Sergio Larraín Valparaiso Passage Bavestrello 1952

Forget about Jackson Hole. This is America.

• 78% of Americans Live Paycheck To Paycheck (CNBC)

No matter how much you earn, getting by is still a struggle for most people these days. 78% of full-time workers said they live paycheck to paycheck, up from 75% last year, according to a recent report from CareerBuilder. Overall, 71% of all U.S. workers said they’re now in debt, up from 68% a year ago, CareerBuilder said. While 46% said their debt is manageable, 56% said they were in over their heads. About 56% also save $100 or less each month, according to CareerBuilder. The job-hunting site polled over 2,000 hiring and human resource managers and more than 3,000 full-time employees between May and June.

Most financial experts recommend stashing at least a six-month cushion in an emergency fund to cover anything from a dental bill to a car repair — and more if you are the sole breadwinner in your family or in business for yourself. While household income has grown over the past decade, it has failed to keep up with the increased cost-of-living over the same period. Even those making over six figures said they struggle to make ends meet, the report said. Nearly 1 in 10 of those making $100,000 or more said they usually or always live paycheck to paycheck, and 59% of those in that salary range said they were in the red.

“Someone once alerted me to the Bohica syndrome. Bohica? I asked.

He sneered: “Bend Over, Here It Comes Again.”

• Systemic Banking Fraud Means Next Crisis Will Be Worse (Feierstein)

Henry Paulson. Hank. Remember him? Of the crisis in 2008, he said: “Where I come from, if someone takes a risk and they’re going to make the profit from that risk, they shouldn’t have the taxpayer pay for the losses.” Quite the wisdom one expects from the 74th US Secretary of the Treasury. Yet, as Paulson played pass the parcel with the rest of us, it was he who unwrapped the final layer when the music stopped, and discovered that the prize within was a grenade. Understandable, therefore, that he offered a second opinion somewhat in contrast to his first: “It’s better to have the taxpayer pay for the losses than have the United States of America become an economic wasteland. If the financial system collapses, it’s really, really hard to put it back together again.”

Well, it did, and it was. Two years after the fall of Lehman Brothers, former Federal Reserve chairman Alan Greenspan was still reflecting on the solution. “There are two fundamental reforms we need — to get adequate capital and… far higher levels of enforcements of… fraud statutes.” So what progress has been made in the efforts to reduce the risks of another crisis? Not enough. In a letter this year to Bank of England’s Governor, Mark Carney, (in his capacity as chairman of the Financial Stability Board), the Senior Supervisors Group reported that “firms’ progress toward consistent, timely, and accurate reporting of top counterparty exposures fails to meet supervisory expectations”. It said there is still too little reform, and too little essential knowledge of counterparty risk.

But what of Greenspan’s assertions of criminal behaviour in financial markets? Again, no change. Market manipulation is not a conspiracy theory. The Bank of Japan has manoeuvred its bond market to a point where bond futures no longer trade. Its interventions have distorted free-market pricing mechanisms to the point that risk is virtually impossible to quantify. But the most pressing concern is the behaviour of central banks, which had previously appeared a solid safe haven.

Guess where the trillions went?!

• Did the Economy Just Stumble Off a Cliff? (CHS)

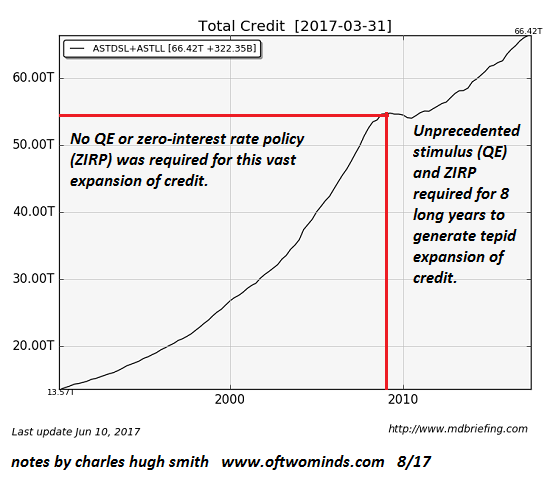

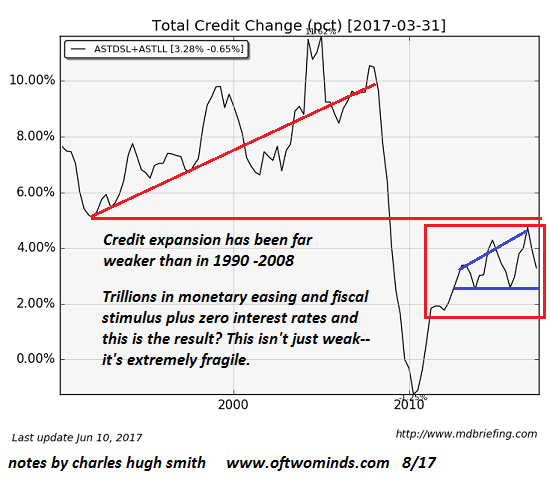

The signs are everywhere for those willing to look: something has changed beneath the surface of complacent faith in permanent growth. This is more intuitive than quantitative, but my gut feeling is that the economy just stumbled off a cliff. Neither the cliff edge nor the fatal misstep are visible yet; both remain in the shadows of the intangible foundation of the economy: trust, animal spirits, faith in authorities’ management, etc. Since credit expansion is the lifeblood of the global economy, let’s look at credit expansion. Courtesy of Market Daily Briefing, here is a chart of total credit in the U.S. and a chart of the%age increase of credit. Notice the difference between credit expansion in 1990 – 2008 and the expansion of 2009 – 2017. Credit expanded by a monumental $40+ trillion in 1990 – 2008 without any monetary easing (QE) or zero-interest rate policy (ZIRP). The expansion of 2009 – 2017 required 8 long years of massive monetary/fiscal stimulus and ZIRP.

This chart of credit change (%) reveal just how lackluster the current expansion of credit has been, despite unprecedented trillions of stimulus pumped into the financial sector.

Back in the real world, have you noticed a slowing of animal spirits borrowing and spending? Have you tightened up your household budget recently, or witnessed cutbacks in the spending habits of friends and family? Have you noticed retail parking lots aren’t very full nowadays, and once-full cafes now have empty tables? According to the conventional economic statistics, everything’s going great: there are millions of job openings, unemployment is near historic lows, GDP is expanding nicely and of course, everyone’s favorite signifier of wonderfulness, the stock market, is hovering near all-time highs.

The possibility that the real economy just stumbled off a cliff creates instant cognitive dissonance, as the official narrative is the economy is expanding slowly but surely and everything is nominal: there’s plenty of everything, from oil/gas to consumer credit to jobs to student loans. Nonetheless, I feel a disturbance in the Force: once credit expansion slows or ceases, the economy will roll over into recession, as wages have been stagnant for the past 17 years, and the bottom 95% of households can only spend more if they borrow more.

The Fed is going to raise rates as Japan and Europe continue to buy everything not bolted down? Boy, I’d like to see that happen…

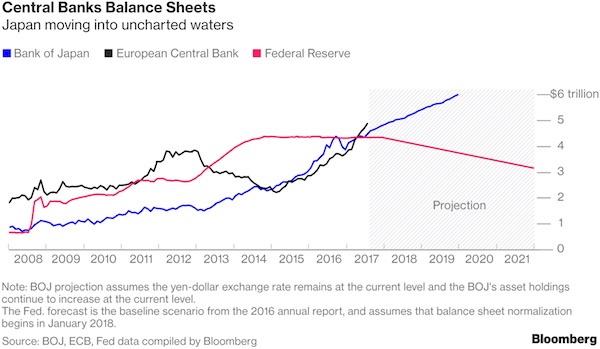

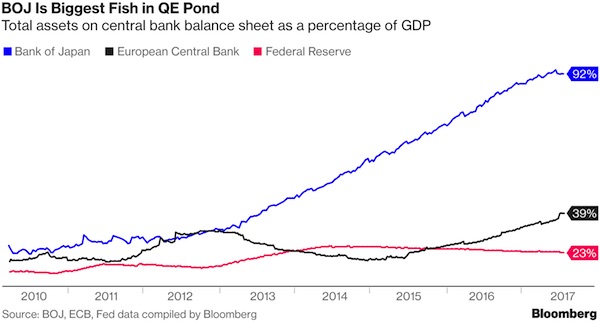

• Central Bank Balance Sheets Are Headed for a Great Divergence (BBG)

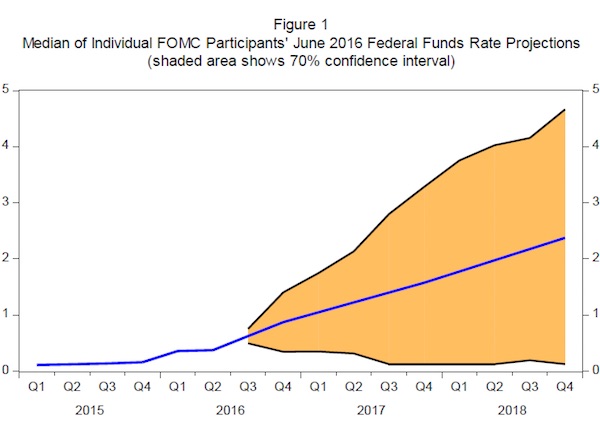

A brief convergence this year in the dollar value of the balance sheets of the Federal Reserve, the European Central Bank and the Bank of Japan has passed and the trio are now set to take very different paths. After all three touched $4.5 trillion in April, they’ve split, mostly due to a rally in the euro and strength in the yen. With expectations that Janet Yellen may begin whittling away at the Fed’s balance sheet in the next few months, and the BOJ set to carry on with its unprecedented asset purchases, the Japanese central bank may find itself carrying something approaching double the load of its American counterpart two years from now. The ECB’s picture is much more difficult to discern, and investors will be listening intently on Friday when Mario Draghi speaks at the annual Jackson Hole summit of central bankers in Wyoming. With Europe’s recovery gathering pace, officials may start talks this fall about a strategy for 2018 that could include gradually reducing net purchases to zero.

When it comes to the size of the balance sheets relative to the economies of the U.S., Europe and Japan, Haruhiko Kuroda’s BOJ is already the uncontested heavyweight, and will keep extending its lead. The BOJ doesn’t expect to hit its 2% inflation target until sometime around the fiscal year starting in April 2019, dictating the need for hefty asset purchases for years to come. This divergence has big implications for the central banks the next time crisis threatens the global economy. The Fed and the ECB are likely to have more room to dive back into asset purchases or cut interest rates, while the BOJ may find itself pinned down unless it can find a way out of its current predicament before the next problem comes along.

Are central bankers really this dumb?

• Low World Inflation Dogs Central Bankers, Even As Economies Grow (R.)

The world’s top central bankers gather in Jackson Hole, their confidence bolstered by a sustained return to economic growth that may eventually allow the European Central Bank and the Bank of Japan to follow the Federal Reserve in winding down their crisis-era policies. Yet in one key area, none of the world’s central banks has found the answer. Inflation remains well below their 2% targets, stoking a debate about whether they are missing signals of a less than healthy economy and the need for a slower path of “rate normalization”, or that they simply don’t understand how inflation works in a globalized world. In Japan, officials have researched behavioral causes, wondering whether businesses and families are just slower to react to economic signals than thought. European officials have blamed slow-moving union wage contracts and online shopping, while U.S. policymakers have cited a lengthy sequence of “one-offs” in pricing from oil to cellphones to prescription drugs.

In each case the response of policymakers has been the same: wait it out and talk confidently about inflation’s return, as the Fed has put it since 2013, over “the medium term”. “Yes, our models aren’t perfect… Certainly the fact that we have had some low inflation readings is something that we take very seriously,” said Cleveland Fed President Loretta Mester. Yet Mester is convinced the problem is not a weakening economy, but changes in how businesses set prices – a supply side issue she says leaves her comfortable pressing ahead with slow but steady interest rate increases. Not everyone is convinced by Mester’s approach. Concerns over the significance of a recent slide in inflation have renewed questions about whether a global tightening of monetary policy can proceed, with U.S. investors betting the Fed will have to hold off on more rate changes until later next year.

[..] The use of inflation targeting has been an important innovation in central banking, rooted in theories of how public expectations, central bank communication and other factors shape economic behavior. It was a recognition that how policymakers talked about inflation, and what households believed, would in part determine the outcome. But the developed world’s alignment around a 2% target has become a headache as much as a policy guide, with central banks trying to estimate and regulate something they acknowledge they don’t fully understand. Bank of Japan consultants have puzzled over whether people shop and save as if they fully see the future, or whether they look at the past and only slowly adapt to change. If the latter, then what central banks say is less important. [..] “Look, inflation is hard to forecast,” Mester said in an interview with Reuters, noting that the most elaborate models don’t do much better than simply saying inflation will be 2% and leaving it at that.

Finance humor.

• Amazon’s Plans to Cut Food Prices Will Be a Headache for the Fed (BBG)

Amazon’s plans to cut prices at Whole Foods is great news for shoppers, but not so much for Federal Reserve officials wondering whether they’ll ever hit their 2% inflation target. A low unemployment rate is supposed to boost inflation, or so the economic theory goes. One possible reason it’s not happening, according to the minutes of the central bank’s latest meeting in July: “Restraints on pricing power from global developments and from innovations to business models spurred by advances in technology.” Chicago Fed President Charles Evans earlier this month mused that “people are utilizing newer technologies, competition is emerging from unexpected places – not necessarily your nearest competitor but somebody else – and that could lead to reduced margins and downward price pressure for some period of time.”

Many years ago.

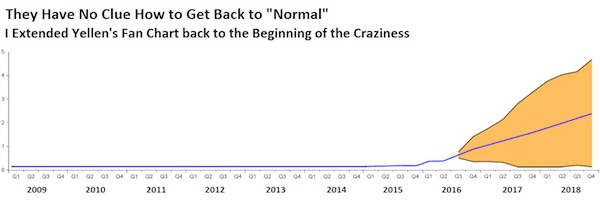

• Has The Fed Completely Lost Control (Roberts)

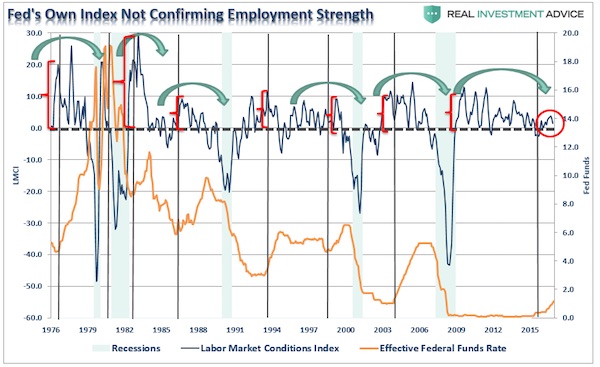

An interesting thing happened on the way to World Domination, uhh, I mean “Stability” – the data quit cooperating with the Federal Reserve’s carefully devised plan. Just recently the Federal Reserve quit updating their carefully constructed “Labor Market Conditions Index” which failed to support their ongoing claims of improving employment conditions. The chart below is the last iteration before it was discontinued which showed a clear deterioration in underlying strength.

The problem for the Fed in making the decision to discontinue their own Labor Market Conditions Index, which is likely providing a more accurate picture of the real conditions, is being forced to remain tied to an outdated U-3 employment index. As noted recently by Morningside Hill:

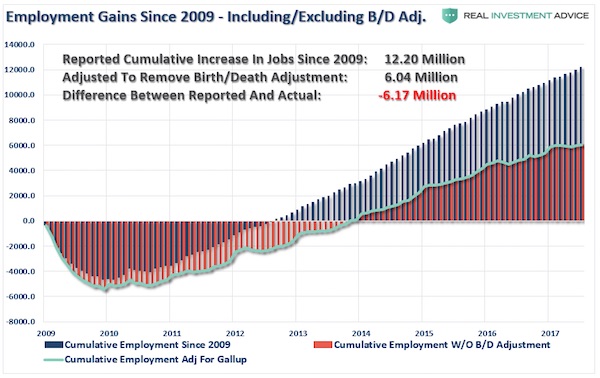

“There is sufficient evidence to suggest the Bureau of Labor Statistics (BLS) calculation method has been systemically overstating the number of jobs created, especially in the current economic cycle. Furthermore, the BLS has failed to account for the rise in part-time and contractual work arrangements, while all evidence points to a significant and rapid increase in the so-called contingent workforce as full-time jobs are being replaced by part-time positions, resulting in double and triple counting of jobs via the Establishment Survey. Lastly, a full 93% of the new jobs reported since 2008 and 40% of the jobs in 2016 alone were added through the business birth and death model – a highly controversial model which is not supported by the data. On the contrary, all data on establishment births and deaths point to an ongoing decrease in entrepreneurship.”

This last point was something I have addressed many times previously, the chart below shows the actual employment roles in the U.S. when stripping out the Birth/Death Adjustment model. With such a large overstatement of actual employment, the flawed model does support the idea of a tight labor market.

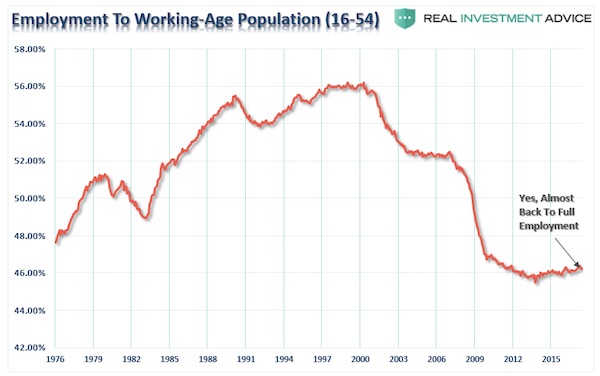

Unfortunately, despite arguments to the contrary, there is little support for why the bulk of Americans that should be working, simply aren’t.

Not everyone is completely nuts.

• No Alternative To Austerity? That Lie Has Now Been Nailed (G.)

Ever since the banks plunged the western world into economic chaos, we have been told that only cuts offer economic salvation. When the Conservatives and the Lib Dems formed their austerity coalition in 2010, they told the electorate – in apocalyptic tones – that without George Osborne’s scalpel, Britain would go the way of Greece. The economically illiterate metaphor of a household budget was relentlessly deployed – you shouldn’t spend more if you’re personally in debt, so why should the nation? – to popularise an ideologically driven fallacy. But now, thanks to Portugal, we know how flawed the austerity experiment enforced across Europe was. Portugal was one of the European nations hardest hit by the economic crisis. After a bailout by a troika including the IMF, creditors demanded stringent austerity measures that were enthusiastically implemented by Lisbon’s then conservative government.

Utilities were privatised, VAT raised, a surtax imposed on incomes, public sector pay and pensions slashed and benefits cut, and the working day was extended. In a two-year period, education spending suffered a devastating 23% cut. Health services and social security suffered too. The human consequences were dire. Unemployment peaked at 17.5% in 2013; in 2012, there was a 41% jump in company bankruptcies; and poverty increased. All this was necessary to cure the overspending disease, went the logic. At the end of 2015, this experiment came to an end. A new socialist government – with the support of more radical leftwing parties – assumed office. The prime minister, António Costa, pledged to “turn the page on austerity”: it had sent the country back three decades, he said. The government’s opponents predicted disaster – “voodoo economics”, they called it.

Perhaps another bailout would be triggered, leading to recession and even steeper cuts. There was a precedent, after all: Syriza had been elected in Greece just months earlier, and eurozone authorities were in no mood to allow this experiment to succeed. How could Portugal possibly avoid its own Greek tragedy? The economic rationale of the new Portuguese government was clear. Cuts suppressed demand: for a genuine recovery, demand had to be boosted. The government pledged to increase the minimum wage, reverse regressive tax increases, return public sector wages and pensions to their pre-crisis levels – the salaries of many had plummeted by 30% – and reintroduce four cancelled public holidays. Social security for poorer families was increased, while a luxury charge was imposed on homes worth over €600,000 (£550,000).

The promised disaster did not materialise. By the autumn of 2016 – a year after taking power – the government could boast of sustained economic growth, and a 13% jump in corporate investment. And this year, figures showed the deficit had more than halved, to 2.1% – lower than at any time since the return of democracy four decades ago. Indeed, this is the first time Portugal has ever met eurozone fiscal rules.

But it’s about political power, not economics: “Germany has a bigger surplus even than China, they should spend it in the European economy.” By bleeding Europe dry, Germany expands its dominance.

• Germany Slammed For Domestic Under-Spending (Ind.)

A Nobel economics laureate, Sir Christopher Pissarides, has hit out at Germany’s refusal to increase its domestic state spending in order to help entrench the eurozone’s recovery. Speaking at the Lindau meetings in Germany on Wednesday, Sir Christopher said that despite the bounce back in the single currency zone in recent months after years of crisis, the Continent’s largest economy was still exerting a damaging and unnecessary drag. “German fiscal policy is not at all what some countries still need,” he said, arguing that demand across the single currency zone was still too low. “Why is there no demand? Because of German fiscal policies! There is austerity, there is low infrastructure spending and therefore companies are hesitating [on] investment.” “Where is expansion going to come from? It’s going to come from the surplus countries spending more. Germany has a bigger surplus even than China, they should spend it in the European economy.”

The German government is running a fiscal budget surplus and its current account surplus (the difference between its total national spending and total national income) of $294bn in 2016 has drawn criticism from a host of economic bodies, including the IMF, for similar reasons as those advanced by Sir Christopher. Sir Christopher, who was awarded the Nobel in 2010 for his theoretical breakthroughs on labour market analysis, said that countries such as Spain had pushed through major and necessary job market reforms in 2010 and 2011 in the teeth of its sovereign debt crisis. The official headline Spanish unemployment rate currently stands at 17.3%, down from a 2013 peak of 27%. But Sir Christopher said it should be falling faster and that higher German state spending would help. “It’s certainly the case that if the European economy as a whole expanded faster we would see faster positive results from these [labour market] reforms,” he said.

Completely nuts.

• EU States Begin Returning Refugees To Greece As German Reunions Slow (G.)

European countries are poised to begin the process of returning refugees to Greece, as migrants seeking reunification with their family members – mostly in Germany – step up protests in Athens. In a move decried by human rights groups, EU states will send back asylum seekers who first sought refuge in Greece, despite the nation being enmeshed in its worst economic crisis in modern times. Germany has made nearly 400 resettlement requests, according to officials in Berlin and sources in Athens’ leftist-led government. The UK, France, the Netherlands and Norway have also asked that asylum seekers be returned to Greece. Greece’s migration minister told the Guardian the first returns were expected imminently.

“The paperwork has begun and we expect returns to begin over the next month,” said Yannis Mouzalas. “It will start with a symbolic number as an act of friendship [towards other EU nations]. Greece has already accepted so many [refugees], it has come under such pressure, that to accept more would be absurd, a joke if it weren’t such a tragedy.” Mouzalas said he had no idea where the returnees would be placed or whether they would ever leave Greece. “I don’t know where they will go. It could be Athens, it could be Thebes … they are accommodated in an apartment scheme,” he said. “Whatever [happens], conditions will be good, they have improved greatly and will meet EU criteria.”

[..] On Monday a reported 330 migrant arrivals were registered on Greece’s eastern Aegean isles, piling the pressure on overcrowded and vastly overstretched reception centres in Lesvos, Chios, Kos, Leros and Samos. An estimated 14,335 people are currently in limbo in accommodation centres on the Greek islands, according to figures released by the country’s interior ministry on Thursday. Conditions in the centres are described as deplorable, and protests and riots are commonplace. Human Rights Watch recently said self-harm and suicide attempts along with aggression, anxiety and depression were all on the rise. Local services complain about being unable to cope.

Our friends and allies.

• Yemen: The War No One Is Allowed To Know About (NS)

Ten thousand people have died. The world’s largest cholera epidemic is raging, with more than 530,000 suspected cases and 2,000 related deaths. Millions more people are starving. Yet the lack of press attention on Yemen’s conflict has led it to be described as the “forgotten war”. The scant media coverage is not without reason, or wholly because the general public is too cold-hearted to care. It is very hard to get into Yemen. The risks for the few foreign journalists who gain access are significant. And the Saudi-led coalition waging war in the country is doing its best to make it difficult, if not impossible, to report from the area. Working in Sana’a as a fixer for journalists since the start of the uprisings of the so-called Arab Spring in 2011 has sometimes felt like the most difficult job in the world.

When a Saudi-led coalition started bombing Yemen in support of its president, Abdrabbuh Mansour Hadi, in March 2015, it became even harder. With control of the airspace, last summer they closed Sana’a airport. The capital had been the main route into Yemen. Whether deliberately or coincidentally, in doing so, the coalition prevented press access. The media blackout came to the fore last month, when the Saudi-led coalition turned away an extraordinary, non-commercial UN flight with three BBC journalists on board. The team – including experienced correspondent Orla Guerin – had all the necessary paperwork. Aviation sources told Reuters that the journalists’ presence was the reason the flight was not allowed to land. The refusal to allow the press to enter Yemen by air forced them to find an alternative route into the country – a 13-hour sea crossing.

Sorry, Greece… (btw, it took a century to figure this out)

• 3,700-Year-Old Babylonian Clay Tablet Just Changed The History of Maths (SA)

A Babylonian clay tablet dating back 3,700 years has been identified as the world’s oldest and most accurate trigonometric table, suggesting the Babylonians beat the ancient Greeks to the invention of trigonometry by over 1,000 years. The tablet, known as Plimpton 322, was discovered in the early 1900s in what is now southern Iraq, but researchers have always been baffled about what its purpose was. Thanks to a team from the University of New South Wales (UNSW) in Australia, the mystery may have been solved. More than that, the Babylonian method of calculating trigonometric values could have something to teach mathematicians today. “Our research reveals that Plimpton 322 describes the shapes of right-angle triangles using a novel kind of trigonometry based on ratios, not angles and circles,” says one of the researchers, Daniel Mansfield.

“It is a fascinating mathematical work that demonstrates undoubted genius.” Experts established early on that Plimpton 322 showed a list of Pythagorean triples, sets of numbers that fit trigonometry models for calculating the sides of a right-angled triangle. The big debate has been about what those triples were actually for. Are they just a series of exercises for teaching, for example? Or are they something more profound? Babylonian mathematics used a base 60 or sexagesimal system (like the minute markers on a clock face), rather than the base 10 or decimal system we use today. By applying Babylonian mathematical models, the researchers were able to show that the tablet would originally have had 6 columns and 38 rows. They also show how the mathematicians of the time could’ve used the Babylonian system to come up with the numbers on the tablet.

The researchers suggest that the tablet may well have been used by ancient scribes to make calculations for building palaces, temples, and canals. But if the new study is right, then the Greek astronomer Hipparchus, who lived about 120 BC, is not the father of trigonometry that he’s long been regarded as. Scholars date the tablet to around 1822-1762 BC. What’s more, because of the way the Babylonians did their maths and geometry, it’s the most accurate trigonometric table as well as the oldest. The reason is that a sexagesimal system has more exact fractions than a decimal system, which means less rounding up. Whereas only two numbers can divide 10 with nothing left over – 2 and 5 – a base 60 system has far more. Cleaner fractions means fewer approximations and more accurate maths, and the researchers suggest we can learn from it today.

Don’t want to cry wolf, but.. Be safe!

• Hurricane Harvey Has All the Ingredients to Become a Monster (AP)

Hurricane Harvey is following the perfect recipe to be a monster storm, meteorologists say. Warm water. Check. Calm air at 40,000 feet high. Check. Slow speed to dump maximum rain. Check. University of Miami senior hurricane researcher Brian McNoldy said Harvey combines the worst attributes of nasty recent Texas storms: The devastating storm surge of Hurricane Ike in 2008; the winds of Category 4 Hurricane Brett in 1999 and days upon days of heavy rain of Tropical Storm Allison in 2001. Rainfall is forecast to be as high as 35 inches through next Wednesday in some areas. Deadly storm surge — the push inwards of abnormally high ocean water above regular tides — could reach 12 feet, the National Hurricane Center warned, calling Harvey life-threatening. Harvey’s forecast path is the type that keeps it stronger longer with devastating rain and storm-force wind lasting for several days, not hours.

“It’s a very dangerous storm,” National Weather Service Director Louis Uccellini told AP. “It does have all the ingredients it needs to intensify. And we’re seeing that intensification occur quite rapidly.” Warm water is the fuel for hurricanes. It’s where storms get their energy. Water needs to be about 79 degrees (26 Celsius) or higher to sustain a hurricane, McNoldy said. Harvey is over part of the Gulf of Mexico where the water is about 87 degrees or 2 degrees above normal for this time of year, said Jeff Masters, a former hurricane hunter meteorologist and meteorology director of Weather Underground. A crucial factor is something called ocean heat content. It’s not just how warm the surface water is but how deep it goes. And Harvey is over an area where warm enough water goes about 330 feet (100 meters) deep, which is a very large amount of heat content, McNoldy said.

“It can sit there and spin and have plenty of warm water to work with,” McNoldy said. If winds at 40,000 feet high are strong in the wrong direction it can decapitate a hurricane. Strong winds high up remove the heat and moisture that hurricanes need near their center and also distort the shape. But the wind up there is weak so Harvey “is free to go nuts basically,” McNoldy said.