Salvador Dali Sick Boy (Self-portrait in Cadaqués) 1923

Tucker

https://twitter.com/i/status/1592040557936795648

Faith is an oasis in the heart which will never be reached by the caravan of thinking.”

~ Khalil Gibran

“The four-star general said during an appearance at the Economic Club of New York that a victory by Ukraine may not be achieved militarily..”

• US Scrambles To Reassure Ukraine After Milley Comments On Negotiations (Pol.)

The Biden administration is in damage control mode after a top U.S. general said a window for peace talks between Kyiv and Moscow could open this winter, with senior officials scrambling to assure Ukraine it wasn’t undercutting its goal of expelling the Russians. Specifically, senior U.S. officials are telling their counterparts in Ukraine that the expected winter fighting pause doesn’t mean talks should happen imminently. Instead, they’re relaying that Washington will continue to support Kyiv’s militarily as it launches the next phase of advances on the battlefield, according to Ukrainian and U.S. officials familiar with the outreach.

The scramble follows comments last week by Gen. Mark Milley, the Joint Chiefs chair. The four-star general said during an appearance at the Economic Club of New York that a victory by Ukraine may not be achieved militarily, and that winter may provide an opportunity to begin negotiations with Russia. The general has spoken regularly with his Ukrainian counterpart, Gen. Valeriy Zaluzhnyy, including on Monday, according to a U.S. official. During the discussion, Zaluzhnyy did not express any concern or mention Milley’s comments even once, the person said. The person, along with others interviewed for this story, spoke on condition of anonymity in order to discuss internal deliberations.

Still, the flurry of calls and meetings with Ukrainians underscores the degree to which the administration is concerned about presenting a unified front on Ukraine and potential peace talks. Any prolonged public split among top U.S. officials could threaten the already delicate relationship between Washington and Kyiv at a key moment in the war. The Biden administration needs to ease those tensions as it balances its support for Ukraine with concerns that Western stockpiles of military equipment are running low, and the possibility of a Republican-controlled House next year that will slash aid for Kyiv. European leaders are growing anxious about the region’s energy crisis, with some raising questions with American counterparts in recent days about the extent to which talks could ease fears about rising costs.

Google translation.

Using the optics of Kherson for a narrative that is utterly unrealistic. That’s how you prolong a war, not end it.

• Zelenksy At G20 Summit: This is The Moment To End The War (Tel.)

Now is the time to end Russia’s “devastating” war and “save thousands of lives,” Ukrainian President Volodimir Zelensky said in a video address on Tuesday at the G20 summit on the Indonesian island of Bali. He presented a plan based on the withdrawal of Russian troops and the restoration of Ukraine’s territorial integrity. “I am convinced that now is the time when the devastating Russian war must and can be stopped,” Zelensky said, addressing the leaders present, including Chinese President Xi Jinping and his US counterpart Joe Biden. “It will save thousands of lives.” Russian leader Vladimir Putin is not present, he is replaced by Foreign Minister Sergey Lavrov.

The Ukrainian head of state stressed that the war must be ended “justly and on the basis of the UN Charter and international law” and called for the release of all Ukrainian prisoners. “Please choose your path to leadership and together we will surely implement the peace formula.” Zelensky wants “effective security guarantees” and insists on an international meeting where the agreements are laid down in a peace treaty. “There are and cannot be any excuses for nuclear blackmail,” he added, emphatically thanking the “G19” – excluding Russia – for “making this clear.” He also called for expansion and extension of the grain deal that expires on November 19. According to the UN, 10 million tons of Ukrainian grain and other foodstuffs have been exported through the Black Sea since the deal was struck in July. That helped prevent a global food crisis.

The UN should never choose sides in a conflict. That makes it obsolete.

• UN Calls On Russia To Pay Ukraine Reparations (RT)

By a majority of votes, the UN General Assembly has adopted a resolution that would oblige Russia to compensate losses inflicted on Ukraine during the conflict and has recognized the need to create a special “international mechanism” that would allow it to do so. The resolution was supported by 94 countries in the 193-member world body vote on Monday. Some 73 more states abstained, while 14 countries voted against. Among others, those voting against the resolution included Russia itself, as well as China, Iran, and Syria. “An international mechanism for reparation for damage, loss, or injury”arising from Russia’s “wrongful acts” in Ukraine needs to be established, the resolution says.

The assembly’s members should create “an international register” that would include claims or data regarding damages, losses and injuries to Ukraine caused by Russia, the UN decided. While the UNGA resolutions are not legally binding, they do carry political weight. Russia’s Permanent Representative to the UN, Vassily Nebenzia, speaking on the topic of the resolution, called it a legally insignificant document. “At the same time, the co-authors cannot help but realize that the adoption of such a resolution will entail consequences that can boomerang back to them,” Nebenzia said. He added that the resolution intended to legalize the seizure of Russian assets previously frozen by Western countries.

“The sacredness of Life is gone. We have become spectators… and our world has become a spectacle.”

• The Kherson Question (Nora Hoppe)

I follow the news regularly on Russia’s Special Military Operation in Ukraine. And I have recently read and heard many varying and divisionary views on the withdrawal of Russian troops from Kherson, a city that is now lawfully part of Russia. Dispensing with the views of the pro-NATO side, which are of no interest, I am observing the division of thought amongst analysts, journalists and commenters in forums siding with the Russians: There are those who are outraged and see the withdrawal from Kherson as “a disgrace”, “a sign of weakness”, “an embarrassment”, “a poor strategy”, “unattractive optics”, etc. Others see it as the outcome of a difficult but wise decision – that was primarily made to save the lives of Russian soldiers, who would have been cut off by a massive flood if NATO were to blow up the Kakhovka Dam. (There may well be additional tactical reasons for the withdrawal, but they are not (yet) known to the public.)

When people speak of the “optics not looking good“… a film set immediately comes to my mind (I have worked in the film world for many years). And that immediately tells me how some people view this operation – as spectators: it has to have a good catchy script, suspense, uninterrupted action and – heaven forbid – no lulls! It has to ultimately supply a dopamine release. It has to have a “Dirty Harry Catharsis”. This reminds me of similar reactions to the prisoner exchange in mid-September, where some saw it as a sign of weakness to even think of releasing Azov prisoners… or when the Chinese government did not deliver a dramatic retort when Pelosi went to do her skit in Taiwan. What is at the base of these kinds of reactions? Why such impatience? Why such concern with “appearances”? Why such a need to satiate one’s own personal sense of justice and retribution?

Does it have something to do with consuming? Especially in the western world one has become an addicted consumer of not only things but “experiences” that can be lived indirectly. Today we witness events of other peoples’ wars and battles on computer screens from the comfort of our homes or on our tiny phones from chic cafés… these events can accessed at any moment – just press a key… and they appear – like a scene in a film, a game, a contest, a sports match. Even the dead bodies that lie mangled, bloodied or in gory stumps strewn over the mud become the pieces of a broken puppets on a stage. “Hell, one gets used to it…” The sacredness of Life is gone. We have become spectators… and our world has become a spectacle.

“..a war of liberation against the Combined West..”

• ‘The Last Battle for the World’ (Batiushka)

When last week Allied troops quit the right (= western, or in this case northern (1)) bank of the Dnieper and so the regional city of Kherson (original population 283,000), confusion reigned among those with a short-term view of this conflict. Probably they had been listening to Western propaganda for too long. Probably they had forgotten that if Russia had difficulties holding right-bank Kherson, then the Ukraine would certainly have even more difficulties. Let us return to some basic facts in order to clear up some of the confusion The government of the Russian Federation was reluctant to intervene in the post-regime change Ukraine of 2014. It always hoped that negotiations and diplomacy would overcome Western aggressiveness and stupidity.

The government of the Russian Federation knew that the USA through its NATO vassals was pumping the Ukraine full of arms and training its troops for the eight years between 2014 and 2022. Therefore the government of the Russian Federation had eight years in which to plan for this conflict, planning different scenarios and also preparing probing and distracting movements, like that towards Kiev last March. One scenario was that the US would continue to intervene on the side of its Kiev puppet and arm it to the teeth, also using NATO countries, officers and huge numbers of mercenaries to prolong the conflict, so that it would develop into a US war against Russia. That is exactly what has happened.

Russia defeated the Ukraine in March, but since then it has had to defeat the USA and its NATO allies, demilitarising them just as it demilitarised the Ukraine in the first month of the conflict. This is why there will be no quick end to what the conflict has become – a war of liberation against the Combined West. A NATO Ukraine with Cargill-Monsanto-Blackstone-Black Rock-owned land, anti-Slav biolabs, potential nuclear arms, US missiles on the border with the Federation, genocide in the Russian East and South, Western globalism and its escaped covid experiment with bioweapons helping it to destroy Russia and so set up its World Dictatorship, became more and more abhorrent. All this made Russian liberation more and more probable. But liberation only of the willing. And who was willing?

The government of the Russian Federation always knew that in the far west of the Ukraine, formerly Poland, there was hatred for Russia and therefore it had no interest in taking that. The government of the Russian Federation and its Allies first had to free its allies in the Donbass and then demilitarise and denazify the rest of the ‘Anti-Russia’ Ukraine, which was threatening its survival. Today Ukraine is running a budget deficit of up to $5 billion per month, with the country’s military spending increasing fivefold to $17 billion for the first seven months of 2022.

Why do they want a pipeline that has no gas flowing through it?

• Poland To Seize Gazprom Assets (RT)

Warsaw is set to confiscate the assets of Russian energy major Gazprom, the country’s media reported on Monday. The move will target the company’s 48% stake in EuroPolGaz, which owns the Polish section of the Yamal-Europe pipeline that used to carry Russian gas to the EU. The decision to seize Gazprom’s shares was reportedly made by Minister of Development and Technology Waldemar Buda at the request of Poland’s Internal Security Agency. It is intended to “ensure the security of [Poland’s] critical infrastructure,” the ministry said. According to the media, Polish authorities said the order should be implemented immediately and established a mandatory administration in respect of the Russian entity to ensure the continued functionality of EuroPolGaz, a joint venture between the Russian gas major and Poland’s PGNiG.

The Polish energy major also owns a 48% stake in EuroPolGaz, and Gas-Trading SA the remaining 4%. The Yamal-Europe gas pipeline passes through Russia, Belarus, Poland and Germany, and it used to carry nearly half of Gazprom’s westbound gas deliveries. Poland’s sanctions against the Russian gas producer have deprived the company of its shareholder status in EuroPolGaz since April, blocking its voting rights and the ability to repatriate dividends. In May, the Polish government terminated a Russian natural gas contract without waiting for its expiry at the end of 2022, saying the country’s section of the Yamal-Europe gas pipeline could be used for supplies from Germany.

G20 – G7 = BRICS. Not exactly, but close.

• G20: What Does It Mean For Putin And The Event Itself? (Maxim Hvatkov)

Participants of the G20 summit have already arrived in Bali, and it seems that some wish Putin was there. French President Emmanuel Macron has stated the need to continue dialogue with Russian President, German Chancellor Olaf Scholz admitted that “it would be good if Putin went,” and Turkish leader Recep Tayyip Erdogan believes that the participation of his Russian counterpart would be appropriate. All this is against the backdrop of China’s support. The Washington Post has written that Western countries are alarmed by the partnership between Putin and Xi. The newspaper’s sources do not think that Beijing will refuse to support Russia at the summit even after the meeting between Biden and and the Chinese head-of-state.

Although several days have passed since Sergey Lavrov’s trip was announced, it is still unknown whether any bilateral meetings are planned for the Russian minister. In particular, Moscow has yet to mention a possible encounter with US Secretary of State Antony Blinken. The main news about Lavrov in Bali, so far, was pushed by AP and some other Western outlets, on Monday, reporting that he had been taken to hospital with heart problems shortly after arriving. Foreign Ministry spokeswoman Maria Zakharova said these reports are “top-level fake news”. The diplomat, who is also in Bali, said that she was reading the news with the foreign minister and they both “just couldn’t believe our eyes.” Earlier she announced that Lavrov plans to speak at the summit about Russia’s initiatives to provide food and energy to foreign markets. In addition, Moscow’s agenda includes presenting its plan to enhance gas cooperation with Turkey.

[..] However, it is not known whether the 2022 Bali summit will be useful in helping the world take a step forward in overcoming the Ukrainian crisis, as some expect. So far, all the statements of Western leaders have indicated the opposite. Western countries have been putting pressure on the summit’s host to exclude the Russian Federation from the event since Vladimir Putin announced the military operation in Ukraine last February. For example, the US president’s national security adviser, Jake Sullivan, said that Russia can no longer take part in the international community’s business “as usual,” while Polish Foreign Minister Zbigniew Rau even suggested that his country should take Moscow’s place in the G20 club. Nevertheless, Indonesia sent an invitation to President Putin, despite the pressure.

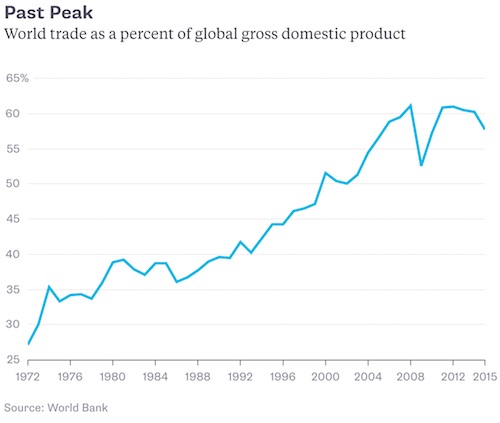

[..] The G20 format was born in the late 1990s after the Asian financial crisis, when the mainly Western countries in the ‘Big Seven’ – the US, the UK, France, Germany, Italy, Japan, and Canada – realized that a number of large economies were not participating in discussions on global issues. The newcomers invited to the table include Argentina, Australia, Brazil, India, Indonesia, China, Mexico, Russia, Turkey, South Korea, South Africa, Saudi Arabia, and the European Union. However, the format did not reach its current status until the next global financial crisis, in 2008-2009. Prior to that, the meetings had only included finance ministers and the heads of central banks. However, subsequently world leaders themselves met at the summits annually to consult, first and foremost, on financial and economic issues. In 2013, the G20 was held in St. Petersburg. [..] The G20 countries are home to two-thirds of the world’s population. They also account for 85% of world GDP and about 75% of world trade.

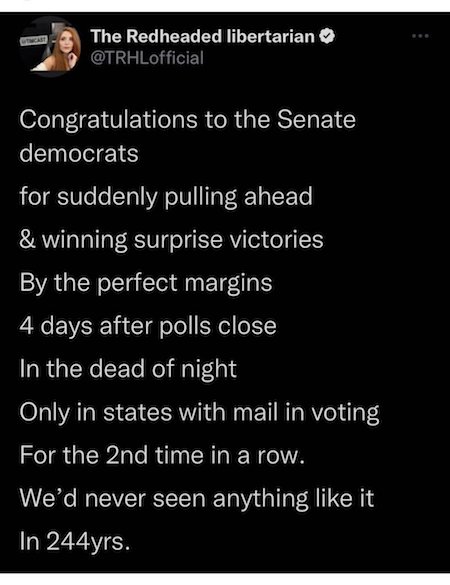

Ballots, not votes.

• GOP Nears House Majority With Two Race Calls In Arizona (JTN)

A Monday night vote dump from Arizona prompted the Associated Press to call two more congressional races in favor of Republican candidates, nearly one week after the Nov. 8 midterm elections. The AP called the contest in Arizona’s 1st District for the GOP’s David Schweikert and the 6th District race for Republican Juan Ciscomani. The outlet has projected Republicans to win 214 seats thus far, meaning they need just four more to claim the speaker’s gavel from House Speaker Nancy Pelosi. Republicans currently lead in seven of the 16 remaining uncalled races. Of those, one is New York’s 22nd District in which Republican Brandon Williams maintains a 4,000-vote lead over Democrat Francis Conole.

In Colorado, Republican Rep. Lauren Boebert is hanging on to a slightly more than 1,000-vote lead. All remaining races currently favoring Republicans are in California. Should Williams and Boebert triumph, the GOP would need to win just two of the five California races in which they currently enjoy leads to take the House, barring any unexpected leader flips in the nine uncalled contests currently favoring Democrats. The final result, regardless of which party wins the House, is likely to be one of the narrowest margins of control in the history of the lower chamber.

Dr. Radhika Desai, a professor at the Department of Political Studies at the University of Manitoba in Winnipeg, Canada and director of the Geopolitical Economy Research Group. She also writes on current affairs for Valdai Club, CGTN, Counterpunch and other outlets and is the author of Geopolitical Economy: After US Hegemony, Globalization and Empire and Capitalism, Coronavirus and War: A Geopolitical Economy

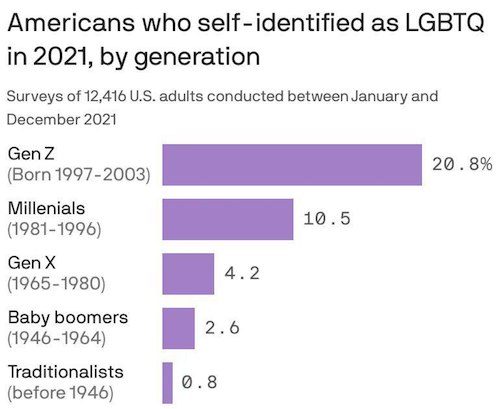

• Midterm Success Brings US Democrats To A Historic Dilemma (Desai)

Pictures of a smirking President Biden graced the front pages of newspapers in the days following the midterm elections. The worst fears of the Democrats – that they would lose both houses of Congress to the Republicans in an electoral debacle that would pave the way to a MAGA Trump presidency in 2024 – remained unrealized. The feared ‘red wave’ had turned into a ‘red ripple’, and President Biden was already talking of running again in 2024, when he will be 82. How sound is this assessment? While the results are yet to be finalized, we know that the Democrats will likely continue narrowly controlling the Senate thanks to the casting vote of the vice president, and that the Republicans will gain a small majority in the House. All the praise for Biden for not losing more comes from comparisons with past midterm losses for incumbent presidents.

However, this fails to take account of critical recent changes which, if factored in, indicate not so much a secure electoral future for the Democrats but the possibility that the Democrats may have jumped from the proverbial frying pan of the increasingly complex structure of US politics, into the fire. Politics scholar William Galston has noticed the change. Speaking of US presidential elections, he observed that ‘between 1920 and 1984… the contest between the two parties resembles World War Two, with a high level of mobility and rapid gains and losses of large swaths of territory. By contrast, the contemporary era resembles World War One, with a single, mostly immobile line of battle and endless trench warfare.’ Given how few seats changed hands, it appears that this logic also applies to congressional elections, and despite recent demographic changes – college education, urbanization etc. – somewhere between 40 and 45% of the US electorate remains solidly Republican.

Moreover, Biden and his Democrats appear to have lost an unpopularity contest, rather than won a popularity contest. As President Biden’s approval rating plumbed new depths, many Democratic candidates shunned him in their campaigns. President Trump, for his part, didn’t do much better. Though most of the candidates he endorsed won, none of those he endorsed for highly contested races did. Many commentators blamed this on his emphasis on candidates who agreed with his false narrative of the ‘stolen’ 2020 presidential election. It led him to scrape the barrel of candidates, and to choose some pretty unattractive specimens. With Ron DeSantis pulling off a spectacular victory in Florida, the possibility that he will replace Trump as the Republican nominee for president is being canvassed. Even if that happens, Trumpist politics are going nowhere anytime soon.

This is clear from many aspects of the voting pattern. The small gains the Democrats made came very substantially from women and young people, generally turning out in large numbers and voting Democrat because they felt strongly about abortion rights. However, this factor may lose its utility for the Democrats if, as seems increasingly the case, the Republicans also soften their stance on abortion. For the rest, the gains came from the usual source, money. Not only was this the most expensive midterm ever, experts suggest that the Democrats outspent the Republicans very considerably. This has returned US elections to the pattern where elections are essentially bought by the highest spending party, a pattern that the election of President Donald Trump very briefly reversed.

“..Trump would have to commandeer a vehicle in order to enact his agenda. The only possible vehicle that could assist him was the GOP. This party’s leadership had no desire to enact Trump’s populist revolution..”

• The Triumph of The Centre (Soldo)

Film and television have trained our brains to expect narrative arcs in everything we experience, from rising action, through to a climax, and ending in a denouement. Real life is not like this at all, but many of us cannot help but to interpret at least some of our own lives in this fashion. We apply this trajectory to our high school lives, our first romantic relationships, even our careers. Thinking that we are at the centre of a story helps give our lives meaning, and we are all guilty of it from time to time. The rise of political theatre is also hostage to this frame of reference. We are wont to perceive political developments progressing along a neat and tidy storyline, with all the ups, downs, shocks, disappointments, and celebrations that are built into traditional storytelling. At the end, our political option is the winner, and they all went home happily ever after.

2016 USA is a classic case of this: two simultaneous challenges to the status quo came out of nowhere to threaten the ruling elites. From the left, the ‘BernieBros’ promised Americans a fairer deal that included goodies like universal healthcare. From the right, #MAGA tapped into the powerful energy of the GOP base and its rejection of mass migration, de-industrialization, and open hostility to ordinary, everyday Americans emanating from the coastal elites. For #MAGA, 2016 was indeed a fairy tale; an example of ‘people power’ where the people steamrolled first their own party’s elites, and then those of the opposing party as well. This massive surprise went to people’s heads (and to be fair, rightly so). The feeling was that the system could be reformed, the ship steered back ‘on course’, and that America genuinely could be made ‘great again’.

The problem was that it was one thing to win an election, but it was a totally different thing to actually govern and lead a revolution. And let’s be honest: a revolution is what the overwhelming majority of Trump voters in 2016 wanted. They saw a system that not only did not work for them, but was actively working against them. Trump tapped into this populist sentiment when no one else did, and rode it to the White House. Unfortunately for his supporters, Trump was no revolutionary and his presidency was a disaster thanks in part to the ruling elites subverting it, in part due to his own incapability, and also due to an Act of God. You wanted a revolutionary, instead you got a reality TV show host who was excellent on the campaign trail, but utterly out of his depth in the Oval Office.

He wasn’t the first to be ill-suited for the White House, but he was the first in a long, long time that [was] not fit and not installed by the elites. One man cannot do it all alone. The US system is a set of checks and balances to ensure that precisely this cannot happen. That means that Trump would have to commandeer a vehicle in order to enact his agenda. The only possible vehicle that could assist him was the GOP. This party’s leadership had no desire to enact Trump’s populist revolution and immediately got to work to strangle his agenda, while using him to implement their own (e.g. Paul Ryan’s tax cut bill in 2017 or SCOTUS appointments).

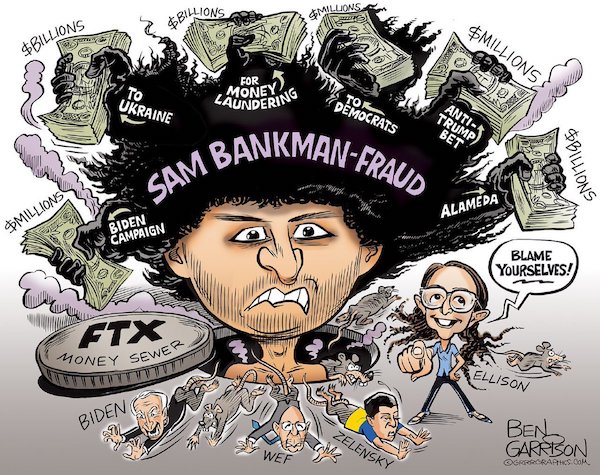

There are 19,000 “coins”?!

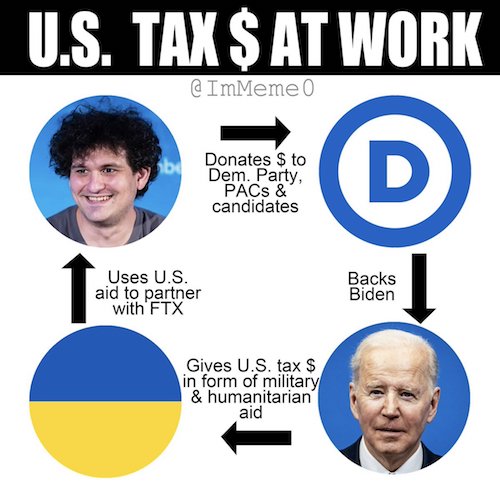

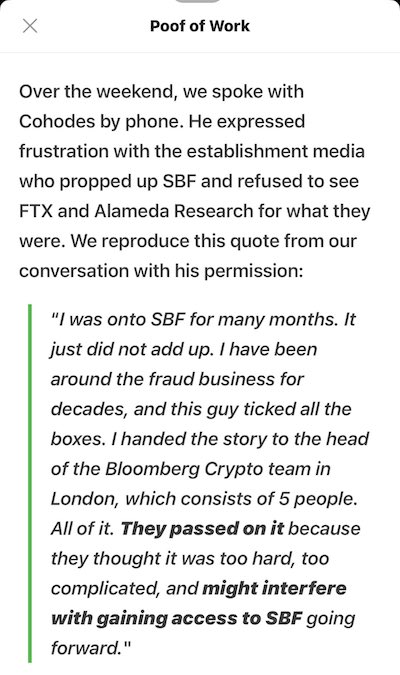

• FTX Implosion Takes Its First Crypto Victim (RT)

The cryptocurrency Solana, associated with the bankrupt FTX exchange, continued its three-day retreat on Monday to trade at around $14 a token. The price is now down 95% from its all-time high of $259.96 last November. The token has lost 61.6% of its value in the last seven days, according to data firm CoinGecko. The drop is a result of the November 8 collapse of the FTX crypto exchange, which filed for Chapter 11 bankruptcy on Friday. Since then, the price of Solana has declined by 51.5%, which translates into a $5.5 billion loss in market value. The launch of bankruptcy proceedings by FTX came days after larger rival Binance abandoned plans to acquire the company and left it with the task of raising roughly $9 billion from investors and rivals to stay afloat. Binance backed out of the deal after a due diligence examination and recent reports of mishandled customer funds, as well as alleged investigations by the US authorities into the company.

Meanwhile, blockchain research firm Nansen revealed over the weekend that $662 million flowed out of FTX’s US and international exchanges. The firm’s main wallet, which was used to process withdrawals, was drained of its entire balance of 45.8 million FTT tokens, worth an estimated $97.2 million, Nansen said. On Monday, Binance CEO Changpeng Zhao announced plans to set up an industry recovery fund in an effort to “reduce further cascading negative effects” of the FTX bankruptcy. Zhao added the fund will assist otherwise strong projects that are facing a liquidity squeeze. The crypto market has lost 17.6%, or $188.4 billion, since November 7, with major crypto Bitcoin sliding down 22.4% in one week. Ether, the second cryptocurrency by market value, has fallen 24.4% over the past seven days.

“Daily volume hit a high of around $11 billion in mid-2021, at a time of soaring cryptocurrency prices and high market volatility—ideal conditions for both a hedge fund and an exchange.”

• What the Collapse of FTX Means (Burja)

After beginning his career in traditional finance at leading quantitative trading firm Jane Street Capital, Bankman-Fried’s initial forays into cryptocurrency began in October 2017 with the founding of the cryptocurrency hedge fund Alameda Research. According to Bankman-Fried, it was founded initially to take advantage of a persistent but hard-to-exploit 20% disparity between the Bitcoin price denominated in Japanese yen and the same price denominated in U.S. dollars, one that lasted until January 2018. From there the firm expanded to quantitative trading more broadly across the entire cryptocurrency domain, moving its headquarters from California to Hong Kong, and later to the Bahamas, due to the difficulty of establishing and maintaining relationships with banks in the U.S. as a cryptocurrency trading firm.

It remains unclear why exactly Bankman-Fried and Alameda decided to start their own exchange. There are two sources of natural fit between an exchange and a quantitative trading firm: one legal, the other less so. The trading firm, acting as market maker, can supply the liquidity the new exchange needs to attract and retain new users. Alameda’s constant presence trading on FTX, initially providing almost 50% of liquidity, was almost certainly largely responsible for the site’s massive growth, as it grew trading volume from $50 million a day to $300 million a day in just four weeks between June and July 2019.16 The nascent exchange also benefited from a timely outflow of customers from the cryptocurrency exchange BitMex, at the time under investigation by the Commodity Futures Trading Commission (CTFC) for illegally providing services to U.S. residents.

Alternatively, however, the exchange’s customer funds can also be used as capital for the trading firm to use on its own account—an illicit practice, as unlike banks, an exchange ostensibly keeps all customer deposits available for redemption and rather makes its money from transaction fees. That FTX’s spreads were notoriously tight, even in its early days, might suggest that Alameda was making money in a different way to the typical methods of market makers.17 FTX soared in popularity thanks to the high leverage it offered,18 provision of cross-margining,19 attractive user interface, and high-quality liquidity and risk engines. Daily active users grew from two thousand in 2019 to almost 15,000 in 2020 to over 60,000 in 2021. Daily volume hit a high of around $11 billion in mid-2021, at a time of soaring cryptocurrency prices and high market volatility—ideal conditions for both a hedge fund and an exchange.

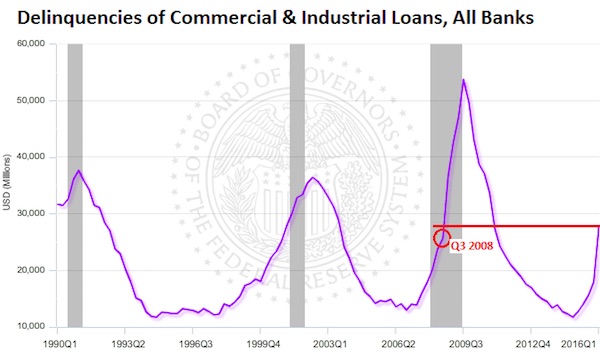

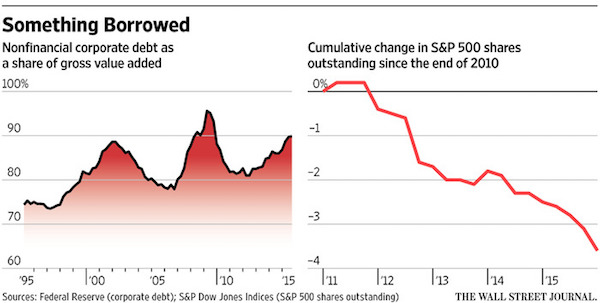

It’s beginning… “We now have $1 trillion in consumer debt on top of $4.1 trillion of Biden debt.”

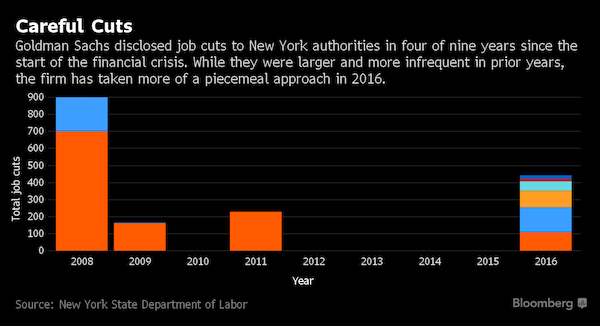

• Corporate Layoffs Are A Warning Sign Of Coming ‘Economic Crash Landing’ (JTN)

Three days after President Biden said the country’s “not anywhere near a recession right now,” Amazon founder and Executive Chairman Jeff Bezos warned a sharp economic downturn is looming. “The economy does not look great right now,” Bezos told CNN on Saturday. “Things are slowing down. You’re seeing layoffs in many, many sectors of the economy. The probabilities say if we’re not in a recession right now, we’re likely to be in one very soon.” The billionaire entrepreneur declined to estimate how long he thinks the recession would last but cautioned people to prepare for a time of economic struggle. “Take as much risk off the table as you can,” he said. “Hope for the best, but prepare for the worst.”

Two days after the interview, several media outlets reported that Amazon plans to lay off about 10,000 employees in corporate and technology roles beginning this week, the largest job cuts in the company’s history. Amazon’s decision was the latest in a string of recent corporate layoffs amid fears of a coming recession next year. Last week, for example, Facebook parent Meta announced the company is laying off 13% of its staff. Meanwhile, Disney is planning a hiring freeze and some job cuts, according to an internal company memo obtained by CNBC. [..] economic experts have been warning a recession is looming. “I think we are on the verge of a debt-driven economic crash landing,” economist Stephen Moore told Just the News. “These layoff announcements are the canary in the coal mine. We now have $1 trillion in consumer debt on top of $4.1 trillion of Biden debt.”

Americans could hold nearly $1 trillion in collective credit card debt before the end of the year due to historically high inflation, which has caused everyday costs such as food to skyrocket. According to experts who previously spoke to Just the News, soaring inflation was caused by Biden’s economic policies — namely too much spending — combined with the Federal Reserve keeping interest rates near zero while continuing to print money. Now the Federal Reserve is raising rates to slow down the economy in order to combat inflation. Doing so, however, may push the economy into a downturn, even a recession, next year. Still, the Biden administration and some economists remain optimistic that the economy can avoid such a fate with a so-called soft landing. Many projections, however, see the situation differently.

There’s a 65% chance of a recession within the next 12-18 months, according to a survey of economists conducted by Bankrate, a consumer financial services company, for its Third-Quarter Economic Indicator. That estimate is up from 52% in its second quarter survey and about one-third in its first quarter survey. Meanwhile, Bloomberg economists’ projection models from last month show a 100% chance of an economic downturn by October 2023, up from a 65% probability for the comparable period in the model’s previous update. The CEOs of both Goldman Sachs and JPMorgan, the U.S. and European economic teams for Barclays bank, and former Boston Federal Reserve President Eric Rosengren are among those who also forecast a recession next year.

Symbolic numbers.

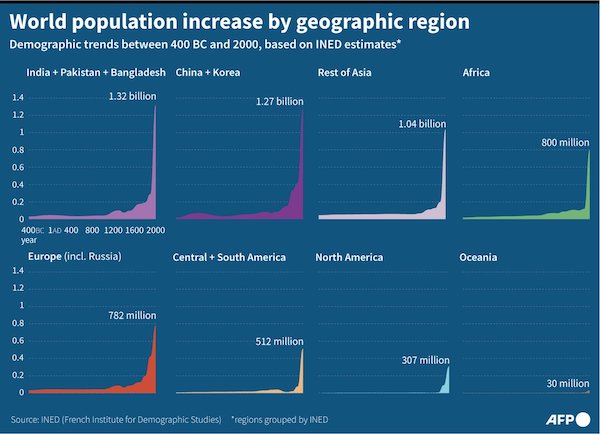

• World Population Expected To Hit 8 Billion On Nov. 15 (JTN)

The world’s human population is expected to reach 8 billion on Tuesday, according to a United Nations report released earlier this year. The United Nations will host events on Tuesday to mark “milestone in human development” that is the “Day of Eight Billion,” according to NEXSTAR. The population cleared 7 billion just 12 years ago and is expected to reach 9 billion in another 15 years. “This is an occasion to celebrate our diversity, recognize our common humanity, and marvel at advancements in health that have extended lifespans and dramatically reduced maternal and child mortality rates,” U.N. Secretary-General Antonio Guterres said in July, per the outlet. “At the same time, it is a reminder of our shared responsibility to care for our planet and a moment to reflect on where we still fall short of our commitments to one another.”

The milestone will come as international representatives meet for the COP27 climate summit and float a draft agreement to establish an international climate damage fund that would compensate poorer countries, often some of the most densely populated, for climate-related damages. Many details, including funding sources and damage amounts, remain undetermined and the plan is likely to stall in the international community, barring extensive revisions. Approximately 70% of births occur in low-income and lower-middle-income nations, NEXSTAR observed. Those countries will account for 90% of global population growth in the 15-year period leading up to the projected 9 billion figure. Many such countries would be beneficiaries under the draft U.N. plan.

Ithaka.

• A Father Fights for His Son & What’s Left of Democracy (Lauria)

These personal attacks were planned as far back as March 8, 2008 when a secret, 32-page document from the Cyber Counterintelligence Assessment branch of the Pentagon described in detail the importance of destroying the “feeling of trust that is WikiLeaks’ center of gravity.” The leaked document, which was published by WikiLeaks itself, said: “This would be achieved with threats of exposure and criminal prosecution and an unrelenting assault on reputation.” An answer to these slurs and the missing focus on Assange as a man is Ithaka. The film, which made its U.S. premiere Sunday night in New York, focuses on the struggle of Assange’s father, John Shipton, and his wife, Stella Assange, to free him.

If you are looking for a film more fully explaining the legal and political complexities of the case and its background, this is not the movie to see. The Spanish film, Hacking Justice, will give you that, as well as the more concise exposition in the brilliant documentary, The War on Journalism, by Juan Passarelli. Ithaka, directed by Ben Lawrence and produced by Assange’s brother, Gabriel Shipton, humanizes Assange and reveals the impact his ordeal has had on the people closest to him. The title comes from the poem of that name by C.P. Cavafy (read here by Sean Connery) about the pathos of an uncertain journey. It reflects Shipton’s travels throughout Europe and the U.S. in defense of his son, arguably the most consequential journalist of his generation.

The story begins with Shipton arriving in London to see his son for the first time behind bars after the publisher’s rights of asylum were lifted by a new Ecuadoran government leading to him being carried out of the embassy by London police in April 2019. “The story is that I am attempting in my own … modest way to get Julian out of the shit,” Shipton says. “What does it involve? Traipsing around Europe, building up coalitions of friendship.” He meets with parliamentarians, the media and supporters across the continent. Shipton describes the journey as the “difficulty of destiny over the ease of narrative.”He speaks to the European Parliament in Strasbourg and the German Bundestag in Berlin. In Paris, Shipton admits to supporters that “he’s not okay, but I say he’s okay not to worry people.”

Attack!

https://twitter.com/i/status/1592391595755966465

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.