DPC Times Square seen from Broadway 1908

“The conflict over austerity is politically explosive because it is becoming a conflict between Germany and Italy, and worse, between Germany and France …”

• Greece Comes Back To Haunt Eurozone As Anti-Troika Rebels Scent Power (AEP)

The eurozone’s long-simmering crisis has returned with a vengeance as snap elections in Greece open the way for an anti-austerity government and a cathartic showdown over the terms of euro membership. Yields on 3-year Greek debt surged 185 basis points to 11.9pc on Monday amid default fears after premier Antonis Samaras failed to win the extra votes in parliament needed to avert a general election on January 25, despite dire warnings that such an outcome risked “bankruptcy and exit from the euro.” The upset opens the door for the hard-Left Syriza movement, which has vowed to tear up Greece’s hated ‘Memorandum’ with EU-IMF Troika creditors “on its first day in office”, and threatened to default on up to €245bn of rescue loans unless the EU grants debt relief.

Syriza is leading by 29.9pc to 23.4pc in the latest Palmos Analysis poll, though other surveys are closer. It is likely to become the first truly radical group to take power in any EMU state since the creation of monetary union. A quirk in Greece’s electoral law gives the winning party an extra fifty seats in parliament. Alexis Tsipras, the bloc’s firebrand leader, vowed to overthrow of the austerity regime and launch a new era of social salvation, claiming the government’s campaign of “blackmail and terror” had failed. “There will be an end to austerity. The future has started,” he said. Markets were caught off-guard. Flight to safety drove yields on German 10-year Bunds to an historic low of 0.54pc, while the Athens bourse crashed 10pc before partly recovering in late trading.

German finance minister Wolfgang Schauble warned Greeks not to play with fire by pressing impossible demands. “Fresh elections won’t change Greece’s debt. Each new government must fulfil the contractual obligations of its predecessors. If Greece chooses another way, it’s going to be tough,” he said. JP Morgan said any Syriza-led coalition is likely to soften its line once in office. It is certain to ditch many of the extreme measures unveiled at a disastrous roadshow in London last month, deemed “Communist” by one hedge fund. Yet it will be hard to settle the core dispute over debt relief, likely to be centred on calls for “Bisque bonds” where payment is linked to GDP growth. The IMF said Greece faces “no immediate financing needs” yet the issue will turn serious once Greece runs out of Troika money in February.

“We could have a problem at the beginning of March,” said finance minister Gikas Hardouvelis. It will be even more serious in July and August when Greece must repay €6.7bn to the European Central Bank. Capital markets are effectively closed. The Greek banking system remains on life-support, kept afloat by $40bn of ECB liquidity. Frankfurt has a duty to safeguard the money of other eurozone members and cannot lightly prop up lenders in a country that is at the same time threatening to default on EU debt. Mr Hardouvelis warned that the ECB could “strangle the Greek economy in a split second” if it switched off funding. Holger Schmieding from Berenberg Bank said there is now a 30pc risk that Greece could stumble into a rolling crisis and a potential euro exit. “That is a big risk,” he said.

Read more …

Not going to happen. What we’ll see is lots of Brussels chest-thumping. The ‘leaders’ don’t want to be transformed.

• Syriza Can Transform The EU From Within (Costas Lapavitsas)

The Greek parliament has failed to elect a new president and the country’s constitution dictates that there should now be parliamentary elections. These will be critical for Greece and also important for Europe. A victory for Syriza, the main leftwing party, would offer hope that Europe might, at last, begin to move away from austerity policies. But there are also grave risks for Greece and the European left. The rise of Syriza is a result of the adjustment programme imposed on Greece in 2010. The troika of the European Commission, the ECB and the IMF provided huge bailout loans, with the cost of unprecedented cuts in public expenditure, tax increases and a collapse in wages. It was a standard, if extreme, austerity package, with one vital difference: austerity could not be softened by devaluing the currency as, for instance, had happened in the Asian crisis of 1997-98. Greek membership of the euro had closed all escape routes.

Brutal austerity succeeded in stabilising Greece and keeping it in the economic and monetary union by destroying its economy and society. The budget deficit has been drastically reduced, the current account deficit has turned into a surplus and the prospect of default on foreign debt has receded. But GDP has contracted by 25%, unemployment has shot above 25%, real wages have fallen by 30% and industrial output has declined by 35%. The human cost has been immeasurable, amounting to a silent humanitarian crisis. Homelessness has rocketed, primary healthcare has collapsed, soup kitchens have multiplied and child mortality has increased. Since the summer of 2014, the depression has been drawing to a close, helped by the strong performance of the tourist sector. Yet, the damage from troika policies is so severe that growth prospects are appalling.

The weakness is manifest in foreign trade, which the IMF expected to act as the “engine of growth”. In 2014, Greek exports will probably contract, while imports began to rise as soon as the depression showed signs of ending. This is a deeply dysfunctional economy. In the midst of this catastrophe, the troika is insisting on further austerity to achieve massive primary budget surpluses of 3% in 2015, 4.5% in 2016 and even more in future years. Its purpose is to service the enormous foreign debt, which has risen to 175% of GDP from about 130% in 2009. Astonishingly, the IMF still expects Greece to register average growth of 3.4% during the next five years – provided, of course, that it goes full speed ahead with privatisation, deregulation of labour and market liberalisation. The troika has truly embraced the economics of the absurd.

Read more …

Doesn’t need to be perfect.

• ‘Perfect Storm’ Could Send Euro Even Lower (CNBC)

The euro traded near a 28-month low on Monday, and analysts forecast its decline could continue, after a last-dash vote in Greece failed to secure a new president for the country. A snap general election was called for January following the result, which could potentially jeopardize this year’s economic progress, as well as delicate negotiations with the country’s “troika” of international loan brokers. The currency fell to $1.2165 in early trading—the nadir for the single currency since European Central Bank President Mario Draghi pledged to do “whatever it takes” to save the euro zone in July 2012. It recovered a little following the results of the Greek vote, but remained subdued at $1.2180, below a key resistance level of $1.2300.

“A perfect political and economic storm is brewing,” said BBH currency strategists led by Marc Chandler in a research note published Monday. Despite the small bounce in the euro after the results were out, SocGen’s Kit Juckes said the currency could continue to decline against the dollar this week. He predicted the euro could move to, or through, $1.20, taking it to lows last seen at the apex of the euro zone debt crisis in 2010. “The failure (of Monday’s vote in Greece) was widely expected, so the immediate response is minimal, despite Greek yields being higher and Greek stocks having failed to bounce,” the macro strategist told CNBC via email. “I think if the euro starts to fall, it could gather some downward momentum, given the uncertainty about the outcome of the elections.”

Lee Hardman, currency economist at Bank of Tokyo-Mitsubishi, forecast that the currency would fall below $1.20 in the first three months of 2015. The euro has typically bottomed around $1.20 over the last 10 years, and Hardman warned of the risk of a sharp adjustment downwards if the currency fell through that level. “Our base case is for the euro to continue to grind lower,” Hardman told CNBC on Monday. “We are looking for a move down below $1.20 within the first quarter, and then our year-end level is $1.14, deeper into undervalued territory.”

Read more …

Vying for stupidest headline of the season. The Saudis face civil unrest on a huge scale. They care a lot, but they can’t do anything. There’s too much oversupply.

• Oil Falls Further But Saudi Arabia Doesn’t Care (CNBC)

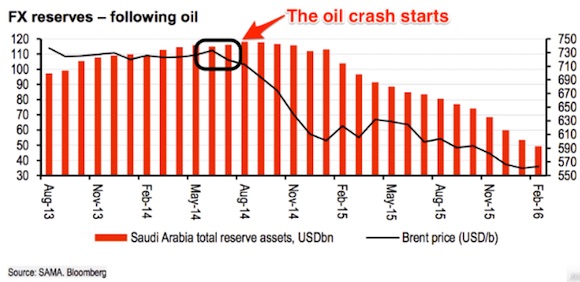

The oil price hit a 5-1/2-year low on Tuesday, in a move likely to wreak yet more economic havoc on countries like Russia and Venezuela but major oil producer Saudi Arabia looked to be relatively unscathed. In fact, despite prices extending losses into a fourth session, one analyst told CNBC that Saudi Arabia – the largest producer in OPEC – was enjoying a “perfect storm”, enabling it to take on its rivals. Brent oil for February delivery fell to under $57 per barrel Tuesday, despite ongoing output disruptions in Libya that had briefly appeared to support prices on Monday. And there is no sign of production being cut any time soon, with Saudi Arabia standing by OPEC’s November decision not to reduce output. “By dint almost of an accident Saudi Arabia is seeing Russia and Iran face some financial pain, and (falling prices) are causing trouble in Canada and some parts of the U.S. as well,” Malcom Graham-Wood, independent oil and gas analysts, told CNBC Tuesday.

“Having this perfect storm of events unwind gave them the chance to play the market share card at the OPEC meeting (in November),” he said. Saudi Arabia is in a stronger position than a number of its fellow oil producers because it is a low-cost producer and can withstand lower prices as it has stockpiled revenues from previous peaks in the oil price in the last five years. But other major oil producers – both inside and outside OPEC – have been hard hit by lower oil revenues. Investment in U.S. shale oil is starting to look threatened, and economic growth forecasts in countries like Russia have been hastily revised lower. Venezuela’s President, Nicolas Maduro, said on Monday that the country’s petroleum export price had halved during the second half of 2014 to $48, Reuters reported. But rather than blame its fellow OPEC member Saudi for failing to back a producing cut, Maduro blamed the oil price decline on the U.S., saying the country was trying to hurt Russia and Venezuela.

Read more …

You bet. There’ll be an earthquake in the industry.

• Oil Industry Set For Year Of Mergers And Takeovers, Says PwC (BBC)

The oil and gas industry is set for a year of mergers and takeovers as a result of the plummeting oil price, a business consultancy has predicted. PwC said 2015 may bring the first hostile takeover in the sector in living memory. It warned of “uncertain times” for the estimated 440,000 people employed in the UK’s oil and gas industry. The oil price has fallen from $115 a barrel in the middle of the year to about $60. Drew Stevenson, PwC’s UK energy deals leader, said: “Oil prices remaining at the current level for a sustained period will light the touch-paper for mergers and acquisitions in 2015. “As the UK industry positions itself for a more uncertain future, we expect to see deal activity levels pick up throughout the year ahead.” PwC said the industry would be “increasingly cash-constrained” with new debt coming at a cost, and existing debt coming under increased scrutiny.

Read more …

Lovely.

• The Cartel: How BP Used a Secret Chat Room for Insider Tips (Bloomberg)

Halfway down a muddy, secluded road on marshland in suburban Essex sits Wharf Pool, a lake stocked with some of the biggest freshwater fish you will ever see. A white sign with red lettering reads: “Private Syndicate: Strictly Members Only.” A metal gate, a barbed-wire fence and two CCTV cameras bar the way. Anglers hoping to spend time on the lake’s carefully tended banks must join a waiting list. Those who make it to the top pay a membership fee that buys them the chance to catch a carp that weighs more than a Jack Russell. There are hundreds of them swimming beneath the surface. It’s close to shooting fish in a barrel. An hour away by train, in London’s financial district, the lake’s owners ply their trade.

Wharf Pool was purchased for about £250,000 ($388,000) in 2012 by Richard Usher, the former JPMorgan trader at the center of a global investigation into corruption in the foreign-exchange market, and Andrew White, a currency trader at oil company BP. With revenue of almost $400 billion last year and operations in about 80 countries, BP trades large quantities of currency each day. Traders at the company regularly received valuable information from counterparts at some of the world’s biggest banks – including tips about forthcoming trades, details of confidential client business and discussions of stop-losses, the trigger points for a flurry of buying or selling – according to four traders with direct knowledge of the practice. Copies of messages sent to BP traders over the course of a year were provided to Bloomberg News by a person with access to the online conversations.

The person, who redacted the names of banks sending the messages and dates of conversations, said they came from firms whose senior foreign-exchange traders belonged to a chat room called “The Cartel” that was set up by Usher and included dealers at JPMorgan, Citigroup, Barclays and UBS. The information offered an insight into currency moves minutes, sometimes hours before they happened. The messages could drag the U.K.’s biggest energy company into a scandal that has enveloped 11 banks and led to more than 30 traders from London to Singapore losing or being suspended from their jobs. Last month six banks were fined $4.3 billion for passing along information about their clients and working together to rig foreign-exchange markets.

Read more …

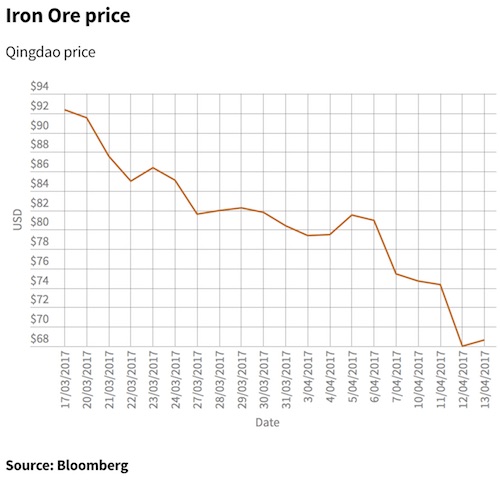

Gambling on China growth that isn’t there.

• Iron-Ore Slump Fails to End Glut as Australia Mines Grow (Bloomberg)

The collapse in global iron-ore prices isn’t chasing Gina Rinehart away from the red soil of Western Australia that made her a billionaire. Like producers in Brazil and some in China, she can still profit from the metal. At the $8 billion Roy Hill mine Rinehart is building in the Pilbara region, where her father made the first discoveries in the 1950s, ore must sell for about $56 a metric ton at Chinese ports to avoid losses, and costs are even lower for Australian output from Rio Tinto and BHP Billiton, UBS data show. Even with prices down 65% from a record in 2011, top buyer China pays $67 for the steel-making ore today.

While some high-cost operations have closed and demand is slowing, there are enough producers making money to extend a global surplus for another four years, after companies spent about $120 billion since 2011 to expand mines, according to Goldman Sachs. More than 80% of global production is still profitable, Bloomberg Intelligence says. “We did base this project on long-run iron-ore prices, which admittedly were higher than what they are today,” Barry Fitzgerald, the chief executive officer of Rinehart’s Roy Hill, told reporters during a tour of the site last month. “There’s going to be an awful lot of impact on the rest of the industry” before Roy Hill is affected, he said.

The iron-ore glut emerged this year after a record expansion of mine capacity and as China, the world’s second-largest economy, grew at the slowest pace in two decades. The surplus will reach 300 million tons by 2017, because Chinese steel production is unlikely to expand fast enough to absorb the excess supply, Goldman Sachs said in a Nov. 6 report. Rising output of low-cost ore will boost shipments from Australia, the largest producer, said Wayne Calder, deputy executive director of the government’s Bureau of Resources and Energy Economics. Supply from Rio, BHP, Fortescue and Roy Hill will add about 100 million tons a year to exports, Calder said in September. Rinehart, the richest woman in the Asia-Pacific region, is pushing ahead with plans to start shipments by September and produce 55 million tons a year.

Read more …

And the BBC just lets them say these things?

• Bernanke Tells UK’s King: We Saved Our Economies (MarketWatch)

Former Federal Reserve Chairman Ben Bernanke believes history has already vindicated the novel efforts of the U.S. central bank to revive the economy after the financial crisis of 2008. The Fed and the Bank of England offered financial aid to beleaguered banks and deployed tools such as quantitative easing – creating new money – on a massive scale to help heal badly damaged economies. The result has been that the U.S. and Britain have grown much faster than the European Union, whose response has been less aggressive. “By stabilizing the financial system, we avoided much, much worse, persistently bad consequences for our economies,” Bernanke said in an interview with Mervyn King on BBC. King was head of the Bank of England during the crisis and was a constant ally of Bernanke, a longtime friend whom he had first met at MIT three decades earlier.

Critics of quantitative easing contend it’s too early for the Fed to declare victory. The central bank still has to successfully manage the reduction in historically large balance sheets without causing any severe economic side effects, they say. In a Pattonesque way, Bernanke said he found dealing with the crisis “incredibly stimulating” because he was able to draw on a lifetime of academic study about the causes of the Great Depression and how to avoid another one. “I feel that the work I did as a academic paid off and that I was able to use that to help solved these problems,” he said. “That’s very satisfying, though it’s not an experience I would voluntarily repeat.” No surprise there. Bernanke spent countless hours managing the crisis through 2008 and 2009 and had to see a doctor after experiencing episodes of physical discomfort. “There certainly was a lot of stress. I once went to a gastroenterologist,” Bernanke recounted. “He said, ‘Do you think your problem might be caused by stress?’ ‘Well, I said, it’s possible.’ ”

Read more …

Golman vs the entire nation of Portugal. We’ll take your bets now.

• Goldman Sachs Set for Fight Over $835 Million Loan to Banco Espírito Santo (WSJ)

Goldman Sachs is squaring up for a fight with the Bank of Portugal over repayment of an $835 million loan made to Banco Espírito Santo weeks before the Portuguese lender’s collapse. The four-year loan, arranged by Goldman Sachs through a finance vehicle called Oak Financ, had been transferred in August to Novo Banco, the “good bank” carved out of Banco Espírito Santo. Last week, the Bank of Portugal decided that transfer was a mistake, and that the loan should instead remain at the “bad bank” that kept the Banco Espírito Santo name and its worst assets. The decision means Goldman Sachs and its clients could lose hundreds of millions of dollars from investments in Oak Finance notes backed by the loan, because assets at the bad bank are estimated to be worth less than $100 million in liquidation.

The Bank of Portugal’s move also puts at a disadvantage junior bondholders at Banco Espírito Santo, who are already embroiled in legal efforts to improve their potential payout. A Goldman Sachs spokeswoman said the Bank of Portugal’s unexpected announcement would harm its clients and financial markets generally, and that it plans to pursue remedies. Banco Espírito Santo failed in August after the central bank started untangling a web of cross-funding between the bank and other companies in the vast Espírito Santo family empire. The Bank of Portugal and the Portuguese prosecutor’s office are conducting separate probes into the matter, and authorities in at least three other countries are investigating individuals and group companies over alleged wrongdoing. The Oak Finance transaction stood out in the wreckage of Banco Espírito Santo, both for its timing and because of the companies involved.

Read more …

2015 will be tough on Brazil.

• Petrobras Deadline Prompts Bondholders To Push For Default (Reuters)

Petrobras, Brazil’s state-run oil company, could be declared in technical default on some of its foreign debt as early as Tuesday if bondholders pursue efforts to force it to speed up its assessment of losses in a giant corruption scandal. The push, led by New York-based Aurelius Capital, applies to $54 billion of Petrobras bonds governed by U.S. law in New York state. Aurelius, a “distressed debt” fund, is asking investors to put the company into default as “a precautionary step,” according to a Dec. 29 letter from the firm reviewed by Reuters. Under the terms of those bonds, Petrobras is required to provide third-quarter financial statements within 90 days of the end of a quarter, in this case by Monday, Dec. 29. Petrobras has not published those accounts because allegations of contract-fixing and bribery at the company have raised doubts about the true value of its assets.

For the default declaration to take effect on any of the more than 20 U.S. law bonds outstanding, investors holding at least 25% of any one series must request the action, Aurelius said in the letter to fellow bondholders. Aurelius was a leading member of a group of investors that refused to accept a debt restructuring with Argentina, taking the country to court. Petrobras, which first planned to release results in early November, has extended the deadline to Jan. 31 as new corruption allegations came to light, saying it had a waiver from investors but not giving any details. “We believe bondholders should immediately take the prudent precaution of giving formal notice of default,” Aurelius managing director Eleanor Chan wrote.

“While mere notice of default should not itself cause a crisis, bondholders cannot avoid a crisis merely by sticking their heads in the sand and accepting Petrobras’ assurances as a certainty.” Distressed debt funds specialize in buying the debt of companies or countries at risk of default. Such hedge funds, also known as vulture funds, often use top flight lawyers to gain favorable terms in any bankruptcy. Few have suggested Petrobras will be unable to pay its debts in the short or medium term. It has huge oil resources and the backing of the Brazilian government, whose officials have said they will backstop the company. Petrobras, though, is already frozen out of capital markets because of the scandal and is in danger of losing its investment-grade debt rating, a situation that would reduce the pool of potential investors and raise its borrowing costs.

Read more …

Slow growth.

• Foreign Automakers Taken To Task In China Over Dealers’ Inventories (Reuters)

Foreign automakers in China may struggle to dictate sales goals in the future after dealers complained to the government that inflexible targets set during a market boom obliged them to buy too much stock and bear the brunt of a drop in demand. Automakers largely stuck to targets throughout 2014, selling cars to dealers on schedule. But dealers slashed retail prices and booked losses as sales growth in the world’s biggest auto market halved from the previous year’s 14%. “Carmakers have high market expectations. But the reality is: supply exceeds demand,” said Luo Lei, deputy secretary general of the China Automobile Dealers Association (CADA).

“In the past, dealers were angry, but dared not speak out. But now, they have to shout because the situation is getting so unbearable,” said Luo, whose body this month filed a report with authorities on the practice of transferring stock to dealers. The report from China’s biggest dealer body could help change the balance of power at a time when automakers are starting to alter expectations in an economy expanding near its slowest rate in 24 years. Japan’s Honda and Nissan cut their China sales forecasts last month while executives say Toyota Motor Corp is likely to miss its 2014 goal. Germany’s BMW said it expects profit margins to narrow as the market “normalizes” from the growth spurt of the past few years.

“Carmakers are making a compromise to dealers” in their worst-ever spat, said Yale Zhang, managing director of consultancy Automotive Foresight. “Over the past years, carmakers, especially luxury brands, have been too aggressive in their quest for China market share. Now with the problem fully exposed, I expect to see an obvious slowdown in their pace of expansion next year.” Honda has been helping dealers “adjust” inventories since the middle of the year, a company spokesman said. Honda’s China sales have fallen every month since July. BMW China head Karsten Engel said in an interview last month that the luxury carmaker had “listened” to dealers saying stockpiles were building up, and that it had started “reducing wholesale supplies”.

Read more …

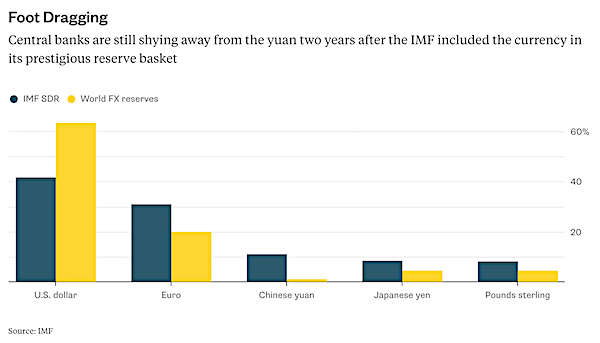

A $25 billion swap is no threat to the dollar.

• Ditching Dollar: China, Russia Launch Financial Tools In Local Currencies (RT)

China and Russia have effectively switched to domestic currencies in trading using financial tools as swaps and forwards, as they seek to reduce the influence of the US dollar and foreign exchange risks. The agreement signed in the end of October comes into force Monday, December 29, and provides a currency swap of CNY150 billion (up to US$25 billion). The country’s Foreign Exchange Trade System will carry out similar transactions with the Malaysian ringgit and the New Zealand dollar. From now on yuan swaps are available for 11 currencies on the foreign exchange market. “China won’t stop yuan globalization or capital account opening because of the volatility in emerging market currencies,” Ju Wang, a senior currency strategist at HSBC in Hong Kong told Bloomberg.

China has set up bilateral currency swap lines with more than 20 countries and regions since 2009, including Switzerland, Brazil, Hong Kong, Indonesia and South Korea, Xinhua News reported in July. A swap is a financial tool to ease transactions by exchanging certain elements of a loan in one currency, like the principal or interest payments into an equivalent loan in another currency. Currency forward is an obligation of two parties to convert an agreed amount of one currency into another by a certain date at an exchange rate specified at the moment of signing the deal. Russia and China have long been looking for ways to cut the dollar’s role in international trade. The question is significant for China as 32%, or $4 trillion of its foreign exchange reserves are in US bonds, which means there is a vulnerability to fluctuations in the exchange rate.

Read more …

Business as usual.

• Jeb Bush and the Making of a $236 Million Federal Contract (Bloomberg)

Republican donor Ric Cooper had a straight line to Florida Governor Jeb Bush, and days after Hurricane Katrina used the access to help secure a $236 million deal that Democrats later called a “boondoggle contract,” according to a trove of e-mails released last week by the Democratic opposition research group American Bridge. The chummy exchange began with a previously unreported direct appeal from Cooper on behalf of Carnival Cruise Line two days after Katrina smashed into the Gulf Coast. “None of us have any idea how to reach out to FEMA or whoever is appropriate,” wrote Cooper in an Aug. 31, 2005, e-mail to Bush. “I decided to do my usual ‘I’ll give Jeb a heads-up.’” The Miami-based company wanted a federal contract for “two or three” of their ships to be used in the response effort, he wrote.

Cooper, who at the time was working in Miami at an advertising agency that Carnival used, said in his e-mail that the ships could provide housing for between 6,000 and 10,000 people and “could feed if needed as well.” Once in place, the ships could stay for weeks or months, he offered. “They would minimize costs involved,” pledged Cooper, who during the 2004 election cycle had donated $50,000 to the Republican National Committee to help re-elect the governor’s brother, President George W. Bush. What followed became public as Democrats began to investigate the Katrina response in early 2006. Jeb Bush, who was famously responsive to e-mail as governor, replied to Cooper within 13 minutes.“I will pass on to Mike Brown,” Bush wrote, referring to the then-director of the Federal Emergency Management Agency. “I can’t believe they haven’t asked as of yet but Mike will respond quickly.”

About three hours later, Brown responded to Bush and Cooper with his cell phone number. “Ric, thanks for the note that Jeb sent,” the FEMA director wrote. “I personally think this is a great idea.” Within days, three Carnival ships steamed to the Gulf Coast. It wasn’t a happy ending: The ships sat half empty. Use of them turned out to be rather expensive, and lawmakers used the contract as an example of post-Katrina waste. “This boondoggle contract, which comes to an end this week, has cost federal taxpayers an enormous amount to provide temporary six-month housing aboard Carnival’s ships,” Representative Henry Waxman, a California Democrat, wrote in a February 2006 letter to Jeb Bush. Waxman calculated that the contract cost taxpayers almost $240,000 to shelter a family of five. “At this price, the federal government could have built permanent homes for the families,” Waxman wrote.

Read more …

“The Snowden documents reveal the encryption programs the NSA has succeeded in cracking, but, importantly, also the ones that are still likely to be secure.”

• Inside the NSA’s War on Internet Security (Spiegel)

US and British intelligence agencies undertake every effort imaginable to crack all types of encrypted Internet communication. The cloud, it seems, is full of holes. The good news: New Snowden documents show that some forms of encryption still cause problems for the NSA.

When Christmas approaches, the spies of the Five Eyes intelligence services can look forward to a break from the arduous daily work of spying. In addition to their usual job – attempting to crack encryption all around the world – they play a game called the “Kryptos Kristmas Kwiz,” which involves solving challenging numerical and alphabetical puzzles. The proud winners of the competition are awarded “Kryptos” mugs. Encryption – the use of mathematics to protect communications from spying – is used for electronic transactions of all types, by governments, firms and private users alike. But a look into the archive of whistleblower Edward Snowden shows that not all encryption technologies live up to what they promise. One example is the encryption featured in Skype, a program used by some 300 million users to conduct Internet video chat that is touted as secure.

It isn’t really. “Sustained Skype collection began in Feb 2011,” reads a National Security Agency (NSA) training document from the archive of whistleblower Edward Snowden. Less than half a year later, in the fall, the code crackers declared their mission accomplished. Since then, data from Skype has been accessible to the NSA’s snoops. Software giant Microsoft, which acquired Skype in 2011, said in a statement: “We will not provide governments with direct or unfettered access to customer data or encryption keys.” The NSA had been monitoring Skype even before that, but since February 2011, the service has been under order from the secret US Foreign Intelligence Surveillance Court (FISC), to not only supply information to the NSA but also to make itself accessible as a source of data for the agency.

The “sustained Skype collection” is a further step taken by the authority in the arms race between intelligence agencies seeking to deny users of their privacy and those wanting to ensure they are protected. There have also been some victories for privacy, with certain encryption systems proving to be so robust they have been tried and true standards for more than 20 years. [..] The Snowden documents reveal the encryption programs the NSA has succeeded in cracking, but, importantly, also the ones that are still likely to be secure. Although the documents are around two years old, experts consider it unlikely the agency’s digital spies have made much progress in cracking these technologies. “Properly implemented strong crypto systems are one of the few things that you can rely on,” Snowden said in June 2013, after fleeing to Hong Kong.

Read more …

I wouldn’t normally address topics like this, but women in rape cases deserve more respect than having someone spent hundreds of thousands of dollars digging into their lives.

• Bill Cosby Hires PI’s To Dig Up Dirt On Women Who Accuse Him of Rape (Ind.)

Bill Cosby hired private investigators to “dig up dirt” on several women who claimed the comedian had raped them, according to a report by the New York Post. More than two dozen women have come forward in recent weeks to allege that Mr Cosby, 77, drugged and sexually assaulted them between the 1960s and 2000s. But Mr Cosby has reportedly been fighting back behind the scenes, spending hundreds of thousands of dollars to scour the women’s pasts in a bid to discredit his accusers. At a recent meeting of his legal and public relations representatives, an insider told the Post, Mr Cosby said: “If you’re going to say to the world that I did this to you, then the world needs to know, ‘What kind of person are you? Who is this person that’s saying it?’”

This counter-attacking strategy is not new to Hollywood scandals generally, nor to Mr Cosby in particular. At the weekend, the New York Times also reported that in 2005, the comedian’s team presented a dossier of “damaging information” to one newspaper about Tamara Green, a California lawyer who accused Mr Cosby of having drugged and sexually assaulted her during the 1970s. The Times described Mr Cosby’s response to his accusers past and present as: “an organised and expensive effort that involved quashing accusations as they emerged while raising questions about the accusers’ character and motives, both publicly and surreptitiously.”

Mr Cosby’s lawyer, Martin Singer, suggested that the investigators were merely doing the work that the press had failed to, telling the Post: “You don’t need private investigators to find out information about the accusers. A simple Google search will obtain the information.” Mr Cosby himself has avoided addressing specific allegations, but did ask journalists to approach the women’s stories with a “neutral mind”. Though his Netflix stand-up special and an NBC sitcom project were both cancelled in the wake of the accusations, Mr Cosby still has several concert dates in place for the coming months. On Friday, comedy writer-director Judd Apatow took to Twitter to confront two Canadian venues for not having cancelled Cosby’s coming appearances, asking one: “are you really going to let Bill Cosby perform on your stage January 7?”

Read more …

God particle.

• Large Hadron Collider To Switch Back On At Double Power (Ind.)

CERN’s Large Hadron Collider is set to be switched back on in March — hoping that a £97 million upgrade could push it to even greater discoveries, after it found the “God particle” in 2012. The second three year run of the huge atom smasher will begin in March 2015. The Large Hadron Collider has been switched off since its last run finished in 2012. The world’s largest particle collider has been undergoing a £97 million upgrade since then, as scientists comb through the data found during the last run. It is being cooled back down ready for the switch on, and is almost at its operating temperature of 1.9 degrees above absolute zero, or about minus 271.25 degrees Celsius.

Scientists are also testing out the equipment and earlier in December activated one of the magnets required to fire atoms around the collider. Scientists are now gearing up to turn both on at once, in 2015. That will produce collisions of a scale never achieved by any accelerator in the past, equivalent with 154 tons of TNT. The extra power will allow the CERN’s numerous experiments to look into deep mysteries of the universe, such as dark matter. The Large Hadron Collider was used in 2012 to confirm the existence of the Higgs boson, known as the God particle, which explains the very beginning of the universe.

Read more …

“I don’t know whether Mr. Obama was a hostage, an empty suit, or a fool, but he broadened and deepened the acquiescence to lying about just about everything.”

• The Trigger (James Howard Kunstler)

The futility of politics in America these days has driven the public into exactly the dream-state of zombie blood-lust depicted in so many popular video fantasies, a nightmare of decay, powerlessness, and degeneracy matching the actual condition of a disintegrating polity that has lost collective consciousness and seeks only to infect the dwindling numbers of the still-sentient. Almost nobody in this country believes we can manage our affairs anymore. Well, can we? One of the hallmarks of an imploding culture is that people lose a sense of consequence. Things just seem to happen and unhappen, and nobody really cares about chains of decision and event. Anything goes and nothing matters.

One reason this is happening to us is that we allowed reality to be divorced from truth. Karl Rove wasn’t kidding back in the Bush-2 days when he quipped that “we create our own reality.” The part old Karl left out is that there’s a price for doing that. In the short run, it allows you to pretend that you have superpowers and can act in defiance of the way things really are. In the longer run, your view of the world comports so poorly with the facts of the world that things stop working. The tragedy of Barack Obama is that he continued the basic Karl Rove doctrine only without bragging about it. I don’t know whether Mr. Obama was a hostage, an empty suit, or a fool, but he broadened and deepened the acquiescence to lying about just about everything. Did criminal misconduct run rampant in banking for years?

Oh, nevermind. Is the US economy actually contracting instead of recovering? We’ll just make up better numbers. Did US officials act like Nazi war criminals in torturing prisoners? Well, yeah, but so what? Did the State Department and the CIA scuttle the elected Ukrainian government in order to start an unnecessary new conflict with Russia? Maybe so, but who cares? Was the Affordable Care Act a swindle in the service of insurance and pharmaceutical racketeering? Oh, we’ll read the bill after we pass it. Shale oil will make us “energy independent.” (Not.) Has anyone noticed the way these incongruities percolate into the public attention and then get dismissed, like daydreams, with no resolution.

I’ve harped on this one before because it was, to my mind, Obama’s greatest failure: When the Supreme Court decided in the Citizens United case that corporations were entitled to express their political convictions by buying off politicians, why didn’t the President join with his then-Democratic majority congress to propose legislation, or a constitutional amendment, more clearly redefining the difference between corporate “personhood” and the condition of citizenship? How could this constitutional lawyer miss the reality that corporations legally and explicitly do not have obligations, duties, and responsibilities to the public interest but only to their shareholders? How was this not obvious? And why was there not a rush to correct it?

Read more …

IMF policies, too, have been blamed for allowing ebola to spread after squeezing health care systems.

• Ebola Spurs Call for Global Health Reserve Corps, Challenging WHO (Bloomberg)

While Ebola rages on in West Africa, world leaders are debating ways to snuff out future contagions. The question they’re asking is: How? The World Bank, headed for the first time by a doctor, wants to create a cadre of outbreak specialists who could be sent anywhere to end deadly epidemics. A similar idea, floated by a World Health Organization panel three years ago in the wake of the swine flu pandemic, didn’t get enough support. The WHO says the idea might not be practical and countries should ideally have the capacity to respond themselves. The Ebola outbreak, which has so far sickened more than 20,000 people in eight countries, shows major weaknesses in global health security. The 2003 SARS outbreak and the 2009 swine flu pandemic were reminders, too, yet the measures necessary to stop Ebola from mushrooming into a three-continent scourge weren’t in place.

World Bank President Jim Yong Kim is determined to ensure lessons are learned this time. “What the Ebola epidemic has taught every single one of us is that we were not prepared for an outbreak of this size,” Kim, a Harvard University-trained physician and anthropologist, told reporters in Liberia on Dec. 2. “I for one, as president of the World Bank Group, will continue to remind all of the leaders that this flaw that was exposed must be taken care of and must be taken care of as quickly as possible.” The virus has killed at least 7,842 people, mostly in Sierra Leone, Liberia and Guinea, according to the WHO. If it continues to spread further in Africa, it could cost as much as $32.6 billion by the end of 2015, the Washington-based World Bank estimated in October.

Kim, who previously headed the WHO’s HIV/AIDS department, has voiced publicly his opinions on Ebola more than a dozen times in op-eds, speeches, statements, media briefings and in webcasts detailing the World Bank’s response and what needs to be done. He’s also been critical of the initial global response, describing it as “late, inadequate and slow.” “Our president is responding to a crisis that he sees first and foremost as a major impediment to the twin objectives of the bank, which are to eliminate extreme poverty and to share prosperity,” said Tim Evans, the World Bank’s senior director of health, nutrition and population. “The fact that he’s had experience with pandemics before and global health perhaps increases his legitimacy as an advocate to bring this epidemic to an end as soon as possible.”

Read more …

TIME was right: these courageous people are the Persons of the Year.

• Ebola in UK: One Patient Diagnosed With Ebola, Two More Tested (Independent)

Two more patients are being tested for Ebola in Scotland and Cornwall. One patient is being examined for possible symptoms at the Royal Cornwall Hospital in Truro, Cornwall, and the other – a female heath worker – at Aberdeen Royal Infirmary. The virus, which had its first case confirmed in the UK yesterday in Glasgow, is just one of several illnesses they could be suffering from. Nicola Sturgeon, the First Minister, said the Scottish woman had recently returned from West Africa but was “low risk” and had no known contact with the virus. “Although this is another returning healthcare worker from West Africa, the patient here has had no, as far as we’re aware, direct contact with people infected with Ebola,” she told BBC radio. “This patient over the course of today will be transferred for tests.”

A spokesperson for the Royal Cornwall Hospitals Trust would not give any further details of their patient but said he or she arrived at the hospital, known locally as Treliske, in the early hours of the morning and is being treated in isolation. “It could be nothing but this patient has possibly been at risk,” he added. “We are in contact with Public Health England (PHE) but it could be 24 hours before we know.” The person is understood to have viral symptoms, which are shared by Ebola and many other illnesses including malaria, and samples are undergoing testing at PHE’s national facility. An NHS worker who has been diagnosed with Ebola after returning to Glasgow from Sierra Leone is believed to be on the way to a specialist unit in London this morning.

Read more …