Matisse Icarus 1944

Well, I was entertained..

• Trump Slams BuzzFeed As “Failing Pile Of Garbage”, CNN As “Fake News” (ZH)

In an epic (mutual) trolling between president-elect Trump on one hand and BuzzFeed and CNN, on the other, the two media organizations which issued yesterday’s unsubstantiated report about Russia having compromising information on the president-elect, Trump first addressed the question of why he referred to Nazi Germany, saying it is “disgraceful” that intelligence communities would allow the release of any information. “That’s something Nazi Germany would have done and did do,” he says. He then unleashed on Buzzfeed which alone published the 35-page memo behind the Russian allegations, saying “Buzzfeed which is a failing pile of garbage… will suffer the consequences” .

And then, in an even more stunning episode, Trump slammed CNN reporter Jim Acosta, who he also called out during the presser over their report on a two-page synopsis they claim was presented to Trump. With Trump looking to call on other reporters, Jim Acosta yelled out, “Since you are attacking us, can you give us a question?” “Not you,” Trump said. “Your organization is terrible!” Acosta pressed on, “You are attacking our news organization, can you give us a chance to ask a question, sir?” Trump countered by telling him “don’t be rude.” “I’m not going to give you a question,” Trump responded. “Don’t be rude. I’m not going to give you a question. You are fake news!” Trump responded, before calling on a reporter from Breitbart.

A snubbed Jim Acosta then tweeted the following: “Fortunately ABC’s Cecilia Vega asked my question about whether any Trump associates contacted Russians. Trump said no.”These exchanges followed an initial statement by Trump spokesman Sean Spicer who said that “for all the talk lately about ‘fake news,’ this political witch hunt by some in the media…is frankly shameful & disgraceful…. Highly irresponsible for a left-wing blog… to drop highly salacious and flat out false information on the Internet.” Following this, we expect the war between Trump and the media in general, or at least CNN in particular, to reach biblical proportions.

View from China offical media.

• Scorching Press Conference Shows Trump Won’t Have An Easy Presidency (GT)

US President-elect Donald Trump, who will officially take office on January 20, held his first press conference since winning the presidency on Wednesday local time. In about an hour, the most questions raised were regarding reports of Russia having compromising information on Trump. He also spent some time responding to how he will handle ties between his business and his presidency. Trump insisted on building a wall on US border with Mexico and the latter is going to pay for it. He also reiterated the future abolishment of Obamacare and will replace it with a new medical reform plan. Trump mentioned China six times on four issues, including describing Jack Ma of Alibaba as an incredible person and that they are going to do tremendous things together.

He said the US is losing hundreds of billions of dollars every year due to trade imbalance with China, Japan, Mexico and other countries. On the issue of Russia hacking the 2016 election, he noted his nation gets hacked by other countries as well, including China, which resulted in the loss of personal information of 22 million employees who work for the US government. He said that “Russia and other countries — and other countries, including China, which has taken total advantage of us economically, totally advantage of us in the South China Sea by building their massive fortress, total. Russia, China, Japan, Mexico, all countries will respect us far more, far more than they do under past administrations.” During the conference, which attracted widespread attention, Trump did not mention the Taiwan question, nor did he articulate how he will handle Sino-US ties. Relevant questions were not raised by reporters either.

It looks like that US mainstream public opinion still finds it hard to accept the fact that Trump has been elected as their new president. They are suspicious about and alert to Trump’s friendly attitude toward Russia, his family businesses and how he would transform Obama’s medical policy. US media outlets are particularly eager to hype Trump’s relations with Russia and the Kremlin’s alleged influence on the election. It seems they are, intentionally or unintentionally, restricting Washington’s ability to improve ties with Moscow under Trump.

Tillerson said many things, but I can’t find a good report on it. Watched the first bit, before the Trump show, wrote some stuff to a friend:

Watching the conformation thing, Unreal. All these senators saying stuff about Russia, and he can’t really tell them they’re wrong, or they won’t confirm him. But he himself knows much more about Russia than they do, yet that’s not what they’re looking for. They just want him to say bad things about Putin.

Marco Rubio asks: Do you think Putin is a war criminal. (Tillerson: I would not use that word.) And now goes off listing all the atrocities Russia is supposed to have committed in Aleppo. As reported by US fake media. Without sources on the ground… Next list of “countless” people supposedly killed by Putin in Russia. All Tillerson can say on all these things is “i don’t have sufficient information”. Next: Sen. Menendez. Topic? Russia!

Tillerson had interesting views on climate change too. Yeah, he has a mind of his own, not a blind Trump follower. Does that surprise anyone? Certainly not Trump.

• Tillerson Says China Can’t Have Access to South China Sea Isles (BBG)

President-elect Donald Trump’s nominee for secretary of state said China must be denied access to artificial islands built in the South China Sea, a move that would raise the risk of conflict between the world’s biggest economies. Hours into a confirmation hearing with the Senate Foreign Relations Committee, where he was grilled extensively about his views on Russia, former Exxon Mobil Corp. chief Rex Tillerson said that a failure to respond to China’s actions had allowed it to “keep pushing the envelope” in the South China Sea. “We’re going to have to send China a clear signal that first the island-building stops and second your access to those islands is also not going to be allowed,” he said when asked whether he would support a more aggressive posture in the South China Sea. He compared China’s actions to those of Russia in the Crimea.

The remark is the latest from Trump’s administration to signal a more aggressive defense posture against China in addition to calls for a tougher line on trade. Trump earlier questioned the U.S.’s policy of recognizing Beijing over the government in Taiwan, and criticized China’s ties with North Korea. China pushed back against Tillerson’s comments on Thursday even while saying it agreed with him on areas of cooperation between the two countries. On Monday, Alibaba Group Holding Ltd. Chairman Jack Ma met with Trump and discussed plans to create 1 million new jobs in the U.S. by helping small businesses sell goods to China. “Like the U.S., China has the right within its own territory to carry out normal activities,” Chinese Foreign Ministry spokesman Lu Kang said at a regular briefing in Beijing in response to a question on Tillerson’s remarks. “That is within the limits of its sovereignty.”

Tillerson offered no detail about how the U.S. could stop China from building islands, or prevent access, but in recent years the U.S. has consistently conducted freedom of navigation operations throughout the area. “This is the sort of off-the-cuff remark akin to a tweet that pours fuel on the fire and maybe makes things worse,” said Malcolm Davis, a senior analyst at the Australian Strategic Policy Institute in Canberra. “Short of going to war with China, there is nothing the Americans can do.”

“.. there is no bigger favor that Trump opponents can do for him than attacking him with such lowly, shabby, obvious shams, recruiting large media outlets to lead the way. When it comes time to expose actual Trump corruption and criminality, who is going to believe the people and institutions who have demonstrated they are willing to endorse any assertions no matter how factually baseless..”

• The Deep State Goes to War with President-Elect (Greenwald)

In January, 1961, Dwight Eisenhower delivered his farewell address after serving two terms as U.S. president; the five-star general chose to warn Americans of this specific threat to democracy: “In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.” That warning was issued prior to the decadelong escalation of the Vietnam War, three more decades of Cold War mania, and the post-9/11 era, all of which radically expanded that unelected faction’s power even further.

This is the faction that is now engaged in open warfare against the duly elected and already widely disliked president-elect, Donald Trump. They are using classic Cold War dirty tactics and the defining ingredients of what has until recently been denounced as “Fake News.” Their most valuable instrument is the U.S. media, much of which reflexively reveres, serves, believes, and sides with hidden intelligence officials. And Democrats, still reeling from their unexpected and traumatic election loss as well as a systemic collapse of their party, seemingly divorced further and further from reason with each passing day, are willing — eager — to embrace any claim, cheer any tactic, align with any villain, regardless of how unsupported, tawdry and damaging those behaviors might be.

The serious dangers posed by a Trump presidency are numerous and manifest. There are a wide array of legitimate and effective tactics for combatting those threats: from bipartisan congressional coalitions and constitutional legal challenges to citizen uprisings and sustained and aggressive civil disobedience. All of those strategies have periodically proven themselves effective in times of political crisis or authoritarian overreach. But cheering for the CIA and its shadowy allies to unilaterally subvert the U.S. election and impose its own policy dictates on the elected president is both warped and self-destructive. Empowering the very entities that have produced the most shameful atrocities and systemic deceit over the last six decades is desperation of the worst kind.

I like Jim’s thinking that since WalMart parking lots are the new town square, and WalMart sells pitchforks and patio torches…..

• America Versus the Deep State (Jim Kunstler)

The bamboozlement of the public is nearly complete. The Deep State has persuaded 80% of Americans that all news is propaganda, especially the news emanating from the Deep State’s own intel department. They’re still shooting for 100%. The fakest of all “fake news” stories turns out to be… “Russia Hacks Election.” It was reported conclusively Saturday on the front page of The New York Times, a wholly-owned subsidiary of the Deep State: “Putin Led a Complex Cyberattack Scheme to Aid Trump, Report Finds: WASHINGTON — President Vladimir V. Putin of Russia directed a vast cyberattack aimed at denying Hillary Clinton the presidency and installing Donald J. Trump in the Oval Office, the nation’s top intelligence agencies said in an extraordinary report they delivered on Friday to Mr. Trump.”

You can be sure that this is now the “official” narrative aimed at the history books, sealing the illegitimacy of Trump’s election. It was served up with no direct proof, only the repeated “assertions” that it was so. In fact, it’s just this repetition of assertions-without-proof that defines propaganda. It can also be interpreted as a declaration of war against an incoming president. The second civil war now takes shape: It begins inside the groaning overgrown apparatus of the government itself. Perhaps after that it spreads to the WalMart parking lots that have become America’s new town square. (WalMart sells pitchforks and patio torches.) Did the Russians make Hillary Clinton look bad? Or did Hillary Clinton manage to do that herself? The NSA propaganda was designed as a smokescreen to conceal the veracity of the Wikileaks releases.

Whoever actually rooted out the DNC and Podesta emails for Wikileaks ought to get the Pulitizer Prize for the outstanding public service of disclosing exactly how dishonest the Hillary operation was. The story may have climaxed with Trump’s Friday NSA briefing, the heads of the various top intel agencies all assembled in one room to emphasize the solemn authority of the Deep State’s power. Trump worked a nice piece of ju-jitsu afterward, pretending to accept the finding as briefly and hollowly as possible and promising to “look into the matter” after January 20th — when he can tear a new asshole in the NSA. I hope he does. This hulking security apparatus has become a menace to the Republic.

This is the America that Obama leaves for Trump.

• 160 Million Americans Can’t Afford To Treat A Broken Arm (BI)

A lot of Americans are really struggling. The precarious personal finance situation of Americans has made news for years. It is something we’ve written about a lot at Business Insider. Elevate’s Center for the New Middle Class wanted to look into the issue to find when an unexpected expense becomes a crisis for ordinary Americans. And the results were pretty depressing. Elevate carried out a study based on a 10-minute online questionnaire surveying 502 nonprime (credit score below 700) and 525 prime Americans (credit score of 700 or above). It turns out that nonprime Americans with credit scores below 700 are likely to be hit harder, and more often, by unexpected expenses than prime Americans. 160 million Americans come under the nonprime category, according to the study.

“A bill becomes a crisis for nonprime Americans at $1,400. For Prime, it’s $2,900,” the study said. “An unexpected expense becomes a significant disruption to prime Americans when it is 53% of their monthly income. Nonprime Americans can only swallow a 31% impact to their income.” The study noted that many common expenses, such as covering the out-of-pocket on a broken arm, an apartment security deposit, or replacing a vehicle transmission, cost more than $1,400. “It’s hard for many to believe that unexpected car repairs can cause a major upset in a household’s finances,” Jonathan Walker, executive director of Elevate’s Center for the New Middle Class, said. “Unfortunately, it happens all too often, simply because nonprime Americans don’t have the available resources to help absorb some of these financial shocks. This can cause a downward spiral on their daily finances as well as their credit history.”

If it quacks like a bubble…

• Suddenly, Home Sale Agreements Are Falling Apart Across the US (BBG)

Spending months to find the perfect home in your price range, only to have your mortgage application rejected, or a home inspection turn up expensive repairs, is a nightmare—one that is coming true with increasing frequency, according to a new report from real estate listings website Trulia. A Trulia analysis of U.S. listings shows that 3.9% of homes that moved from for-sale to pending moved back to for-sale again, nearly double the rate in 2015. Such “failed sales” increased in 96 of the 100 biggest U.S. metros, with big swings in areas large and small, rich and poor. That includes Los Angeles and Charleston, S.C., as well as San Jose and Akron, Ohio.

In Ventura County, Calif., where the median home value is $548,000, 11.6% of prospective sales failed to close in 2016. That’s the highest in the U.S., up from 3.1% in 2015. Tucson, where the median home price is $176,000, had the second-highest rate of failed sales, at 10.8%, up from 3.5% the year before. The problem of failed sales has been most acute for cheaper homes and older ones: Some 6.3% of sales of starter homes fell through last year, according to Trulia’s analysis, compared with 3.6% of so-called premium home sales. Homes built in the 1960s had the highest fail rates, while sales of newer and older houses were more likely to go through.

“There will certainly be tax cuts but circumstances are nothing like the Reagan stimulus of the early 1980s when the US was coming out of recession.”

• Perils Of The Icarus Trade As The World Runs Short Of Dollars (AEP)

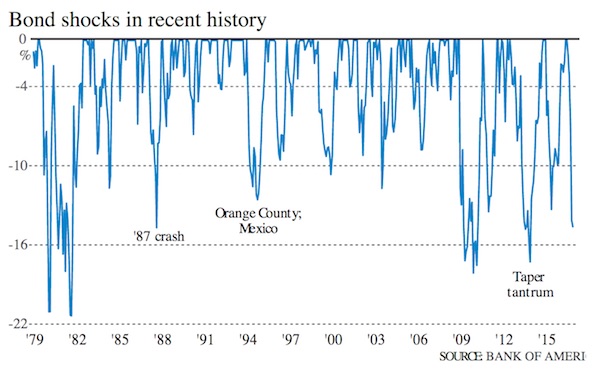

The great unknown is where the pain threshold lies in a global system with debt ratios that are now roughly 40pc of GDP higher than just before the Lehman crisis. Bank of America fears a further rise in yields of 50 to 75 basis points may be enough to trigger a “financial event”. HSBC’s latest global outlook is even darker. Indeed, it is astonishing. The bank expects yields on 10-year US Treasuries to push a little higher to 2.5pc before crashing back to historic lows of 1.35pc by the end of the year, taking global yields with them. Markets will conclude by the summer that Trumpian stimulus does not add up to much, and that the reflation narrative is a hoax. “We believe that equities are walking a tightrope, and there is a fairly long way to fall,” said the bank.

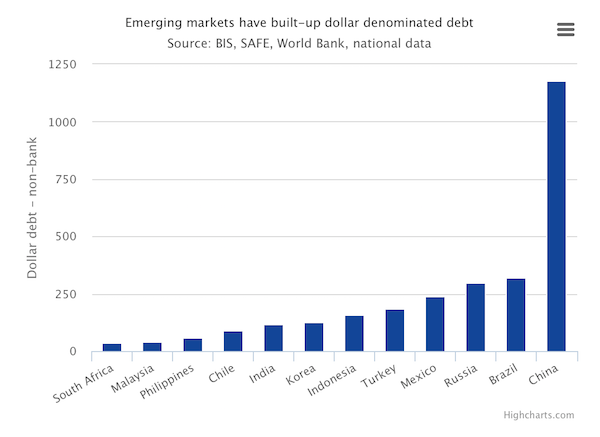

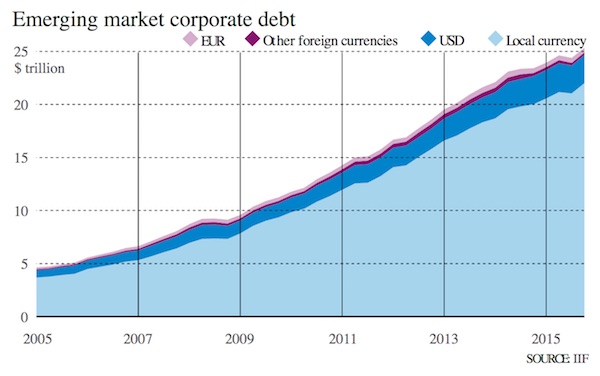

While I do not take a view on stock prices, HSBC’s outlook is broadly in line with my own. The world cannot easily withstand the sort of Fed tightening now being etched into forecasts by the macro-economic fraternity. The Institute of International Finance says debt has reached $217 trillion, a record ratio of 325pc of GDP. What is remarkable is that even in mature economies – trying to ‘deleverage’ – the ratio jumped by 6pc of GDP to 390pc over the first nine months of last year. There is almost nowhere left to hide. Corporate debt in emerging markets has risen from $6.5 trillion to $25.5 trillion since Lehman, with the ‘credit gap’ signalling danger in China, Hong Kong, Singapore, Thailand, Saudi Arabia, Chile, Turkey, and Indonesia. Total off-shore dollar debt has risen fivefold to $10 trillion since 2000.

The financial system is clearly out of kilter. The pattern of the last 35 years is a steadily falling “natural” rate of interest, requiring ever more radical action by central banks at the trough of each cycle. The policy elites badly misjudged the force of this ‘Wicksellian’ slide in the build-up to the global crisis in 2008. While the subprime saga makes for electrifying Holywood films, it was not the reason why the Western banking system collapsed. The trigger of the crash was overly tight money. The ECB raised rates into the teeth of the storm. Hawkish Fed rhetoric from March to August 2008 pushed up US borrowing costs sharply, ignoring warnings from some of their own staff that the money supply was by then imploding. Both banks under-estimated the fragility of the system.

Central bankers are more alert this time but they have not scrapped their infamous ‘DSGE’ models, and I suspect that political pressure – from Congress, or regional Fed banks, or from Germany – will cause them to over-tighten again. We may find that three US rate rises and even a smidgeon of ECB tapering are all it takes to detonate the next crisis. Markets seem to be betting that Donald Trump’s fiscal largesse will be large enough to break the deflationary grip. HSBC says they are “cherry-picking the good bits” from his campaign. We do not yet know whether his infrastructure plan really exists. There will certainly be tax cuts but circumstances are nothing like the Reagan stimulus of the early 1980s when the US was coming out of recession.

Excellent by Bass. Recommended. h/t Valuewalk

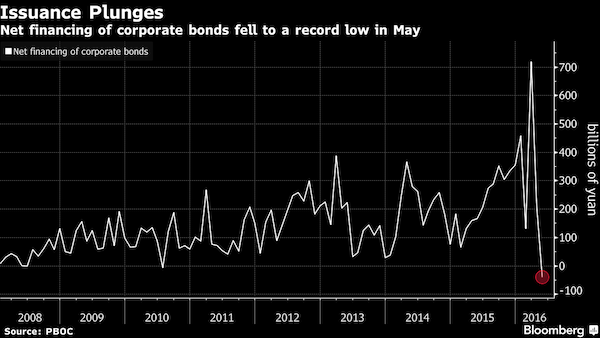

• China’s $34 Trillion Experiment Is Exploding (Kyle Bass)

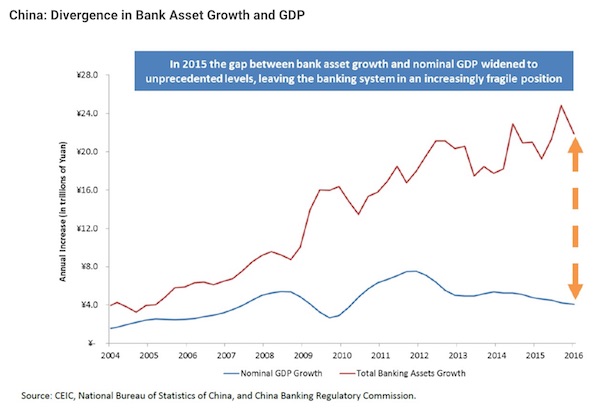

Over the past decade, we have worked diligently to identify anomalies in financial systems, governments, and companies around the world. We have been vigorously studying China over the last year, with the view that the rapid credit expansion in the Chinese banking system will result in significant credit losses that will require the recapitalization of Chinese banks and materially pressure the Chinese currency. This outcome will have many near-term and long-term effects on countries and markets around the world. In other words, what happens in China will not stay in China. The unwavering faith that the Chinese will somehow be able to successfully avoid anything more severe than a moderate economic slowdown by continuing to rely on the perpetual expansion of credit reminds us of the belief in 2006 that US home prices would never decline.

[..] China has allowed (and encouraged) its banking system to grow into a gargantuan $34 trillion behemoth (a whopping 340% of Chinese GDP). For context, consider what the United States banking system looked like going into the GFC of 2007-2009. On-balance sheet, the US banking system had about $1 trillion of equity and $16.5 trillion of banking system assets (100% of US GDP). If non-banks and off-balance sheet assets are included, it would add another $12.5 trillion to get to about 175% of GDP. US banks lost approximately $650 billion of their equity throughout the GFC. We believe that Chinese banks will lose approximately $3.5 trillion of equity if China’s banking system loses 10% of assets.

Historically, China has lost far in excess of 10% of assets during a non-performing loan cycle (The Bank for International Settlements estimated that Chinese banking system losses throughout the 1998-2001 cycle exceeded 30% of GDP). We expect losses in this cycle to exceed prior cycles. Remember, 30% of Chinese GDP approaches $3.6 trillion today. Think about how much quantitative easing (QE) the US Fed had to create in order to entice $650 billion of common and preferred equity into the US banks and prevent a Japanese-style deflationary bust. The Fed had to expand its balance sheet by roughly $4.5 trillion.

How significantly will the Chinese central bank have to expand its balance sheet in order to compensate for $3.5 trillion of lost bank capital? What will that do to the renminbi? What will happen to Chinese credit growth and broader Asian credit growth while this happens? If the US Fed’s experience serves as a proxy for what could happen in China, we believe that China will likely have to print in excess of 10 trillion US dollars’ worth of yuan to recapitalize its banking system. The weakening renminbi is the product of larger banking system problems. By the time the loss cycle has peaked, we believe the renminbi will have depreciated in excess of 30% versus the US dollar.

What country does this remind me of?

• China To Merge State Media For Stronger Voice In Financial News (R.)

China is set to consolidate five state media companies to create a “modern financial media group” to increase the state’s voice in economic and financial news coverage, the state-run Xinhua news agency said on Wednesday. Since taking power in 2012, President Xi Jinping, who has called for Beijing to take a bigger role in a global governance system, has stepped up media control and scrutiny to project China’s “soft power” and better communicate its message. The State Council, China’s cabinet, has given Xinhua permission to acquire and consolidate China Securities Journal, Shanghai Securities News, Economic Information Daily and Xinhua Publishing House and launch a new company under the banner China Fortune Media Corporation Group.

The move aims at “deepening the central authority’s reforms of the cultural system” and “increasing mainstream media’s influence in the area of financial information,” Xinhua said in a notice. The new financial news-focused company will be launched in Beijing on Thursday next week, it said. While visiting three major state news agencies in February last year, Xi ordered the organizations to strictly follow the Communist Party’s leadership and focus on “positive reporting”, Xinhua reported at the time. “All news media run by the Party must work to speak for the Party’s will and its propositions and protect the Party’s authority and unity,” Xi was quoted as saying. The three media Xi visited – Xinhua, People’s Daily and state-owned broadcaster CCTV – are considered by the central leadership as the “throat and tongue” of the party.

“No one is going to bail out these folks that got in late and are losing a ton of money on their bitcoin bets, or those that tried to catch that knife and got their fingers sliced off. On the contrary. Learn your lesson – that’s what Chinese authorities seem to say..”

• Bitcoin Collapses, Chinese Latecomers Get Fleeced (WS)

The People’s Bank of China announced on Wednesday that it is probing the major bitcoin exchanges in Beijing and Shanghai – BTCC, Huobi, and OKCoin – for a list of violations, including market manipulation, money laundering, and unauthorized financing. This is part of the PBOC’s efforts to crack down on capital flight, a major escalation from last week, when Chinese officials warned investors – if you can call them “investors” – to be careful with bitcoin. That warning came at the peak of the spike and tipped the whole thing over. Ironically, China’s many other crackdowns on capital flight have pushed the hapless Chinese, who want their capital to flee, into bitcoin. It was seen as a way of converting their yuan into something other than yuan, which they fear will depreciate relentlessly.

The yuan lost 6.5% against the dollar last year, its worst year since 1994, which is nothing compared to some other major currencies, such as the British pound which lost 16.3% against the dollar, and the Mexican peso which lost 17%. But the Chinese are not used to getting whacked by a depreciating currency. It spooks them. So the promise of convenient capital flight along with the lure of bitcoin’s semi-anonymity and the hope of quickly doubling their money have just been too much to resist. The rest of the world lost interest in bitcoin after it transferred a lot of money to those that got in early and got out in time from the latecomers that ended up holding the bag when it began to crash in late 2013. It went from over $1,100 to a range of around $250 in 2015. But recently, the Chinese have picked up the baton and in an insane frenzy drove it to $1,140 all over again.

And just in time, bitcoin crashed again. As of Wednesday evening, as I’m writing this, it plunged 14.5% to $772, just in one day. In the five days since its peak of $1,140 on January 6, it has crashed 32% against the dollar. What a crazy spike! In terms of yuan, it’s even worse: It plummeted 19% against the yuan on Wednesday and 41% over those five misbegotten days! No one is going to bail out these folks that got in late and are losing a ton of money on their bitcoin bets, or those that tried to catch that knife and got their fingers sliced off. On the contrary. Learn your lesson – that’s what Chinese authorities seem to say..

6 arrests now?!

• VW Officials Destroyed Files, E-Mails as Diesel Scheme Unraveled (BBG)

Volkswagen’s nearly decade-old plot to cheat U.S. emissions tests – all while marketing its diesel cars as environmentally friendly – was quickly unraveling by 2015. A campaign to mislead regulators was failing so badly that top executives signed off on a script for employees to use when questioned. It didn’t work. The next day, Aug. 19, 2015, an employee went off script and told regulators for the first time that its diesel cars were designed to behave differently during emissions tests, according to court documents. In the home office in Germany, some executives and engineers began deleting documents related to U.S. emissions and the company’s head of engine development told an assistant to dispose of a hard drive containing e-mails from him and other supervisors.

All this was laid out by U.S. prosecutors on Wednesday as they announced charges against five officials they said had been key to developing and carrying out the scheme. As part of the carmaker’s settlement concluding criminal and civil probes in the U.S., VW agreed to plead guilty to conspiracy to defraud the government and consumers and obstruction of justice, and to pay $4.3 billion in penalties. Prosecutors continue to look into the roles individuals played and the investigation is still open, U.S. Attorney General Loretta Lynch said at a press conference Wednesday.

“..citing danger to life and national security..” Does this imply it wasn’t Modi who took the decision? Whose life is at risk?

• India Central Bank Won’t Share Details Of Modi Cash Ban, Mystery Deepens (BBG)

India’s central bank refused to share specific details of Prime Minister Narendra Modi’s ban on high-value banknotes citing danger to life and national security, as the mystery deepens over who took the unprecedented decision. The Reserve Bank of India recommended the move, which was accepted by the cabinet and announced by Modi on Nov. 8, Power Minister Piyush Goyal told parliament in November. The RBI board approved the ban three hours before Modi’s speech and hadn’t discussed the matter before, a slew of responses to Bloomberg News’s Right to Information requests show. However, the RBI told a lawmakers’ panel this week that the government had “advised” the monetary authority to “consider” the ban a day before the RBI board made its recommendation. The government then “considered the recommendations” and decided to withdraw the notes, culminating in Modi’s address that blindsided the nation.

The cloak of secrecy that has shrouded the currency ban decision is likely to bolster the view that authorities, both on Mint Street and in New Delhi, were not prepared for such a decision and the way it was announced. It risks undermining perceptions of the central bank’s independence and raises questions about Modi’s decision-making style and his communication with the RBI. More clarity may emerge when RBI Governor Urjit Patel deposes before a parliamentary committee on Jan. 20. Details are essential to help assess the success of the shock move as well as gauge the impact of the decision “It is very perplexing that the RBI doesn’t answer questions about how the decision was arrived at,” said Shilan Shah, Singapore-based India Economist at Capital Economics. “There are concerns that in the whole process the RBI has been sidelined by the government and that raises questions about its independence,” he said, adding that authorities have not been transparent.

They have horses and barns in Greece too. Now the worst cold seems to pass, here’s the cavalry.

• Greece Sends Navy Ship To Lesbos To House Freezing Refugees (AP)

Greece’s navy has sent a tank landing ship to the island of Lesvos to house refugees and migrants during a cold snap that has triggered public health warnings. The vessel has docked and is due to provide accommodation for about 500 migrants. A medical association on Lesvos said Tuesday that conditions at the main camp there were “inhuman” with migrants in tents exposed to freezing temperatures. Schools have been closed on Lesvos because of the bad weather, as a state of emergency was expanded to other areas in northern Greece, where snow has blocked roads and caused power and water outages.

This country is not prepared for any kind of snow. Saw footage of Evia island, which had 10 feet. Luckily, no refugees there.

• Weather Wreaks Havoc In Northern Greece (Kath.)

Transport Minister Christos Spirtzis has ordered an administrative investigation into why hundreds of passengers remained trapped in trains in northern Greece on Wednesday in the freezing weather. Two trains carrying around 600 passengers came to a halt at Thermes and Larissa in central Greece while traveling from Thessaloniki to Athens because of icy conditions, while another Intercity train stopped in Tithorea and Larissa’s suburban railway ran into mechanical problems in Platy Imathias. Rail management company Trainose said on Wednesday that the problems were due to heavy snowfall in northern and central Greece and announced that it will be cancelling several services between Athens and Thessaloniki, as well as local services in the area, on Thursday.

Heavy snowfall has also caused problems with public transport in the northern port city of Thessaloniki, where bus company OASTH said that 11 neighborhoods are too snowed in to allow service. It also said that around 50 buses have been fitted with snow chains so they can navigate icy streets along their routes. Meanwhile on Thursday morning, fog and low-lying clouds led to flight cancellations and delays at Thessaloniki’s Makedonia airport, while freezing temperatures caused problems in the city’s natural gas and electricity network, leaving thousands of residents without heat or power as temperatures dropped to as low as -14 Celsius.

Look, if nobody else helps out, people find ways. But it’s still wholly unnecessary suffering. Konstantinos and his crew have scoured the streets of Athens with tea and bread and blankets.

• Refugees In Greece Defy Extreme Cold To Help The Homeless (AJ)

Temperatures in northern Greece have fallen to -10. Refugees living in camps have been collecting spare food and donating it to those sleeping on the streets – including homeless Greek families.