Edouard Boubat Paris 1950

Disasters as opportunities.

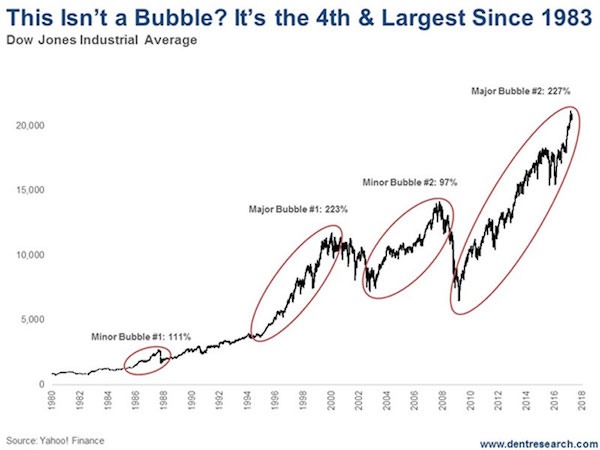

• Think Like a Surfer in the Largest Stock Market Bubble Since 1983 (Dent)

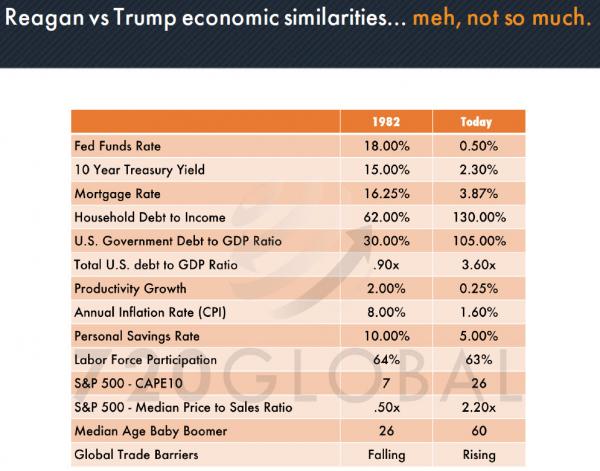

I took up surfing in my early 30s. It didn’t last long. But I learned a tremendous amount from the experience (least of which is that I suck at surfing). Well, it’s time to think like a surfer. Your sole focus is to catch the wave. The best surfers can see the waves building, just like we can in the markets, but they only care about where the biggest, best waves will crash. That’s where you get the ride. And if you catch the biggest wave in the right place, you get the ride of a lifetime. Look at this fourth and largest wave building in the stock market. It’s the wave of a lifetime for investors, and it’s rolling onto our shores right about now… Remember, all the action comes when the wave crashes, not as it’s building. As the swell grows around you, you can go with the flow and harness the energy of the wave with little effort.

That’s when you become one with the universe, sitting there on your board, surrounded by dark water, rolling up and down as the power builds beneath you. That’s why surfers get addicted. Then, at the perfect moment, all the wave’s pent up energy releases in a roaring spray of water and power. That’s where we want YOU to be when the greatest market wave of your lifetime comes crashing to shore! That’s when the greatest profits come. That’s when the greatest innovations spring up. The smartest people (I include surfers in this group) and the greatest innovators understand this. They don’t look at a good economy as the best opportunity for success. Seeds of radical innovation only grow in the most challenging conditions.

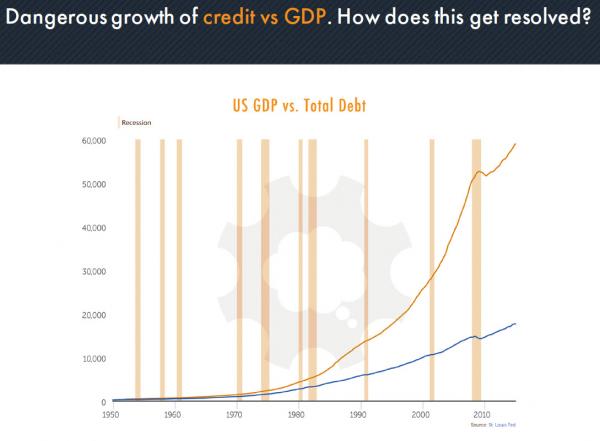

Private debt is far more dangerous than public debt.

• US Student, Auto Loans Hit New All Time High Of $2.6 Trillion (ZH)

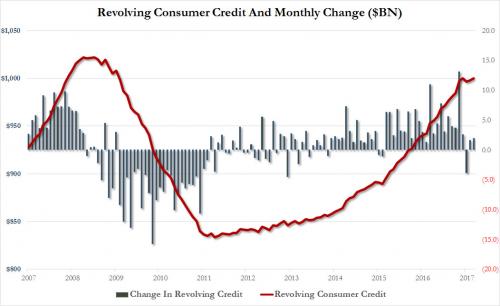

One month after we, and every other financial media, reported that US credit card debt had risen back over $1 trillion for the first time since January 2017, the Fed demonstrated just how meaningless such reports are when in its latest consumer credit report it revised the total stock of revolving debt back under $1 trillion for the month of March, while boosting December’s amount to $1,000.1 billion, meaning that all those “$1 trillion in credit card” debt headlines were about 4 months late. Fed screwing around with the financial reporters aside, the latest monthly report showed that total consumer credit rose by $16.4 billion, more than the $14 billion expected, an increase which was offset by a downward revision to the February consumer credit number from $15.2 billion to $13.8 billion. Revolving credit accounted for $2 billion of the increase with the rest, or $14.4 billion, in the form of auto and student loans.

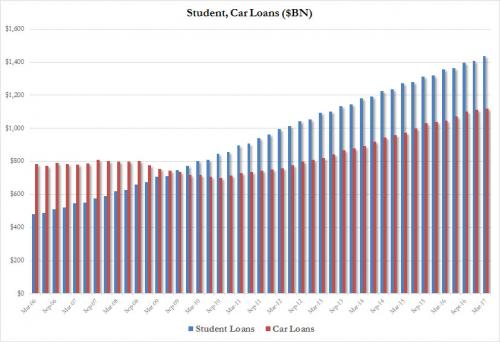

And speaking of student and auto loans, the Fed also released its latest quarterly estimate for the two series as of March 31, and as one would expect, the numbers rose to new all time highs, and as of the end of the first quarter, US consumers owed $1.44 trillion in student loans, an increase of $32 billion for the quarter and $80 billion for the year, as well as $1.12 trillion in auto loans, an increase of $8 billion Q/Q and $73 billion Q/Q. This means that as of March 31, Americans owed two and a half times as much on their auto and student loans, as on their credit cards, a new all time high.

“..since these products aren’t logged as loans or other assets on their balance sheets, banks have to set aside little or nothing for potential losses associated with them..”

• China’s War on Debt: Stocks Drop, Bond Yields Shoot Up and Defaults Rise (WSJ)

A wave of regulations aimed at cutting risk in China’s financial system is rippling through the country’s markets and sending banks and companies scrambling for funds. During the past month, Chinese shares have fallen nearly 5%, draining almost half a trillion dollars out of the country’s markets. Bond yields have shot up to their highest levels in two years, and bond defaults hover at record levels. The uncertainty has also weighed on metals and commodity prices, already hurt by doubts around China’s growth momentum. The price of iron ore plunged 8% on Thursday, the daily trading limit. Investors blame the volatility on a host of measures Chinese authorities have rolled out to curb runaway debt levels, from raising the cost of short-term funds to measures that are prompting banks to unwind hidden loans and securities.

A particular target is high-risk, high-yielding investment products that banks have used to boost returns, but that regulators say may conceal dangerous amounts of risky lending. Regulators are responding to prodding from Chinese President Xi Jinping, who issued a call for financial stability ahead of a major power reshuffle later this year, and just last week warned finance officials not to miss “a single risk” or “hidden danger.” The market turbulence will test Beijing’s resolve in tackling China’s snowballing debt, especially if it looks like regulators’ crackdown is jeopardizing short-term growth. If they can withstand the short-term squeeze and continue to push it through, the effort will help put China’s economy on a sounder footing longer-term. Banks—especially small and midsize lenders—sell the risky investment products to Chinese savers, then lend the funds to outside asset managers who invest them in bonds, stocks and loans.

The lenders make money from the difference between what they pay their investment clients and what they get from the outside managers. But since these products aren’t logged as loans or other assets on their balance sheets, banks have to set aside little or nothing for potential losses associated with them. That leaves banks more exposed to risk and shows their financial position as stronger than it really is. The maneuvering also encourages leveraged purchases of securities by asset managers and enables banks to continue funding troubled customers, such as property developers with excess inventory and bloated steelmakers. Such grey-area investments reached nearly 20 trillion yuan ($2.8 trillion) at the end of last year, says Fitch Ratings, or about 26% of China’s GDP in 2016, up from less than 10% three years earlier. They now represent an average of 19% of small and midsize banks’ total assets, compared with about 1% for big state banks, according to Fitch.

America’s unsolvable problem has been solved in dozens of countries.

• This Is Not a Bill (Jim Kunstler)

The way it works now, the so-called “providers” (doctors, hospitals) refuse to post the cost of any service, and then charge whatever they feel they can extract, subject to an abstruse and dishonest ceremonial “negotiation” with the insurance company. The result: hospital and insurance executives get paid multi-million dollar salaries, doctors get to drive fine German cars, and the patient gets financially ass-raped, kicked to the curb, and eventually stuffed into the bankruptcy courts. ObamaCare did nothing to fix this. It just added more victims to the rolls and upped the price of admission for a personal financial ass-raping, so that an insured individual could go to the hospital for an emergency appendectomy and end up getting dunned for thousands of dollars — or even more if one of the hosptial’s favorite cute scams is applied, such as calling in an out-of-network anesthesiologist to knock you unconscious (in which state you are unlikely to inquire whether he/she/zhe is in-network or out).

Under the current system, a hospital can bill you $5,999 to stitch up a cut finger, mitigate a bee-sting, or wind an Ace bandage around a sprained ankle, and you’re sure not to learn the cost-of-treatment until the postman drops off the incomprehensible “explanation of benefits” from the insurance company that states in bold print on top “This Is Not a Bill,” but actually is a report of your own incipient financial ass-raping. But judging from the news reports this day, none of these issues is actually on the table in the congressional debate. I don’t believe the editors of The New York Times are necessarily “in bed” with the overpaid hospital CEOs and the insurance company fraudsters. They are simply putting up a defense of their previous psychological investment in Democratic Party ideology — in the shibboleth that ObamaCare was unquestionably a great thing because it was created under the magically empowered 44th president.

I can believe that both Democratic and Republican law-makers are not only in bed with the medical fraudsters of all categories, but are performing a particularly odious form of sadomasochistic bondage-and-discipline sex in exchange for payoffs. Note, too, that none of the aforementioned major media have reported what the medical and insurance lobbyists have paid to their rent-boys and doxies in the US capitol. Wouldn’t you like to know?

“Money is seen as a “veil” placed over the activities of the real economy, a mere contrivance to get around the inconveniences of barter.”

• Review of Steve Keen’s Can We Avoid Another Financial Crisis? (R.)

The preference for high theory and abstruse mathematical modeling meant that mainstream economics had come to rest on a number of gloriously improbable assumptions. In their models, millions of households were reduced to a single “representative agent,” a God-like being, omniscient and immortal. This unreal creature inhabited a world where peace – or equilibrium – ruled. Crises were impossible in such an Eden, unless a mischievous serpent entered from abroad. But such an outcome was naturally impossible to predict. Both Romer and Keen agree that the most serious error of modern macroeconomics is that it ignores finance. Money is seen as a “veil” placed over the activities of the real economy, a mere contrivance to get around the inconveniences of barter.

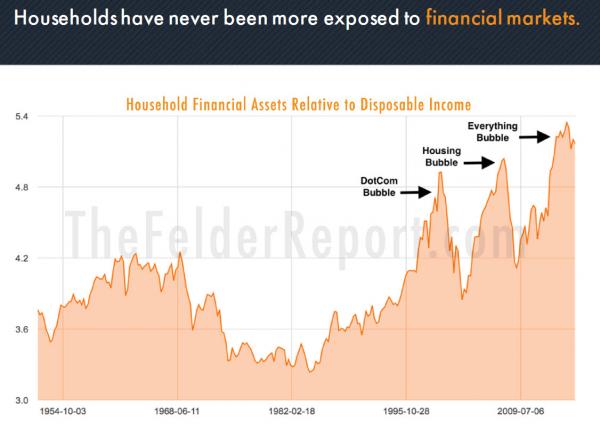

Minsky, by contrast, saw capitalism as a financial system in which millions of balance sheets and cash flows were intertwined in a highly complex fashion. Money and credit are the essence of capitalism: economic transactions can only take place after financing. The trouble is that credit is inherently unstable, prone to expand excessively and to inflate asset price bubbles, which in time collapse, causing a cascade of defaults throughout the economy. In Minsky’s world, the tail of finance wags the real economy dog. Anyone who paid serious attention to credit, as Keen did prior to 2008, could hardly have failed to notice that something was amiss. After all, credit was growing very rapidly in the United States, in Australia and across much of Europe. Keen’s own contribution at the time was to point out that it wouldn’t take a collapse of credit to cause a serious economic downturn – a mere slowdown in the rate of lending would do the job.

This prediction was vindicated in 2008, when credit growth slowed sharply but remained positive, sending the U.S. economy into a tailspin. Keen is now calling for the dominant macroeconomic models to be jettisoned and replaced by ones that take account of credit. In his book, he develops a simple credit-based macro model. The economists at the Bank for International Settlements have constructed a “financial cycle” model along similar lines. In the end, the money-free macro models appear doomed. Yet progress has been painfully slow to date. As Max Planck said, science advances one funeral at a time – failing death, retirement would do the trick.

So what of the next crisis? With his eye on credit growth, Keen sees China as a terminal case. The People’s Republic has expanded credit at an annualized rate of around 25 per cent for years on end. Private-sector debt exceeds 200 per cent of GDP, making China resemble the over-indebted economies of Ireland and Spain prior to 2008, but obviously far more significant to the global economy. “This bubble has to burst,” writes Keen unequivocally.

Untenable, but zero movement towards addressing the issue.

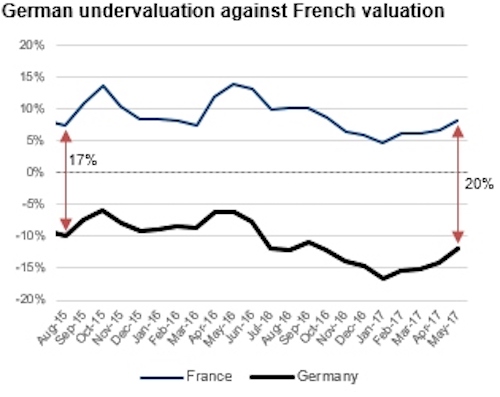

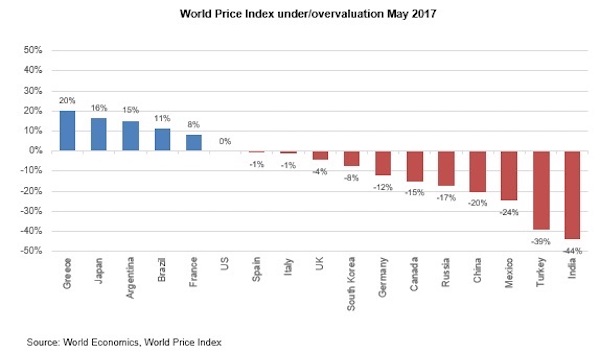

• France and Greece Heavily Disadvantaged by Euro as Germany Benefits (WE)

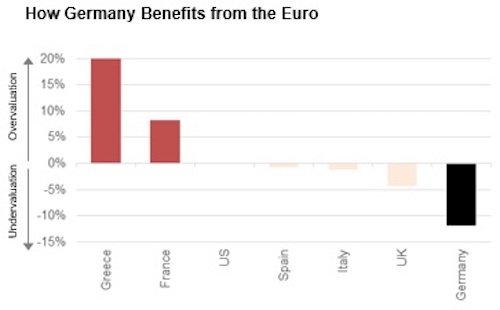

It is now incontestable that Germany benefits greatly from the Euro. The weaker members of the Euro drag down the external value of the Euro compared with the US Dollar making German exports far more competitive than they would otherwise be. Despite the relative value of the Euro being lower than would be the case if the Euro was the currency of Germany alone, the Euro’s value relative to the Dollar is still significantly higher than would be the case were the Euro the currency of an independent Greece or France.

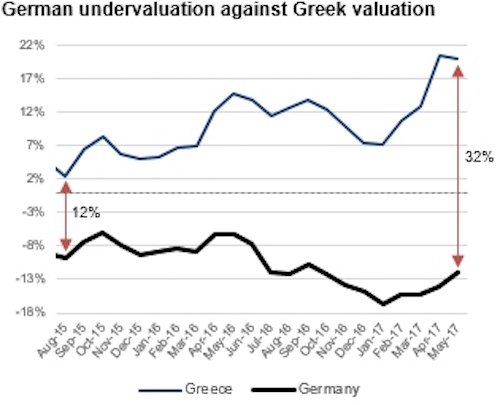

In Purchasing Power Parity (PPP) terms the Euro in Germany is some 32% undervalued compared with the Greek Euro, greatly benefiting German exporters, but imposing a burden on Greek exporters that they must find impossible to cope with. Conversely the overvaluation facing French companies is now a clear 20% compared with German companies.

Brazil and Argentina suffer from overvalued currencies against the US Dollar, suggesting one reason for the serious recession suffered by South America’s biggest economies over the past year. In contrast Canada, Russia, China, Mexico, Turkey and India all have currencies between 15% and 44% undervalued against the US Dollar, suggesting that at least some of Mr Trump’s rhetoric is justified. Over time these fundamental disparities have not shrunk, they have in fact widened. The charts to the upper right show the trend of German undervaluation against the French and Greek Euro’s in Purchasing power terms.

“Although the major Western media portrays the EU authorities’ policies as the only sensible course, in economic terms, it is anything but.”

• How the Eurozone Damaged French Politics – And The Election (Nation)

[..] there is a structural problem in the eurozone, and in the EU. The ECB, the European Commission, and the IMF (which is not an independent entity but generally answers to its European directors for decisions affecting Europe), are the European authorities that have increasingly constrained the economic decision-making of European governments. We can also include the eurogroup of finance ministers, which has tormented poor Greece and helped prolong that country’s interminable economic crisis. These people have shown that they are committed to creating a different kind of Europe. This can be seen in a paper trail of thousands of pages of documents, called Article IV consultations, where the IMF and EU government finance ministries hammer out their views on economic policies. These documents represent an elite consensus which can differ greatly from public opinion within the countries.

A review of 67 of these agreements for the four years 2008 through 2011, for 27 EU countries, showed a clear pattern of policy choices: cutting government spending, including on health care and pensions; increasing labor supply; reducing public sector employment; and changes in labor law that would reduce the scope of collective bargaining. This is the economic program that any politician or political party who does not want to be labeled as “anti-Europe” must adhere to, and it can be seen in the most recent (July 2016) IMF Article IV consultation for France, as well as the Stability Program that France has agreed to with the EU. These documents see France as freezing real spending, and committing to reducing its budget deficit to zero by 2021. These commitments imply that the French government can do nothing to reduce mass unemployment, which has averaged about 10% over the past year.

Although the major Western media portrays the EU authorities’ policies as the only sensible course, in economic terms, it is anything but. With France’s real borrowing costs near zero and inflation well below target, it makes sense for France to implement an economic stimulus, for example by increasing public investment. Fears of increasing the French public debt are unfounded; annual interest payments on that debt are currently at about 1.7% of GDP, a modest burden by any historical or international comparison.

[..] Since the 2008–09 world financial crisis and recession, the project of the eurozone, and to some extent of the EU, has created a destructive feedback loop that leads directly to the kind of dysfunctional politics now unfolding in France. It is one thing to give up some national sovereignty for a common project that can raise common living standards; it is quite another to surrender a country’s most important macroeconomic decision-making (monetary, exchange rate, and increasingly fiscal policy) to unaccountable authorities who have demonstrated their commitment to a regressive agenda. The Center Left’s collaboration with this program, e.g., President Hollande’s in France, has given the Far Right opportunities not seen since the 1930s.

Good thing everybody already knows it’s Putin again. No reasoning needed.

• Macron Team Blasts ‘Massive Hacking Attack’ (R.)

French presidential candidate Emmanuel Macron’s campaign team says it has been the victim of a massive and coordinated hacking operation. A large trove of emails from the campaign of French presidential candidate Emmanuel Macron was posted online late on Friday, 1-1/2 days before voters go to the polls to choose the country’s next president in a run-off against far-right rival Marine Le Pen. Some nine gigabytes of data were posted by a user called EMLEAKS to Pastebin, a document-sharing site that allows anonymous posting. It was not immediately clear who was responsible for posting the data or whether the emails were genuine. In a statement, Macron’s political movement En Marche! (Onwards!) confirmed that it had been hacked.

“The En Marche! Movement has been the victim of a massive and co-ordinated hack this evening which has given rise to the diffusion on social media of various internal information,” the statement said. An interior ministry official declined to comment, citing French rules which forbid any commentary liable to influence an election, and which took effect at midnight French time on Friday (2200 GMT). Comments about the email dump began to appear on Friday evening just hours before the official ban on campaigning began. The ban is due to stay in place until the last polling stations close on Sunday at 8 p.m. (1800 GMT).

Perhaps the failure of the EU is not clear enough yet everywhere.

• Macron Personifies The Very Europe Whose Failure Feeds Le Pen (Zizek)

The title of a comment piece which appeared in The Guardian, the UK voice of the anti-Assange-pro-Hillary liberal left, says it all: “Le Pen is a far-right Holocaust revisionist. Macron isn’t. Hard choice?” Predictably, the text proper begins with: “Is being an investment banker analogous with being a Holocaust revisionist? Is neoliberalism on a par with neofascism?” and mockingly dismisses even the conditional leftist support for the second-round Macron vote, the stance of: “I’d now vote Macron – VERY reluctantly.” This is liberal blackmail at its worst: one should support Macron unconditionally; it doesn’t matter that he is a neoliberal centrist, just that he is against Le Pen. It’s the old story of Hillary versus Trump: in the face of the fascist threat, we should all gather around her banner (and conveniently forget how her side brutally outmanoeuvred Sanders and thus contributed to losing the election).

Are we not allowed at least to raise the question: yes, Macron is pro-European – but what kind of Europe does he personify? The very Europe whose failure feeds Le Pen populism, the anonymous Europe in the service of neoliberalism. This is the crux of the affair: yes, Le Pen is a threat, but if we throw all our support behind Macron, do we not get caught into a kind of circle and fight the effect by way of supporting its cause? This brings to mind a chocolate laxative available in the US. It is publicised with the paradoxical injunction: “Do you have constipation? Eat more of this chocolate!” – in other words, eat the very thing that causes constipation in order to be cured of it. In this sense, Macron is the chocolate-laxative candidate, offering us as a cure for the very thing that caused the illness.

[..] In the hopeless situation we are in, facing a false choice, we should gather the courage and simply abstain from voting. Abstain, and begin to think. The commonplace “enough talking, let’s act” is deeply deceiving – now, we should say precisely the opposite: enough of the pressure to do something, let’s begin to talk seriously, ie, to think! And by this I mean we should also leave behind the radical leftist self-complacency of endlessly repeating how the choices we are offered in the political space are false, and how only a renewed radical left can save us – yes, in a way, but why, then, does this left not emerge? What vision has the left to offer that would be strong enough to mobilise people? We should never forget that the ultimate cause of the act that we are caught into – the vicious cycle of Le Pen and Macron – is the disappearance of the viable leftist alternative.

Sharp thinking. Make literally everyone incapable of understanding anything that’s said.

• The English Language Is Losing Importance In Europe – Juncker (G.)

The English language is losing importance in Europe, the president of the European commission has said amid simmering tensions over the Brexit negotiations. Speaking to an audience of European diplomats and experts in Florence, Jean-Claude Juncker also described the UK’s decision to leave the EU as a tragedy. “Slowly but surely English is losing importance in Europe,” Juncker said, to applause from his audience. “The French will have elections on Sunday and I would like them to understand what I am saying.” After these opening remarks in English, he switched to French for the rest of the speech. Making a stout defence of the EU, Juncker said the UK had voted to leave the project despite historic successes and a recent uptick in economic growth. “Our British friends decided to leave the EU, which is a tragedy,” he said.

[..] It is not the first time the English language has been caught in the crossfire of the Brexit negotiations. At a recent EU summit May slapped down reports that Brexit negotiations would be conducted in French, and after the June referendum EU officials made it known they planned to downgrade the use of English in the corridors of Brussels. In reality, the Brexit talks are most likely to be conducted in French and English with simultaneous interpretation. Barnier, a former French EU commissioner who clashed with the City of London, speaks English but wants the right to negotiate in his native tongue. English is also highly unlikely to disappear as a dominant language in the EU any time soon. Not only is it an official language for the Irish and Maltese governments, but many diplomats prefer to use English as a common second language rather than French.”

2018 at the earliest. Then again, debt relief would make Greece less of a slave, so maybe much longer or not at all.

• Germany Says No Debt Relief Being Prepared For Greece (R.)

No debt relief measures are being readied for Greece, Germany’s Finance Ministry said on Thursday after the Handelsblatt business daily reported measures were under consideration. The implementation of reforms that Greece agreed to in return for aid would help ensure the sustainability of the country’s debt, the ministry said in a statement e-mailed to Reuters. “No debt relief is being prepared,” it added. Regarding possible debt measures, a clear agreement was reached in a statement by the Eurogroup of eurozone finance ministers last May. “According to that, after the full implementation of the adjustment program, there will be an assessment of whether debt measures are necessary. That still applies,” it said. Earlier, Handelsblatt reported that Greece’s international lenders were preparing possible debt relief for Athens for discussion by the finance ministers.

The European Commission, the ESM eurozone rescue fund, the ECB and the IMF had prepared various debt measures in a document to be sent to the Eurogroup for further discussion, it said, citing people familiar with the document. One option was for the ESM to take over loans paid out by the IMF. The advantage would be lower interest rates charged by the ESM. Others included extending debt maturities and having the ECB and national central banks send profits made on Greek bonds to Athens through national governments, Handelsblatt reported. An EU source told Reuters the document was originally a paper by the ESM, not all four institutions, and had been modified on the way to the version Handelsblatt saw.

“It lays down several options for the restructuring of Greek debt and specifies possibilities which were given by the Eurogroup last May. One of the options still is that ESM would take debt from IMF,” the source said. “It is not clear yet if the IMF would agree on that.” Separately, German Finance Minister Wolfgang Schaeuble said in Durban, South Africa that the EU needed to “exert pressure on national governments to implement … much-needed reforms.” “Those countries which received help under European assistance programmes, and therefore had to actually implement unpleasant reforms, and those countries which have kept to the agreed rules are among the most successful countries in the EU today,” he said. “The problem is therefore not with the rules, but with the lack of implementation of them.

Warfare, financial or otherwise.

• The Forgotten History of Cinco de Mayo (IC)

Cinco de Mayo celebrates the victory of Mexican troops over the invading French army at the Battle of Puebla southeast of Mexico City on May 5, 1862. Because the Mexican soldiers were badly outnumbered and outgunned, the unexpected triumph was a watershed in forging the country’s national identity. (Militarily it wasn’t that significant — the next year France captured the Mexican capital and installed a member of the Austrian nobility as Maximillian I, “Emperor of Mexico.”) But here’s important part for everyone else to remember today: France was invading Mexico essentially because Mexico owed France money. Mexico had borrowed enormous amounts from Europe during the Mexican-American War from 1846-8 and in a civil war from 1858-61.

By 1862 it was impossible for the government to make timely payments on the loans without starving the country, and Mexican president Benito Juárez declared that all payments on foreign debt would be suspended for two years. Getting into unsustainable debt is not something unique to Mexico; countries have done so over and over throughout history, particularly during wars. The U.S. borrowed more than we could ever repay from France and the Netherlands during the Revolutionary War, and the U.K. borrowed far beyond its means from the U.S. during World War I. When this happens, it’s far better for both the debtors and creditors to organize some kind of default rather than forcing the debtors to pay all the money back on the original terms. The advantage for debtors is obvious.

More intelligent creditors understand it’s also good for them, because they generally don’t have a choice between getting all or just some of their money back. Instead, it’s a choice between getting some of it back or much less. To understand why, imagine loaning too much money to a software engineer. If you demand that the engineer sell all their computers to make interest payments, you’re unlikely to get much more money after that. And indeed both the U.S. and U.K. defaulted to varying degrees after their wars. Likewise, in 1862 the U.K. and Spain agreed to accept less than they were formally owed by Mexico. France, however, invaded Mexico in an attempt to get all its money back, which is why French troops were there for the Battle of Puebla on May 5.

In a sense, the invasion was admirably honest. International relations are often like organized crime on a gigantic scale, but people pretend otherwise. Here there was no pretense: The loanshark’s enforcers beat the crap out of an entire country. By contrast, creditors today have institutions like the IMF, which has often functioned as a creditors’ cartel — squeezing countries until they pay back their debts. This often involves lots of people dying … but in quiet ways, without armies involved.

The EU isn’t only giving us Le Pen, it’s presenting us with this too.

• Rescuers Pick Up 560 Migrants Off Libyan Coast On Thursday (R.)

Rescuers picked up 560 migrants from unsafe boats off the coast of Libya on Thursday, Italy’s Coast Guard said, including the body of a young man who the migrants said had been shot by smugglers on the beach for his baseball cap. Italian Navy and Coast Guard boats participated in the rescues together with two humanitarian vessels, a spokesman said. The migrants were traveling on board two large rubber boats and five small wooden ones, he added. The Phoenix, a rescue ship operated by the Migrant Offshore Aid Station (MOAS), took 422 on board, plus the body of the allegedly murdered young Gambian. “According to eyewitnesses, the deceased teenager was killed by human traffickers because they wanted his baseball hat. What cruelty,” MOAS co-founder Chris Catrambone said.

“The medical team onboard the Phoenix have confirmed that the deceased teenager died from gunshot wound,” he added. MOAS doctors are also caring for another teenage boy who has a gunshot wound to the stomach, but is stable. German NGO Jugend Rettet also helped with the rescues. Separately, Doctors Without Borders said its rescue ship Prudence would arrive in the Sicilian port of Catania early on Friday with the corpses of six migrants, including five women, who it had picked up in the Mediterranean in recent days. There had been a pause of boat departures from Libya, where smugglers operate with impunity, since Easter, because of bad weather and sea conditions. But boat migrant arrivals in Italy are still up 30 percent so far this year from 2016, when a record 181,000 arrived.

Humanitarian rescue ships have come in for criticism in Italy in recent months, with Catania chief prosecutor Carmelo Zuccaro opening a fact-finding investigation into possible ties between NGOs and people-smugglers. The NGOs have strongly denied the accusations, including representatives from MOAS who testified in Italy’s parliament earlier on Thursday. They say their only mission is to save lives. Zuccaro has yet to present any evidence of illicit activities and has not opened a criminal investigation.