Claude Monet Éretrat sunset 1882-3

Ukraine cannot win this war. But it can win peace.

Fuellmilch

Dr. R.einer F.uellmich and his dang c.onspiracy t.heories.pic.twitter.com/Q0qD2kvgEi

— NEWSNANCY (@NewsNancy9) September 11, 2022

Tried to find some western sources for this, but they all say this was done in retaliation for Ukraine “successes”, which they can’t prove, and then just lazily cite Zelensky verbatim. And I can’t even remember the last time he said something true. So we’re stuck with RT.

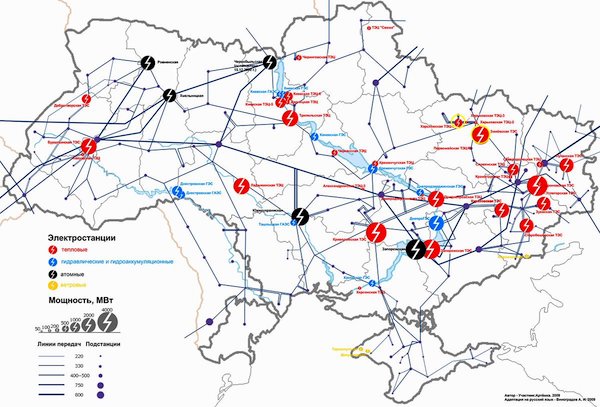

• Ukraine Suffers Massive Blackout After ‘Russian Strikes’ (RT)

Multiple regions of southeastern Ukraine suffered electricity shortages and blackouts late on Sunday. President Vladimir Zelensky has said the cause was missile attacks by Moscow on “critical infrastructure.” Full blackouts have hit Kharkov and Donetsk regions, Zelensky said in a social media post, apparently referring to the Ukrainian-controlled part of Donetsk People’s Republic. Sumy, Dnepropetrovsk, Poltava, Zaporozhye and Odessa regions have been hit by partial blackouts, according to the president, who blamed the incident on “Russian terrorists.” So, far Moscow has remained silent on the matter, neither confirming nor denying its involvement. Still, the incident has been preceded by a reported launch of multiple cruise missiles from Russian ships positioned in the Black and Caspian Seas.

Footage circulating online shows the aftermath of the purported attacks, with firefighters trying to extinguish flames at what appear to be power plants. Another video, purportedly shot in Poltava, shows a trolleybus that caught fire, apparently due to a power surge in the grid. The blackout has affected the operations of Ukrainian railways, which reported delays across the country. It also brought the subway system in the eastern city of Kharkov to a halt the, footage circulating online purports to show. So, far, emergency services have managed to restore power supply only in Poltava, Sumy and Dnepropetrovsk regions, according to Ukrainian media reports.

I think this was just a warning shot, not an attempt to kill the grid. There are ways to do that.

• Ukraine Says It’s Repaired Damaged Power Infrastructure (RT)

Blackouts allegedly caused by Russian strikes on the Ukrainian power grid were partially dealt with overnight, according to President Vladimir Zelensky’s deputy chief-of-staff. In a Telegram post, Kirill Timoshenko reported the full restoration of electricity supplies in the Ukrainian cities of Sumy, Dnepropetrovsk and Poltava. Grid capacity in Kharkov region, which was the scene of a successful Ukrainian counter-offensive last week, was at 80% on Monday morning, according to the official. The Mayor of Kharkov, Igor Terekhov, said on Monday morning that the city’s subway and trolleybus systems were back online and that the water supply would be fully restored during the day. Electric-powered transport was paralysed during the Sunday outage.

Kiev blamed the blackouts in several of its regions on Russian missile attacks targeting power stations and key nodes of the transmission grid. The Russian military has neither confirmed nor denied carrying out such attacks. The purported Russian military action on Sunday followed Ukraine’s counter-offensive in the north of the country. Last week, Kiev forced Russian troops to leave a swath of previously captured territory in Kharkov region. Kiev called it a major success for its military and a harbinger of further victories on the battlefield. Moscow has described the loss of territory as a temporary setback, necessary to win time for regrouping Russian troops.

12,000 in 5 days. Over 4,000 killed and another 8,000 injured.

Gonzalo Lira: “Assuming that Dima at Military Summary channel is correct (and I think he is), in these past two weeks of offensives, Ukraine lost +10,000 and another +20,000 wounded.”

As the Russians reportedly mostly just walked away these past few days.

• Ukraine Lost Thousands Of Soldiers In Counteroffensive – Moscow

Ukrainian military casualties in just five days of its counteroffensive exceeded 12,000, Russia’s Defense Ministry has claimed. More than 4,000 Ukrainian troops were killed and another 8,000 injured between September 6 and 10 in the south and east of the country, ministry spokesman Lieutenant General Igor Konashenkov said during a daily briefing on Sunday. According to the official, Russian forces conducted “precision strikes” with missiles and artillery targeting pro-Kiev units in Kharkov region, from where Russian troops retreated earlier as part of what Moscow described as “redeployment.” Russia said its military has destroyed, among other things, numerous command posts and shot down a helicopter over the past few days.

The Defense Ministry also accused the Ukrainian troops of having shelled the Zaporozhye nuclear power plant 26 times since September 1. The Russia-controlled facility located in Ukraine’s southern Zaporozhye region was seized by Russian forces in early March, soon after Moscow launched its military operation. On Sunday, the last working reactor at the plant was switched off. According to a member of the region’s pro-Russian administration, the decision was made due to continued shelling of the plant by Ukraine and damage to the power lines. The constantly changing modes in which the reactors and turbines were forced to operate, because of the attacks, created the risk of an accident, Vladimir Rogov told RIA-Novosti.

Kiev and Moscow have been accusing each other of targeting the power plant and risking a nuclear disaster for several months now. In its Sunday briefing, the Russian Defense Ministry also alleged that the Ukrainian military was deliberately striking “energy infrastructure on liberated territories,” including in the Donetsk People’s Republic.

They want to advertize direct US involvement?!

• Ukraine and US Increased Intel-sharing Prior To Counteroffensive – NYT (RT)

Ukraine had stepped up intelligence-sharing with the US in preparation for its counteroffensive against the Russian forces in the Kharkov Region, The New York Times reported on Saturday. Despite Washington providing information on Russian command posts, ammunition depots and other targets to Kiev, Ukrainian officials had been reluctant earlier in the conflict to reveal operational plans to their US counterparts, over concerns that this “could highlight weaknesses and discourage continued American support,”the newspaper claimed. But it all changed during the summer as Kiev decided that sharing plans for its counteroffensive would, contrary to previous concerns, prompt Washington to provide Ukraine with even more assistance, unnamed senior US officials told the NYT.

This shift allowed the US to offer “better and more relevant information about Russian weaknesses,” the sources reported. They declined to expand on how much information has been shared between the sides or on how deep the Americans have been involved in the planning of the Ukrainian counteroffensive, the newspaper said. However, one official claimed that the US had“constantly” discussed with Ukraine ways that it could blunt the Russian advance in the east of the country.

The large-scale Ukrainian offensive with the use of weapons supplied by the US and other Western nations started in the north-eastern Kharkov Region on Thursday after Kiev’s attempts to advance in other areas failed.On Saturday, Russia’s Defense Ministry announced the withdrawal of its troops from the city of Izyum and some other settlements in the region, saying that these are being regrouped in order “to build up efforts in the Donetsk direction.” During the operation, it added, the military had performed what it called a “number of distracting and demonstration activities imitating the real action of troops.” Ukrainian president Vladimir Zelensky celebrated the Russian retreat as a victory, but the NYT pointed out that “it is not yet clear how much broad strategic importance those gains [by Kiev] will have.” Moscow has many times warned Washington against providing weapons and sharing intelligence data with Ukraine, saying that the US risked becoming a party to the conflict through such actions.

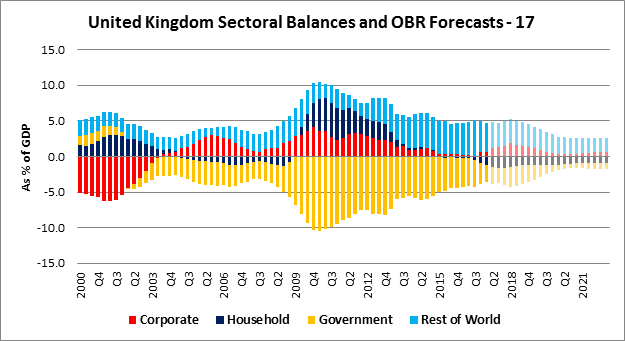

“..they sacrificed their main supplier of energy to save a nation with a GDP of roughly only $200 billion..”

“The war in Ukraine has only promoted capital to rush into the dollar.”

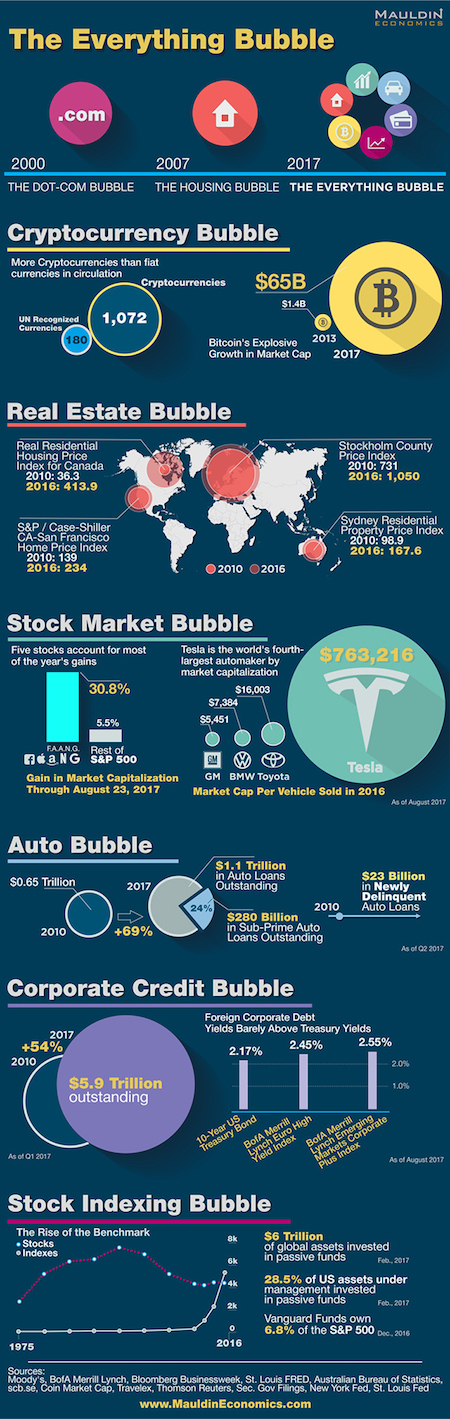

• Is the US Sacrificing Europe to Maintain Global Dominance? (Armstrong)

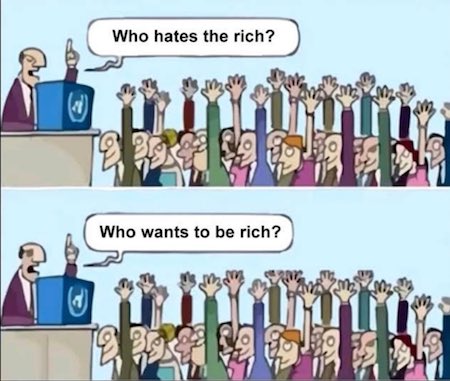

Vladimir Putin believes that Washington is sacrificing Europe to maintain global dominance. The United States has always been the world police, and the top country that others turn to in times of crisis. America’s post-World War II status left it as the financial capital of the world, and the dollar has remained the world’s reserve currency. Nothing has topped the dollar. Europe attempted to create the European Union in an effort to prevent European conflicts, but it also created the euro to compete against the dollar. I explained various times how their attempts have failed. However, the euro is now beneath the dollar and on the decline. Nations maintain diplomatic relations, but only Schwab wants a one-world government as everyone is competing for global dominance.

Putin claims that the West rushed to place sanctions on Russia. There was indeed a rush to place sanctions on Russia despite Joe Biden himself coming out and admitting sanctions never work. Peace talks were never an option. Returning land or promising to curtail NATO was never an option. Sanctions and threats were immediately imposed. Why? “The pandemic has been replaced by new challenges of a global nature, carrying a threat to the whole world, I’m talking about the sanctions rush in the West and the West’s blatantly aggressive attempts to impose their modus vivendi on other countries, to take away their sovereignty, to submit them to their will,” Putin told delegates at Russia’s Eastern Economic Forum in the port city of Vladivostok on Russia’s Pacific coast, as reported by CNBC.

It is true that Europe is facing the brunt of these sanctions as they sacrificed their main supplier of energy to save a nation with a GDP of roughly only $200 billion. Europe did not want to allow Ukraine to join the euro, and they had no interest in the country prior to this conflict. The hatred for Russia runs deep in Europe, especially in Germany after Russia took hold of the east after the last World War. The politicians are certainly old enough to remember when Germany was split in two until 1989. There is a reason Russia’s integral support for the axis powers during World War II is diminished in Western history books. Putin went on to say that the standard of living in Europe and overall social and economic stability was “being thrown onto the fire of sanctions.” The United States has been eager to sanction Russia since the war in Syria began. Obama tried but failed to kick Russia out of the SWIFT system in 2014, with Christine Lagarde offering her support. Zelensky, who rand the NYSE bell this week remotely, admitted that he needed America to place harsh sanctions on Russia to accelerate the war.

“So far, I think that the United States of America is the accelerator of the sanction policies and I think they do more than any other country. And this is the way it should be because they are the most powerful country right now. I see the same support with respect to sanctions from the United Kingdom,” Zelensky told reporters at Fox in May. The dollar remains strong and is the last safe haven. The war in Ukraine has only promoted capital to rush into the dollar. So is Europe “being sacrificed in the name of preserving the US dictatorship in global affairs,” as Putin claims? Europe will suffer more than the United States due to these sanctions. In fact, had Biden not eliminated domestic oil production, the US would not be facing an energy crisis at all. One thing is clear – the support to Ukraine is not an act of kindness. The invisible hand is at play.

He’s said a few smart things. That won’t make him popular on the other side of Brussels.

• Belgium PM Fears “Severe Risk Of Social Unrest”

“A few weeks like this and the European economy will just go into a full stop…” That is the ominous warning of yet another EU leader who recognizes the needs of his people over the needs to signal virtue towards Ukraine (and against Putin “for the sake of democracy.”) Belgian Prime Minister Alexander De Croo warned that Europe needs to act immediately to address the energy crisis or risk the kind of fundamental economic shutdown that the bloc would struggle to recover from. During an interview with Bloomberg News, De Croo warned: “The risk of that is de-industrialization and severe risk of fundamental social unrest.”

Like a number of other EU leaders, who are rapidly diverging from Brussels bureaucrats on the path forward, the Belgium leader warns against unilateral action against Russia, urging “I honestly do not see any other choice than doing market interventions,” De Croo said. “We don’t get a second chance to prove as 450 million Europeans that we take things in our hands. What you are seeing today is a massive drainage of prosperity out of the European Union.” Specifically, Belgium’s federal government is calling for introducing broad price caps on gas markets rather than just on Russian imports “because Vladimir Putin already said that he would stop selling gas.”

“What you are seeing today is a massive drainage of prosperity out of the European Union,” De Cross concluded. “A cap on Russian gas only is a purely political objective,” Belgium’s energy minister doubled-down on De Croo’s warnings, adding that Belgium “will not agree to this” as it did not “see the added value in that.” On security of supply for gas and electricity this winter, De Croo reassured his people that Belgium will be fine (thought we are unclear how he knows that), but warned that if any European country gets into a situation of blackouts it will be a “gigantic problem for all of us.”

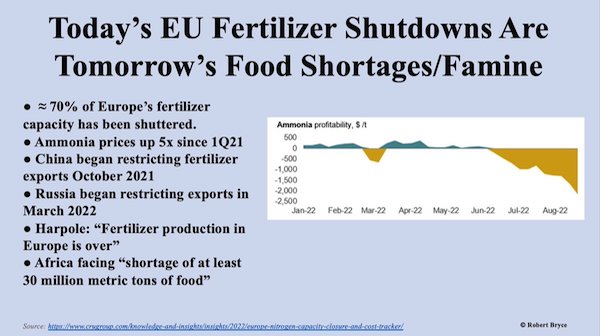

“..prices for electricity in the region saw a surge of up to 40% after April 2021, and have now soared nearly 400%..”

• Europe To Blame For Electricity Crisis – Former Austrian FM (RT)

The crisis affecting the electric power industry across Europe started in 2021 and was caused by European policymakers themselves, according to former Austrian foreign minister Karin Kneissl. “We had a crisis in the electric power industry even before the gas crisis began,” she said on Saturday in an interview with Russian news agency TASS. “That’s the result of the liberalization of the past 15-18 years, and we have been going through this since April 2021, for more than a year so far,” Kneissl added. According to the former foreign minister, the electricity market in Europe is not a classic supply-and-demand market anymore, and is now operating “in accordance with some incomprehensible principles.”

She added that the market had been redirected with a preference for renewable energy, and had turned into a unbalanced one as a result. “The electricity market, despite the role of renewable energy sources, is still highly dependent on gas prices, even when more electricity is generated from renewable sources,” Kneissl said. The former minister stressed that prices for electricity in the region saw a surge of up to 40% after April 2021, and have now soared nearly 400%, inevitably dragging households’ finances down.

“For manufacturers, for the industrial sector, the situation is even worse. There’s already a movement in the UK – it’s not [part of] the EU, but it might spread further – where people are simply boycotting their electricity bills,” she said, noting that the electricity crisis had begun prior to the gas crunch. Kneissl attributed the crisis to the significant reduction in investment in oil and gas projects, explaining that supply was declining while demand remained. “The demand has been growing after the pandemic. It was quite calm during the pandemic for a year and a half,” she said. “And we can still be glad that in China demand remains at a fairly low level, since they are introducing quite a lot of lockdowns,” Kneissl added.

“Nobody needs a meeting for the sake of a meeting”: Kremlin press-secretary Dmitry Peskov.

• Talks With Ukraine Still On The Table – Russia (RT)

Moscow is not giving up on the idea of peace talks with Kiev, but the sides need to start negotiations sooner rather than later, Russia’s Foreign Minister Sergey Lavrov has said. “We don’t reject the negotiations; we’re not giving up on the negotiations” with Ukraine, Lavrov told the Rossiya 1 channel. “Those who reject them must understand that the longer this process is delayed, the harder it will be to reach an agreement,” he added in an apparent reference to the authorities in Kiev. Lavrov noted that Russia’s President Vladimir Putin earlier voiced the same stance on peace talks. The conflicting sides have not sat down at the negotiating table since talks in Istanbul in late March.

Russia, which initially expressed optimism on the peace process, later accused Kiev of backtracking on the progress achieved in Turkey, saying it had lost trust in the Ukrainian negotiators. Russian officials warned that Moscow’s demands would be more extensive if the talks were to restart. In recent months, Ukraine has been either putting forward terms that Moscow deemed ‘unrealistic’ for the resumption of the negotiations, or said that they can only begin after Russia is defeated on the battlefield. Ukrainian leader Vladimir Zelensky has also claimed on several occasions that he wanted to discuss the outcome of the conflict directly with President Putin.

But Moscow’s position has been that the two leaders should only meet to sign concrete agreements, prepared for them by the negotiators. “Nobody needs a meeting for the sake of a meeting,” Kremlin press-secretary Dmitry Peskov said earlier this week. Ukraine launched a major counter-offensive in the north-eastern Kharkov region earlier this week after attempts to advance in other areas failed. On Saturday, Russia withdrew its forces from Izuym and some other settlements in the area, saying that they will be regrouped “to build up efforts in the Donetsk direction.”

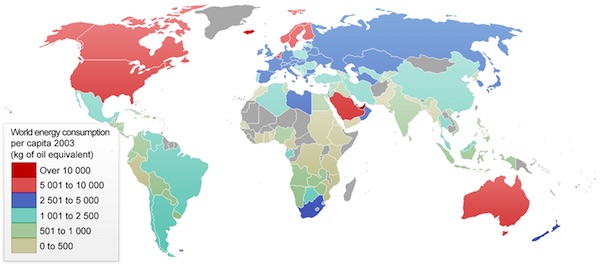

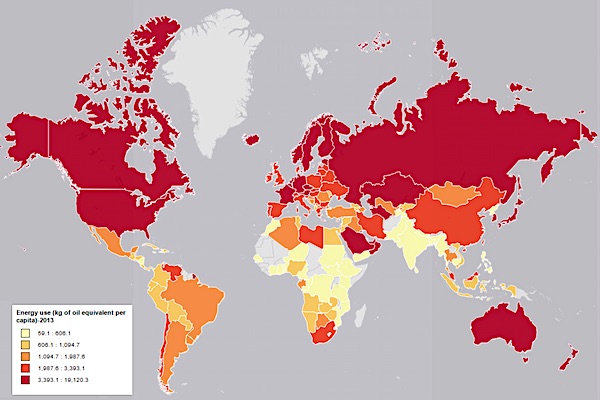

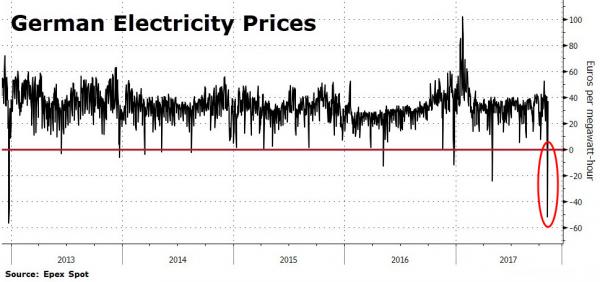

The people who make the policies don’t know a thing about energy.

• Climate Policy Is a Much Greater Threat Than Climate Change (Mish)

Germany’s decision to scrap its nuclear reactors before having replacement energy is in play. In April, then UK Prime Minister Boris Johnson bragged his Energy Security Strategy would “bring clean, affordable, secure power to the people for generations to come.” In the US, California marches on with the blessing of president Biden, preposterous targets for electric cars without having the faintest idea where the minerals and mining for those batteries will come from. The Wall Street Journal comments on the Coming Global Crisis of Climate Policy. A crisis isn’t coming, it’s already here, and obviously so.

“The Federal Reserve, Bank of England and European Central Bank, among others, want to know how global temperature variations a century hence might weigh on Citi’s or Barclays’ or Deutsche Bank’s capital and risk weightings today. The fad is for quantifying, with preposterous faux-precision, the costs of reinsuring flood risks, or fire, or the depressed corporate profits of a dystopian hotter future. Well, if you seek “climate risk” to financial stability, look around you. It has arrived, although in exactly the opposite manner to what our current crop of eco-financiers predicted. Europe’s plight tells a tale that could become all too familiar in the U.S. soon.

The U.K. may be facing a wave of business bankruptcies exceeding anything witnessed during the post-2008 panic and recession. Some 100,000 firms could be forced into insolvency in coming months, bankruptcy consultancy Red Flag Alert warned this week. These are otherwise healthy firms with at least £1 million in annual revenue. Business failures on this scale would dwarf the roughly 65,000 firms of any size that went under from 2008-10. Matters are probably worse in Germany, the eurozone’s largest economy. Some 73% of small and medium-sized enterprises in one survey reported feeling heavy pressure from energy prices, and 10% of those say they believe they face “existential” threats to their businesses over the next six months. And that poll, from the small-business association BMD, is the optimistic one. [..]

Policy decisions by clueless heads of state bow down to Saint Gretta, AOC, and president Biden. They have put in place an inflationary inferno that central bankers do not know how to stop. Even more ridiculous, President Biden, Elizabeth Warren and others want the Fed to take on a third mandate and stress test the economic impact of continued rise in temperature. What needs to be stress tested is the reverse, the inflationary impact of a push for clean energy before battery storage technology exists, grid improvements exist, and whether or not physical metals for all the batteries that will be needed are even available.

With the shift into SCO, BRICS et al, who will be hurt most?

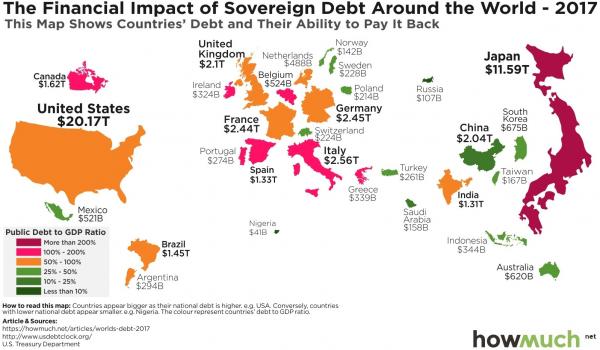

• US Creates Dollar Shortage As Russia Creates Oil, Gas & Grain Shortage (Peters)

“We must cut Russia’s revenues which Putin uses to finance this atrocious war,” said European Commission chief Ursula von der Leyen, discussing a proposal to cap the price of Russian gas. There are no easy solutions to Europe’s energy crisis, just a range of suboptimal outcomes, each of which carries unknown costs in a world growing increasingly uncertain. Making difficult decisions is always hard and subjects all involved to unintended consequences. But in a world trending toward ever greater economic integration the risk of unexpectedly bad outcomes is more muted than in periods of conflict, division, deglobalization. The reason for this (as Zoltan Pozsar pointed out two weeks ago) is a matter of trust.

When we trust that we are all competitors striving for a greater share of a more prosperous common future, the price of misjudgments and misunderstandings is relatively lower than in a world filled with real and perceived adversaries who expect the worst from one another. “We will not supply gas, oil, coal, heating oil – we will not supply anything,” said Putin in response to Ursula’s statement. In recent years, the possibility that such stark outcomes might manifest were seen by consensus as pure fancy. But those innocent times have passed, perhaps not to return for decades. The Japanese continued to cap government bond yields, intervening in markets to monetize their enormous debts. The yen extended its dramatic losses as markets prepare for another 75bp rate hike from the Fed.

The US is naturally doing what it sees as in its national interest, creating a shortage of dollars, just like Russia is doing in oil and gas, grain, and fertilizer (perhaps someday we will suffer a shortage of Taiwan’s chips). Without an ample and growing supply of dollars, the global economy sputters, markets too. Then things break. In more peaceful times, the Americans rarely adjusted domestic policy to help foreigners until the overseas problem washed ashore here at home. And we are now left to wonder how such decisions will be made in a world without trust.

“sundance” argues that Trump’s lawyers expected the case to be dismissed, but filed it anyway, because now everything in it is “on the record”.

• A Different Take on the Dismissal of the Trump v Clinton Lawsuit (CTH)

[..] when I originally read the 108-page lawsuit filed in March, it took me a few moments, and then I realized this was not a lawsuit; this was a legal transfer mechanism created by lawyers to establish a proprietary information silo. Second, because I do not want another ridiculous subpoena from DC simply because they can’t fathom how any outside entity could solve a puzzle without insider assistance. As to the former, I have prayed on it and come to the opinion it’s worth sharing. As to the latter, it’s just another waste of taxpayer funds, but whatever – the truth has no agenda. So, here’s a totally different take on the issues surrounding the Trump -v- Clinton lawsuit, which -from the outset- I always believed was going to be dismissed because suing all of those characters under the auspices of a civil RICO case was never the objective.

However, in the aftermath, the silo created by the lawsuit is also grounded upon attorney-client privilege, a legal countermeasure to a predictable DOJ-NSD lawfare maneuver, which unfolded in the Mar-a-Lago raid and ongoing issues. In March 2022 President Trump filed a civil lawsuit against: Hillary Clinton, Hillary for America Campaign Committee, DNC, DNC Services Corp, Perkins Coie, Michael Sussmann, Marc Elias, Debbie Wasserman Schultz, Charles Dolan, Jake Sullivan, John Podesta, Robby Mook, Phillipe Reines as well as Fusion GPS, Glenn Simpson, Peter Fritsch, Nellie Ohr, Bruce Ohr, Orbis Business Intelligence, Christopher Steele, Igor Danchenko, Neustar Inc., Rodney Joffe, James Comey Peter Strzok, Lisa Page, Kevin Clinesmith and Andrew McCabe.

When I was about one-third of the way through reading the lawsuit, I initially stopped and said to myself this is going to take a lot of documentary evidence to back up the claims in the assertions. Dozens of attachments would be needed and hundreds of citations to the dozens of attachments would be mandatory. Except, they were not there. After reading further, while completely understanding the background material that was being described in the filing, I realized this wasn’t a lawsuit per se’. The 108-pages I was holding in my hands was more akin to legal transfer mechanism from President Trump to lawyers who needed it. The filing was contingent upon a series of documents that would be needed to support the claims within it.

Whoever wrote the lawsuit had obviously reviewed the evidence to support the filing. However, the attachments and citations were missing. That was weird. That’s when I realized the purpose of the lawsuit. In hindsight, things became clear when the DOJ-NSD raided the home of Donald Trump, and suddenly the motive to confiscate the documents that would be the missing lawsuit attachments and citations surfaced. With the manipulative, and I say intentional, “ongoing investigation” angle of the John Durham probe essentially blocking public release of declassified documents showing the efforts of all the lawsuit participants (Trump-Russia Collusion Hoax), President Trump needed a legal way to secure and more importantly share the evidence.

Think of it like the people around Trump wanting to show lawyers the evidence in the documents. However, because of the construct of the lawfare being deployed against Trump, any lawyer would need a *reason* to review the evidence. The Trump -v- Clinton et al lawsuit becomes that ‘reason.’ [..] If the documents seized by the FBI were part of the lawsuit established by President Trump and his legal team via Trump -v- Clinton, then the material seized is all attorney client work product. Lawfully obtained, constitutionally declassified and legally protected material. sThis is where the ‘special master’ will play a key role.

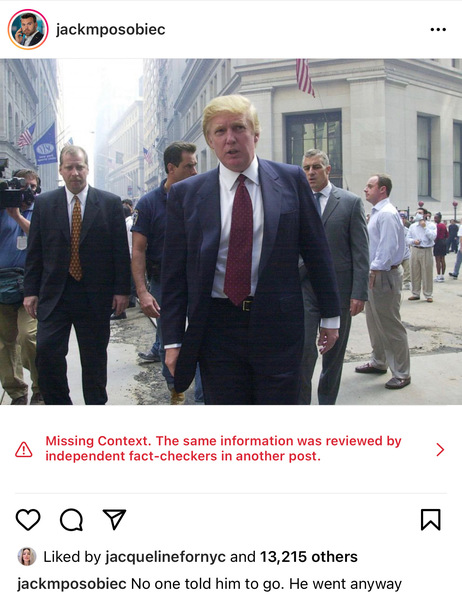

Don’t think there’s any doubt that Trump loves NYC.

• Instagram Fact-checks Trump WTC Photo As ‘Missing Context’ (PM)

In honor of the 21st anniversary of the attacks on the World Trade Center, Human Events Daily’s Jack Posobiec posted a photo of Donald Trump visiting Ground Zero in 2001. In response to the Instagram post, showing Trump at that horrific scene so many years ago, Instagram posted a “fact-check,” reading: “Missing Context. The same information was reviewed by independent fact-checkers in another post.” Posobiec’s comment was “No one told him to go. He went anyway.” The photo is credited to Getty Images. The fact-check was posted on the photo, despite no claims being made other than that Trump was there. Instagram’s parent Meta’s algorithms appear to be looking to discredit Trump, even when there is nothing to discredit.

Opening up the message brings readers to a fact-check showing two fact checks. Lead Stories says that the conclusion of their fact check is that the post has “missing context,” by which they explain that there is “No evidence that Donald Trump paid hundreds of workers to help with search and rescue after 9/11.” This is a fact check on a photo showing Trump at the site of the terrorist attack in 2001. It made no claims other than that he was there, which he was. A fact-check from Snopes states that their conclusion is that the post is “partly false,” giving as “more information” the question “Was Donald Trump at Ground Zero searching for survivors two days at 9/11 with workers he paid for?” This on a fact-check of a photo which made no additional claims. Snopes’ rating as to whether or not Trump brought employees down to Ground Zero is recorded as “unproven.”

It was years later that a meme, using the same Getty photo, began circulating that was captioned: “2 days after the September 11th attacks Donald Trump was at ground zero with hundreds of workers that he payed for, to help find and identify victims.” Trump visited Ground Zero on September 13, 2001, two days after the attacks. According to The New York Times, Trump had said “Many of those affected were firefighters, police officers and other first responders. And I was down there also, but I’m not considering myself a first responder. But I was down there. I spent a lot of time down there with you” at a speaking event years later. Others said he wasn’t there for extended periods of time. Trump said in 2001 that “I have a lot of men down here right now. We have over 100 and we have 125 coming. So we’ll have a couple of hundred people down here.”

He added: “We will be involved in some form helping to reconstruct.” The reconstruction efforts were led by the City of New York, and Larry Silverstein, who was the existing developer of the property. At a 2016 speaking event in Buffalo, NY, Trump said “Everyone who helped clear the rubble — and I was there, and I watched, and I helped a little bit — but I want to tell you: Those people were amazing. Clearing the rubble. Trying to find additional lives. You didn’t know what was going to come down on all of us — and they handled it.” Trump was a private citizen in 2001, a native New Yorker, and a local businessman.

CJ Hopkins is not impressed with Mattias Desmet.

• Mass Formation Hypnosis Disorder (CJ Hopkins)

Well, gosh, this is kind of embarrassing. For approximately the last two and a half years, I have been documenting, analyzing, and occasionally satirizing the so-called “New Normal,” i.e., the new, pathologized, official ideology that has been rolled out all across the planet by the global-capitalist ruling classes under the pretext of combating an apocalyptic pandemic … or at least that’s what I thought was going on. As it turns out, I was totally wrong. Apparently, the global-capitalist ruling establishment (or “GloboCap,” as I often refer to the unaccountable, supranational network of global corporations, banks, governments, and non-governmental governing entities that unaccountably govern our world) has not been rolling out a new official ideology, or pathologized form of totalitarianism, or not intentionally in any event.

No one has been methodically gaslighting anyone, or terrorizing anyone with propaganda, or censoring or segregating anyone, or coercing anyone to get needlessly “vaccinated” with any sort of dangerous experimental drugs, or consciously conspiring with anyone to do anything. Everyone has simply been suffering from Mass Formation Hypnosis Disorder! I know, you probably find this hard to believe, especially because I have been making precisely the opposite case for over two years now, but I saw it on the Alex Jones show! Mattias Desmet, a professor from Belgium, and “the world’s leading expert” on this new disorder, explained it all in meticulous detail.

According to Desmet, the way this disorder works is, people feel “lonely and isolated,” which makes them feel angry, but they don’t have anything or anyone to unleash their anger on, so they form a mass and hypnotize each other, and invent a new fanatical ideology that they all fanatically hypnotically believe in, which, at that point, their rulers, who are also hypnotized, have no choice but to go full-totalitarian, and hypnotize everyone even more, because that is what the hypnotized mass demands, so that they can finally unleash their anger on someone, i.e., those who have managed to avoid being hypnotized (one assumes with some special anti-hypnosis technology, but I don’t think Professor Desmet explained that part). And, OK, before you hypnosis deniers start sending me emails denying the power of hypnosis to totally totalitarianize society, listen to Professor Desmet explain how surgeons in Belgium are routinely performing open-heart surgery on hypnotized patients without any anesthetic whatsoever!

They just saw right through their breastbones with a sternum saw, ratchet open their rib cages with a sternal retractor, and start slicing into the patients’ hearts … and these patients don’t even flinch or anything! He has witnessed this with his own two eyes! Or, all right, it seems he hasn’t actually witnessed this with his own two eyes. It seems he was actually just lying when he said that, which he confessed to in a lengthy Facebook post (after people pointed out that he had lied) in which he publicly wondered why he had lied, and then rationalized his lie with various excuses, and posted several misleading links in an attempt to suggest that he hadn’t actually lied, despite the fact that he had just admitted he did, and just generally tried to muddy the waters with a lot of awkward psychobabble.

“22,000 to 30,000 Previously Unaffected Young Adults Must be Vaccinated to Prevent Just 1 Hospitalization..”

• ‘Unethical’ and up to 98 Times Worse Than the Disease (ET)

A team of nine experts from Harvard, Johns Hopkins, and other top universities has published paradigm-shifting research about the efficacy and safety of the COVID-19 vaccines and why mandating vaccines for college students is unethical. This 50-page study, which was published on The Social Science Research Network at the end of August, analyzed CDC and industry-sponsored data on vaccine adverse events, and concluded that mandates for COVID-19 boosters for young people may cause 18 to 98 actual serious adverse events for each COVID-19 infection-related hospitalization theoretically prevented. [..] As the study pointed out, students at universities in America, Canada, and Mexico are being told they must have a third dose of the vaccines against COVID-19 or be disenrolled.

Unvaccinated high school students who are just starting college are also being told the COVID-19 vaccines are “mandatory” for attendance. These mandates are widespread. There are currently 15 states which continue to honor philosophical (personal belief) exemptions, and 44 states and Washington, D.C. allow religious exemptions to vaccines. But even in these states, private universities are telling parents they will not accept state-recognized vaccine exemptions. Against a backdrop of confusing and often changing public health recommendations and booster fatigue, the authors of this new paper argue that university booster mandates are unethical. They give five specific reasons for this bold claim:

1) Lack of policymaking transparency. The scientists pointed out that no formal and scientifically rigorous risk-benefit analysis of whether boosters are helpful in preventing severe infections and hospitalizations exists for young adults. 2) Expected harm. A look at the currently available data shows that mandates will result in what the authors call a “net expected harm” to young people. This expected harm will exceed the potential benefit from the boosters. 3) Lack of efficacy. The vaccines have not effectively prevented transmission of COVID-19. Given how poorly they work—the authors call this “modest and transient effectiveness”—the expected harms caused by the boosters likely outweigh any benefits to public health. 4) No recourse for vaccine-injured young adults. Forcing vaccination as a prerequisite to attend college is especially problematic because young people injured by these vaccines will likely not be able to receive compensation for these injuries. 5) Harm to society. Mandates, the authors insisted, ostracize unvaccinated young adults, excluding them from education and university employment opportunities. Coerced vaccination entails “major infringements to free choice of occupation and freedom of association,” the scientists wrote, especially when “mandates are not supported by compelling public health justification.”

The lack of effectiveness of the vaccines is a major concern to these researchers. Based on their analysis of the public data provided to the CDC, they estimated that between 22,000 and 30,000 previously uninfected young adults would need to be boosted with an mRNA vaccine to prevent just a single hospitalization. However, this estimate does not take into account the protection conferred by a previous infection. So, the authors insisted, “this should be considered a conservative and optimistic assessment of benefit.” In other words, the mRNA vaccines against COVID-19 are essentially useless. But the documented lack of efficacy is only part of the problem. The researchers further found that per every one COVID-19 hospitalization prevented in young adults who had not previously been infected with COVID-19, the data show that 18 to 98 “serious adverse events” will be caused by the vaccinations themselves. These events include up to three times as many booster-associated myocarditis in young men than hospitalizations prevented, and as many as 3,234 cases of other side effects so serious that they interfere with normal daily activities.

Stoltenberg

How they built the proxy army against #Russia: #NATO boss @jensstoltenberg – although #Ukraine is not a #NATO member we have armed and trained them since the #Kiev coup of 2014. pic.twitter.com/R4O12ulGSz

— tim anderson (@timand2037) September 11, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.