Andy Warhol Judy Garland 1978

SBU

Zelensky's government is targeting and disappearing journalists. I sat down with award-winning war correspondent @EvaKBartlett, and what she told me is terrifying. My full interview here: https://t.co/LM79CNCrUZ#Ukraine️ #WarCrimes pic.twitter.com/H6JDJ2ve7T

— Clayton Morris (@ClaytonMorris) May 2, 2022

Cernovich:

Hack of the Supreme Court’s email must be presumed, even if that turns out to be inaccurate after a full investigation. This is far too important an issue to speculate that it was a leak. Immediate Special Counsel appointment, unlimited budget.

Not acceptable. How can the judges work this way? Was this leaked, or is the court’s email system compromised?

• Supreme Court Has Voted To Overturn Abortion Rights, Draft Opinion Shows (Pol.)

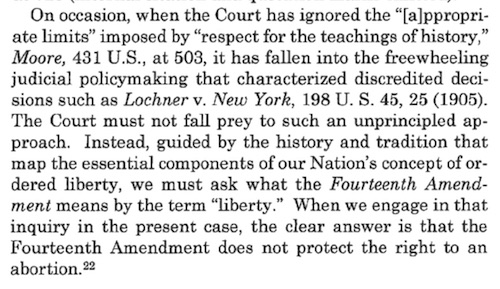

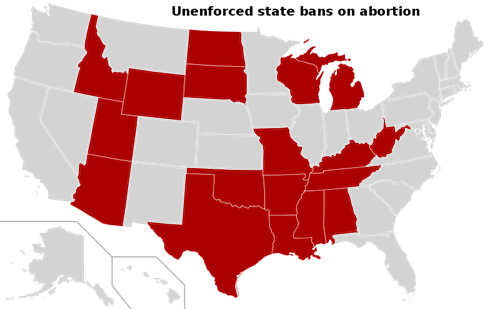

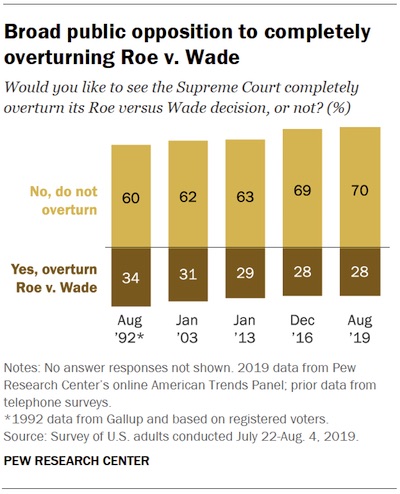

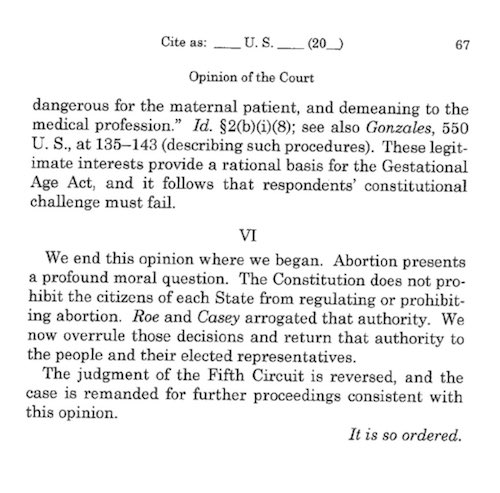

The Supreme Court has voted to strike down the landmark Roe v. Wade decision, according to an initial draft majority opinion written by Justice Samuel Alito circulated inside the court and obtained by POLITICO. The draft opinion is a full-throated, unflinching repudiation of the 1973 decision which guaranteed federal constitutional protections of abortion rights and a subsequent 1992 decision – Planned Parenthood v. Casey – that largely maintained the right. “Roe was egregiously wrong from the start,” Alito writes. “We hold that Roe and Casey must be overruled,” he writes in the document, labeled as the “Opinion of the Court.” “It is time to heed the Constitution and return the issue of abortion to the people’s elected representatives.”

Deliberations on controversial cases have in the past been fluid. Justices can and sometimes do change their votes as draft opinions circulate and major decisions can be subject to multiple drafts and vote-trading, sometimes until just days before a decision is unveiled. The court’s holding will not be final until it is published, likely in the next two months. The immediate impact of the ruling as drafted in February would be to end a half-century guarantee of federal constitutional protection of abortion rights and allow each state to decide whether to restrict or ban abortion. It’s unclear if there have been subsequent changes to the draft.

No draft decision in the modern history of the court has been disclosed publicly while a case was still pending. The unprecedented revelation is bound to intensify the debate over what was already the most controversial case on the docket this term. The draft opinion offers an extraordinary window into the justices’ deliberations in one of the most consequential cases before the court in the last five decades. Some court-watchers predicted that the conservative majority would slice away at abortion rights without flatly overturning a 49-year-old precedent. The draft shows that the court is looking to reject Roe’s logic and legal protections.

A person familiar with the court’s deliberations said that four of the other Republican-appointed justices – Clarence Thomas, Neil Gorsuch, Brett Kavanaugh and Amy Coney Barrett – had voted with Alito in the conference held among the justices after hearing oral arguments in December, and that line-up remains unchanged as of this week. The three Democratic-appointed justices – Stephen Breyer, Sonia Sotomayor and Elena Kagan – are working on one or more dissents, according to the person. How Chief Justice John Roberts will ultimately vote, and whether he will join an already written opinion or draft his own, is unclear.

“The court’s holding will not be final until it is published, likely in the next two months.”

• SCOTUS Draft To Overturn Roe v. Wade Leaked (TCS)

In an unprecedented turn of events, someone leaked a SCOTUS initial draft majority opinion to overturn Roe v. Wade to Politico. “We hold that Roe and Casey must be overruled,” writes Justice Samuel Alito in the leaked document. “It is time to heed the Constitution and return the issue of abortion to the people’s elected representatives.” “…. Roe was egregiously wrong from the start. Its reasoning was exceptionally weak, and the decision has had damaging consequences. And far from bringing about a national settlement of the abortion issue, Roe and Casey have enflamed debate and deepened division.”

The justices that support striking down Roe v. Wade and making abortion a state issue are Justice Alito, Justice Thomas, Justice Barrett, Justice Kavanaugh, and Justice Gorsuch, with Justice Roberts being a flip vote and the three Democrat Justices opposing the overruling. As many have pointed out, leaking a draft of a SCOTUS vote is unprecedented and appears to be a clear attempt to instigate left-wing riots across the country to pressure justices not to overturn Roe v. Wade. There are many potential reasons for doing this. As Politico notes, “Justices can and sometimes do change their votes as draft opinions circulate and major decisions can be subject to multiple drafts and vote-trading, sometimes until just days before a decision is unveiled.

“The court’s holding will not be final until it is published, likely in the next two months.” Moreover, the leak will have huge ramifications regarding the upcoming midterms and even the 2024 general election, as both sides will indefinitely utilize the decision (and even the draft vote if it’s dropped) as the ultimate wedge issue to argue that if Americans don’t vote for a particular candidate, then Roe v. Wade will or won’t be overturned. As it stands, many on Twitter are already calling for the Biden administration to pack the courts, and the Supreme Court has been barricaded as they await the impending riots likely to pop off tomorrow afternoon.

Twitter thread by Sundance. “The leak is real, the news is fake. Alito opinion is real. The justice’s concurrances or formal alignments are not. How does the court respond to an accurate Alito opinion, and a non factual alignment?

Why would Politico want to participate in a strategically explosive political effort to manufacture a fear of a not real SCOTUS opinion based on fabricated claims?”

• Upon Reread, It Looks Like FAKE NEWS (CTH)

Having read the Politico article carefully, my original suspicions have shifted a bit. “Exclusive: Supreme Court has voted to overturn abortion rights, draft opinion shows “We hold that Roe and Casey must be overruled,” Justice Alito writes in an initial majority draft circulated inside the court.” First, Politico is in the Domestic DOJ/FBI pipeline with the New York Times. CNN = State Dept. WaPo = CIA/Intel. NYT/Politico = FBI/DOJ. So the outlet sourcing leans toward DOJ and Justice Branch coverage. Which makes sense given the leaker is inside SCOTUS giving stolen documents to Politico. However, there’s no citation in the article for the actual alignment of the other justices with the Alito opinion. Factually there’s nothing other than Politico author supposition for judicial alignment with Alito opinion.

There’s nothing cited in the politico report that would indicate this is anything more than just Alito telling his peers what his position on the oral arguments was/is. Essentially, here’s my draft of what I believe. There’s nothing more than that present. Reread it. With no factual citation for the claim that Clarence Thomas, Neil Gorsuch, Brett Kavanaugh and Amy Coney Barrett are in concurrence, the article framework could likely be much ado about absolutely nothing. It’s one justice’s opinion, which is not surprising as Alito has already outlined this opinion before. Nothing else. Every reaction is complete projection based on unsubstantiated claims (of concurrences) by the Politico journalist. The “majority” is the part that matters…. and there is zero evidence to substantiate a claim that a majority decision exists.

Upon reread, it looks like FAKE NEWS. Then you switch to motive. Why would Politico want to participate in a strategically explosive political effort to manufacture a fear of a not real SCOTUS opinion based on fabricated claims? The answer to that question is found in the immediate reaction from the political left. Just the accusation alone is enough to trigger the most extreme of leftist base political demands. From that perspective, everyone is reacting to a carefully coordinated con job…. that carries the odor of Ron Klain, the DNC, and a desperately needed political reset for 2022 all over it.

“U.S. taxpayers are also going to subsidize farming in Europe and fund the climate change initiatives by paying for the development of alternate energy sources.”

• This Is Why Nancy Pelosi And Adam Schiff Were In Kyiv Yesterday (CTH)

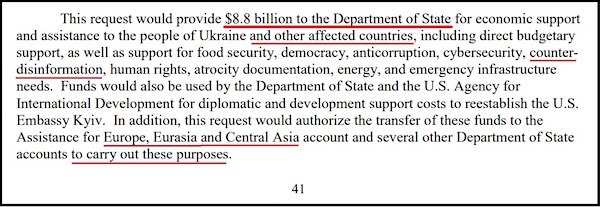

The details of the Joe Biden $33 billion supplemental budget allocation have been released. I would strongly urge everyone to read the proposal which now heads to congress for passage. The spending request outlines a massive amount of money for various ideological foreign policy initiatives under the guise of Ukraine relief (it isn’t). The proposal outlines a kickback and bribery scheme. Some of the spending includes an allocation of funds to the State Dept including funds to USAID to “provide $8.8 billion to the Department of State for economic support and assistance to the people of Ukraine and other affected countries, including direct budgetary support, as well as support for food security, democracy, anticorruption, cybersecurity, counter-disinformation, human rights, atrocity documentation, energy, and emergency infrastructure needs.” The request specifically authorizes the transfer of these funds globally, outside of Ukraine.

Apparently, the State Dept is going to set up an international version of DHS “disinformation governance board.” But wait, it gets worse… U.S. taxpayers are also going to subsidize farming in Europe and fund the climate change initiatives by paying for the development of alternate energy sources. “This would include [$500 million] support for small- and medium- sized agrobusinesses during the fall harvest and for natural gas purchases by the Ukrainian state energy company.” Mechanisms to legalize defense contractor kick-backs: “This request would authorize Ukraine to utilize Foreign Military Financing Program funds appropriated in this Act and prior Acts to the Department of State to contract directly with U.S. companies to procure defense related materials which would facilitate the delivery of military assistance and security sector support.”

Mechanisms to spread the money all over government institutions without prior approval: …”This request would provide the authority to reprogram funds appropriated in this Act and prior Acts making appropriations for the Department of State, foreign operations, and related programs for assistance to Ukraine without regard to any minimum amounts specifically designated in such Acts. This authority would provide the needed flexibility to match resources with evolving needs and decrease reliance on new appropriations.” The last segment is a massive change in the U.S. government power to seize Russian private property and assets, sell them to whoever Biden chooses, and then give the proceeds of the sales to U.S. politicians, friends, family members, or perhaps Ukraine President Volodymyr Zelenskyy.

Pelosi Ze -again-

— Wittgenstein (@backtolife_2022) May 2, 2022

“This will necessarily impact beyond belief a still clueless population which continues to play the role of vassal puppets to Anglo-Saxon malignant dictates..”

• New Pure-bred ‘Schrödinger-seizable’ Euros (Vilches)

The EU had already promoted and achieved all-around chaos regarding very simple yet absolutely essential trading terms urgently to be agreed with the Russian Federation. As if that were not enough, now adding fuel to the fire EU member countries continue to dangerously play their traditional fiddles while declaring that “ some contracts are holier than others, didn´t you know ? ” This daring criterion also means getting back to square one with an ever larger and riskier conflict while everybody´s patience is running thin. If Europe does not reverse course within a very limited time frame it will needlessly smash itself head-on against a very harsh reality. Once triggered, the subsequent uncontrolled demolition cannot rewind no matter how many desperate “emergency meetings” EU officials call for.

The EU has now come up with a ground-breaking legal criterion that international jurisprudence should rapidly adhere to and possibly improve. Thus it could include it in Treaties and other important legislation and, in view of its apparent virtues, even apply it ex-post-facto such as in this case. By the way, with this new international flat-Earth public policy, the EU would be the only party entitled to unilaterally uphold some contracts and not others per its own wishes and convenience as if it were a God-given right. Not anybody else, no way. So Europe, supposedly the cradle of Western civilization, is now trying hard to earn “The Joker” award disregarding the livelihood of at least 800 million human beings plus serious negative impact upon the rest of the world. Granted, history will not be kind with EU leaders.

Obviously, in view of the above, the interruption of Russian imports – including very specific, exclusive, and unreplaceable grades of Russian natural gas, oil, and coal – is now definetly in the cards for some or all European countries. This will necessarily impact beyond belief a still clueless population which continues to play the role of vassal puppets to Anglo-Saxon malignant dictates without actually following how they are being had. Four weeks ago, in view of the massive seizure of its legitimate funds, Russia was left with the only option of requiring Rubles as payment for its exports as such currency is exclusively under Russia´s purview and thus cannot be freezed and/or seized by any stakeholder, EU included. And negotiations were making very definite progress along such lines up until the past week.

A month ago, the only real problem was for EU countries to find Rubles other than by selling their “theoretical” gold bullion vaulted in the UK and the US which many claim is either non-existent or highly encumbered with many dozens of claimees standing in line. So the alternative viable solution wisely found up until last week was to convert euros into Rubles at Russia´s Gazprombank as it had not been sanctioned – at least not yet – as possibly the EU had foreseen its role for the proposed solution at hand. So Vladimir Putin, President of Russia, took the trouble to personally explain the exact simple two-step payment procedure by phone conversation with German Chancellor Olaf Scholz. By the way, the procedure is so simple and so straight-forward that even tie-wearing boomers can understand it.

But now European governments and energy companies are proudly rejecting the idea of paying in Rubles on the basis that gas import contracts clearly specify that the allowed currencies to be used for payment are only euros or dollars, not Rubles. Accordingly, they argue that one side of the deal – in this case the Russian Federation – cannot change such contractual obligation by its own decision (!). The EU now says “This is an absolutely clear circumvention of the EU sanctions.” “Opening a Ruble account at Gazprombank in and by itself may breach the EU sanctions…”

“If Mr. Biden is still on-the-scene in January next year, he’ll be the first president not only impeached but convicted and removed by the Senate..”

• “Disinformation” is Just a Boot in Your Face (Kunstler)

Now we have the Disinformation Governance Board to be run by a TikTok musical comedy star, Nina Jankowicz, an instant laughingstock, since retailing disinformation has been her main occupation in the scant years she’s been on the Deep State scene. Ms. Jankowicz is a notorious RussiaGate hoaxer and psy-op agent in the October 2020 emergence of Hunter Biden’s laptop. She has zero credibility as anything but a professional falsifier. Her Disinfo Governance Board has no authority to regulate anything. It’s just a lame charade that can only draw more attention to the Left’s hatred of truth and reality. The Left pretends that free speech is a threat to civilization because, as usual, they are projecting psychologically. Their world is a mirror. In fact, the Left is a threat to civilization.

Behind all this is the growing panic in the Left that they are culpable for an enormous raft of crimes committed against their own country, and will eventually end up in court, in prison, or worse. Mr. Durham is just the leading edge of what will eventually be a heavy blade of judgment falling down on their necks. He’s busy sorting out the “Russia collusion” flimflam that turned into a coup to oust Mr. Trump, but that is only the beginning. In November, the Democrats will lose control of Congress and its oversight powers of agency operations, and in 2023 there will be inquiries galore into the neo-Jacobin craziness imposed on our country by the folks behind “Joe Biden.”

That includes such dicey matters as the several years of malevolent mismanagement of Covid-19, which looks more and more like a deliberate effort to kill a large number of citizens, and then moving along to the behind-the-scenes official support for those 2020BLM /Antifa riots, the ballot shenanigans around the last presidential election, the colossal failure to enforce border security (featuring Homeland Security Secretary Alejandro Majorkis), the Biden Regime’s conduct in provoking and prolonging the war between Russia and Ukraine, and (not least) the overseas moneygrubbing of President Biden’s family, as documented in Hunter’s laptop. I’m sure I left a few things out.

If Mr. Biden is still on-the-scene in January next year, he’ll be the first president not only impeached but convicted and removed by the Senate. And if for some reason he avoids criminal prosecution for treason out of some pitiful need for the government to maintain official decorum before the rest of the world, his brothers and his degenerate son may not be so lucky.

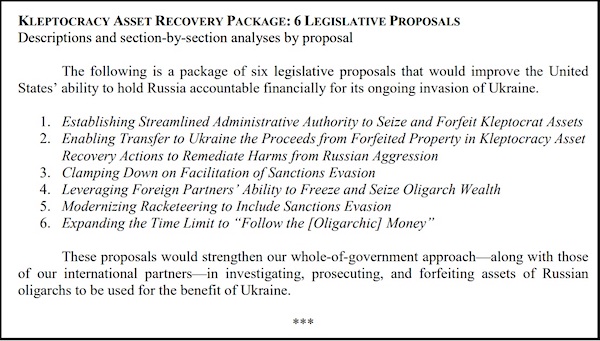

“..the DNC and Hillary for America violated the law by hiding the real purpose of payments meant for Fusion GPS as “legal and compliance consulting.”

• The Clinton Campaign Is About To Lose Its Privilege Fight (Techno Fog)

As part of the prosecution of former Clinton Campaign/DNC lawyer Michael Sussmann: Special Counsel Durham is seeking the following e-mails/communications that have been either redacted or hidden from his review: Documents involving Fusion GPS’s provision of opposition research and media-related strategies to Hillary for America, the DNC, and Perkins Coie. This includes the Fusion GPS/Perkins Coie contract and 38 e-mails and attachments between and among Fusion GPS, Rodney Joffe, and Perkins Coie. Communications between Fusion GPS and Rodney Joffe relating to the Alfa Bank allegations, and “other emails that precede, and appear to relate to, those communications.” This include emails between Joffe and Laura Seago, whom Durham has subpoenaed as a trial witness.

The Clinton Campaign (including Robby Mook and John Podesta), Fusion GPS, Perkins Coie, Rodney Joffe, and the DNC are fighting to keep these e-mails and records secret, reasoning Fusion’s “role was to provide consulting services in support of the legal advice attorneys at Perkins Coie were providing to” the Clinton Campaign. That argument – that Fusion GPS was helping with “legal advice” – is hopefully the last conspiracy theory they’ll provide to the public, after Fusion GPS has already poisoned the America, through the FBI, DOJ, and the press, with baseless allegations of secret back-channels between Trump Organization and Russian marketing servers, piss tapes, and broader allegations of Trump/Russia collusion.

Today, Special Counsel Durham addressed those arguments by providing to the court the FEC findings where the agency found “probable cause to believe” the DNC and Hillary for America violated the law by hiding the real purpose of payments meant for Fusion GPS as “legal and compliance consulting.” In support, he provided the First (link) and Second (link) General Counsel Reports, which recommend that the Federal Election Commission find the DNC and Hillary for America violated election laws (52 USC 30104(b)(5)(A)) “by misreporting the payee of the funds paid to Fusion GPS through Perkins Coie LLP.” While much of the information in these now-public reports has been known for years (Glenn Simpson’s testimony to Congress, for example), they provide additional context – and newly uncovered details – on how the FEC dismantled the bogus Hillary for America/DNC Billing.

“He emblemised wartime courage as Father Christmas does the spirit of giving.”

• Ghosting Propaganda (Dodsworth)

He was not written into existence by “Ukrainians” but by the Ukrainian authorities. The Ukraine Security Service originally showed a fighter pilot on Telegram, with a caption calling the Ghost of Kyiv an “angel” for downing 10 Russian planes. The Ukrainian military released a photograph on Facebook of the Ghost of Kyiv in March 2022 with the caption, “Hello, occupier, I’m coming for your soul!” His name evoked the dark hero of a fairy tale. His feats were exaggerated, gathering mythic status. Whereas an ‘ace’ might eliminate 5 enemy aircraft, the Ghost was reputed to have downed about 40 Russian pilots. He didn’t seem real. And now we know that he was a purposeful piece of propaganda. He emblemised wartime courage as Father Christmas does the spirit of giving.

[..] This has not been the only Ukrainian propaganda. (Of course there has been Russian propaganda too, but it’s not for this article.) BBC Breakfast used old footage of a Russian parade to show the invasion of Ukraine. It’s hard to see how it was used in error, but that’s the claim. An early, blurry video claiming to show a Ukrainian girl confronting a Russian soldier actually showed a Palestinian girl confronting an Israeli soldier. Billboards declaring “Be brave like Ukraine” were displayed in London, Rome, New York, Amsterdam, Washington and Stockholm. A powerful campaign entitled “Stop Bloody Energy” – again in English, for us and the international audience – linked buying Russian fuel directly with funding the Russian war campaign and calls on us to stop financing terror and genocide.

The masterfully produced but gruesome video includes real life footage of dead bodies. (Not necessarily verified.) The video is produced by Ukrainian energy companies. The irony is that every modern machine of war uses oil. (We’ve also never seen anything like this to persuade us of the immorality of buying goods from China which is arguably ethnically cleansing the Uyghurs.) Ukrainian propaganda has been enthusiastically received. Social media avatars switched from masked faces to Ukraine flag colours overnight. Beyond the support which is natural and due to a country which has been invaded, I wonder if the enthusiasm also signalled the relief of having a good old-fashioned baddie. During Covid, we were all vectors of disease and potential ‘enemy agents’. Once more, the enemy is located in a distant snowy country with a red button at his fingertips. We can follow a war which pits us against Russkies, not our neighbours, families and co-workers, and sink into a fear which is familiar. It’s close, but not too close.

Azov

Resident of #Mariupol:

"#Azov were hiding among schools, kindergartens, covered themselves with children, women, they were hiding behind maternity hospitals. And you call it warriors?

They started to change into women’s clothes, wigs, tried to slip through the green corridor." pic.twitter.com/ip7uC2W55a— ZradaXXII (@ZradaXXII) May 1, 2022

BMGF = Bill and Melinda Gates Foundation.

• Fraudulent Trial On Ivermectin Published By World’s Top Medical Journal (Kory)

Big Pharma (Pfizer and BMGF from what it looks to me) dropped another nuclear bomb on ivermectin 3 weeks ago with their successful publication of the fraudulent Brazilian TOGETHER trial. They did it in one of the world’s top read and rated medical journals, the New England Journal of Medicine (NEJM), a journal born in the year 1812, but captured by Pharma for who knows how long now. This is an open secret as per former Editor Marcia Angell in the book Drug Companies & Doctors: A Story of Corruption: “It is simply no longer possible to believe much of the clinical research that is published, or to rely on the judgment of trusted physicians or authoritative medical guidelines. I take no pleasure in this conclusion, which I reached slowly and reluctantly over my two decades as an editor of The New England Journal of Medicine.” -Dr. Marcia Angell.

First off, the saddest part of this fraud is that the TOGETHER trial’s published conclusion brazenly contradicted the data within the manuscript as it actually showed an 81% “Bayesian” probability of the superiority of ivermectin. But media and science reporters no longer critically analyze the data or questions the abstract’s conclusion, instead they all trumpet headlines in unison that “ivermectin doesn’t work in COVID.” Further contributing to the catastrophic toll of human life due to yet another deployment of “the Diversion,” a Disinformation tactic that Big Pharma employs when “science inconvenient to their interests” emerges.

Their first successful Disinformation campaign was against hydroxychloroquine in 2020, and despite Robert Kennedy’s in-depth, highly referenced and detailed exposing of the numerous sinister actions against HCQ in his best-selling book called “The Real Anthony Fauci,” they are again having success against ivermectin (just not as much – I would credit the work of the physician leaders and science experts of numerous non-profit, non-conflict-of-interest groups such as the US’s FLCCC, American Association of Physicians and Surgeons, Truth For Health, Covid Early Treatment Fund, South Africa’s Transformative Health Justice, UK’s World Council for Health, the Canadian COVID Care Alliance, and the anonymous C19early.com group among others).

Yet real people, real families, across the world destroyed each day by a lack of access to or support for safe, effective, early treatments with repurposed, generic medicines such as ivermectin, fluvoxamine, or hydroxychloroquine. All a direct result of Big Pharma and BMGF tactics like this one. Time to remind ourselves that BMGF is not a philanthropic organization but rather a corporation with massive investments in vaccines (and many other problematic industries) that has been corrupting public health the world over in service of the vaccine industry for decades now, none more so than in the last two years. By the way, what kind of philanthropist organization.. increases its wealth in a global pandemic?

MEP

https://twitter.com/i/status/1521326246076219392

“it plans to have scraped 100 billion facial images from the internet.”

• Your Face Is Now a Weapon of War (NI)

Who owns your face? You might think that you do, but consider that Clearview AI, an American company that sells facial recognition technology, has amassed a database of ten billion images since 2020. By the end of the year, it plans to have scraped 100 billion facial images from the internet. It is difficult to assess the company’s claims, but if we take Clearview AI at face value, it has enough data to identify almost everyone on earth and end privacy and anonymity everywhere. As you read these words, your face is making money for people whom you’ve never met and who never sought your consent when they took your faceprint from your social media profiles and online photo albums. Today, Clearview AI’s technology is used by over 3,100 U.S. law enforcement agencies, as well as the U.S. Postal Service.

In Ukraine, it is being used as a weapon of war. The company has offered its tools free of charge to the Ukrainian government, which is using them to identify dead and living Russian soldiers and then contact their mothers. It would be easy to shrug this off. After all, we voluntarily surrendered our privacy the moment we began sharing photos online, and millions of us continue to use websites and apps that fail to protect our data, despite warnings from privacy campaigners and Western security services. As so many of us sympathize with Ukraine and are appalled by Russia’s brutality, it is tempting to overlook the fact that Ukraine is not using Clearview AI to identify dead Ukrainians, which suggests that we are witnessing the use of facial recognition technology for psychological warfare, not identification. Some people will be fine with the implications of this: if Russian mothers have to receive disturbing photos of their dead sons, so be it.

To understand why we might want to rethink the use of facial recognition technology in conflict, consider the following thought experiments. First, imagine that it was Russia that had scraped Ukrainian biometric data from the internet to build a facial recognition technology tool which it was using to identify dead Ukrainians and contact their mothers. Liberal democracies would likely condemn these actions and add them to its growing list of Russia’s barbaric actions. Second, imagine a conflict in which the United States was fighting against an opponent who had taken American faceprints to train its facial recognition technology and was using it to identify dead American soldiers and contact their mothers. This would almost certainly cause howls of protest across the United States. Technology executives would be vilified in the press and hauled before Congress, where lawmakers might finally pass a law to protect Americans’ biometric data.

“..the US dollar has created the conditions to be the most demanded currency simply because other central banks have been much more reckless.”

• The Vacuum Effect of the US Dollar (Lacalle)

April 2022 will go down in history as a milestone that has only been seen on three previous occasions since 1973. A month in which the S&P500 Index and US Treasuries have fallen at the same time, 5% and 2% respectively. Additionally, the US dollar has appreciated against the main currencies with which it trades and reaches a new year high. Years of monetary laughing gas have not diminished the strength of the US dollar as world reserve currency, rather the opposite. Now we witness the vacuum effect. Inflows into the US dollar in a period of risk aversion. The PBOC, the Central Bank of China has had to give in and allow an aggressive devaluation of the yuan, although it tried to keep the currency stable via capital controls and a daily fixing.

The government-programmed weakness of the yuan is probably designed to provide a boost to the Chinese economy in a slowdown and dissolve part of the yuan-denominated debt. However, it reduces the Chinese yuan’s appeal as an alternative to the US dollar as global investors may fear both the central bank fixing as well as the tight capital controls imposed in China. It is not surprising, for example, that many commodity-exporting countries’ currencies have weakened against the US dollar despite rising exports and foreign exchange inflows. From the Norwegian krone to the currencies of major exporters, it seems only the Brazilian real appears to be holding strong… and that’s because it’s had several atrocious years, so it is more a bounce than an appreciation.

[..] It is very worrying that the European Central Bank is allowing the euro to get dangerously close to parity with the US dollar because of its obsession with staying far away from the normalization process of other central banks. The global demand for euros is falling, and the trade surplus that supported the European currency is diminishing. All those who defend a weak euro should look at reality. Empirical evidence shows that the eurozone does not export more due to a weak euro, but with products of higher added value. With a weak euro, imports skyrocket and become more expensive. Thus, the US dollar has created the conditions to be the most demanded currency simply because other central banks have been much more reckless.

Ron Johnson

Sen. Ron Johnson: “We are now witnessing what President Obama, what President Biden meant when they said they were going to fundamentally transform America. They are fundamentally destroying this country… pic.twitter.com/cxvj74WYSh

— Wittgenstein (@backtolife_2022) May 2, 2022

Seneff

Stephanie Seneff – alarming pic.twitter.com/4iRreg1aKp

— Zola (@betterworld_22) May 2, 2022

Musk and mum

Elon Musk wants to "make Twitter as inclusive as possible" as well as "interesting, entertaining, and funny." pic.twitter.com/251cUPms3Z

— Wittgenstein (@backtolife_2022) May 3, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.