Carl Bloch The transfiguration c1865

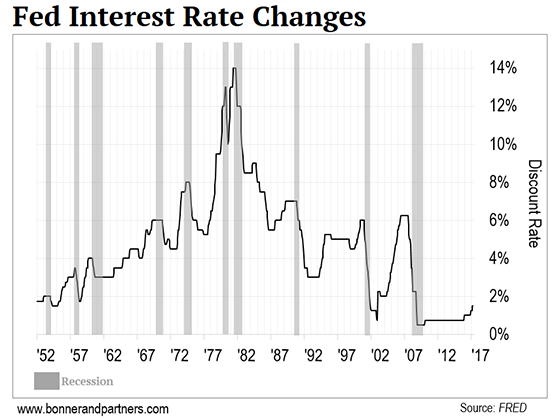

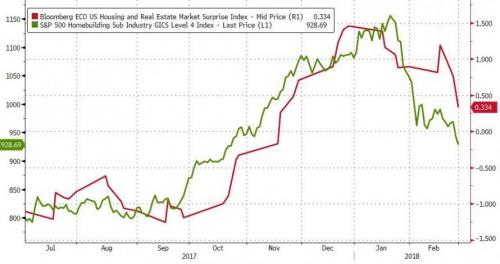

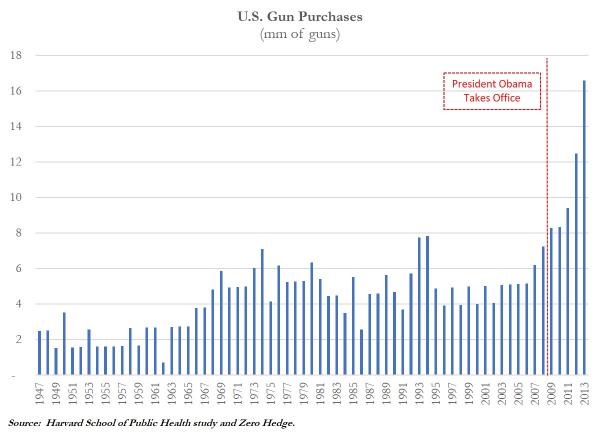

Inflation

The Biden administration has finally said they “got it wrong” on inflation.

But they weren’t “wrong” — they were LYING. pic.twitter.com/xd8uDqv5yK

— RNC Research (@RNCResearch) June 1, 2022

Kat Lindley

Dr. Kat Lindley, mother of 5, was born in Croatia and now is a practicing physician living in Fort Worth, Texas.

I can’t stress enough how important her message is here for humanity + doctors around the world.

Follow: @kat_lindley pic.twitter.com/Smfy1J3LNj— Lindsay (@TexasLindsay) May 28, 2022

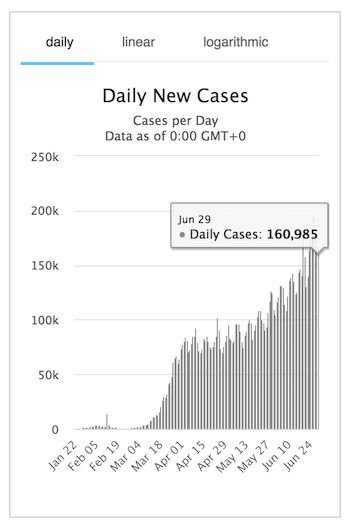

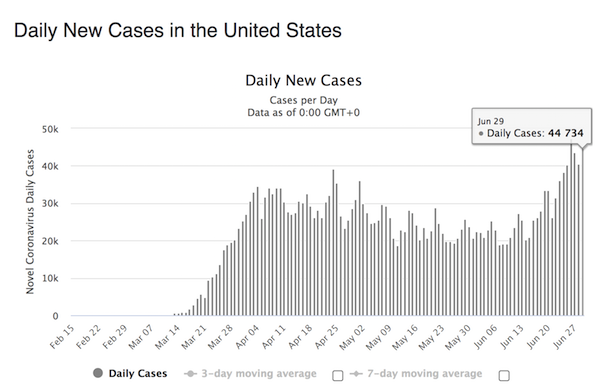

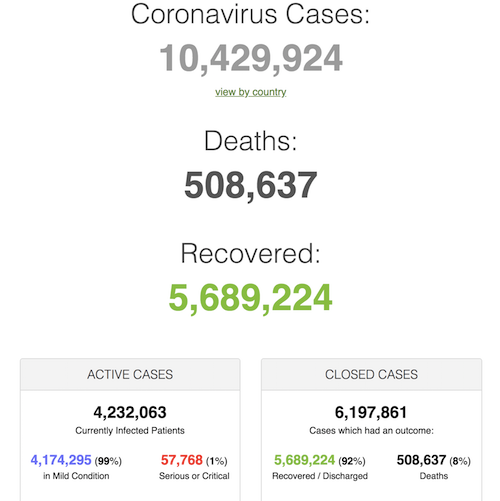

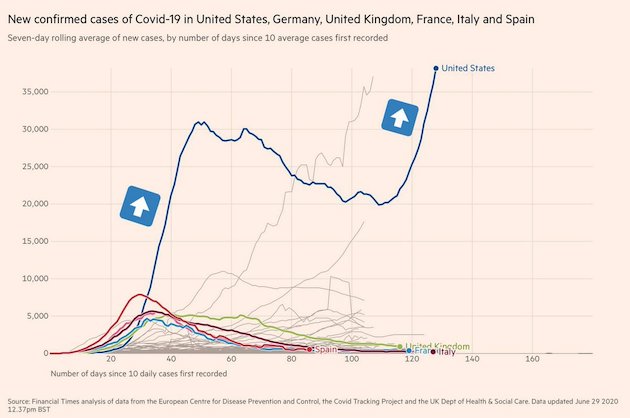

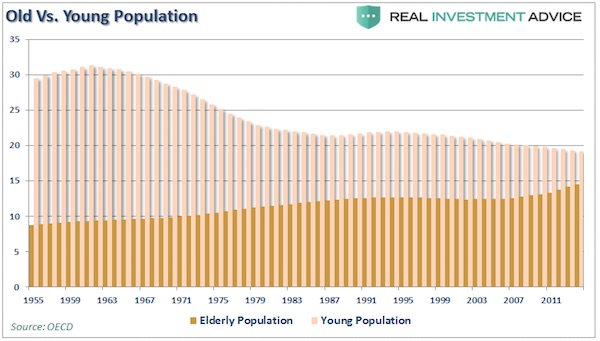

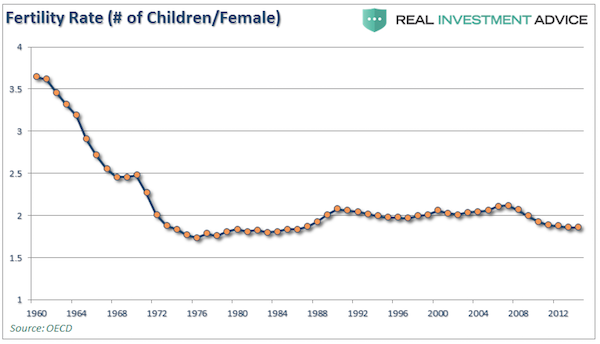

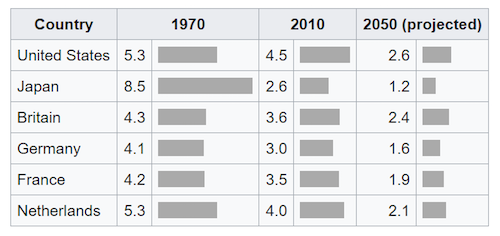

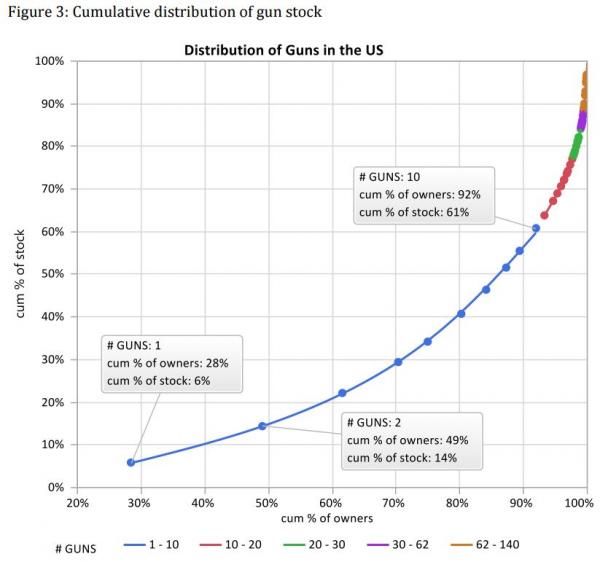

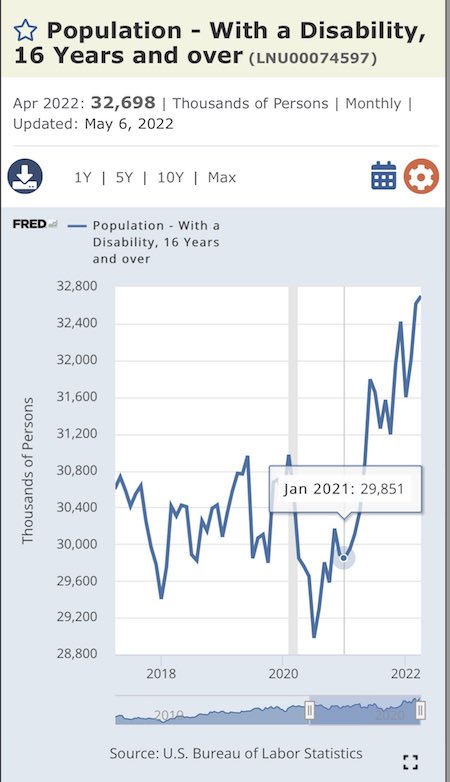

Interesting graph. Qué pasa?

It’s like they do it on purpose.

• The East Grows Stronger While The West Gets Weaker (ZH)

The latest agreement among member nations on export bans targeting Russia is largely oil focused, not natural gas focused, with the union demanding an immediate 70% decrease in Russian oil transferred BY SHIP. Oil transferred by pipeline will continue to flow into the EU for now. The ban is intended to expand to 90% of all shipborne Russian oil by the end of this year. Natural gas imports from Russia will also continue. While some European nations are more dependent on Russian energy than others, overall 40% of the EU’s needs are supplied by the country’s industry. It is not surprising that they are seeking an incremental approach to sanctions, they simply would not be able to survive another winter if they were to go cold turkey and block Russian imports completely. Of course, this does not mean that Russia has to operate on Europe’s timetable.

Russia is already reducing exports of natural gas to multiple EU countries, with Denmark, Netherlands and Germany being the latest to see losses. The EU’s ban was oil and ship focused because they cannot find an alternative source for natural gas that would resolve shortages if they banned everything. Germany in particular would be destroyed by the loss of natural gas supplies from Russia with its 42% dependency. The solutions offered by governments and in the mainstream media neglect certain realities. Namely, they claim that output can be increased or diverted to Europe to fill the gap. Joe Biden has suggested that the US is a “net exporter” of oil (this advantage has swiftly declined since he entered the White House according to the IEA) and that the US could help alleviate European demand. The IEA and OPEC members like Saudi Arabia have offered to increase market availability and output of oil if Russian exports are hit with sanctions.

The problem is that increased production is a fantasy stifled by the realities of labor shortages, increased drilling costs due to inflation and shortages in raw materials caused by supply chain disruptions. There is little chance that production capacity will ever be able to match EU demands, according to experts in the drilling industry. [..] Russia has shown considerable resilience to sanctions on oil as both China and India have increased purchases in tandem with Europe’s bans. The wider implication of this being that Europe and the West will be facing reduced global oil supplies and paying a premium while countries like China and India will be enjoying increased supplies and lower prices from Russia. The East grows stronger while the West gets weaker

“Zelensky admits Russia now holds one-fifth of Ukraine, the largest country entirely within Europe. What he didn’t acknowledge is that Russia controls Ukraine’s industrial heartland, 90% of its energy resources (including all of offshore oil), and its critical ports and shipping.”

“BREAKING: Tribunal over Ukrainian warcrimes will be held in Mariupol. It will be called the Mariupol Tribunal. In addition to the Ukrainian Nazis who committed war crimes in Mariupol, foreign mercenaries and NATO instructors will also be tried there.”

• Zelensky Says Russia Controls A Fifth Of Ukrainian Territory (BBC)

Ukraine’s President Volodymyr Zelensky says that Russian forces have seized 20% of his country’s territory, as Moscow’s invasion nears its 100th day. Addressing lawmakers in Luxembourg, he added that the front line extended for more than 1,000km (621 miles). “All combat-ready Russian military formations are involved in this aggression,” he told MPs via videolink. Russian forces have been intensifying attacks on the city of Severodonetsk in the eastern Donbas region. UK defence officials say Russia has seized most of the city and are making “steady local gains, enabled by a heavy concentration of artillery”.

Severodonetsk is the easternmost city under Ukrainian control and regional governor Serhiy Haidai said Russia was trying to break through defences in the city “from all directions”. However he said Ukrainian troops were carrying out counter-attacks, “pushing back the enemy on some streets and taking several prisoners”. Intense street-to-street fighting in the city had hampered evacuations, he said, describing such efforts as “extremely dangerous”. In a video address late on Thursday evening, Mr Zelensky said the situation in Donbas had not changed significantly that day but that Ukrainians had experienced “some success” in battles in Severodonetsk.

“..Johnson regurgitates the old Victorian anti-Russian myths of ‘The Great Game’..”

• Quo Vadis, Mr Johnson? (Batiushka)

Alexander Johnson, or to give him his full name, Alexander Boris de Pfeffel Johnson, was born to wealthy British parents in New York in June 1964, fifty years after the Sarajevo assassination in June 1914. Since 2019 Johnson has been the Prime Minister of the UK. Giving the impression of an elitist and snobbish aristocrat and distantly related to Queen Elizabeth II, he used to work as a right-wing journalist but is above all a renowned political opportunist. A man of the people he is not. Like so many other politicians, does he actually believe in anything, apart from in himself? Johnson is a biographer of his idol, the half-American Winston Churchill, whom he appears to imitate in his stoop and gait. His fawning book The Churchill Factor, clearly indicates who his model is.

He has five or six or seven children (he himself does not seem to be too sure how many he has fathered by various mothers) and enjoys drunken parties in Downing Street during and outside lockdowns. A highly divisive and controversial figure inside the UK, loved by a few and hated by most, the following quip is made about him: What is the difference between Zelensky and Johnson? Zelensky is a buffoon who became a politician, whereas Johnson is a politician who became a buffoon. More serious commentators ask the question: Is Johnson a natural buffoon, or does he just pretend to be a buffoon? Or, perhaps most likely of all, is he a natural buffoon who pretends to be an even greater buffoon? Of course, most people will admit that as regards Zelensky, he never became a politician, but remained a buffoon. But that is another story.

Despite his middle name of Boris (1), Johnson is a Russophobe to the core, as prejudiced as Sir Arthur Conan Doyle (given his title because he defended the indefensible Boer War) or any other old Imperialist. Like other blinkered representatives of the Norman-British Establishment, Johnson regurgitates the old Victorian anti-Russian myths of ‘The Great Game’ as well as the new ones. These latter include the 2006 poisoning of the British spy and traitor, Alexander Litvinenko (clearly not an act of the Russian secret services, who would have acted so as not to be identified), and the 2018 Skripal poisonings in the British Establishment military centre in Salisbury (and the subsequent censorship of the case and the father’s and daughter’s abductions carried out by MI5). These poisonings were due to a nasty substance to be found, perhaps uniquely on earth, at the highly secretive and evil Porton Down chemical weapons plant, just six miles from Salisbury. That MI5 and its SIS assassination arm (100 murders per year on average) with its many South African hirelings, could have been responsible would never be admitted by Johnson’s tiny mind.

“..infrastructurally devastating cyberattacks..”

• US Engaged In “Offensive” Cyber Ops Against Russia In Ukraine: NSA Director (ZH)

The US military has issued a stunning but perhaps not entirely unexpected admission that it has been conducting offensive cyber operations in support of Ukraine. It marks the first ever such acknowledgement, and suggests – as many observers have long suspected – a deeper Pentagon and US intelligence role in Ukraine against the Russian military than previously thought. National Security Agency (NSA) and US Cyber Command Director Gen. Paul Nakasone told the UK’s Sky News on Wednesday, “We’ve conducted a series of operations across the full spectrum: offensive, defensive, [and] information operations.” This includes “offensive hacking operations” he said.

Without offering specific details, he continued, “My job is to provide a series of options to the secretary of Defense and the president, and so that’s what I do.” Importantly, Gen. Nakasone gave the interview from allied Baltic country Estonia, from which other supporting operations including weapons transfers for Ukraine have come. He spoke of major attempts of the Russians to launch infrastructurally devastating cyberattacks on Ukraine, saying, “And we’ve seen this with regards to the attack on their satellite systems, wiper attacks that have been ongoing, disruptive attacks against their government processes.” “This is kind of the piece that I think sometimes is missed by the public. It isn’t like they haven’t been very busy, they have been incredibly busy.

“And I think, you know, their resilience is perhaps the story that is most intriguing to all of us,” he said, describing the Ukrainian response. As for support the US has given Ukraine in the lead-up to the Russian invasion, the NSA director referenced the following: Nakasone previously said his agency deployed a “hunt forward” team in December to help Ukraine shore up its cyber defenses and networks against active threats. But his latest remarks appear to be the first time that a U.S. official said publicly that the U.S. has been involved in offensive cyber operations in response to Russia’s invasion of Ukraine.

Pick your enemies wisely.

• Biden To Visit Saudi Arabia In Push To Lower Oil Prices And Punish Russia (G.)

Joe Biden will reportedly visit Riyadh later this month and meet Crown Prince Mohammed bin Salman, abandoning a campaign pledge to make Saudi Arabia “a pariah” for the murder of Washington Post columnist Jamal Khashoggi. The Riyadh trip, first reported by the Washington Post and New York Times, suggests Biden has prioritized his need to bring oil prices down and thereby punish Russia for its invasion of Ukraine, over his stand on human rights. The visit will be added on to an already planned trip to Israel, Germany and Spain. The White House said it had no new travel plans to announce, but made clear there was no barrier to Biden meeting the crown prince.

“If he determines that it’s in the interests of the United States to engage with a foreign leader and that such an engagement can deliver results, then he’ll do so,” a senior White House official said. “In the case of Saudi Arabia, which has been a strategic partner of the United States for nearly 80 years, there’s no question that important interests are interwoven with Saudi Arabia. And the President views the Kingdom of Saudi Arabia as an important partner on a host of initiatives that we are working on both in the region and around the world.” The end of the crown prince’s US isolation has looked likely since the Ukraine invasion began on 24 February. Seeking to cut off Russian revenue, Washington has sought an expansion of the global oil supply to bring down prices, which also represented a threat to already poor Democratic prospects in this year’s congressional elections.

The White House reportedly sought to set up a phone call between Biden and Mohammed in March, but was snubbed by the crown prince. However, the president’s top Middle East adviser, Brett McGurk, and his special envoy for energy issues, Amos Hochstein, have persevered in paving the way for a meeting with a string of quiet trips to Riyadh.

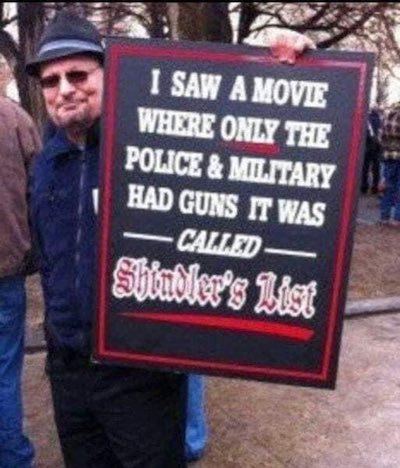

“..politicians are once again ignoring what is constitutionally possible..”

• Biden’s Inner Trudeau (Turley)

In our increasingly hateful and divisive politics, there are times when our nation seems incapable of coming together for a common purpose. Tragedies — moments of shared national grieving and mutual support — once were the exception. Yet one of the most chilling aspects of the aftermath of the school massacre in Uvalde, Texas, was how the moment of unity was quickly lost to political posturing. Politicians have long admitted that a crisis is an opportunity not to be missed — the greater the tragedy, the greater the opportunity. After the mass shooting at a Buffalo supermarket, New York’s Gov. Kathy Hochul (D) called for censorship to “silence the voices of hatred and racism.” After the Uvalde massacre, some Democrats renewed calls for everything from court packing to ending the Senate filibuster.

The most immediate response, however, was a call for gun bans. Vice President Kamala Harris got out front of the White House by demanding a ban on AR-15s, the most popular weapon in America. Then President Joe Biden created a stir by suggesting he might seek to ban 9mm weapons. Such calls are not limited to the United States. Canadian Prime Minister Justin Trudeau announced that his government is introducing legislation to “implement a national freeze on handgun ownership.” He said Canadians would no longer be able “to buy, sell, transfer or import handguns anywhere in Canada,” adding that “there is no reason anyone in Canada should need guns in their everyday lives.”

The difference between the push in the two countries is the existence of the Second Amendment in the United States — a constitutionally mandated “reason” why Americans are allowed to have guns; they don’t have to prove it to the government. While the White House subsequently tried to walk back his comments, Biden saying there’s “no rational basis” to own 9mms and AR-15s sounds like he’s channeling his inner Canadian.There is now a strong majority for gun control reforms. However, politicians are once again ignoring what is constitutionally possible by focusing on what is politically popular with their voting base.

A strange difference between guns for Ukraine and guns in America.

• Arms Sent To Ukraine Will End Up In Criminal Hands, Says Interpol Chief (G.)

Weapons sent to Ukraine after Russia’s invasion in February will end up in the global hidden economy and in the hands of criminals, the head of Interpol has said. Jürgen Stock says once the conflict ends, a wave of guns and heavy arms will flood the international market and he urged Interpol’s member states, especially those supplying weapons, to cooperate on arms tracing. “Once the guns fall silent [in Ukraine], the illegal weapons will come. We know this from many other theatres of conflict. The criminals are even now, as we speak, focusing on them,” Stock said.

“Criminal groups try to exploit these chaotic situations and the availability of weapons, even those used by the military and including heavy weapons. These will be available on the criminal market and will create a challenge. “No country or region can deal with it in isolation because these groups operate at a global level.” He added: “We can expect an influx of weapons in Europe and beyond. We should be alarmed and we have to expect these weapons to be trafficked not only to neighbouring countries but to other continents.” He said Interpol urged members to use its database to help “track and trace” the weapons.

“We are in contact with member countries to encourage them to use these tools. Criminals are interested in all kinds of weapons … basically any weapons that can be carried might be used for criminal purposes.” Ukraine’s western allies have sent shipments of high-end military weapons to Ukraine since the Russian invasion more than three months ago. On Tuesday, the American president, Joe Biden, announced the US would supply Kyiv with advanced missile systems and munitions. After the US pulled out of Afghanistan in 2021, following 20 years of war, huge amounts of often highly sophisticated military equipment was left behind and fell into the hands of the Taliban.

Who wrote that headline? It’s Dominion, in 16 states!

• Voting Software Vulnerable In Some States (AP)

Electronic voting machines from a leading vendor used in at least 16 states have software vulnerabilities that leave them susceptible to hacking if unaddressed, the nation’s leading cybersecurity agency says in an advisory sent to state election officials. The U.S. Cybersecurity and Infrastructure Agency, or CISA, said there is no evidence the flaws in the Dominion Voting Systems’ equipment have been exploited to alter election results. The advisory is based on testing by a prominent computer scientist and expert witness in a long-running lawsuit that is unrelated to false allegations of a stolen election pushed by former President Donald Trump after his 2020 election loss. The advisory, obtained by The Associated Press in advance of its expected Friday release, details nine vulnerabilities and suggests protective measures to prevent or detect their exploitation.

Amid a swirl of misinformation and disinformation about elections, CISA seems to be trying to walk a line between not alarming the public and stressing the need for election officials to take action. CISA Executive Director Brandon Wales said in a statement that “states’ standard election security procedures would detect exploitation of these vulnerabilities and in many cases would prevent attempts entirely.” Yet the advisory seems to suggest states aren’t doing enough. It urges prompt mitigation measures, including both continued and enhanced “defensive measures to reduce the risk of exploitation of these vulnerabilities.” Those measures need to be applied ahead of every election, the advisory says, and it’s clear that’s not happening in all of the states that use the machines.

That’s all?

• Bill Barr Applauds Durham For Showing Truth On Clinton Campaign, FBI (JTN)

Former Attorney General Bill Barr defended special counsel John Durham after the acquittal of ex-Clinton Campaign attorney Michael Sussmann, saying the prosecutor was able to shed light on the Hillary Clinton campaign’s “dirty trick” with the disproven Trump-Russia scandal and the related problems at the FBI. “No, I’m very proud of John Durham, and I do take responsibility for his appointment, and I think he and his team did an exceptionally able job, both digging out very important facts and presenting a compelling case to the jury,” Barr told Fox News host Jesse Waters on Wednesday. After Sussmann was acquitted of lying to the FBI, the jury forewoman told reporters that the case was a waste of time. “I don’t think it should have been prosecuted,” she said, according to The Washington Times.

“There are bigger things that affect the nation than a possible lie to the FBI.” Durham told Waters that while Durham “did not succeed in getting a conviction from the D.C. jury, I think he accomplished something far more important, which is he brought out the truth in two important areas. “First, I think he crystalized the central role played by the Hillary campaign in launching, as a dirty trick, the whole Russiagate Collusion narrative and fanning the flames of it,” Barr explained. “And second, I think he exposed really dreadful behavior by the supervisors in the FBI… who knowingly used this information to start an investigation of [former President Donald] Trump and then duped their own agents by lying to them and refusing to tell them what the real source of that information was,” Barr said, adding, “And that was appalling.”

“..not a single aspect of globalization has been spared from the fallout of new geopolitical conflicts..”

• The Decline and Fall of Davos Man (PS)

“Davos Man” has had a grim 14 years. The late Harvard University political scientist Samuel P. Huntington popularized the term in 2004 to describe a new overclass of evangelists for globalization. Davos Man, he claimed, wanted to see national borders disappear and the logic of politics superseded by that of the market. But since the 2008 global financial crisis, politics has increasingly trumped economics, a trend that reached its apotheosis in 2016 with Donald Trump’s election in the United States and the Brexit referendum. Both events represented a backlash against Davos Man’s vision of a frictionless world governed (not run) as efficiently as possible by “multi-stakeholder processes.”

Moreover, at this year’s annual gathering in Davos, attendees had to confront an even bigger challenge than national politics: the return of geopolitics. The World Economic Forum’s theme was “History at a Turning Point,” in recognition of the fact that we have reached the end of the “end of history.” Although the WEF’s ethos is to promote cooperation in the pursuit of “one world,” the new agenda is necessarily focused on conflict and division. Russian President Vladimir Putin’s war of aggression on Ukraine obviously loomed large at this year’s meeting. To open the event, Ukrainian President Volodymyr Zelensky – appearing virtually in his now familiar military fatigues – spoke of a world split along the fault lines of fundamental values. And Russia House, the facility where Russian delegations hosted parties and networking events in years past, was transformed by Ukrainian activists and donors into the Russian War Crimes House, with an exhibition calling attention to Russian atrocities in Ukraine.

After browsing this year’s program, it soon became clear that not a single aspect of globalization has been spared from the fallout of new geopolitical conflicts – between Russia and the West, China and the West, China and its neighbors, and so forth. Instead of panels discussing free-trade agreements, there were multiple sessions on economic warfare. Political and business leaders grappled with the fact that we now live in a world where central-bank reserves can be confiscated, commercial banks can be summarily disconnected from the SWIFT international payments system, and private assets can potentially be seized to pay for a country’s reconstruction.

Fertilization

https://twitter.com/i/status/1532366041115938816

Crazy dog

https://twitter.com/i/status/1385955664506150913

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.