Wyland Stanley REO taxicab, San Francisco 1924

Overleveraged overinvestment.

• China’s Steel Industry Peers Into Abyss as Output to Plunge (Bloomberg)

Crude steel production in China will collapse by 23 million metric tons next year, according to the nation’s leading industry group. That’s equivalent to more than a quarter of annual output from the U.S. Supply from the top producer may drop 2.9% to about 783 million tons from 806 million tons in 2015, according to the China Iron & Steel Association. The slump would be driven by a deepening downturn in local demand and as mills encounter stiffer opposition to exports, Deputy Secretary General Li Xinchuang said in an interview on Wednesday. “You can’t find any bright spots,” Li said in Shanghai, citing weakness across Asia’s largest economy.

“Property developments used to enjoy annual growth of 20% and now at best it is 5%. Infrastructure investments haven’t taken off due to lack of funds despite of all the planned numbers of projects. Manufacturing investments have also dropped like a stone.” China’s mills, which produce about half of worldwide output, are battling against losses, oversupply and sinking prices as local consumption shrinks for the first time in a generation. The fallout from the steelmakers’ struggles is hurting iron ore prices and boosting trade tensions as mills seek to sell their surplus overseas. Shanghai Baosteel Group Corp. has forecast that China’s steel production may eventually shrink 20%.

Li’s estimate of 783 million tons of Chinese production compares with supply from the U.S. of 88.3 million tons in 2014, according to data from the World Steel Association for 2014, the last complete year of figures. That year, output in China was 823 million tons. Steel demand in China would slump to about 654 million tons in 2016 from 668 million tons this year, said Li, who’s also president of the China Metallurgical Industry Planning & Research Institute. Iron ore imports may drop to 920 million tons in 2016 from about 930 million tons, according to Li. The oversupply of steel in China is so acute that David Humphreys, a former chief economist at mining company Rio Tinto Group, said that the country would do well to demolish unneeded mills. “There’s about 300 million tons of surplus capacity in China that needs to be not just shut down, it needs to be eradicated, it needs to be bulldozed,” Humphreys said ..

Read more …

What can they do but talk their books?

• Rio Tinto’s Optimistic About Iron Ore And That’s Reason To Worry (Bloomberg)

You’re concerned about the slowdown in China’s economy. It bothers you that industrial output has plunged to the weakest levels since 2008. You’re unsettled that the China Iron & Steel Association “can’t see any bright spots” for the metal that’s driven the country’s urbanization. You’re perturbed Jim Chanos thinks the world’s second-biggest economy is heading the same way as Japan in the 1990s. Stop fretting: Rio Tinto, the world’s second-biggest iron ore miner, says China’s going to be O.K. The world should stop focusing on daily price gyrations for the steelmaking metal and concentrate on the long-term trend, CEO Sam Walsh told Bloomberg. The company’s analysts have been “very, very careful” in their forecasts that iron ore demand will reach 3 billion tons by 2030, up about 36% from last year, Megan Clark, a non-executive director at the miner, said.

That’s good news, right? Not so fast.The Anglo-Australian miner has good reason to err on the side of optimism. Like peers Vale and BHP Billiton, it has some of the world’s cheapest iron ore mines, and the least to lose from oversupply hitting the market.The big three miners are engaged in the same game with higher-cost competitors as the one Saudi Arabia is playing against the U.S. shale industry: Let’s flood the market, and see who’s left standing. Like Ali al-Naimi, the Saudi minister who said in June that Chinese oil demand was growing, Walsh and Clark are glass-half-full sorts of people. But their optimism stands in contrast to the industry’s own assessment. China’s steel sector needs to go through a “painful restructuring” and output will collapse by 20%, Baosteel Chairman Xu Lejiang said last month.

Demand is evaporating at “unprecedented speed” and oversupply is worsening, the deputy head of the China Iron & Steel Association said a week later. Steel demand in China fell in 2014 and will slip again in 2015 and 2016, the World Steel Association said in April. Even the flood of exports driven by lackluster domestic demand is shrinking as mills in other countries push governments to impose import charges and start trade disputes. The U.S. is levying tariffs of as much as 236% on some varieties of Chinese steel. A price index for the rebar used in making reinforced concrete for buildings dropped below 2,100 yuan a metric ton Monday for the first time since at least 2003:

For a reality check, see what the higher-cost producers have to say. Rio Tinto and BHP are in an “imaginary world” and more production needs to be halted, according to Lourenco Goncalves, the chief executive officer of U.S.-headquartered Cliffs Natural Resources. Steel demand in China has “plateaued”, Nev Power, his counterpart at the world’s fourth-largest producer Fortescue Metals, said last month. Commodity gluts do eventually correct themselves as the least profitable producers quit the market and bring supply back in line with demand. But there’s little sign of that happening right now. After a modest recovery during the third quarter, an index of Chinese iron ore prices compiled by Metal Bulletin has slipped, and on Tuesday was just 99 cents above July’s record-low $44.59 a metric ton.

Read more …

Everything’s becoming a worry going into 2016.

• Zinc Lowest in 6 Years, Nickel at 12-Year Low on China Concerns (Bloomberg)

Zinc dropped to the lowest in more than six years amid signs of ample supply and concern that demand is faltering in China, the world’s biggest user. Nickel closed at the lowest in 12 years. Global refined zinc output of 10.486 million metric tons January through September exceeded demand of 10.298 million tons, the International Lead and Zinc Study Group said in a report Wednesday. China President Xi Jinping said the economy faces “considerable downward pressure,” while data showed the nation’s home-price recovery slowed in October. “It certainly continues to point to a more bearish view on China, and they haven’t released any other stimulative type of measure,” Mike Dragosits at TD Securities in Toronto, said. “The market continues to trade pessimistically on the Chinese demand outlook.”

Read more …

ZIRP. How the Fed destroys markets.

• Can Anything Stop Companies From Loading Up on Debt? UBS Says No. (Alloway)

It’s no secret that companies have been taking advantage of years of low interest rates to sell cheap debt to eager investors, locking in lower funding costs that have allowed them to go on a spree of share buybacks and mergers and acquisitions. With fresh evidence that investors are becoming more discerning when it comes to corporate credit as the first U.S. interest rate rise in almost a decade approaches, it’s worth asking whether anything might stop the trend of companies assuming more and more debt on their balance sheets. In a note published on Wednesday, UBS analysts Matthew Mish and Stephen Caprio offer an answer to that question. After looking at four factors that could theoretically derail the corporate debt train they answer: pretty much nothing.

For a start, they note that higher funding costs are unlikely to dissuade companies from continuing to tap the debt market since, even after a rate hike, financing costs will remain near historic lows. “The predominant reason is the Fed[eral Reserve] is anchoring low interest rates,” the analysts wrote. When it comes to the hubris of corporate chief financial officers, who have been more than happy leveraging up balance sheets in order to reward shareholders, the analysts didn’t mince words. “We find that corporate CFOs historically are inherently backward-looking when setting corporate financing decisions, relying on past extrapolations of economic activity, even when current market pricing suggests future investment returns may be lower,” they wrote.

“Several management teams have been on the road indicating higher funding costs of up to 100 to 200 basis points would not impede attractive M&A deals, in their view.” Higher market volatility has often been cited as one factor that could knock the corporate credit market off its seat, but the UBS duo sees little reason for it to put a dent in debt issuance. “In a low-yield environment, we anticipate significant vol[atility] selling interest to resurface so long as fundamentals are not falling off a cliff,” they said. Even in the third quarter of 2015, when markets were roiled by a global stock selloff, sales of investment-grade bonds were up 32% year-on-year, they noted.

Read more …

What goes up…

• Debt, The Never-Ending Story (Economist)

It is close to ten years since America’s housing bubble burst. It is six since Greece’s insolvency sparked the euro crisis. Linking these episodes was a rapid build-up of debt, followed by a bust. A third instalment in the chronicles of debt is now unfolding. This time the setting is emerging markets. Investors have already dumped assets in the developing world, but the full agony of the slowdown still lies ahead. Debt crises in poorer countries are nothing new. In some ways this one will be less dramatic than the defaults and broken currency pegs that marked crashes in the 1980s and 1990s. Today’s emerging markets, by and large, have more flexible exchange rates, bigger reserves and a smaller share of their debts in foreign currency.

Nonetheless, the bust will hit growth harder than people now expect, weakening the world economy even as the Federal Reserve begins to raise interest rates. In all three volumes of this debt trilogy, the cycle began with capital flooding across borders, driving down interest rates and spurring credit growth. In America a glut of global savings, much of it from Asia, washed into subprime housing, with disastrous results. In the euro area, thrifty Germans helped to fund booms in Irish housing and Greek public spending. As these rich-world bubbles turned to bust, sending interest rates to historic lows, the flow of capital changed direction. Money flowed from rich countries to poorer ones. That was at least the right way around. But this was yet another binge: too much borrowed too fast, and lots of the debt taken on by firms to finance imprudent projects or purchase overpriced assets.

Overall, debt in emerging markets has risen from 150% of GDP in 2009 to 195%. Corporate debt has surged from less than 50% of GDP in 2008 to almost 75%. China’s debt-to-GDP ratio has risen by nearly 50 percentage points in the past four years. Now this boom, too, is coming to an end. Slower Chinese growth and weak commodity prices have darkened prospects even as a stronger dollar and the approach of higher American interest rates dam the flood of cheap capital. Next comes the reckoning. Some debt cycles end in crisis and recession—witness both the subprime debacle and the euro zone’s agonies. Others result merely in slower growth, as borrowers stop spending and lenders scuttle for cover. The scale of the emerging-market credit boom ensures that its aftermath will hurt.

Read more …

“The IMF warned this week against austerity overkill and “pro-cyclical” cuts before the economy is strong enough to take it. [..] Finland should not even be thinking of a “front-loaded” fiscal contraction or slashing investment at a time when its output gap is 3.2pc of GDP. The Finnish authorities admitted in their reply to the IMF’s Article IV report that they had no choice because they had to comply with the Stability Pact. This is what European policy-making has come to.”

• Finland’s Depression Is The Final Indictment Of Europe’s Monetary Union (AEP)

Finland is sliding deeper into economic depression, a prime exhibit of currency failure and an even more unsettling saga for theoretical defenders of the euro than the crucifixion of Greece. A full 6.5 years into the current global expansion, Finland’s GDP is 6pc below its previous peak. It is suffering a deeper and more protracted slump than the post-Soviet crash of the early 1990s, or the Great Depression of the 1930s. Nobody can accuse Finland of being spendthrift, or undisciplined, or technologically backward, or corrupt, or captive of an entrenched oligarchy, the sort of accusations levelled against the Greco-Latins. The country’s public debt is 62pc of GDP, lower than in Germany. Finland has long been held up as the EMU poster child of austerity, grit, and super-flexibility, the one member of the periphery that supposedly did its homework before joining monetary union and could therefore roll with the punches.

Finland tops the EU in the World Economic Forum’s index of global competitiveness. It comes 1st in the entire world for primary schools, higher education and training, innovation, property rights, intellectual property protection, its legal framework and reliability, anti-monopoly policies, university R&D links, availability of latest technologies, as well as scientists and engineers. Its near-perfect profile demolishes the central claim of the German finance ministry – through its mouthpiece in Brussels – that countries get into bad trouble in EMU only if they drag their feet on reform and spend too much. The country has obviously been hit by a series of asymmetric shocks: the collapse of its hi-tech champion Nokia, the slump in forestry and commodity prices, and the recession in Russia.

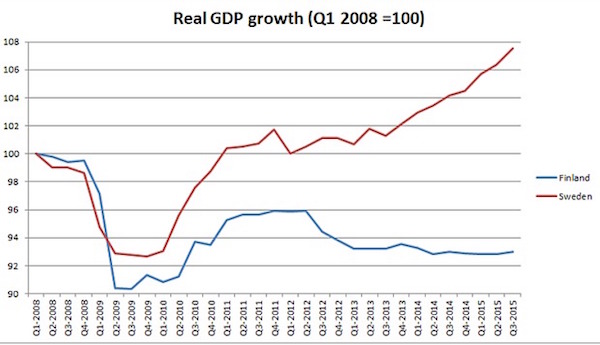

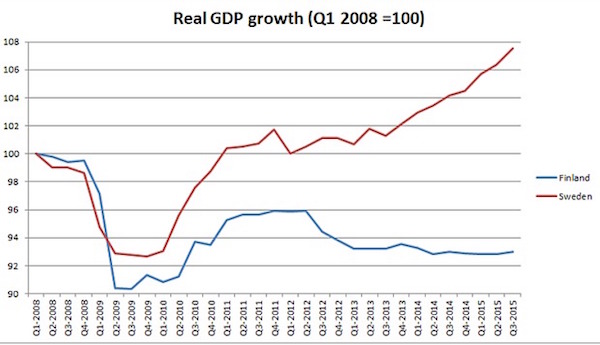

The relevant point is that it cannot now defend itself. Finland is trapped by a fixed exchange rate and by the fiscal straightjacket of the Stability Pact, a lawyers’ construct that was never intended for such circumstances. The Pact is being enforced anyway because rules are rules and because leaders in the Teutonic bloc have an idee fixee that moral hazard will run rampant if any country in the EMU core sets a bad example. Finland’s output shrank a further 0.6pc in the third quarter and the country’s three-year long recession is turning into a fourth year. Industrial orders fell 31pc in September. “It’s spooky,” said Pasi Sorjonen from Nordea. Sweden was able to navigate similar shocks by letting its currency take the strain at key moments over the last decade. Swedish GDP is now 8pc above its pre-Lehman level.

The divergence between Finland and Sweden is staggering for two Nordic economies with so much in common, and it has rekindled Finland’s dormant anti-euro movement. The Finnish parliament is to hold ‘Fixit’ hearings next year on exit from monetary union and a return to the Markka, the currency that saved Finland in the early 1990s (once the ill-judged hard-Markka policy and the fixed ECU-peg was abandoned). Paavo Väyrynen, a Euro-MP and honorary chairman of the ruling Centre party, forced the euro hearings onto the parliamentary agenda after collecting 50,000 signatures. “The eurozone is not an optimal currency area and people are becoming aware of the real reasons for our crisis,” he said. “We are in a similar situation to Italy and have lost a quarter of our industry. Our labour costs are too high,” he said. [..] .. if the euro cannot be made to work for what is supposed to be the most competitive country in the EU, who can it work for?

Read more …

My gut says Xi’s going to regret this, and/or get into trouble with the rest of the world. He gives no sign of understanding hia own power limits.

• China Inclusion In IMF Currency Basket Not Just Symbolic (FT)

Back in 2009, the west was desperately seeking green shoots of recovery and paid little attention when Zhou Xiaochuan called for nothing less than a new world financial order. China’s central bank governor proposed replacing the US dollar as the international reserve currency with a global system controlled by the IMF. If, as expected, the IMF this month approves the inclusion of China’s renminbi as a reserve currency, it will mark a small step for Mr Zhou’s 2009 vision, but a big move for the renminbi. The prospect of China’s currency joining the dollar, euro, yen and sterling in backing the IMF’s Special Drawing Rights — its unit of account, restricted to member governments — has been described as everything from a symbolic ego trip by Beijing to the dawning of a new era.

In all probability it will be like many Chinese financial reforms: significant in hindsight, but harder to get excited about in its early stages. Market enthusiasm over early-stage reforms such as the de-pegging of the renminbi 10 years ago has gradually given way to a level of ennui as the changes get smaller and China gets bigger. The result is often disappointment in the numbers as China maintains a staunch antipathy to the sort of sweeping changes, accompanied by headline-grabbing figures, beloved of newly-installed western executives and politicians. Even the Shanghai-Hong Kong Stock Connect, one year old this week, was shrugged aside by many, because the absolute numbers involved are relatively small.

However, its real significance lies in the fact that it was the first scheme under which China had let foreign investors in “blind” — that is, without requiring approval of each investor. SDR inclusion risks being categorised the same way. That would miss the point, since this is not about boosting short-term demand from central banks for renminbi. Rather, it is about embedding the currency in the international system and committing China to financial reform. If China were to constitute up to 10% of the SDR basket, that would result in a need for reserve managers to buy just $28bn or its currency — not a particularly meaningful number compared with the $20bn traded daily in the onshore spot market. Reserve figures are thus another source of headline number disappointment.

If China were to make up 3% of the $11.5tn of reserves held globally by the end of 2016, as forecast by DBS economist Nathan Chow, the $340bn that implies would vault the renminbi straight into the top league alongside sterling and the yen. Yet the dollar comprises almost two-thirds of reserves and the euro a further 20%. Numbers aside, the bigger ramifications of SDR inclusion come from its effect on financial reform. Xiangrong Yu, economist at CICC, likens it to the impact of China joining the World Trade Organisation in 2002. “Even if the renminbi fails to be added this time around, it will be impossible to reverse these reform measures,” he adds.

Read more …

Oh, lovely…

• New Players Break Into Credit Derivatives (FT)

New entrants are breaking into the dealer-dominated credit derivatives market as trading increasingly occurs on electronic platforms. Eagle Seven, a proprietary trading firm in Chicago, confirmed it began quoting prices on cleared index credit default swaps last week. Verition, a New York-based hedge fund and Stifel Nicolaus, a new bank entrant to CDS markets, have also been making inroads, according to people familiar with the matter. It comes as banks draw close to settling a court case in which investors allege they have been shut out of the clubby CDS market for years. Traditionally CDS has been traded bilaterally between banks and their clients.

But regulation mandating the electronic trading of index CDS has since been introduced in the US, with platforms like Bloomberg replicating the bilateral model using a “request for quote system”, whereby investors can request electronic quotes from market makers. The new entrants are active in RFQ, with Eagle Seven also streaming prices on to a public screen called a central limit order book — a nascent trading model for CDS investors. Similar changes have also occurred in interest rate swap markets with Citadel, a non-bank electronic market maker, claiming to be one of the leading participants on Bloomberg’s trading venue.

A number of firms have also actively been pushing single-name CDS — which tracks the likelihood of default of a single company — to trade electronically and with the counterparty risk of buyers and sellers pushed centrally into a clearing house. Centralised clearing mutualises counterparty risk across the market and helps reduce bank capital requirements. Michael Hisler, head of fixed income cleared products at Stifel, said central clearing also removes the need for bilateral execution documents because all trades face the clearing house. Investors hope this may help encourage more new entrants and improve liquidity in the product, which has waned since the 2008 financial crisis. “Central bank regulation is making uncleared derivatives punitive for banks to hold on their balance sheet,” said Mr Hisler.

“Consequently, the traditional financing of uncleared positions is being significantly reduced or eliminated and forcing clearing of all standardised products.” Some of the biggest CDS users are currently drafting a letter with the intention of collecting investor signatures to commit to begin clearing single name CDS starting in the new year, according to a person familiar with the matter. Some banks have also begun offering clients incentives to move old trades into clearing, including cutting fees or giving very favourable pricing. “Clearly there is an incentive,” the head of CDS sales at a European bank said. “You are trying to reduce your counterparty exposure and capital. There is a value attached to that.”

Read more …

Detroit was never alone.

• Atlantic City’s Mayor Warns of Insolvency by April Without Aid (Bloomberg)

Atlantic City, the distressed New Jersey gambling hub that’s under state oversight, will run out of money by the end of April if bills aimed at bolstering its finances aren’t enacted, Mayor Don Guardian said. “Cash flow runs out April 29,” Guardian told reporters Wednesday during the New Jersey State League of Municipalities conference in his city. Governor Chris Christie conditionally vetoed legislation that would have redirected a portion of casino revenue to the city, which was counting on the money to help close a $101 million deficit this year. He requested changes that steps up the state’s power over the funds. Lawmakers must approve them by Jan. 12 to avoid having to re-introduce the bills in the next session.

The measures were aimed at addressing the financial strains that have gripped Atlantic City as its onetime dominance over East Coast gambling is eroded by competition from neighboring states. The closing of four of 12 casinos last year battered Atlantic City’s revenue, and some of those that remain have sought to lower their property-tax bills by challenging the city’s assessments. If the city runs out of cash, it won’t be able to borrow to stay afloat, Guardian said. Moody’s Investors Service grades the city’s debt Caa1, seven steps below investment grade. Standard & Poor’s ranks it B, five levels into so-called junk. “It would be foolish to bond at the rates we would have to,” he said. “If we could find anyone to take our bonds.”

Read more …

Yada yada yada.

• Fed Tipping Toward December Rate Hike, Minutes Show (Hilsenrath)

The Federal Reserve sent out new signals that officials will raise interest rates in December as long as job growth and inflation trends don’t take a turn for the worse. Most officials meeting last month anticipated that December “could well be” the time to lift short-term rates after leaving them near zero for seven years, according to minutes of their last meeting three weeks ago, released Wednesday. Officials changed the wording of their policy statement at the October meeting—adding a reference to the possibility of a December increase—to ensure their options were open. The Fed has been waiting to see further improvement in the job market and to gain confidence that inflation, which is running below its 2% target, will start moving up.

“Most participants anticipated that, based on their assessment of the current economic situation and their outlook for economic activity, the labor market, and inflation, these conditions could well be met by the time of the next meeting,” the October meeting minutes said. Since the Fed’s October gathering, economic data have generally supported the central bank’s view that the job market is improving and offered some evidence wage and inflation pressures are slowly and gradually starting to build. The U.S. central bank has now warned about rate increases so many times that investors appear to be getting used to the idea. Raising the cost of borrowing typically sends stock prices tumbling, but stocks rose Wednesday, a sign that a rate increase is already priced into markets.

[..] The minutes stated “some” Fed officials felt in October it was already time to raise rates. “Some others” believed the economy wasn’t ready. The wording meant that minorities on both sides of the Fed’s rate debate are pulling in different directions, with a large center inside the central bank inclined to move. Officials cited a number of reasons to avoid delay: They risked creating uncertainty in financial markets by holding off; they risked allowing financial market excesses to build if they kept rates too low; they risked signaling a lack of confidence in the economy if they didn’t move rates higher; and they risked ignoring cumulative gains in the economy already registered. At the same time, the Fed minutes included several new signals that after the Fed does move rates higher, the subsequent path of rate increases is likely to be exceptionally shallow and gradual.

Read more …

They need to stop selling themselves. The reason why makes no difference.

• Australia Blocks Ranch Sale to Foreigners on Security Fears (Bloomberg)

Australia blocked the sale of the nation’s largest private landowner to an overseas buyer, saying the location of one of the company’s 10 cattle ranches in a weapons testing area could compromise national security. S. Kidman & Co.’s properties were listed for sale in April, with local media reporting that China’s Shanghai Pengxin Group was in exclusive talks to buy the string of ranches for about A$350 million ($250 million). Treasurer Scott Morrison said in a statement that half of Kidman’s Anna Creek station, the nation’s largest single property holding, sits within the Woomera Prohibited Area – a remote stretch of the outback that’s been used to test nuclear bombs, launch satellites and track space missions. Selling Kidman in its current form to a foreigner would be “contrary to Australia’s national interest,” Morrison said in the statement.

Australia’s government has increased scrutiny of foreign acquisitions of agricultural land and earlier this month passed legislation to set up a register of overseas holdings of farm properties. Kidman’s ranches span 101,000 square kilometers (39,000 square miles), or about 1.3% of the nation’s total land area, and carry about 185,000 cattle. The Woomera range “makes a unique and sensitive contribution to Australia’s national defense and it is not unusual for governments to restrict access to sensitive areas on national security grounds,” Morrison said. All bidders have withdrawn their applications to the Foreign Investment Review Board to buy Kidman, Morrison said without identifying them, and it was “now a matter for the vendor to consider how they wish to proceed.”

Read more …

The world’s biggest hornet’s nest.

• Turkey Could Cut Off Islamic State’s Supply Lines. So Why Doesn’t It? (Graeber)

In the wake of the murderous attacks in Paris, we can expect western heads of state to do what they always do in such circumstances: declare total and unremitting war on those who brought it about. They don’t actually mean it. They’ve had the means to uproot and destroy Islamic State within their hands for over a year now. They’ve simply refused to make use of it. In fact, as the world watched leaders making statements of implacable resolve at the G20 summit in Antalaya, these same leaders are hobnobbing with Turkey’s president Recep Tayyip Erdogan, a man whose tacit political, economic, and even military support contributed to Isis’s ability to perpetrate the atrocities in Paris, not to mention an endless stream of atrocities inside the Middle East. How could Isis be eliminated? In the region, everyone knows.

All it would really take would be to unleash the largely Kurdish forces of the YPG (Democratic Union party) in Syria, and PKK (Kurdistan Workers party) guerillas in Iraq and Turkey. These are, currently, the main forces actually fighting Isis on the ground. They have proved extraordinarily militarily effective and oppose every aspect of Isis’s reactionary ideology. But instead, YPG-controlled territory in Syria finds itself placed under a total embargo by Turkey, and PKK forces are under continual bombardment by the Turkish air force. Not only has Erdo�an done almost everything he can to cripple the forces actually fighting Isis; there is considerable evidence that his government has been at least tacitly aiding Isis itself. It might seem outrageous to suggest that a Nato member like Turkey would in any way support an organisation that murders western civilians in cold blood.

That would be like a Nato member supporting al-Qaida. But in fact there is reason to believe that Erdo�an s government does support the Syrian branch of al-Qaida (Jabhat al-Nusra) too, along with any number of other rebel groups that share its conservative Islamist ideology. The Institute for the Study of Human Rights at Columbia University has compiled a long list of evidence of Turkish support for Isis in Syria. How has Erdogan got away with this? Mainly by claiming those fighting Isis are terrorists’ themselves And then there are Erdogan’s actual, stated positions. Back in August, the YPG, fresh from their victories in Kobani and Gire Spi, were poised to seize Jarablus, the last Isis-held town on the Turkish border that the terror organisation had been using to resupply its capital in Raqqa with weapons, materials, and recruits – Isis supply lines pass directly through Turkey.

Read more …

What’s Justin going to do when the pressure increases?

• Trudeau Tells Canada To Reject Racism Amid Opposition To Refugee Plan (Reuters)

The Canadian prime minister, Justin Trudeau, urged Canadians to resist hatred and racism as a poll showed most Canadians were opposed to his plan to bring in 25,000 Syrian refugees by year-end and a flurry of racist incidents were reported around the country. The Liberals, who took power after an election last month, campaigned on a promise to bring in the refugees by 1 January. Critics say the number is too large and could threaten security following the Paris terror attacks. An Angus Reid poll released on Wednesday showed 54% of Canadians opposed the plan, up from 51% before the bloodshed in Paris.

But support for the plan also increased, with 42% in favour, up from 39% in October. Most of those who opposed Trudeau’s plan did so because of the short timeline, with 53% saying the schedule was too short to ensure all the necessary security checks were completed. Another 10% said 25,000 was too many, and 29% said Canada should not be accepting any Syrian refugees. Trudeau has vowed to stick to the plan despite the growing criticism. Travelling through Europe and Asia as part of his first global trip, Trudeau issued an appeal to Canadians to reject racism, and condemned attacks on “specific Canadians” in the aftermath of the attacks by Islamic State in Paris.

A mosque was burned in the Ontario city of Peterborough at the weekend, windows were smashed at a Hindu temple in another city, and a Muslim woman was attacked in Toronto by two men who called her a terrorist and said she should go home. “Diversity is Canada’s strength. These vicious and senseless acts of intolerance have no place in our country and run absolutely contrary to Canadian values of pluralism and acceptance,” Trudeau said. A separate poll by Leger for the TVA news network showed 73% of people in the predominantly French-speaking province of Quebec were worried about attacks in Canada while 60% felt that 25,000 refugees were too many.

Read more …

Well, some of the intolerance lasted for centuries. And is over only in law, not in practice.

• History Is A Cruel Judge Of Intolerance In America (Bloomberg)

History is a cruel judge of intolerance in America. Let that be a warning to politicians rushing to bar Syrian refugees, especially Muslims, from seeking sanctuary in the U.S. Segregationists are condemned today, even those who later recanted; think of George Wallace. There are few kind words for the American nativist strain, embodied by political movements like the anti-Roman Catholic Know-Nothing Party that flourished in the 1850s. Even progressive icons like Franklin Delano Roosevelt and Chief Justice Earl Warren are censured for their role in interning Japanese-Americans in World War II. On the positive side, Seth Masket of Vox wrote this week about Governor Ralph Carr of Colorado, who in 1942 became a lonely voice for the rights of Japanese-Americans.

Now Republican presidential candidates and governors, and a handful of Democrats, are playing a politically motivated fear card. It doesn’t matter, they argue, if families and little children are fleeing mayhem and carnage in Syria. Don’t let them in, especially if they are Muslims. They cite, of course, the terrorist attack in Paris. Public concern about Syrian refugees is understandable; one of the Paris terrorists might have slipped into Europe with refugees. But real leaders shouldn’t exploit people’s fears. Sometimes their responsibility is to calm them. That’s not what we’re getting from Donald Trump, or from Governor Bobby Jindal of Louisiana, who is straining to get to the right of the other candidates.

Jindal and David Vitter, the Republican senator who is running to replace him – the election is Saturday – have warned of hordes of Syrian refugees threatening the citizens of Louisiana. Vitter said there’s an “influx coming” and that vetting can’t guard against possible “terrorist elements.” The New Orleans Times-Picayune reported this week that there are Syrian refugees in the Bayou State – 14 to be exact. The resettling agency is the New Orleans Archdiocese’s Catholics Charities. The general counsel for the Archdiocese is Wendy Vitter, the wife of Senator Vitter. After Pearl Harbor, the Roosevelt administration decided to put Japanese-Americans in guarded camps.

Colorado’s Carr objected. He said Japanese-Americans were entitled to the same constitutional rights as other citizens and decried the “shame and dishonor” of racial hatred. He was dumped by his own Republican party. The country overwhelmingly supported FDR and Earl Warren, then attorney general of California, who whipped up anti-Japanese sentiment. FDR is now celebrated as a great president. Warren went on to become governor of California and Chief Justice of the United States. His Supreme Court expanded civil rights and civil liberties. Both, however, get bad marks from most historians for their role in internment. Carr’s courage ended his political career. But history smiled. Today there’s a statue of him in downtown Denver. A scenic section of a highway bears his name. The Japanese-American Citizens League has an award in his honor.

Read more …

Someone’s got to be getting wealthy over this?!

• Former Yugoslav Republic of Macedonia Building Fence Along Greek Border (Kath.)

The Former Yugoslav Republic of Macedonia is erecting a fence on its border with Greece in a bid to block refugees and migrants heading to Central Europe, Kathimerini understands. FYROM has threatened in recent days to put up a fence along the Greek border if countries further along the Balkan refugee trail reduce the number of refugees they are taking in. FYROM’s security council has also taken a decision foreseeing such a move. According to Christos Gountenoudis, the mayor of Paionia, close to the FYROM border, construction is already under way. “Machines have started work behind the border,” he told Kathimerini. The project, which is being overseen by the Balkan state’s army, is expected to raise a 1.5-kilometer-long barbed wire fence running from opposite the small Greek town of Idomeni to the bank of the Axios River.

It appears that FYROM authorities are rushing to get the fence up before countries further north close their borders. Hungary and Slovenia have already built fences along their respective borders with Croatia while Croatia has threatened to put up a fence along its border with Serbia. Thousands of migrants and refugees have crossed into FYROM from Greece in recent weeks. On Wednesday around 5,000 people gathered at Idomeni, while on Tuesday it was 4,600 and on Monday 6,892, sources said. Gountenoudis told Kathimerini he briefed Immigration Policy Minister Yiannis Mouzalas on the construction of the fence. He said he asked Mouzalas what will happen if thousands of refugees end up unable to leave Greece. “He told me the government has a plan,” he said. There are plans for reception centers in Thessaloniki, Kavala and Kilkis, the mayor said.

Read more …

Found under ‘disgrace’ in your dictionary.

• EU Nations Miss Deadline To Appoint Officers For Refugee Relocations (Guardian)

EU nations have once again missed their own deadline for appointing liaison officers required to coordinate refugee relocations with Greece and Italy, according to information provided by the European commission this week. European council conclusions from 9 November noted that member states committed to appointing the liaison officers to Italy and Greece by 16 November. But the figures released the day after the self-imposed deadline show that 11 member states still have not done so – and six of these – Bulgaria, Croatia, the Czech Republic, Hungary, Latvia and Slovakia – have not provided liaison officers at all. At the council meeting member states had also said they would “endeavour to fill by 16 November 2015 the remaining gaps in the calls for experts and border guards” requested by the European Asylum Support Office (EASO) and Frontex, the European border control agency.

However, the commission figures reveal that only 177 of the 374 experts requested, and 392 border guards of the 775 requested, have so far been provided. The pace of relocation of refugees from the most affected countries – such as Greece and Italy – remains slow. Only 128 refugees from Italy and 30 from Greece have been relocated so far. EU member states agreed in September to relocate 160,000 people in “clear need of international protection” through a scheme set up to relocate Syrian, Eritrean and Iraqi refugees from the most affected EU states to others. The relocation is meant to take place over the next two years, but at this rate it would take 166 years to meet the commitment.

European nations are also falling short in terms of their funding pledges. As of 17 November there is a shortfall of €2.2bn (£1.5bn) to reach the €5.6bn pledged for the UN refugee agency, UNHCR, World Food Programme and other relevant organisations and funds. Member states have collectively provided €573m so far, while the EU, which is matching the national funds, has provided its €2.8bn share. Moreover, the latest data reveals that still too few member states have responded to calls from Serbia, Slovenia and Croatia to provide the resources they need to cope with the refugee crisis. Many items requested by the three countries have not been delivered, including essentials such as beds, blankets, winter tents, clothing and first aid kits.

Read more …

Not even near Greece.

• 20 African Migrants Lost At Sea In Atlantic After Boat Sinks (Reuters)

Around 20 African migrants are missing at sea after their boat sunk in the Atlantic Ocean around 20 miles off the coast of Western Sahara, Spanish sea rescue services said on Wednesday. Spanish lifeguards rescued 22 African men from the sea late on Tuesday in stormy conditions and recovered the corpse of one man. The search continues for the remaining migrants. Survivors say there were over 40 people traveling in the boat, including one woman, the sea rescue services spokesman said. Photographs showed the survivors being transferred from the rescue boat to Gran Canaria island where they were attended to by Red Cross workers in makeshift tents set up in the port. The sea route from West Africa to Spain’s Canary Islands was a major route for migrants attempting to enter Europe until about 10 years ago when Spain stepped up patrols.

Read more …

Only solution: immediate ban on feeding livestock antibiotics. Which won’t happen because the chemical industry likes its profits too much.

• Antibiotic Resistance: World On Cusp Of ‘Post-Antibiotic Era’ (BBC)

The world is on the cusp of a “post-antibiotic era”, scientists have warned after finding bacteria resistant to drugs used when all other treatments have failed. Their report, in the Lancet, identifies bacteria able to shrug off colistin in patients and livestock in China. They said that resistance would spread around the world and raised the spectre of untreatable infections. Experts said the worrying development needed to act as a global wake-up call. Bacteria becoming completely resistant to treatment – also known as the antibiotic apocalypse – could plunge medicine back into the dark ages. Common infections would kill once again, while surgery and cancer therapies, which are reliant on antibiotics, would be under threat.

Chinese scientists identified a new mutation, dubbed the MCR-1 gene, that prevented colistin from killing bacteria. It was found in a fifth of animals tested, 15% of raw meat samples and in 16 patients. The resistance was discovered in pigs, which are routinely given the drugs in China. And the resistance had spread between a range of bacterial strains and species, including E. coli, Klebsiella pneumoniae and Pseudomonas aeruginosa. There is also evidence that it has spread to Laos and Malaysia. Prof Timothy Walsh, who collaborated on the study, from the University of Cardiff, told the BBC News website: “All the key players are now in place to make the post-antibiotic world a reality. “If MRC-1 becomes global, which is a case of when not if, and the gene aligns itself with other antibiotic resistance genes, which is inevitable, then we will have very likely reached the start of the post-antibiotic era.

“At that point if a patient is seriously ill, say with E. coli, then there is virtually nothing you can do.” Resistance to colistin has emerged before. However, the crucial difference this time is the mutation has arisen in a way that is very easily shared between bacteria. “The transfer rate of this resistance gene is ridiculously high, that doesn’t look good,” said Prof Mark Wilcox, from Leeds Teaching Hospitals NHS Trust. His hospital is now dealing with multiple cases “where we’re struggling to find an antibiotic” every month – an event he describes as being as “rare as hens’ teeth” five years ago. He said there was no single event that would mark the start of the antibiotic apocalypse, but it was clear “we’re losing the battle”.

Read more …