DPC Pere Marquette transfer boat 18 passing State Street bridge Chicago River 1901

This is the Fed narrative: “Ignore transitory volatility in energy prices.”

• Why Falling Oil Prices Won’t Delay Fed Rate Increases (MarketWatch)

Financial markets have been shaken over the past several weeks by a misguided fear that deflation has imbedded itself not only into the European economy but the U.S. economy as well. Deflation is a serious problem for Europe, because the eurozone is plagued with bad debts and stagnant growth. Prices and wages in the peripheral nations (such as Greece and Spain) must fall still further in relation to Germany’s in order to restore their economies to competitiveness. But that’s not possible if prices and wages are falling in Germany (or even if they are only rising slowly). The prospect of what Mario Draghi has called “lowflation” will almost certainly push the European Central Bank to approve quantitative-easing measures very soon.

In Europe, deflation will extend the economic crisis, but that’s not an issue in the United States, where households, businesses and banks have mostly completed the necessary adjustments to their balance sheets after the great debt boom of the prior decade. The plunge in oil prices will likely push the annual U.S. inflation rate below 1%, further from the Federal Reserve’s target of 2%. At least one member of the Fed’s policy-setting Federal Open Market Committee thinks the Fed is risking its credibility by letting inflation dip closer to zero. Minneapolis Fed President Narayana Kocherlakota dissented from the FOMC’s last statement, saying the Fed should fight the disinflationary trend by signaling that it is not ready to raise interest rates this summer as is widely expected. But Kocherlakota’s colleagues don’t agree, and for a very good reason: Falling oil prices are a temporary phenomenon that shouldn’t alter anyone’s view about the underlying rate of inflation.

On Wednesday, the newly released minutes of the Fed’s latest meeting in December revealed that most members of the FOMC are ready to raise rates this summer even if inflation continues to fall, as long as there’s a reasonable expectation that inflation will eventually drift back to 2%. Fed Chairman Ben Bernanke got a lot of flak in the spring of 2011 when oil prices were rising and annual inflation rates climbed to near 4%, double the Fed’s target. Bernanke’s critics wanted him to raise interest rates immediately to fight the inflation, but he insisted that the spike was “transitory” and that the Fed wouldn’t respond. Bernanke was right then: Inflation rates drifted lower, just as he predicted. Now the situation is reversed: Oil prices are falling, and critics of the Fed say it should hold off on raising interest rates. The Fed’s policy in both cases is the same: Ignore transitory volatility in energy prices.

Read more …

“To keep all capital sidelined and curtail investment in shale until the market has re-balanced, we believe prices need to stay lower for longer ..”

• Goldman Sees Need for $40 Oil as OPEC Cut Forecast Abandoned (Bloomberg)

Goldman Sachs said U.S. oil prices need to trade near $40 a barrel in the first half of this year to curb shale investments as it gave up on OPEC cutting output to balance the market. The bank cut its forecasts for global benchmark crude prices, predicting inventories will increase over the first half of this year, according to an e-mailed report. Excess storage and tanker capacity suggests the market can run a surplus far longer than it has in the past, said Goldman analysts including Jeffrey Currie in New York. The U.S. is pumping oil at the fastest pace in more than three decades, helped by a shale boom that’s unlocked supplies from formations including the Eagle Ford in Texas and the Bakken in North Dakota. Prices slumped almost 50% last year as OPEC resisted output cuts even amid a global surplus that Qatar estimates at 2 million barrels a day.

“To keep all capital sidelined and curtail investment in shale until the market has re-balanced, we believe prices need to stay lower for longer,” Goldman said in the report. “The search for a new equilibrium in oil markets continues.” West Texas Intermediate, the U.S. marker crude, will trade at $41 a barrel and global benchmark Brent at $42 in three months, the bank said. It had previously forecast WTI at $70 and Brent at $80 for the first quarter. Goldman reduced its six and 12-month WTI predictions to $39 a barrel and $65, from $75 and $80, respectively, while its estimate for Brent for the period were cut to $43 and $70, from $85 and $90, according to the report. “We forecast that the one-year-ahead WTI swap needs to remain below this $65 a barrel marginal cost, near $55 a barrel for the next year to sideline capital and keep investment low enough to create a physical re-balancing of the market,” the bank said.

Read more …

“If we don’t get an immediate 10pc cut, then that will be the death knell for the industry ..”

• UK Oil Firms Warn Osborne: Without Big Tax Cuts We Are Doomed (Telegraph)

North Sea oil and gas companies are to be offered tax concessions by the Chancellor in an effort to avoid production and investment cutbacks and an exodus of explorers. George Osborne has drawn up a set of tax reform plans, following warnings that the industry’s future of the industry is at risk without substantial tax cuts. But the industry fears he will not go far enough. Oil & Gas UK, the industry body, is urging a tax cut of as much as 30pc and an overhaul of what it says is a complex, unfriendly and outdated tax structure. Mr Osborne asked Treasury officials to work on a new, more wide-ranging package than the 2pc tax cuts he promised in the Autumn Statement last month. The basic tax levy is currently 60pc but can run to 80pc for established oil fields. He plans to open talks with industry leaders this week on new options for the pre-election March Budget.

Mr Osborne acknowledged on Sunday that “more action” was needed. He said he could not pre-empt the Budget, but hinted strongly there could be a “further reductions in the burden of tax on investment in the North Sea”. Ed Davey, the Energy Secretary, is due in Aberdeen on Thursday for talks about investment, the jobs outlook and the help being provided by the new Government- backed Oil and Gas Authority. Industry leaders have presented the Chancellor with a bleak picture of the North Sea outlook after the big falls in the price of crude since the summer, and particularly the impact on the Scottish economy. Mike Tholen, the economics director at Oil and Gas UK, dramatically summed up the situation. “If we don’t get an immediate 10pc cut, then that will be the death knell for the industry,” he said.

The industry sees the 10pc cut as a “down payment” to be followed by a further 20pc reduction to provide an investment incentive. The speed and scale of the collapse in oil prices, down almost 60pc to below $50 a barrel over the past five months, has forced North Sea operators in a high-cost oil basin to take emergency action. A modest recovery in exploration is almost at a standstill, some projects have been mothballed and cost-cutting programmes accelerated. Oil contract workers’ pay has been slashed by 15pc and redundancy programmes are under review. The industry’s “rescue” programme is simple, but costly. Allowances, supplementary taxes and other additions have made North Sea taxation one of the most complex in the business. Companies operating fields discovered before 1992 can end up with handing over 80pc of their profits to the Chancellor; post-1992 discoveries carry a 60pc profits hit.

Read more …

“.. shipments have fallen by half since June when oil was fetching more than $100 a barrel ..”

• As Oil Plummets, How Much Pain Still Looms For US Energy Firms? (Reuters)

With nearly a quarter of U.S. energy shares’ value wiped out by oil’s six-month slide, investors are wondering if the sector has taken enough punishment and whether it is time to pile back in ahead of earnings reports later this month. The broad energy S&P 1500 index gained more than 4% over the past month, suggesting many believe markets have already factored in the pain caused by oil prices tumbling by more than half since June below $50 a barrel. Yet since the start of this year, most energy stocks have given up some of those gains, revealing anxiety that some nasty surprises might still be lurking somewhere and that last month’s bounce may not last.

A closer look at valuations and interviews with a dozen of smaller firms ahead of fourth quarter results from their bigger, listed rivals, shows there are reasons to be nervous. What small firms say is that the oil rout hit home faster and harder than most had expected. “Things have changed a lot quicker than I thought they would,” says Greg Doramus, sales manager at Orion Drilling in Texas, a small firm which leases 16 drilling rigs. He talks about falling rates, last-minute order cancellations and customers breaking leases. The conventional wisdom is that hedging and long-term contracts would ensure that most energy firms would only start feeling the full force of the downdraft this year.

The view from the oil fields from Texas to North Dakota is that the pain is already spreading. “We have been cut from the work,” says Adam Marriott, president of Fandango Logistics, a small oil trucking firm in Salt Lake City. He says shipments have fallen by half since June when oil was fetching more than $100 a barrel and his company had all the business it could handle. Bigger firms are also feeling the sting. Last week, a leading U.S. drilling contractor Helmerich & Payne reported that leasing rates for its high-tech rigs plunged 10% from the previous quarter, sending its shares 5% lower.

Read more …

“People were only taking into account consumer spending and there was a sense that falling energy is ubiquitously positive for the U.S., but I’m not convinced.”

• Oil’s Plunge Wipes Out S&P 500 Earnings (Bloomberg)

While stock investors wait for the benefits of cheaper oil to seep into the economy, all they can see lately is downside. Forecasts for first-quarter profits in the Standard & Poor’s 500 Index have fallen by 6.4 percentage points from three months ago, the biggest decrease since 2009, according to more than 6,000 analyst estimates compiled by Bloomberg. Reductions spread across nine of 10 industry groups and energy companies saw the biggest cut. Earnings pessimism is growing just as the best three-year rally since the technology boom pushed equity valuations to the highest level since 2010. At the same time, volatility has surged in the American stock market as oil’s 55% drop since June to below $49 a barrel raises speculation that companies will cancel investment and credit markets and banks will suffer from debt defaults.

“Either there is nothing to worry about and crude is going quickly back to $70 plus, or we have entered an earnings down cycle for an appreciable portion of the market,” said Michael Shaoul, CEO at Marketfield Asset Management in New York. “I don’t see much room for a middle ground and I don’t think the winners will cancel out the losers.” American companies are facing the weakest back-to-back quarterly earnings expansions since 2009 as energy wipes out more than half the growth and the benefit to retailers and shippers fails to catch up. Oil producers are rocked by a combination of faltering demand and booming supplies from North American shale fields, with crude sinking to $48.36 a barrel from an average $98.61 in the first three months of 2014.

Except for utilities, every other industry has seen reductions in estimates. Profit from energy producers such as Exxon Mobil and Chevron will plunge 35% this quarter, analysts estimated. In October, analysts expected the industry to earn about the same as it did a year ago. “My initial thought was oil would take a dollar or two off the overall S&P 500 earnings but that obviously might be worse now,” Dan Greenhaus at BTIG said in a phone interview. “The whole thing has moved much more rapidly and farther than anyone thought. People were only taking into account consumer spending and there was a sense that falling energy is ubiquitously positive for the U.S., but I’m not convinced.”

Read more …

“.. December is the most important month of the year for retailers, but economists polled by MarketWatch are expecting a flat reading, and quite a few say a monthly decline wouldn’t be a surprise.”

• How Falling Gasoline Prices Are Hurting Retail Sales (MarketWatch)

Aren’t declining gasoline prices supposed to be good news for the economy? They certainly are to households not employed in the energy industry, but it might not seem so from the one of the biggest economic indicators due for release this week. On Wednesday, the Commerce Department is set to report retail sales for December. It’s the most important month of the year for retailers, but economists polled by MarketWatch are expecting a flat reading, and quite a few say a monthly decline wouldn’t be a surprise. That’s because of the tremendous drop in gasoline prices. Gasoline stations are a key component of the retail sales report, so their revenue quite naturally will fall as prices at the pump decline. So rather than the headline, economists say to examine other elements of the report.

“Apart from gasoline, we anticipate solid sales in December, reflecting strong holiday shopping,” said Peter D’Antonio, an economist at Citi. “The drop in sales at gas stations actually provides the cost savings for the expected gains in spending in coming months.” That said, Morgan Stanley’s Ted Wieseman cautions that consumer spending may not have been as aggressive in December as in November. After department stores saw a 1% monthly gain in November, the segment may reverse some of that advance in the final month of the year. Nonetheless, savings reaped by households on lower gasoline costs will likely show up in part of the consumer-inflation report released Friday by the Labor Department.

The expected fall in consumer prices last month may mean that average hourly wages actually rose in December when inflation is factored in. Hourly earnings not adjusted for inflation fell by 0.2% last month to mark the biggest drop since at least 2006, according to the government’s December employment report. The bigger question is whether the plunge in gasoline will spill over into so-called core prices that reflect the cost of a wide variety of other goods and services other than energy and food. That’s also a potential bonanza for consumers and a scenario that could prompt the Federal Reserve to keep interest rates ultra low even longer than expected.

Read more …

“It’s pretty rare that you have a price adjustment this significant in a market that is this significant and not have some corner of the market or the world really cause some instability.”

• Mind The Gap In Multi-Speed World Economy After Oil Plunge (Reuters)

Robust recovery in the United States, a moribund euro zone and slowing Chinese growth reflect global splits which plunging oil prices are likely to widen. On the face of it, lower energy bills should give consumers and companies more money to spend and boost economic growth, at least for oil importers. But for those countries facing stagnation or even deflation the prospect of downward pressure on prices is more worrying. The likelihood is that a near 60% fall in the price of oil – from above $115 in mid-2014 to just $50 – will see those already growing strongly pick up further, leaving the laggards trailing in their wake. Central bankers in the United States and Europe have clearly expressed the divide over an oil dividend in recent weeks. “It is a huge plus for consumers, for businesses,” San Francisco Fed President John Williams said on Monday.

A drag from weak economies elsewhere in the world would not counteract that, he calculated. Williams is not alone. Minutes of the Fed’s December meeting said some of those present thought “the boost to domestic spending coming from lower energy prices could turn out to be quite large”. Compare that with European Central Bank chief economist Peter Praet, speaking on the last day of 2014, days before euro zone inflation turned negative for the first time since 2009. “With the recent oil prices, inflation would be even lower, even substantially lower than expected so far,” he said, noting that in the past the ECB would have looked past external shocks such as this but could no longer afford to. “In an environment … in which inflation expectations are extremely fragile we cannot simply ‘look through’.”

Markets are certain the ECB will launch a Fed-style government bond-buying program with new money. Given that it may be curbed in some way to meet German concerns, there is much less certainty that it will deliver a jolt. Most economists agree the U.S. economy will benefit from low oil, which will harden expectations of an interest rate rise this year, but some see real stress elsewhere. “You’ve got a handful of places that are seemingly doing very well – like the U.S., the UK, Canada – but it trails off pretty quickly after that,” said Carl Tannenbaum, chief economist at Northern Trust. “It’s pretty rare that you have a price adjustment this significant in a market that is this significant and not have some corner of the market or the world really cause some instability.”

Read more …

“Deputy Prime Minister Andreas Uldum says Greenland’s hope of growing rich quickly on fossil fuels was “naïve.” “I myself believed back when I was first elected”

• $50 Oil Kills Bonanza Dream That Made Greenlanders Millionaires (Bloomberg)

Greenland, an island that may be sitting on trillions of dollars of oil, has had to acknowledge that its dream of tapping into that wealth looks increasingly far-fetched. Back when oil was headed for $150 a barrel, Greenlanders girded for a production boom after inviting in some of the world’s biggest explorers, including Chevron and Exxon Mobil. Now, with Brent crude dipping below $50 last week, Deputy Prime Minister Andreas Uldum says Greenland’s hope of growing rich quickly on fossil fuels was “naïve.” “I myself believed back when I was first elected” to parliament in 2009 “that billions from oil and minerals would start flowing to us the next year or the year after that,” he said in an interview in Copenhagen.

“However, that’s just not the reality. I don’t know any politician in Greenland today who won’t admit to having fueled the hysteria.” The nation of about 56,000 had imagined its oil and mineral production would turn every citizen into a millionaire. Instead, Greenland continues to rely on an annual 3.68 billion-krone ($586 million) subsidy from Denmark to stay afloat, a sum that’s equivalent to almost half its gross domestic product. Talk of severing ties from its former colonial master has also faded as Greenlanders see little prospect of achieving economic independence anytime soon. “Now we know what is realistic and what isn’t, and we should not expect any revenue or pseudo-figure flowing into our budget from this and that,” Uldum said.

“That’s simply not realistic. We’ll conduct a responsible economic policy.” Less than a decade ago, the combination of a hotter planet melting the ice around Greenland and a booming Chinese economy driving up commodities prices looked destined to turn the world’s largest island into an Arctic El Dorado. But none of the companies awarded licenses was able to make any commercial finds, even before the oil price dropped to a level that would make production unprofitable.

Read more …

“There’s less demand, and there’s oversupply. And both are recipes for a crash in oil. And that’s what happened. It’s a no-brainer.”

• Saudi Prince Alwaleed: $100-A-Barrel Oil ‘Never’ Again (Maria Bartiromo)

Saudi billionaire businessman Prince Alwaleed bin Talal told me we will not see $100-a-barrel oil again. The plunge in oil prices has been one of the biggest stories of the year. And while cheap gasoline is good for consumers, the negative impact of a 50% decline in oil has been wide and deep, especially for major oil producers such as Saudi Arabia and Russia. Even oil-producing Texas has felt a hit. The astute investor and prince of the Saudi royal family spoke to me exclusively last week as prices spiraled below $50 a barrel. He also predicted the move would dampen what has been one of the big U.S. growth stories: the shale revolution.

In fact, in the last two weeks, several major rig operators said they had received early cancellation notices for rig contracts. Companies apparently would rather pay to cancel rig agreements than keep drilling at these prices. His royal highness, who has been critical of Saudi Arabia’s policies that have allowed prices to fall, called the theory of a plan to hurt Russian President Putin with cheap oil “baloney” and said the sharp sell-off has put the Saudis “in bed” with the Russians.

Q: Can you explain Saudi Arabia’s strategy in terms of not cutting oil production?

A: Saudi Arabia and all of the countries were caught off guard. No one anticipated it was going to happen. Anyone who says they anticipated this 50% drop (in price) is not saying the truth. Because the minister of oil in Saudi Arabia just in July publicly said $100 is a good price for consumers and producers. And less than six months later, the price of oil collapses 50%. Having said that, the decision to not reduce production was prudent, smart and shrewd. Because had Saudi Arabia cut its production by 1 or 2 million barrels, that 1 or 2 million would have been produced by others. Which means Saudi Arabia would have had two negatives, less oil produced, and lower prices. So, at least you got slammed and slapped on the face from one angle, which is the reduction of the price of oil, but not the reduction of production.

Q: So this is about not losing market share?

A: Yes. Although I am in full disagreement with the Saudi government, and the minister of oil, and the minister of finance on most aspects, on this particular incident I agree with the Saudi government of keeping production where it is.

Q: What is moving prices? Is this a supply or a demand story? Some say there’s too much oil in the world, and that is pressuring prices. But others say the global economy is slow, so it’s weak demand.

A: It is both. We have an oversupply. Iraq right now is producing very much. Even in Libya, where they have civil war, they are still producing. The U.S. is now producing shale oil and gas. So, there’s oversupply in the market. But also demand is weak. We all know Japan is hovering around 0% growth. China said that they’ll grow 6% or 7%. India’s growth has been cut in half. Germany acknowledged just two months ago they will cut the growth potential from 2% to 1%. There’s less demand, and there’s oversupply. And both are recipes for a crash in oil. And that’s what happened. It’s a no-brainer.

Read more …

“A vast transfer of wealth from exporters to importers is occurring.” Yeah, sure, but a lot of money/credit is ismply vanishing.

• Here’s What Happens When Oil Prices Crash – Not Pretty For Producers (Guardian)

The longest and biggest oil boom in history is over. In a boom – and the latest one lasted almost 10 years – everything shines for producer nations: the economy grows, consumption explodes, businesses make fat profits regardless of their productivity, poverty declines even if social protection programmes are ineffective, politicians are popular and get re-elected even if they are incompetent and corrupt, and people tend to be happier. But oil prices tend to be cyclical, so when the downturn comes, the party ends. During the oil price decline of the 1980s, most oil-dependent countries suffered the consequences of the resulting collapse in investment and consumption. A few, such as Oman and Malaysia, were able to compensate for the price collapse by increasing production, but many oil exporters suffered, also due to the production cuts agreed by OPEC.

Some recovered better than others, but in general between 1982 and 2002 they fared much more poorly than the rest of the developing world. Those that fared worst were typically the ones that got into debt during the boom. Poverty and unemployment rose sharply. In fact, such underperformance led to the widespread idea that having oil is a curse, which has generated extensive literature. The reality is more complex, as shown by economic overperformance during the past decade’s boom. In fact, taking out those two “bust” decades, oil countries have outperformed their peers over the past 70 years. So the real “curse” is in fact an oil price collapse. The current price collapse – for the first time since 2009 prices are below the symbolic $50 a barrel – is largely a result of the boom in shale oil production in the US, adding more than 3m barrels over the past few years. High prices bring investment and supply, and this boom was no different.

Oil prices are notoriously difficult to predict, so we do not know if the current bust will last, despite evidence that points to at least two more years of lower prices. Moreover, prices are still above historical standards. For the majority of the more than 120 years of history of the oil industry the price has been below $50 in today’s money. But geopolitics or renewed consumption could alter the oversupply scenario and surprise us once again. In fact, oil busts tend to lead to booms down the road precisely because investment in oil exploration dries up. Net importers, like most European countries, will benefit from the oil price decline. In the US, citizens will pay significantly less for gasoline than they have over the past five years, leading them to spend more on other goods. A vast transfer of wealth from exporters to importers is occurring.

Read more …

Tsipras: “Greece is fated to become a “colony” without a future ..”

• Greek PM Stuns Creditors With Election Promise To Ease Austerity (Guardian)

In a move likely to stun international creditors keeping debt-stricken Greece afloat, the prime minister, Antonis Samaras, has stepped up his electoral campaign with a promise to ease the austerity policies demanded in exchange for financial aid, two weeks before crucial snap elections. Unveiling a “roadmap” of measures for a “post-bailout Greece”, the leader pledged he would restrict spending cuts and reforms that have seen the popularity of the main opposition radical left Syriza party soar. “I personally guarantee there will be no more pension or wage cuts,” he told his centre-right party members in Athens at the weekend as electioneering intensified ahead of the vote on 25 January. “The next breakthrough in our growth plan includes tax cuts across the board which can happen gradually, step by step.”

Both pension reform and streamlining of the profligate public sector have been set as conditions for the future financial assistance Athens so desperately needs from the European Union and International Monetary Fund. Failure to agree on the painful measures, nearly five years after its near-economic collapse, has prevented Greece concluding talks with lenders consenting to provide bailout funds only until the end of February. With a workforce of 2.7 million paying for retirees of roughly the same number, creditors have insisted that pensions be pared back. The demand has been the centrepiece of Athens receiving a new “precautionary credit line” when its €240bn financial assistance programme runs out. It is also a condition of any future talks over the rescheduling of Greek debt, at 177% of GDP not only the largest in the EU but by far the biggest drain on the economy. [..]

Stepping up his own campaign, Syriza’s leader, Alexis Tsipras, announced on Sunday that his party was seeking “a clear mandate” that would allow it to renegotiate the tough conditions attached to financial assistance. Latest polls show that while the radical leftists are leading by a 3 to 5% margin, they are still unlikely to win an outright majority in the 300-seat parliament. “We are asking the Greek people to give us a strong mandate so that the memorandum [bailout accord] won’t become a permanent status quo [causing] social catastrophe for the country,” he told Real News. “So that the commitments [agreed by] today’s government are not enforced … and so that there won’t be a new memorandum of austerity.” Earlier, the leader had told supporters that Greece is fated to become a “colony” without a future if the cost-cutting policies imposed by the bailout terms continued unabated.

Read more …

“Italy could follow Greece’s steps if the exit will prove successful in providing some relief to the country’s economic crisis ..”

• Banks Ready Contingency Plans in Case of Greek Eurozone Exit (WSJ)

Banks and other financial institutions in Europe are stress-testing their internal systems and dusting off two-year-old contingency plans for the possibility that Greece could leave the region’s monetary union after a key election later this month. Among the firms running through drills are Citigroup, Goldman Sachs and brokerage ICAP, according to people familiar with the matter. The firms’ plans include detailed checks on counterparties that could be significantly affected by a Greek exit, looking at credit exposures and testing how they would provide cross-border funding to local operations. Some firms are also preparing for the impact on payment systems and conducting trial runs of currency-trading platforms to see how they would cope with adding a new Greek currency or dealing with potential capital controls.

The moves come as Greek leftist opposition party Syriza continues to lead in recent public opinion polls ahead of national elections on Jan. 25. The ruling coalition government has framed the election as a de facto poll on whether the country stays in the eurozone, saying Syriza’s antiausterity policies would force a break with eurozone partners. Syriza, though, hasn’t campaigned on an exit and most Greek voters want to stay in the monetary union, according to recent polls. Most analysts still say the chances of a Greek exit are quite low. Economists at Commerzbank rate the chances on an exit at below 25%. “Hope for the best, plan for the worst,” said Frederic Ponzo, managing partner at consultancy Grey Spark. Financial firms often test their systems for events such as a rapid change in oil prices or the recent referendum on Scottish independence, he added.

At some European banks, that currently means dusting off plans drawn up a couple of years ago, when a eurozone breakup was a hot topic. In 2011 and 2012, banks, brokers and companies with significant exposure to Greek assets put in place contingency plans to minimize the fallout from a breakup. In late 2011, former ICAP Chief Executive David Rutter said the firm had stress-tested its currency trading platform EBS for all 17 currencies that would have resurfaced in the case of a complete breakup of the eurozone. The brokerage conducted similar tests earlier this month, two people familiar with the matter said. Other European banks are running similar tests on trading platforms to ensure they would be capable of dealing with a rash of new currencies, according to several people familiar with the matter.

The head of currencies trading at a large European bank said that reintroducing the Greek drachma to its trading system wouldn’t be too difficult, but dealing with a larger breakup would be more challenging. “Italy could follow Greece’s steps if the exit will prove successful in providing some relief to the country’s economic crisis,” he said.

Read more …

Dead end.

• ECB Plans QE According To Paid-In Capital (CNBC)

The European Central Bank could be ready to announce a quantitative easing program based on the contributions made from national central banks, a source close to the central bank has told CNBC. The source said that the central bank is planning to design a sovereign debt purchase program based on the paid-in capital contributions made by euro zone central banks. Every national central bank pays a certain amount of capital into the ECB. For example Germany pays in 17.9% of the total contributions, while France contributes 14.2%. Cyprus, meanwhile, pays the least with 0.15% of the total. The level of this paid-in capital contribution would determine how much of that country’s sovereign debt the central bank would purchase, according to the source, although nothing has been finalized yet.

The comments were made ahead of the ECB’s next meeting on January 22, at which it is widely expected that it could announce a full-blown quantitative easing program in order to stimulate growth and demand in the deflation-hit euro zone. On Friday, sources told Reuters that the bank was considering a hybrid approach to government bond purchases which would combine the ECB buying debt with risk sharing across the euro zone and separate purchases by national central banks. The latter element of such a design would hope to ease German concerns over the central bank taking on the debt of struggling nations such as Greece.

Read more …

“.. quantitative easing has faced significant obstacles even in areas exactly where it has scored apparent successes.”

• European Central Bank’s Bond-Acquiring Plans Face Doubt (WSJ)

The European Central Bank is widely expected to follow the U.S. Federal Reserve’s lead this month with a new system of bond purchases meant to stimulate the eurozone’s limp economy. Whether or not it performs is an additional matter. Bond-shopping for programs, identified as quantitative easing, are meant to drive down borrowing expenses to encourage households and companies to borrow, invest and commit. They also aim to enhance the value of assets such as stocks and encourage far more risk-taking. In addition, they have a tendency to push down the value of a nation’s currency, which helps to boost exports. The currency element is specially critical in Europe, where the euro has tumbled to a nine-year low against the dollar.

Yet quantitative easing has faced significant obstacles even in areas exactly where it has scored apparent successes. These obstacles could be even much more formidable in Europe, where gross domestic item remains beneath 2008 levels and unemployment remains in double digits. The Fed, for instance, accumulated a portfolio of $1.7 trillion worth of mortgage-backed securities, but its efforts to push down mortgage prices didn’t support millions of Americans who had been locked out of refinancing at reduce prices or taking out new mortgages for the reason that they have been burdened by bad credit and faced tighter bank standards.

Some research of the effectiveness of quantitative easing in the U.S. have recommended it was most potent when aimed at private securities markets such as those primarily based on mortgages, even with the impediments in these markets. But private debt-securities markets in Europe are too smaller for the ECB to tap aggressively. About 80% of corporate lending in Europe is completed by means of the region’s monetary institutions, rather than via bond markets. And the banking method is hugely fragmented along national boundaries. For instance, compact firms in Germany are able to borrow at two.eight% interest, according to ECB figures, versus 4% in Spain.

Read more …

“The EU’s malaise is self-inflicted, owing to an unprecedented succession of bad economic decisions, beginning with the creation of the euro. Though intended to unite Europe, in the end the euro has divided it ..”

• Europe’s Economic Madness Cannot Continue (Joseph Stiglitz)

At long last, the United States is showing signs of recovery from the crisis that erupted at the end of President George W. Bush’s administration, when the near-implosion of its financial system sent shock waves around the world. But it is not a strong recovery; at best, the gap between where the economy would have been and where it is today is not widening. If it is closing, it is doing so very slowly; the damage wrought by the crisis appears to be long term. Then again, it could be worse. Across the Atlantic, there are few signs of even a modest US-style recovery: the gap between where Europe is and where it would have been in the absence of the crisis continues to grow. In most European Union countries, per capita GDP is less than it was before the crisis. A lost half-decade is quickly turning into a whole one. Behind the cold statistics, lives are being ruined, dreams are being dashed, and families are falling apart (or not being formed) as stagnation – depression in some places – runs on year after year.

The EU has highly talented, highly educated people. Its member countries have strong legal frameworks and well-functioning societies. Before the crisis, most even had well-functioning economies. In some places, productivity per hour – or the rate of its growth – was among the highest in the world. But Europe is not a victim. Yes, America mismanaged its economy; but, no, the US did not somehow manage to impose the brunt of the global fallout on Europe. The EU’s malaise is self-inflicted, owing to an unprecedented succession of bad economic decisions, beginning with the creation of the euro. Though intended to unite Europe, in the end the euro has divided it; and, in the absence of the political will to create the institutions that would enable a single currency to work, the damage is not being undone.

The current mess stems partly from adherence to a long-discredited belief in well-functioning markets without imperfections of information and competition. Hubris has also played a role. How else to explain the fact that, year after year, European officials’ forecasts of their policies’ consequences have been consistently wrong? These forecasts have been wrong not because EU countries failed to implement the prescribed policies, but because the models upon which those policies relied were so badly flawed. In Greece, for example, measures intended to lower the debt burden have in fact left the country more burdened than it was in 2010: the debt-to-GDP ratio has increased, owing to the bruising impact of fiscal austerity on output. At least the IMF has owned up to these intellectual and policy failures.

Read more …

They’ve completely lost it.

• Japan Readies Record $800 Billion 2015-16 Budget (Reuters)

Japan’s government will propose a record budget for next fiscal year of more than $800 billion but cut borrowing for a third year, government officials said on Sunday, as Prime Minister Shinzo Abe seeks to maintain growth while curbing the heaviest debt burden in the industrial world. The third annual budget since Abe swept to power in late 2012 also highlights his struggle to contain bulging welfare costs for the fast-ageing society while increasing discretionary spending in areas such as the military. Abe’s 96.3 trillion yen ($813 billion) draft budget for the year from April, to be approved by the Cabinet on Wednesday and submitted to an upcoming session of Parliament, is up from this fiscal year’s initial 95.9 trillion, the two officials told Reuters.

But spending restraint and a surge in tax revenues as the economy recovers allows the government to cut bond issuance by 4.4 trillion yen to 36.9 trillion, the third decrease in a row and the lowest level in six years, the officials said. The improved fiscal picture helps Abe trim Japan’s public debt, which is well over twice the country’s GDP after years of sluggish growth and huge stimulus spending. The budget for the coming year follows an extra budget of 3.1 trillion yen for this fiscal year, approved last week. With the budget deficit – excluding new bond sales and debt servicing – projected at roughly 3% of gross domestic product for the 2015-16 fiscal year, Abe will meet the government’s promise of halving the debt ratio from 2010-11 levels. But Finance Ministry calculations show that the goal of balancing the budget by 2020-21 remains ambitious.

Read more …

“.. Mr. Jakobsen argues that the real challenge is if the central banks become successful in raising interest rates. That, he says, will cure everything. However,every single goal stated by central banks and policy makers actually makes things worse.”

• Steen Jakobsen Warns “Things Are About To Take A Different Turn In 2015” (ZH)

Jakobsen is a firm believer in the business cycle, and sees a seven-year cycle in play. The last peaks in the cycle were in 2000 and 2007. Before that, it was in 1993, and before that, it was in 1986. There are exactly 7 years between the peaks and the lows that followed and that is why he is so optimistic about 2015. We will see a new low for everything next year, which could trigger a significant improvement towards year-end. Mr. Jakobsen believes that things are so bad they can only get better. Take Russia, for instance. Today it is minutes, maximum days away from having capital restrictions. Capital restrictions are also in place in Cyprus and in Iceland. This suggests that the world is turning inwards and not outwards. But, according to Jakobsen that creates more crises and not less crises, and that is good news!

The West is over-indebted, growth is near zero and there are no growth impulses on the horizon. There are not many options left. Politicians would prefer to create inflation. But Jakobsen believes the only solution is haircuts. The investor will take a loss but everything will be better the next day. He clearly and firmly believes that a haircut for Greece and a haircut for Portugal is exactly what they need because underneath all of this, their competitiveness is now at a level with Germany for the first time since the introduction of the Euro. He goes on to explain that they have taken the internal devaluation, but they are still being front-loaded with interest on debt which they pay off in the first six months of every year.

Central banks understand that interest rates cannot go up. At zero interest rate you can carry debt for a long time. But Mr. Jakobsen argues that the real challenge is if the central banks become successful in raising interest rates. That, he says, will cure everything. However,every single goal stated by central banks and policy makers actually makes things worse. According to Jakobsen, what needs to happen is to have low interest rates for a considerable time and have the real economy take over. If the haircuts do not take place, the world will face a huge risk where a collapse in the long-term debt cycle would take place.

Read more …

Jeez, how did they manage to bungle that one?

• Kerry to Visit France After US Faulted for Rally Presence (Bloomberg)

Secretary of State John Kerry will travel to France to consult with President Francois Hollande and express solidarity in the wake of last week’s terrorist attacks. The White House has come under criticism for failing to show a visible presence at a rally in Paris yesterday that was attended by 56 world leaders. The largest crowd in French history – more than 3.7 million strong – turned out for rallies across the country. “The United States has been deeply engaged with the people of France since this occurred,” Kerry told reporters in Gujarat, India, when asked about criticism that the U.S. didn’t have a senior official present for the Unity March. “We have offered from the first moment our intel,” and help, Kerry said.

At the time of the march, Kerry – a French speaker with long ties to France – was in India for meetings with Prime Minister Narendra Modi and to attend a business event. The U.S. was represented by the Ambassador to France, Jane Hartley. Thousands of police and soldiers were deployed for the march to mark France’s worst terrorist attack in more than half a century. Among world leaders present were Prime Minister David Cameron of the U.K., German Chancellor Angela Merkel, King Abdullah of Jordan, Palestinian President Mahmoud Abbas and Israel’s Benjamin Netanyahu. Kerry said the U.S. had offered France security assistance. “The president and our administration have been coordinating very, very closely with the French on FBI matters, intel, law enforcement across the board, and we will continue to make available any assistance that may be necessary,” he said.

Read more …

Someone (Obama) better get De Blasio around the table with his policemen.

• The Curious Case Of New York’s Zero Crime Wave (Independent)

Is it really possible that no one among the roughly one million revellers who jammed Times Square on New Year’s Eve did anything naughty at all? No double-parking, no sipping from a vodka flask, not one person relieving a stretched bladder in the open air? According to the police crime statistics, yes. A big fat zero is the answer if you ask how many tickets were issued on New Year’s night for petty crimes at the crossroads of the world. Actually, it was still zero if you counted the week after Christmas. My, how well behaved everyone was this year. Or is there, perchance, another explanation? It now seems plain that the curious case of collapsing crime in Gotham City has very little to do with societal self-improvement and everything to do with the pique of the city’s police force with their leader, Mayor Bill de Blasio. He incensed rank-and-file officers at the end of last year by seeming to side with those protesting at the deaths of unarmed black men at the hands of white officers.

Their union leaders have so far denied it is so, but there is no longer any doubt that the police in New York have joined together in a quiet act of mass insubordination by turning a blind eye to every kind of low-level infraction. The enforcement go-slow was certainly under way over Christmas and the New Year. New statistics due out on Monday will show if it’s still happening. It took Police Commissioner William Bratton until Friday to admit he had a discipline problem. “We’ll work to bring things back to normal,” he told clamouring reporters. He signalled a degree of forbearance, however, pointing to the “extraordinarily stressful situations” members of his force had faced. New York was one of many cities that witnessed huge anti-police protests late last year after two notable cases of grand juries declining to indict police officers involved in the killings of unarmed black men.

Read more …

“Birmingham is home of Black Sabbath and other terrifying Muslim musicians.”

• Birmingham A ‘Totally Muslim’ City: Fox News ‘Terror Expert’ (Ind.)

Birmingham is a “totally Muslim” place where “non-Muslims just simply don’t go”, a self-proclaimed terrorism expert told the US Fox News channel, sparking a tidal wave of mockery. Steve Emerson’s comments saw the Twitter hashtag foxnewsfacts trend worldwide on Twitter as people made things up about Birmingham, Fox News or pretty much anything. Mr Emerson was taking part in a television discussion about supposed Muslim-controlled areas in Europe. “In Britain, it’s not just no-go zones, there are actual cities like Birmingham that are totally Muslim where non-Muslims just simply don’t go in,” he said. “Parts of London, there are actually Muslim religious police that actually beat and actually wound seriously anyone who doesn’t dress according to Muslim, religious Muslim attire.”

He said there were sharia courts in Birmingham “where Muslim density is very intense, where the police don’t go in, and where it’s basically a separate country almost, a country within a country”, adding that the UK government did not “exercise any sovereignty” there. Jeanine Pirro, the host of the Judge Pirro show, replied: “You know what it sounds like to me, Steve? It sounds like a caliphate within a particular country.” Their laughable remarks saw British politicians, leading journalists, novelists and others take part in the general derision of the news channel on Twitter. Labour MP Tom Watson retweeted a message which said: “Birmingham is home of Black Sabbath and other terrifying Muslim musicians. #FoxNewsFacts.” Fellow writer Irvine Welsh said: “I warn you, @FoxNews, I have an Ocean Colour Scene download and I’m not afraid to use it! (Well, maybe a wee bit…).” Broadcaster Robin Lustig came up with: “Jihadi extremists have forced the city of Oxford to rename the Thames the River Isis. #foxnewsfacts”

And even ITN newsreader Alastair Stewart, joined in “If you do not clean your finger-nails regularly, potatoes will grow in your stomach, crush your lungs & suffocate you. #FoxNewsFacts,” he wrote. Sean Kelly, who describes himself as a “regular bald guy”, tweeted: “Extremist rock group Showaddywaddy have reformed and changed their name to Jihaddywaddy #foxnewsfacts.” Mr Emerson later apologised but did not provide a full explanation of how he came to make the remarks. He told ITV News: “I have clearly made a terrible error for which I am deeply sorry. My comments about Birmingham were totally in error. And I am issuing an apology and correction on my website immediately for having made this comment about the beautiful city of Birmingham. “I do not intend to justify or mitigate my mistake by stating that I had relied on other sources because I should have been much more careful. There was no excuse for making this mistake and I owe an apology to every resident of Birmingham.

Read more …

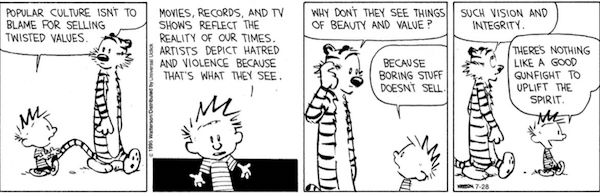

“This economic model has been based on the idea that consumer wants and needs are inexhaustible and that is the job of companies and the state to satisfy those demands as best they can.”

• The Economics Of Happiness Can Make For Sad Reading (Guardian)

From the collapse of the Roman empire to the dawn of the industrial age, incomes per head barely grew at all. The standard of living for the average European peasant when Attila the Hun was attacking the Roman empire was little different from that when Frederick the Great was on the throne of Prussia in the mid-18th century. Since then, though, there has been a steady and spectacular increase in living standards. People in developed countries are richer, live longer and are healthier than they were 250 years ago. Growth has brought benefits. This economic model has been based on the idea that consumer wants and needs are inexhaustible and that is the job of companies and the state to satisfy those demands as best they can.

There has yet to be a political party that has won an election on the slogan: vote for us and we will make you worse off. A company’s share price is not based on what is happening to its global footprint. For businesses, even right-on businesses, the imperative is to expand. The “more is better” model is, if anything, stronger now than it was before the financial crisis. That’s partly the result of the state of the economic cycle: environmentalism and alternative measures of progress to incomes per head rise in prominence during the good times, then slip down the political agenda when times are tougher. That, though, is not the only factor. There have been challenges to the idea that there is no link between rising incomes and happiness. Betsey Stevenson and Justin Wolfers, for example, produced a 2013 study showing that money does matter.

They say that happiness rises as income rises, and that this holds true in comparisons both between and within countries. The relationship between incomes and happiness does not diminish as incomes rise. “If there is a satiation point we have yet to reach it,” the pair conclude. The debate between the two rival camps will rumble on. But the falls in living standards seen during the Great Recession and its aftermath should shed fresh light. Studies showing no link between income and happiness go back to Richard Easterlin’s work in 1974, but this came at the end of the long postwar boom. It will be interesting to see whether levels of happiness hold up even when living standards are falling.

Read more …