Marjory Collins “Italian girls watching US Army parade on Mott Street, New York” 1942

One of many factors that could be the trigger.

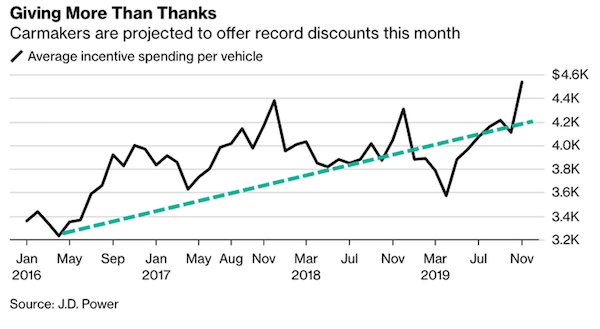

• Will $4.6 Trillion Leveraged Loan Market Cause Next Financial Crisis? (Cohan)

Financial crises take about a decade to be born. Having lived through four of them, I see the raw materials for a fifth one — flowing from the collapse of so-called leveraged loans — debt piled on top of companies with weak credit ratings. Before examining the latest news on leveraged loans, let’s take a quick tour down the memory lane of financial crises I’ve lived through. My first one was in 1982 — that’s when banks lent too much money to oil and gas developers in Oklahoma and Texas as well as local real estate developers. At the suggestion of McKinsey, money-center banks like Chemical Bank thought it would be a great idea to buy a piece of those loans. It’s all described nicely in a wonderful book — Belly Up. Too bad the price of oil and gas tumbled, leaving lenders in the lurch and causing a spike in bank failures that gave me the chance to spend a balmy summer in Washington helping the FDIC develop a system to manage the liquidation of those failed banks.

By 1989, it was time for another banking crisis — this one was pinned to too much lending to commercial real estate developers in New England and junk-bond-backed loans for what used to be known as leveraged buyouts. The government shut down Bank of New England and was threatening my employer, Bank of Boston, with the same. I worked on a government-mandated strategic plan intended to save the bank from a similar fate. Next up — the dot-com bust — which introduced me to the idea that not all bubbles are bad if you can get in when they’re forming and exit before they burst. I invested in six dot-coms and had a mixed record — the three winners offset the three wipe outs.

Finally, there is the latest and greatest — the so-called Great Recession of 2008. I am now getting to the end of Ben Bernanke’s The Courage To Act. It brings back all the memories — from my first story on subprime mortgages back in December 2006 in which I recommended selling short shares of subprime lender, NovaStar Financial when they traded at $106 apiece. (NovaStar changed its name to Novation in 2012 and you can pick up a share for 17 cents.) The key causes of the crisis that Bernanke describes as the worst in history were weak subprime regulation, liar loans, global securitization, too little capital, limited transparency, skewed banker and ratings agency incentives, and lame risk management. What does this little financial crisis tour have to do with leveraged loans? I have often cited the Mark Twain’s expression that history does not repeat itself, but sometimes it rhymes.

I think leveraged loans rhyme with junk bonds and subprime mortgages. Banks make leveraged loans “to companies that have junk credit ratings in the hope of quickly selling the debt to investors, including mutual funds, hedge funds and entities called collateralized loan obligations,” according to the New York Times. Why the rhyme? As in the late 1980s, leveraged loans are made to companies with bad credit ratings; like subprime mortgages they are being packaged into securities that supposedly give investors a diversified portfolio; and like the early 1980s crisis, there is excess debt on the books of energy and mining companies.

Read more …

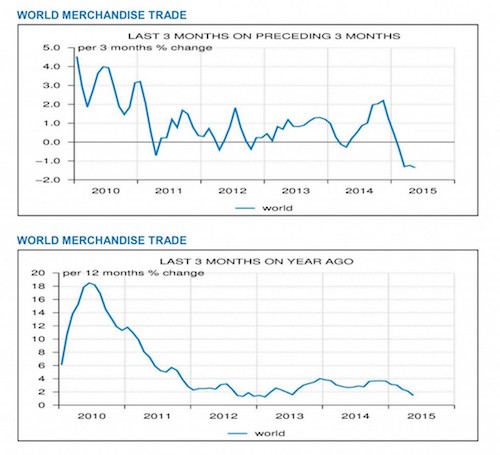

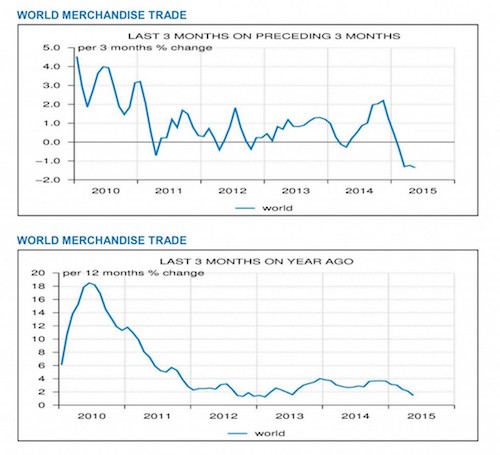

World trade comes to a crawl.

• Asia-Europe Container Freight Rates Drop 70% in 3 Weeks (Reuters)

Shipping freight rates for transporting containers from ports in Asia to Northern Europe plunged by 27.9% to $295 per 20-foot container (TEU) in the week ending on Friday, one source with access to data from the Shanghai Containerized Freight Index told Reuters. The drop came after spot freight rates on the world’s busiest route dropped 39.3% last week, and the current rates are widely seen as loss-making levels for container shipping companies. The spot freight rates for transporting containers, carrying anything from flat-screen TVs to sportswear from Asia to Northern Europe, has fallen 70% in three weeks.

In the week to Friday, container freight rates fell 22.5% from Asia to ports in the Mediterranean, dropped 8.6% to ports on the U.S. West Coast and were down 8.0% to ports on the U.S. East Coast. Maersk Line, the global market leader with more than 600 container vessels and part of Danish oil and shipping group A.P. Moller-Maersk, earlier in November reported a 61% drop in net profit in the third quarter. The Danish shipping company controls around one fifth of all transported containers from Asia to Europe.

Read more …

He leaves nothing for others to buy.

• Nightmare of Mario Draghi’s Crowded Trade (FT)

Investors are putting too much faith in Mario Draghi. The ECB president is largely responsible for one of the most overcrowded trades in markets — and there is a risk it could all go horribly wrong. In the past month, every investor I have spoken to has told me they are overweight European equities, citing the quantitative easing policy of Mr Draghi and the ECB as one of the main reasons. But is Mr Draghi creating a potential nightmare scenario for investors? The European equity trade makes sense for a variety of reasons. The eurozone economy is recovering, albeit sluggishly, earnings are growing, valuations are relatively attractive and, most important of all, the ECB is buying billions of euros of bonds to underpin the market.

Indeed, European equities have rallied sharply since the start of September when Mr Draghi first hinted he was prepared to launch a second round of QE, expected in December. Investors reason that it is unwise to fight a central bank. It makes sense to be fully invested in risk assets such as equities when a central bank is actively easing, as looser monetary policy encourages corporations to borrow at cheap rates. This is certainly true. Euro-denominated investment grade corporate debt issuance has surged to a record high so far this year. This corporate borrowing often translates into higher profits as the money is invested for growth, which in turn boosts the share price. With the US Federal Reserve expected to diverge from the ECB and tighten policy next month, it makes European stocks even more appealing, particularly given that US valuations are stretched.

With the ECB easing and the Fed tightening, the euro is likely to remain weak. A cheaper euro should lift demand for exports. This is helpful to Germany, the region’s biggest economy, which relies on exports for growth. However, when a trade becomes this crowded, there are risks. Upside is limited because the good news is largely priced in. More significantly, if the market reverses, it can be difficult to exit as everyone wants to sell at the same time. Investors only have to look back to the summer for a reminder of the dangers. Worries about the Chinese economy wiped out all the equity gains from Mr Draghi’s first round of QE, which was launched in March, in a matter of days. European equities plunged about 10% in August.

Read more …

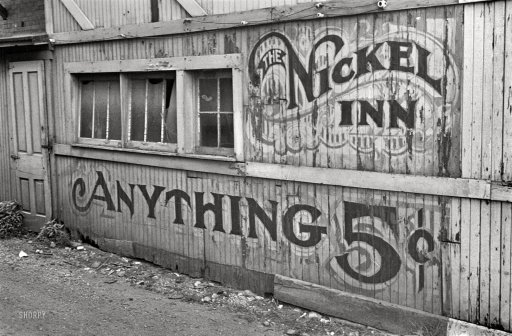

“..somewhere between collapsing oil prices, dollar strength, and consumer lethargy the economy’s narrative has drifted off plot. The theme has transitioned from one of renewed growth and recovery to one of recurring sickness and stagnation.”

• The Long, Cold Winter Ahead (Tenebrarum)

Cold winds of deflation gust across the autumn economic landscape. Global trade languishes and commodities rust away like abandoned scrap metal with a visible dusting of frost. The economic optimism that embellished markets heading into 2015 have cooled as the year moves through its final stretch. If you recall, the popular storyline since late last year has been that the U.S. economy is moderately improving while the world’s other major economies – Japan, China, and Europe – are rolling over. The U.S. economy would power through. Moreover, stock prices had achieved a permanently high plateau. But somewhere between collapsing oil prices, dollar strength, and consumer lethargy the economy’s narrative has drifted off plot. The theme has transitioned from one of renewed growth and recovery to one of recurring sickness and stagnation.

Mass malinvestments in U.S. shale oil, Brazilian mines, and Chinese factories and real estate must be reckoned with. Price adjustments, bankruptcies, and debt restructuring must be painfully worked through like a strawberry picker hunkered over a seemingly endless furrow row of over ripening fruits. Sore backs, burnt necks, and tender fingers are what the over-all economy has in front of it. The U.S. economy is not immune to the global disorder after all. More evidence is revealed each week that the unexpected is happening. Instead of economic strength and robust growth, economic fundamentals are breaking down. Manufacturing is slowing. Consumer spending is soft. For additional edification, let’s turn to Dr. Copper…

Dr. Copper – the metal with a PhD in economics – is always the first to know which way the economy will go. Copper’s broad use in industry and many different sectors of the economy, ranging from infrastructure to housing and consumer electronics, makes it a good early indicator of economic activity. When copper prices rise, economic activity soon increases. When copper prices fall the economy often then stagnates. Thus, here’s the latest from Dr. Copper and his industrial metals cohorts… As Bloomberg reported earlier this week: “Copper plunged to the lowest intraday price since May 2009 on concern Chinese demand is slowing and as the dollar traded near its strongest level in more than a decade. Lead touched the lowest since 2010, while all industrial metals retreated.”

No doubt, marking price levels last seen during the depths of the Great Recession would not be happening if the economy was strengthening. If demand was robust industrial metals prices would be going up. Instead, they continue their slide into the void of worldwide non-activity. Stocks may soon follow…The last time copper prices were this low, in May 2009, stocks were also much lower. Yet, today, they’re at extremely lofty prices. The Dow Jones Industrial Average is currently over 17,500. Back then, the Dow was less than half that…it ranged in the low 8,000s. In other words, stocks are still up while the economy is slowing down. Perhaps the economy is taking a brief pause before roaring back to life. Most likely it’s hunkering down for the long, cold winter ahead.

Financialization, namely massive amounts of leverage, has made the disconnect between the stock market and the economy extend wider and longer than ever before. Maybe another speculative melt up is ahead. Who knows? Maybe DOW 20,000 or 30,000 is in the cards. With enough monetary deception anything’s possible. But, nonetheless, gravity still exists. Stocks cannot go up for ever. After a six year bull market, accompanied by a lackluster recovery, stocks could return to prior levels that were in line with present commodity prices. Remember, just a few years ago, Dow 8,000 matched up with current copper prices. Soon it likely will again.

Read more …

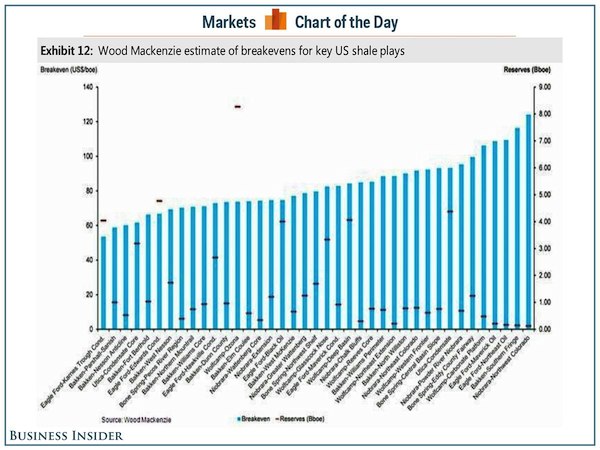

Remember how lower oil prices would be a boon for the economy?

• Oil Companies Brace For Big Wave Of Debt Defaults (CNBC)

Low oil prices are leaving many oil and gas companies with difficult debt loads, causing them to default at an extraordinary rate. On top of that, rating firm Moody’s forecasts the default rate will increase. “The energy sector remains the most troubled, accounting for almost a quarter of the 79 defaults so far this year,” said Sharon Ou, Moody’s Credit Policy Research senior credit officer. The strain on the oil patch comes after years of borrowing heavily at the start of the domestic energy renaissance. At the time, oil was hovering around $100 a barrel. But now, with West Texas Intermediate crude oil slightly above $40 a barrel, these companies are seeing their revenue dry up — and remain saddled with debt.

Marc Lasry, the chief executive of distressed investing specialist Avenue Capital Group, said these energy companies boosted their borrowings to between $250 billion and $300 billion, compared with the $100 billion at the start of this year. The energy boom of the past decade was fueled by a wave of credit from U.S. banks that now say they expect more delinquencies and charge-offs from energy companies this year. Federal Reserve officials earlier in November noted an increase in weakness among credits related to oil and gas exploration, production, and energy services following the decline in energy prices since mid-2014. Among the major banks raising red flags about the health of the loans are Wells Fargo, Bank of America and JPMorgan Chase.

Some banks are renegotiating their credit lines to gas and oil companies, while others are cutting credit lines to oil and gas firms and are requiring more collateral to protect against the surge of defaults. Of the 31 companies that have disclosed information on loan resets so far, banks have cut credit lines of 10 firms by just over $1.1 billion, Reuters reported. Some energy companies are aggressively looking to take matters into their own hands to alleviate the debt pressure. Some are selling assets, others are cutting spending, some are issuing new shares, and others are hedging their oil production at a certain price. Some, however, can’t escape the grip of debt, falling victim to low oil prices and filing for bankruptcy.

Read more …

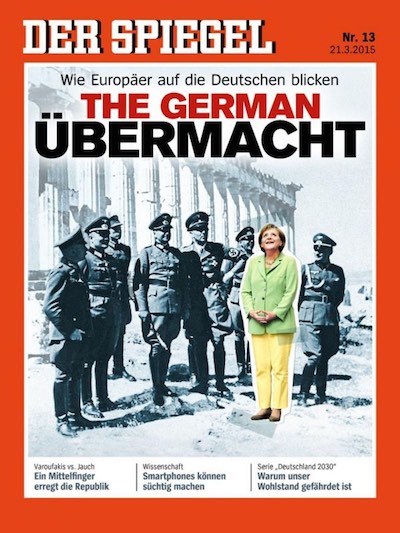

There is a government in Greece only to lend legitimacy to Brussels.

• Eurozone Agrees Greece Can Get Next Loan Tranche, Cash For Bank Recap (Reuters)

Greece has done all the reforms in the a first package of measures agreed with euro zone creditors, which paves the way for Athens to get the next tranche of loans, the head of euro zone finance ministers Jeroen Dijsselbloem said on Saturday. Greece is getting very cheap loans form the euro zone bailout fund ESM under its third bailout agreement in exchange for putting its public finances in order and reforming the economy to make it more efficient and competitive. Euro zone deputy finance ministers (EWG) reviewed on Saturday the progress made by Athens in the reforms.

“On the basis of a final compliance notice… the EWG agreed that the Greek authorities have now completed the first set of milestones and the financial sector measures that are essential for a successful recapitalization process,” Dijsselbloem said. “The agreement paves the way for the formal approval by the ESM Board of Directors on Monday 23 November of disbursing the €2 billion sub-tranche linked to the first set of milestones,” he said. He said that it will also allow the ESM to make case by case decisions to transfer money to Greece for the recapitalization of the Greek banking sector. The ESM already has €10 billion earmarked for this purpose and the capital needs of Greek banks from the euro zone are estimated at between six and nine billion, one euro zone official said on Friday.

Read more …

This is happening all across the western world. We better make up our minds, fast, about what kind of society we want.

• Half Of UK Care Homes To Close If £2.9 Billion Gap Is Not Plugged (Guardian)

Up to half of Britain’s care homes will close and the NHS will be overwhelmed by frail, elderly people unless the chancellor, George Osborne, acts to prevent the “devastating financial collapse” facing social care, an alliance of charities, local councils and carers has warned. In a joint letter, 15 social care and older people’s groups urge Osborne to use his spending review on Wednesday to plug a funding gap that they say will hit £2.9bn by 2020. They warn that social care in England, already suffering from cuts imposed under the coalition, will be close to collapse unless money is found to rebuild support for the 883,000 older and disabled people who depend on personal care services in their homes.

Osborne has already decided to use his overview of public finances to give town halls the power to raise council tax by up to 2% to fund social care, in a move that could raise up to £2bn for the hard-pressed sector. However, the signatories of the letter, such as Age UK and the Alzheimer’s Society, want him to commit more central government funding to social care. The looming £2.9bn gap “can no longer be ignored”, the letter says. “Up to 50% of the care home market will become financially unviable and care homes will start to close their doors,” it adds. “74% of domiciliary home-care providers who work with local councils have said that they will have to reduce the amount of publicly funded care they provide. If no action is taken, it is estimated that this would affect half of all of the people and their families who rely on these vital services.”

Osborne’s endorsement of a hypothecated local tax to boost social care comes after intense lobbying behind the scenes and public warnings from bodies such as the King’s Fund health thinktank. “Social care in England has been in retreat for a long time. But the fact that the industry is now losing its appeal, both as a business and as a form of employment, marks a new and dangerous phase in its decline,” said Caroline Abrahams, Age UK’s charity director. She urged Osborne to use the spending review “to bring stability to a worryingly fragile situation”. Jeremy Hughes, chief executive of the Alzheimer’s Society, another signatory, said: “Since 2010, £4.6bn of cuts have already resulted in an estimated 500,000 older and disabled people being denied access to care. If the government blazes ahead with 25%-40% cuts to local authority budgets, more people with dementia will be severely affected.”

Read more …

I count on them to fail spectacularly.

• Report Urges UK Government To Act Now To Avoid Energy Crisis (EAEM)

Britain is on the verge of an energy crisis, with demand set to outstrip supply for the first time in early 2016, according to a new report by a leading energy analyst. In the report The Great Green Hangover, published by the Centre for Policy Studies, author Tony Lodge says that electricity demand is set to outstrip dispatchable supply for the first time from early 2016. Due to widespread plant closures, on-tap energy capacity has been in decline – and now for the first time will be lower than the forecasted demand. Lodge argues that decades of energy policy mismanagement have overseen the shutdown of energy plants vital to Britain’s long-term energy security.

The average dispatchable capacity remaining by the end of March 2016 is calculated to be 52,360MW, whereas National Grid’s 2015/2016 Winter Outlook demand forecast is 54,200MW. The report also raises concerns over the continued affordability of energy costs. Over the last ten years electricity bills have risen by 131% in real terms, easily outstripping any other household essential. High energy prices also burden British industry, jeopardising manufacturing in particular as businesses consider closure or overseas relocation due to unaffordable production costs. Though operating efficiently, they nevertheless consume large quantities of energy, which can account for between 20 and 70% of their production costs.

Author Tony Lodge comments: “Britain has lost over 15,400MW (20%) of its dispatchable electricity generating capacity in the last five years as baseload power plants have closed with no equivalent replacement. This month National Grid used emergency measures for the first time to call on industry to reduce its power usage in order to avoid shortages. “High UK Carbon Price Support should be abandoned before it forces the premature closure of more baseload power plants and thus threatens energy security and affordability,” he added. Lodge says the Government should prioritise energy security alongside its environmental commitments and legislate to deliver targets to maintain security of energy supply, diversity and affordability.

Read more …

I can see Britain’s future from here.

• How Did a UK Power Plant Get 25 Times the Market Price? (Bloomberg)

On the afternoon of Nov. 4, a U.K. power station began to shut down one of its gas-fired units and the network manager was told it wouldn’t be available. Within an hour, the operator ramped it up again after the grid called for increased reserves and the power station got paid a handsome premium for doing so. The facility at the Severn power plant in Wales, operated by Macquarie Group Ltd., was running near full throttle at 396 megawatts. It didn’t report any operational problems, a requirement of European regulations, that would have prevented it supplying the market. Nonetheless, it began to decrease output from 3 p.m. When the network manager requested additional generation capacity for two hours from 4:30 p.m., Severn responded.

The reward for providing extra power was a payout 25 times the market price for that time in the day, according to calculations by Bloomberg based on exchange and grid data. The episode raises questions about how U.K. power plants operate as National Grid Plc, the company responsible for ensuring supply meets demand, grapples with a thinner buffer of surplus generating capacity. That margin will be about 5% this winter, down from as much as 16% four years ago, according to data from the London-based company. “This is a market, and it might be argued that price spikes are a necessary condition for its long-term viability, and therefore that it’s not unreasonable for individual generators to exploit scarcities,” said John Rhys, a senior research fellow at the Oxford Energy Institute. “If we really are in a period of very tight capacity, then I’m afraid that’s what having a market means and it’s going to happen.”

Read more …

Curious that this didn’t happen earlier.

• State Of Emergency In Crimea After Electricity Pylons ‘Blown Up’ (Reuters)

A state of emergency has been declared in Crimea after pylons carrying electricity from Ukraine were blown up cutting off power to almost two million people, media and the Russian government said on Sunday. The Russian Energy Ministry didn’t say what had caused the outages, but Russian media reported that two pylons in the Kherson region of Ukraine north of Crimea had been blown up by Ukrainian nationalists. The attack, if by Ukrainian nationalists opposed to Russia’s annexation of Crimea from Ukraine last year, is likely to further increase tensions between Russia and Ukraine. Russia’s Energy Ministry said in a statement that two power lines bringing power from Ukraine to Crimea had been affected, as a result of which 1,896,000 people had been left without power.

The ministry said that a state of emergency had been declared in Crimea. It also said that emergency supplies had been turned on for critical needs and 13 mobile gas turbine generators were being prepared. Ilya Kiva, a senior officer in the Ukrainian police who was at the scene, also said on his Facebook page that the pylons had been blown up, without giving further details. On Saturday, the pylons were the scene of violent clashes between activists from the Right Sector nationalist movement and paramilitary police, Ukrainian media reported. The pylons had already been damaged by the activists on Friday before they were blown up on Saturday night, according to these reports.

Read more …

“..compromised for a minimum of a 100 years..”

• Brazil Dam Toxic Mud Reaches Atlantic Ocean (BBC)

A wave of toxic mud travelling down the Rio Doce river in Brazil from a collapsed dam has reached the Atlantic Ocean, amid concerns it will cause severe pollution. The waste has travelled more than 500km (310 miles) since the dam at an iron mine collapsed two weeks ago. Samarco, the mine owner, has tried to protect plants and animals by building barriers along the banks of the river. Workers have dredged the river mouth to help the mud flow out to sea fast. The contaminated mud, tested by the water management authorities, was found to contain toxic substances like mercury, arsenic, chromium and manganese at levels exceeding human consumption levels. Samarco has insisted the sludge is harmless.

In an interview with the BBC, Andres Ruchi, director of the Marine Biology school in Santa Cruz in Espirito Santo state, said that mud could have a devastating impact on marine life when it reaches the sea. He said the area of sea near the mouth of the Rio Doce is a feeding ground and a breeding location for many species of marine life including the threatened leatherback turtle, dolphins and whales. “The flow of nutrients in the whole food chain in a third of the south-eastern region of Brazil and half of the Southern Atlantic will be compromised for a minimum of a 100 years,” he said. The magazine Chemistry World quotes Aloysio da Silva Ferrao Filho, a researcher at the respected Oswaldo Cruz Foundation, as saying that the impact has been severe in the river itself. “The biodiversity of the river is completely lost, several species including endemic ones must be extinct.”

Read more …

Compromised forever.

• Deforestation Threatens Majority of Amazon Tree Species (PSMag)

It’s been estimated that the Amazon rainforest and surrounding areas are—or once were—home to upwards of 11,000 different tree species. It’s also been estimated that those forests have shrunk by about 12%, and that human meddling could double or triple that number by 2050. Now, researchers report, the loss of forest cover could threaten the existence of more than half the tree species in the Amazon. The Amazon basin hosts perhaps the greatest biodiversity on Earth—so much so that researchers know relatively little about many of the region’s native species. “While we know quite a bit about Amazonian deforestation, we know little about the effects on the Amazonian [tree] species,” says lead author Hans ter Steege at Naturalis Biodiversity Center in Leiden, the Netherlands.

“We’ve never had a good idea about how many species are threatened in the Amazon, and now with this study we have an estimate,” adds study co-author Nigel Pitman, a senior conservation ecologist at the Field Museum in Chicago, Illinois. To get a picture of the health of forests in the Amazon basin and the Guiana Shield north of Brazil, a team of 160 botanists, ecologists, and taxonomists from 97 institutions went out into the field and, well, started counting. The team ultimately mapped 4,953 “relatively common” tree species at 1,485 sites throughout the region. Using a standard model of biodiversity, the researchers inferred the existence of another 10,000 species, which they assumed were largely hidden in the densest Amazonian forests, but rare enough that even a careful accounting could have missed them.

Hans ter Steege and his colleagues next compared species maps with maps of deforested and protected areas, then computed how many trees of each species could be lost under two different chain of events: a business-as-usual scenario, in which deforestation continues more or less as it has been for decades, and 40% of the Amazon’s trees would be gone by 2050; and a less severe scenario, in which governments step up protections, and deforestation tops out at 20%. Under the business-as-usual scenario, 51% of the Amazon’s common tree species’ populations and 43% of rare tree species’ populations would decline by 30% or more, qualifying them for inclusion on the International Union for Conservation of Nature’s “Red List” of threatened species.

Even under the less severe scenario in which forest governance improves, 16% of common species and 25% of rare species qualify for the Red List. Those losses would likely affect iconic tree species including Brazil nut, cacao, and açai palm, which play central roles in the regional economy. What’s more, Amazonian forests help trap a vast amount of carbon, which, if unleashed through deforestation, could exacerbate an already warming climate. “We want to make sure the Amazon keeps the carbon sink,” ter Steege says. “This is important.”

Read more …

Russia has far fewer qualms about confronting The House of Saud.

• Saudi Arabia, an ISIS That Has Made It (NY Times)

Black Daesh, white Daesh. The former slits throats, kills, stones, cuts off hands, destroys humanity’s common heritage and despises archaeology, women and non-Muslims. The latter is better dressed and neater but does the same things. The Islamic State; Saudi Arabia. In its struggle against terrorism, the West wages war on one, but shakes hands with the other. This is a mechanism of denial, and denial has a price: preserving the famous strategic alliance with Saudi Arabia at the risk of forgetting that the kingdom also relies on an alliance with a religious clergy that produces, legitimizes, spreads, preaches and defends Wahhabism, the ultra-puritanical form of Islam that Daesh feeds on. Wahhabism, a messianic radicalism that arose in the 18th century, hopes to restore a fantasized caliphate centered on a desert, a sacred book, and two holy sites, Mecca and Medina.

Born in massacre and blood, it manifests itself in a surreal relationship with women, a prohibition against non-Muslims treading on sacred territory, and ferocious religious laws. That translates into an obsessive hatred of imagery and representation and therefore art, but also of the body, nakedness and freedom. Saudi Arabia is a Daesh that has made it. The West’s denial regarding Saudi Arabia is striking: It salutes the theocracy as its ally but pretends not to notice that it is the world’s chief ideological sponsor of Islamist culture. The younger generations of radicals in the so-called Arab world were not born jihadists. They were suckled in the bosom of Fatwa Valley, a kind of Islamist Vatican with a vast industry that produces theologians, religious laws, books, and aggressive editorial policies and media campaigns.

One might counter: Isn’t Saudi Arabia itself a possible target of Daesh? Yes, but to focus on that would be to overlook the strength of the ties between the reigning family and the clergy that accounts for its stability — and also, increasingly, for its precariousness. The Saudi royals are caught in a perfect trap: Weakened by succession laws that encourage turnover, they cling to ancestral ties between king and preacher. The Saudi clergy produces Islamism, which both threatens the country and gives legitimacy to the regime. One has to live in the Muslim world to understand the immense transformative influence of religious television channels on society by accessing its weak links: households, women, rural areas. Islamist culture is widespread in many countries — Algeria, Morocco, Tunisia, Libya, Egypt, Mali, Mauritania.

There are thousands of Islamist newspapers and clergies that impose a unitary vision of the world, tradition and clothing on the public space, on the wording of the government’s laws and on the rituals of a society they deem to be contaminated. It is worth reading certain Islamist newspapers to see their reactions to the attacks in Paris. The West is cast as a land of “infidels.” The attacks were the result of the onslaught against Islam. Muslims and Arabs have become the enemies of the secular and the Jews. The Palestinian question is invoked along with the rape of Iraq and the memory of colonial trauma, and packaged into a messianic discourse meant to seduce the masses. Such talk spreads in the social spaces below, while up above, political leaders send their condolences to France and denounce a crime against humanity. This totally schizophrenic situation parallels the West’s denial regarding Saudi Arabia.

Read more …

“The more one side gains political control in the name of Islam, the more vulnerable it becomes to accusations from the other side that its claim to power is less than legitimate.”

• The Saudi Connection to Terror (Daniel Lazare)

[..] the proceeds from a hundred-odd oil trucks doesn’t explain how ISIS pays its bills. Nor does the speculation about ISIS’s antiquity sales. So if Islamic State does not get the bulk of its funds from such sources, where does the money come from? The politically inconvenient answer is from the outside, i.e., from other parts of the Middle East where the oil fields are not marginal as they are in northern Syria and Iraq, but, rather, rich and productive; where refineries are state of the art, and where oil travels via pipeline instead of in trucks. It is also a market in which corruption is massive, financial controls are lax, and ideological sympathies for both ISIS and Al Qaeda run strong. This means the Arab Gulf states of Kuwait, Qatar, the United Arab Emirates, and Saudi Arabia, countries with massive reserves of wealth despite a 50% plunge in oil prices.

The Gulf states are politically autocratic, militantly Sunni, and, moreover, are caught in a painful ideological bind. Worldwide, Sunnis outnumber Shi‘ites by at least four to one. But among the eight nations ringing the Persian Gulf, the situation is reversed, with Shi‘ites outnumbering Sunnis by nearly two to one. The more theocratic the world grows – and theocracy is a trend not only in the Muslim world, but in India, Israel and even the U.S. if certain Republicans get their way – the more sectarianism intensifies. At its most basic, the Sunni-Shi‘ite conflict is a war of succession among followers of Muhammad, who died in the Seventh Century. The more one side gains political control in the name of Islam, consequently, the more vulnerable it becomes to accusations from the other side that its claim to power is less than legitimate.

The Saudi royal family, which styles itself as the “custodian of the two holy mosques” of Mecca and Medina, is especially sensitive to such accusations, if only because its political position seems to be growing more and more precarious. This is why it has thrown itself into an anti-Shi‘ite crusade from Yemen to Bahrain to Syria. While the U.S., Britain and France condemn Bashar al-Assad as a dictator, that’s not why Sunni rebels are now fighting to overthrow him. They are doing so instead because, as an Alawite, a form of Shi‘ism, he belongs to a branch of Islam that the petro-sheiks in Riyadh regard as a challenge to their very existence. Civil war is rarely a moderating force, and as the struggle against Assad has intensified, power among the rebels has shifted to the most militant Sunni forces, up to and including Al Qaeda and its even more aggressive rival, ISIS.

In other words, the Islamic State is not homegrown and self-reliant, but a product and beneficiary of larger forces, essentially a proxy, paramilitary army of Gulf state sheiks. Evidence of broad regional support is abundant even if news outlets like The New York Times have done their best to ignore it.

Read more …

Are they making it up as they go along? Something fishy: “It later emerged that the passport was fake and that four other people, including a dead Syrian soldier, shared the same details.” Look, if there are four people with identical -fake- passports, how do they know the perpetrator was the one who passed through Greece, and not one of the other three?

• Terrorism Links Trigger Greater Scrutiny For Greece (Kath.)

Greece is under growing pressure to monitor its borders and properly register the thousands of refugees and migrants who arrive each week after it emerged that at least two of the Paris suicide bombers passed through the country on their way to France. The European Union has already started taking measures in the wake of the deadly terrorist attacks in Paris. EU interior ministers agreed on Friday to tighten checks on points of entry to the 26-country Schengen area, which includes Greece. French Interior Minister Bernard Cazeneuve said the European Commission would present plans to introduce “obligatory checks at all external borders for all travelers,” including EU citizens, by the year’s end. Previously, only non-EU nationals had their details checked against a database for terrorism and crime when they enter the Schengen area.

Earlier, Cazeneuve revealed that a second suicide bomber at the Stade de France in Paris had entered the EU via Greece. A total of three jihadists blew themselves up at the stadium. One had already been identified as having arrived on Leros with a larger group of migrants. He was carrying a Syrian passport in the name of Ahmad Almohammad. It later emerged that the passport was fake and that four other people, including a dead Syrian soldier, shared the same details. It is thought a second bomber arrived with him on Leros, while unconfirmed sources suggest that the third Stade de France bomber also followed the same route. There has been no official reaction from the government to these revelations but Greek authorities have handed all the information from the registered arrivals to Europol.

Athens, however, has not confirmed that the alleged leader of the terrorist cell that carried out the fatal attacks in Paris, Abdelhamid Abaaoud, had been in Greece in January. In fact, the citizens’ protection minister issued a statement on Friday asking Cazeneuve to retract comments in which he suggested the Belgian national, who was killed in a police raid last week, had passed through Athens. Greek authorities mounted a search for Abaaoud in Athens after his mobile phone was allegedly traced to the Greek capital but the device was eventually found in the possession of an Algerian man who was extradited to Belgium due to alleged links with a terrorist cell there.

Nevertheless, this adds to the pressure on Greece to ensure proper checks are being carried out. Authorities made multiple arrests last week in connection to the alleged forging of documents for migrants. Also, the police picked up 50 migrants that were allowed to board ferries in Lesvos and Chios without having registered with authorities there.

Read more …

It’s hard not to think now and again that the EU deliberately screws this up. Couldn’t do a better job at it if they tried.

• Chaos In Greek Islands Over Three-Tier Refugee Registration System (Guardian)

The EU’s refugee registration system on the Greek islands has created a three-tier system that favours certain nationalities over others, encourages some ethnic groups to lie about their backgrounds to secure preferential treatment, and has led to a situation Human Rights Watch calls absolute chaos. The dynamic will increase fears over the security threat posed by the hundreds of thousands of migrants arriving in Europe amid a backlash against refugees after the Paris attacks. The passport of a Syrian refugee who passed through Greece was found on or near the body of a dead suicide bomber. It will also amplify calls to scale up resettlement schemes from the Middle East, which will help Europe to improve screening of refugees and give them an incentive not to take the boat to Greece.

Syrian families arriving on the island of Lesbos, where nearly 400,000 asylum seekers have landed so far in 2015, are separated from other nationalities and given expedited treatment that allows them to leave the island for mainland Europe within 24 hours. Syrian males, Yemenis and Somalis are registered in a separate and slower camp but still receive preferential treatment and are usually able to continue their journey within a day. But a third category of asylum seekers – including many from war-torn countries such as Iraq and Afghanistan – are being processed in another camp where there are roughly half as many passport-scanners. The result is a chaotic parallel registration process that can last up to a week, and which has left many non-Syrians sleeping outside in the cold of winter for several nights, while they wait to be registered.

The Guardian found families living in dire, unsanitary conditions in an olive grove surrounding the main registration centre. They said they were receiving just one significant meal a day, and had resorted to burning trees to keep warm at night. Even once they are finally processed, Afghans only receive one month’s leave to remain in Greece, while Syrians are given six months. The island’s mayor told the Guardian that the three-track process is to prevent fighting between different ethnic groups and nationalities. But the director of one of the three camps admitted that non-Syrians are given lower priority because officials assume that they do not have as strong a claim for asylum. “In the [lowest-priority] camp, there are the Iraqis, Afghans, Pakistanis who are mostly migrants, economic migrants,” said Spyros Kourtis. By contrast, he said that the better-equipped centre was for “people who come from countries with a refugee profile”.

Read more …