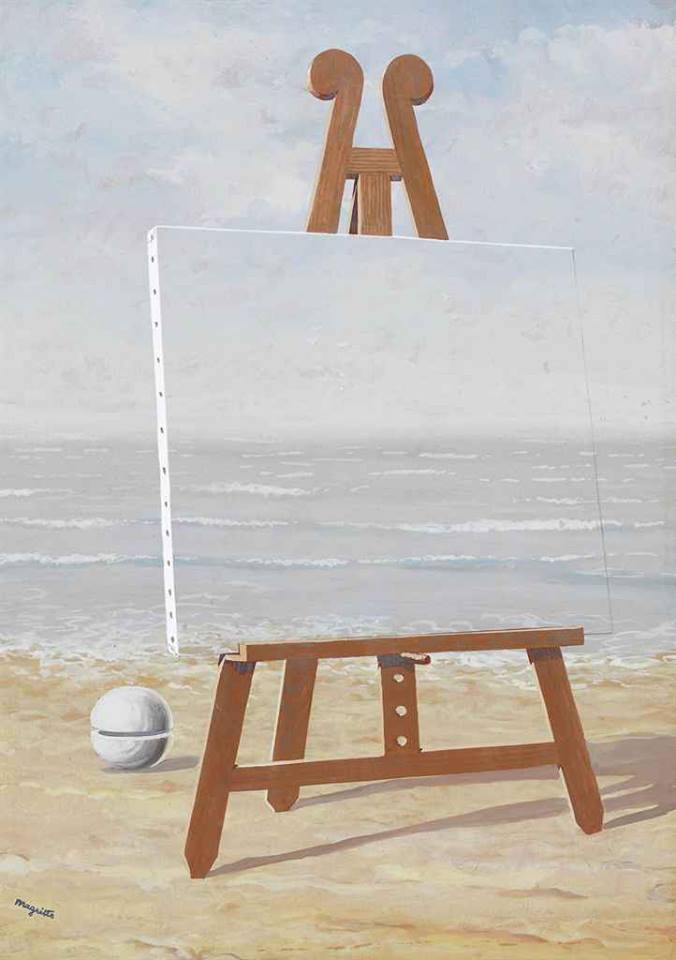

René Magritte La belle captive 1946

Happy New Year!

54 states

I've tweeted out a lot of clips of Joe Biden this year so I decided to put a little something together.

I present: Top 10 Biden Dementia Moments of 2022 pic.twitter.com/z5WFsGhGhN

— Greg Price (@greg_price11) December 30, 2022

Yeadon

BREAKING NEWS: 17,000 Physicians and Scientists declare that Pfizer, Moderna, BioNTech, Janssen, Astra Zeneca, and their enablers, withheld and willfully omitted safety information from patients and physicians which led to toxic death and should be immediately indicted for fraud. pic.twitter.com/qqvydb5Kd5

— Truth Justice ™ (@SpartaJustice) December 31, 2022

Ed Dowd

https://twitter.com/i/status/1609235208183726089

Just 5.5% of Americans aged 18 to 24 have received the bivalent COVID-19 booster, according to data from the CDC, while 66% of the same age group received the initial COVID-19 vaccine

This erudite priest has become one of my favorite writers.

• The End of 500 Years of Conquistador Civilisation (Batiushka)

[..] now we come to the end of the vital crossroads year of 2022 and a revolution that happens only once every 500 years. What we had been waiting for over so many years is now here. The date of 24 February 2022 has already gone down in world history. With the incredibly aggressive refusal of Washington to allow the Kiev puppet regime to grant freedom to the people of the Donbass, Russia has been obliged to turn to Defence Plan B, to partial mobilisation and the demilitarisation and liberation of all of the Ukraine and even beyond, as the suicidal attitudes of the Western world will oblige it to do. A limited operation has had to be turned by Western aggression into a full-scale war and the US/West/NATO has deprived itself of peace and prosperity through its suicidal sanctions. It means the end of Western Conquistador Civilisation.

Thus, we try to peer over the horizon into 2023 and beyond. What will come once the Ukrainian war is over? Some who follow the Western reporting of the conflict may be surprised by these statements. However, that reporting has been a strange mixture of delusional fantasies/wishful thinking and straightforward propaganda, organised by Western secret services and PR agencies, omitting truth, logic and reality. Venal journalists have been ordered to report such nonsense from on high – otherwise, they would have lost their careers and their income. Such reporting has essentially been destined to try and keep Western peoples under control in the hardships they are facing as a result of the suicidal decisions of their US-controlled political elites.

The US elite is making use of the meagre resources of its NATO vassals (so-called ‘allies’), using as its battlefield the Ukraine and as its cannon fodder Ukrainians and mercenaries. But Russian victory is inevitable, even if delayed because the US is deliberately and suicidally making the Ukraine into its Second Vietnam. The Western elite wants to fight ‘to the last Ukrainian’. (“We don’t care how many Ukrainians will die. How many women, children, civilians and military. We don’t care. Ukraine cannot take the peace decision. The peace decision can only be taken in Washington. But for now we want to continue this war, we will fight to the last Ukrainian.” Former US Senator Richard Blake). Therefore, it is immorally supplying all sorts of lethal arms for hundreds of thousands more of these hoodwinked Slavs to die or to be maimed.

How are they ever going to negotiate peace after this?

• Hollande, Merkel Confessions ‘Formalization Of Betrayal’ – Russian Senator (RT)

Thousands of people have lost their lives in eastern Ukraine since 2014 because the West treated the Minsk agreements as scrap paper, the vice speaker of Russia’s upper house of parliament said on Saturday. Senator Konstantin Kosachev was reacting to an admission by former French president Francois Hollande that the Minsk agreements were actually a ploy to buy time for the Kiev government to strengthen its military. This move should be credited for Ukraine’s “successful resilience” to Russia in the ongoing conflict with its neighbor, he added. Hollande was echoing a statement by former German chancellor Angela Merkel, who described the Minsk accords in December as “an attempt to give Ukraine time” to build up its armed forces.

The Minsk-1 and Minsk-2 deals were signed in 2014 and 2015 following mediation by Germany, France and Russia. They were designed to put an end to fighting between Kiev and the People’s Republics of Donetsk and Lugansk by giving them special status within the Ukrainian state. Kiev’s failure to implement those agreements has been cited as one of the reasons for Moscow launching its military operation on February 24. “For the West, the territorial integrity of Ukraine is all about control over land and not about achieving social consensus. It’s about territory, not people. It’s about violence, not negotiations,” Kosachev wrote on Telegram. This approach “directly contradicts so-called European values,” he said. The senator noted that Western attitudes towards the territorial integrity of the UK and Spain have been completely different in the face of Scotland and Catalonia’s push for independence.

“The confessions by Merkel and Hollande are a formalization of betrayal… The price of this betrayal is thousands of human lives lost over the past eight years of civil war in Ukraine. The civil war that the West didn’t stop by treating the Minsk agreements as scrap paper,” Kosachev wrote. According to the UN estimates, more than 14,000 people were killed in Donbass between 2014 and early 2022. The only co-author of the Minsk agreements that genuinely tried to act as a guarantor was Russia, the senator claimed. Moscow sided with the people and left the territorial issue aside for as long as “it was still possible to implement the Minsk accord,” he added. The People’s Republic of Donetsk and Lugnask, as well as Zaporozhye and Kherson regions, joined the Russian state in autumn after holding referendums. Kiev and its Western backers have called the votes a “sham” and refused to recognize the results.

Merkel hated the Soviet Union and that is somehow supposed to make all this alright.

• German Chancellor Merkel Has Just Declared Russia Was Never Pacified (Helmer)

Angela Merkel, the chancellor who destroyed the Christian Democratic party in German politics always hated Russia and President Vladimir Putin most of all. She concealed this for as long as she calculated she needed to preserve the votes of East Germany, German businesses and unions for her re-election. But lie after lie she leaked through her staff to the German and English press. She even tried to promote a German candidate to rule the Ukraine in her war against Russia – until Washington installed their own in Kiev, and told Merkel to fall in line. She did. The outcome of Merkel’s rule between 2005 and 2021 is her 4-election failure to win a majority of votes or seats in the Bundestag; the defeat of every German voting bloc which had supported her in power in Berlin; the rebuilding of the Berlin Wall in the minds of the remaining Germans who disagree and who resist; and the return of Russia-hating and Adolf Hitler’s war aims for Germany against Moscow.

They are also the war aims of Joseph Kennedy, father financier of the US Democratic Party whose fascist line was tolerated by the White House until the fighting war started in earnest in Europe and Kennedy was gotten rid of. No comparable resistance to the alliance between German and American fascism exists today in the US, Europe, Berlin or London. The resistance, however, is worldwide; does not speak English as a native language; and the Russian armed forces are stronger than they ever were. The problem for them is how wide and deep the demilitarized zone must be drawn to defend Russia for the foreseeable future – how far west of the Dnieper River? To the Oder and Neisse Rivers of Poland and Germany, or to the Berlin Wall? With every new bombing, missile, and drone raid, the Stavka meeting daily in Moscow conducts its experiment in drawing the lines westward to the last Ukrainian, then to the last German.

In the Russian Foreign Ministry’s final briefing for the year, spokesman Maria Zakharova had not yet registered what Merkel said in Italian, in her interview with Corriere della Sera on December 27. That was: “ We all knew that it was a frozen conflict, that the problem was not solved, but this gave Ukraine precious time…the Cold War never really ended because Russia was never pacified.” For Merkel’s “problem to be solved” and “pacify Russia” read the US and NATO war to destroy Russia. “Today we act like this under the pressure of war,” she added, “which I approve of.” According to Zakharova, referring to Merkel’s earlier interviews in German with Die Zeit and Der Spiegel, “Angela Merkel’s confessions that the Minsk agreements only served to buy “time for Ukraine” leads to an interesting situation.

The Western countries prevented their media from visiting Donbass. At the same time, they needed time, as they say, for the Kiev regime to grow stronger. This is real evidence of what Russian leadership has been talking about. All this indicates that the Ukrainian army and the West are using unacceptable methods not only on the battlefield, but also in the information war that they have unleashed against Russia. The Kiev regime and its Western handlers are trying to hide their own crimes and the truth about what is really happening in Ukraine.”

“..operation of the system requires dozens of trained personnel..”

“Training repair crews for the Patriot system alone takes some 53 weeks..”

“..estimated to cost about $4 million per missile.”

• US Congress Urged To Assess ‘Risks’ Of Patriot Delivery To Ukraine (RT)

The US Congress is facing issues “in both its legislative and oversight roles” over the planned delivery of Patriot anti-aircraft systems to Ukraine, the Congressional Research Service (CRS) has warned. The research institute is a US government agency that provides expert support to members of Congress on a nonpartisan basis. The US government pledged to deliver one battery of the advanced MIM-104 Patriot anti-aircraft system to Kiev earlier this month, following an unannounced visit to Washington by Ukrainian President Vladimir Zelensky. The timeframe for the delivery remains unclear, as the operation of the system requires dozens of trained personnel. US media outlets have suggested that Ukrainian troops may be invited to America for training, which has yet to occur in the context of the ongoing conflict between Ukraine and Russia.

Training repair crews for the Patriot system alone takes some 53 weeks, the CRS noted, adding that “there is a lot of learning to do before Ukraine will have a functioning Patriot system on the ground.” The research body also urged lawmakers to examine the exact source of the battery to be supplied to Kiev. It’s still unclear whether Washington itself or some of its NATO allies will provide the Patriot battery. The CRS warned that, ultimately, the “battery and associated interceptors being sent to Ukraine could be taken from existing army units and stockpiles.” “If it is withdrawn from other operational forces, such as US Central Command or US Indo-Pacific Command, transferring the system to Ukraine may create opportunity costs and potential risks in those theaters,” it said, adding that supplying a battery from the US homeland “could impede training or modernization cycles.”

The research agency also raised concerns over the “massive price tag” of the Patriot systems and their interceptor missiles, which are “estimated to cost about $4 million per missile.” According to available data, “a newly produced Patriot battery costs about $1.1 billion, including about $400 million for the system and about $690 million for the missiles,” the CRS said. Congress should therefore consider the question of whether certain “restrictions [would] be imposed on what types of hostile systems can be engaged by” the systems operated by Ukrainian troops, the agency suggested.

They declare sanctions with big words…and then seek to undermine them.

• Russian Oil Products Refined Abroad Exempt From Price Cap – US Treasury (RT)

Seaborne deliveries of Russian petroleum products that are ‘substantially transformed’ outside Russia will not be subject to a price cap, the US Treasury Department said in preliminary guidance on the measure on Friday. The cap on Russian oil products is set to come into force on February 5. In order to be exempt from the price limit, Russian oil products must undergo one of a number of processes abroad, according to the document. These include distillation, thermal or fluid coking, catalytic cracking, hydrotreating, de-waxing, as well as other refinery processes involving chemical transformation, separation, conversion, or treatment. Previously published guidance confirmed that the same exemption applies to Russian oil if it undergoes deep refining outside of the country.

“Once Russian petroleum products or Russian oil are substantially transformed… in a jurisdiction other than the Russian Federation, they are no longer considered to be of Russian Federation origin, and thus the price cap no longer applies,” the document states. It noted, however, that blending operations, including gasoline, distillate and crude blending, would not be considered “substantial transformation” and therefore oil products resulting from them would still be subject to the price cap. The US Treasury Department has not yet provided specific figures for the price cap on Russian oil products. The price ceiling on Russian oil was set at $60 a barrel, but may be revised depending on market conditions.

It was introduced by the EU, the G7 countries, and Australia, and came into effect on December 5. Earlier this week, Russian President Vladimir Putin signed a decree banning the supply of oil and petroleum products under contracts that apply or even mention the price cap. According to Deputy Prime Minister Alexander Novak, Russia is ready for a partial output reduction that is expected as a result of the measure. Novak expects output to drop by between 500,000 and 700,000 barrels per day, or between 5% and 7% of the total production volume.

Scientific method.

• Elon Musk: Dr. Anthony Fauci ‘Cannot Be Regarded As A Scientist’ (DW)

Twitter CEO Elon Musk announced Wednesday that the social media company’s new official policy will not penalize users for legitimately questioning scientific claims and narratives that are promoted in the media. The statement from Musk comes as he has taken multiple shots at leftists this week for buying into mainstream media narratives. “New Twitter policy is to follow the science, which necessarily includes reasoned questioning of the science,” Musk said. In a subsequent tweet, Musk responded to professor Gad Saad, who posted a video mocking Dr. Anthony Fauci and his decision to retire as Republicans are set to take over the House of Representatives next week.

“Anyone who says that questioning them is questioning science itself cannot be regarded as a scientist,” Musk said in response to the video about Fauci. Prior to Musk’s purchase of Twitter, users could often face suspension or permanent bans for questioning some scientific matters, especially those surrounding COVID, vaccines, and transgender issues. Musk called out other social media companies and Google earlier this week for alleged censorship on their platforms. Musk made the remarks in response to a tweet from left-wing journalist Glenn Greenwald, who wrote: “For the crime of reporting that the US Security State agencies are heavily involved in Big Tech’s censorship regime, and for confessing that he found this deeply disturbing, liberals have spent a full week saying that @mtaibbi has mental health problems and needs therapy.”

Included in Greenwald’s tweet was a screenshot of one of journalist Matt Taibbi’s Twitter Files threads. “The government was in constant contact not just with Twitter but with virtually every major tech firm,” Taibbi said. “These included Facebook, Microsoft, Verizon, Reddit, even Pinterest, and many others. Industry players also held regular meetings without government.” Musk responded, “Most people don’t appreciate the significance of the point Matt was making: *Every* social media company is engaged in heavy censorship, with significant involvement of and, at times, explicit direction of the government.”

Click the headline to get the other 9.

• 10 Ways COVID Changed How People Think About Health–Part 1 (ET)

1. Declining Trust in Vaccinations – Vaccines, once seen as sacrosanct in modern medicine, have begun to lose favor with the general public since the COVID-19 pandemic response. As early as June 2022, an analysis of data from the Centers for Disease Control and Prevention (CDC) showed that the uptake of influenza vaccine doses has fallen in states that also saw low COVID vaccine uptake. Authors of the study suggest that the two polarizing attitudes toward the COVID-19 vaccines are influencing behavior toward other public health measures, and that those who approved of the COVID-19 vaccines readily took up the influenza annual vaccine, while those that declined the COVID-19 vaccines also declined subsequent vaccines.

“Safety concerns and mistrust of COVID-19 vaccines or government” may also have been associated factors, the authors wrote. The pandemic response to COVID-19 saw many changes to public health. For the first time in history, emergency-use products were mandated and heavily promoted by the government and social media with little to no disclosure of possible health risks and informed consent. Dr. Robert Malone, a biochemist and one of the inventors of the mRNA pharmaceutical platform, said mandating experimental drugs challenged basic bioethics. It has since resulted in “push back,” against Big Pharma by the public, said CEO of Progenabiome and gastroenterologist Dr. Sabine Hazan.

Despite the continuous “safe and effective” narrative from public health agencies on COVID-19 vaccinations, emerging reports of myocarditis, pericarditis, immunological, and neurological symptoms, as well as an unprecedented increase in vaccine adverse event reports suggest otherwise. A December poll conducted by Rasmussen Reports on COVID-19 vaccines found that 57 percent of Americans were concerned about “major side effects” of the vaccine. Hazan said that doctors are getting more and more of their patients coming to their clinics, asking why they are falling ill after vaccination, and have had to challenge the safe and effective narrative. “It’s hard to tell a parent who’s son was an 18-years-old athlete who died 4 days after a shot, that [the death] is not from the shot,” Hazan wrote to The Epoch Times.

“It’s lucky that Twitter didn’t exist when Pope John Paul II proclaimed, “Be not afraid.” The Soviet Union might still be standing.”

• The Shameful Suppression Of Pandemic Public Policy Dissidents (OCR)

In March 2021, Harvard epidemiologist Dr. Martin Kulldorff answered a question on Twitter about whether younger age groups and people who had already had COVID needed to be vaccinated. “No,” he responded, “Thinking that everyone must be vaccinated is as scientifically flawed as thinking that nobody should.” Dr. Kulldorff recommended vaccination for “high-risk people and their care-takers,” but said it was not needed by children or those with prior natural infection. Internal emails at Twitter show that a moderator flagged the tweet by Kulldorff, a Harvard Medical School professor, as “false information” and a violation of the company’s COVID-19 misinformation policy. Twitter slapped a “Misleading” warning on the tweet and suppressed its reach. “This Tweet can’t be replied to, shared or liked,” the warning label stated.

Twitter flagged tweets as “misleading” if they diverged at all from the official government line, even if the tweets quoted or copied data directly from scientific journals or government websites. Dr. Andrew Bostom, an internal medicine specialist who was on the faculty of Brown University Medical School from 1997 to 2021, was permanently suspended from Twitter for tweeting a link to a scientific article on COVID-19 vaccines lowering sperm counts. Dr. Bostom’s account has been restored to Twitter under Elon Musk’s new regime, along with the accounts of many other distinguished, accomplished and frequently published scientists and medical doctors. One particularly revealing communication about content moderation unearthed by Zweig involves then-President Donald Trump’s personal experience as a COVID patient.

“I will be leaving the great Walter Reed Medical Center today at 6:30 p.m.,” Trump tweeted on October 5, 2020. “Don’t be afraid of Covid. Don’t let it dominate your life. We have developed, under the Trump Administration, some really great drugs & knowledge. I feel better than I did 20 years ago!” Twitter Deputy General Counsel Jim Baker, formerly a top attorney at the FBI, sent an email to two Twitter executives that read, “Why isn’t this POTUS tweet a violation of our COVID-19 policy (especially the ‘Don’t be afraid of Covid’ statement)?” One of the executives responded that the tweet is a “broad, optimistic statement” that “doesn’t incite people to do something harmful,” and so “doesn’t fall within the published scope of our policies.” However, the executive acknowledged that Baker might have a “different read on it.” It’s lucky that Twitter didn’t exist when Pope John Paul II proclaimed, “Be not afraid.” The Soviet Union might still be standing.

It’s not the Infection Fatality Rate we’re worried about. It’s the vaccines.

• Age-Stratified Infection Fatality Rate Of Covid-19 In The Non-elderly (Ioannidis)

The largest burden of COVID-19 is carried by the elderly, and persons living in nursing homes are particularly vulnerable. However, 94% of the global population is younger than 70 years and 86% is younger than 60 years. The objective of this study was to accurately estimate the infection fatality rate (IFR) of COVID-19 among non-elderly people in the absence of vaccination or prior infection. In systematic searches in SeroTracker and PubMed (protocol: https://osf.io/xvupr), we identified 40 eligible national seroprevalence studies covering 38 countries with pre-vaccination seroprevalence data. For 29 countries (24 high-income, 5 others), publicly available age-stratified COVID-19 death data and age-stratified seroprevalence information were available and were included in the primary analysis.

The IFRs had a median of 0.034% (interquartile range (IQR) 0.013–0.056%) for the 0–59 years old population, and 0.095% (IQR 0.036–0.119%) for the 0–69 years old. The median IFR was 0.0003% at 0–19 years, 0.002% at 20–29 years, 0.011% at 30–39 years, 0.035% at 40–49 years, 0.123% at 50–59 years, and 0.506% at 60–69 years. IFR increases approximately 4 times every 10 years. Including data from another 9 countries with imputed age distribution of COVID-19 deaths yielded median IFR of 0.025–0.032% for 0–59 years and 0.063–0.082% for 0–69 years. Meta-regression analyses also suggested global IFR of 0.03% and 0.07%, respectively in these age groups. The current analysis suggests a much lower pre-vaccination IFR in non-elderly populations than previously suggested.

Large differences did exist between countries and may reflect differences in comorbidities and other factors. These estimates provide a baseline from which to fathom further IFR declines with the widespread use of vaccination, prior infections, and evolution of new variants.

“..Schwab’s core commitment is to political and economic arrangements which used to be known as corporatism.”

• Why It Isn’t Mad To Oppose The World Economic Forum (Gregg)

A key concept for Schwab’s vision of a reset world is ‘stakeholder capitalism.’ In his 2021 book Stakeholder Capitalism: A Global Economy that Works for Progress, People and Planet, Schwab defines it as ‘a form of capitalism in which companies do not only optimise short-term profits for shareholders, but seek long-term value creation, by taking into account the needs of all their stakeholders, and society at large.’ By value-creation, Schwab partly has in mind economic prosperity. But he also calls for the promotion of three other values: ‘People,’ ‘Planet,’ and ‘Peace.’ These rather broad concepts illustrate just how all-embracing Schwab’s stakeholder capitalism seeks to be.

So who are the stakeholders who will collaborate to usher in the four Ps? For Schwab, they are ‘governments,’ ‘companies,’ and ‘civil society’ (NGOs, unions, etc.). At this point we arrive at the essence of Schwab’s grand redesign. For all his invocation of the predictable woke pieties, Schwab’s core commitment is to political and economic arrangements which used to be known as corporatism. Schwab is quite explicit about this. In one article describing the origins of his present outlook, he writes: “This approach was common in the postwar decades in the West, when it became clear that one person or entity could only do well if the whole community and economy functioned. There was a strong linkage between companies and their community. In Germany, for example, where I was born, it led to the representation of employees on the board, a tradition that continues today.”

Corporatism is a broad concept. It can run the gamut from the hyper-authoritarian version embraced by Mussolini’s Italy to worker-boss structures of the type described by Schwab in postwar western Europe. All forms of corporatism, however, share some common themes. One is the necessity of limiting market competition in order to preserve social cohesion. Another is mandating cooperation between representative groups of different social and economic sectors – a process overseen and, if necessary, enforced by government officials for the sake of the common good. What, you might ask, could be wrong with this? The answer is: plenty.

For a start, corporatism – including its Schwabian expression – isn’t big on freedom. It’s all about forming and then maintaining a consensus on economic and social policies. For this reason, corporatism doesn’t cope well with dissent. Indeed, it discourages any questioning of the consensus, whether the issue is tax-rates or climate change. The language of corporatism, like that of Schwab’s WEF, may be one of coordinated consultation, but the agenda is one of control. For what matters is the harmonisation of views, no matter how absurd the idea and or how high the cost in liberty.

The Gorgon Stare.

• In War for Control of Humanity (ET)

Inventor of mRNA vaccines Dr. Robert Malone, having worked with the U.S. Department of Defense (DOD) for many years, warns that a war is being waged by the government for control of people’s minds, and that social media platforms are being weaponized in this war and are “actively employed” by the intelligence community to influence what people think and feel. “This new battleground, in which your mind and your thoughts, your very emotions are the battleground. It is not about territory,” Malone said during a recent interview for EpochTV’s “American Thought Leaders” program. “Twitter, it’s clear now, has become the premium platform for shaping emerging global consensus about the topics of the day.”

During his work with the DOD, Malone became aware of companies researching multilingual programs that assess the emotional content of the language used on social media, which those companies then use to “map relationship clouds,” including what topics people are discussing, who the influencers are, and who is at the fringe of that cloud, said Malone. Phenomena like being deplatformed, shadowbanned, and a “tweet” going viral is a part of this weaponizing of social media. “By using these tools of manipulating what information, what tweets you put out, what messages you put out to your influencer cloud, they can modulate how those people behave,” he said. “You can actually very actively control what individuals are thinking, the information that they’re gathering, what they’re being influenced to do.”

The people who control information warfare weapons can modulate the messaging within the influencer clouds that can be readily mapped, Malone said. “Your current state of mind, based on the language that you’re using and the topics that you’re talking about, can be mapped very precisely, psychologically,” he said. “It can be tied into a web of influence relationships.” Members of a specific “influencer cloud” can be tracked using the military spy technology called the Gorgon Stare, said Malone. This spy technology is capable of detecting movements including what car you drive, who gets in your car, and where you go, he said.

The Gorgon Stare is a surveillance technology, originally created to target terrorist groups, that utilizes high-tech cameras mounted on drones to capture video images of large areas, such as entire cities. Then artificial intelligence is used to analyze the surveillance footage. Arthur Holland Michel, author of the book, “Eyes in the Sky: The Secret Rise of Gorgon Stare and How It Will Watch Us All,” called this technology the “pinnacle of aerial surveillance” during a 2019 interview with the CATO Institute and said the things he learned while writing the book were so troubling, they kept him up at night.

Feel lucky?

• Law Will Install Kill Switches In All New Cars (Y!)

According to an article written by former U.S. Representative Bob Barr, hidden away in the recently passed infrastructure bill, the very one I warned before would negatively impact drivers across the country if it were to pass, is a measure to install vehicle kill switches into every new car, truck, and SUV sold in this country. The regulation likely won’t be enforced for five years, so maybe there’s time to do something about this. As we’ve seen both in this country and others recently, what constitutes “law-abiding” can change drastically overnight. For example, in September a car was pulled over in New Zealand and the occupants arrested when police discovered the trunk was full of Kentucky Fried Chicken meals. They were smuggling the fast food to customers in locked-down Auckland, against quarantine measures. Yet not too long before, delivering restaurant orders to people was considered a reputable, legal activity.

It gets even better: Barr points out that the bill, which has been signed into law by President Biden, states that the kill switch, which is referred to as a safety device, must “passively monitor the performance of a driver of a motor vehicle to accurately identify whether that driver may be impaired.” In other words, Big Brother will constantly be monitoring how you drive. If you do something the system has been programmed to recognize as driver impairment, your car could just shut off, which could be incredibly dangerous. There is the possibility the kill switch program might measure your driving as impaired, then when you try to start the car up again the engine won’t fire up. That would potentially leave you stranded.

But wait, there’s more. This kill switch “safety” system would be open, or in other words there would be a backdoor. That would allow police or other government authorities to access it whenever. Would they need a warrant to do that? Likely not. Even better, hackers could access the backdoor and shut down your vehicle. Barr points out what a tremendous violation of Americans’ privacy this is, and he’s right. In addition, the term “impaired driving” isn’t defined by the legislation, so it would be open to interpretation by regulators such as the Department of Transportation and the National Highway Traffic Safety Administration. Do you want government regulators helping to write algorithms which might force your car to pull over and stop because you might be a little tired instead of tipsy?

Last ever Calvin and Hobbes, Dec 31 1995.

Walters

https://twitter.com/i/status/1609069514049880064

Brush strokes

What matters most in life are the beautiful memories we share with the people we love most. pic.twitter.com/Wv4s2kDZVu

— Vala Afshar (@ValaAfshar) December 31, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.