As I wrote yesterday in The Virus is a Time Machine, it’s not about the number of deaths or cases, it’s about the disruption. Today, stock markets are down 7-8%, and oil plummeted 30% to $30. At your service. “Fake Wealth” is popping, say some.

Italy has an oversized role today so far, but there are a number of countries that could take off at any time now. As I said in that article, US, Germany, France, Spain appear to be in a phase where for instance Italy was about a week ago.

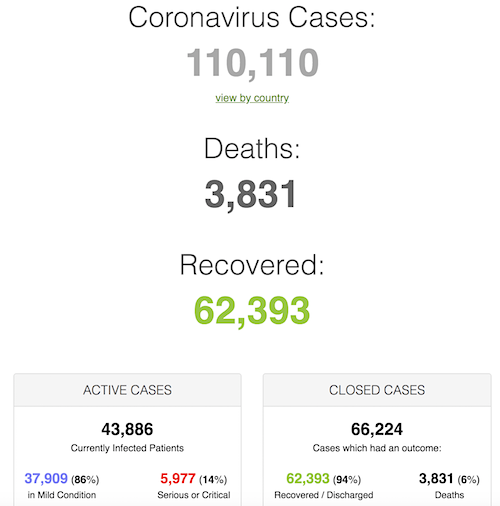

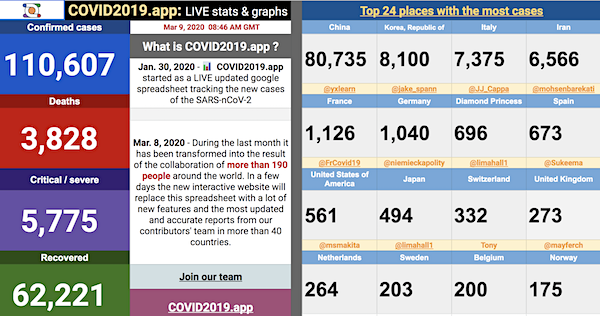

Something odd about the numbers today is that COVID2019.app puts South Korea at 8,100 cases, while the other two have it at around 7,400. It must be hard getting the numbers right, and on time.

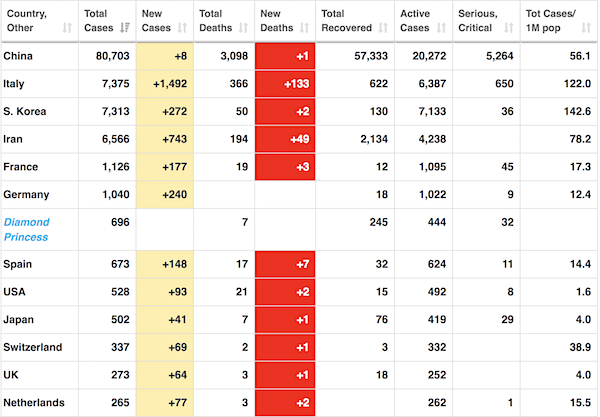

• Cases 110,607 (+ 4,120 from yesterday’s 106,487)

• Deaths 3,831 (+ 231 from yesterday’s 3,600)

From Worldometer yesterday evening (before their day’s close)

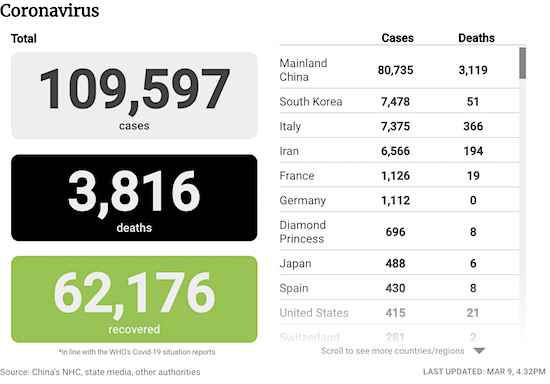

From SCMP:

From Worldometer:

From COVID2019.app:

Smart cookie.

• ‘Fake Wealth’ Set To Pop (ABR)

Sharemarket and property investors are about to experience a reckoning that sweeps away the pretence of “fake wealth and artificial economy”, Lucerne Investment Partners portfolio manager Jerome Lander says. In a note to clients issued on Monday, Mr Lander said investors were “reacting in horror to the reality of the coronavirus as it begins its exponential growth around the world”. His note came as the Australian sharemarket was experiencing its biggest one-day fall since the global financial crisis, with the S&P/ASX 200 plunging 6 per cent to a 14-month low of 5840.90 amid a collapse in oil prices. “This is a truly frightening pandemic with significant ramifications which much of the developed world is unlikely to cope with well,” Mr Lander said.

“The reality is ICUs [intensive care units] are likely to be overrun around the world and people will increasingly seek to avoid social contact and hide at home in order to avoid contracting the deadly virus.” Mr Lander said a 10 per cent ICU admission rate for Italy’s 1492 cases of coronavirus was a “truly horrifying statistic”. Underlying economic weaknesses was being expose, he said. “One bubble after another is at risk of popping, as the fake wealth and artificial economy of the last few years explodes in the face of a devastating global recession.” With sharemarkets now “crashing, with delusional housing prices likely to follow”, he predicted central banks would shortly attempt to restore order to financial markets through so-called quantitative easing.

“Unlimited QE is likely but won’t help alter the destruction from the pandemic,” Mr Lander said. “These are truly dangerous times for all investors, but particularly for those holding large amounts of overvalued equity and property assets at fake economy prices.”

Trillions upon trillions in fake wealth are going POOF. And the central banks that created the fake wealth will throw more fake money at the walls.

• Global Markets Plunge 7-8%, Oil Falls 30% To $30 (G.)

Global stock markets have suffered their biggest falls since the 2008 financial crisis while the oil price crashed amid panic selling because of the double threat of a coronavirus-driven global recession and an oil price war. The FTSE 100 index in London plunged 8.5% to 5,911 points, losing 550 points, when trading began on Monday morning. Germany’s Dax tumbled 7.5% and Spain’s Ibex lost 7%. Asian markets also recorded huge losses as fears over the world economy were exacerbated by the shock decision by Saudi Arabia over the weekend to ramp up oil production in an attempt to drive rivals such as Russia and the US out of the market.

The price of Brent crude oil fell almost 30% to $31.14 on Monday, its biggest decline since the start of the Gulf war in 1991. Some experts expect it to fall further unless the Saudis and Russians return to the bargaining table. Turmoil spread on international markets as the coronavirus epidemic deepened around the world. Italy, the worst-hit country in Europe, was plunged into chaos as government plans to quarantine more than 16m people – more than a quarter of its population – were leaked to the media. Italian bond yields jumped on Monday. The number of people infected by coronavirus worldwide has passed 110,000.

Stock markets in Asia Pacific experienced the worst wave of selling since the collapse of Lehman Brothers in 2008 heralded the onset of the global financial crisis. With fears growing of a recession in Australia because of the virus, the Australian share market closed down 7.4%. The Nikkei in Japan fell more than 5%, while Hong Kong’s Hang Sen lost 3.9% and the Shanghai stock exchange dropped just over 3%. US 10-year government bond yields fell to fresh record lows and the Japanese yen and gold soared as investors rushed into safe haven investments.

Putin stopped supporting MbS. Isn’t that a good thing? How much do we like MbS?

• Goldman Cuts Brent Forecasts To $30 On Price War, Virus (R.)

Goldman Sachs cut its second- and third-quarter Brent price forecasts to $30 per barrel, citing the oil price war between Russia and Saudi Arabia and a significant collapse in oil demand due to the coronavirus that has killed more than 3,500 globally. Oil fell by the most since 1991 on Monday after Saudi Arabia started a price war with Russia by slashing its selling prices and pledging to unleash its pent-up supply onto a market reeling from falling demand because of the virus outbreak. “The aggressive cut to Saudi’s Official Selling Prices and Russia’s reluctance to be pushed into a deal on Friday point to a low probability of an immediate (OPEC+) agreement,” Goldman said in a note dated March 8.

A three-year pact between OPEC and Russia ended in acrimony on Friday after Moscow refused to support deeper oil cuts and OPEC responded by removing all limits on its own production. “While we can’t rule out an OPEC+ deal in coming months, we also believe that this agreement was inherently imbalanced and its production cuts economically unfounded,” the bank said. Goldman’s base case is now for no such deal, it said. Goldman’s base case is now for no such deal, it said. Lower oil prices will start creating acute financial stress and declining production from shale as well as other high cost producer, the bank said.

There will be a negligible response from U.S. shale producers in the second quarter, but output will fall in the third quarter by 75,000 barrels per day (bpd) and a further 250,000 bpd in the fourth quarter of 2020, the bank said. This will not prevent, however, a third-quarter supply surplus of 1.2 million bpd. “At that point, the fundamental rebalancing could require oil prices falling to operational stress levels for high-cost producers with well-head cash costs near $20/bbl,” it said.

Home deliveries are set to double, but the people working the field don’t get paid anything. The future’s so bright…

• Gig Economy Workers Can’t Afford To Be Ill (G.)

Shane Stephen, a Deliveroo rider, pulls a snood over his mouth and nose as he manoeuvres his mountain bike down a narrow side-street in central London. It is his makeshift defence against coronavirus. “If I catch something I’m screwed,” explains the 23-year-old. “Gig economy workers can’t afford to be ill. My bank balance is literally £4 something right now.” Stephen – like tens of thousands of other couriers and drivers in the UK – is classed as self-employed and therefore not entitled to any sick pay. He stands to gain nothing from Boris Johnson’s pledge last Wednesday to give coronavirus-hit workers statutory sick pay from the first day off work rather than the fourth. Yet Stephen and other gig economy couriers could be called on to deliver food and other essentials to self-isolating households when the virus reaches its peak.

Some industry analysts foresee the number of home deliveries doubling if people are told to work from home and avoid large gatherings under the government’s so-called social-distancing strategy, which will kick in if the virus continues to spread across the country. Unions representing gig economy workers, such as the GMB and Independent Workers Union of Great Britain (IWGB), fear couriers with coronavirus symptoms may keep working. “Many will carry on because they need to put food on the table and pay the rent. They will then come into contact with other people and spread the virus,” says Mick Rix from the GMB, which represents thousands of couriers. “This would be going against everything the government is trying to achieve at the moment.”

[..] Josh Lane (not his real name) jumps into his DPD Local van after making a delivery in Tottenham. He cleans his hands with hand sanitiser. “I’m in a rush, but I’m doing my bit,” he says through the rolled-down window. However, the 30-year-old cannot afford to stop work if he contracts the virus. “It’s like a flu and I’ve worked through flu before. If you’re self-employed you have to continue working,” he says. “It’s not about me. I’ve got three children. I’m not about to make them starve because of coronavirus. If I’m physically able to work, then isolation is not happening for me.”

The kind of stuff that stumps me: “This resiliency of the consumer will once again support equities and most likely show that this current market reaction is a ‘blip’..

These people have zero connection to reality.

• Plummeting Oil Prices And Mortgage Rates Could Boost Consumers (CNBC)

As the deadly coronavirus spreads across the globe, oil prices are down 30% for the year and the average rate on the popular 30-year fixed mortgage has fallen to an eight-year low. It’s positive news for consumers in the short term, even as some economists warn that the virus could tip the U.S economy into recession as the outbreak escalates. The drop in mortgage rates and oil prices could boost consumer confidence, which rose less than expected in February just one day after the stock market had one of its worst days amid virus concerns. A boost in consumer confidence, in turn, could ease those recession fears. “The U.S. economy is 70% consumer driven,” said John Kilduff, founding partner of Again Capital.

“A drop in gasoline prices acts like a tax cut, freeing up money to spend in other sectors of the economy, especially discretionary sectors, such as travel and leisure and dining.” The relentless pace of headlines related to the coronavirus, however, could ultimately act as a psychological break on any boost in confidence that low oil prices and mortgage rates might deliver to the consumer. “The question is whether the fear factor attributable to the virus will overwhelm any positive impact from lower gasoline prices and lower mortgage rates,” said Edward Yardeni, president of Yardeni Research. “That’s hard to answer, but it seems to me that fear is winning the tug of war currently as evidenced by the drop in stock prices and the panicky responses of governments, the media … and the public,” he added.

[..] Jeff Kilburg, founder and CEO of KKM Financial, said that the short-term reaction to lower oil prices will translate into lower prices at the pump for Americans, and that in combination with historically low mortgage rates will provide substantial strength for consumers in the second quarter. “This resiliency of the consumer will once again support equities and most likely show that this current market reaction is a ‘blip,’ not the end of this bull market … and certainly not the beginning of a recession,” Kilburg said.

Absolutely right. Will I be able to get to Greece in time?

• More Countries Will Adopt Italy’s Measures – Austria PM (G.)

Austria’s chancellor has said other European countries will be forced to adopt containment measures as drastic as Italy’s, after Rome placed a quarter of the population in lockdown in an effort to halt the rapid spread of the coronavirus. As the head of the World Health Organization praised Italy’s “genuine sacrifices”, Sebastian Kurz said the situation in Austria, which has reported 99 Covid-19 cases, was under control and the measures it had adopted were appropriate for the time being. He said EU leaders and health ministers were in close contact over their countries’ handling of the epidemic [..] “It will be important to decide which steps to take when,” Kurz said. “You can close schools for one or two weeks and this is urgently necessary in Italy. It will happen in other European countries. The decisive question is when to do it.”

The difficulty will be in balancing the need to head off a peak in infections that could paralyse public health systems against excessive economic damage, he said. “You have to consider carefully when to adopt these measures, because a national economy cannot handle this over too long a period.” Speaking to French radio, the EU commissioner for the single market, Thierry Breton, said European countries were “each acting according to the latest available data in their countries. The virus has spread faster in some places than in others, so naturally the measures in each differ”. In the US, Anthony Fauci, the head of the infectious diseases unit at the National Institutes of Health, said Americans , and particularly those who are vulnerable, may have to stop attending big gatherings. Nor could large-scale quarantines be ruled out, he said.

The WHO director general, Tedros Adhanom Ghebreyesus, tweeted his appreciation for Rome’s efforts after the government published a decree barring people from entering or leaving vast areas of northern Italy without good reason until 3 April. The quarantine zones are home to about 16 million people and include the regions around Venice and the financial capital, Milan. Cinemas, theatres and museums will be closed nationwide and leave has been cancelled for health workers as the prime minister, Giuseppe Conte, said the country was facing a national emergency.

You announce an upcoming travel ban, so what do people do? Travel.

• Leaked Italy Quarantine Plans Create Chaos, Threaten To Spread Virus (ZH)

Italians have become inured to alarming news over the past month as the outbreak has spiraled out of control in Lombardy. But following a flurry of uncontrolled leaks warning about an imminent lockdown as part of the government’s planned emergency decree, restaurants and bars started emptying out and many fled to the train station, where they hopped trains to get out of the region, especially those who had plans to travel elsewhere that were being interrupted by the lockdown. According to an SCMP reporter in Padua, packed bars and restaurants quickly emptied out as news of a coming lockdown hit, as many people rushed to the railway station. Travellers with suitcases, wearing face masks, gloves and carrying bottles of sanitising gel shoved their way on to the local train.

This appears to have been a phenomenon across the North. The video shows passengers with large bags packed heading toward a cross-country train to take them out of the quarantine zone and into the Italian south, where the virus has penetrated, but infection numbers and deaths remain much lower than in the north. This could be terrible news for the impoverished south: experts have repeatedly warned that southern Italy – best known as an agricultural and fishing center rife with organized crime – doesn’t possess the medical infrastructure to handle a surge in life-threatening cases of pneumonia. While Andrew Cuomo has repeatedly insisted during his seemingly never-ending series of press conferences that the panic is worse than the virus itself, in Italy, the situation is rapidly deteriorating on both fronts.

One epidemiologist described the series of panic-provoking leaks as “pure madness.” Fortunately, Italian markets were closed during the panic, and now people have more or less accepted the new rules. But at this point, the horse is already out of the barn. Panicked Italians are now traveling around the country, potentially bringing the virus with them. “The draft of a very harsh decree is leaked, sparking panic and prompting people to try and flee the [then] theoretical red zone, carrying the virus with them,” wrote Italian virologist Roberto Burioni on Twitter. “In the end, the only effect is to help the virus to spread. I’m lost for words.”

Even before the virus, Britain’s reality is devastating: ““or so many families now, schools are the first line of defence against hunger..“

• Charities Preparing To Feed Children If Schools Shut Over Coronavirus (G.)

A charity led by the archbishop of Canterbury is preparing to help feed children if schools are closed by coronavirus, amid fears the withdrawal of free school dinners could leave up to 3 million children at risk of hunger. Feeding Britain, which runs food poverty schemes in 12 areas of England including Cornwall, Leicester, Barnsley and South Shields, is exploring how to set up emergency programmes similar to those used to feed the poorest children during the summer holidays. The Akshaya Patra Foundation, which serves thousands of hot meals to children every summer in London boroughs, is also “prepared to enter crisis mode”, while food projects in Bristol and Huddersfield said they were exploring how their schemes to feed hundreds of children in school holidays could be adapted to help cope with emergency closures.

“For so many families now, schools are the first line of defence against hunger,” said Andrew Forsey, the national director of Feeding Britain, whose president is the Most Rev Justin Welby. “In many cases it is breakfast as well as lunch, so if the schools close it’s two meals we have to find. There is early-stage planning going on around ensuring supplies of food and the extent of voluntary support that could be drawn upon if some schools do need to close.” Downing Street said on Tuesday that school closures would be among “distancing strategies” used if the virus became established in the UK. On Thursday, Italy closed all of its schools and colleges for a month.

[..] An immediate challenge is likely to be finding a way to deliver meals in a way that maintains the distance between people that school closures are meant to achieve. The Bristol project said it could involve delivering food parcels door-to-door. Forsey also said panic-buying that cleared supermarket shelves could hinder efforts as many free meal programmes relied on retailers’ donations.

“106 people in New York have confirmed cases of Coronavirus. But- “As of Saturday only about 120 people in New York City had been tested..”

The dumbest advice ever. “Take the next train”.

• NYC Asks Commuters to Stay Off Public Transit ‘If You Can’ (NBC)

City and state officials issued new travel suggestions amid growing novel coronavirus cases in the tri-state area. New York Governor Andrew Cuomo and New York City Mayor Bill de Blasio asked sick people to stay off public transit, especially subways and buses. Their warnings included a suggestion to avoid dense crowds on buses, subways and trains, or take alternate travel if possible. “If you take the subway and you are able to wait for a less packed train, please do. If you have the option of walking or biking, please do. Buses can be crowded too, but less than subways, so please use these if you can,” de Blasio said. “Move to a train car that is not as dense. If you see a packed train car, let it go by. Wait for the next train. Same if you’re taking a bus,” Cuomo said.

Avoiding public transit is not an option for most New Yorkers and they’re not afraid to let the mayor know. “Happy to ride a bike to work. Can you make it so people don’t die in Queens while biking? Vehicular deaths are a public health crisis too,” one Twitter user said in response to de Blasio’s announcement. In the city’s other effort to stop the spread of COVID-19, transit workers started to disinfect subway turnstiles, station handrails, MetroCard and ticket vending machines daily and other frequently used parts of the system, according to a statement from Transport Workers Union President Tony Utano. The deep clean extends to Long Island Rail Road, Metro-North and Access-A-Ride services as well. In addition to the daily cleaning, the MTA says its full fleet of subway trains and buses will undergo sanitization every 72 hours.

I think Yanis is getting ahead of himself. What the situation will be once the pandemic is over is so murky right now we must all be very cautious about predicting anythig.

• A Perfect Storm Of Nationalism And Financial Speculation (Varoufakis)

Nationalism and speculation have seldom had a better opportunity to combine forces as the one riding today on the coattails of Covid-19, known as the coronavirus. When Covid-19 leapfrogged from China to Italy, even ardent Europeanists normally appreciative of open borders joined the deafening calls to end freedom of movement across Europe’s national borders – a longstanding demand of nationalists. Meanwhile, the money men speculating on government debt are performing a classic flight from Italian to German government bonds, seeking the financial safety that only the continent’s hegemon can offer during any crisis. As if in a bid to remind us of the great contradiction of our times, Covid-19 is illuminating gloriously the freedom of money to transcend a borderless financial universe while humans remain as fenced in as ever.

Meanwhile in the United States, President Trump is combining his standard call for taller walls with a fresh instruction to moneymen to “buy the dip” in Wall Street, rather than to follow their natural instinct to seek refuge in the boring but safe bond markets. A great deal will depend on whether financiers believe Mr Trump or not, and not just because this is an election year. If speculators do believe the American president, Wall Street will recover swiftly even before the epidemic subsides. The forces of xenophobic financialisation will then have triumphed and America’s progressives will face an uphill struggle on every political front. As for the European Union, ruling elites will breathe a sigh of relief that a new depression was avoided and return to managing as best as they can the economic stagnation of recent times, tinged this time with a large dose of additional, coronavirus-reinforced, xenophobia.

Will Wall Street follow Mr Trump’s advice to “buy the dip”? For now, the large players are in two minds. The drop in the stock market does not worry them as such. Their concern is that the recent bull market was running on increasingly suspect debt and that Covid-19 may have pricked a bubble that was going to burst anyway. Similarly in Europe, the worst spectre hovering over investors’ heads is that large corporations, relying for too long on free money from the European Central Bank, may be downgraded from investment to junk-grade – especially so at a time of stagnant domestic demand and a collapsed Chinese import market.

Maybe electric cars should run on electric tires?

• Tyre Wear Produces 1,000 Times More Harmful Pollution Than Car Exhausts (BW)

Car tyres could be doing more damage to our health than the fumes from exhaust pipes, according to the results from a new test. Measurements found that 5.8 grams per kilometre of harmful particles are emitted by tyres as they wear when a car is being driven. That compares to 4.5 milligrams per kilometer produced from exhaust pipes of the latest vehicles on sale today – meaning harmful tyre outputs are higher by a factor of over 1,000. Assessments were conducted by UK-based experts Emissions Analytics, which specialises in calculating the pollution produced by cars in real-world driving.

The type of emissions tyres have been found to produce is harmful particulate matter that is almost impossible to see with the naked eye. It’s made up of microscopic solids or liquid droplets that are so small that they can be inhaled and cause serious health problems. Particles less than 2.5 micrometers in diameter – also known as PM2.5 – pose the greatest risk to our health. Exposure can affect both the lungs and heart, with numerous scientific studies linking them to a variety of problems. This includes premature death in people with heart or lung disease, nonfatal heart attacks, irregular heartbeat, aggravated asthma, decreased lung function and wider respiratory symptoms.

But there are videos of Turkish troops destroying Greek fences to let migants pass. Erdogan is in Brussels today.

• Putin Saves Erdogan From Himself (Escobar)

At the start of their discussion marathon in Moscow on Thursday, Russian President Vladimir Putin addressed Turkish President Recep Tayyip Erdogan with arguably the most extraordinary diplomatic gambit of the young 21st century. Putin said: “At the beginning of our meeting, I would like to once again express my sincere condolences over the death of your servicemen in Syria. Unfortunately, as I have already told you during our phone call, nobody, including Syrian troops, had known their whereabouts.” This is how a true world leader tells a regional leader, to his face, to please refrain from positioning his forces as jihadi supporters – incognito, in the middle of an explosive theater of war. The Putin-Erdogan face-to-face discussion, with only interpreters allowed in the room, lasted three hours, before another hour with the respective delegations.

In the end, it all came down to Putin selling an elegant way for Erdogan to save face – in the form of, what else, yet another ceasefire in Idlib, which started at midnight on Thursday, signed in Turkish, Russian and English – “all texts having equal legal force.” Additionally, on March 15, joint Turkish-Russian patrolling will start along the M4 highway – implying endless mutating strands of al-Qaeda in Syria won’t be allowed to retake it. If this all looks like déjà vu, that’s because it is. Quite a few official photos of the Moscow meeting prominently feature Russian Foreign Minister Sergey Lavrov and Defense Minister Sergey Shoigu – the other two heavyweights in the room apart from both Presidents. In the wake of Putin, Lavrov and Shoigu must have read the riot act to Erdogan in no uncertain terms.

That’s enough: now behave, please – or else face dire consequences. A predictable feature of the new ceasefire is that both Moscow and Ankara – part of the Astana peace process, alongside Tehran – remain committed to maintaining the “territorial integrity and sovereignty” of Syria. Once again, there’s no guarantee that Erdogan will abide. It’s crucial to recap the basics. Turkey is deep in financial crisis. Ankara needs cash – badly. The lira is collapsing. The Justice and Development Party (AKP) is losing elections. Former prime minister and party leader Ahmet Davutoglu – who conceptualized neo-Ottomanism – has left the party and is carving his own political niche. The AKP is mired in an internal crisis.

Erdogan’s response has been to go on the offensive. That’s how he re-establishes his aura. Combine Idlib with his maritime pretensions around Cyprus and blackmail pressure on the EU via the inundation of Lesbos in Greece with refugees, and we have Erdogan’s trademark modus operandi in full swing. In theory, the new ceasefire will force Erdogan to finally abandon all those myriad al Nusra/ISIS metastases – what the West calls “moderate rebels,” duly weaponized by Ankara. This is an absolute red line for Moscow – and also for Damascus. There will be no territory left behind for jihadis. Iraq is another story: ISIS is still lurking around Kirkuk and Mosul.

[..] No NATO fanatic will ever admit it, but once again it was Russia that just prevented the threatened “Muslim invasion” of Europe advertised by Erdogan. Yet there was never any invasion in the first place, only a few thousand economic migrants from Afghanistan, Pakistan and the Sahel, not Syrians. There are no “one million” Syrian refugees on the verge of entering the EU. The EU, proverbially, will keep blabbering. Brussels and most capitals still have not understood that Bashar al-Assad has been fighting al Nusra/ISIS all along. They simply don’t understand the correlation of forces on the ground. Their fallback position is always the scratched CD of “European values.” No wonder the EU is a secondary actor in the whole Syrian tragedy.

The Russian TV exposed: #Putin humiliated #Erdogan and his entire entourage by making them wait outside the door until he couldn’t stand anymore. Where he sat is where butlers sit and wait for the next order from the boss. When inside, they stood under the statue of Catherine II. pic.twitter.com/WArE5ssway

— Amir Tsarfati (@BeholdIsrael) March 9, 2020

No doubt #Turkey is planning something very big in #Idlib #Syria. Last night, the longest convoy of military equipment to date has been seen with over 300 vehicles. The #US supports turkeys right to enforce the #Sochi agreement that gives the #Sunni rebels in Idlib a safe zone. pic.twitter.com/BPyzNM8jx8

— Amir Tsarfati (@BeholdIsrael) March 9, 2020

To think there were scores of people who said Hill made so much sense. Very simple questions that remain unanswered: what exactly do the Russians do according to her, and how exactly does that divide Americans? Never an answer, other than “US intelligence believes that…”

• Fiona Hill Says Putin Has America ‘Exactly Where He Wants Us’ (CNN)

President Donald Trump’s former top Russia adviser is warning that President Vladimir Putin has America “exactly where he wants us.” “Putin, sadly, has got all of our political class, every single one of us, including the media, exactly where he wants us. He’s got us feeling vulnerable…on edge, and he’s got us questioning the legitimacy of our own systems,” Fiona Hill told CBS’ Lesley Stahl in an interview set to air on “60 Minutes” Sunday. The interview marks the former top White House official’s first since testifying in the impeachment inquiry into Trump. During congressional hearings in the inquiry, Hill warned that the Republican defense of the President — by peddling Ukraine conspiracy theories — was in danger of extending Russia’s meddling in the 2016 US presidential election.

Hill, who left the Trump administration last summer, has studied Russia for decades and is a critical biographer of Putin, authoring or co-authoring a number of books on Russia, including two editions of a book titled “Mr. Putin: Operative in the Kremlin. In the interview, Hill said Russia understands how to exploit American divisions. “The Russians didn’t invent partisan divides. The Russians haven’t invented racism in the United States,” Hill said. “But the Russians understand a lot of those divisions, and they understand how to exploit them.” Russian interference in the last presidential election — which the US intelligence community believes was aimed at boosting Trump’s candidacy and hurting his opponent, Hillary Clinton — led to special counsel Robert Mueller’s investigation.

Part of the election interference included a Russian government-linked troll operation that sought to help Trump’s candidacy and undercut that of Clinton in part by posting messages in support of Sanders. Concerns over the Kremlin’s role in US politics have continued. The US intelligence community has assessed that Russia is interfering in the 2020 election and has separately assessed that Russia views Trump as a leader they can work with. In February, Democratic presidential candidate Sen. Bernie Sanders also said his campaign was briefed about Russian efforts to help his operation. It was unclear how Russia was attempting to help the Vermont senator.

It’s been brought to my attention not every single human being has had the privilege of watching this phenomenal German commercial. It deserves a goddamn Oscar imho pic.twitter.com/vc5SqUOPhj

— Diego Lopez (@thisdiegolopez) March 7, 2020

Democratic Establishment: maybe if we close our eyes really tight no one will notice Biden’s cognitive decline.

Rest of the world:

— Benjamin Dixon (@BenjaminPDixon) March 8, 2020

Trumps team is already campaigning on Biden’s cognitive decline. pic.twitter.com/hjbwZWNtkA

— Andrew Hassett (@AndrewHassett6) March 7, 2020

Today is International Women’s Day. So of course the DNC changes its rules yet again, this time to bar its only remaining female candidate from participating in the next debate.

If you read us, please support us. Allow the Automatic Earth to survive. Donate on Paypal and Patreon.