“Europe really needs to act as a negotiator between NATO, Russia and Ukraine, and include China in the discussions..”

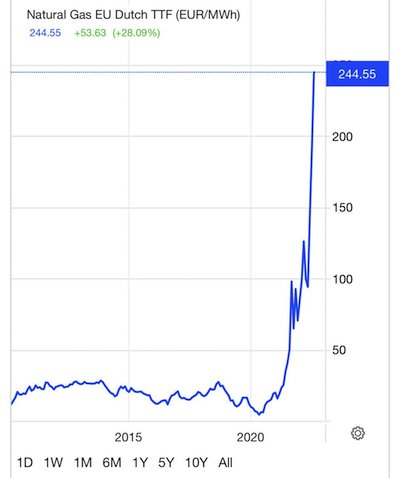

• Just How Bad Could Things Get This Winter? (RT)

Natural gas prices across Europe have quadrupled this year. Looking ahead to winter and imagining the new heights energy values may hit, consumers are starting to opt for an alternative (old) form of heating – wood. Huge demand for combustibles, as well as for wood stoves, has been detected in several Western states. In Germany, where almost a half of homes are heated with gas, people are turning to a more guaranteed energy source. Firewood sellers tell local media that they are barely coping with the demand. The country is also witnessing a rise in cases of wood theft. Next door, in the Netherlands, business owners note that their clients are buying wood earlier than ever. In Belgium, wood producers are struggling with demand, while prices are going up – as they are across the region.

In Denmark, one local stove manufacturer told the media that, while demand for his product was on the rise since the start of the Covid pandemic, this year’s profit is forecast to reach over 16 million kroner (€2 million), compared with 2.4 million in 2019. A huge increase. Even Hungary, a country that didn’t support the EU’s decision to phase out Russian fossil fuels and agreed a new gas purchase with Moscow this summer, is making preparations for a tough winter. The country has announced a ban on the export of firewood and relaxed some restrictions on logging. The World Wildlife Fund Hungary has expressed its concern on the matter, declaring: “There has been no precedent for such a decision in our country for decades.” In fact, the conflict in Ukraine is not the only reason for the energy crisis. The increase in prices had already been observed in 2021.

“It was the effect of supply chain interruptions due to COVID, a very cold winter, very hot summer and China’s energy crisis, that led to [the] buying [of] huge amounts of LNG around the world,” says Professor Phoebe Koundouri, Director of the Research laboratory on Socio-Economic and Environmental Sustainability at Athens University of Economics and Business, and President of the European Association of Environmental and Resource Economists. When the conflict in Ukraine came about, the sanctions against Russia – followed by Moscow’s response to the restrictions – sent prices through roof. “Europe really needs to act as a negotiator between NATO, Russia and Ukraine, and include China in the discussions, in order to find a solution that is meaningful for the millions of people that are being affected by this geopolitical crisis,” Prof. Koundourisays.

“It is conceivable that the population would rebel or that there would be looting..”

• Swiss Revolt Warning Issued (RT)

Swiss people may revolt and resort to looting if the Alpine nation is hit by a severe energy crunch this winter, the police chief of one of its cantons told local media on Saturday. Fredy Fassler, the head of the Security and Justice Department in the canton of St. Gallen, told German-language daily Blick that a blackout would have “far-reaching consequences.” “Imagine, you can no longer withdraw money at the ATM, you can no longer pay with the card in the store or refuel your tank at the gas station. Heating stops working. It’s cold. Streets go dark. It is conceivable that the population would rebel or that there would be looting,” he said, adding that the country’s authorities should take measures to prepare for such extreme scenarios. According to Fassler, while he does not think such a disaster is likely, police have prepared for such an eventuality.

Exercises that were conducted in 2014 to prepare for a blackout scenario revealed major shortcomings, including lack of emergency generators for police, hospitals and other critical infrastructure and services, he said. “These shortcomings have been addressed in recent years, so the security forces are ready,” the police chief added, noting that his agency is even prepared to provide the Swiss with cash if they are unable to use cards in stores, given that relevant agreements with banks have been signed. Fassler’s comments come after Swiss authorities said last week that they may place restrictions on energy consumption this coming winter, signaling that “power shortages [are] among the most serious risks” for the landlocked country. Earlier, Werner Luginbuhl, the head of Switzerland’s electricity regulator ElCom, complained that electricity was being used “completely thoughtlessly,” and urged citizens to stock up on candles and firewood due to possible power outages in the country this winter.

“..I think going through your regulatory process will actually hurt the quality of my food and that’s what I’m being paid top dollar for, it is this high quality food.”

• Amish Farmer Fighting US Government For Right To Sell His All-natural Food (RN)

Miller’s Organic Farm is located in the remote Amish village of Bird-in-Hand, Pennsylvania. The farm supplies everything from grass-fed beef and cheese, to raw milk and organic eggs, to dairy from grass-fed water buffalo and all types of produce, all to roughly 4,000 private food club members who pay top dollar for high quality whole food. The private food club members appreciate their freedom to get food from an independent farmer that isn’t processing his meat and dairy at U.S. Department of Agriculture facilities, which mandates that food be prepared in ways that Miller’s Organic Farm believe make it less nutritious. Amos Miller, the farm’s owner, contends that he’s preparing food the way God intended — but the U.S. government doesn’t see things that way. They recently sent armed federal agents to the farm and demanded he cease operations. The government is also looking to issue more than $300,000 in fines — a request so steep, it would put the farm out of business.

“There’s this farmer named Amos Miller and he’s been farming for 25 years. No electricity, no fertilizer, no gasoline. He has really, really impressive crop yields using only the only the oldest of methods, totally organic. He has milk, he has beef, he has different types of sheep. He has chicken, all types of vegetables. And he has a private buyers club of about 4,000 people all across the country that pay him top dollar for his food. And the government doesn’t like this idea of a private buyers club. They have raided his farm with armed federal agents and they have said he needs to stop selling his meat until he gets regulated by the federal agencies whose job it is to, you know, regulate food.

And he says, “you know, the way you guys regulate it, it kind of hurts the nutrition of the food — you know, you wash it in these things, you’ve given these vaccines and the cows get all types of medicine, I don’t do any of that. So I think going through your regulatory process will actually hurt the quality of my food and that’s what I’m being paid top dollar for, it is this high quality food.” So they are fining him hundreds of thousands of dollars, and they’ve actually sent armed federal agents there to take inventory of his meat, of his dairy, and they visit him to make sure that he’s not selling anything and that he’s not ramping up his production in any way. So that’s where he is now. He’s figuring out how to fight the federal government, what he’s going to do. And you know, he’s been put in this really tight spot along with the people who, you know, look to him for this food. They’re not getting their meat and dairy right now because of the government.

“No farms, no food.”

• Dutch Farmers Confront Billionaire ‘Green’ Elite’s Food System Reset Plan (GZ)

Dutch farmers’ protests offer a preview of the resistance to come as transnational “green” billionaires advance a “reset” of the global food system. The elite agenda threatens to deepen an international cost of living crisis and spark unrest well beyond The Netherlands. Ingrid de Sain is a Dutch farmer who lives in the Northern Holland town of Schellinkhout, where she and her family tend to a 62 acre farm with about 100 dairy cows. Like thousands of fellow citizens in her industry, she now finds herself locked in an existential conflict with her government. “Farming is in your heart,” de Sain told The Grayzone. “And you don’t want to do something else. You’re a farmer or you’re not.” She says she will oppose any efforts requiring her to give up a farm that guarantees prosperity for future generations of her family.

The Dutch government announced plans to slash nitrogen oxide and ammonia emissions in June 2022, enforcing an ambitious agenda in the name of protecting the climate. The imposed reductions could spell devastating consequences for the country’s farming industry and add enormous stress to already chaotic global food supply chains. Today, the Netherlands is Europe’s top exporter of meat and the second largest agricultural exporter overall in the world, right behind the US. The tiny nation’s agricultural success is the product of its traditional dependence on generously sized farms that use nitrogen-rich fertilizer to produce heavy yields. Such methods were encouraged by Brussels through the EU’s Common Agricultural Policy, which prioritized the growth of cattle lots, incentivized the use of chemical fertilizers, and pushed many smaller family farmers out of operation.

In 2019, a Dutch court order declared in 2019 that nitrogen-compound fertilizer was a top threat to the climate and biodiversity, and mandated a 70-80% decrease in its use. If implemented in the country, the proposed reductions could destroy a full third of its farming output and eliminate somewhere between 30 and 50% of Dutch livestock. The stage was set for open conflict. Once the pro-EU coalition government of Dutch PM Mark Rutte took steps to implement the restrictions in June 2022, local farmers responded immediately with ferocious mass protests that have blocked roads, airports, and grocery distribution centers. Since the outbreak of demonstrations, supermarkets shelves have gone empty as the farmers’ cry of “No farms, no food” reverberates nationwide.

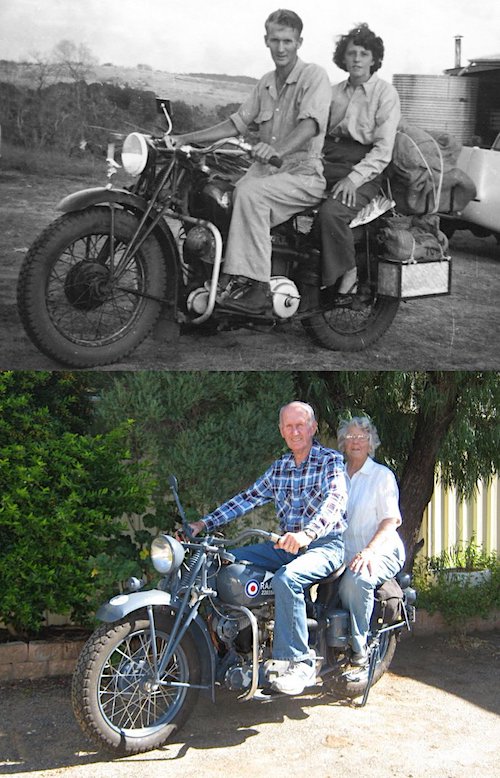

Same bike, same couple – 1955 and 2015

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.